227: Hyperscaler Cloud Crossroads?, Danaher 101, Nvidia + ARM vs UK Regulators, DuckDuckGo, RIP Lou Simpson, MBS Issuance, and Fancy Cards

"John Nash walking around having epiphanies"

Nature understands no jesting. She is always true, always serious, always severe. She is always right, and the errors are always those of man.

—Johann Wolfgang von Goethe(I wonder if Richard Feynman had read that one, or he came up with his version independently 🤔)

📍🗺 🚗 Google Maps and Apple Maps are both very solid (I use Google Maps, but Apple Maps has been improving rapidly over the years), but there’s one thing I wish they would add:

The ability to take into account that some people speak more than one language.

Just a setting for “I understand English, French, and Spanish” (or whatever applies), so when you’re driving somewhere that has street names in those language, the software would pronounce them properly in that language *even if the app is set to a different language, like English*.

I drive around both Québec, where street names are mostly French-language, and Ontario, where they’re English.

When I use GPS guidance with audio turn-by-turn directions, I often can’t understand street names because the English voice is trying to pronounce French street names, totally garbling them (they don’t even get pronounced the way an Anglophone person would pronounce them — it’s a kind of bespoke text-2-speech failure mode language).

I don’t want to completely change the language of my phone OS, or even of just Google Maps, I want the app to get that it’s ok to speak to me with French pronunciation. Even if I did switch language, then I’d just have the reverse problem, with English street-names being garbled.

There’s got to be millions of us multi-lingual people in this situation.

👨💻 I like to alternate between various web browsers and search engines to test them out and see how they compare. I’ve been that way for over 20 years, I don’t know why I enjoy it.

I’ve been meaning to give the ad-free search engine Neeva a try, but it’s not available in 🇨🇦 yet ...

Well, I can be impatient sometimes, so I hopped on a VPN, signed up for an account from a US IP, and now I can use it in Canada with that account.

I’ll keep it as my browser homepage for a while and see how it does.

(So far I’ve noticed it being slower than DDG, but I won’t hold that against them yet, since they’re not officially expecting traffic from Canada and probably haven’t set up their infrastructure for max performance up here)

🎨 I had an interesting conversation with friend-of-the-show Jimmy Soni, and with his permission, I’m sharing some of it with you. The starting point is feedback about something I wrote in the intro of edition #226 (which itself was a follow-up to the intro of #225..).

I wrote

I think it’s too bad that so many people don’t have creative outlets, because they literally don’t know what they’re missing. They think it’s like the homework they used to have in school, and often don’t realize that when you do it for yourself, it’s very different from when you have to “create” something for someone else..Jimmy’s insights:

If you looked at what I have to do for my books — reading a lot, writing, researching, revising, then revising again about 7 times — it would look like homework. [...]

But, when I'm in it, it's not like that. Some days are hard. But generally, the thing you get hooked on is the discovery (you feel like a digital version of Indiana Jones!) and then the creation/translation to audiences.

My reply:

Exactly. I don't know what's the best way to make people understand it.. a lot of fiction tries to do it — show the creative process and romanticize it — but I think it almost goes too far and makes it look like you need to be John Nash walking around having epiphanies, being a genius, rather than the much more mundane work of creating stuff bit by bit

Back to Jimmy:

Yeah, I often tell people that I just love boredom more than maybe others do. Meaning that at the root of a lot of so-called "creativity" is just epic amounts of boredom and being able to tolerate that.

Which is tough for people to understand, because "creativity" sounds romantic. Even the word sounds fun and exuberance. But what it really is (at least in my experience) is something more like this: Get up at 4 AM. Read http://X.com press releases. Read Confinity press releases. Compare them to old Levchin/Musk interviews. See what stands out. Rinse. Repeat. For years.

And then the positive side—what the original post was pointing to—is that once you have that outlet, it has this wonderful clarifying effect on the rest of your life. Like I know exactly what to read, what to watch, how to spend my day, how to manage my time. [...]

its the upside to the boredom, which is that you get real clarity on such many other things.

Finding a guiding star removes a lot of decision-fatigue, and makes you more productive without really needing too much extra willpower or discipline, just from the clarity.

💚 🥃 If you were me, and I was you, do you think I’d become a supporter?

If you were me, how much would you appreciate it if you did?

Exactly. Thank you!

Investing & Business

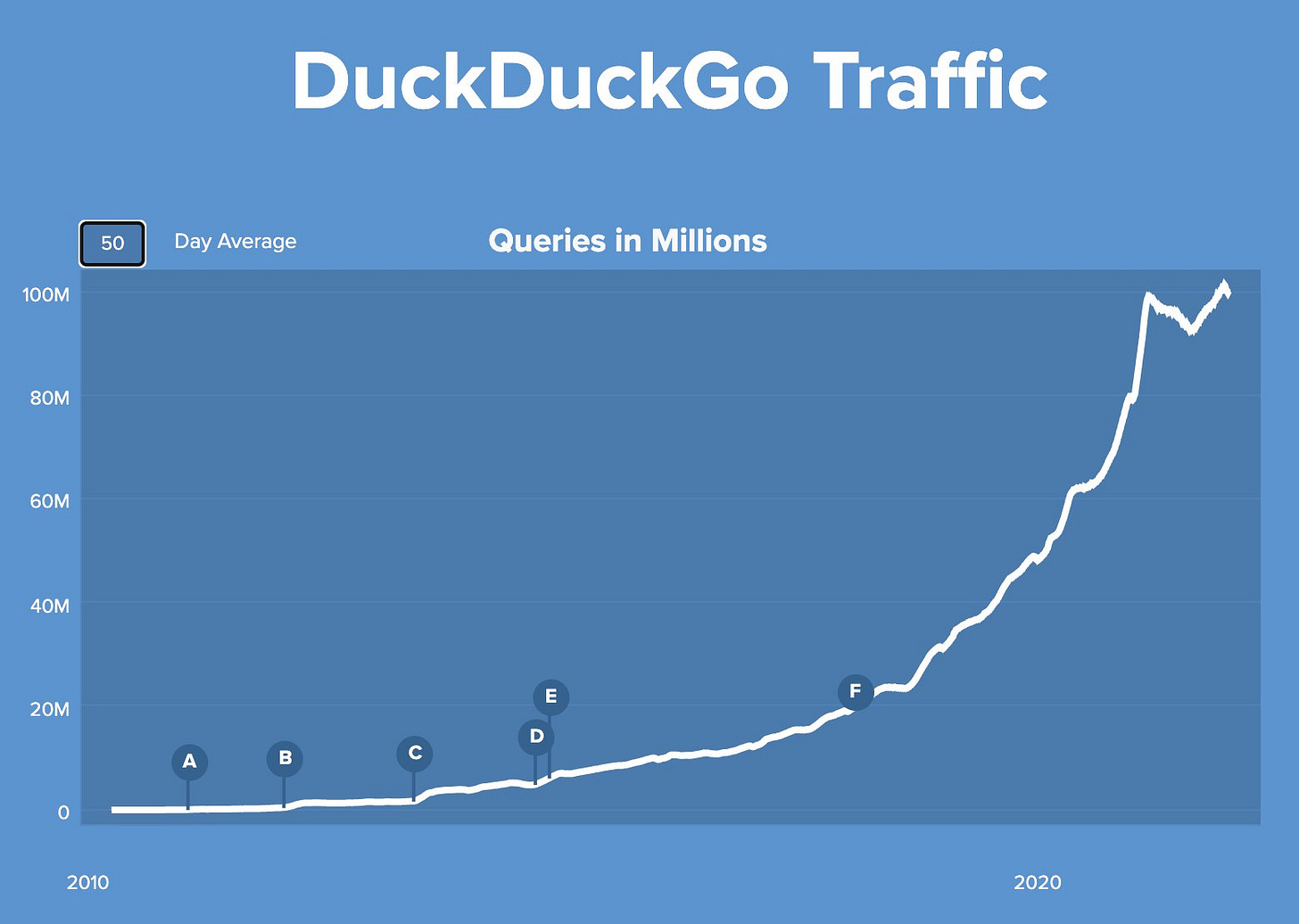

🦆🦆Go

DuckDuckGo is getting about 100 million queries a day now.

Must be a really nice business, considering how few employees they have (about 150) and relatively low capital needs.

They have their own webcrawler, but also use third-party sources like the Bing API to build a large part of their index. Most of their value is the post-processing and mixing-together of these various sources, their UI, and their stance on privacy/tracking.

In other words, you don’t compete with Google head-on, by doing things that Google sees as important, that’s just a land-war in Asia.

You won’t crawl the web more thoroughly and faster than they do, you won’t have more data-centers around the world to shave milliseconds from results, you won’t have more AI researchers, etc.

You find your niche and compete by doing things that Google doesn’t want to do, like focus on user privacy and fewer ads (and, apparently, offer the ability to have a dark mode—yes I know there’s third-party extensions).

DDG is a very interesting company and service, and I’m glad it exists as one more choice out there. Monocultures rarely end up in good places over time without competitive pressures to force them to innovate and stay honest…

Hyperscaler Clouds: Competition or Cooperation with 3P Serverless SaaS?

I wrote a bit about this in edition #217. Here’s Bucky Moore of Kleiner Perkins:

Last year, it became clear that 3rd party serverless infrastructure solutions would begin to challenge the dominance of the cloud providers. This appears to have played out beyond expectations, as evidenced by the success of companies like Netlify,* Snowflake, PlanetScale,* and Vercel. What has been even more surprising is the cloud providers’ response, or lack thereof, to this growing threat.

I believe we are witnessing a shift in their collective mindset that will accelerate the success of the 3rd party serverless ecosystem. It’s no secret that design and UX are a glaring weakness of the cloud providers. As this continues to be exploited, the cloud providers seem to be evolving their strategy from one of coopetition, to full-on enablement of 3rd party players.

As the serverless ecosystem continues to blossom, the perceived opportunity cost of competing with it goes up for the cloud providers. Over time, I expect to see decelerating R&D investment in higher-level services, and more emphasis on advancing the capabilities of their core primitives like storage, networking, and compute. So long as the providers are compelling platforms to build on, they continue to capture meaningful value.

Counterintuitively, the economics of this value could be equal, or even superior, to that of competing directly. In this scenario, the cloud providers benefit from reduced R&D and GTM spending on these higher-level solutions, and continue to capture their share of overall revenue with minimal effort.

(ok, I broke up one massive paragraph into 4 smaller ones for readability. Sorry Bucky!)

The implications of this shift are enormous. The relationship between developers and the cloud providers will eventually be disintermediated by serverless infrastructure players. We will begin to think of the cloud providers as “utility” rather than “solution” providers.

Gavin Baker makes an analogy to Craig Moffett’s “Dumb Pipe Paradox” (“written in 2006 and postulated that high speed broadband providers would be more profitable if they stopped trying to offer services over their networks and instead opened them up.”)

This makes some sense to me. If you have two options where the bottom-line economics are not vastly different, but one of those options can make you grow faster for longer by reducing friction, improving your core product, turning enemies into allies that see your success as their success, etc, then that’s probably the way to create the most value.

There’s a bunch of “if” statements embedded in there, and I don’t have a transparent view into the economics of it all for AWS or Microsoft or GCP, but I can imagine it being true, at least for certain verticals, if not others.

Or it may not happen and we may see a renewed focus by the big clouds on these types of services/products. ¯\_(ツ)_/¯

Danaher 101 📖

Good thread on Danaher, its culture, management, and operational/M&A model, with highlights from the book ‘Lessons from the Titans: What Companies in the New Economy Can Learn from the Great Industrial Giants to Drive Sustainable Success’ (the book may be shorter than its title!) from friend-of-the-show and supporter (💚 🥃) Frederik Gieschen.

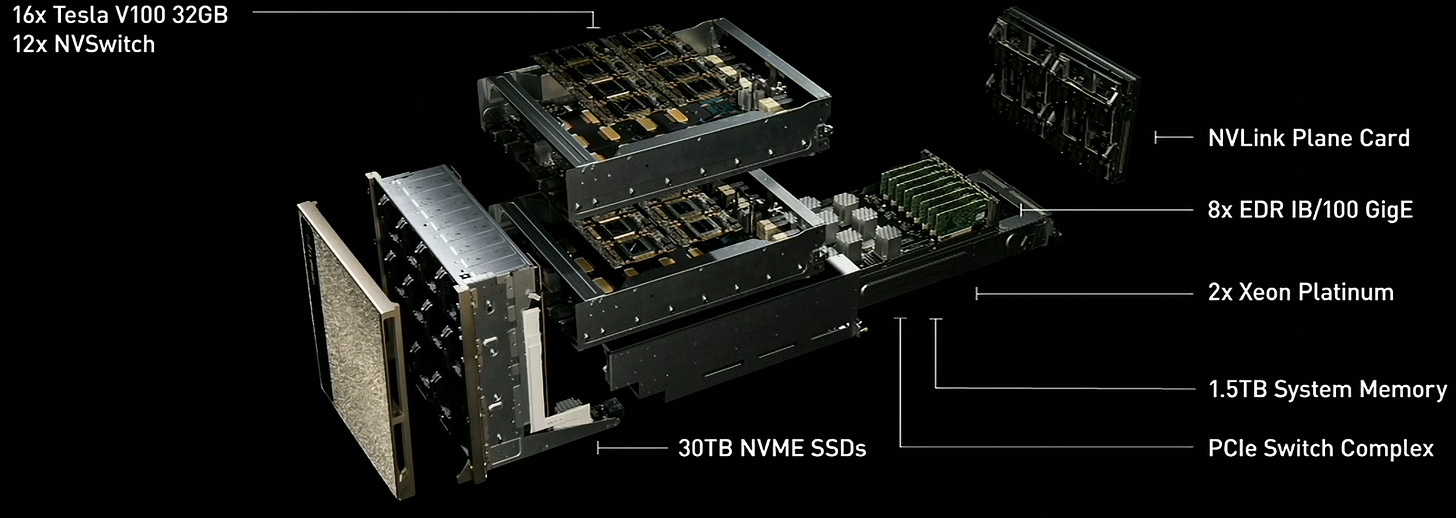

Nvidia’s Argument to UK Regulators in Favor of ARM Deal

Some interesting stuff in this document.

On whether it would be better for ARM to stay independent and instead IPO:

SoftBank considered and rejected an IPO in 2019 and again in early 2020 because the markets would not give SoftBank the necessary return on its investment. While Arm’s licensees such as Apple, Qualcomm, and Amazon have enjoyed skyrocketing revenue growth and profits, as well as soaring market valuations, Arm has lately endured comparably flat revenues, rising costs, and lower profits that would likely present challenges for a 30-year old public company. The capital markets would expect Arm to make significant strategic changes, including cutting costs to maximize Arm’s value. [...]

It does make some sense that as a public company, ARM would have trouble investing as much into a transition to more data-center R&D than it would inside of Nvidia, and that it would probably be its licensees that would make most of that investment and keep most of the benefits for themselves.

Their success would increase volumes for ARM, but likely wouldn’t capture nearly as much value for the company than if ARM developed and held the IP itself and could then license it.

Arm’s original market, and the largest source of its revenue, mobile, is saturated.

Datacenter and PC, two markets that SoftBank targeted with its investments in Arm, are far more difficult to crack. Unlike Arm, the x86 incumbents in datacenter and PC (Intel and AMD) benefit from an established ecosystem of developers, software, systems, and peripherals. They are also vertically integrated, enjoying profits generated from multiple levels of the technology stack, allowing them to make massive R&D investments. As a result, any competitor following an IP-only licensing model, like Arm, is at a major ecosystem and economic disadvantage.

In addition, Arm does not have the systems building expertise, the software engineering scale, or the R&D resources of x86 vendors like Intel and AMD. Even under the most optimistic projections, standalone Arm could not generate the revenue necessary to invest and compete toe-to-toe with the entrenched x86 incumbents.

To date, Arm has only managed to achieve limited inroads in datacenter, mainly licensing to Amazon, which makes custom chips for its own use, and start-up Ampere Computing, the only entity that offers merchant Arm central processing units (“CPUs”) for datacenter.

On how the proposed transaction came to be:

NVIDIA did not approach SoftBank to buy Arm. NVIDIA is a strong supporter of the x86 ecosystem and has developed accelerated computing platforms for x86 PCs and datacenters throughout its history. Intel and AMD make industry-leading CPUs and SoCs suitable for many industries and products, including NVIDIA’s own DGX systems [...]

When SoftBank approached NVIDIA with the possibility to buy Arm, the Parties realized that NVIDIA would be uniquely suited to help Arm create new IP and develop a world-class ecosystem that could stand as an alternative to x86, giving customers more choice and growing markets worldwide. A viable alternative ecosystem would spur growth and demand for NVIDIA’s platforms. It would encourage the x86 giants to innovate and expand their offerings as well, benefitting NVIDIA.

I could be wrong, but this sounds like the most likely scenario to me. Standalone, ARM has a much worse chance to really compete with Intel and AMD in the data-center, but with Nvidia’s muscle, that chance increases significantly.

The exciting part to me is that competition always results in better and cheaper goodies for us customers, so Intel and AMD’s SKUs would probably be even better over time with pressure from ARM-Nvidia in the space.

The Transaction would materially change Arm’s incentives and opportunities. In contrast to a standalone Arm, the Merged Entity would have every incentive, and the ability, to dramatically increase investment in Arm R&D across the board, rather than facing the difficult choices of where to de-invest and face further customer and competitive pressures. [...]

NVIDIA would also bring its expertise in SoC design, software, accelerators, and system designs to attract software, hardware and system developers to the Arm datacenter ecosystem. NVIDIA would port its platform solutions to Arm, and help developers optimize code for Arm-based accelerated systems.

the Transaction represents a unique, once-in-a-generation opportunity to expand and enhance Arm’s ecosystem in critical markets. NVIDIA’s investments in Arm and the UK would deconcentrate CPU markets long dominated by Intel’s x86 CPUs, while accelerating Arm’s roadmaps for mobile, IoT, and other areas Arm has traditionally served

Bonus points for the use of the word “deconcentrate”.

This sounds like something that Jensen Huang would say 🤔

Deal opponents romanticize Arm’s past and either ignore or disparage Arm’s most powerful competition. But if Arm had market power, it would have sizable revenue growth and would be enormously profitable. If Arm alone could vanquish x86 in datacenter and PC, its market share would not be mired in the low single digits, and tomorrow’s technologies—such as Omniverse—would be developed on Arm, not x86.

Rejecting the prospect of any remedy, the Decision would not promote competition. Rather, it would prevent Arm from bringing competition into areas that have been long dominated by x86

Opponents of the deal clearly have an incentive to keep ARM out of the hands of Nvidia because they know that they’d get more competition. The x86 people would rather keep ARM weaker, and the ARM licensees who design their own ARM chips (like Qualcomm) would rather keep selling their chips without competition from Nvidia’s likely better chips.

That’s insane

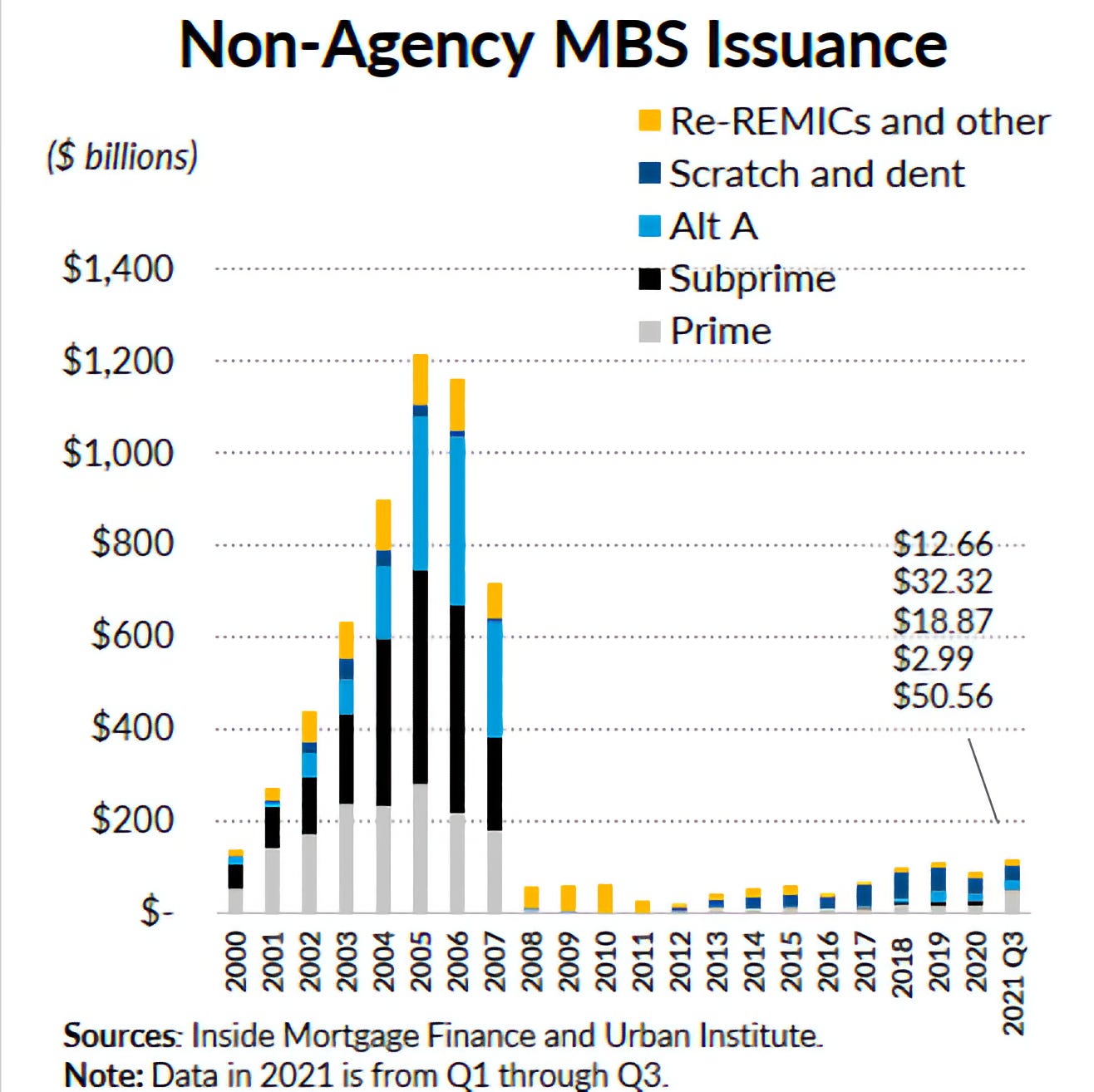

Via Modest Proposal (in a great thread about the housing situation in the U.S.)

Lou Simpson has Died

Louis Simpson, who helped pick stocks for famed investor Warren Buffett as part of a financial career that spanned more than 50 years, has died. He was 85. [...]

Simpson spent more than three decades selecting equities for Geico, the auto insurer owned by Omaha, Nebraska-based Berkshire Hathaway Inc. Buffett, Berkshire’s billionaire chief executive officer whose stock-picking prowess earned him a worldwide following, was a longtime stakeholder in Geico and helped choose Simpson to be its chief investment officer in 1979. [...]

In his 2004 letter, Buffett included a section called “Portrait of a Disciplined Investor,” saying Simpson’s picks had produced an annual average return of 20 percent since 1980, compared with 14 percent for the S&P 500 Index.

Science & Technology

‘Signal CEO Moxie Marlinspike steps down; WhatsApp co-founder Brian Acton will act as the interim CEO as the search for a permanent replacement begins’

Wow that’s a long headline from Techmeme, but it says it all.

What struck me reading the farewell blog post by Moxie (real name: Matthew Rosenfeld, a former head of the security team at Twitter) was how dependent the whole thing was on him as recently as just a few years ago, and that even now, Signal has just 30 employees.

It’s not Whatsapp or iMessage in scale, but the latest numbers (from early last year) that I could find still put it at around 40 million monthly actives and 105m cumulative downloads. That’s close to Canada’s population in MAUs, so it’s not nothing.

And speaking of Whatsapp, Brian Acton is stepping in as interim CEO, and he’s been largely funding Signal so far (it’s an interesting structure: he gave a $105 million 0%-interest unsecured loan to the Signal Foundation, which is due to be repaid in 2068).

‘HEICO Subsidiary Supplies Flight-Critical Components On James Webb Space Telescope’

*Lloyd Christmas voice from Dumb & Dumber*

Wait, so you’re you're telling me I'm responsible for the success of the JWST!!!

(If you’re curious, Heico subsidiary Sierra Microwave Technology made the high power K-band transmitter system that beams telescope data back to Earth)

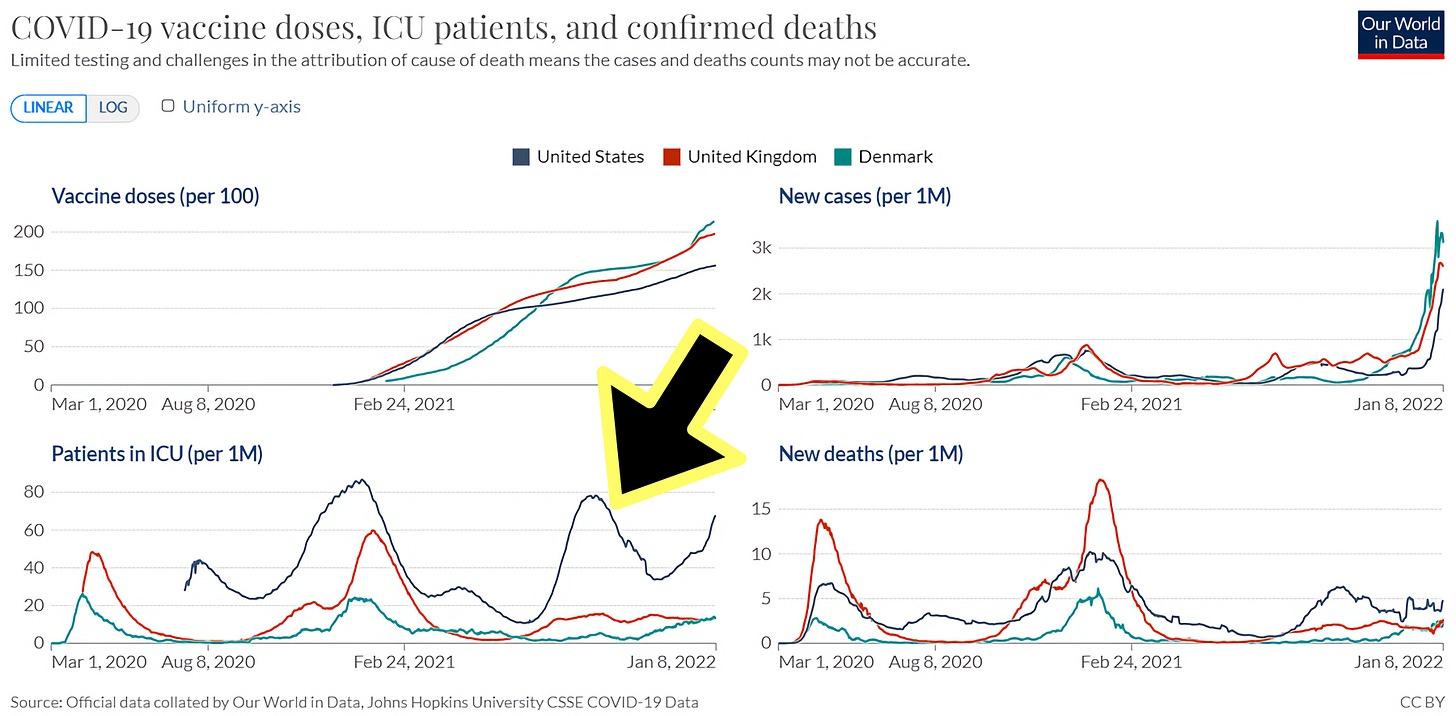

Omicron De-coupling: U.S. not doing as well..

Katelyn Jetelina on Jan 10th:

what’s becoming more clear is the decoupling phenomenon is less pronounced in the U.S. compared to other countries like Denmark and the U.K. There are clearly more cases in Denmark and the U.K. compared to the U.S. (see figure below). However, the U.S. has many, many more patients in the ICU per capita. There are many reasons for this (like demographics, human behaviors, etc.), but the most glaring is that the U.S. started off at an already high rate (thanks to Delta) and has a lower vaccination (and specifically booster) rate. [...]

18 states are forecast to exceed capacity within the next 1-10 days […] While states as a whole haven’t reached circuit-breaker status yet, 585 counties peppered throughout the United States are considered to be at breaking point

The Arts & History

Fancy Decks of Cards

A couple editions ago, I wrote about my new hobby of learning some very basic cardistry tricks.

Because everything that interests more than two people has a whole sub-culture dedicated to it online, I found card sub-reddits and Youtube channels, and ended up browsing the Theory11 store for nicely designed decks (couldn’t resist).

Here’s the ones I ordered:

Green Monarch

Animal Kingdom

Artisan (Black version)

The Beatles (Orange deck, this is a gift for my parents who play cribbage every day 🤫)

Thanks Theory11 was a bit of a black hole as I am starting to play cribbage and other card games with one of my sons who also loves Avengers and Star Wars

Check out Elephant playing cards! Also did you know Heico doesn't have an IR team? Pretty crazy for a company of their size.