204: Nvidia + ARM, SDC vs Align, Liviam's Investing Checklist, Rivian, NFTs, MoviePass, Twitter, Rotten Tomatoes, Russian Tests Anti-Satellite Missile, and Elementary Education

"The most frequent test of my zen detachment"

When you see a good move, look for a better one.

—Emanuel Lasker

🛀 🌶 You know what I’d like to see happen?

I think Huy Fong should make a Sriracha-like sauce, but with habaneros rather than jalapeños.

Keep the rest of the recipe similar: a lot less vinegar than most hot sauces, fresh ripe peppers, roasted garlic, low price point for a huge bottle, etc.

This would be such a home run, it would probably double the size of the company. ⚾️

Anyone knows a habanero-based sauce that kind of fits that description?

🚌 🎓 A few classes I’d add to elementary schools (all explained with age-appropriate language and examples):

Non-zero sum thinking vs zero-sum

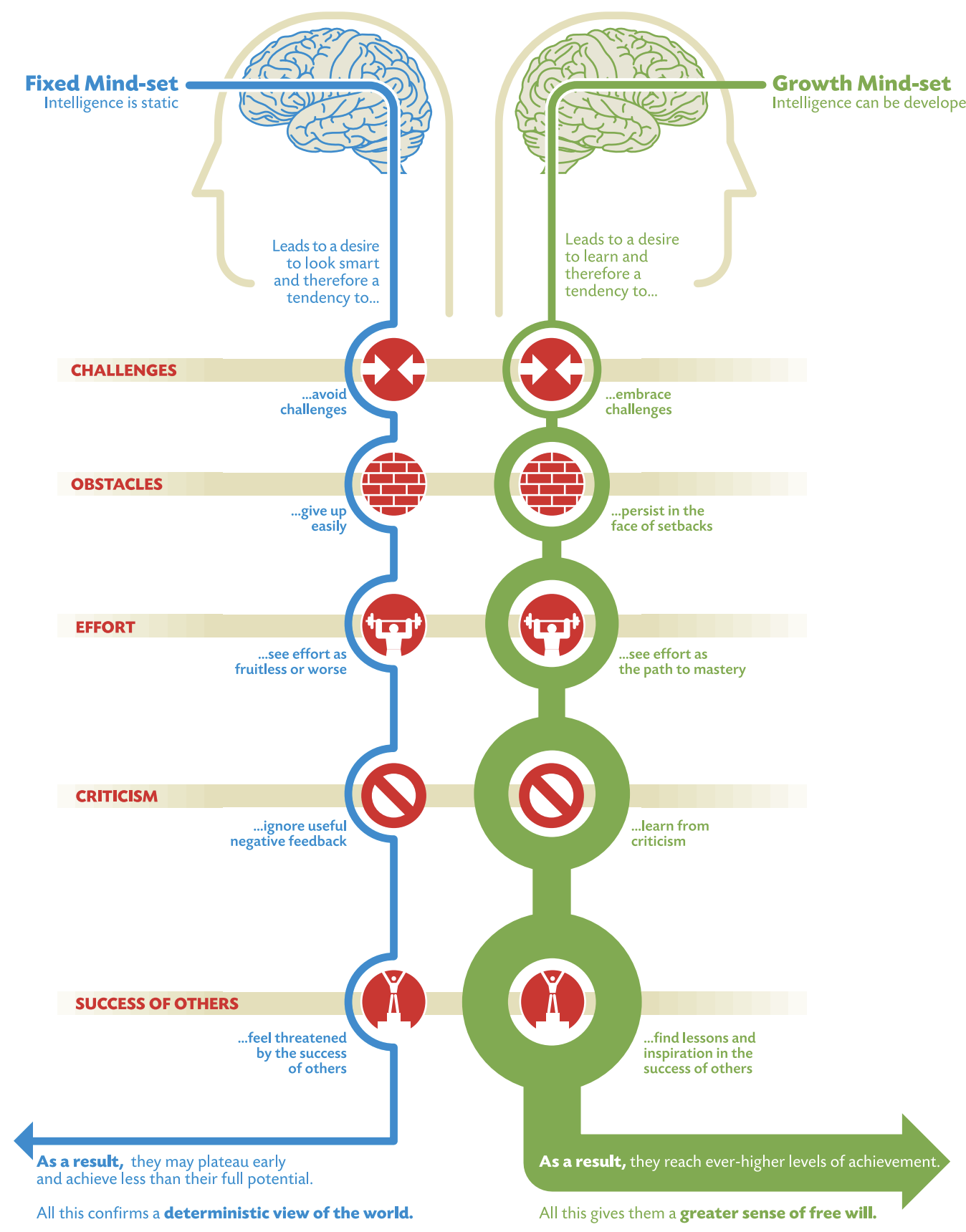

Fixed mindset vs growth mindset

First principles vs analogy reasoning

What we know of the science of happiness

The basics of good sleep hygiene

The basics of mental health maintenance + early warning signs things are going wrong

🐦 If you properly curate who you follow on twitter, you should spend most of your time in the reverse-chronological "latest" view instead of the algorithmic "home" view. Here's why.

I follow people because I want to hear what they have to say because I think they're smart people, but they may be "small" accounts with "low engagement", so the twitter algo will almost never show me what they post in the algo-timeline, because it'd rather show me all the high-engagement stuff from big accounts (even stuff I don't follow but that others are liking, so it's Pomp this and Naval that all the time).

If you have a badly curated follow list and follow a lot of noisy accounts with low signal-to-noise, this won't really help you, and it may actually make things worse...

But if that's the case, this is just a symptom of a larger problem that you should fix today.

It's worth it. People you follow have a pretty direct access line to your brain, so don't let too much garbage and noise in, because you know the saying...

🚙💨 The most frequent test of my zen detachment is people unnecessarily idling their vehicles.

I see it almost every day, letting the engine run for 5-10-15 minutes in the school parking lot, at the daycare, at the grocery store, in their driveway, etc. Don’t get me started about drive-thrus with long lines of SUVs outside while the inside of the restaurants are empty…

💡 I like this bit of advice from Generativist:

Don’t bookmark your sudden insights for later. Spend time with them right away.

You gotta explore the terrain when you’ve stumbled upon it, not the partial map later on

There's a lot that probably matters that is loaded in brain-RAM/short-term memory at the moment of the insight that probably won't be there later on when you re-read that note...

A lot of this is likely things you’re not even consciously aware of, so it’s not like you can write it all down or recall it on demand later on.

💚 🥃 I can only do it with your help:

A Word from our Legendary Sponsor: 🏰 Greenhaven Road Capital 🏰

Some context: Back in edition #159, I wrote as a joke that I’d love to review Parmigiano-Reggiano (aka real parmesan). I just love the stuff, and was probably hungry at the time, so it seemed like the ultimate gig.

Dreams *do* come true — I was contacted by a reader and supporter (💚 🥃) at Greenhaven Road Capital (check out their investor letters) who wanted to sponsor my parmesan adventure.

After recruiting my wife to the project, here we are with round #2:

The Pecorino: second attempt to dethrone the king 👑

This one is made from sheep's milk. Apparently, "pecorino" comes from “pecora”, which means “sheep” in Italian.

Pecorino is also often used to finish pasta dishes, and used to be the natural choice for most Italian regions from Umbria down to Sicily, rather than the more expensive Parmigiano-Reggiano. It is still preferred today for the pasta dishes of Rome and Lazio.

Tasting notes:

Wow, this one is salty! It's almost too much when you have it on its own, but I can imagine how it blends in well with a pasta dish.

Compared to the #1 challenger, the Padano, this one has a much stronger flavor. The texture is closer to the Reggiano, with some of those neat little crunchy crystals, but taste is pretty different.

It's going to sound weird, but what it reminds me of is that powdered "parmesan" cheese by Kraft, you know that round plastic container with a green label and a red cap? If you're like me and you've ever taken a spoonful of it directly, the taste kinds of reminds me of this, but with more complexity and more intensity (and saltiness!).

My wife's verdict is that the saltiness is too much and brings it into active 'dislike' territory for her, at least standalone.

We both agreed, the king stays the king... For now. There's one last contender, and this one is coming from left field. Stay tuned!

And how can I not end with a cool photo of Pecorino cheese being marked with 🔥:

Investing & Business

🦷 SmileDirectClub since IPO vs Align

SDC has been trying to disrupt Align from the low end…

If you come at the king, you better not miss.

Can you pick winners prospectively or is it all luck & survivorship bias?

Friend-of-the-show Liviam tweeted:

But isn’t that what we as stock pickers should be able to do? Differentiate between RIM and Apple and figure out why $AAPL might win? A lot of this “survivorship bias” makes it sound like these things are pure guesses, and they are not. Just my opinion.

My view:

To say that it's doable doesn't mean that *everybody* can do it.

Some people don't want to even attempt something unless they can claim there's a clear system for anyone to be able to do it... But that's not how life works.

I also can't play in the NBA, but I know it's possible for some people to do so.

Of course with investing, feedback cycles are much longer and it’s harder to be sure about anything…

Liviam’s Investing Checklist (yea, it’s a double-Liviam edition)

The Right Questions™ are where the money’s at. Without them, not only will you miss the right answers, but you probably won’t even know you’re missing them.

Friend-of-the-show Liviam (👋 again) published the kind of questions he tries to ask himself when considering an investment.

There’s a lot of good stuff in there, and even if you disagree with the specifics or the examples he gives, I think the process should be learned from.

Some highlights:

Considering valuation, can it realistically outperform Big Tech (Amazon, Apple, Facebook, Google, Microsoft) over a period of ten years?

Needs to be a reason to own it

Even if you think performance will be similar to big tech, what’s the point?

It’s much easier to hold big tech so the risk/reward has to be clearly better than Big Tech

Even if you like the business, should you own it now?

Just because you like a business does not mean you need to own it now

Take what the market gives you at any point in time

Aka add to current positions if it offers the best IRR and circle back to this stock at a later time when IRR is more favorable AND you will know more about it

Is this a winner or a second-place business?

Own the winners even if overvalued a little

Remember, the second place might get better IRR for 2-3 years but will it be relevant in 10 years?

If you think this is a second place business: is it actually a second-place business or is it still early and could be a first place business?

Is this a special, unique, and differentiated asset?

You don't need to buy a business that is dime and dozen

Does this business have an "out of the money call option"?

The way NZS Capital defines optionality: "Optionality as asymmetry which is not priced in at current prices." Key factor: NOT PRICED IN.

Optionality can be subjective: ie. Is Mastercard optional because it has tailwinds in e-commerce, touchless transactions, micro-transactions, digital wallets, etc? Or is it a legacy moat?

Some other simple examples:

SQ: CashApp

Paypal: Venmo

FB: Commerce, VR

Google: GCP, YT, Waymo

Apple: Cars, AR/VR

Sea/Meli: Fintech

Wix: Payments

JD: spinoffs

Rivian post-IP😮 🚀

A few days after IPO, and Rivian stock has taken off like a SpaceX rocket (wow that’s a terrible analogy, it’s like a grade school kid wrote this..).

But here’s the way I’m looking at it:

I'm not investing in it, so I don't care if it's overvalued… but I care about the transition to EVs, so if they can raise lots of capital basically for free and it helps de-risk their manufacturing ramp up process, then why not, I'm all for it ¯\_(ツ)_/¯

The world certainly benefited because the dot-com bubble gave free capital to companies laying fiber across continents and oceans..

You mean NFTs can go down?! 📉

Consider “Earth” -- one of several NFTs issued by Grimes in February. Depicting a cherub spearing the globe, perhaps in a reference to her baby with SpaceX’s Elon Musk, it was part of a collection that netted the artist (whose real name is Claire Elise Boucher) about $5.8 million after selling out in 20 minutes. While the cost to originally own one of the 303 limited editions was $7,500, one unit recently resold for just $1,200 in a stunning 84% drop. Likewise, a piece rapper A$AP Rocky sold for $2,000, showing him spinning around in space, in April just traded for about $900.

The list goes on. After seeing artists like Beeple make tens of millions from selling nonfungible tokens, a slew of celebrities including singer Shawn Mendes, socialite Paris Hilton and wrestler John Cena have jumped on the bandwagon to create their own digital art tied to blockchains. However, the prices of many of these art pieces have declined precipitously since their release. The resale market outside of fans appears to be small, with long-time NFT investors shunning the category as a money grab. [...]

“From what we’ve seen so far, most of these collections don’t have much liquidity, which is one of the two ways for NFT collections to die: lose value or get frozen,” said Gauthier Zuppinger, chief operating officer of NonFungible. “It’s probably too soon to draw any conclusion for now, but it looks like these were more experiments than truly valuable collections.” (Source)

UK Confirms “24-week Phase 2” Investigation on Nvidia + ARM Merger 📑

The suspense continues. Will they, won’t they? ¯\_(ツ)_/¯

The CMA found the transaction raises the possibility of a “substantial lessening of competition across four key markets” - data centres, Internet of Things, the automotive sector and gaming applications.

Seems to me like if Nvidia can put its R&D resources into ARM, and put a bunch of its IP into the IP buffet that ARM customers can pick from, you’ll see a much more vibrant competitive landscape with better and more varied products for customers and more competition for the incumbents… But hey, that’s just like, my opinion, man.

Matt Levine on MoviePass

You can never be sure about alternate histories, but this *has* to be correct:

Obviously if MoviePass hadn’t gone bankrupt in January 2020, but had instead limped along until January 2021, it would be a $50 billion company right now. How could it not have become a meme stock? (Source)

Science & Technology

🌎 Just a reminder

Paul Byrne reminds us:

In case you forgot, there's a shell of spinning, molten iron about the size of Mars about 2,900 km under your feet... and always has been.

‘Space station crew takes cover as Russia blows up a satellite, creates debris hazard’

Russia keeps making decisions based on the ‘movie villain playbook’, recreating the plot of Gravity:

An anti-satellite missile test Russia conducted on Monday generated a debris field in low-Earth orbit that endangered the International Space Station and will pose a hazard to space activities for years, U.S. officials said.

The seven-member space station crew – four U.S. astronauts, a German astronaut and two Russian cosmonauts – were directed to take shelter in their docked spaceship capsules for two hours after the test as a precaution to allow for a quick getaway had it been necessary, NASA said.

The research lab, orbiting about 250 miles (402 km) above Earth, continued to pass through or near the debris cluster every 90 minutes, but NASA specialists determined it was safe for the crew to return to the station’s interior after the third pass, the agency said. (Source)

Twitter’s API 2.0

The updated API seems more open to third-parties making Twitter clients and tools.

Hopefully my beloved Tweetbot can go back to its glory days — it used to be my primary Twitter client, until I was basically forced to use the official app when Twitter crippled the third-party API access.

Bonus: They fixed the annoying auto-refresh on the web timeline that made that tweet you were reading disappear…

The Arts & History

Mad Men Rewatch Update (S5E8)

I recently saw Mad Men S5E8, ‘Lady Lazarus’. Not quite on the level of the previous one (Codfish Ball), but very very good.

That ending with ‘Tomorrow Never Knows’ was neat.

I like Megan’s arc. Being good at something that lots of other people wish they could do doesn’t mean you should keep doing it if it’s not what you want to do. Too many people basically let others vote on what they do (the votes can be money, compliments, prestige, expectations, etc…).

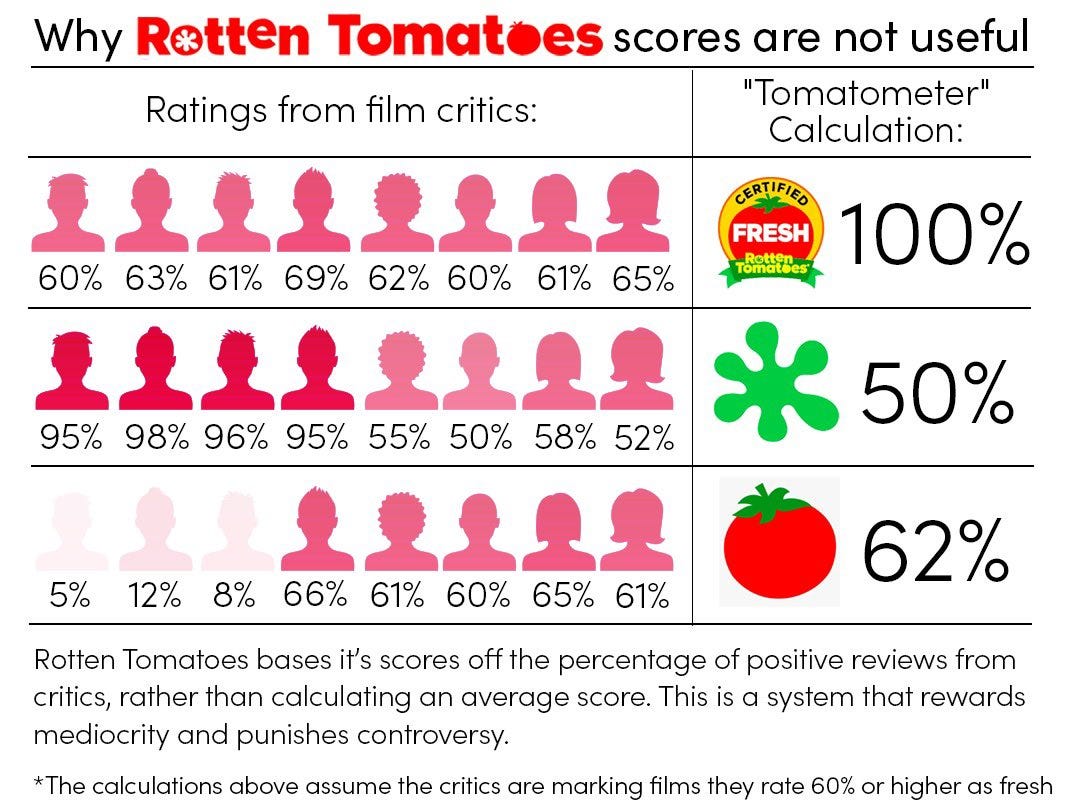

Methodology is Important, Rotten Tomatoes Edition

Personally, I tend to use IMDB, but even that has to be calibrated.

By that I mean that some films draw a very self-selected audience, so them getting a very high score tells you that you’re likely to like it *if* you’re part of that audience (ie. super-hero movies. Maybe Avengers Metroid Prime or whatever got 8.7/10, but if you don’t like Marvel’s films, it doesn’t tell you much).

Other films will draw a very large swath of the audience, and the score tells you something different…

I agree that reverse-chronological is the better Twitter view. But it bothers me that it is "reverse". In "reverse", with newer tweets at the top, I start scrolling up to see newer tweets but if it's a long tweet, thread, or reply I have to scroll back and forth to find the start and then read to the end. It would be much easier if it was just "chronological", with the latest tweets at the bottom so that I could scroll in just one direction.

If you can find it, Pecorino aux truffes is fabulous! Loaded with umami. So good, just on its own. There’s an Italian cheese guy at my local weekly market. Generously distributes samples of whatever the current person being served is buying to everyone standing in the queue. Awesome marketing.