22: My Thoughts on 'Internal Diversification', David Tepper vs Fax Machines, My Thoughts on Cloud Backups, John Arnold's Gas Trading

"Think of it like the root systems of plants and trees"

If it costs you your peace, it's too expensive. —Unknown

Today’s recommendation for something-that-made-my-life-better is for cloud backup services for your Windows PC or Mac (if you’re on Linux or BSD, you’ve probably built your own rsync backup server and can skip this).

Personally, I use BackBlaze, but there are others that do similar things, like CrashPlan. But based on my research, BackBlaze hits the sweet spot when it comes to price/functionality/UX/reputation/agent resource usage/etc.

With BackBlaze, for $6/month, or $60/year, or $110/two years, you get unlimited backup space and everything happens automatically in the background (you can set upload speeds, times of day, etc, and then forget about it).

Of course, I picked the two-year plan because it’s cheaper and gives you a bit of protection against potential price increases during the interval. I guess it’s the value investor gene…

The idea is that even if you do local backups on external drives, there are failure modes that would destroy these backups too (fires, floods, tornadoes, voltage spikes, you or a family member doing something dumb, etc). Since these days our data is basically our second brains, it’s worth going overkill with as many copies as possible to protect it. Belts and suspenders. My kids’ photos are in there.

So I also do local backups, and I put the most important stuff in Dropbox and Google Drive and iCloud Drive for extra redundancy, but I also have BackBlaze making another secure copy offsite. Only a continental EMP could get at my 1s and 0s.

I can log into BackBlaze from anywhere, even a phone, and access single files, so it’s also a way to access my data remotely. But if I ever have to recover from a total loss, I can have them mail me a hard drive or USB stick with everything on it, which can be more convenient than trying to re-download terabytes of stuff.

I recommend it for the peace of mind. For a very low price, you can know that if you lose your whole computer, you can recover. That’s worth a lot, at least to me. Probably to you too.

Btw, this isn’t an ad, I’m not getting anything to talk about the service. There’s even a referral program where I could get some free months, but I’m not using the referral code in the links above. If I ever do an ad for something, I’ll be really clear about it upfront.

Investing & Business

My Thoughts on ‘Internal Diversification’/’Look-Through Diversification’

A concept that I don’t see mentioned enough when it comes to portfolio construction and evaluating risk is the internal diversification of businesses. A lot of people will ask you “how diversified” you are, but they often stop at the level of “how many stocks do you own?”

One way I like to think of it is, if my portfolio was a conglomerate, how many businesses would I actually own?

Someone with a 5 stock portfolio may actually be more diversified than someone with a 20 stock portfolio because he may own 5 companies that each have lots of business units in various industries/niches, in various geographies, while the person with 20 stocks many own mostly single-product companies that cluster in just a couple industries and/or countries.

Think of it like the root systems of plants and trees. Some may have a single root that is fairly shallow, while others may sprawl in all directions and over great distances and be a lot harder to pull out, and may survive even if large sections are cut off.

One is not necessarily better than the other, and even with highly internally diversified companies you can have risks that aren’t diversified by all the sub-businesses (ie. if the CEO is bad or a crook). But I think it’s something you should still take into account to get a more accurate picture of what you actually own.

Of course there are other important aspects when it comes to evaluating diversification, but this is the one that I wanted to touch on today.

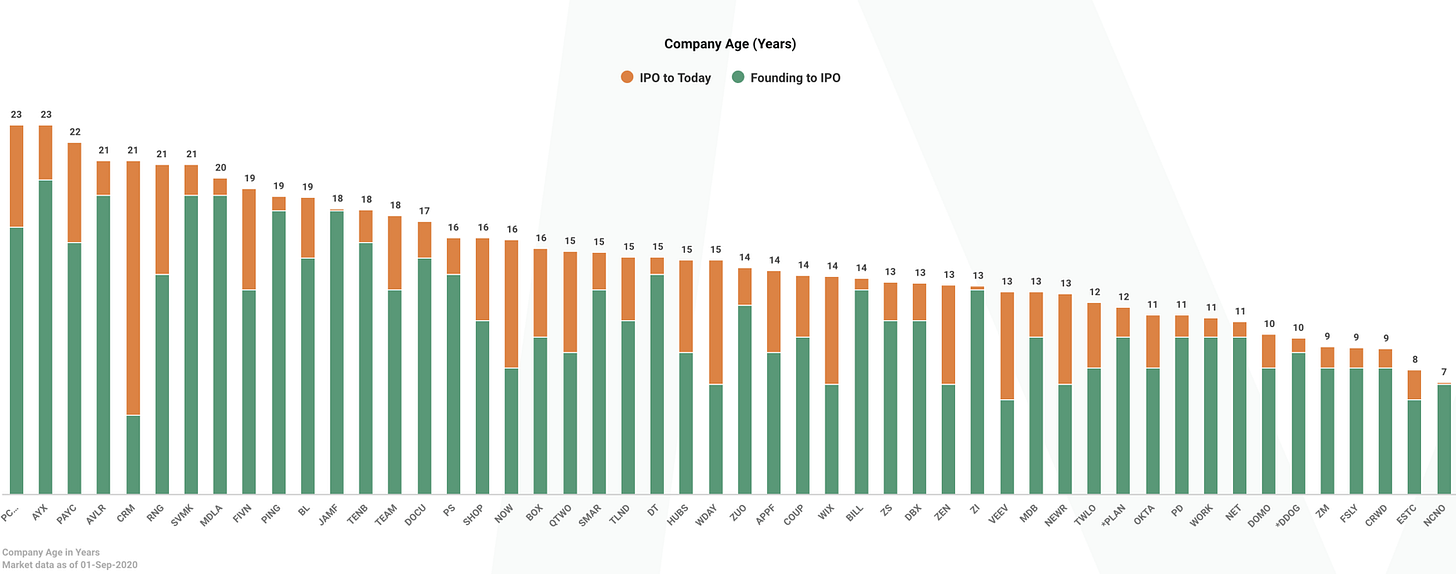

How Long Until IPO?

You may have to click to see a bigger version. This graph shows a bunch of software companies, the number on top is their age in years, the green part of the bar is how long they existed pre-IPO, and the orange part is from IPO to today.

Salesforce (CRM) stands out as having IPO’ed relatively early…

Source. Via Paul Barnes.

Interview: John Arnold (Natural Gas Trading, Philanthropy)

Excellent podcast interview with John Arnold by Peter Attia.

The first hour of the interview is about how he got started in trading (baseball cards first!), his natural gas trading career at Enron and the creation of his hedge fund, including some anecdotes about the infamous 2006 trade that brought down Amaranth Advisors.

The second hour is mostly about his philanthropic efforts at Arnold Ventures (spending about $400m/year and trying to spend it all in his lifetime) focusing on education, criminal justice reform (including his support of the Innocence Project, which I wrote a bit at the end of edition #19 — I recommend the documentary mini-series ‘The Innocence Files’ on Netflix) and health care policy.

He talks about his systems-thinking and long-term approach to solving problems and how his independence of thought has made him a target for both the right and the left sides of politics.

Duration: 2h30 (or 1h15 at 2x)

Pentagon JEDI: Still Microsoft Azure over Amazon AWS

Quite a photo (above) that the Washington Post used to illustrate this story…

The Pentagon reaffirmed its controversial decision to give its largest-ever cloud computing contract to Microsoft instead of to market-leader Amazon, defying a court decision that blocked the earlier award amid criticism that President Trump’s animosity toward Amazon influenced the decision.

With Amazon likely to continue its legal challenge, the decision means there is still no end to the bitter legal fight that has held up the Joint Enterprise Defense Infrastructure, commonly known as JEDI, for close to two years. [...]

Under government procurement rules, politicians are not supposed to steer government work toward or away from specific companies, but Trump had taken a direct interest in JEDI, saying on television that he would ask defense officials to take a closer look at the procurement strategy. (Source)

So it’s not over, but this increases the odds of Azure being the winner in the end.

David Tepper Trivia

Tepper also regaled the audience with the story of why he chose the name Appaloosa for his firm. “At the time we started the fund, information was sent out by faxes,” he explained. “If you were at the beginning of the alphabet you got the info ten minutes faster.” He had originally wanted to call the firm Pegasus, as Greek titles were popular at the time, but the name was already taken. (Source)

So I’m guessing there was an Aardvark Capital back then..?

Visa: History and Business Overview

I want to recommend two pieces from 2019 about Visa by @MineSafety:

Good stuff for anyone trying to get an overview of the business (and a lot applies to MasterCard too).

Also on the same site, you can find a collection of 25 years of Berkshire Hathaway shareholder meeting transcripts. Thanks MS!

Interview: Bill Ackman (August 24, 2020)

DongJoo Kim made this useful chronology of the interview, if you want to jump ahead to specific topics:

2:21 CDS deal and covid19 6:43 going opposite direction 9:30~12:25 today's market environment 14:26 view on the dollar 17:40 no one share their political views (election) 21:03 US china tension 24:16 why market all time high instead of supply chain friction 25:58 ultra low interest rate environment - do not buy long date fixed income asset. 30:12 zero interest rates pushes people's imagination too high? bubble? 30:50 Amazon changed the way to people thought about how to build the value of a company 33:31 Danger on the new normal ( big balance sheet ) - 10 years ago people worried about national debt of United States. Now no one worries about trillions. - Think about United States as business 36:54 Key topics to choose a company - business quality and durability 38:58 How about management? 40:29 limit on quant strategy - I can't understand how they make money. 44:40 Big advantage of Bill's SPAC 51:22 Why don't you create Pershing Square as massive company? - My mentor is Warren Buffet. I just want to follow his career. 53:40 Moment of reflection ( after losing 30% of assets in a 24 months period of time)

Science & Technology

Google DeepMind Helps Google Maps Improve ETA Accuracy

Every day, over 1 billion kilometers are driven with Google Maps in more than 220 countries and territories around the world. [...]

Recently, we partnered with DeepMind, an Alphabet AI research lab, to improve the accuracy of our traffic prediction capabilities. Our ETA predictions already have a very high accuracy bar–in fact, we see that our predictions have been consistently accurate for over 97% of trips. By partnering with DeepMind, we’ve been able to cut the percentage of inaccurate ETAs even further by using a machine learning architecture known as Graph Neural Networks–with significant improvements in places like Berlin, Jakarta, São Paulo, Sydney, Tokyo, and Washington D.C. This technique is what enables Google Maps to better predict whether or not you’ll be affected by a slowdown that may not have even started yet! (Source)

I love when cutting edge machine learning techniques are used to actually make life better for millions of people. Esoteric research or making a company’s process a bit more efficient is cool, but when Google or Apple make one of their heavily used feature a bit better, so many people benefit that it’s definitely worth the effort, even if it can be very hard to eke out that last 1% or 0.1%.

We divided road networks into “Supersegments” consisting of multiple adjacent segments of road that share significant traffic volume. [...] Our model treats the local road network as a graph, where each route segment corresponds to a node and edges exist between segments that are consecutive on the same road or connected through an intersection. In a Graph Neural Network, a message passing algorithm is executed where the messages and their effect on edge and node states are learned by neural networks. [...]

Graph Neural Networks extend the learning bias imposed by Convolutional Neural Networks and Recurrent Neural Networks by generalising the concept of “proximity”, allowing us to have arbitrarily complex connections to handle not only traffic ahead or behind us, but also along adjacent and intersecting roads

In this case, DeepMind’s algo has been able to improve the accuracy of real-time ETAs by 30-50% in many big cities around the world (43% in Sydney, 37% in Osaka, 34% in Orlando, 26% in Toronto, 31% in Singapore, etc).

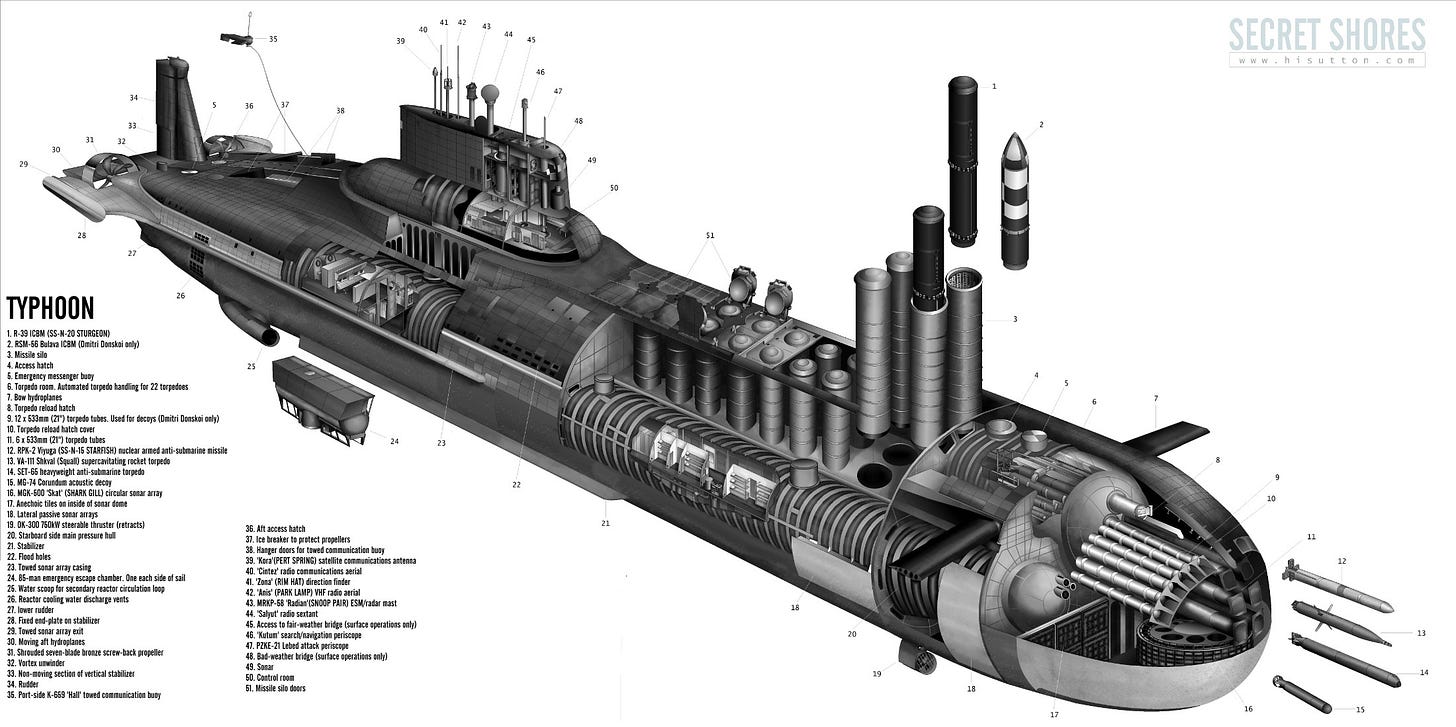

Typhoon Class Submarines

Caption: “Soviet designed and built "Typhoon" Type nuclear submarine as it wafts along a beach in Severodvinsk in the White Sea.”

With a submerged displacement of 48,000 tonnes, the Soviet-era Typhoons are the largest submarines ever built (known as the акула (akula), meaning shark, in Russian). Made between 1976–1986, they were able to accommodate relatively comfortable living facilities for the crew of 160 when submerged on multi-month long missions. As can be expected, everything was redundant so that there were no single points of failure in the system (“Two is one, one is none.”).

Via Massimo, more details here too.

Robotic Adaptive Shape Gripper Based on Chameleon Tongue

Biomimicry is cool. Evolution spent billions of years solving various problems, so the least we can do is learn from it (doesn’t mean it’ll always have a solution for everything, or the best solution when it does, but it’s a good source of inspiration).