213: Amazon Logistics vs Fedex/UPS, Microsoft Office Pricing, Intel Mobileye IPO, Omicron Updates, Valuation Subjectivity, Hubble, and PlayStation 5 Design

"Skinny Santa is back!"

The creation of the world did not take place once and for all time, but takes place every day.

—Samuel Beckett(what part have you played in creation today?)

⚡️ 🔌 🏭 Friend-of-the-show and supporter (💚 🥃) Brent Muio had very interesting follow-up on what I wrote in edition #212 about a “personal decarbonization plan”, and more specifically about replacing a natural gas furnace with either an electric furnace or ground-source heat pump.

He wrote:

Based on your comments from today's NL where you say your province is 95% hydro, leads me to believe you live in Quebec. From what I understand Quebec exports the excess MWs to the US just like my province of Manitoba does as well.

Interestingly if you were to switch from a gas furnace to an electric furnace, you would be reducing the amount of electricity being exported. That electricity is on the margin displacing gas generation in the US. BUT not only are you reducing the generation that will be exported, you're reducing gas consumption from an appliance that is 95% efficient and increasing the gas consumed by a combustion turbine that is between 30% and 60% efficient. Using round numbers your decision to switch to an electric furnace may actually double the amount of CO2 produced related to you heating your house.

Obviously that only considers the short term effects of the decision. The long term effects may be different.

I love this kind of thinking. It's what I try to do:

Look at the whole system, not just the local decision.Of course, I have uneven success doing this, but gotta try — you miss 100% of the shots you don’t take, <insert another cliché>, etc.

Back to the decarbonization dilemma:

The way I look at it, it may still make sense longer-term largely because on my end it probably won't be for another 5-10 years, and hopefully by then the US grid has improved a lot, and is on its way to improve even more.

I’m also not sure Québec exports quite exactly whatever is in excess. There’s probably long-term contracts with the US and what ends up there probably depends on a bunch of factors, including how much water is in the reservoirs, what’s demand like, price of the marginal supply in the US (wind and solar can also have 0 marginal cost, so as capacity goes up, one may displace the other when there’s excess..?) etc…

There’s probably also a benefit to buying a GSHP in helping that industry scale up, kind of like being an early adopter of electric cars.

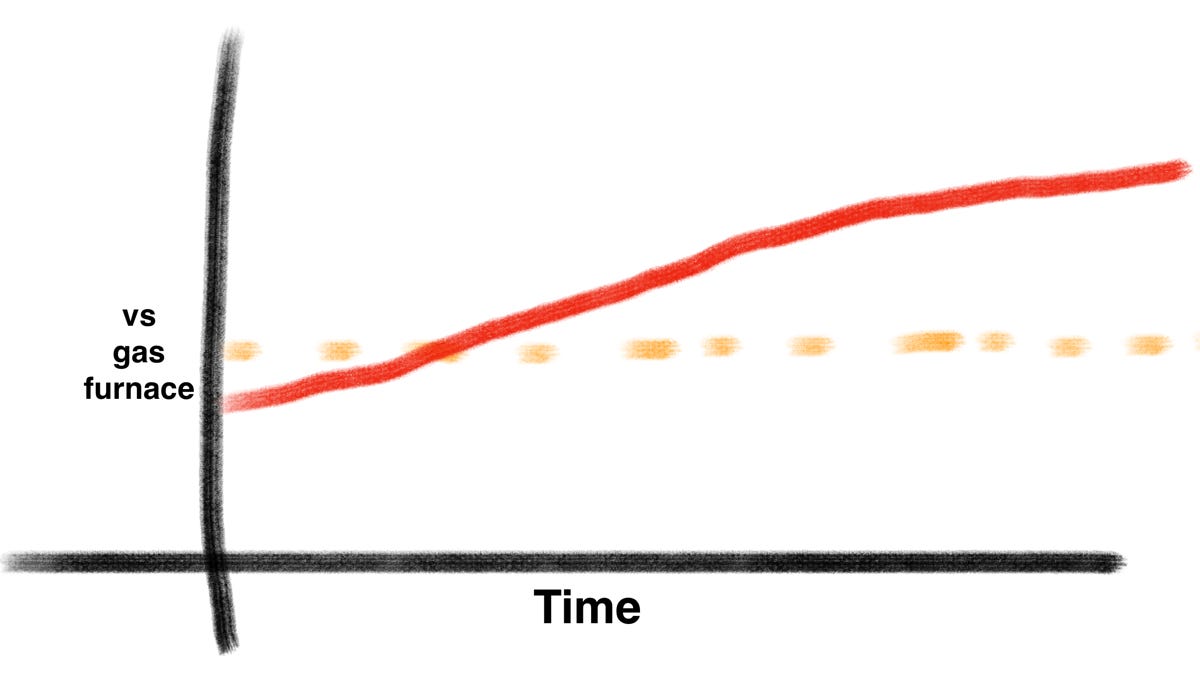

If I look at the 30 years after going from gas furnace to a ground-source heat pump (which is a lot more efficient than a purely electric furnace, by a factor of around 4x), it may be a small net negative in early years and then become an increasingly bigger net positive over time… Kind of like this:

But it's an interesting question to think about.

And it reminds me that we need to build more hydro power (both run-of-river and with reservoirs). It’s an incredibly flexible source of power that can help decarbonize the grid, and it isn’t getting the attention it deserves. I know it’s not 100% without problems, but what is?

Update from Brent (who I showed this draft to):

The only thing I would add is that in my opinion with a GSHP with a COP ~4 would have an immediate benefit even if you're going to increase gas generation in the US. Again using round numbers from my first example, a GSHP cause about 1/2 the CO2 of your gas furnace all things considered

Even better! (in the meantime, I should probably look into adding even more insulation to my attic… blown cellulose is cheap and effective)

🎮 👾 Game design is such an interesting topic.

Very hard, very subtle, lots of stuff that needs to be balanced on a razor’s edge, lots of systems’ thinking required, understanding feedback loops (positive and negative), etc…

I learned about it partly by studying some of the games I loved, and those that turned out to be terrible despite sounding great on paper, but also when I used to build maps and mods for games like Doom, Quake, Starcraft, etc.

When you try to make just one map fun, and realize how hard it is, it gives you appreciation for creating a whole game out of thin air and making it an enduring part of a whole generation’s mindspace (not that there isn’t always luck involved, but that just makes it even harder and less deterministic..).

🎄Skinny Santa is back! It’s a tradition I’m trying to start with my family. He’s been there every year since my kids were born.

I first wrote about him last year at the bottom of edition #69 (Elon Musk’s favourite edition, I hear).

I like the idea that in 30 years, my kids are going to talk about the holidays when they were young, and they’ll suddenly remember, “oh yeah, for some reason dad always had this figurine of a really skinny santa.. that was kinda weird 🤨”

🗣 I did a video call with friend-of-the-show and supporter (💚 🥃) Aaron Edelheit for the first time.

It was great, and like most of the calls I’ve done with people that I already knew online — by following them on Twitter, reading their newsletters, listening to their podcasts, etc — it felt very much like “meeting an old friend for the first time”, if that makes sense.

💚 🥃 For the price of one alcoholic drink, you get 12 emails per month (plus 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤). It’s the serendipity engine for 77¢ per edition!

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 secs on mobile with Apple/Google Pay — if you don’t see paid options, it’s because you’re not logged into your Substack account):

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products. 👩💻

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

David Schawel posted this yesterday (aka growth name rally day):

“Dunking on Cathie” Twitter Spaces this weekend marked the local bottom

There should be an equivalent of the "Fear & Greed Index", but for dunking.

When dunking gets too high on the Dunk-o-Meter, we're probably close to a bottom...

(I don’t mean on any specific target — dunking in general, on value or growth, on certain managers when they’re down, on people on Twitter, whatever)

Dunking just adds emotions *on both sides*, the giver and the receiver, and makes everyone make worse decisions..

⚖️ Objectively “Correct” Valuation Doesn’t Exist

We’ve all heard from Buffett and others how you can only estimate the intrinsic value (IV) of a security. It’s a range, not an exact number, because there are too many factors, too many things you can’t know, and too many uncertain events ahead.

What we don’t hear often enough about is the other side of the lens — not what you’re looking at, but who is looking.

The exact same stock at the exact same price can be expensive for one person and cheap for the other, and this can be a correct statement for both investors.

If you have Alice who’s going to own a stock for 1 year, it’s very possible that at its current price, it’s a bad risk-reward and likely to lead to sub-par outcomes.

But the same stock at the same price may be a good risk-reward for Beatrice (what, did you expect Bob?), because she’s going to own it for 20 years.

Maybe Alice has a hurdle rate of around 15% based on her other opportunities and maybe Beatrices’ hurdle is 10%…

Maybe Alice can’t handle volatility and is going to freak out if the stock moves down more than 20% and panic-sell, while Beatrice has ice water in her veins and didn’t even have an elevated heart-rate in March 2020.

Things are dynamic too: Maybe Alice is great at constantly updating her ‘valuation’ of the company based on various developments (positive and negative) while Beatrice bought at the exact same time and for the same reasons, but will totally miss important changes, possibly at her detriment.

Plenty of factors, many of which are about the investor, not the company or the market.

Don’t tell others that they’re right or wrong about their views on the valuation of something without taking all of this into account.

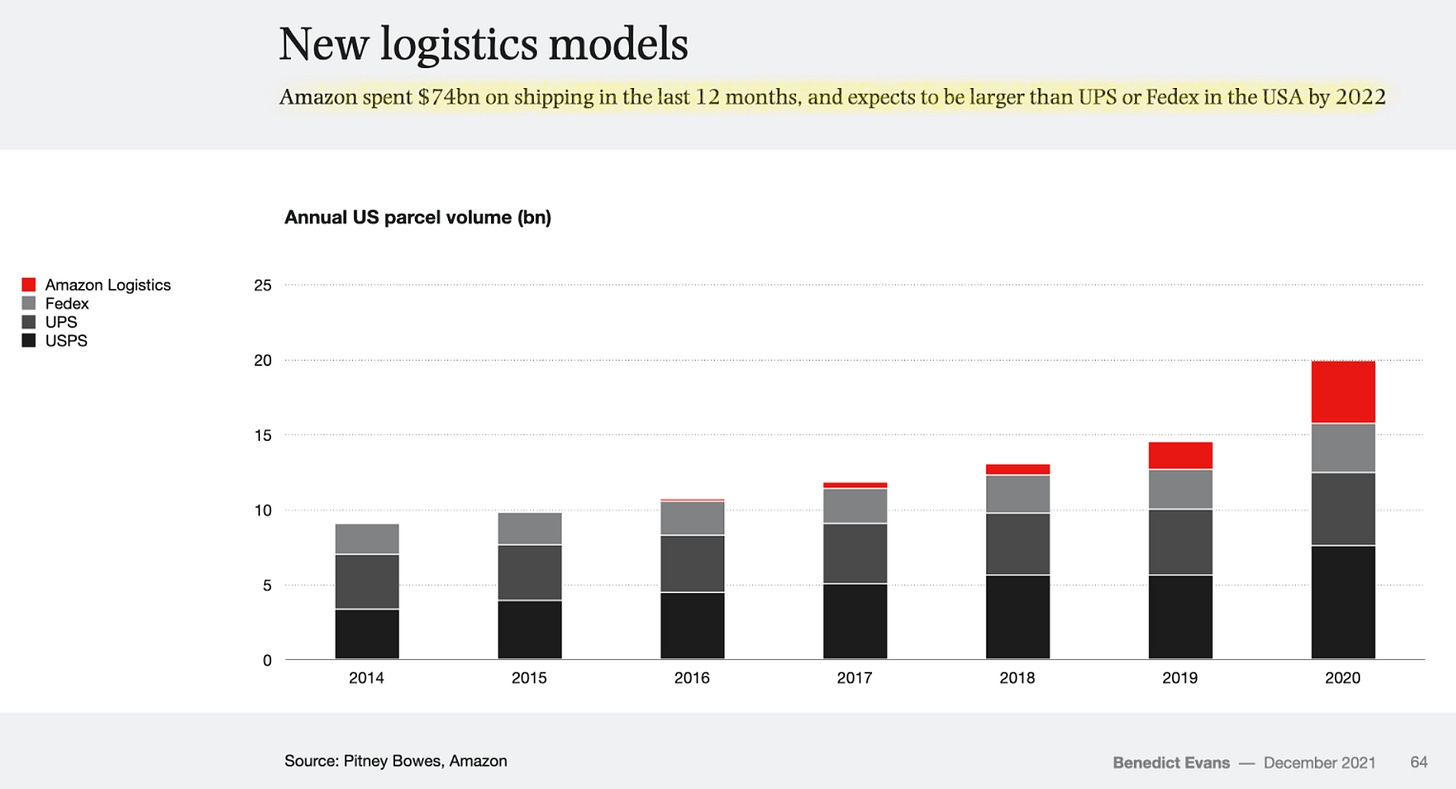

📦📦📦📦 Amazon Logistics vs Fedex & UPS 📦📦📦📦

Microsoft pushing Office customers to annual subscriptions with 20% price increase for monthly

In 2022, Microsoft is rolling out what it’s calling the New Commerce Experience for Office, revamping the way customers buy its software through business partners. While the company hasn’t publicly announced a specific price change, it has informed partners that organizations paying by the month will face a 20% hike unless they move to annual subscriptions. (Source)

I think ARPUs (that’s ‘average revenue per user’, for those of you who don’t swim in the ocean of financial acronyms daily) probably won't move that much.

I suspect a lot of customers who weren’t already annual will just move to that plan, which is better for Microsoft because it makes revenues more predictable and reduces churn and transaction costs.

Probably relatively few users really need the monthly flexibility for 20% more... When it’s about the same price, why not, but for 20% extra? Meh.

👀 🚙 Intel to IPO Mobileye Unit

Intel is planning to publicly list shares in its Mobileye self-driving-car unit, the latest move by Chief Executive Pat Gelsinger to revive the semiconductor giant’s fortunes.

Intel said it would take the unit public in the U.S. in mid-2022 through an initial public offering of new Mobileye stock. The move, earlier reported by The Wall Street Journal, could value Mobileye at north of $50 billion, according to people familiar with the matter.

Mobileye, an Israeli company Intel acquired in 2017 for around $15 billion, specializes in chip-based camera systems that power automated driving features in cars. It originally went public in 2014. [...]

Mobileye’s revenues have roughly tripled since Intel bought it. It had $326 million of revenue in the third quarter, a 39% year-over-year increase. (Source)

Maybe they looked at Rivian’s market cap and it gave them the idea..?

I mean, Intel has a $207bn market cap right now, so that’s only two Rivians ¯\_(ツ)_/¯

But if that listing seems like a good deal, let’s look at this alternate timeline possibility:

The News-Distance Postulate 🌏 ➡ 🌎

Interesting observation by friend-of-the-show and supporter (💚 🥃):

My theory on this:

Good news doesn't travel far, bad news does.Science & Technology

Omicron Updates

Keeping an eye on this. Some recent updates on the science and how to interpret the news we’ll keep getting soon as scientists have time in the lab with this new beast:

Russian groups that hacked Solarwinds still at it…

Mandiant continues to track multiple clusters of suspected Russian intrusion activity that have targeted business and government entities around the globe.

Some of the tactics Mandiant has recently observed include:

Compromise of multiple technology solutions, services, and reseller companies since 2020.

Use of credentials likely obtained from an info-stealer malware campaign by a third-party actor to gain initial access to organizations.

Use of accounts with Application Impersonation privileges to harvest sensitive mail data since Q1 2021.

Use of both residential IP proxy services and newly provisioned geo located infrastructure to communicate with compromised victims.

Use of novel TTPs to bypass security restrictions within environments including, but not limited to the extraction of virtual machines to determine internal routing configurations.

Use of a new bespoke downloader we call CEELOADER.

Abuse of multi-factor authentication leveraging “push” notifications on smartphones

In most instances, post compromise activity included theft of data relevant to Russian interests. In some instances, the data theft appears to be obtained primarily to create new routes to access other victim environments. The threat actors continue to innovate and identify new techniques and tradecraft to maintain persistent access to victim environments, hinder detection, and confuse attribution efforts.

‘The Popular Family Safety App Life360 Is Selling Precise Location Data on Its Tens of Millions of Users’

Life360, a popular family safety app used by 33 million people worldwide, has been marketed as a great way for parents to track their children’s movements using their cellphones. The Markup has learned, however, that the app is selling data on kids’ and families’ whereabouts to approximately a dozen data brokers who have sold data to virtually anyone who wants to buy it. (Source)

I’ve heard that lots of “free” weather apps also do this, because they’re a category of apps that users are going to give permission to track their location without it being suspicious.

They harvest all of this data and sell it to third parties, as it can be quite valuable for advertisers building profiles.

Not surprised this model is used by a bunch of other apps too, but not being surprised by something doesn’t make it right…

🪐 🛰 🔭 ‘NASA Returns Hubble to Full Science Operations’

NASA’s Hubble Space Telescope team recovered the Space Telescope Imaging Spectrograph on Monday, Dec. 6, and is now operating with all four active instruments collecting science. [...]

Hubble has been operating now for over 31 years, collecting ground-breaking science observations that have changed our fundamental understanding of the universe. With the launch of the Webb Telescope planned for later this month, NASA expects the two observatories will work together well into this decade, expanding our knowledge of the cosmos even further. (Source)

The Arts & History

Mark Cerny, Lead System Architect, Explains how the PlayStation 5 was Designed

This is more technical than what I usually put in this section, but somehow it kinda felt like it belonged. Making paintbrushes that artists are going to use feels related to art, even if they’re silicon paintbrushes. 👩🎨🎨

h/t to friend-of-the-show and OG supporter (💚 🥃 🎩) Nick Ellis