20: Are Stock Market Indices Ships of Theseus, Zoom Q2, Patrick Collison Interview, Three-Body Problem for Netflix

"the Ship of Theseus, of which every part was replaced over time"

The Company that needs a new machine tool is already paying for it. -Old Warner & Swasey ad

⚙️

Investing & Business

When is a Thing Not the Same Thing Anymore?

Something I’ve been harping on for a while — and I’m not alone on this — is that people often think they’re comparing something to an older version of itself, while in fact they’re comparing two different things. The mistake often happens because the things have the same name.

A common example is stock indices. When you look at “the Dow/S&P500/etc did X during this period of history and then it did Y and we can probably expect Z”, it may seem like you’re trying to learn about the behavior of a thing to better predict its future behavior.

But the thing itself is a bit like the Ship of Theseus, of which every part was replaced over time, or the proverbial grandfather’s axe, of which both the head and the handle had been replaced multiple times.

Is it the same thing?

Well, it depends what you’re asking, and how you replaced the parts.

Functionally it may serve the same purpose. It may have the same name. If you replace every part with a similar part, both the ship and axe may even have the same performance as before at their respective uses.

But if you take a basic old axe and replace the handle with a high-performance composite handle and the head with a fancy modern steel alloy, is it the same axe?

This is what this part of Andrew Walker’s recent post reminded me of:

I can't help but wonder if worrying about CAPE ratios or market cap to GDP is missing the forest for the trees. The largest companies in the indices (Apple, Google, Microsoft, etc.) are better businesses than anything the marker has ever seen. Their returns on incremental capital are off the charts, they are much less cyclical than the largest businesses of yesteryear, their growth opportunities are much more interesting, and honestly it's just harder to think of something that could kill them than the giants of 20-40 years ago. [...]

In 1965, of the 10 largest companies in America, you had the three major car companies (GM, Ford, Chrysler), U.S. Steel, and then four oil majors. All of those are somewhere between somewhat cyclical to super cyclical companies. Growth for those companies is also extremely, extremely expensive as those are very capital intensive businesses. Growth requires buying a new steel plant / car factory / oil well.

So is the Dow/S&P500 still the same thing that it was?

It depends what you’re asking… There’s not a right answer here (school teaches us as kids to look for "the right answer", but for most things in life, there's no single right answer, you just have to keep in mind the underlying facts and nuances when you’re thinking about something to reduce your error rate).

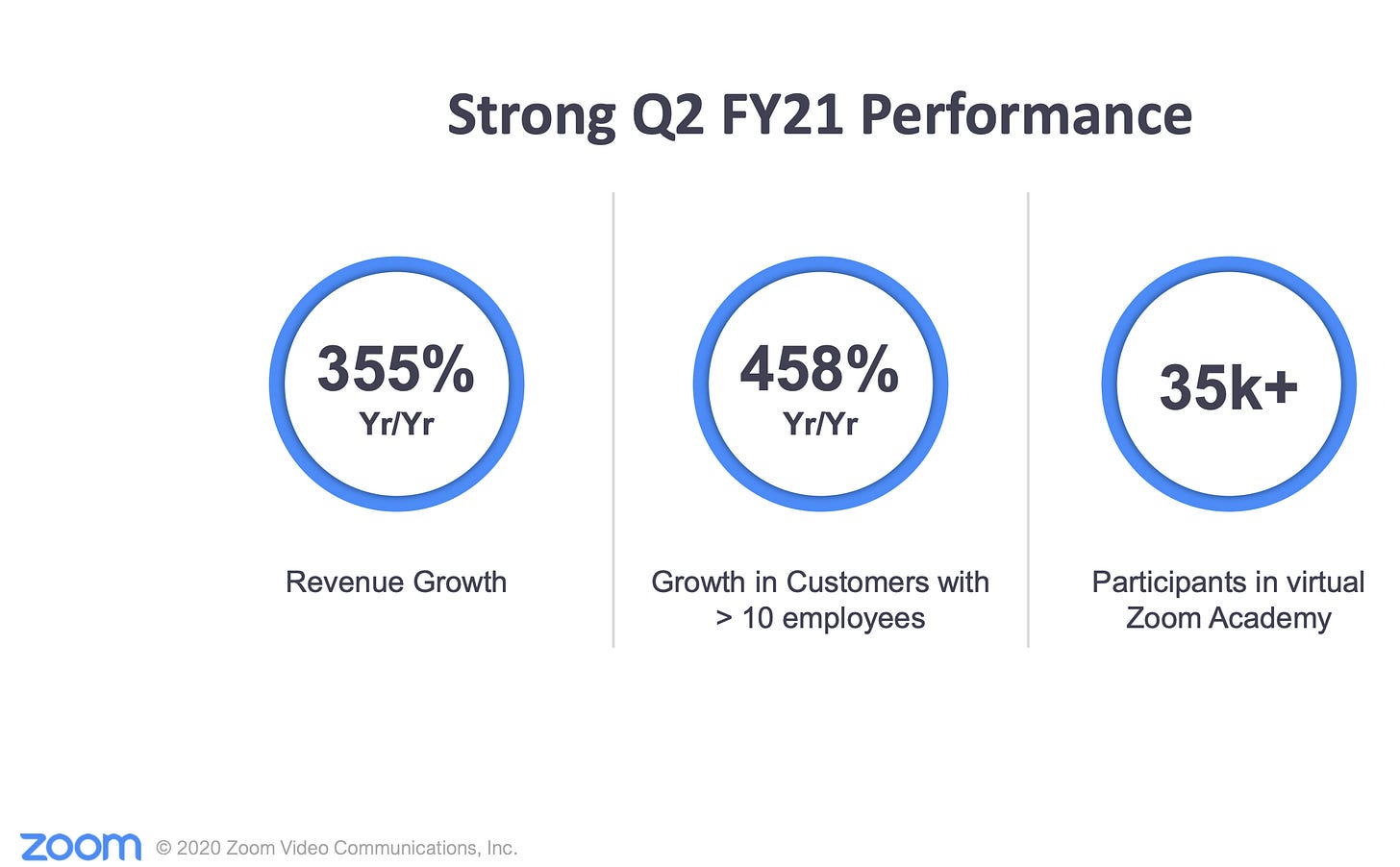

“Strong”…

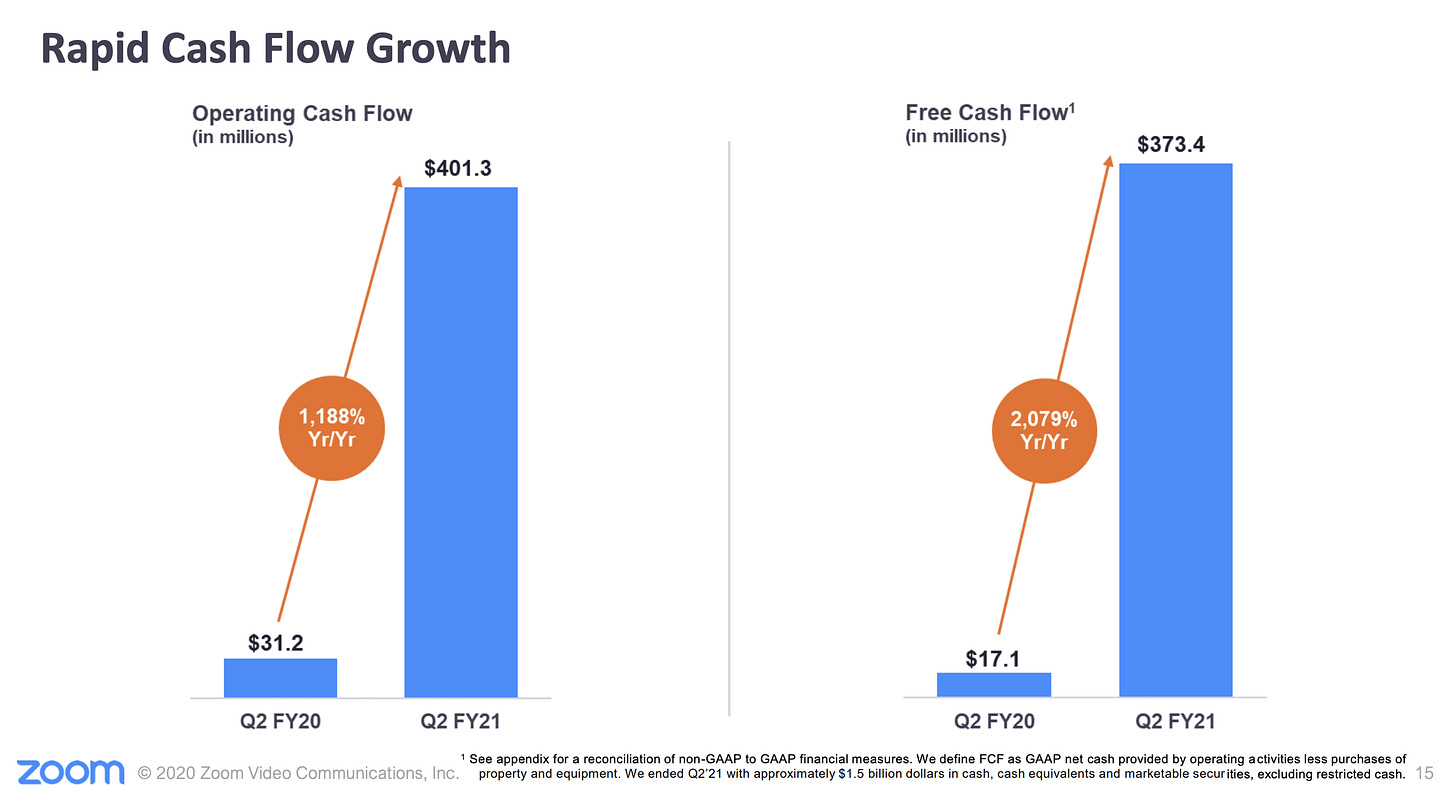

…“Rapid”

Some companies like to exaggerate their results, and some have to resort to euphemisms.

What will be fascinating to see is what happens when the pandemic finally ends (or at least, becomes ignorable for most people). How will things settle down when it comes to work-from-home vs back-to-the-office, which will have a big impact on video calling usage.

The day after this earning release, the stock was up over 40% at open, giving the company a market cap of close to $125 billion. The company started 2020 with a market cap of about $19 billion.

If you started the year with 90% cash and 10% in Zoom, you still are having a pretty strong year...

Interview with Patrick Collison, Stripe CEO

The Information has an interview with Patrick Collison, one of the best and smartest CEOs operating at the moment (and 31 years old!):

The Information: How has Covid-19 affected Stripe?

Collison: We’ve seen a huge surge in businesses [...]

E-commerce as a fraction of total consumer spending was actually not that high pre-Covid. The U.S. actually lagged some other countries like the U.K. or China.

Back in January of this year, [e-commerce] was running around 15% of consumer spending. And obviously that was growing with each year. Covid has been a kind of multiyear accelerant.

Answering a question about when they’d IPO, Collison went on an interesting tangent:

We’re an infrastructure company, right? [...]

What’s been so distinct about Amazon is the durability of their compounding. They’re 20%, 30% a year. Now they’re in the third decade. They are a logistics and an infrastructure company. That is the kind of pattern of other companies that operate at lower levels of the stack, as opposed to, for example, something that is entertainment. TikTok is obviously at the center of the news today and has had staggering growth rates.

That is the kind of thing that’s possible when you’re building that kind of product and you do as well as they did.

Just look at the internet itself. The internet actually didn’t grow that quickly in any given year. It has sustained this 30%, 40% compound annual growth rate for many decades at this point.

I don’t assume for a second [we’re] comparing Stripe to either Amazon or the internet in terms of how far we’re actually gonna go. We’re a minnow compared to either of them at this point today. For a platform, a lower-level foundation, these things just tend to evolve more slowly.

It’s got to make you wonder, what are some other of these digital “infrastructure” companies that may not explode out of the gate quite as fast as the fastest-growing consumer-oriented companies, but that will keep going for very long periods at still-high growth rates? I can think of a few, but I’m sure I’m not thinking of many of them…

Source (subscription required).

h/t @HangfireCapital (locked account)

Francisco Olivera Podcast Interview

Tobias Carlisle had a good conversation with Francisco Olivera, a good follow on Twitter (@FrancoOlivera) and a thoughtful investor.

They cover his process and investing philosophy, talk about Malone and the Liberty complex, Charter (CHTR), Disney and FOX (DIS) and a little bit of Netflix (NFLX), Restaurant Brands International (QSR), 3G, etc.

You can listen or watch the video here.

Duration: 60 mins, (30 mins at 2x)

Local News Being Reborn from the Bottoms Up for the Digital Age

This thread by Andrew Wilkinson shows a great example of how local news may be reborn (highlights are mine):

In 2019, I set out to do something simple:

Recreate the local newspaper in digital form, by creating a simple daily newsletter focused on Victoria, Canada, my home town Newspaper

I hired a journalist and we started sending out a quick summary of what’s happening every day at 7AM...

We wanted to give people a quick overview of what’s happening (news, events, sports, arts) in 2 min or less.

Something you can skim over your morning coffee, like the front page of the newspaper, to feel more informed.

I figured it would be a short lived goofy experiment...

After all, local/community news is dead, right?

Nope. Not at all...

It turns out people—at least in Victoria—are desperate to know what was happening in their local community.

I’ve been involved with all sorts of flashy companies, but for the first time I got stopped in local cafes and people gushed about Capital Daily, our newsletter...

Before we knew it, we had 5,000 subscribers.

Then 20,000.

A year later, we have over 40,000 subscribers.

The population of Victoria is only around 367,000, so 1 in 10 residents reads our newsletter(!).

We are now bigger than The Times Colonist, the 100 yr old daily paper...

To think that we went from all these Buffett letters a few decades ago talking about how impregnable the newspaper monopolies were in most cities to this. The Internet truly is reshaping the world, and very quickly.

We’ve started hiring full-time journalists to do original reporting and covering topics that other newsrooms (focused on short form quick bites) can’t or won’t cover.

So what made this work so well?

A few things:

1. We figured out the pareto principal. 80% of the results for 20% of the effort. We realized that the key thing people wanted was a simple briefing instead of a complex news website.

The job to be done was: “something to skim that gives me a rough sense of what’s happening”...

2. We cut out all the legacy costs of a news business. No printing press. No office. Cheap software (Mailchimp/Webflow).

3. Most importantly: we used cheap digital advertising to build up our audience. We spent about $200k on Facebook and Instagram with almost zero competition.

These keywords are untouched. Nobody is spending money on news audience acquisition.

Think about this: I could have gone and bought the local paper for $5-$15MM.

Instead, I spent $200k on FB ads, $50 on Mailchimp, and $60k on a writer and BOOM!

Now I own the largest daily audience in the city, with no gatekeepers (direct to inbox, no FB or platform risk).

This is crucial. A lot of businesses are built with someone else in between you and your customers. When you don’t own the relationship and are at the mercy of someone else, problems are inevitable down the road.

This is part of what I talked about in my Spotify piece in newsletter #18. Podcasters used to own their audiences, but now they’re increasingly letting third parties like Spotify get in between.

I expected to burn money, but now advertisers are lining up and we’ve realizing it can not only break even, but be profitable...

My original goal was to make the community more informed, bring important issues to the forefront, and report on stories that others couldn’t or wouldn’t.

So we’re going to keep pounding our profits into hiring more journalists, and I’m continuing to inject cash to grow faster..

But what’s cool about this is that, even in 2020, local news is relatively untouched (everyone thinks it can’t be done) and can be profitable...

We are doubling down. I have hired an amazing CEO and we want to roll this out across Canada and maybe the US, but I wanted to share some inspiration for anyone thinking about how to best support local news....

For about $100-200k, you can probably do something similar in your city.

Hopefully we can do some good and start to re-engage people in local issues.

How defensible is this as a business long-term without high capital needs providing a barrier to entry?

I don’t know, but I don’t really care. I’m just glad to see some tailwinds for this important societal function after so many crushing blows.

h/t Nick (locked account)

John Huber Podcast Interview

Another good interview recently was John Huber interviewed on The Investor’s Podcast Network (you can follow John on Twitter here and his website is here).

He goes over a lot of the ways that the thinks about quality businesses and how to find them, as well as some very good points about how volatile even the biggest businesses in the world are and how it can be more important to get business selection right than valuation.

As I often say, a lot of it is the basics, but in investing, most of the important things are the basics. It’s the whole “simple but not easy” dynamic. We have to constantly make sure we keep the obvious stuff in mind...

On the quant side, there’s no doubt big secrets that can make you a lot of money (secret algorithms and private data sets), but if you’re just picking businesses to invest in for the long-term, there’s no secrets. There’s a lot of industry-specific expertise that may help you invest in some things that others don’t understand, but to me that’s not the same thing.

Duration: 60 mins (30 mins at 2x)

(Hi John!)

Science & Technology

Drone-Bombing Assassinations by Drug Cartels

Tools multiply our abilities to do things, both good and bad. As we get more powerful tools and technologies, we’re going to see stuff like this:

Now at least one of [Mexico’s drug cartels] appears to be increasingly making use of small quadcopter-type drones carrying small explosive devices to attack its enemies. This is just the latest example of a trend that has been growing worldwide in recent years, including among non-state actors, such as terrorists and criminals, which underscores the potential threats commercially-available unmanned systems pose on and off the battlefield. (source)

In the same way that good ideas diffuse through the civilization once they’re invented, bad ideas too…

The C4 was packed with ball bearings to serve as shrapnel in Tupperware-like containers that were equipped with a remote detonation system and duct-taped to the drones, militia members explained. (source)

If you want to see a vision of a scary future, check out Slaughterbots, a dramatized video about swarms of small drones that find and assassinate people using facial recognizing and close-range single bullets to the head (the video itself doesn’t have to be 100% correct in all details — the fact remains that the technological capabilities are moving in that direction).

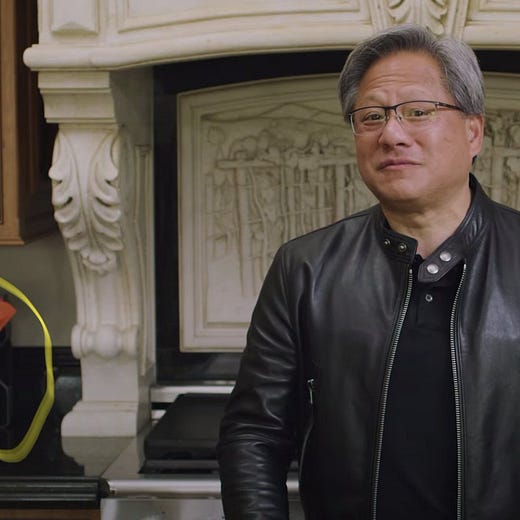

Nvidia GeForce Gaming Event

Good event announcing the new Ampere-based GeForce GPUs (28 billion transistors fabbed at 8nm by Samsung, impressive performance/power scaling), as well as a bunch of other related technologies.

This letter is getting long, so I won’t go into to much detail here, but here’s the video of Jensen Huang doing the announcements in his kitchen, and here’s the press release.

Funny how they had the new GPU hidden in frame from the beginning of the presentation (behind Jensen’s spatula collection?!). And that “BFGPU” joke during the 3090 unveil? Just in my sweet spot.

New Interview with Matthew Walker on Sleep

Peter Attia has a new interview with sleep scientist Matthew Walker (podcast, duration 1h41, or 51 mins at 2x). It covers:

many sleep-related topics, starting with what we’ve learned about sleep through the lens of the COVID-19 pandemic and how sleep impacts the immune system. He then covers topics such as how dreaming affects emotional health, the different sleep chronotypes, the best sleep hygiene tips, and the pros and cons of napping. Matthew finishes by addressing several of the errors that readers have pointed out in his book, Why We Sleep.

If you haven’t heard his original three-part podcast interview, I recommend it. I’ve listened to it multiple times and making some life-changes based on it (and on my Oura Ring sleep-tracker) has had noticeable benefits to my life: Part 1, part 2, part 3.

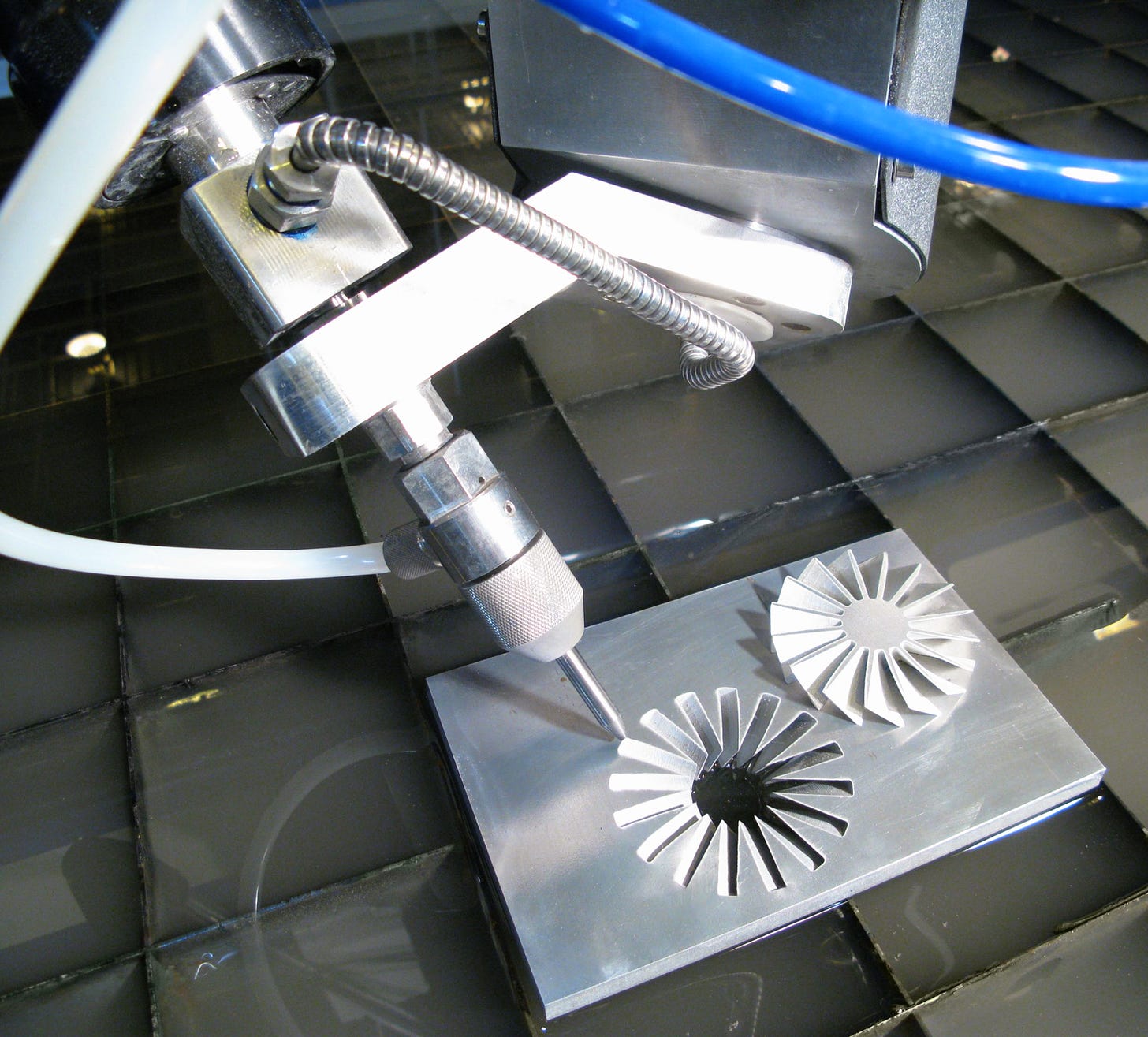

Ultra-High Pressure Water Jet Cutter

A water jet cutter, also known as a water jet or waterjet, is an industrial tool capable of cutting a wide variety of materials using a very high-pressure jet of water, or a mixture of water and an abrasive substance.

Above is an OMAX water jet. Not sure which one, but the specs I’ve seen were around 30,000 PSI. I’m sure they have more powerful ones too. Some models go up to 100,000 PSI.

The ‘Cut in Half’ Youtube channel has a bunch more videos like this.

It gets really cool when you combine this tech with multi-axis cutting:

Via Massimo

The Arts

Samurai: Single-Sheet Origami (without any cutting!)

It took me 50 hours to fold this origami model from a single square piece of paper, without any cutting.

Folded from a single 68cm x 68cm Wenzhou paper, without any cutting or ripping. Final size of the model with the stand is 17cm x 17cm x 23cm. The model contains hundreds of folds and steps to achieve all the details, such as fingers. Special wet folding techniques were used to create the expressive and organic shaping of the model.

What the folding looks like:

Here’s how the artist, jkonkkola_art, comes up with the designs and folding patterns:

Its mostly done in my mind, I use basic drawing program to memorize all the hundreds of folds and it allows me to see the structure fully as a clean crease pattern.

I usually have a rough idea in my mind what I wan't to achieve. Then I lay out all the features and limbs on the paper. Each feature or flap takes roughly circular or rectangular space on paper. Then I figure out the folds to be able to fold all the features. After that I test fold the model to see how it works and looks.

For this model I did 3 test folds, then folded first version in June and this model last week. The designing process can take months of work before I even get to work on the final model and higher quality paper. The most scary part in the process is that I don't know what the finished result looks like before the last 10-20 hours of folding the final model. I can only guess what it would look like. (Source)

Here’s a couple different ones by the same artist:

‘Game of Thrones’ Benioff and Weiss to adapt Liu Cixin’s sci-fi epic The Three-Body Problem at Netflix’

This is big news:

After striking up a development deal with the streamer last August, reportedly to the tune of $200 million, David Benioff and D.B. Weiss departed HBO and ditched an assignment to write their own Star Wars trilogy. On Tuesday, Netflix VP of Original Series, Peter Friedlander unveiled the first fruits of the deal: a new live-action series inspired by Chinese author Liu Cixin’s acclaimed science fiction novel The Three-Body Problem.

I haven’t had a chance to read the series yet, but its reputation among science-fiction enthusiasts whose taste I respect is high enough that this news is making my heartbeat quicken. It’s been so long since we had a really great science-fiction series…

The Expanse showed great promise in season 1, at first giving me hope that it was “the next Battlestar Galactica”, but in my opinion the quality dropped off after that, enough that I stopped somewhere late in season 3.

Hopefully this new show is good, and stays good. So many shows just can’t maintain quality (f.ex. ‘Sneaky Pete’ was great in S1, but I couldn’t get through S2…).

Director Rian Johnson (Star Wars: The Last Jedi, Knives Out) and his producing partner, Ram Bergman, will serve as executive producers on the series. Similar to George R.R. Martin’s role on Thrones, Cixin will work with Benioff and Weiss as a consulting producer alongside Ken Liu, who wrote the English translation for The Three-Body Problem. Plan B Entertainment, the company founded by Brad Pitt, Jeremy Kleiner and Dede Gardner —which previously produced films like Ad Astra, The Lost City of Z, Okja and Moonlight — will oversee the production.

They’re bringing a lot of people on board, including the author.

Source. Via @JacksonWharf