125: TSMC's Expanding Expansion, Amazon Q1, Spotify, Jack Ma & John Nash, Muji, Berkshire Breaking Nasdaq, Audacity, Age Segregation, and Note-Taking Software

"I mean, if you’re going to kill, you may as well overkill."

It all adds up to normality.

—Greg Egan, Quarantine

(one way to interpret this: when you look at various scientific discoveries, like Einsteinian relativity or quantum physics, you can find it really “weird” that time, electrons, and electromagnetism behave in the way they do, but when you look around, the “normal” world you see is, deep down, governed by these phenomenon. Hence: all these things add up to normality. The “weirdness” is not in the things themselves, but in our perception of them.)

📩 If there’s one thing I’ve got too much of, it’s little projects.

Latest one is to upgrade my email situation. I’m kind of bored of my GMail address, and figured that now that I’m using one of my .com domains (the one for this newsletter), I may as well use it for email too.

(As an aside, when my wife asked me about my day and I said I was thinking about getting a new email address at my own domain, she basically looked at me like I was crazy for caring about such things… Basically, “what’s the point? who cares?”. What can I say, I think it’s nicer ¯\_(ツ)_/¯ )

And if I’m going to do something, I may as well do it in the coolest way that I can.

After some research, I think I’ve settled on using ProtonMail for the back-end, a Swiss-based company that is very security/privacy focused (they also operate a VPN that seems well-rated by some of the security analysts I follow).

Runner ups were: Fastmail and Tutanota.

I mean, if you’re going to kill, you may as well overkill.

🧓🏻 Byrne Hobart with a thought-provoking tweet:

It feels very natural to write that an old person—or old people in the aggregate—are “out of touch” with younger generations. Are younger generations ever out of touch with older ones?

My response was that it’s very much the case.

Our society (at least in the Western countries that I'm familiar with) is very very segregated by age. Most age groups almost never interact in non-transactional ways with people outside their age brackets that aren't family.

How can that possibly be good? Why would everybody you could possibly learn from or be interested in being friends with or do activities with or whatever just so happen to have been born around when you were born?

This is one of the big benefits of the internet — nobody knows you're a dog, and nobody knows you don't belong to the age bracket of the group you’re hanging with.

Ageism is clearly one of the most accepted and invisible-to-most forms of discrimination. I suspect it's one of the things we'll look back on at some point of the future and go "how could they not see it?"

If we do cure the diseases of aging and everybody looks like they’re 30 and doesn’t get visibly older over time (until they get hit by a bus), I suspect we’ll see a lot of that societal stratification change offline too.

🗣 Email from reader Braden Dennis:

Liberty, I don’t even know you from a beautiful satellite and I still read these in your voice. Well done as per usual

That made my day, because this is one of my top goals.

As I said here, #1 goal is to have fun, and if it stops being fun, I’ll just stop. But part of that — if we unpack it — is definitely to write in my real voice, not to create some polished persona or imitate the conventions of the industry or whatever.

So if someone tells me that when they read this stuff, they recognize my voice, that the writing is distinctive in some way, then that’s a nice attaboy.

Trivia: My avatar is a radio-telescope dish from the Atacama Large Millimeter Array (ALMA) in Chile.

📝 Ok, that’s just cool. Timelapse video of someone’s Obsidian notes over time. The emergent connections, the clusters, all very bio-like.

I started experimenting with Obsidian this week, learning the hotkeys, the feature-set, setting up a vault and trying to figure out how I could use it for some of my investment notes.

I’m very impressed so far. I kind of wish it was more WYSIWYG-based rather than pure markdown, but I can also see the power of having everything stored as local plain-text files that can be opened in anything. In 10 years, I can be sure everything will still be accessible.

I also loved how this video explained how the way certain tools are shaped will shape your work in them.

If you pick a tool where what you’re trying to do is aligned with how the tool is built, it’ll be like water flowing downhill, but if you’re going against the current and fighting the tool’s design, you’ll either have unnecessary friction, or the tool will win and you’ll end up doing what the tool is nudging you to do rather than what you’d like to actually do.

Ideally you realize this upfront before you have too much time/data invested in a system and it’s impossible to get out.

Having used Evernote, Ulysses, and Bear a bit, and seem plenty of videos about Roam and Obsidian, I think the classification above makes a lot of sense.

No app is just one thing, so you can do all kinds of stuff in each, but if you’re trying to do “connecting” in Bear, you’ll have a much more difficult time than in Roam or Obsidian.

Now I just have to figure out if the outliner-file/folder-free format of Roam works best for me, or the more architected structure and text-friendly format of Obsidian.

Investing & Business

Roaming Investor

Speaking of note-taking-apps/knowledge systems, this post by Kyle Harrison on how he uses Roam for his investing research is quite interesting.

I liked his intro:

Investing, in simplest terms, is taking one finite resource and trying to allocate it to maximize for an ideal outcome. Whether you're allocating money, time, energy, or attention. Everyone is an allocator of something. Investing is an opportunity to evaluate what you believe. To gain conviction. And then to act on that conviction.

The post goes into a fair amount of detail on how he uses various features of Roam to structure his notes on companies/research, and to be able to keep everything connected and discoverable over time as he looks back.

To see some of what he’s talking about in action, you can check out this video:

There’s more videos by Kyle here.

TSMC’s U.S. Expansion Plans are… Expanding

TSMC announced in May 2020 it would build a $12 billion factory in Arizona [...]

TSMC is setting up a 12-inch wafer fabrication plant in Phoenix, and the facility is expected to start volume production in 2024 [...]

The initial fab is relatively modest by industry standards, with a planned output of 20,000 wafers - each of which contains thousands of chips - every month using the company's most sophisticated 5 nanometre semiconductor manufacturing technology. [...]

"The United States requested it. Internally TSMC is planning to build up to six fabs," the person said, adding that it was not possible to give a timeframe. [...]

A second person familiar with the plans said the company had already made sure there was enough space for expansion when they obtained the land for the first plant.

"It's so they can build six fabs," the source said.

The third person, from a TSMC supplier involved in the Arizona project, said TSMC had told them the plan was to build a total of six fabs over the next three years. (Source)

It looks like they have three sources saying 6. The question is, how big would these fabs be, what node size, and how fast will they start shipping.

In any case, it’s certainly good news. Gotta start somewhere if the world is to become less brittle in its dependence on one company in one location.

Highlights from Amazon Q1

Just a few things I noticed:

Net sales increased 44% to $108.5 billion in the first quarter

Operating cash flow increased 69% to $67.2 billion for the trailing twelve months

That’s just bonkers at that scale.

Our [third party] seller services revenue increased 60% on an FX-neutral basis year-over-year in the first quarter, growing significantly faster than online stores revenue. Third-party units represented 55% of our total paid units in Q1, up from 52% in Q1 of last year. [...] Revenue growth in our international segment grew 50%

Over the past 12 months, Prime Video streaming hours were up over 70% year-over-year.

WS offers 80 availability zones across 25 geographic regions around the world. And we've announced plans to launch 15 more availability zones in 5 more regions.

These zones surely aren’t all the same size, and I suspect that new ones are bigger on average than the oldest ones… 15 new ones is a growth of 18.75%.

Hours watched on Twitch nearly doubled year-over-year in the first quarter, and we now average more than 35 million daily visitors.

we expect to incur approximately $1.5 billion in COVID-19-related operating costs in the second quarter.

A reminder that current profitability is depressed because of the pandemic (though it’s also improved because of the demand boost).

On last-mile delivery and going from batch to continuous flow:

We actually think our cost right now is very competitive with our external options, and we measure that very closely. It certainly gets better with demand and amortization and route density, etc. [...]

the ability to control the whole flow of products from the warehouse to the end customer... normally was a batch process where we would hand off a large batch of orders to a third party once a day, let's say, to a continuous flow process, where we continually have orders leaving our warehouses 5, 6 times a, day going through middle mile and then to final delivery, either through our AMZL drivers or DSP partners. [...]

gives us a lot of ability not only to control the flow of the product, but also flow of information. We're seeing a lot of progress in that area. And I think you'll see it, too, as a customer where you're starting to get more precise estimates of delivery.

AWS:

the backlog growth, just to give you the figures for March 31, it's $52.9 billion [...] that's up about 55% right now.

Advertising:

We're using new deep learning models to show more relevant sponsored products. We continue to improve the relevancy of the ads being shown on the product detail pages. And we've seen rapid adoption of the video creative format for sponsored brands

It’ll be interesting when they break out advertising from “other” like they did with AWS a few years ago, to see the margin performance.

I mean, “other” is already mostly advertising (growing at 73% last Q), but I bet advertising is growing faster than Echo and Kindle, and has much better margins, so it’s even better than it seems when looked at bundled with these.

🔥 Muji Unleashed 🔥

Friend-of-the-show Muji (💚💚 — he gets two hearts, don’t be jealous) is at the very top when it comes to thinking, understanding, and explaining what's going on with many of the most interesting hhhypergrowth (gotta have those 3 "H"s) tech companies out there. Pretty much in a league of his own, along with his brother-from-another-mother Peter Offringa.

Last night Muji made a big announcement:

I have spent the last few months extracting myself out of my beloved "last job ever," after working as a lead data architect for a national energy science lab for the past 7 years.

I am now dedicating myself towards turning HHHYPERGROWTH into an investment research service. That's right - I'm going premium.

Big congrats to him on the move, and I’m sure that his awesome site will now be even awesomer with his full-time attention. Go over and sign up right now!

Disaster Girl NFT ¯\_(ツ)_/¯

I don’t even know what to think of this stuff anymore. I mean, I guess it’s great that a girl who’s childhood photo became a famous meme made money from it…?

Ben Lashes, who manages the Roths and stars of other memes including “Nyan Cat,” “Grumpy Cat,” “Keyboard Cat,” “Doge,” “Success Kid,” “David After Dentist” and the “Ridiculously Photogenic Guy,” said his clients had cumulatively made over $2 million in NFT sales.

So people who’s photos became famous memes have managers/agents now? What next, they unionize? Or maybe the Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA) will have them..?

The world sure is getting weirder by the day…

Interview: Alex Morris aka The Science of Hitting on Spotify

Friend-of-the-show and supporter (💚) Andrew Walker did a good interview with Alex Morris that focuses mostly Spotify:

This is probably a good opportunity to re-iterate my #1 wish for the space:

Data portability between music streaming platforms. As far as I know, there’s still no easy way to switch from one to the other. There’s apps that can help you migrate your playlists, but not your whole album/song library and your metadata.

This makes it almost impossible for a big music fan to switch without spending days or weeks manually porting things over (I just looked, I have 3,381 albums and 32,461 songs in my library, and I still haven’t ported over everything I have ripped from CDs on another computer).

If regulators want to increase competition and dynamism in the space, this is the thing to put pressure on.

Jack Ma & Nash Equilibrium

China’s most outspoken billionaire has gone silent. [...]

“Jack Ma amassed far too much power, this is understood by everyone in China,” says Song Qinghui, an independent economist who contributes to Chinese state media. “Alibaba’s influence grew far too great. It got to the point where it had to be brought under control.” (Source)

This situation reminds me of of the scene in A Beautiful Mind when John Nash has an epiphany about what would become known as the Nash Equilibrium.

In this case, in China, the goal now seems to be not to go after the number one spot in wealth/influence/power, as it’s too dangerous.

After what happened to Ma, will everybody try to stay just below the very top strata so that there’s always someone else to attract more attention and draw the heat?

It’s kind of like when a car is speeding, and they see another car zoom by much faster; they can feel safer knowing that if there’s a police car, it’ll go after the faster car and not them.

Interview with William Barnes, co-founder of In Practise (Investment Research Platform)

In case you missed it yesterday, 𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #𝟜 is an interview with the co-founder of a very interesting business that helps investor learn directly from operators.

It may be a little meta to interview an operator who’s business is interviewing operators, but hey, I’m a fan of recursion (I’m a fan of recursion (I’m a fan of recursion (I’m a…))

Berkshire’s A Shares are Y2K’ing NASDAQ

Nasdaq and some other market operators record stock prices in a compact computer format that uses 32 bits, or ones and zeros. The biggest number possible is two to the 32nd power minus one, or 4,294,967,295. Stock prices are frequently stored using four decimal places, so the highest possible price is $429,496.7295.

BRK.A currently trades at $421,420.00. uh-oh

How about they duct tape this one and just lop off a decimal or two from BRK.A. I’m guessing that when a single share trades for the price of a house, few traders care about ten-thousandths of a penny.

Do-Nothing Investing™

Science & Technology

SARS-CoV-2: Lineage prevalence in United States

Here's the lineage (variant) map of the US through the pandemic, based on 360,000 sequences. Dark blue is B.1.1.7 that became dominant throughout. The only other major variant competing now is P.1 (Brazil) at 2% prevalence

Good illustration that with exponential processes, something that sustainably grows faster than something else will entirely take over given enough time.

Interview: Paul Offit, M.D. (expert in virology and vaccine development)

Everybody must be getting pretty tired of hearing about viruses and vaccines at this point, but sadly, there’s so much misinformation (malicious or accidental) floating around that it’s not a bad idea to arm yourself with quality knowledge to inoculate yourself against it (how apt a metaphor!) and to be able to answer questions that people in your social circles may have.

Here’s your dose, Peter Attia with another great interview:

I thought the part around 15 minutes in was very good. It explains what RNA is and whether it’s even possible for it to interact with DNA, and then at all the problems with vaccines in the past. The tl:dr is that RNA simply can’t mechanically interact with DNA and change it, and RNA itself doesn’t stick around for very long, and that past severe side-effects of vaccines have all taken place within weeks/months, and simply don’t show up years later.

This makes sense given everything in a vaccine is degraded and disappears from your body pretty rapidly, and your immune system reacts to stuff all day, every day, and a vaccine is just one more thing, so whatever is left behind as immune memory isn’t that different from business as usual.

Audacity Acquired by Muse Group

This is a bit niche, as I’m guessing not many of you play around with audio editing tools. But if you do, you probably know Audacity, the cross-platform, free, open-source tool used by millions.

It was recently acquired by the Muse group. ‘Tantacrul’, a musician and UI/UX designer who’s now in charge of the project, made a great video giving a good overview of the history of its development, and where it may go in the future:

The Arts & History

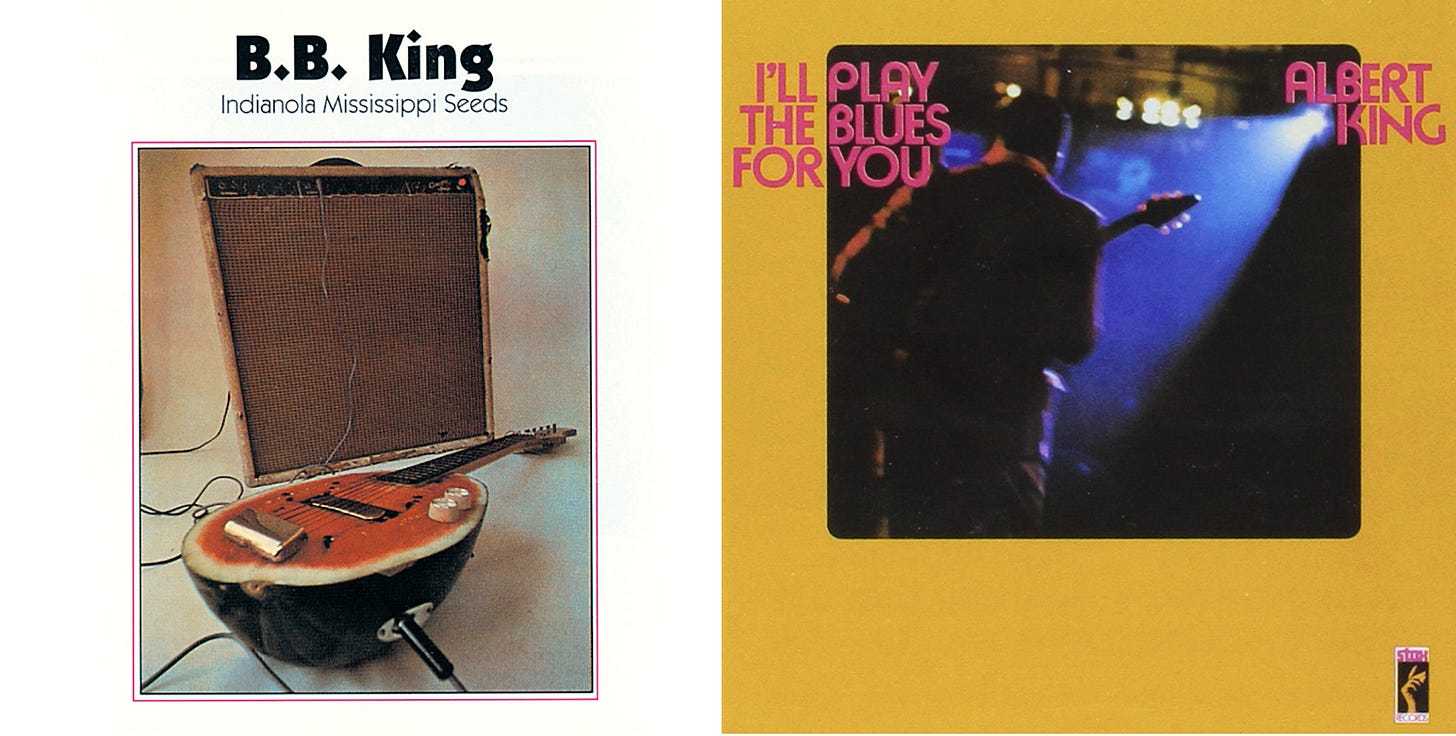

Let’s do some Blues Today (cuz why tf not?)

Here are the two songs that I want you to encourage to rock to today (blues to? what’s the verbiage for listening to blues and feeling it?), from two Kings:

B.B. King — You’re Still My Woman (Apple Music | Spotify | Youtube)

Albert King — I'll Play the Blues for You (Apple Music | Spotify | Youtube)