155: The Microsoft Inside Apple, Invidia (not a typo), ByteDance IPO, the REALIST Tech Stack, David Sacks, India's Coal, Richard Branson, Hugh Jackman, and The Office

"It’s not the Blue Checkmark"

In business, where there’s mystery, there’s margin.

—Peter Kaufman

💵 🏡 👨👩👧👦❓If you could press a button, and it meant you made 10x as much money from now until retirement, but you only got to see your family and friends about 20% as much as you would if you hadn’t pressed the button, would you press it?

A lot of you will quickly and answer “no”, with a very definitive tone, or at least think they know what they would answer.

The thing is, this is a trick question.

I’m pretty sure many of you reading this have pressed that button. You may not have realized it when you did, and the numbers may not be exactly the same, but that high-powered job that requires a long commute and crazy hours on and off the clock may be the equivalent of this button.

If this is you, just make sure that you pressed the button with your eyes fully open, and that you don’t come to regret it later. There’s no “rewind” button, there’s no do-overs.

I recommend that you — that everybody — at least makes a deep effort to learn about these other buttons called “Enough” and “I changed my mind, sunk costs don’t matter, from now on I’m going in a different direction”.

🏁 In the totally arbitrary numbers category based on how long it takes a rock to spin around a big ball of hydrogen undergoing nuclear fusion, July 20 is the one-year anniversary of this boat, and we’re pretty close to 5,000 total subs (4,832 right now — 4% are paid supporters (💚🥃), 96% are free (🕸).

Goes to show how forecasts for things you haven’t done before can be tough. A year ago I thought it’d be great if I could get 1,000 aviators to fly by.

I guess I’ll take being wrong in that direction rather than the other ¯\_(ツ)_/¯

🦻🏻Peter Attia has a good piece about hearing protection/preventing hearing loss.

Not something I think about often, or see mentioned much, but I think it’s worth a quick reminder to follow best practices, because it may not seem like a big deal now, if you have good hearing, but you may regret it later.

I installed the Decibel X app on my phone.

It seems to have decent free functionality, and has both an instant meter and a dosimeter so you can see your exposure over time (ie. at a rock concert or whatever). Attia’s point about how hard it is to estimate the decibel level without tools and total exposure is important.

I sure am glad today that, unlike some of my friends, I wore earplugs at most of those super-loud underground metal shows when I was a teenager…

💚 🥃 I figure that the price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month full of eclectic ideas and investing/tech analysis.

The entertainment has to be worth something, but for those that care most about the bottom line, there’s also optionality:

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 on mobile with Apple/Google Pay):

Investing & Business

The Microsoft Inside of Apple (and pieces of other stuff)

Over its history, Apple has mostly chosen to monetize its software via hardware.

Partly because both are integrated together, but mostly because consumers are much more ready to pay for hardware than software (software is easier to sell to enterprises, because they can calculate the ROI — consumers usually don’t or can’t do that. Apple used to sell OS updates, but they made them free years ago because there were more benefits to having a less fragmented OS/API base).

Everybody knows that what makes software have good economics is that you only have to build it once, and then you can sell ♾ copies with almost zero marginal costs.

Well, that works in reverse.

Even if Apple doesn’t ship as many units as Microsoft, it’s still as hard to build an operating system. In fact, it has to build multiple operating systems (MacOS, iOS, Watch OS, iPad OS, etc — lots of shared code, but still), a productivity suite (Pages, Numbers, Keynote, similar to MS Word, Excel, and Powerpoint respectively), and a bunch of other apps and services, like a web browser (Safari, and the underlying Webkit engine, similar to Google’ Chrome), email clients, note apps, etc.

So regardless of how many copies you ship, it’s just as hard to build all these things. Or rather, it’s not easier because you ship fewer copies (you just make less money per unit of effort).

That’s why I like to think that inside Apple, there’s a pretty big chunk of Microsoft (OSes, productivity apps), Facebook (iMessage is a gigantic messaging app, not that dissimilar to Whatsapp or Messenger), Google (Safari similar to Chrome, iCloud Photos similar to Google Photos), Spotify (Apple Music, iTunes), iCloud storage similar to Dropbox, Final Cut Pro is kinda like Avid’s video editor, etc.

I’m not saying that these things are all equally as complex or good or whatever as their counterparts, but to build them certainly requires a similar order of effort and resources.

ie. Amazon Music has a lot fewer subs than Spotify, but that doesn’t mean it was easy to build Amazon Music.

I wish that when people thought of Apple, the software part came to mind more easily. Sometimes it feels a bit like how when people think of Amazon, the retail part is much more available to mind than the giant AWS part.

Apple’s software is probably providing more of the value and differentiation to customers than the hardware anyway, and it’s the real beating heart of the company, IMO.

Here’s a thought experiment: Ask an Apple customer if they’d rather run MacOS on a high-end non-Mac laptop, or run Windows on their Macbook Air? Ask them if they’d rather run iOS on a high-end Android phone, or if they’d rather run Android on their iPhone hardware..?

I suspect that the answers will heavily skew in favor of the software ecosystem, even if the hardware is also very important (the ratio between the two changes over time, btw… When Windows was at its worse *cough* Vista *cough* OS X was an even bigger differentiator, today with the M1, the hardware may be on the upswing…).

ByteDance IPO and China Trying to Fence Unicorns In

In edition #154, I quickly mentioned ByteDance’s scrapped plans for an IPO because of “security concerns” (similar to what happened to Didi after its IPO).

Dennis Hong had an interesting theory on what is going on on Twitter:

My guess (if they go out near term) is that they’ll IPO in Hong Kong. The new cyber rules are less burdensome if the company lists in Hong Kong.

I think the govt is trying to encourage companies to list closer to the mainland (in addition to increased oversight). It makes sense to me. Trillions of EV have been created offshore over two decades - and domestic investors have not participated in any of the value creation.

I’m a total tourist when it comes to reading the tea laves in China (unlike friend-of-the-show and supporter (💚 🥃) Lillian Li — go read her stuff if you want to understand what’s going on), but that makes some sense to me.

At first, I thought it was mostly about political control, but the financial aspect has to be a big part of it too. Not that political control isn’t top of mind and that the government isn’t always flexing to remind Chinese companies of who’s boss (see Jack Ma, if you can find him).

Ever wondered where ‘Nvidia’ came from, what it means?

I guess I’m not that curious, because until recently, I just kinda took it as a given that Nvidia was a made-up word design to look cool and evoke certain things, kind of like “Lexus”.

But it turns out (IT TURNS OUT!, he said) there’s a neat story to it:

With $40,000 in the bank, Nvidia was born. The company initially had no name. “We couldn’t think of one, so we named all of our files NV, as in ‘next version,’ ” Huang says. A need to incorporate the company prompted the cofounders to review all words with those two letters, leading them to “invidia,” the Latin word for “envy.” It stuck. (Source)

I guess it took guts to name yourself after the only deadly sin that you can’t have fun with, in the words of Charlie Munger, but it does sound cool.

In Latin, invidia is the sense of envy, an intense gaze associated with malice and the "evil eye". Invidia is also the Roman name for the ancient Greek "Titan" deity, Nemesis. Who's the personification of hatred and jealousy in Roman mythology. [...]

In magic folklore envy or the "evil eye" is the principal vice that motivates demons. It's also what drives the "biting eye" of witches who would cast their spells with poisonous tongues. It was a deeply held belief by the ancient Greek & Romans that envy originates from the eyes.

That does explain Nvidia’s green “eye” logo…

The company's name "nVidia", pronounced invidia, was carefully chosen because of its nuanced meanings which are tied to vision and envy. In addition to the way it sounds being quite similar to video. [...]

All of that plays into Nvidia's green theme and logo. The slogan for the GeForce 8 series was in fact "Green with envy". The company's highest-end offerings are also branded Titans. Again playing into the mythological background of it all.

The “Ti” cards where Ti stands for Titanium, the element named after the Titans..

Gotta admit, even after this, I’d still love to hear Jensen Huang say more about why they picked the name, and what *he* thinks it represents and mean.

Maybe he’s talked about it and I just haven’t seen it… If you have a source for that, please send it my way. Thanks.

Scuttleblurb on Nvidia (Part 1 of 2)

Speaking of the green eye, friend-of-the-show and Extra-Deluxe (💚💚💚💚💚🥃) supporter David Kim just published a great piece on the company (sub required):

Looking forward to part 2!

If you want to learn more about David and his investment/writing approach, check out this interview we did.

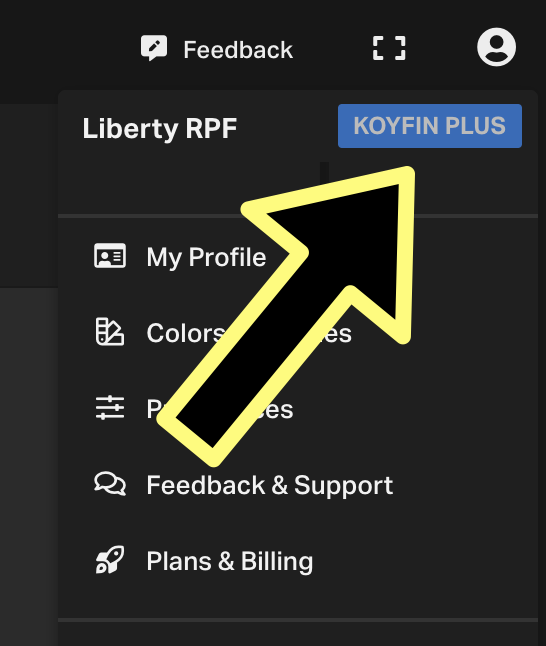

The New Status Symbol on FinTwit…

It’s not the Blue Checkmark, it’s the Blue Koyfin Badge on your account:

Yes, I’ve invested in Koyfin, so I have a conflict of interest. But I invested because I lived in the product daily for a couple years and loved it. You won’t get me to shut up about it just because it’ll ‘look bad’ to say nice things about something I have a financial interest in — what am I going to do, only invest in companies whose products I hate to make sure I don’t talk about them? ¯\_(ツ)_/¯

‘India received no bids for 48 of the 67 mines up for sale as part of its plan to open up coal mining to private companies’

India has the world's fourth largest coal reserves and is the second largest coal consumer, importer and producer.

In a statement released late on Friday after a deadline for the submission of technical bids, the coal ministry said only 19 of the 67 mines had drawn interest. [...]

While coal still accounts for over 70% of India's power production, India has pushed a renewables policy which envisages increasing green energy capacity more than four-fold by 2030. (Source)

I gotta admit, I won’t miss coal when it’s finally gone from our power grids.

It did a great job getting humanity to transition from an agrarian to a modern industrial society, but now it’s past-due for a ride in the sunset…

Interview: David Sacks (founding COO of Paypal, founder of Yammer, co-founder Craft Ventures, etc)

I really enjoyed this one, again by Patrick O’Shaughnessy (the energizer bunny of financial podcasting):

This part near the end really made me think about what other companies may be in similar situations now:

Reid was in charge of all the biz-dev relationships. And Reid's job was kind of to make sure that all the platforms that could switch us off didn't, he went to eBay and they wanted to kill us, but Reid would try and convince them. Reid has a very nice personality and would sort of convince them, keep them at bay, and same thing with Visa or MasterCard. He managed those relationships to make sure that we didn't get switched off. [...]

Keith and Reid were sort of flip sides of the same coin. Meaning that we had these huge platform dependencies at PayPal, and we were constantly worried about, how do we not get switched off? How do we not get switched off by eBay? How we not get switched off by Visa, MasterCard? And Reid, frankly, was the good cop. Keith was the bad cop. He spun up an effort to make sure that the antitrust authorities like the FTC, like the DOJ, were aware of any potential anti-competitive actions that these big monopolies might take against us. And it was very important in terms of brushing them back from the plate, because these big monopolies, if they get the chance to stomp on a little competitor who's innovating and potentially doing something disruptive in their space, they will. Keith was a little bit of our pit bull to keep those big monopolies at bay.

Richard Branson, Space’s Chief Virgin

So Branson, always the showman, found a way to sneak to space before Bezos.

Now the obvious next step is for Bezos to go and do what Elon did to him, and say that Branson only went to 86.1 kilometers of altitude, and that he went to “X kilometers of altitude”, which is “real space”, etc…

Basically the 2021 equivalent of “My yacht is bigger than your yacht”, except that the pissing contest is helping fund cool space tech; I don’t think big yacht tech has quite the second-order benefits on humanity’s tech tree.

Science & Technology

‘Battery-Electric Vehicles Have Lower Scheduled Maintenance Costs than Other Light-Duty Vehicles’

From the U.S. Department of Energy’s Vehicle Technologies Office, looking at fleet costs:

The estimated scheduled maintenance cost for a light-duty battery-electric vehicle (BEV) totals 6.1 cents per mile, while a conventional internal combustion engine vehicle (ICEV) totals 10.1 cents per mile. A BEV lacks an ICEV’s engine oil, timing belt, oxygen sensor, spark plugs and more, and the maintenance costs associated with them. The hybrid-electric vehicle (HEV) and the plug-in hybrid-electric vehicle (PHEV) share costs with both the ICEV and the EV but save money on brake maintenance.

And that’s just the maintenance costs. Add the fuel costs — which are generally significantly lower for electricity vs gasoline/diesel — and the difference widens even more.

So as lithium-ion batteries costs keep falling , pretty soon there’ll be little reason not to go electric.

h/t Friend-of-the-show and supporter (💚🥃) Brad Slingerlend

Venkatesh Rao’s REALIST Tech Stack

Tangentially related to the above is this post by VGR about the tech stack on which the world is increasingly being built:

The idea of thinking of engineering as happening on multi-layered technology “stacks” came from software, but the REALIST stack applies to all engineering. And increasingly, all engineering should happen on the REALIST stack to the extent possible. If you can build something on the REALIST stack, you probably shouldn’t build it any other way. [...]

The REALIST stack, I believe, is taking over all technology. The rates depends on the churn rate of the underlying materialities. So the automotive sector is going REALIST over about 20 years, while housing will probably take like 50 or 60.

The REALIST stack is how software is eating the hardware-based world of things, and preparing it for existence on a terra being terraformed by energy and material transitions.

More details about the implications of all this here.

Conversation: Peter Attia & Hugh Jackman

This isn’t some celebrity being interviewed about his films or whatever, this is a conversation between two close friends who happen to be very perfectionistic over-achievers and are curious about everything and constantly trying to improve.

I enjoyed it. Very honest and raw.

The Arts & History

The Office Season 2 Finale

Recently, my wife and I watched the finale of season 2 of The Office (US) for the first time.

Wow, did not expect that.

I like how they’re not dragging things over 4 seasons like a regular show would. Gut punch, though.

(As Bryan Green said: “Wow, this is one of the latest takes I've ever seen. 👏👏👏”

What can I say? I’m not slow, I’m deliberate…

And friend-of-the-show and supporter (💚🥃) Willis Cap had a good take-on-my-take:

“So wild. That show has been a main part of US popular culture for so long and I’ve seen it so many times that I forget there was actual suspense in it!”)

"You won’t get me to shut up about it just because it’ll ‘look bad’ to say nice things about something I have a financial interest in — what am I going to do, only invest in companies whose products I hate to make sure I don’t talk about them? ¯\_(ツ)_/¯"

If you owned all of Koyfin you'd shout it to the rooftops. What you're doing is acting like an owner because you *are an owner*. I wear Fruit of the Loom underwear because I'm a BRK shareholder. It's 100% consistent with a business owner mindset and I'd have it no other way!