186: Roper Divests Transcore, Rivian IPO, Amazon Fulfilment Centers, Apple Safari 15 Design Blunder, Owning Stocks vs Businesses, How Hackers Copy Keycards, and Abbey Road

“Cherish your loved ones.”

WAR is a beast that needs death, so it doesn’t die itself.

—Samuel Maoz

🍼 There are some things you do for the last time, but you don't realize it at the time. It's only looking back that you know.

The last diaper I changed for each of my kids, I had no idea at the time. Then looking back, "hey! there it was" (if I had known I’d have celebrated it more…).

This also applies to friends/acquaintances that you lose touch with. I was just thinking about the last time that I saw a certain couple that we know, and now realize it may have been the last time that we see them (at least for a very long time).

Or the last episode of Hello Internet… a podcast I had been following for years. At one point I realized, hey, it’s been a while since the last episode, I wonder what’s going on. I found a note somewhere, they’re on indefinite hiatus… 😔

What last time have you had lately? How would you act differently if you pretended you were doing everything for the last time?

🛏 I recently had a conversation with friend-of-the-show and supporter (💚 🥃) MICapital (after a respite, he’s back on Twitter! Couldn’t stay away from the circus 🎪🎡. Go follow him). He mentioned my weirdly-shaped pillow, which I wrote about at the top of edition #185, which made me think some more about it.

How many millions (billions?) of people don't sleep well because a regular-shaped pillow can't accommodate a mix of both back and side sleeping? That seems like an important problem that I never hear about…

But it’s also crazy that it took humanity so long to put wheels on luggage 🧳, I guess ¯\_(ツ)_/¯

🙂🙃 I think we’ve all had our challenges during this past year-and-a-half, but my heart goes out to my friend (💎🐕) MBI who has had quite a year, with some ups (creating his wonderful business) and downs (having to move solo to a new country during a pandemic with a closed international border between him and his wife).

He wrote about his experience in this thread. I admire his ‘glass-half-full’ perspective on the whole thing. I think it’s very much the correct approach, even if human nature often pushes us to be more glass-half-empty…

“Cherish your loved ones.”

Indeed!

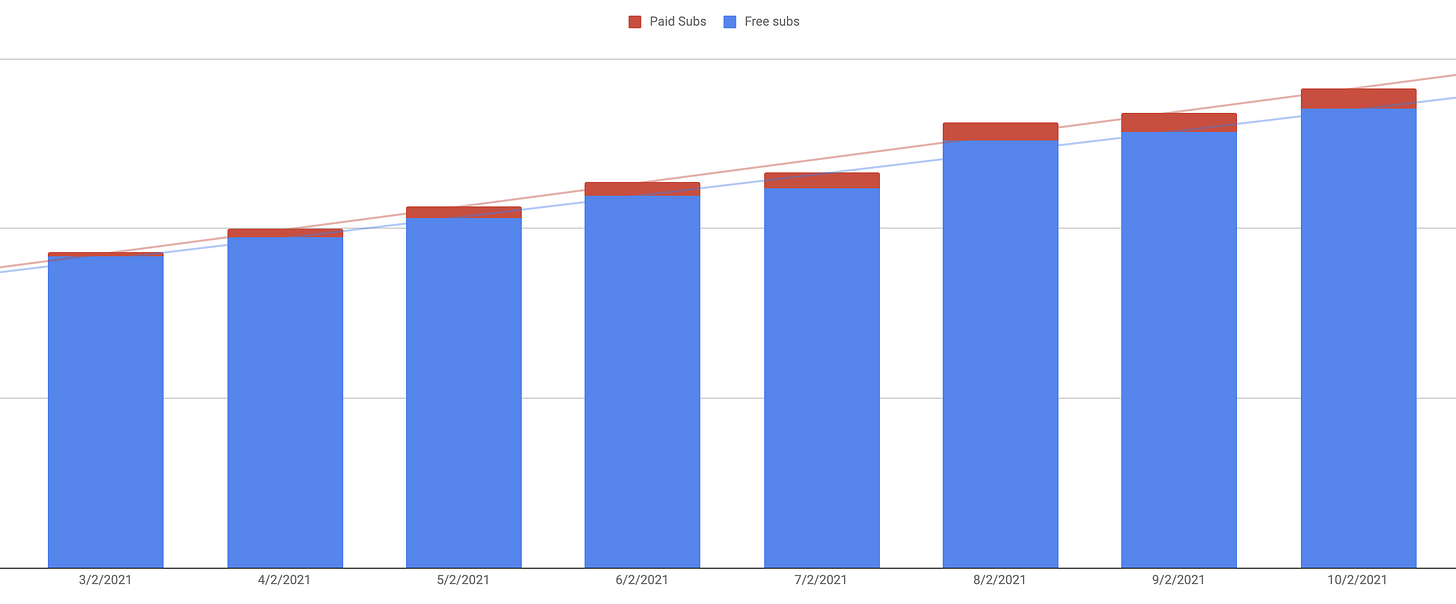

💚 🥃 Here’s an update on how things are going when it comes to making this project win-win-win and sustainable (because y’know, I’ve got bills to pay and young kids to feed):

The blue bars are the free subs and red is paid supporters (🍻 🎩).

If you want to make the transition from the blue masses to the red elite club, it’s very easy (3 seconds with Apple or Google Pay) and inexpensive.

It makes a big difference to me and I truly appreciate each and every one of my badass supporters:

A Word from our Sponsor: 💰Watchlist Investing 💰

Are you a value investor looking to expand your watchlist of great companies to own at the right price? Because what’s an investor without a good watchlist?

Watchlist Investing is a monthly newsletter devoted to studying great businesses and helping readers be ready to pounce when Mr. Market gets irrational (🤪).

You’ll get access to independent, bottom-up primary research, including Deep Dives, Quick Looks, and analysis of long-term capital allocation decisions.

Watchlist Investing founder Adam Mead spent over a decade in commercial credit, has skin in the game as a value investor, and is the author of ‘The Complete Financial History of Berkshire Hathaway’. 📕

Sign up here for just $199/year and get 10% off your first year with the coupon code “Liberty”.

Here’s a free taste with two issues from the back-catalogue:

Investing & Business

Roper Sells Transcore to Singapore Technologies Engineering for $2.68 Billion

TransCore is expected to generate approximately $545 million of revenue and $135 million of EBITDA in 2021. Roper will retain its DAT and Loadlink network software businesses, which it acquired together with TransCore in 2004.

Sold for 19.4x EBITDA, after 17 years of ownership.

Here’s ST’s presentation on the deal.

Roper acquired it for $600m in 2004 *but* they are keeping what seems to be the jewels — DAT and the Canadian freight-matching business — which they originally acquired as kind of ‘hidden assets’ within Transcore and then separated.

It’s hard to know what kind of return they got on the original acquisition without knowing the financials of DAT and Loadlink, and without knowing how much cash they took out of the business over the years (probably a lot, since it’s not capital-intensive).

It was certainly one of the lumpier of their big business units, and with an EBITDA margin of around 25%, it was bringing down their average (36.4% last quarter). Most of what they buy these days is in the 40-50% EBITDA margin range.

I’m guessing they have a good M&A pipeline and feel like the opportunity cost of waiting for a natural deleveraging is fairly high vs basically swapping this asset for whatever they buy next (even with the tax hit).

Vertafore, their last big acquisition, was purchased for $5.35bn and was expected to produce $590 million of revenue and $290 million of EBITDA in 2021. That’s a 49.15% EBITDA margin and a 18.45x valuation multiple.

That’s basically cheaper than what they got for Transcore! Maybe TC grew a bit faster, but every other metric has to be worse…

Rivian files for IPO, Pre-Revenue Edition

Its paperwork shows a $994 million net loss on zero revenue in the first six months of 2021. In 2020 the company’s net loss came to $1.02 billion.

“We are a development stage company and have not generated material revenue to date. Vehicle production and deliveries began in September 2021.”

Kind of surprising to IPO pre-revenue like this, but at the same time, as we keep talking about how we need more innovation in the world of “atoms” and not just the digital world, this is probably how you do it.

They could’ve waited one more year to start shipping vehicles, but that has opportunity cost too — nice to see some urgency.

If you need to spend a lot upfront to get thing going and have access to cheap capital, go for it! It can only be good for the world to have more R&D spent on EVs, more scale flowing through to battery manufacturers, further driving down the cost per kWh, more engineers gaining experience, more models on the market, etc.

We’re way behind schedule on scaling up EVs, IMO, and so far the pure-play EV makers have such a better pace than the legacy guys that are slowly, slooooowly switching over in very measured steps, being very careful to not cannibalize their more profitable lines and to squeeze as much out of their large legacy capital investments as possible… Ugh, the atmosphere doesn’t care about your EPS, let’s get moving.

So more pure play EVs companies with deep pockets and the ability to attract lots of talent is just fine with me (Rivian has backing from both Amazon and Ford).

The early reviews of Rivian’s EV pickup truck are very positive, and the specs are impressive:

All-wheel drive is standard on the 2022 R1T thanks to an arrangement similar to the Tesla Model X, where each wheel is powered by its own electric motor. The R1T boasts up to 800 horsepower and a claimed zero-to-60-mph time of 3.0 seconds. Adjustable air suspension will be standard at launch and can adjust the clearance height from eight to 14 inches. Every version of the R1T has all-wheel drive, with an electric motor at each wheel. This allows the R1T to do what Rivian calls a Tank Turn, which sets the electric motors to rotate the left wheels in the opposite direction of the right ones to spin the truck on its axis.

A tank turn! That’s cool.

At first it’ll have a 135-kWh battery pack with a range of ˜300 miles, but it’ll later also be available with a 18o-kWh pack doing around ˜400 miles.

“Owning Stocks” 📈📉📈 vs “Owning Businesses” 🏭🗄👩🏻🏭🛠👷♂️

I really enjoyed this thread by friend-of-the-show and supporter (💎 🐕 🤠) Mostly Borrowed Ideas. Here’s a slightly condensed version:

Owning stocks vs businesses It is "Investing 101" that when you buy a stock, you are essentially owner of a business. I know this and liberally parrot it to anyone who wants to listen. I realized a few months ago that I myself never probably walked the talk.

This finally occurred to me when an interested buyer showed up to take a minority stake (~20-30%) in "MBI Deep Dives". As I own 100% ownership of MBI Deep Dives, I finally had to think about valuing my own business.

The buyer wasn't a random rich person trying to buy a stake, but a strategic one who I believe could unlock value. But considering I just launched my business in September 2020, I was initially at best lukewarm since it just felt too early to "value" my biz. [...]

I realized there is non-negligible probability that I may accidentally massively undervalue my biz. [...]

The whole process consisted of a few sleepless nights and lots of soul searching, what-ifs, and probable regrets. I had my eureka moment then: "Ah, so this is how it feels when you own a business, not a stock."

I thought about the stock I most recently sold: $ISRG. [...]

There was no gut wrenching what ifs or sleepless nights involved. It felt very transactional, kinda how you feel if you own "stock", not business.

Now that I know what a visceral feeling it is to think about selling a *business* you own, I doubt whether I can recreate that in public market.

There'll always be an invisible asymptote in terms of what it means to own a biz in a public market vs the one you fully own.

I believe even if it's not possible to recreate that feeling, the closer I can get, the better shot I have to become a better long-term investor. If you feel some pain and a tinge of sadness to part your stocks in public market, you'd realize you own a biz.

I think the closest I've come to feeling like I "own the business" with publicly traded stocks only comes after years of ownership and learning about it pretty intensely for the duration (it does't work for totally passive holdings).

It may be an unconscious process, but it feels like at first, you’re thinking way more of the numbers and the stock, the margins, the valuation, etc… And over time, the amount that you think about these things decreases and the amount that you think about the actual business, the dynamics in its market, its culture, its management, its innovation velocity or whatever.. That part increases.

It’s not so much about going from 100/0 to 0/100 — we all start at different points based on our experience and how we’re wired — but for me, I’ve seen things I own do something like 85/15 → 45/55 over some years, or something like that.

🧗♂️ Interview: Tom Morgan 🪡

Friend-of-the-show Tom Morgan, who I previously mentioned in edition #172 for his interview on Infinite Loops, recently recorded a podcast with friend-of-the-show Brandon Beylo:

There’s plenty of thought-provoking ideas in there.

I liked when Tom boils down that what you can offer people (at least in his line of work): to save them time or help them make money.

Time is so valuable that if you can read lots of things and then reliably curate and create a synthesis of it, that can be very valuable.

Also, very good point on how to learn something new, you often have to destroy something old, which to most is very unpleasant.

The way I try to frame it in my mind: I’m looking forward to the next time I can change my mind on something big in public. (in good faith and for good reasons, that is, you don’t want to change just to change)

It’s like a muscle, and the more you practice, the better you get and the more you can be confident in your ability to do it again if you need to.

It’s this thing again:

Amazon Fulfilment Center Video Tour (April 2021)

I’ve long wanted to tour an Amazon FC, but haven’t had a chance yet (last I checked, the FC in my area doesn’t offer tours).

But I found the next best thing, which is this relatively recently video tour, showing both the more traditional FCs and the new robotized ones where it’s the the shelves that are moving around rather than people:

Of course, this video is produced by Amazon, so keep in mind that it’s part of the company’s marketing. But it still gives an idea of what this type of infrastructure is like and how it works.

Science & Technology

Apple Safari 15, When Designers Forget Users Edition

If I were preparing a lecture for design students about what Jobs meant, I’d use Safari 14 and 15’s tab designs as examples. If anything, Safari 15 feels like a ginned-up example — too obviously focused solely on how it looks, too obviously callous about how it works. If it hadn’t actually shipped to tens of millions of Mac users as a software update, you’d think it was a straw man example of misguided design.

John Gruber has a great piece on the UX/UI blunders that Apple’s browser team made in the latest version of Safari.

Nobody bats a thousand, so these things happen once in a while, especially if you’re trying to innovate and push the envelope. Sometimes you think you’ve found an interesting way to improve things, but it turns out it’s worse than the previous way, or there are good aspects, but also some fatal flaws.

Ideally you want to catch bad designs before they’re released to users, but it’s not always possible for various reasons.

What matters most then is how you react; do you dig your heels in and reject all feedback and assume that people just don’t know (yet) what’s good for them and will get used to what you’re offering (because sometimes, that’s how things work out…), or do you re-evaluate and if the feedback makes sense, do you course-correct.

In the case of Safari, Apple has done some of that, walking back the worse aspects of the new design on iOS and allowing settings elsewhere to revert back to a more conventional tab design.

But I think at this point, they should just scrap it and go back to the drawing board. Learn from this and come back with something even better in the future.

Because Safari is a great browser and — many people may not know this — the ancestor of most modern browsers.

The original Safari was built on the KHTML rendering engines from KDE’s Konqueror browser (on Linux). They took this open-source codebase and turned it into Webkit/Safari. This was then used by the Google Chrome team to build their browser, and later forked into the Blink rendering engine. Microsoft later dropped its own engine and forked Chromium (Chrome’s open source version) to create the modern MS Edge browser.

So basically, almost all modern browsers (Firefox is an exception) have a direct lineage to Apple’s Safari/Webkit engine.

Here’s how hackers copy access keycards to open locked doors 🚪 🔐 💳

The video is pretty self-explanatory, so I don’t have too much to add. Very interesting stuff:

The Arts & History

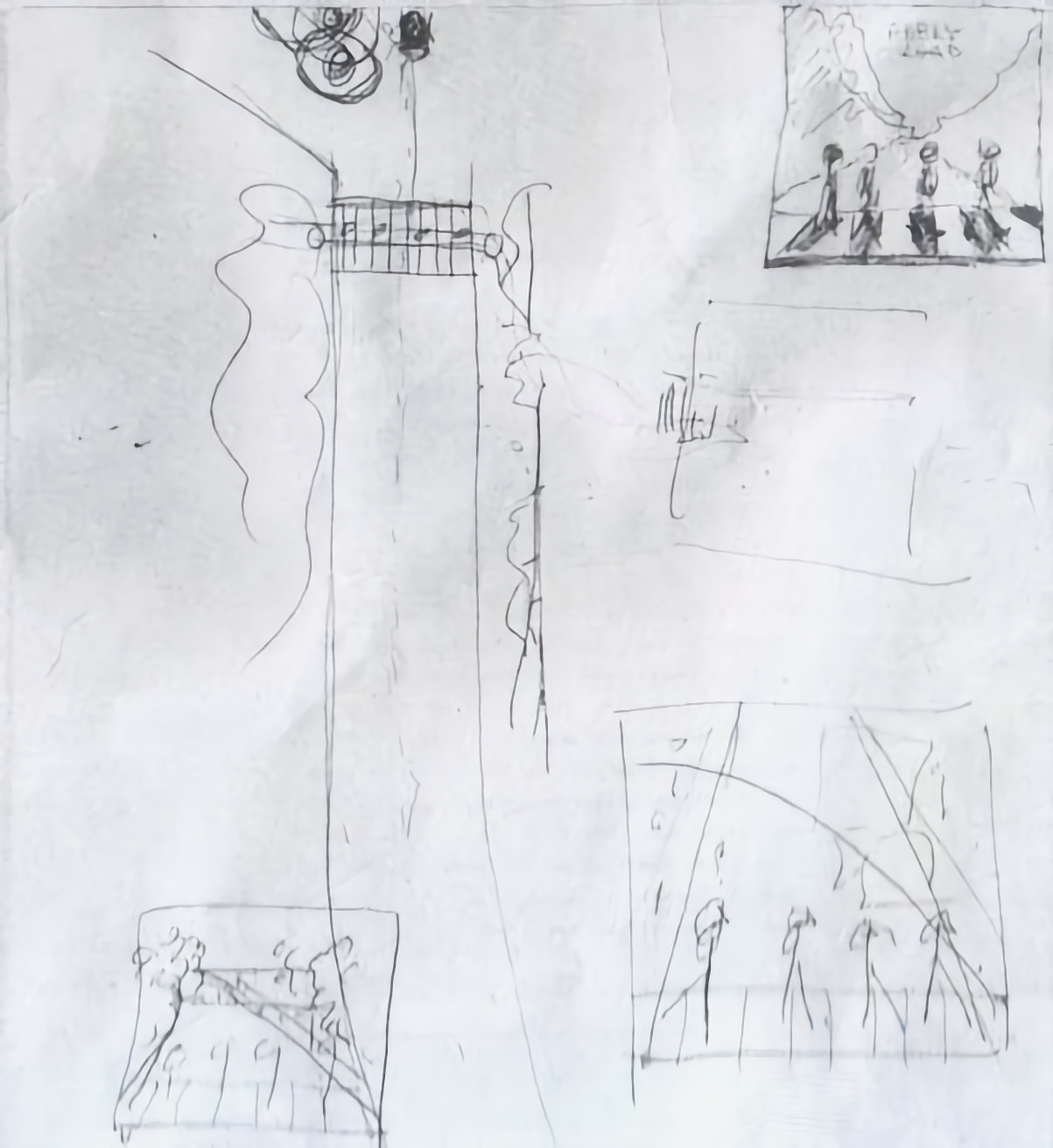

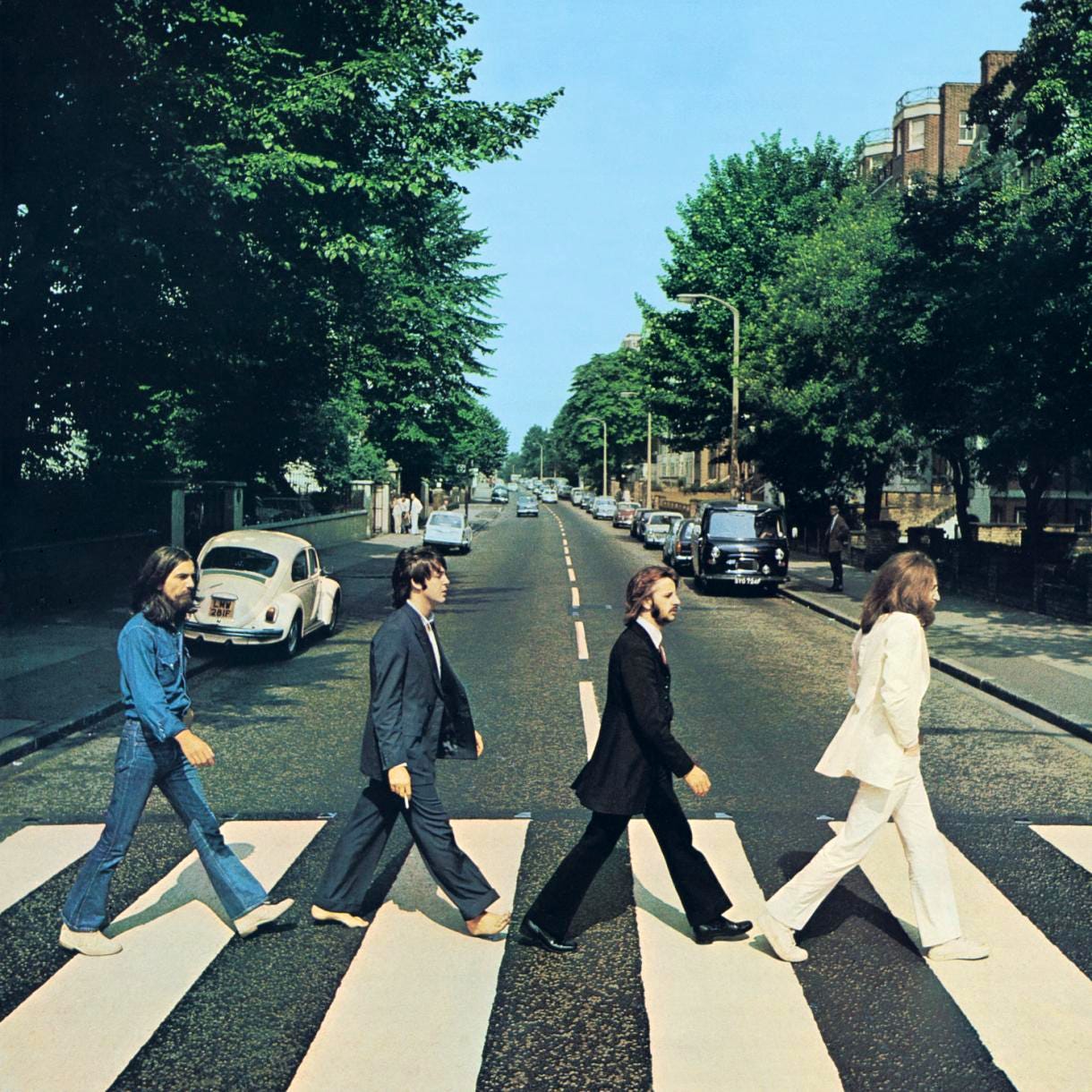

‘Paul McCartney's concept sketch of the Abbey Road album cover.’

Yea, I’m basically publishing napkin sketches now.

But I thought this one was cool. Shows how much thought went into the exact angle and perspective, with even a top-down view of the scene.

Cool to get a peek inside the creative process of this iconic album cover.

h/t Carl Quintanilla

RFID copiers for 125khz cards can be bought for ~10USD and the cloning process is extremely easy.

Tip: One legitimate use is for replacing your company-issued card with something more convenient: a fob, a wristband, or a sticker you can attach to the back of your watch.

https://www.getkisi.com/blog/how-to-copy-access-cards-and-keyfobs

I love your Substack! I learn so much from it.