181: Mark Leonard, Software Base Rates, Airbnb Creeps, GitLab's Unicorn Cohorts, Twitter, Amazon, China Evergrande EVs, Longevity Science, and Covid19 vs 1918 Flu

"the reincarnation of Peter Drucker on roller skates"

It ain't a true crisis of faith unless things could just as easily go either way.

—Thor Shenkel

🐈⬛🐕 🐓🐄 🥕🌽 👩🌾 Humans pretty much "created" cats and dogs through selective breeding, just like we made major genetic alterations to most of what we eat (look up the wild ancestors of corn or carrots or most fruits) and the animals we've domesticated (could a cow or a chicken survive long in the wild?).

Here’s some wild corn vs today’s corn:

And you probably wouldn’t want to keep the wild ancestors of cats in your house…

It makes me wonder: what if we could somehow rewind and re-run history. What would our creations look like? Alternate-world corn, alternate-world cows, etc.

There’s *no chance* they'd be exactly the same, since there's plenty of randomness in the process, and our ancestors didn’t exactly use a metaphorical-scalpel; trait selection was pretty blunt, and based only on what could easily be observed at the phenotype level (nobody had any idea what kind of genes slipped in below the radar and only became important later).

Fun to think of all the other possible paths that spread out alongside the actual path taken, even for everyday things (not to mention changes to the rest of our civilization, but that's a different question...)

👶 We don’t have memories before a certain age. It varies, with some at the very edge of the curve remembering things from when they were 1-year-old, but most probably don’t remember much very clearly before they were about 4.

So a 7-year-old like my oldest boy has effectively only about 3 years of memories.

I’m a late-bloomer, and in many ways, I feel like I only really became human around 20-21yo. That’s when I started to figure who I was, what I was interested in, to think more independently, to accelerate the rate at which I was learning new things and to get my life in order. Before then, I was pretty much just hanging out with my friends, playing video games, and listening to music.

I still remember that time, and they weren’t wasted years per se, but past-me was a very different person until that point (which, thankfully, is around when I met my wife — if we had met earlier, I wouldn’t have been ready for a real relationship).

(I wrote more about the concept of past-me/present-me/future-me in edition #143.)

Anyway, so in a certain way, at 39 years of age now, I kinda feel like I only have about 18 years of experience at being me. It’s kind of arbitrary because I could find other turning points in my life where I feel I evolved particularly fast and became a new version, but it feels to me like the biggest turning point was around 21.

🗣🎤 I had the great pleasure of having a conversation with friend-of-the-show and supporter (💚 🥃) Jim O’Shaughnessy yesterday.

The call was recorded for his podcast Infinite Loops, and should be published around November (Jim is so productive that he has a backlog of episodes). I’ll mention here when it’s live, but you should subscribe to the podcast feed, it’s great stuff!

💚 🥃 The price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month (plus 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤) full of eclectic ideas and investing/tech analysis. That’s 77¢ per edition.

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 secs on mobile with Apple/Google Pay):

Investing & Business

📉 Base Rates vs Modern Global Software Companies 🚀

Base rates are great.

Using this tool is one of the biggest unlocks when it comes to thinking better, both for investing and life in general, in my opinion. Michael Mauboussin deserves a lot of credit for teaching the concept to countless investors.

But base rates aren’t magic, and to have good base rates, you need good data.

It feels to me like there’s some businesses that we don’t have great base rates for.

Many people, instead of just increasing their level of uncertainty around them and saying “we don’t yet know” will try to use base rates that were built with data for pretty different businesses and assume that the predictive power is strong. Maybe it is, but seems like a significant shortcut to me.

Here’s what I mean: If you have a generic business and you don’t have any info about it, using the generic base rates for all businesses to look at it will give you a good starting point. But if you know the business is a mining company or a semiconductor company, you’ll do better using the base rates for mining or semi companies than the generic business base rates, right?

Well, it feels to me like in the past ˜10 years a lot of businesses came of age that don’t have that many historical analogs. I wrote a tweet about this recently:

So many companies these days with basically no historical precedent... Growing organically really fast, really profitably, globally, with no capital needs, with great management, founder-led, gigantic TAM, etc.

When in the past has it ever been possible for a startup to get global scale within a few years just by clicking around on its AWS dashboard to add capacity? To grow topline organically at 50% or 80% with basically no capital needs, to have almost all its revenue be recurring and with gross margins in the 70-90% range, which gives a ton of options for reinvestment, to have negative working capital, the ability to recruit the best talent globally through remote work, all in a field with gigantic leverage where the very best talent can create 10-100-1,000-1,000,000x more value than the average talent, etc.

That all seems pretty new to me.

There’s long been great tech and software businesses, but as great as they were, when you start looking at the details, they were pretty different, shipping shrink-wrapped boxes to retailers and trying to sell to what was a very small number of potential customers compared to today (how many people were even online 30-40 years ago? What was the PC installed base? How many enterprise processes were still paper/manual? etc).

Don’t get me wrong, in some ways the very best of these businesses (Microsoft) were even better than today’s crop, but there were only a few of these, and it took them decades to get to number of users and inflation-adjusted numbers that some companies reach in a handful of years today.

Economists often complain that the sample size of market data is pretty small because it only goes so far back, and the quality of data gets lower the farther back you go or if you go to certain countries, etc.

Well, how about the data for these types of companies, then? We only have a few years, so how can we have a quality base rate to predict what they might do? Maybe they’ll “revert to the mean” of other businesses, but maybe they’re a new category, just like “mining” is different from “consumer packaged goods”…?

Constellation Software Shareholder Q&A

It had been a while since CSI published one of these.

This one doesn’t have any of my questions answered (I didn’t ask any recently — most of the past Q&A have at least 1 question by me, if not more… see if you can recognize the writing style).

There’s some interesting stuff, and as always, Mark Leonard has a way with words:

I suspect we are willing to be more patient with both existing and new managers than other software company buyers. We are permanent owners. We don't need to find the reincarnation of Peter Drucker on roller skates to whip the newly acquired business into shape, so it can be flipped to the next buyer.

This largely dodges your question about management attributes. I despair of answers that are some version of "intelligent, energetic, ethical". I know some great business builders who didn't win the genetic lottery in the intelligence category but compensated with hard work and determination. Energy can be poorly channeled. Ethics seem to get pretty plastic under enough carrot and stick stress. I'd rather use a track record of consistently happy and loyal customers and employees to judge a team. That strikes me as a far better predictor of future performance than psychometric questionnaires or dowsing for cultural fit.

Does Airbnb have a creep problem?

I had never even thought of this problem before I randomly stumbled on this video, but here’s a tutorial on how to spot if there are hidden cameras in your Airbnb (camouflaged as alarm clocks, smoke detectors, even USB chargers):

I wonder how common a problem that is, and when the first large scandal about this explodes (or maybe it already has and I missed it?).

Interview: Lia DiBello, on “Business as distributed cognition”, Strategic Rehearsals, etc

This interview of Lia DiBello by friend-of-the-show Cedric Chin is really really interesting.

The part in the first half when she describes her work with a foundry doing metal casting is an all-time great business story, IMO.

I really recommend it:

h/t friend-of-the-show Tom Morgan

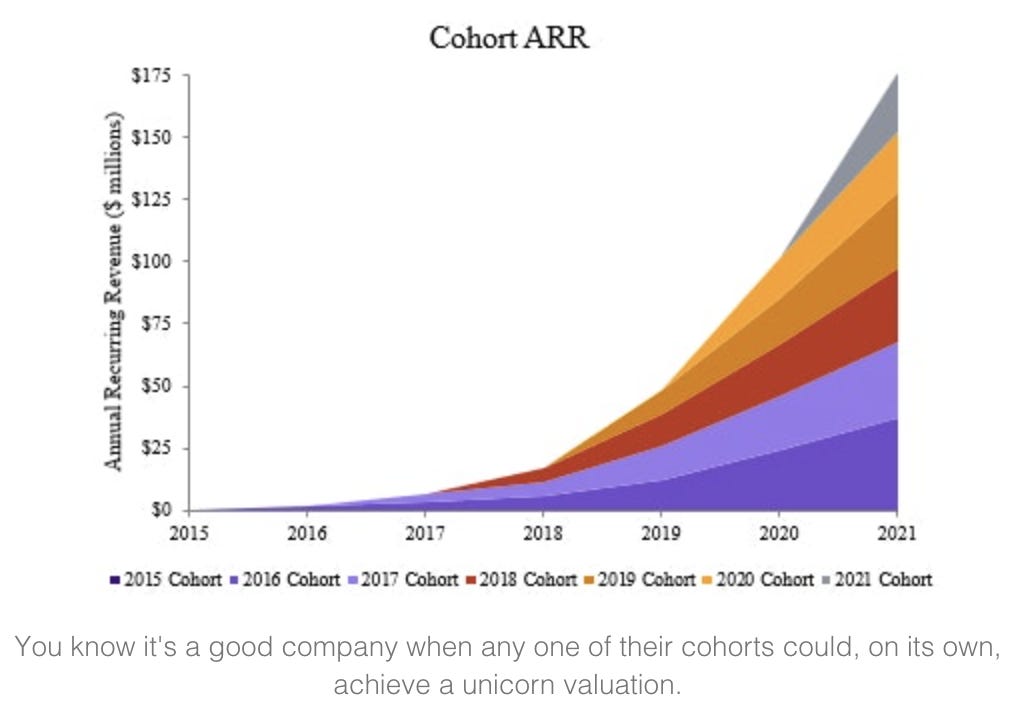

🦄 Unicorn Cohorts *chef’s kiss*

I just loved the caption on this cohort chart for GitLab in Extra-Deluxe supporter (💚💚💚💚💚 🥃) Byrne Hobart’s piece on the company (sub $ required).

Twitter Settles Shareholder Lawsuit ($810m)

Twitter Inc. agreed to pay $809.5 million to settle a shareholder class action lawsuit that accused the social media company of painting an overly rosy picture of its future.

The suit, originally filed by Twitter shareholder Doris Shenwick, claimed executives misled investors over the company’s growth prospects in November 2014, promising an increase in monthly active users to 550 million in the “intermediate” term and more than a billion in the “longer term.” The company failed to deliver on either estimate and concealed that it had no basis for those projections, according to the complaint. (Source)

That’s a lot of moolah.

If we go back to 2014, when the offense took place, the company’s entire revenue line for the year is $1.4bn, so they’re basically paying out 58% of that year’s revenue.

I wonder if the lawyers are taking a 30% cut, App Store style... 🤔

🥕 Incentives 101, Amazon Edition

Amazon gave away cars and $100,000 cash bonuses to a handful of vaccinated warehouse workers as part of its running sweepstakes to encourage employees to get inoculated. (Source)

China Evergrande New Energy *chef’s kiss*

Remember when Evergrande had an EV company that was worth more than Ford without ever making a single car? One of the better business descriptions you'll ever see...

Science & Technology

Gurwinder’s Concepts You Should Know

Nice thread with a bunch of good concepts/mental models/heuristics & biases, and even an interesting kind of sci-fi governance concept thrown in at the end.

Even when you already know them, it’s always good to refresh your memory once in a while on these so they are more available to mind when you encounter them in the wild. My highlights:

Scope Neglect: We evolved for the small scale of tribal life, so we can't comprehend the big numbers that recently entered human life. We can appreciate the difference between 50 and 100, but not a million and a billion. It's why we often treat geopolitics like family politics.

The Toxoplasma of Rage: The ideas that spread most are not those everyone agrees with, but those that divide people most, because people see them as causes to attack or defend in order to signal their commitment to a tribe.

Paradox of Abundance: Easy availability of food led to obesity for the masses but good health for the few who used the increased choice to avoid the mass-produced junk. Equally, you can avoid intellectual diabetes by ignoring junk info like gossip & clickbait.

Status Quo Bias: Those who were unfazed by Covid because it had a ~1% fatality rate were suddenly concerned about vaccines when they yielded a 1 in a ~million fatality rate. People see the risks of doing something but not the risks of doing nothing.

Bias Against Null Results: Studies that find something surprising are more interesting than studies that don't, so they're more likely to be published. This creates the impression the world is more surprising than it actually is. Also applies to news, Twitter.

Bulverism: Instead of assessing what a debate opponent has said on its own merits, we assume they're wrong and then try to retroactively justify our assumption, usually by appealing to the person's character or motives. Explains 99% of Twitter debates.

Scout Mindset: We tend to approach discourse with a "soldier mindset"; an intention to defend our own beliefs and defeat opponents'. A more useful approach is to adopt a "scout mindset"; an intention to explore and gather information.

Hitchens' Razor: What can be asserted without evidence can be dismissed without evidence. If you make a claim, it's up to you to prove it, not to me to disprove it.

The Messiah Effect (my term): most people don't believe in ideals, but in people who believe in ideals. Hence why successful religions tend to have human prophets or messiahs, and why when a demagogue changes his beliefs, the beliefs of his followers often change accordingly.

Futarchy: What if people voted not for political parties, but for metrics that society should seek to maximize (e.g. median household income, average life expectancy) and then betting markets determined the policy that would maximize the metric best?

‘Covid is officially America’s deadliest pandemic as U.S. fatalities surpass 1918 flu estimates’

Reported U.S. deaths due to Covid crossed 675,000, the estimated U.S. fatalities from the 1918 flu, and are still increasing.

So much suffering, much of it avoidable.

Oh, and before someone talks about population differences and such: Yes, of course.

But if we’re going to make comparisons… they didn’t have gene-sequencing or any over the past century’s advances in biological and medical knowledge, didn’t have the internet to work from home and do video calls rather than meet in person or travel, and they never had a vaccine. So if someone is going to point out differences on one side, make sure to look at the other side too.

Interview: Steve Austad on longevity science & his work with wild animals

This was — literally — a pretty wild ride of an interview.

This scientist had quite the unorthodox path to get to where he is now, and the anecdote about driving around with a lion in the backseat and a cattle-prod with a dead battery, making “buzzt” noises with his mouth to try to fool the lion, and then getting stopped by a police car… That was something!

On the more science-y side of things, his explanation of the B6 “mouse-like object” mouse strain used in the lab to do all kinds of research — most of the medical research we read about, in fact — is mindblowing 🤯

I never would have guessed just how bizarre and unnatural that strain was. It’s worth listening to the episode just for that:

The Arts & History

Cinematographer Roger Deakins Podcast

I could say that Roger Deakins is my favorite cinematographer, but I’m not sure what that means since I don’t really know any other cinematographers by name (my level of film nerdery doesn’t quite go that far… yet).

But the fact that he’s good enough that I specifically noticed the quality of the cinematography in his work, while I mostly know about directors otherwise probably says something too.

I think it’s his work with one of my favorite directors, Denis Villeneuve that made me first notice him (and not just because Denis is from Quebec like me — I’m not tribal at all when it comes to these things… Denis could be Australian, all that matters is that he makes films I really like) .

How about this for a standout resumé for Deakins: Prisoners (2013), Sicario (2015), Blade Runner 2049 (2049 — oh, I mean, 2017).

Once I knew who he was, I looked back at his filmography and he worked on a lot of other films that looked great, including many great Coen Bros movies: Fargo (1996), Big Lebowski (1998), O Brother, Where Art Thou? (2000), No Country for Old Men (2007), Hail, Caesar! (2016). (he’s done a lot more, but I’m listing the ones I saw and liked.)

He also did ‘1917’ (2019) which I thought was quite a tour de force when it comes to the cinematography (that night scene! wow).

Anyway, big thanks to reader Mark Wittman (👋) for pointing out that Deakins has a podcast (with his long-time collaborator who is also his wife), and he alternates between episodes where he talks about one of his projects, and episodes where he interviews people from his field (actors, technical people in the crew, etc).

It’s pretty fun, and they get fairly geeky about why they did a certain shot that way in Sicario or in Fargo or whatever. A nice behind the scene look at this craft.