12: Andy Grove, China Makes Moves on TSMC, and Richard Feynman's Little Sister

Ancient Vulcan curse: "May you be smart enough to understand what is going on, but not smart enough to change it."

Ancient Vulcan curse: May you be smart enough to understand what is going on, but not smart enough to change it. —Steve Randy Waldman

I’ve been keeping an investing journal since 2014. It’s just a text document where I take notes on the things I read, my own thoughts, but also links to sources, excerpts, etc. I try to tag everything by company ticker symbol, so that it’s easy to search for everything I ever wrote about a company, and I also highlight key words and passages so that it’s also easy to skim and see what each section is about.

I’ve found it a great tool. Our memories are very unreliable, and we tend to overwrite what we actually thought with what we thought later, or what we think we thought… So it’s useful to be able to go back a few years and see, in my own words, what I really though about X or Y at the time.

It’s a good way to study successes and mistakes, and even if you don’t go back and re-read often, the very act of selecting things and writing them down commits them more effectively to memory. At least that’s what I found.

So far this year, my journal has 165k words. The past few years I’ve been averaging 300k words per year, so I’ve probably got over a million words since I started.

Maybe in a few years I’ll be able to run a machine-learning algorithm on the corpus and extract some insights..?

Investing & Business

1996 Talk by Andy Grove (One of the best CEOs Ever)

Funny anecdote: Grove mentions that he wanted the title of his classic book ‘Only the Paranoid Survive’ to be titled ‘Strategic Inflection Points’ but his publisher wanted a catchier title.

Duration: 1-hour (sounds good at 1.5x, so 40 minutes). Found via David Lee.

Two Chinese government-backed chip projects have together hired more than 100 TSMC veterans

Speaking of semiconductors…

Quanxin Integrated Circuit Manufacturing (Jinan), better known as QXIC, and Wuhan Hongxin Semiconductor Manufacturing Co., or HSMC, along with their various associate and affiliate companies, are little-known outside the industry. But in addition to employing more than 50 former TSMC employees each, both are also led by ex-TSMC executives with established reputations in the chip world. The two projects are aiming to develop 14-nanometer and 12-nanometer chip process technologies, which are two to three generations behind TSMC but still the most cutting-edge in China. [...]

"Hongxin offered some amazing packages, as high as two to 2.5 times TSMC's total annual salary and bonuses for those people," said a source familiar with the matter. [...]

Taiwan has lost more than 3,000 chip engineers to China, Nikkei reported. [...]

China boasts the world's most new or planned chip plants and is expected to top other countries in chipmaking equipment spending, an indicator of investment for future chip facilities, in 2020 and 2021, according to SEMI, an industry organization

This makes it all the more dangerous that Intel has been having problems and has fallen behind with its own cutting-edge fabbing… There are currently too few bottlenecks for making the best chips in the world, and this important — vital — resource should be spread around more. You can’t have just TSMC and Samsung and ASML basically be the last remaining Jenga blocks at the bottom of the tower, holding together almost everything else.

I think Intel has a move here, if they're smart. They should JV with the hyperscalers (AWS, Azure, GCP) and spin-out their fabs and just go bananas on capex and hiring for a few years to build out the foundation of a contract-fab TSMC rival.

If they can get their ops together and channel Andy Grove a little...

Big Acquisition at Roper: Vertafore for $5.35bn

Vertafore is a “leading provider of SaaS solutions for the Property & Casualty insurance industry”. All-cash deal at a valuation of 9x FWD sales and 18.45x EBITDA. Based on the numbers provided, this company has a 49.15% EBITDA margin (not bad!).

Official press release here. I posted some of my notes in this thread on Twitter.

They also did a $365m bolt-on at Strata, buying EPSi from Allscripts. Someone dug into Allscripts disclosure and found that “The business does about $39 million in revenue and $21 million in EBITDA (unallocated segment in linked document), greater than 50% EBITDA margins. EV/EBITDA of about 18x”. But I haven’t verified those numbers myself.

“Uber CEO says its service will probably shut down temporarily in California”

Uber would likely shut down temporarily for several months if a court does not overturn a recent ruling requiring it to classify its drivers as full-time employees, CEO Dara Khosrowshahi said in an interview with Stephanie Ruhle Wednesday on MSNBC. (Source)

This reminds me of the classic negotiation tactics used in carriage disputes between cable companies and broadcasters. Anyone who has read (and you should!) the book ‘Cable Cowboy’ by Mark Robichaux will be familiar.

Here’s a relatively recent example:

The 2012 dispute between DirecTV and Viacom is an example of a dispute involving a non-terrestrial broadcaster. Viacom's cable/satellite channels, including Comedy Central, Nickelodeon and MTV, were blacked out for some 20 million DirecTV subscribers, who together represented about 20 percent of all U.S. households who subscribed to cable or satellite. DirecTV claimed Viacom was seeking a 30 percent fee hike, about $1 billion over five years. Viacom countered that while its channels represented 20 percent of total DirecTV viewing, the broadcaster received only 5 percent of the distributor's license fees. (Source)

From memory, Cable Cowboy talks about one such dispute where the blacked out channel just had contact info on the screen, asking angry viewers to call the other party in the negotiation and complain to them…

Update: And Lyft may do the same…

Lyft may suspend services in California if the state does not overturn a recent ruling requiring it to classify its drivers as full-time employees, Lyft co-founder and President John Zimmer said on the company’s second-quarter earnings call.

Podcast on the Payment Industry (Goodbye, Cash)

Mawer (“Be Boring, Make Money” — good tagline) has a nice podcast episode on the payment industry. If you are already very familiar with the space, you may not learn much, but for everyone else, it’s a good overview of many of the dynamics and players in the industry (Visa, MasterCard, Adyen, the Banks, Fintech, etc):

Highlights include:

Unpacking why the payments industry is fractured

Visa, MasterCard, and the competitive advantage of the two-way network effect

The payments value chain 101—if our host Rob Campbell bought flowers, what processes need to happen behind that transaction?

Why we should look beyond C2B payments—hint: $200 trillion

Banks, Bitcoin, and fintech—dynamics between incumbents and disruptors

Themes we’re watching: cash-to-card and integrated payments

If reading is your thing, there’s a full transcript here. (Found via Jerry Capital and Talbott — thanks!)

Epic Games Playing Chicken with Apple

Then Apple actually kicked Fortnite off from the App Store!

Fortnite is hitting back with an anti-Apple “new short”, with a graphic that is a parody of Apple’s iconic “1984” original ad for the Macintosh… and filing a lawsuit against Apple.

Basically, it’s full on guerilla-warfare now. Who will blink first?

Science & Technology

Global Phone-Based Earthquake Detection Network

Now that there’s a rapidly increasing number and variety of sensors everywhere, there are many security and privacy challenges that comes with that, but also some opportunities to do cool things. For example, I’ve long wished that we could embed air-quality sensors everywhere to better track air pollution.

Because all smartphones already have accelerometers, it’s possible to create a mesh Earthquake tracking network, and that’s exactly what Google has done:

A few seconds of warning can make a difference in giving you time to drop, cover, and hold on before the shaking arrives. [...]

Starting today, your Android phone can be part of the Android Earthquake Alerts System, wherever you live in the world. This means your Android phone can be a mini seismometer, joining millions of other Android phones out there to form the world’s largest earthquake detection network.

All smartphones come with tiny accelerometers that can sense signals that indicate an earthquake might be happening. If the phone detects something that it thinks may be an earthquake, it sends a signal to our earthquake detection server, along with a coarse location of where the shaking occurred. The server then combines information from many phones to figure out if an earthquake is happening. We’re essentially racing the speed of light (which is roughly the speed at which signals from a phone travel) against the speed of an earthquake. And lucky for us, the speed of light is much faster!

At first, the data will be shared through Google Search, so if you search for “earthquake” or “earthquake near me” you should see this data along with resources on what to do.

Sukhoi Su-57

I have to admit, that’s a decent-looking plane.

The Su-57 is planned to be the first aircraft in Russian military service to use stealth technology. Its maiden flight took place on 29 January 2010 and the first production aircraft are planned to be delivered in 2020. (Source)

AI/ML Impact on Semiconductor Demand

Good newsletter by @FoolAllTheTime:

This is the graph below, which notes that AI compute intensity is doubling every ~3.4 months, while historical Moore’s law is every 2 years.

The red dot is GPT-3 based on their paper, at approximately ~3624 petaflop/s-days.

Kind of hard to summarize or excerpt. I recommend reading the whole thing.

And while we were discussing his article, @FoolAllTheTime also recommended this episode of the Software Engineering Daily podcast, an interview with Scott Stephenson, the CEO of Deepgram, a company that does speech recognition and analysis using end-to-end deep learning.

I particularly liked the last segment where he describes the GPU clusters used to train their models, and the kind of things their algorithms do on the dataset. The amount of computing power required to get high-value out of audio is immense, and makes it clear why Nvidia is an investor in the company.

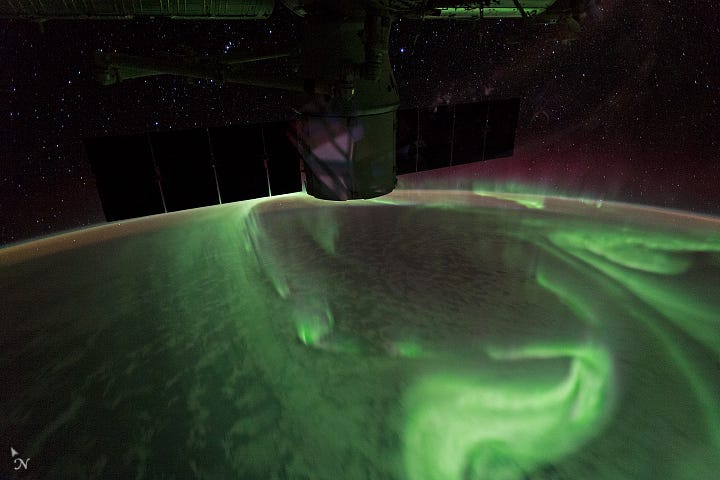

Joan Feynman 1927–2020

Joan Feynman, an astrophysicist known for her discovery of the origin of auroras, died last month, on July 21.

Over the course of her career, Feynman made many breakthroughs in furthering the understanding of solar wind and its interaction with the Earth’s magnetosphere, a region in space where the planetary magnetic field deflects charged particles from the sun. As author or co-author of more than 185 papers, Feynman’s research accomplishments range from discovering the shape of the Earth’s magnetosphere and identifying the origin of auroras to creating statistical models to predict the number of high-energy particles that would collide with spacecraft over time. In 1974, she would become the first woman ever elected as an officer of the American Geophysical Union, and in 2000 she was awarded NASA’s Exceptional Scientific Achievement Medal. (Source)

Looking at her name, you may wonder if she was related to Richard P. Feynman (my oldest son’s middle name is “Feynman” in his honor).

She was his younger sister. I love this anecdote (found via this comment) from the book "A Passion For Science: Tales of Discovery and Invention":

Her pioneering work on these processes led to an understanding of the mechanism responsible for auroras. She found this work wonderful, and her immediate reaction was to tell her brother, who’d first introduced her to these beautiful phenomena all those years before.

But then a second thought crossed her mind. “Richard is pretty smart, and if I tell him about an interesting problem, he’ll find the answer before I do and take all the fun out of it for me.” So Joan decided to strike a deal with him. “I said, Look, I don’t want us to compete, so let’s divide up physics between us. I’ll take auroras and you take the rest of the Universe. And he said OK!” (Source)

What interesting conversations these two must’ve had around the diner table.

The Arts

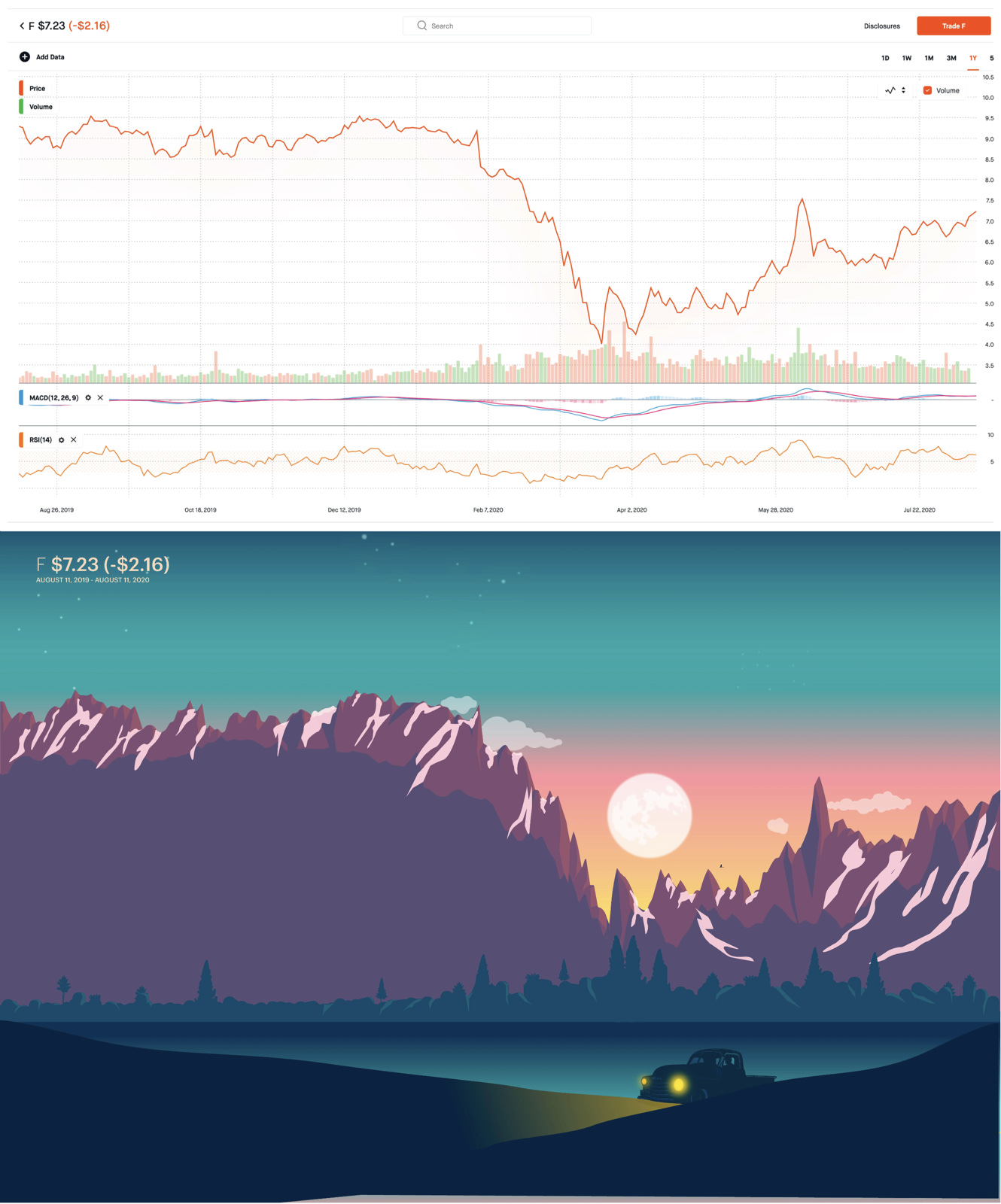

Turning Stock Charts into Landscapes

I’ve been taking Stock Market Chart and turning them into landscape art. An alternative and simple explanation of the pandemic affect these companies. This one a years snapshot of Ford. —LLMOONJ (Source)

Here’s Tesla:

And Exxon is here. Disney. Apple.

Update: You can follow the artist on Twitter @Stoxart, and buy prints here.

h/t MazwoodCap for finding that info.