201: Cloudflare Q3 Highlights, Microsoft Q3, Nvidia = Coolest Company in the World?, Facebook/Meta + AMD, US Energy Infrastructure, TSMC & Sony, and Asimov's Foundation

"But yeah, there’s the problem of all the bad parts."

I have made a ceaseless effort not to ridicule, not to bewail, not to scorn human actions, but to understand them.

―Baruch Spinoza

💻 This is kind of a tech/business-heavy edition. Sometimes things line up that way… If that’s your thing, enjoy! 🦾

🛫 🌎 🌏 🇧🇩 My friend MBI is leaving Canada and flying back to Bangladesh, to be reunited with with family and wife. He wrote one of his organic, hand-carved threads about his experience in Ottawa.

This is bittersweet for me.

On one hand, I'm very happy that my friend will join his family & wife, and won't have so much trouble finding as much good Bangladeshi food as he wants. 😁

On the other, he's moving away, and I'll miss our walks in the woods and along the river 😔

Trivia: Did you know that Bangladesh has a population over over 160m (and based on my own sampling, all of them are very smart and very nice).

⚡️🔌 Here’s one that I can’t believe isn’t ubiquitous by now… I’ve been saying this for 10+ years, and I haven’t seen that much traction on it (it’s not zero, but it’s still fairly marginal — hopefully it catches on more soon):

I think every house and every building should have a prominently displayed dashboard where you can see real-time and historical graphs of that buildings “vitals” when it comes to energy and water consumption, maybe even air quality measures, all showed in the most intuitive way possible (so in absolute units like kWh or liters/gallons, but also in intuitive $/month or last-twelve month running total, etc).

And of course, maybe it easy (with a QR code?) to mirror that on your smartphone, get monthly emails with a summary, etc.

Immediate feedback has been shown over-and-over-again to influence behavior.

In fact, the early hybrid cars like the Prius got a significant chunk of their fuel economy benefits not from their mechanical drivetrain differences (electric motors, batteries, regenerative braking, etc), but because they had a nice big screen front and center that showed fuel economy metrics, and drivers were trained by that feedback to do better (“wow, look at how it crushes my MPG when I do X, and look at how high the number gets when I do Y..”).

I think it’s the same for almost anything. Just tracking what you eat probably leads to better decisions, wearing a constant blood glucose monitor (CGM) trains people not to eat certain things, Oura ring helps sleep, etc.

We should do the same for buildings. Let’s put some behavioral psych to work! With the low cost and ubiquity of screens, IoT devices and sensors, it would be an incredibly cheap way to get some improvements, and would likely rapidly pay for itself and then keep providing benefits at basically no costs once people have new habits.

Let’s do it.

💚 🥃 Big thanks to all supporters, recent and OG, you guys & gals are keeping the fun going. Don’t be left out, join the elite group:

Investing & Business

Cloudflare Q3 Highlights

Just some stuff I noted while looking at ☁️🔥 results:

In Q3, we achieved revenue of $172 million, up 51% year-over-year.

We continue to see particular strength across our large customer segment, those that pay us more than $100,000 per year, and ended the quarter with 1,260 large customers, up 16% quarter-over-quarter and 71% year-over-year.

Our average contracted customer now spends over $100,000 annually with us, up from an average of $72,000 when we went public just over 2 years ago, evidencing our success selling to larger and larger enterprises.

Somewhat like Atlassian, Cloudflare NET 0.00%↑ started with a very bottom-up, self-serve sales model.

They have millions of free users. Some % of those graduate to paid users with a credit card and some checkboxes on their account webpage, some grow big over time and kept laddering up to large and larger packages and services. Mostly.

But in recent times, they’ve been beefing up their sales force to target larger enterprise customers and drive up that ARPU.

These large customers have different needs and mating habits than the small ones, so there’s a learning curve, but the rewards to getting it right can be pretty large, as the numbers reported by Matthew Prince above show (large customers growing 71% YoY as revenue per customer also keeps going up).

Our dollar-based net retention remained strong at 124%, and we achieved a record gross margin of over 79% in the quarter.

Akamai’s gross margin is in the low 60s, Fastly’s bouncing around in the mid to high 50s.

Cloudflare’s ˜80% gross margins always told a story, and showed that they were not in the same business as some of the others they used to be compared with not so long ago…

They’ve architected a different kind of machine, and they’re now pushing through it different things.

The 124% NRR is notable because Cloudflare is largely not consumption-based, so they achieve these high margins and this expansion mostly on flat-rate contracts. This is very different from, say, Fastly, Snowflake, Elastic, Datadog, etc…

Both approaches have pros and cons (life is trade-offs), but I think that for Cloudflare, this is an indirect way to invest in growth by providing more value to customers and holding back pricing.

It was also a milestone quarter because we reached profitability, delivering a positive operating margin and EPS. When we went public, we anticipated we'd reach breakeven in the second half of 2022. [...]

We have a long-term operating margin target of 20%. We remain confident in our ability to reach that long-term target, but we are not in a rush to get there. When we say long term, we really mean it. As long as we can achieve extraordinary growth, we anticipate that we will pour our profits back into our research and development and sales and marketing machine. We are nowhere close to being out of ideas from new products to build for customers to buy them.

We anticipate that we will hover just below or just above breakeven likely for years to come. Rather than depositing our profits in the bank, we will core them back into our business, investing in innovation and bringing more customers onto our platform, and that's exactly what we've done, already evidenced by our torrid pace of new product announcements through Q3 and into Q4 and our record growth in new large customers.

Don’t focus too much on profitability at this point. It’s a red herring. If they did focus on short-term profitability, they’d actually be destroying value vs the path where they focus more on long-term growth.

If they have opportunities to re-invest at high returns, they should take them.

Right now, that’s hiring more engineers that will build more products, infrastructure (beefing up their stuff so its ready for all the new compute and storage-intensive use cases that may pop up on the Workers/R2/etc platform), and hiring lots of sales people.

I don’t know about you, but I think they’re lowballing it on the operating margin. I mean, it depends how long-term we’re looking at and how long they keep finding high-ROI areas to invest into before reaching maturity, but I feel like an 80% gross margin business has a pretty good chance of being a fair bit higher than 20% at maturity.

Matthew Prince talked about an interesting aspect of their product-release weeks: They’ve very good marketing.

It may not get headlines on Bloomberg and the WSJ, but their potential customers certainly pay attention:

These weeks don't just deliver new products, they're also some of the most effective marketing we do to attract new customers.

During Birthday Week this year, for example, our organic inbound leads spiked nearly tenfold.

He then mentioned that they have two more product-release weeks planned before the end of 2021 (CIO Week and Full Stack Week).

Many companies don’t release as many products as Cloudflare releases in one of these weeks over a full year…

Here’s a good explanation of the system that leads to this pace and development velocity (I’ve already written about this in past editions, but worth reiterating because it’s important):

Our strategy has always been to get these products to market early and then relentlessly iterate to improve them until they're best-of-breed and significant new lines of business for us. [...]

I'm often asked about how Cloudflare innovate so quickly.

We have demonstrated not only the ability to release new products, but then build those products into meaningful new lines of business. The key to our pace of innovation starts with our flexible platform. Every server that makes up Cloudflare's network is able to run every one of our features. Workers, which we've opened up to customers is, first and foremost, the computing platform on which our developers build most of our own features and our fully software-defined network then than routes traffic to wherever it will be handled most efficiently. [...]

One of our secrets to success is our broad customer base that we have millions of customers. Many of whom use our services for free means that we have an eager pool excited to test new features before they're released. While traditional B2B companies have extensive QA teams, we regularly ask volunteers from our community to be our earliest alpha testers. Our iteration cycles can then be extremely fast. And by the time a feature makes it to production at one of our enterprise customers, it's bulletproof, having been through the paces under real network conditions.

This one reminds me a bit of how companies like Crowdstrike, Datadog, and Elastic keep adding new products and modules to existing offerings, with existing customers buying more and more form them over time (growing from the inside as well as the outside..):

Matthew Prince: as we have successfully launched more and more products, we're seeing those products attach to our existing customers. And so about half of the customers that are new, large customers are existing customers that spend more with us and grow into that category. But the other half are new customers -- are totally new logos to us.

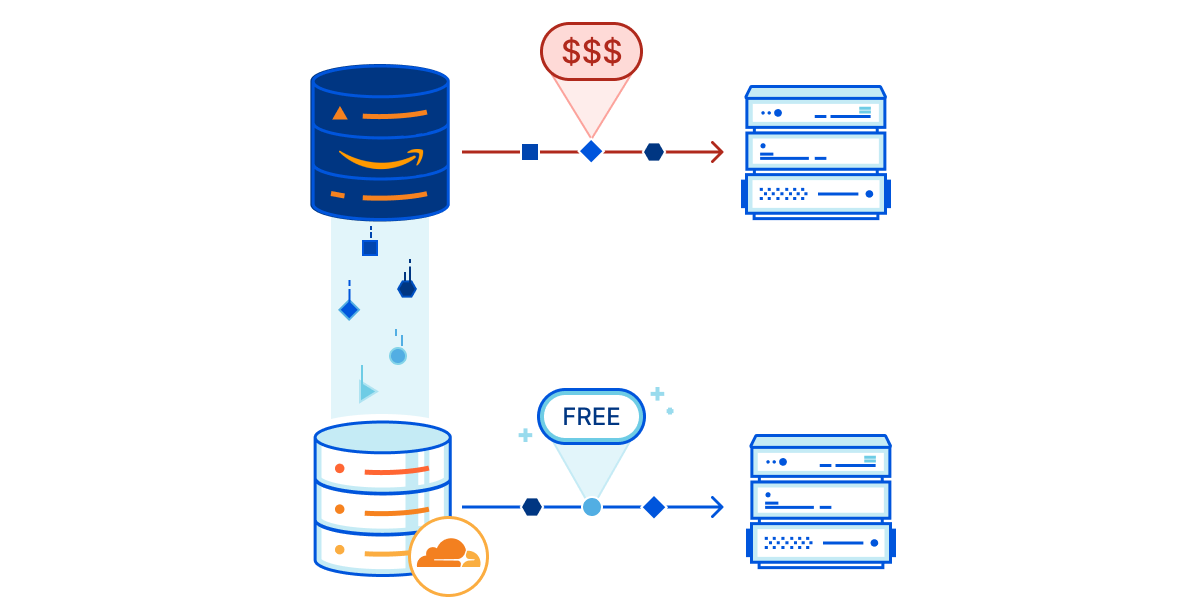

Comment on R2, their object store (kind of like AWS S3), and why being at the edge is a benefit:

one of the things that is unique about where we sit versus some of the more traditional and legacy cloud providers is that because we are distributed at the edge, it allows us to be significantly more efficient in the bandwidth usage that we have. And so while typical cloud providers have to pay a series of middlemen to deliver from Ashburn, Virginia to the other side of the earth, we are already on the other side of the earth, and we have usually a direct connection to all of those other networks that are there, which means that we have an inherent competitive advantage in terms of the cost of bandwidth delivery that we can provide. [...]

because of the fact that we have that attractive pricing, we should be passing that on to customers.

Of course, the hyperscalers don’t necessarily have to deliver very far because they have big datacenters in various regions, but they’re still typically a bit farther from the end user than someone like Cloudflare, who started out as a distributed content delivery network sitting right inside many ISPs, and a DDoS protection service that serves as reverse proxy to almost 1/5 of the internet.

it's early days in terms of R2. But what I think that we hope is that R2 can be very disruptive in the market and not only allow us to capture more of the object store spend, but also put downward pressure on all of the different cloud providers to eliminate their egress fees.

It is completely absurd that companies are charging nothing to send data to them, but then charging what can be massive markups, 80x what the wholesale price is to take data back out. And we don't think that's sustainable, and we want to push that down.

Interesting how they see victory not only as them winning customers, but also in competitors giving a better deal to their customers because of the competitive pressure.

The reason why that's attractive to us is we think that our long-term opportunity is really to be the fabric that connects together the various cloud providers. And in an ideal world, what we hear from customers is that they want to use some Cloudflare services, but they want to use Google services, Microsoft services, Amazon services and pick the best of what they need across all of those different providers in order to deliver a more robust application. And I think that is the inevitable way that the market will play out over time. [...]

being that fabric that can connect those different networks together is a very powerful position for us to be in. And so R2 is both, I think, an opportunity for us to grow TAM. But it's also an opportunity for us to accelerate what I think is the inevitable next generation of the cloud, which is allowing customers to pick the best of breed across multiple clouds.

They clearly see themselves deeply interwoven in the fabric of the internet, and being a secure and performant conduit between the other important players, rather than trying to be just an island unto themselves that tries to suck in everything to its own center of gravity.

Here’s the answer to a question about “what if AWS takes egress fees to 0”:

If AWS takes egress fees to 0 tomorrow, I will do a dance of joy for all of our mutual customers. And that will put us in a position, I think, of finally realizing what is the ultimate opportunity of the cloud, which is how do we allow customers to take advantage of the best of what Amazon offers, the best of what Google offers, the best of what Microsoft offers, the best of what Oracle offers and the best of what Cloudflare offers. And if we can be the fabric that connects all of that together, that's great. In the meantime, because I don't think that AWS is going to take egress fees to 0 tomorrow, we're going to make products that perform at least as well as theirs do. But don't rate customers over the cold for what are agreed just egress fees.

Similarly with web 3.0, they are trying to be a bridge/fabric:

what we announced around Web 3.0 and the crypto space, again, I think that we want to be the bridge between what was the traditional web and what may be coming with Web 3.0. And we've been investing in this space for quite some time. I think we don't know exactly where it's going to go, and I don't think anyone necessarily does. But we have a really brilliant team that's thinking about this

This is a very good encapsulation of the long-term vision:

we are focused on how we can be the network that any company plugs into and literally doesn't have to worry about anything else.

In the tech world, things change fast, so nimbleness, adaptability, ability to attract and retain talent, development velocity, etc.. All these things are worth a lot more than some static moat that your competitors are working hard on breaching every day.

So Cloudflare being so attractive to talent is definitely worth a lot:

we are amazed that over the last 12 months, we've had nearly a quarter million people apply to work at Cloudflare, which is just astonishing. And so if you look across that, about half of those applicants are for our go-to-market team and the caliber and quality of the people that we're getting is great

A prediction on Cloudflare for Offices:

I'll predict that the sleeper announcement from our Birthday Week that might be the most impactful to our business over the course of the next 10 years will be Cloudflare for Offices. And what we have seen is that the excitement from landlords and real estate groups about being able to offer Cloudflare services to their tenants is much higher than we actually expected… What it really offers is an ability for any tenant to plug into our network and be able to, yes, have fast connections to the Internet, but also get all the security, reliability and efficiency gains that we deliver.

On selling to the gov’t:

We also anticipate that early in 2022, we will reach our moderate full FedRAMP compliance.

This could potentially be pretty big, considering the big push that the feds are making on cyber-security and hardening everything against ransomware and foreign attacks.

One thing I’m keeping an eye on is growth in the Asia-Pacific region. It’s been much slower than the rest for a while, but if they can just bring it up to the level of growth as N-A and Europe, it’ll be be quite a nice tailwind:

The U.S. represented 53% of revenue and increased 53% year-over-year. EMEA represented 26% of revenue and increased 62% year-over-year. APAC represented 14% of revenue and increased 25% year-over-year.

👋

Microsoft Q3 Highlights

I’ll try to keep it brief (unlike Cloudflare). MSFT 0.00%↑

Here’s Satya:

GitHub is now home to 73 million developers, up 2x since our acquisition 3 years ago [...] 84% of the Fortune 100 use GitHub

Not bad at all.

Would be interesting to see the alternate timeline where GitHub became a public company, to see how it would compare to GitLab (currently $17.7bn market cap).

They also mentioned this:

With our Microsoft Cloud for sustainability, we are creating an entirely new business process category to help organizations monitor their carbon footprint across their operations.

Picks & shovels for ESG. Probably not a bad business…

LinkedIn now has nearly 800 million members.

LinkedIn advertising revenue was up 61% year-over-year.

That’s crazy, right?

Cybersecurity is the #1 threat facing businesses today [...] We analyze over 24 trillion signals across e-mail, endpoints and identities each day and translate this intelligence into innovative features to protect our customers.

We have prevented more than 70 billion attacks over the past year alone. We now have nearly 650,000 customers using our security solutions, up 50% year-over-year.

By comparison, to give an idea of scale (not saying this is 🍎2🍏), Crowdstrike has 13,080 subscription customers.

we did add a year-over-year 14% headcount growth.

👋

Nvidia GTC ‘21 Keynote by Jensen Huang — “Maybe the coolest company in the world”

I’ll likely have more to say on the gigantic truckload of stuff Nvidia NVDA 0.00%↑ announced at GTC in future editions… But these Keynotes are always fun and provide a good overview, check it out:

I gotta say I’m extremely impressed and intrigued by their Omniverse software and how it interconnects with a broad ecosystem of tools from other companies, helping them make digital twins of real-world assets, train robots and optimize factories, build digital worlds, etc.

That demo of how Ericsson is using a digital-twin of a whole city to tweak 5G antenna positioning and track beam-forming using AR/VR is mind-blowing.

It looks like Nvidia is carving itself a nice central spot in this ecosystem, both on the software and hardware side.

Also, Nvidia may be the coolest company out there:

Robots and digital twins and games and machine learning accelerators and data-center-scale computing and cybersecurity and self-driving cars and computational biology and quantum computing and metaverse-building-tools and trillion-parameter AI models! Yes plz

Facebook to Use AMD Chips in its Datacenters

Are we over calling them Meta yet? META 0.00%↑

AMD announced Meta is the latest major hyperscale cloud company that has adopted AMD EPYC CPUs to power its data centers. AMD and Meta worked together to define an open, cloud-scale, single-socket server designed for performance and power efficiency, based on the 3rd Gen EPYC processor.

This will certainly help them in future pricing negotiations with Intel…

The company also gave some details on its next-gen Zen 4 chips:

“Genoa” is expected to be the world’s highest performance processor for general purpose computing. It will have up to 96 high-performance “Zen 4” cores produced on optimized 5nm technology, and will support the next generation of memory and I/O technologies with DDR5 and PCIe® 5.

“Bergamo” is a high-core count CPU, tailor made for cloud native applications, featuring 128 high performance “Zen 4c” cores. AMD optimized the new “Zen 4c” core for cloud-native computing, tuning the core design for density and increased power efficiency

128 Zen 4 cores on the same package! Wow, that thing is going to 🤘

Science & Technology

‘Energy Infrastructure Update for June 2021’

Interesting report from the U.S. Federal Energy Regulator Commission (FERC, like, almost a Battlestar Galactica swear word…) on new energy generation capacity being built in the first half of 2021, compared to the same period in 2020.

Renewable sources are now 25% of the capacity in the US, up from 23% last year.

Out of 11,949 megawatts of capacity installed in the first half of 2021, solar and wind represented the vast majority adding up to almost 11 gigawatts!

In 2020, a lot more natural gas capacity was built, but wind & solar still represented a majority of the new capacity with about 8.5 gigawatts.

Of course, there’s a difference between nameplate capacity and the actual utilization factor… Some resources produce power 80% of the time, others are more intermittent and produce 30-40% of the time, etc… So not every MW of capacity is equivalent.

But what matters in the end is if the electrons that come out of the wire come from clean sources, and what’s the cost per kWh when all is said and done.

Clean sources have been on this reverse-exponential decreasing cost curve that is impossible to keep up with for fossil fuels, so all that’s needed now is to keep mitigating their downsides (the intermittency), which we can do with things like a smarter grid, demand-response, time-of-use pricing, large scale storage (which is also rapidly coming down in cost), V2G tech for EVs, etc.

TSMC to Partner with Sony to build $7bn Fab in Japan

The plant isn’t set to start mass production until late 2024, so it won’t help solve the immediate shortages hitting production of cars and electronics. But when it does open, it will make an older type of chip that has been in particularly short supply this year and fill a gap in an industry that puts most of its investment dollars into the most advanced chips. (Source)

The Arts & History

Early Thoughts on ‘Foundation’ TV Series

I’ve now seen 3 episodes of ‘Foundation’ (2021, Apple TV+).

Cards on the table, this is probably the first science-fiction book I read as a teen (one of the first English-language books too…). I loved it then, but haven’t re-read it since, so I mostly remember the big things and some small memorable moments, but not that many of the details.

I was certainly primed to love this series, being a big Asimov fan (his autobiography ‘I.Asimov’ was great too..).

But so far, the show is extremely uneven.

Some parts are incredibly beautiful, showcasing good world-building. Some scenes are just on this side of iconic sci-fi, and a large part of the art design is very good, even sometimes great.

But many parts of the show are incredibly mediocre, with bland writing, cardboard characters, a very made-for-TV-feel to plot moments, etc. And I don’t think we can blame the source material, since this is a fairly big reimagination and update of it.

So lots to like, but there’s the problem of all the bad parts. I shouldn’t catch myself looking at the time to see how long is left to the episode…

I suspect it’ll end up in the “miss” bucket for me, unless the next episode really draws me back in. Otherwise, I may not finish the season…

Too bad, I really could’ve used a great sci-fi TV series with high production values and classic source material 😔

You have convinced me of just how wonderful the Cloudflare business is, but I am truly curious how you think about valuation. I think we would agree that 1x revenue is too cheap and 1,000,000x revenue is too expensive. So somewhere between those two goalposts is a fair value.

As a backwards looking thought experiment, I calculated the IRR one would have generated if they had bought Google at IPO and paid 100x TTM revenue. The result is just under 9% (assuming my data and math is correct) which isn't terrible but isn't exceptional either. Of course we know that Google has become the best or one of the best businesses the world has even seen and was growing revenue above 100% at IPO.

Something I really admire about you is how infrequently you talk about valuation. Ironically, I would be just as happy with you not wanting to answer.

LIBERTY- "Robots and digital twins and games and machine learning accelerators and data-center-scale computing and cybersecurity and self-driving cars and computational biology and quantum computing and metaverse-building-tools and trillion-parameter AI models! Yes plz"

ME- I KNOW, RIGHT!! 😝🤘🤖🤙💥👩🎤👨🎤🚀