176: The S&P500 *Inside* Amazon, China vs Video Games, Liquid Death, Heico, Constellation Software, Neutrino Detection, Swedish Blood Donors, and Combined mRNA

"in charge of office desks and chairs in Mexico or something"

A few hours in the zone may be worth more than weeks in the haze.

Creative people should notice and cultivate the state in which they excel.

Crafting the conditions that promote excellence may not feel like important work, but it leads to important work.

Perfect the process.

— Stoic Emperor

🗣📞 💻 📹 Back in edition #172, I wrote about how much I was enjoying doing more video calls with online friends. I used to think that as an introvert, text was a perfectly fine medium for me, but in the past year I’ve been doing more video calls and they’ve been excellent.

One conclusion that emerged is that Twitter acts as a great filter: If you’ve been following someone for a while, you know the “shape of their mind” and have a pretty good idea of who they are, what they’re into, and if you’ll get along with them. It’s very different from a blind date.

🛀 We’ve all learned as school kids that dolphins and whales are mammals, just like us. Then we ‘know’ the answer and you stop thinking about it…

But if you think about it some more, how cool is it that these animals are both so different from us, yet they have this common ancestor not so far back in time, and are like us in very fundamental ways.

Nature is 🤯

🐦 Twitter still hasn’t fixed the basic UI blunder of having the follow buttons be the inverse of what our brains intuitively expect:

When you press a button, you expect to *give* it something, like a color. Not remove it.

As things are, the “empty” buttons are those that you pressed, and every button that you haven’t pressed contains a solid color.

That’s ass-backwards.

Proof that this isn’t just a “like with any change, you just need time to get used to it” is that weeks later it still feels confusing to my System 1 thinking every time, and I need to engage my System 2 to confirm if I’m following that person or not (at least the word in the button changes — it would be even worse if only the color changed, but you shouldn’t need to read the text to know if a button is pressed or not).

Update: After I wrote the above, Julie Young pointed out another UI change that Twitter is considering (video in that Tweet shows what it is):

Bad idea: it lowers information density too much, so you'll do 30% more scrolling for very little benefit since as things are, anything you like enough to want to see bigger, you can simply tap on.

If you'd only tap on 1 out of 30 things, having them all be huge isn't a good trade for all the extra scrolling.

If they do this, they *need* to have a setting option to disable it.

🎼 🎶 I was talking with my friend JPV about what I listen to while working, mostly instrumental music that favors a nice flow state and doesn’t use the language part of my brain.

For some reason, I haven’t been listening to that many movie scores. I think it’s because they tend to have huge dynamics (very quiet, very loud, low-tempo, high-tempo) which I find distracting, and also because I’ve never taken the time to curate a group of scores that worked for me.

He’s a fiction writer, so for him, the epic ambiance is a valuable tool to get into the right mindset, as is the association that comes from using the same soundtracks or musical pieces over and over, telling your brain “ok, it’s writing time, you’re entering this world”.

He’s suggested a few, like the score of ‘The Martian’ by Harry Gregson-Williams, and ‘The Crown Season 2’ by Rupert Gregson-Williams and Lorne Balfe and I’ve been enjoying them.

Makes me want to do some film score exploration and find what tickles the right spot in my brain 🧠

(note that film scores is where most of the modern classical music is going, and a lot of really good composers that, a few centuries ago, may have written for the church or a wealthy patron are writing for Hollywood).

💚 🥃 The price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month (plus 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤 like this great interview with Ho Nam) full of eclectic ideas and investing/tech analysis.

The entertainment has to be worth something on its own, but for those that care most about the bottom line, there’s optionality:

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 secs on mobile with Apple/Google Pay):

Investing & Business

The S&P 500 *Inside* of Amazon

From the outside, if you haven’t been studying the company, it’s easy to look at Amazon as fairly monolithic. In fact, most people seem to focus almost exclusively on the retail side and forget about AWS (I once wrote about how it would be interesting to see an alternate history where somehow AWS had been first, and the massive retail operation came later).

But internally, Amazon is run as a collection of businesses, a kind of conglomerate, with people in charge of a bunch of businesses like “tires in North America”, “televisions in Europe”, selling the Aurora SQL database or whatever. And not just established businesses like these either, many are more like startups within the organization, trying to get traction with some new product (f.ex. the cashierless Amazon Go stores or building some new ad analytics product).

With almost $450 billion in revenue in the past 12 months, Amazon is now big enough and varied enough that it’s functionally an economy.

This makes me wonder, what would its internal S&P 500 be if you considered internal businesses to be separate? Which ones would be the biggest, which would be the fastest-growing, which the most profitable (clearly must be software and ad products at the top, but I’m still curious how the whole ordered list would look), etc?

What about trying to slice and dice Amazon businesses the same way people slide and dice the rest of the economy? What would be the growth index (with say, 25 components) vs the value index inside of Amazon? Which are the boring dividend aristocrats and utilities? Small caps vs large caps? Small-growth vs large-value?

Some “CEOs” inside Amazon are no doubt in charge of much bigger businesses than a lot of “real” CEOs of whole companies outside of Amazon, which is an interesting dynamic.

Some Amazonian man or woman is in charge of office desks and chairs in Mexico or something, and that may be a bigger business than a lot of other retailers in that country…

Amazon Offers “fully funded college tuition” to 750,000 operations employees

Speaking of Amazon:

Amazon plans to expand the education and skills training benefits it offers to its U.S. employees with a total investment of $1.2 billion by 2025. Through its popular Career Choice program, the company will fund full college tuition, as well as high school diplomas, GEDs, and English as a Second Language (ESL) proficiency certifications for its front-line employees—including those who have been at the company for as little as three months. Amazon is also adding three new education programs to provide employees with the opportunity to learn skills within data center maintenance and technology, IT, and user experience and research design. (Source)

They’ve long had training and re-training programs, but this looks like the next level.

Seems like it can only be a good thing, but as always, the devil will be in the details, so let’s wait and see how it’s implemented (but adding the cost of books and other fees *is* a nice touch).

‘Liquid Death’ 101

Interesting thread on the company Liquid Death (be warned, their art style is kinda gory and violent).

They basically sells canned water, but in a very self-aware way, with an extreme amount of branding and marketing, and apparently with great success (hey, as long as everyone’s in on the joke, I see nothing wrong with it).

Before Mike Cessario founded Liquid Death in 2017, he worked as a Creative Director over at Netflix on shows like House of Cards, Narcos and Stranger Things.

And before that, he played in metal and hardcore/punk bands, which obviously influenced some choices later on... [...]

they are also masters of using consumer feedback to their advantage, both good and bad (especially bad.. more on that in the next tweet). I think this is genius.

they have now released two full-length albums written solely with negative reviews as lyrics, called Greatest Hates - with musicians from Rise Against, Anti-Flag, Alkaline Trio & so on. My fav: "Dumbest Name Ever For Water".

From the company’s ‘about’ page:

We started Liquid Death with the totally evil plan to make people laugh and get more of them to drink more water more often.

How? By taking the world’s healthiest beverage and making it just as unnecessarily entertaining as the unhealthy brands across energy drunks, beer, chips, and candy.

Anyone wants to make broccoli cooler?

🛩 Heico Flight Support Group, Q2 Highlight 🛫

Eric Mendelson: We are continuing to take market share. We're doing very well in all of our businesses in the aftermarket. I feel that since we were able to hang on to a greater percentage of our people than our competitors that we are very well positioned for the recovery… across the board, no, we have not seen a drop in business as a result of the delta variant thus far. The Americas, in general, has been strong.

Europe, never saw really the recovery. Asia, ex China, hasn't seen the recovery. So I think that we've got a lot of wind to our backs. [...]

I can tell you, the airlines with whom we deal are very optimistic, and I've never spoken to our sales force before and seeing them so positive and optimistic.

Doesn’t always feel like this looking at headlines, but hey, if that’s what they’re seeing on the ground… (or should that be “in the air”?)

our businesses are focused on profitability. And if you see the profitability and the margin, it far outpaced the sales increase. We evaluate businesses on cash flow and profitability. Sales is sort of irrelevant. As a matter of fact, if you have a lot of sales and not profitability, that's not a good thing at HEICO, so -- because we don't want to tie up capital in that.

This reminds me of something that Texas Instrument management says when analyst keeps asking about metrics like gross margins or whatever. In the end, you should manage the business to get the most per-share value creation, not to maximum revenue growth or margins or whatever. Sometimes you can create more value by lowering margins or not going after unprofitable topline growth or whatever.

China vs Video Games, Déjà Vu All Over Again Edition

Chinese regulators have temporarily slowed down approval for new online games in the country, dealing a fresh blow to video gaming companies like industry giants Tencent Holdings and NetEase, as Beijing steps up measures to tackle gaming addiction among young people [...]

representatives of Tencent and NetEase were told to “strictly enforce” the NPPA’s latest rule that limits gaming time for players under the age of 18 to between 8pm and 9pm only on Fridays, Saturdays, Sundays and statutory holidays. [...]

In addition, video gaming companies were directed to cleanse their video games by removing at authorities described as the “wrong set of values”, including “worshipping money” and “gay love”. They were also reminded not to maximise their profits from video gaming and ensure that young people do not get addicted to games. [...]

It is unclear when this slowdown in new game approvals will ease up, according to the sources.

There was a nine-month freeze on new video game approvals in 2018 (Source)

They even found a way to get homophobia in there…

Interview: Jeff Bender, CEO of Harris (Constellation Software)

Found this interesting interview with Jeff Bender, which is largely about operations and M&A at Harris (one of Constellation’s 6 operating groups… Basically a mini-Constellation within Constellation, itself larger than what the whole company used to be a few years ago):

Interview: Austin Lieberman, Two Reasonable Dudes Talking Edition

I listened to this conversation between friend-of-the-show and supporter (💚 🥃) Bill Brewster and Austin Lieberman a while ago, wrote about it in my notes, and then forgot to actually post about it.

It’s an interesting podcast with two very reasonable dudes. Instead of falling into ego-stroking opposition just because they come from different investing schools-of-thought and made a bet and such, they’re basically going “you may be right about this” “no, you may be right” “I learned so much from you” “no, I learned so much from you”.

I find it refreshing to see people care more about learning from others and trying to be well-calibrated rather than try to “win” an argument through rhetorics and pretending that they know for sure who’s right about the unknowable future.

I also liked the discussion about mental health and personal challenges.

Anyway, enough of me babbling, check it out:

Investor Psychology

h/t friend-of-the-show Terminal Value

Science & Technology

Super-Kamioka Neutrino Detection Experiment

a neutrino observatory located under Mount Ikeno near the city of Hida, Gifu Prefecture, Japan. It is located 1,000 m (3,300 ft) underground [...] The observatory was designed to detect high-energy neutrinos, to search for proton decay, study solar and atmospheric neutrinos, and keep watch for supernovae in the Milky Way Galaxy.

It consists of a cylindrical stainless steel tank about 40 m (131 ft) in height and diameter holding 50,000 metric tons (55,000 US tons) of ultrapure water. Mounted on an inside superstructure are about 13,000 photomultiplier tubes that detect light from Cherenkov radiation. A neutrino interaction with the electrons of nuclei of water can produce an electron or positron that moves faster than the speed of light in water, which is slower than the speed of light in a vacuum. This creates a cone of Cherenkov radiation light, the optical equivalent to a sonic boom. The Cherenkov light is recorded by the photomultiplier tubes. Using the information recorded by each tube, the direction and flavor of the incoming neutrino is determined.

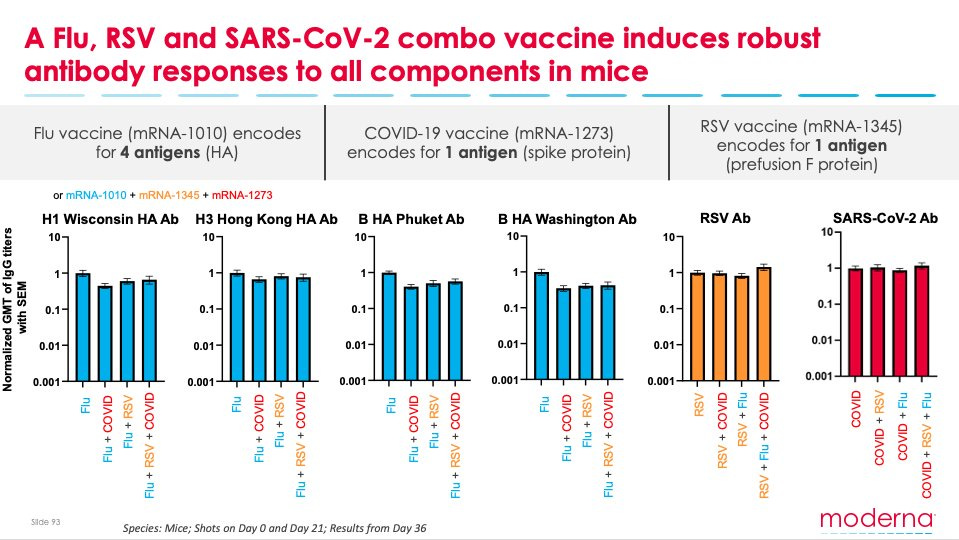

Moderna: “demonstrating our ability to combine 6 mRNAs against 3 different respiratory viruses in 1 vaccine”

We’re only at the beginning of discovering all that we can do with mRNA vaccines (I can’t wait for a universal cold vaccine — wish that had existed before we had kids and spent years having colds non-stops):

Today, we shared positive pre-clinical data demonstrating our ability to combine 6 mRNAs against 3 different respiratory viruses in 1 vaccine: COVID-19 booster + Flu booster + RSV booster.

Swedish Blood Donors Get Text Messages when Their Blood is Used, Incentives 101 Edition

With blood donation rates in decline all over the developed world, Sweden’s blood service is enlisting new technology to help push back against shortages.

One new initiative, where donors are sent automatic text messages telling them when their blood has actually been used, has caught the public eye.

People who donate initially receive a 'thank you' text when they give blood, but they get another message when their blood makes it into somebody else’s veins. [...]

“It's a great feeling to know you made such a big difference and maybe even saved someone else's life,” says Ms Blom Wiberg.

“We get a lot of visiblity in social media and traditional media thanks to the SMS. But above all we believe it makes our donors come back to us, and donate again.” (Source)

This is kind of an old source, and I don’t know for sure if they still do this in Sweden (or where else this may be done today), but my point isn’t so much about this specific case as about using this type of thing much more widely, and copying the places where something is shown to work.

The world could use a lot more of “best practices” sharing… Every government should probably have an entire ministry or department dedicated to copying the best of what others do (h/t to my friend JPV for mentioning the idea recently), with some real power and budget to make it happen.

The Arts & History

Ready for some 🪄 Magic 🧙♂️?

This is kind of a follow-up to the Richard Turner stuff from editions #174-175, but not really, since Turner is a card mechanic/close up magician and this is more stage magic. But hey, I just really enjoyed this one and hope you’ll do too!

And if you liked it, his name is Asi Wind. And I think the iPhone trick that they mention is this one (really 🤯).

Richard Turner Interview by Tim Ferriss

Thanks to reader V.K. for pointing out that über-card-mechanic Richard Turner has been interviewed by Ferriss:

The link has both audio and video of the interview (they recorded it in person, just before the pandemic shut everything down — some of the card stuff he shows Tim, mostly near the end, only makes sense on the video).

Turner talks about a bunch of stuff that isn’t mentioned in the documentary ‘Dealt’ (2017), including a very interesting neurological condition, so this interview is nicely complementary.