188: Tech Profit Pool, Facebook, Psych 101: Change Blindness, Nvidia's ARM Deal, Schrödinger’s Financial Headlines, Tesla's HQ, Apple's A15 Performance, and Google's AlphaFold

"like they’re buying a bunch of tanks and F35s or something"

Prize familiar truths over original falsehoods.

—Stoic Emperor

🤔 While getting some login and password info from my kid’s school to get access to some schoolwork, I was thinking how interesting it is that schools can now take for granted that everybody has computers and an internet connection.

I wonder what was the year when that became a safe assumption?

It also made me think: how much of a contrarian life-choice it would be for someone to voluntary decide not to own a computer.

I don’t just mean a laptop or a desktop, but any form-factor that can be described as a computer (smartphone, tablet, etc). Not even an ISP connection.

How different would my life be without computers and the internet? Hmm.

🧖♀️🏖👨👦👦 This weekend I’ll be visiting my parents for Canadian Thanksgiving, so I may not have much time to write.

If I had to put a number on it, I’d say there’s 80% chance your inbox will feel a bit lighter Monday morning…

But don’t worry…

💚 🥃 It’s been a while since I gave an update on how many people are in the club (I think the fire marshal may soon shut us down):

It’s just you and I and 5500 of our closest friends.

But if you want to join the 💎 VIP Club 💎, it’s quick and inexpensive, click this button (make sure you’re logged in your Substack account to see the upgrade options):

Investing & Business

Tech Profit Pool Enabled by Semiconductors, Dutch Wizards Edition 🧙♂️🧙♀️

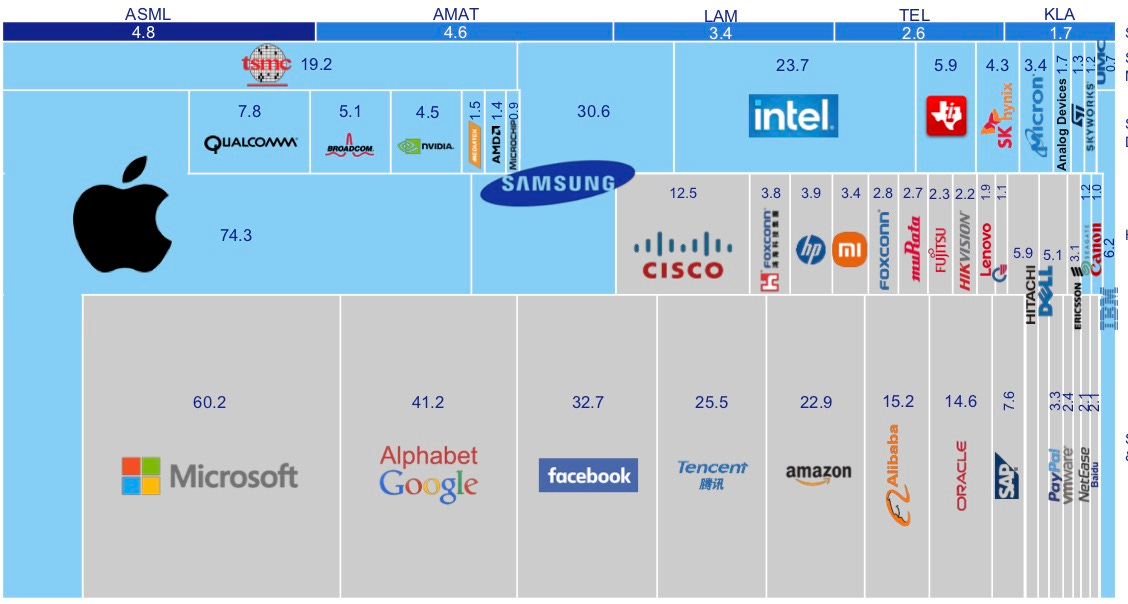

Friend-of-the-show and supporter (💚 🥃) Jon Bathgate shared a very neat slide from ASML (the Dutch wizards who make these magical devices used to turn sand into computation):

My favorite ASML slide, which they've continued to update over the years.

It shows the $500B profit pool across the tech ecosystem enabled by semicap equipment, and those profits are growing mid-teens 🤯

How Facebook’s Outage was Like Valentine’s Day

Snapchat use surged more than 20% after Facebook Inc.’s services went down for six hours Monday, the biggest winner among rival apps during the U.S. social media giant’s worst outage in years. [...]

Snap Inc. saw a 23% boost in time spent on its Android app on Monday compared with the same day the prior week, according to Sensor Tower data shared with Bloomberg News. That led gains in activity on apps from Telegram and Signal to Twitter Inc. and ByteDance Ltd.’s TikTok on Oct. 4, the mobile researcher said. [...]

Telegram founder Pavel Durov said his app added 70 million users and set new highs for registrations and activity on Monday. It jumped to the top of the iPhone App Store as the most-downloaded free app in 40 markets, while Signal was no. 1 in Poland and in the top 10 in 35 markets, Sensor Tower said.

Every time there’s some big controversy or outage with one of Facebook’s services, competitors see spikes in interest.

This made me think that for retailers some days of the year are by far the busiest and most profitable, for example Valentine’s day for florists.

Looks like for Facebook competitors, those days are FB outages/big media controversy days. Kind of an unpredictable business model, but hey ¯\_(ツ)_/¯

Psych 101: Change Blindness (this has to apply to investing & business too)

I don’t know if this study on change blindness is part of the replication crisis, but while the exact strength of the effect may be weaker or stronger than the original study claims, I think the general idea makes perfect sense and we can probably all relate to how our brains are very selective in what they perceive.

We just don’t have that much attention “bandwidth” to go around, so we filter things out aggressively based on what we’re looking for or what we’re doing, or more importantly, on what we’re expecting — the brain is after all largely a prediction machine.

Sometimes we’re driving, come to an intersection, and are very careful to look around for cars, and so we don’t notice that cyclist because our brain was specifically looking for vehicles.

I can easily imagine being in a situation where a stranger asks me to help with something, and my brain is actively engaged in trying to do that (in the video above it seems to be helping with directions on a paper map — how quaint), and I could easily not notice if that person was switched out if I only had a chance to glance at them briefly before.

This is because the little attention that I have would be on the map and trying to think up how to explain how to navigate the city, which probably uses the visual part of the brain heavily, and because my expectations would be that whatever is there when I look up is still the same person as before, so whatever I’m seeing, my brain probably just backfills that — kind of like false memories, or how new memories of someone tend to overwrite old ones.

Ok, that’s a longer intro than I intended, but the general idea is, how do these concepts apply to business and investing?

How often do we see what we expect to see rather than what is really there?

How often do we fall to a bait & switch where expectations are set but are changing under us without us noticing, and we just kind of unconsciously update to these new expectations as if they were always the thing that we expected?

I’m sure this kind of stuff happens all the time, and I’m trying to do some meta-thinking on it to hopefully have a more finely tuned antenna to detect it more often (I don’t expect 100%, but hopefully better than 0%).

Nvidia offers ARM deal ‘concessions’ to EU

Wow, I just realized how “an ARM deal” sounds. It’s like they’re buying a bunch of tanks and F35s or something… I bet there are ARM chips in those, though.

So Reuters is reporting that Nvidia has offered some mysterious concessions, which haven’t been made public, and the EU competition enforcer should make a decision on October 27th.

I’m curious how this’ll turn out. I certainly hope the deal gets through, because it seems to be the most interesting future from a technological perspective. I think Nvidia can make ARM better and innovate faster, and distribute some of its cool technologies farther and wider through the ARM platform.

Schrödinger’s Financial Headlines

Financial journalist daily morning todo:

-In the morning, gather as many news items that can explain either a positive or a negative market performance.

-As things unfold, pick what you need from either bucket.

Tesla Moving HQ to Texas

Tesla is moving its headquarters from Palo Alto, California, to Austin, Texas, CEO Elon Musk announced at the company’s shareholder meeting on Thursday.

“To be clear we will be continuing to expand our activities in California,” Musk said. “Our intention is to increase output from Fremont and Giga Nevada by 50%. If you go to our Fremont factory it’s jammed.”

But, he added, “It’s tough for people to afford houses, and people have to come in from far away....There’s a limit to how big you can scale in the Bay Area.” (Source)

The company is building a new plant in Austin. Musk himself has moved to Texas in 2020.

Competition is good for companies and consumers, and ultimately, I think it’ll be good for states, cities, and citizens.

If some place gets too complacent, does a bad job with governance, or is too hostile to entrepreneurs, over time they will lose out to those who aren’t, and this will create some incentives to do better.

California has been such an engine of creation for the U.S. and the world, I really hope it can get its act together and fix some of its problems. It still has so many great qualities, it’s really too bad if it stays stuck in a morass. (I say this as an outside observer who doesn’t claim to have first-hand knowledge of any of this, but even from the outside, it’s clear that that there’s a lot of dysfunction)

Science & Technology

🔥 Apple’s A15 System-on-a-Chip 🔥

Looks like Apple undersold its new iPhone 13 chip during the launch presentation, because lots of us assumed it would be a ho-hum year, but Anandtech’s in-depth piece about it reveals a pretty big improvement, all things considered:

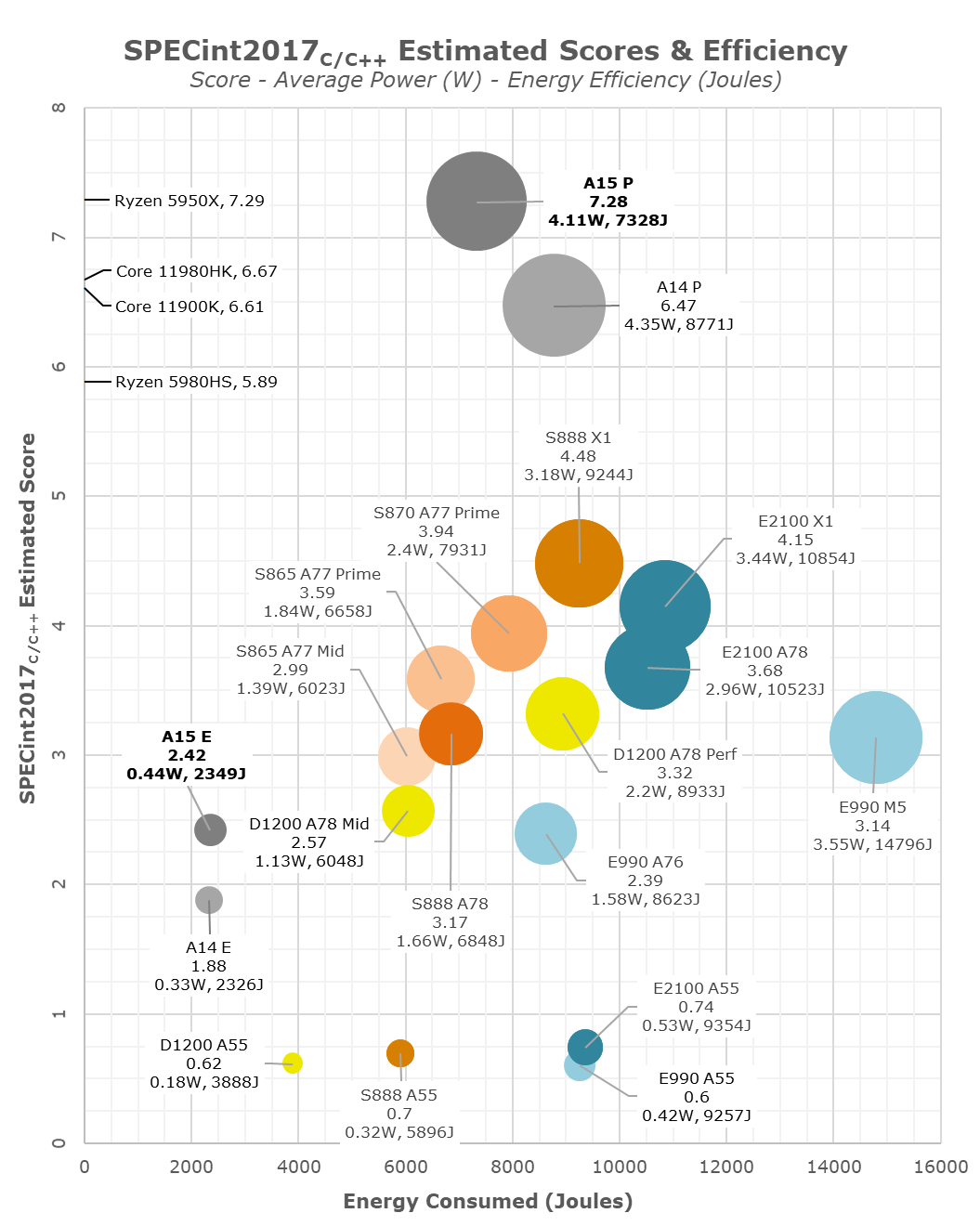

Compared to the Snapdragon 888, there’s quite a stark juxtaposition. First of all, Apple’s E-cores, although not quite as powerful as a middle core on Android SoCs, is still quite respectable and does somewhat come close to at least view them in a similar performance class. The comparison against the little Cortex-A55 cores is more absurd though, as the A15’s E-core is 3.5x faster on average, yet only consuming 32% more power, so energy efficiency is 60% better. Even for the middle cores, if we possibly were to down-clock them to match the A15’s E-core’s performance, the energy efficiency is multiple factors off what Apple is achieving.

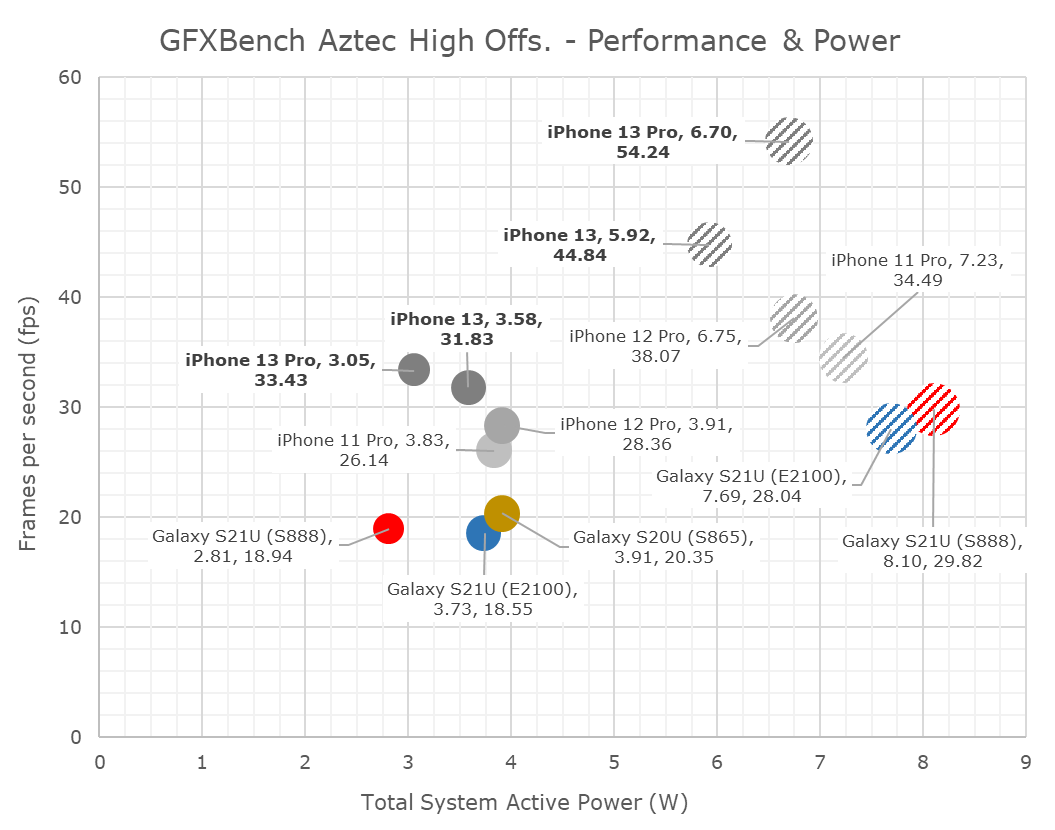

Apple’s *efficiency* cores (the smaller gray circles on the graph) are almost comparable to a Snapdragon’s fast cores, and probably are faster than the faster cores that could be found on an Android phone from just 1-2 years ago.

If you look at the graph with the bubbles at the top, Apple’s A14 from last year is still in a league of its own compared to the rest of the ARM SoCs being sold, and the A15 somehow further forged ahead (despite only a minor process upgrade from TSMC, and no shrink) *while* improving energy efficiency.

This is just bonkers.

Apple claimed to be “50% faster than the competition”, and it’s this fuzzy metric that had many worried. But it turns out:

Compared to the competition, the A15 isn’t +50 faster as Apple claims, but rather +62% faster.

But the CPU isn’t the only important thing. The most demanding modern software often uses a mix of CPU, GPU, and ML-acceleration cores. On the GPU front, Apple stands out too (the graph shows both peak and sustained GPU performance):

Anandtech concludes:

In our extensive testing, we’re elated to see that it was actually mostly an efficiency focus this year, with the new performance cores showcasing adequate performance improvements, while at the same time reducing power consumption, as well as significantly improving energy efficiency.

The efficiency cores of the A15 have also seen massive gains, this time around with Apple mostly investing them back into performance, with the new cores showcasing +23-28% absolute performance improvements, something that isn’t easily identified by popular benchmarking. [...]

In the GPU side, Apple’s peak performance improvements are off the charts, with a combination of a new larger GPU, new architecture, and the larger system cache that helps both performance as well as efficiency. [...]

while the A15 isn’t the brute force iteration we’ve become used to from Apple in recent years, it very much comes with substantial generational gains that allow it to be a notably better SoC than the A14. In the end, it seems like Apple’s SoC team has executed well after all.

Life is trade-offs, and I think Apple probably made the right ones here.

Most iPhone users will notice and appreciate the extra hours of battery life a lot more than they would an extra 10-15% speed on the CPU side, since the A14 was already so much faster than pretty much anything else.

AlphaFold Keeps Getting Better, Multi-Chain Protein Complex Edition

One of the recent scientific advances that I’m most excited about is computation protein prediction/design, with the recent breakthrough by DeepMind’s AlphaFold.

While the vast majority of well-structured single protein chains can now be predicted to high accuracy due to the recent AlphaFold [1] model, the prediction of multi-chain protein complexes remains a challenge in many cases. In this work, we demonstrate that an AlphaFold model trained specifically for multimeric inputs of known stoichiometry, which we call AlphaFold-Multimer, significantly increases accuracy of predicted multimeric interfaces over input-adapted single-chain AlphaFold while maintaining high intra-chain accuracy.

Yes, you could fit all the red circles in it…

This would be sad enough if almost all these were unavoidable deaths, but so many in the US, and around the world, we’re avoidable.

The Arts & History

🥁 Such a smooth one-man-orchestra 😎

This is kind of a lighter one, and it takes a bit to get going in the video, but I still think it’s really cool and y’know what? It mostly makes me think about how you develop this skill in the first place.

How do you get going? You’re playing guitar and thinking, what if I built a custom contraption on my back where I could play percussion at the same time. Ok, some strings tied to my feet, oh wait, I could tie one to the guitar neck too. Oh, even my strumming hand could be tied to some kind of cowbell, oh, and my elbow, etc. He’s even got guitar amplification built-in the backpack, a lot of work went into this.

And the final bell!

The choreography required to make all of this sounds this smooth, combined with the showmanship of how he moves and his expressions… I don’t care if it’s not as prestigious, street art is art!

See for yourself if you need a smile this morning:

The artist is Santiago Moreno.