130: ASML's Manhattan Project, CAGR, Apple M1 vs Intel, GameStop, Indonesia, SemiconductorLand, DarkSide Ransomware Gang Disbands, and Focus matters a lot

"Focus matters a lot"

Facts do not cease to exist because they are ignored.

—Aldous Huxley

🤔 The modern equivalent of the Manhattan project took place in large part in the Netherlands, and it’s ASML’s extreme ultra-violet photo-lithography (EUV) systems and the 15+ years and incredible science & technology firepower it took to develop them.

🛀 I don’t really know how I know a lot of what I know, and it really bugs me.

📝 If you’re still following my Obsidian adventures, I’m still learning new ways in which it’s awesome (this video about plugins was very helpful — if you’re looking for an introduction to Obsidian, this series of videos is great).

I made this timelapse of my graph after about one week of use:

I think it’s very cool to see the connections pop up as I add notes and connect them (the timelapse makes it look like all the nodes are there from the start and then get connected, but they were created over time. They probably did it that way because it looks cooler to start with that ball of dots that gets organized into a complex system).

If this is after just a week, can't imagine what it'll be like in a year…

🐙 Friend-of-the-show and supporter (💚 🥃) Rishi Gosalia had a good tweet recently that reminded me how to think about competition from the giants (Apple, Google, Amazon, Microsoft, etc).

These are not monolithic entities. Not everybody inside those companies are the “A team”.

Sure they have lots of cash, but money is just one of many ingredients when it comes to running a successful business (and sometimes it can hurt if it keeps you fat and lazy, while lack of it can make you a lean, mean, killing-machine).

So when some 800lbs gorilla starts competing against a 20lbs Dachshund, a lot of people’s mental picture will be exactly that (800lbs against 20lbs), but in reality, a lot of the time, if the space where this competition is taking place isn’t one of the things at the top of the priority list of the gorilla, it’s more like — in Rishi’a words — “[Daschund] vs. a poorly funded startup with mediocre talent at best and high turnover within [Gorilla].”

Except that the startup is nimble and moves fast and the “startup within the big co” may have some of the disadvantages of BigCos (bureaucracy, centralized decisions, etc).

It’s probably why even companies with a reputation for entering new verticals and being ruthless competitors with endless resources will, in practice, rarely really kill everyone else and dominate.

Focus matters a lot. So Facebook Dating hasn’t hurt Match too much, Amazon isn’t killing the grocers and pharmacies yet, Microsoft hasn’t crushed Sony and Nintendo in gaming, Prime Video isn’t quite the existential threat to Netflix or Apple Music to Spotify (despite its many unfair structural advantages/orthogonal biz model), etc.

Focus matters a lot

Focus matters a lot

Focus matters a lot

Focus matters a lot

Focus matters a lot

(I just thought you’d imprint on it more this way)

🇮🇩 Indonesia has over 270 million people, and yet I know almost nothing about the country. I’ve got to be missing out on a lot of good stuff…

I wonder who’s the Indonesian musician/band that I’d enjoy the most, if I only knew about them.

The novel that would blow my mind, the great Indonesian thinkers and entrepreneurs that I’ve never heard about, the Indonesian film or TV series that would stick with me for a long time, the visual artist that is doing amazing and unique things that I’ve never seen…

This isn’t so much about Indonesia as about the vastness of humanity, and how most of us are barely scratching the surface of what’s out there.

Don’t be bored, dig in new places.

🌏 ⏱ Days are too short on our planet. I wish they were longer…

💚 🥃 I figure that the price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month full of eclectic highlights and investing/tech analysis.

The entertainment has to be worth something, but for those that care most about the bottom line:

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 20 seconds:

Investing & Business

Today, Mr. Bathgate will be your tour guide as we journey across the magical world of SemiconductorLand 🧙♂️

This could go in either the science of investing section, but I’ll leave it here, because it’s prime real estate.

I really enjoyed this interview of friend-of-the-show and supporter (💚🥃 ) Jon Bathgate by John Mihaljevic (who I feel like I’ve known from a distance forever, as one of the long-time pillars of the investing community, but our paths have never really crossed online):

What do they cover in this convo? What don’t they cover!

There’s some stuff on ASML, AMD, Cadence Design Systems, Intel, Lam Research, Microchip Technology, Micron, NVIDIA, Synopsys, TSMC, and Texas Instruments (arranged in convenient alphabetical order).

I like that Jon talked about that last one, TI. One of my fave semi companies.

I think it often gets overlooked because it's like 500 years old and nobody outside of the industry really understands what they really do, which is why you constantly hear about that one consumer product (the TI-84 calculator!) if you talk to a normal, sane, not polished-sand-crazy person about them.

-Oh, they make *analog* chips... analog, you mean like vinyl?Yes, exactly. These chips give a warmer sound than digital, just ignore the crackle 🙄

‘DarkSide Ransomware Gang Quits After Servers, Bitcoin Stash Seized’

Wow! Wasn't expecting that, which is kind of sad that swift action after a large international crime is remarkable in itself.

The crime gang announced it was closing up shop after its servers were seized and someone drained the cryptocurrency from an account the group uses to pay affiliates.

“Servers were seized (country not named), money of advertisers and founders was transferred to an unknown account,” reads a message from a cybercrime forum reposted to the Russian OSINT Telegram channel.

“A few hours ago, we lost access to the public part of our infrastructure,” the message continues, explaining the outage affected its victim shaming blog where stolen data is published from victims who refuse to pay a ransom. The outage also took down its payment server and those that supply its distributed denial-of-service feature, which is used to turn up the heat on victims who balk at paying. [...]

“Also, a few hours after the withdrawal, funds from the payment server (ours and clients’) were withdrawn to an unknown address.” [...]

Affiliates also will be required to get approval before infecting victims.

The new restrictions came as some Russian cybercrime forums began distancing themselves from ransomware operations altogether. (Source)

I don’t know how much of this is true, and how much is them throwing a smoke bomb on the ground and trying to vanish.

I mean, are they really this magnanimous or did they just fly too close to the sun and now they are trying to lower the heat:

DarkSide organizers also said they were releasing decryption tools for all of the companies that have been ransomed but which haven’t yet paid.

In any case, until there are arrests, the people responsible are still on the loose and can just rebrand as something else and keep on their crimin’ ways.

Update: Elliptic tracked down the Bitcoin wallet used by DarkSide:

This wallet received the 75 BTC payment made by Colonial Pipeline on May 8, following the crippling cyberattack on its operations - leading to widespread fuel shortages in the US.

Our analysis shows that the wallet has been active since 4th March 2021 and has received 57 payments from 21 different wallets. Some of these payments directly match ransoms known to have been paid to DarkSide by other victims, such as 78.29 BTC (worth $4.4 million) sent by chemical distribution company Brenntag on May 11. [...]

In total, the DarkSide wallet has received Bitcoin transactions since March with a total value of $17.5 million. Ransoms associated with previous attacks were paid to other wallets.

Ireland’s Healthcare Service Under Cyber-Attack

While on the topic of cyber-attacks, this one on the healthcare system in Ireland seems pretty bad:

A cyber attack on Irish health service computer systems is "possibly the most significant cybercrime attack on the Irish state", a minister has said. [...]

The health service has temporarily shut down its IT system to protect it after the attack. [...]

The National Cyber Security Centre (NCSC) has said the HSE became aware of a significant ransomware attack on some of its systems in the early hours of Friday morning and the NCSC was informed of the issue and immediately activated its crisis response plan. [...]

A number of hospitals in the Republic of Ireland are reporting disruption to services. (Source)

‘U.S. senators close to announcing $52bn chips funding’

Speaking of polished-sand:

A group of U.S. senators are close to unveiling a $52-billion proposal Friday that would significantly boost U.S. semiconductor chip production and research over five years sources briefed on the matter said. [...]

Sources said there remains at least one sticking point over whether to include a provision on labor rates.

The chips funding is expected to be included in a bill the Senate will take up next week to spend more than $110 billion on basic U.S. and advanced technology research to better compete with China. [...]

The draft summary says it would include $39 billion in production and R&D incentives and $10.5 billion to implement programs including the National Semiconductor Technology Center, National Advanced Packaging Manufacturing Program, and other R&D programs. (Source)

What that Track Record CAGR Probably Hides…

Good reminder via friend-of-the-show and extra-deluxe supporter (💚💚💚💚💚 🥃 ) Byrne Hobart:

It's practically an iron law in finance that time-weighted returns are higher than dollar-weighted returns: a fund that performs well will raise more money, and that subsequent performance won't necessarily be as high as the performance that got them all that attention in the first place. (There are investors who have a good lifetime track record but generated negative lifetime returns in dollars because they peaked in assets under management at the worst possible time.)

It’s something I used to hear about a lot more in my early days learning about investing, reading all those books about low-cost investing.

They often gave the example of — I think — the Magellan Fund, and how it had a great track record, but that most dollars in the fund didn’t benefit from it and came near the top.

Interview: ‘Jesse Livermore’ (Podcast)

Another very interesting conversation by friend-of-the-show and supporter (💚🥃) Jim O’Shaughnessy with bona fide genius known as Jesse Livermore (if you don’t believe me about the genius part, go read his stuff at Philosophical Economics).

I like the part about intrinsic value (what would you pay for something if you could never sell it, just bequeath it to your heirs) vs transactional value (which is where the speculative value of something comes from — what you think someone else will pay you for it), and how that applies to crypto-currencies. It’s a simple, but powerful model.

Like Jesse, I’ve long been of two minds about crypto.

I’ve been interested by cryptography since the late 90s (OGs will remember the era of encryption being classifieds as munitions in some US export law and browsers outside of the US having weaker 40-bit encryption, and the PGP folks publishing their source code in a paper book to be protected by the 1st amendment) and so the technical underpinnings of blockchain have been an interest of mine since around 2013-2014, iirc.

But I’ve been disappointed by how few real-world problems are being solved by distributed blockchains (even fewer by private blockchains), at least in relation to the amount of attention and wealth in the space that comes from speculation (and building products that allow you to speculate more easily or in more leveraged ways).

I like people that solve hard problems and do cool things that make the world a better place. Maybe crypto will do that, but so far, I’m not seeing a ton of it. Would love to be proven wrong. And yeah, it’s cool to have digital money, but govt-backed currencies are pretty much digital too and nothing says fees & delays on transactions/transfers couldn’t be reduced to almost nothing — it’s not a forever technical limitation of that system, but rather is a legacy thing that may change over time through regulation or competitive pressures.

What I’m seeing is once people own some crypto coin, they immediately have an incentive to convince others to buy it, since increasing demand for a scarce asset should increase its value; so the thing has kind of a built-in decentralized marketing function that is very effective at creating an army of evangelists who will recruit others and make all kinds of claims about it. This greatly decreases the signal/noise ratio and makes it even harder to figure out what’s interesting and what’s just made up BS.

Anyway, this is kind of a tangent… The convo with Jesse is very interesting, and only a small part of it is about crypto. Check it out.

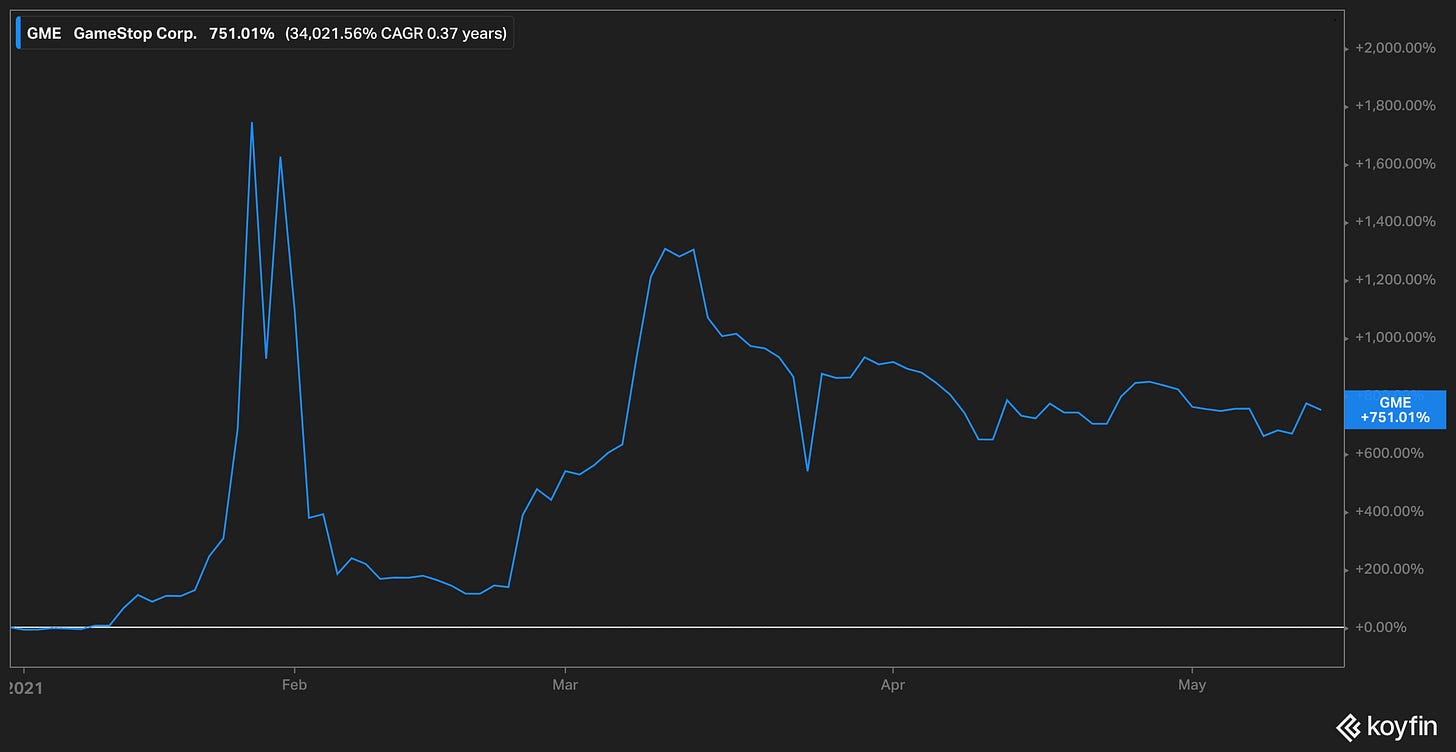

So GameStop is still up 751% YTD…. ¯\_(ツ)_/¯

Science & Technology

Real-World Example of what doing UI/UX/Product Thinking Is Like

If you've never thought too much about product/UX/UI design, I think watching this video by Jason Fried about the email service that his company created is a good exposure to the kind of thought process that goes into it.

Personally, I love thinking about that stuff and can’t help try to improve any website or software that I use, if only in my head.

The video is not the whole creation cycle, because he’s talking about the end result and why it’s the way it is — you don’t get how they got there and the permutations they played with to arrive to that point, or even just (re)discovering what’s bad about the old ways of doing things, because we become blind to them over time — but I still think it’s very instructive.

Apple M1 iMac vs Intel iMac Benchmarks

I wrote about Apple’s new M1 iMac in 𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #𝟛 (among other editions).

Note that this is the low-end iMac, based on the same chip as the Macbook Air, low-end Macbook Pro, and Mac Mini. I expect a faster iMac Pro to come out with a beefier M1X or M2 chip, along with the rest of the higher-end lineup of Macbook Pros.

Here’s how these low-end M1 iMacs compare to the Intel versions of the iMac that Apple sold until recently, via the Geekbench numbers:

In single-core results the M1 iMac is:

78% faster than the Intel Core i3 21.5-inch iMac

42% faster than the Intel Core i7 21.5-inch iMac

In multi-core results the M1 iMac is:

124% faster than the Intel Core i3 21.5-inch iMac

16% faster than the Intel Core i7 21.5-inch iMac

That’s impressive in these days of relatively modest CPU improvements from one generation to the next.

The benchmark results indicate that the M1 iMac operates with a base CPU frequency of 3.2GHz.

Clock speed isn’t insane or anything, they truly got the speed improvements via better architecture and some specialization to target Mac workloads (ie. common low-level OS operations are particularly fast).

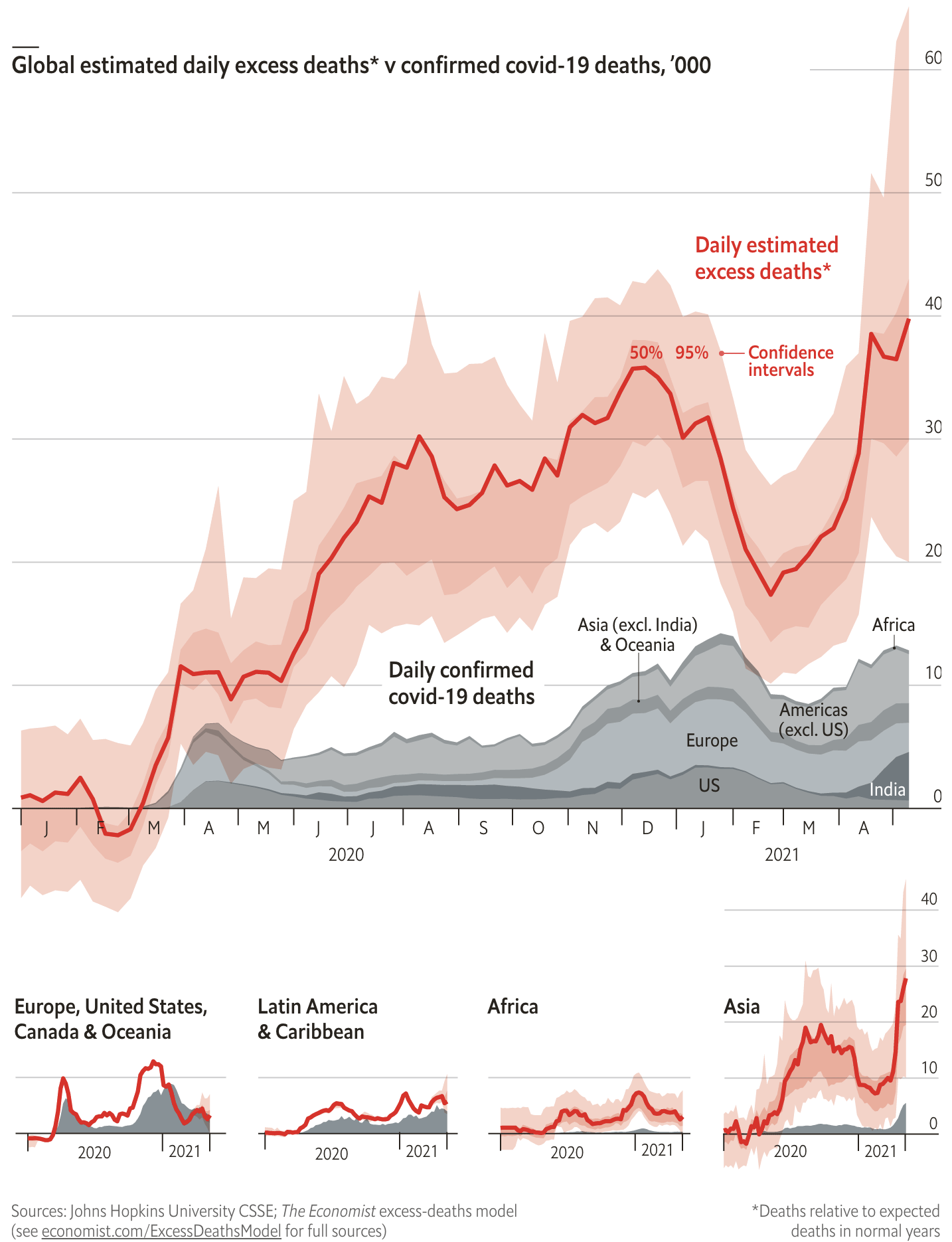

Global ‘excess deaths’ vs ‘confirmed COVID-19 deaths’

It’s not a cheery topic… Over very large numbers, random variations tend to cancel each other out and things become a lot smoother and more predictable. Kind of like how the atoms in a gas are all bouncing around chaotically, but if you zoom out enough, the gas will behave in very predictable ways.

Our planet’s population is kind of like that when it comes to births and deaths. This is why we can look at how many ‘excess’ deaths are over what we’d expect to have seen in a normal year to estimate the impact of the pandemic (hopefully controlling for factors like the fact that when you try to stop a high R0 virus, you basically stop transmission of lower R0 viruses like the flu, so there are fewer flu deaths than usual, etc).

Global estimates have used the official numbers, despite knowing that the figure—currently 3.3m—surely falls well short of the true total. [...]

This work gives a 95% probability that the death toll to date is between 7.1m and 12.7m, with a central estimate of 10.2m. The official numbers represent, at best, a bit less than half the true toll, and at worst only about a quarter of it.

Remember that the pandemic isn’t over, even if some places are doing a lot better thanks to the vaccines, and the situation in places like India and Brazil is especially tragic. Source.

Correlation ≠ Causation, but…

In the words of Randall Munroe of XKCD:

Correlation doesn't imply causation, but it does waggle its eyebrows suggestively and gesture furtively while mouthing 'look over there'.

‘Air Pollution Linked to Increased Mental Health Outpatient Visits’

The findings, which were recently published in the journal Environmental Research, stem from nearly six years of outpatient visits data collected at two major hospitals in Nanjing, China — a heavily polluted major city in China. After comparing the numbers with the amount of particulate matter found in the air every day, researchers discovered that visits were generally higher when the air quality was particularly poor. [...]

Lowe and her collaborators decided to focus on particulate matter — small bits of soil, organic compounds and liquid — because it poses the biggest danger to human health. These micron-sized specks of dust can rip through lung tissue and even enter the bloodstream, through which they can influence mental health. (Source)

The Arts & History

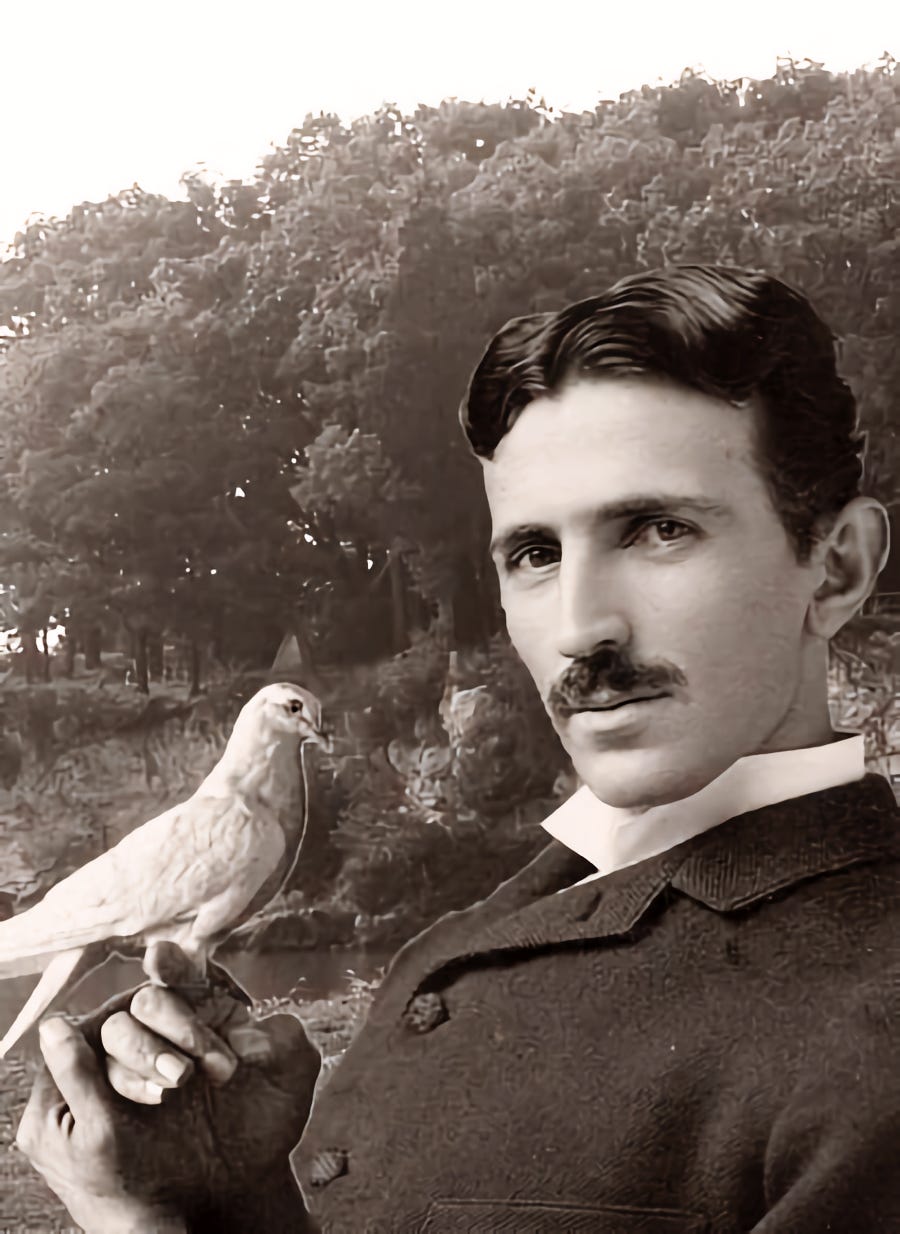

Nikola Tesla’s Avian Love, Weird History Trivia Edition

Weird that both names of this man are now associated with very controversial companies… What would he think of this?

Anyway, here’s some fun trivia on this epochal genius:

Tesla walked to the park every day to feed the pigeons. He began feeding them at the window of his hotel room and nursed injured birds back to health. He said that he had been visited by a certain injured white pigeon daily. He spent over $2,000 to care for the bird, including a device he built to support her comfortably while her broken wing and leg healed.

Tesla stated:

I have been feeding pigeons, thousands of them for years. But there was one, a beautiful bird, pure white with light grey tips on its wings; that one was different. It was a female. I had only to wish and call her and she would come flying to me. I loved that pigeon as a man loves a woman, and she loved me. As long as I had her, there was a purpose to my life.

Tesla's unpaid bills, as well as complaints about the mess made by pigeons, led to his eviction from St. Regis in 1923.

¯\_(ツ)_/¯

Oh, and also:

Focus matters a lot

Focus matters a lot

Focus matters a lot

Focus matters a lot

…

Interview: ‘Jesse Livermore’ (Podcast)

That conversation with Jesse is really good about Bitcoin, society and economics. Very thoughtful and thought provoking!

Jesse's ability to look forward through something and then invert it backwards... his process of thinking is worth observing...

I think...... Focus matters a lot!!!