109: Enterprise Spending on Cloud, WCM, Amazon in 1999, Microsoft + Discord, NFTs, OpenAI's GPT-3 Ecosystem, Samsung DDR5, and FBI Bribing Congressmen

"People waste years of their lives not being willing to waste hours of their lives"

“You should ride your fear like a fast horse.”

—Archie Moore, “professional boxer, the longest reigning World Light Heavyweight Champion of all time (December 1952 – May 1962)”

🌱 ‘Hey, Do You Remember’ has been one of my favorite “entertainment” podcasts for the past few years. I listen before bed to relax.

The concept is simple: the three hosts discuss their memories of a film that they saw growing up, then they re-watch it and talk about how it held up (they’re about the same age as me, so mostly late 1980s-1990s stuff — Back to the Future, Dead Poets Society, Groundhog Day, Reservoir Dogs, you get the idea).

The podcast ran for 8 years, and seemed to be quite popular.

But recently, they decided to end it, and recorded a final episode to look back and explain why.

It gets emotional, but the part that stood out to me is when one of the hosts talks about how he had to stop doing this very successful thing to move forward on another long-term goal of making films/TV content, and be really fully dedicated to that. I’m paraphrasing a bit, but he said:

Make decisions not on what you think will make you happier, but on what will force you to grow as a person, because that leads to fulfillment, and happiness is a byproduct of fulfillment.

I think those are very wise words.

We’re really bad at predicting what will make us happy, which is why so many people chase all the wrong things and aren’t happier when they get them (this simple insight from the book ‘Stumbling on Happiness’ by Dan Gilbert changed my life trajectory).

We may not know what makes us happy, but I think we know pretty well what will make us grow.

When we don’t do it, it’s mostly because we’re afraid or lazy or don’t take the time to really consider the choices that we have, not because it’s so hard to know.

Sometimes you have to take the jump — make a leap of faith, like Indiana Jones in The Last Crusade.

🎛 I’m always looking for high-leverage investments, and here I’m not talking about finance.

There are things in life where you invest some time and/or money into something (a skill, some equipment), and then forever after, you get benefits from that investment.

An obvious example is learning to type on a keyboard.

It’s hard at first, but it’s one of the most useful skills to have in the modern world (it’s ubiquitous enough now that we even forget that it’s a skill, but growing up I remember watching adults peck at the keys with one finger and it felt like a super-power that I could to type 60 wpm even if my technique was all wrong and bespoke).

What’s making me think of this is the research into audio I’ve been doing the past couple weeks.

I went from knowing almost nothing about it to having a decent understanding of mic technique, the differences between condenser and dynamic microphones, how to properly set gain, what an audio interface does and which one would work for my needs, how to use Audacity to edit audio (compression, multi-track, time-shifting stuff, normalizing volume, fades, cross-fades, trimming silences dynamically, voice EQ, etc).

Not saying that I’m any good at it yet, but my knowledge went from non-existent to a working base that I can use as a starting point to iterate on (remember the Pareto principle? You can get a good way to 80% fairly quickly, especially in this internet world where you can find experts who will just hand you knowledge they accumulated over years — for example, here are 10 tips for better vocal recordings).

So while I don’t expect this audio knowledge to have nearly the leverage/benefits to my life that typing does, I figure that it may go along this kind of sliding scale:

1) Worst case, I’ll just have a little bit of gear and technique that makes me sound better when I do video/audio calls with friends and family, and that’s worth something.

2) If I do interviews once in a while on other people’s podcasts, I’ll be easier to understand, and that’s nice for the listener. I like that.

3) Maybe I’ll keep doing these Mini-Podcasts as the sprinkles on top of the newsletter cake, and having this second medium that is better than text for certain things will allow me to do interesting projects. That’s very cool.

4) What if I figure out over time that I love this stuff and I keep doing Minis and sometimes longer interviews with people I like (both remotely and in person)? Well, this investment in learning a new skill will have been quite worth it!

It’s kind of like what learning a bit about photography did in my life. Adding a few of the basics skills like composition, color adjustments, editing/cropping, how to look for interesting angles, “zooming with your feet” and all that…

This meant that all the photos of my kids that I’ll be looking at all my life and that I’m sending their grand-parents are much better than if I had never looked into this hobby.

That alone makes it 10,000x worth it.

High-leverage life skills FTW.

🎤🧒🏻 Speaking of kids, I think I want to do interviews of my kids. Not to publish, just for my family’s archive.

I think it would be neat to sit down with my sons at some point and ask them about their lives, what they like, their favorite games, who are their friends, what they’re doing in school/daycare and such.

Maybe I can set a yearly calendar reminder to do a quick interview. I certainly wish my parents had done that, and I could listen to what I sounded like and what I was thinking as a 5 or 8 years old.

🤬 You know what they say, two points are a trend…

Well, I screwed up. Again.

In edition #108 I wrote about an interview that Andrew Walker did with Abdullah Al-Rezwan aka ‘Mostly Borrowed Ideas’ on Autodesk. But I included the wrong video in the email, something I had done in the past.

What happened is I listened to the audio version, and when I wrote I checked the show-notes and there was a Youtube link on top, so I grabbed that, loaded it and saw the right people, and then used it.

But it was their first interview, not the second one. I fixed it on the site, but I can’t do anything about the emails that went out (can’t unring that bell), so mea culpa, here’s the correct video of the interview.

Investing & Business

One is not like the other

Source. h/t Jamin Ball

Interview: Sanjay Ayer, WCM

Another great one by Bill Brewster, who is still on a roll.

I’ve heard many interviews with WCM people over time, starting with Paul Black’s appearances on Ted Seides’ pod (Ep. 05 and Ep. 51), and Mike Trigg (Ep. 162). \

They make it sound like the kind of firm where I could see myself working, if I wanted to be in that business.

Here Bill talks to Sanjay Ayer, a portfolio manager at WCM, and it confirms that impression that they have a very thoughtful, no-BS, independent-thinking, and creative approach to the game:

At one point Sanjay says:

If you're trying to make money all the time, you're less likely to make money over time. If you're trying to time every cycle, get in and out. The more decisions you make, the more room there is for error.

This is so true (for me).

He also paraphrases this by Michael Lewis:

People waste years of their lives not being willing to waste hours of their lives. If you mistake busyness for importance — which we do a lot — you’re not able to see what really is important.

This is one of my big things in life (I’ve said it a bunch and I’m sure I’ll talk about it a bunch more in the future, because the important things are simple, but we need to constantly re-learn them — that’s another one of my big things), about making sure you're doing the right thing in the first place, not just focusing on how productive you are being at that thing.

Hence spending some hours of introspection and an unflinching look at things, to make sure you really are going in the right direction and avoid wasting years going full steam ahead down a wrong path.

1999 ‘60 Minutes’ Segment on Amazon.com

Yeah, they still had the “.com” in their name back then… That segment near the end where they are baffled that Amazon is “now worth more than Sears” sounds funny to modern ears, but putting yourself back in the context of the 1999 bubble, things were very different, and Amazon’s stock price did deflate not that long after.

I also enjoyed the part where they talk about how Amazon is gathering “half a gigabyte, whatever that is… I’m told it’s about 360 floppy disks” of data on their customers each day.

h/t Matthew Cochrane

Microsoft Now in “Exclusive” Talks with Discord

You know the courting phase is getting more serious when you go exclusive, who knows how this will end.

Microsoft Corp. is in advanced talks to acquire messaging platform Discord Inc. for $10 billion or more [...]

Microsoft and Discord are in exclusive talks and could complete a deal next month, assuming the negotiations don’t fall apart (Source)

Kinda crazy that Discord is only 6 years old.

What do those NFTs even point to?

Interesting thread by Jonty Wareing. Some highlights:

Out of curiosity I dug into how NFT's actually reference the media you're "buying" and my eyebrows are now orbiting the moon

Short version:

The NFT token you bought either points to a URL on the internet, or an IPFS hash. In most circumstances it references an IPFS gateway on the internet run by the startup you bought the NFT from.

Oh, and that URL is not the media. That URL is a JSON metadata file [...]

THAT file refers to the actual media you just "bought". Which in this case is hosted via a cloudinary CDN, served by Nifty's servers again.

So if Nifty goes bust, your token is now worthless. It refers to nothing. This can't be changed.

"But you said some use IPFS!"

Let's look at the $65m Beeple, sold by Christies. Fancy.

That NFT token refers directly to an IPFS hash […]

IPFS only serves files as long as a node in the IPFS network _intentionally_ keeps hosting it.

Which means when the startup who sold you the NFT goes bust, the files will probably vanish from IPFS too [...]

In short: Right now NFT's are built on an absolute house of cards constructed by the people selling them.

It is likely that _every_ NFT sold so far will be broken within a decade. [...]

Yes I know there are plenty of NFTs that do not suffer from these problems. I was just covering the mainstream ones that have been hitting the news.

I’m sure over time there will be some ways to mitigate this, but I think it still shows that the people spending millions on this probably care more about short-term speculation than long-term “ownership”.

h/t Generalist Lab

The Hero’s Journey

Good introspective piece of writing by Frederik “Neckar”:

To me, the acts of investing and building companies are not so different from creating art, striving for innovation, and pursuing athletic achievements. The specifics are quite different. But the struggles are universally human and relatable. They are all stories of people looking for meaning in an unpredictable, complex, sometimes cruel world. [...]

My favorite lens through which to view the stories of investors, entrepreneurs, innovators, traders, and dealmakers is the hero’s journey. I see them all as protagonists who leave the safety of their village, the known world, to embark on a journey. They face danger, navigate chaos, take risks. They find new friends and mentors on the way. Finally, they descend to the depths of the underworld. Their skills and their resolve are tested. To earn treasure, they must slay a dragon. They are on a quest for transformation, for learning, for growth.

Exponent Podcast, Substack Edition

It’s a cliché that writers write about writing, and Substackers probably spend too much time covering Substack, so I won’t take too much space with this one, but I think it may interest you even if you don’t have any plans to start a newsletter.

Ben and James raise a lot of broader points about the nature of the internet and how it is reshaping the old battle lines that have been around for long enough that many had started to assume that they were just laws of nature (spoiler: they weren’t), and the pros and cons that come with the new model.

A good one, I recommend it:

Science & Technology

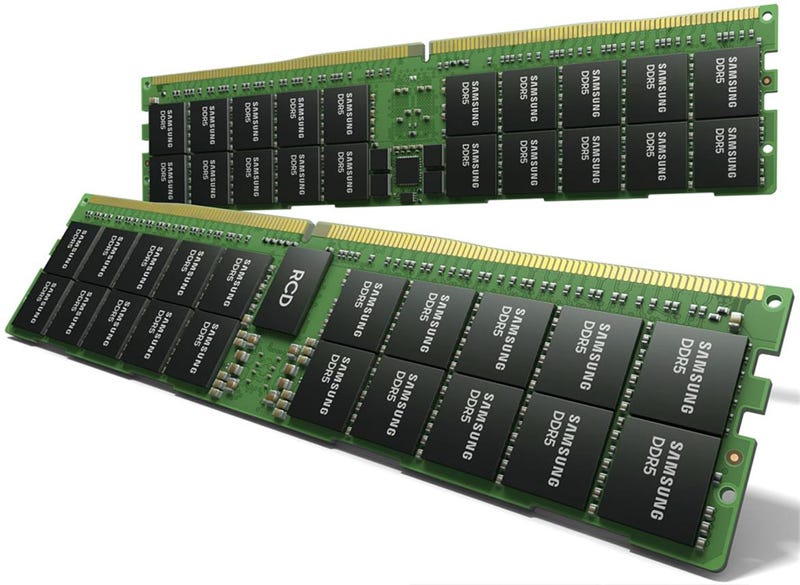

‘Samsung Announces 512GB DDR5 Memory That Is Twice As Fast As DDR4’

Isn’t Technology Amazing?

As we inch closer to Intel's Alder Lake and AMD's Zen 4 architectures (late this year and/or early next, barring any delays), memory makers have started announcing advances in DDR5 memory, which will deliver a big increase in bandwidth. We've even seen some DDR5 module launches. Samsung, however, has managed to separate itself from the pack on announcing what it says is the industry's first 512GB memory module based on high-k metal gate (HKMG) process technology. [...]

According to Samsung, its 512GB DDR5 memory module delivers more than twice the performance of DDR4, at up 7,200 megabits per second (Mbps). [...]

The 512GB capacity comes by way of stacking eight layers of 16-gigabit (Gb) DRAM chips. There's no mention of cost (Source)

If I could bring this info back in time, half-a-terabyte of RAM at 7.2 gigabits/sec would make 12-year-old me go 🤯

Modern “Powers of Ten” + Who Knew Metric Paper Was Interesting

You may have seen the classic 1977 animation video “Powers of Ten” that shows what happens when you zoom down into the microscopic and zoom out into the universe (really well made and mind-blowing for the time).

CGP Grey, who I’ve been a fan of for a long time (for his Youtube videos, but also his podcasts: Hello Internet and Cortex), has made an updated version with modern knowledge and modern graphics, but with a very original starting point that could’ve been a neat video in just itself.

I won’t spoil it here, but I think you’ll like it (and if you don’t have 8 minutes, the video is easy to follow at 2x, and who doesn’t have 4 minutes?).

h/t friend-of-the-show and supporter Will Geffen

OpenAI Updated on the GPT-3 Ecosystem

This autoregressive deep-learning language model with 175 billion parameters made quite a splash when it came out 9 months ago (which in this pandemic seems like both yesterday and 10 years ago, because time has lost all meaning).

The model was made available over APIs, and a whole ecosystem has been building things with it. OpenAI has given an update on some of the ones that stand out:

To date, over 300 apps are using GPT-3 across varying categories and industries, from productivity and education to creativity and games. These applications utilize a suite of GPT-3’s diverse capabilities (and have helped us discover new ones!).

‘01 Call Missed. IED that was defused before the detonation call was received.’

Chilling Image. Source.

Would-Be Suicide Bomber Killed by Unexpected SMS From Mobile Carrier

An unexpected and unwanted text message from a wireless company prematurely exploded a would-be suicide bomber’s vest bomb in Russia New Year’s Eve, inadvertently thwarting a planned attack on revelers in Moscow, according to The Daily Telegraph. The would-be suicide bomber was planning to detonate a suicide belt bomb near Red Square

The Arts & History

Split Screen: The Scene, and How it was Shot

I still can’t embed Tiktok videos, so you’ll have to click here to see it, but trust me, it’s pretty cool:

The choreography needed to get what looks effortless when you don’t know what is going on is impressive. Now I wonder how often actors are running around behind or ducking when a camera passes by in the films/TV shows I’m watching… 🤔

It always surprises me how seemingly simple shots can be composited and you’d never know, like this one.

‘In 1980 the FBI formed a fake company and attempted to bribe members of congress. Nearly 25% of those tested accepted the bribe’

This is the ABSCAM sting operation.

The FBI employed Melvin Weinberg, a convicted swindler, international con artist and informant, and his girlfriend Evelyn Knight, to help plan and conduct the operation. They were facing a prison sentence at the time and in exchange for their help, the FBI agreed to let them out on probation. Weinberg, supervised by the FBI, created a fake company called Abdul Enterprises in which FBI employees posed as fictional Arab sheikhs led by owners Kambir Abdul Rahman and Yassir Habib, who had millions of dollars to invest in the United States. Weinberg instructed the FBI to fund a $1 million-account with the Chase Manhattan Bank in the name of the fictional company [...]

the Abscam operation was re-targeted toward political corruption. Each congressman who was approached would be given a large sum of money in exchange for "private immigration bills" to allow foreigners associated with Abdul Enterprises into the country and for building permits and licenses for casinos in Atlantic City, among other investment arrangements. [...]

The first political figure ensnared in the phony investment scheme was Camden mayor Angelo Errichetti. In exchange for monetary kickbacks, Errichetti told the sheikhs' representatives "I'll give you Atlantic City." Errichetti helped to recruit several government officials and United States congressmen who were willing to grant political favors in exchange for monetary bribes (originally $100,000 but then reduced to $50,000) [...]

The FBI recorded each of the money exchanges and, for the first time in American history, surreptitiously videotaped government officials accepting bribes.

Reading this, isn’t it obvious that this should be done every few years, at random intervals?

Can’t be too predictable and expected, but often enough to keep everyone on their toes…