238: Amazon Q4 Highlights, 'Cheap' & 'Expensive', Akre Capital, Texas Instruments, $META, Apple M1 Getting Old, and Dune 1984 Shield FXs

"Writing is thinking (and writing is hard because thinking is hard)."

Be yourself, everyone else is taken.

—Oscar Wilde

🤒 My turn. I have covid.

During the night of Saturday, I had bizarre fever dreams and knives in my throat — I dreamed I was in a bed in some dark victorian-style room, and my ankle was broken, a bit like in Misery.

There was no Kathy Bates, but a small rat-sized monster-demon was telling me that my ankle wasn’t broken right and wouldn’t heal, so I should shoot it point-blank (somehow I had a handgun in my hand).

I kept aiming at my ankle but couldn’t press the trigger, I was too scared of the damage the bullet would do… I had a vague feeling the demon wasn’t really trying to help me, that it was trying to get me to suffer for its amusement, but I couldn’t think straight.

Anyway, sharing dreams is probably never a good idea, I’ll stop here!

The only upside is my voice sounds like Barry White now.

🛀 My 7yo has rarely seen live-action films or TV.

It's almost all been animated or video games (playing or watching a recording of someone else). In fact, he’s almost never seen live/linear TV, it’s always been on-demand.

Such a different world from me when I was his age. Certainly a lot less filler, ads, and reruns…

✍️ This is a better-written and more poetic way of saying what I’ve been saying for a while: Writing is thinking (and writing is hard because thinking is hard).

💚 🥃 We’re now at a ratio of 4.9% of paid supporters to free subs.

Getting *really* close to the 5% goal, where I’ll do an AMA podcast with your questions to celebrate.

A Word From Our Sponsor: 📈 Revealera 📊

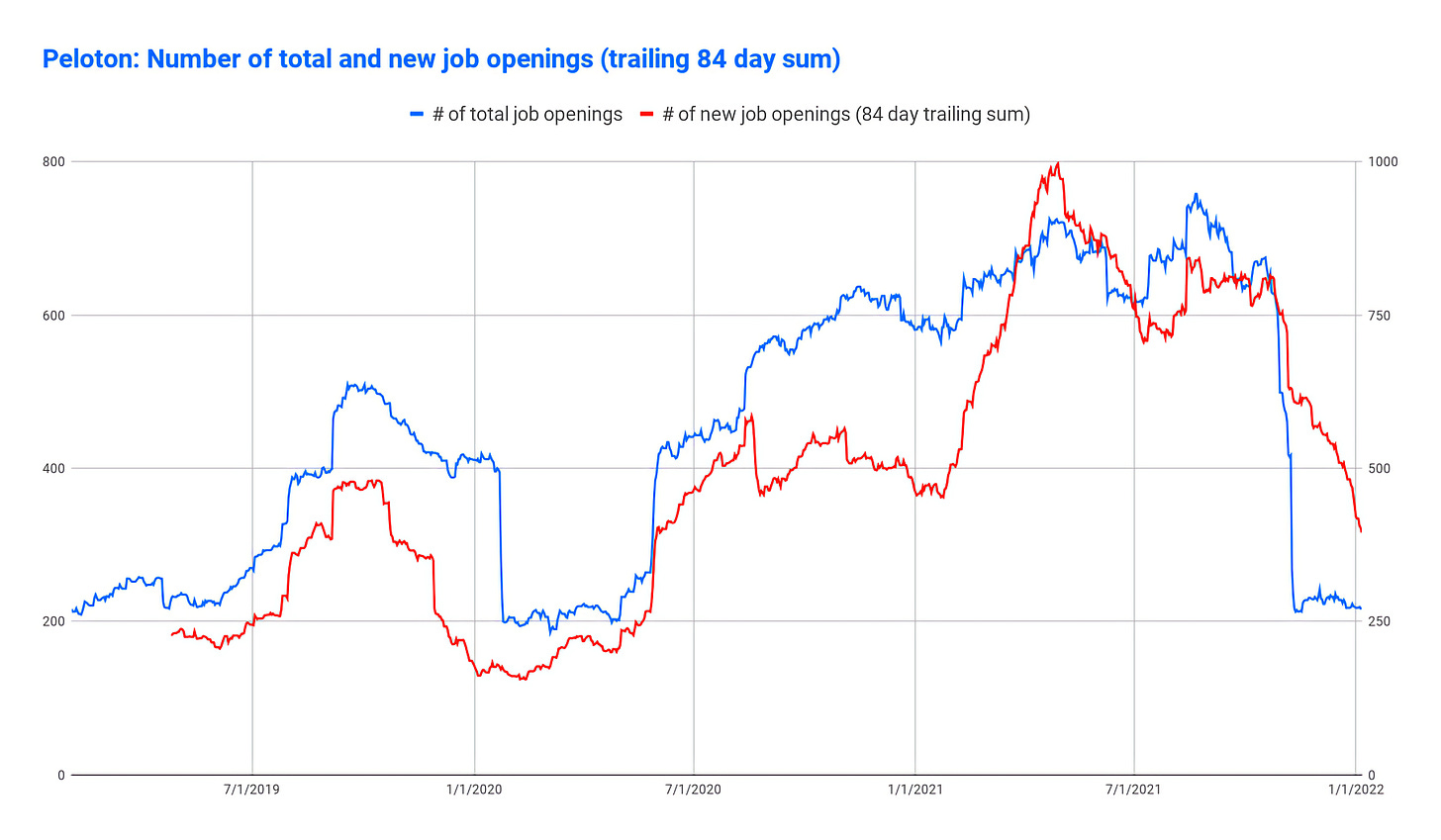

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

Amazon SQ-FT 🚀 & Q4 Highlights

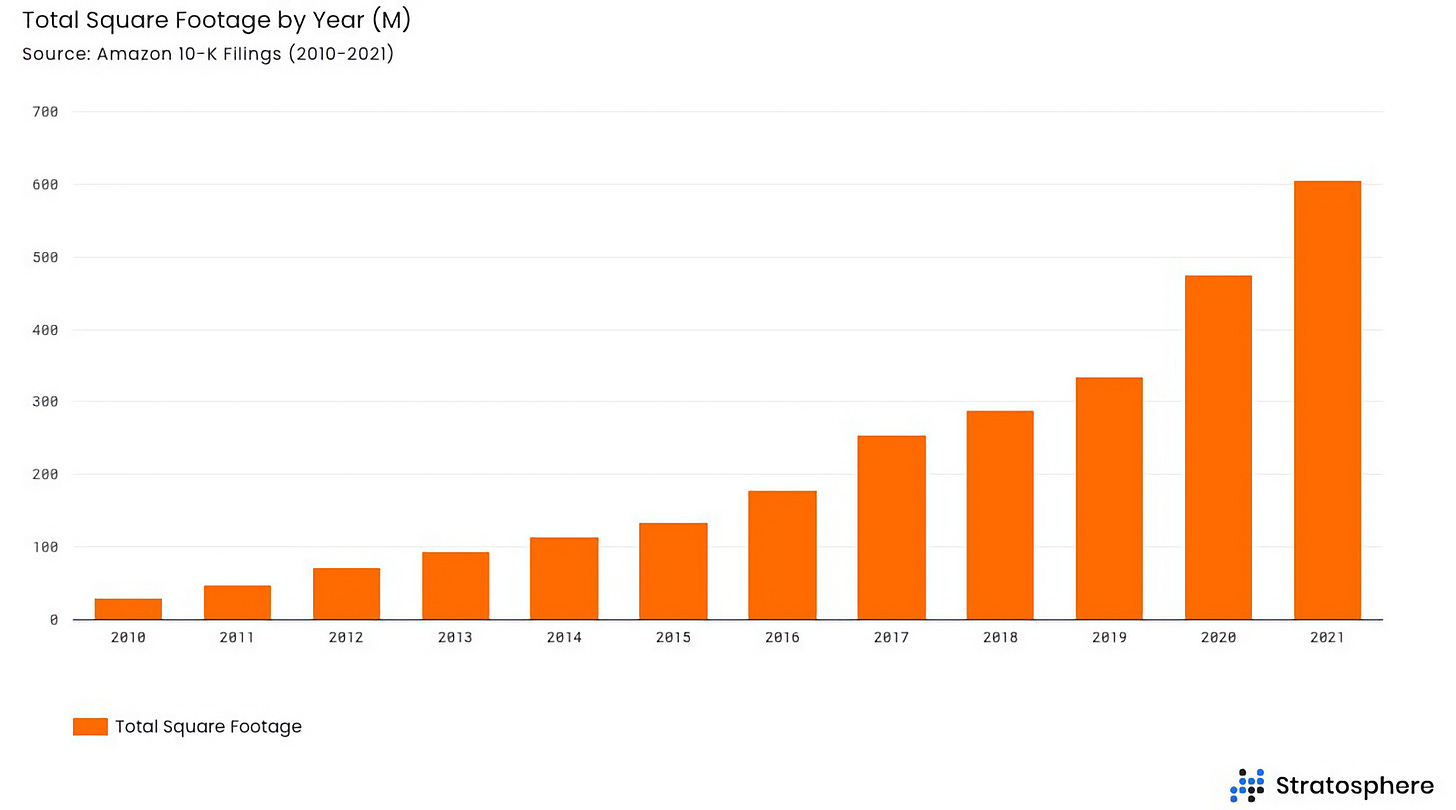

Reader Braden Dennis made this graph showing the past 11 years of Amazon’s square footage expansion.

In the past 2 years, they almost have doubled the number of ⬛️ 👣 compared to 2019, and it’s not like they were a small company then.

This is just 🤯

Question: do you trust that Amazon is making these massive investments in things that will have high ROIC over time? They certainly have a good track record on that front…

Also worth noting: They bought back $1.3bn in stock during January, subsequent to quarter-end. They don’t do this often — last time was 2012 — but they time it well:

Some highlights from the Q4 call:

For the fourth quarter, net sales were $137.4 billion, an increase of 10% year-over-year, excluding the impact of foreign exchange.

Revenue growth may seem low, but you have to remember that in Q4 of last year sales went up 44%. If you look at it on a multi-year basis (because one lap around the sun is arbitrary), you get this:

For Q4, Amazon's 2-year annual compounded growth rate was 25% [...]

on a 2-year basis, you're still seeing 31% compounded annual growth in the 3P seller services revenue

Not bad.

3P sellers provided 56% of all unit sales in the quarter, the highest fourth quarter mix ever.

I wonder what’s the end state on this. How high can that number go before things stabilize..?

We've invested significantly to keep pace with this demand, including nearly doubling our operations capacity in the past 2 years, expanding our fulfillment center footprint while adding significant transportation assets to ensure fast on-time delivery.

This is what you can see in the sq-ft chart at the top.

We added over 273,000 employees in the last half of last year. But I think if you look at the prior year, it was over 400,000. [...]

There are now 1.6 million Amazon employees worldwide, also doubling in the 2-year period.

That’s the population of Barcelona. 🇪🇸

AWS is now a $71 billion annualized run rate business, up from $51 billion run rate 1 year ago. Even on a large base, revenue increased 40% year-over-year.

That’s bonkers. At that rate, we’ll see them cross $100bn annualized soon, which is quite the milestone for a business that started pretty much from scratch in 2006.

net income includes a pretax valuation gain of $11.8 billion related to our common stock investment in Rivian Automotive, which completed its initial public offering in November

They own a little under 20% of Rivian. What’s most interesting about it is not so much the stock, but whether they can deliver on making a massive number of EV delivery vehicles for Amazon.

They’re now breaking out advertising from “other stuff”:

The [ads] growth rate in the quarter is 33%. It was down from 66% in Q4 of last year. Q4 last year obviously had Prime Day in it for first time. And Prime Day carries a lot.

To understand that 33%, you have to understand that last year it was boosted by Prime Day, but that this year Prime Day was in June (in the US anyway), and yet it was able to grow 33% over that very tough comp. Sounds pretty robust to me!

A benefit of Amazon’s “slotting fees/endcaps” type ads in product search result pages is that they aren’t blocked by ad blockers (not the ones I’ve tried, anyway).

A highlight of the call was when they broke out how they’ve been spending their ginormous mountain of capex 💰💰💰💰💰💰:

just under 40% of that CapEx is going into infrastructure, most of it is feeding AWS, but also certainly, Amazon is a large customer of that as well as we build infrastructure for ourselves directly or through AWS. About just under 30% is fulfillment capacity building warehouses -- warehouse only, not transportation. And then just under 25% is transportation capacity and building out our AMZL network, principally globally. The remaining 5% or so is small things like offices and stores and other capital areas. But those are the 3 main areas.

Looks like that’ll keep going on the infrastructure side, but moderate on the fulfillment capacity side

We see the CapEx for infrastructure going up [in 2022]. We still have a very fast-growing business this growing globally, and we're adding regions and capacity to handle usage that still exceeds revenue growth in that business.

On the fulfillment center side, that's about 30% of the spend in the last 2 years. We see that moderating and that will probably now match growth of our underlying businesses

👋

‘Cheap’ and ‘Expensive’ Short-Hand

I always find the "cheap"/”expensive” multiples shorthand a bit incomplete, because FB could've been cheaper than IBM at a much higher multiple.

Some companies are tremendously expensive at P/E of 5 and some are very cheap at a P/E of 30…

I get what he means, but using the same words to say two different things doesn’t help with clarity. I translate "cheap" and "expensive" to "higher multiple" and "lower multiple", but I don’t think everybody does that, especially newer investors.

I wish people didn’t conflate “cheap” with “low multiple” and “expensive” with “high multiple”, because I think word choice impacts how we think about things, and if you keep saying that something is cheap or expensive when you mean it has a high or low multiple, it can make your thinking fuzzier, IMO.

A lot of the time, cheap things have low multiples, and expensive things have high multiples, but there are important exceptions that we’ll miss if we don’t think about this with more nuance.

Interview: Chris Cerrone, Akre Capital Management

Very interesting conversation between friend-of-the-show and supporter (💚 🥃) Bill Brewster and Chris Cerrone:

Among other things, they discuss Josh Waitzkin’s book ‘The Art of Learning’ (I recommend his podcast interviews with Tim Ferriss).

I have fond memories of it, but the details are fuzzy, so I read Derek Sivers’ summary of it.

This passage, which is a note by Sivers, felt like thoughtful pushback on the process-centric ideas that I mostly agree with, but that may need to be better balanced:

Many people take a process-first philosophy and transform it into an excuse for never putting themselves on the line or pretending not to care about results.

They claim to be egoless, to care only about learning, but really this is an excuse to avoid confronting themselves.

Short-term goals can be useful developmental tools if they are balanced within a nurturing long-term philosophy.

Too much sheltering from results can be stunting.Texas Instruments Capital Allocation Presentation

I’ve been following this company for a handful of years, and one of the things they do that I like — and wish more companies in other industries would do — is a yearly update on their capital allocation priorities and long-term goals, as well as looking back on the past year to see how they did vs what they said they would do.

You can see this year’s slides here.

Here’s what the scorecard looks like for the past year:

And here’s a forecast for the next 10 years (!!) of capital expenditure at multiple fabs, and how they rank on a few financial metrics:

There’s an interesting B2B e-commerce story going on there. More and more, customers go directly to TI.com and order their parts directly from the company.

In 2021, such revenues grew 7x year-on-year to reach ˜11% of revenue!

$META

I was wondering why I was seeing lots of mentions of $META on Twitter — I was like, don’t people know this is Matt Ball’s ETF?

It turns out that Facebook paid up and got the ticker, with the ETF changing to METV and Facebook announcing in Q4 filing that they would change to META “in the first half of 2022”.

Congrats to Matt (👨🚒) — he’s like those early internet people who grabbed great domain names and then sold them back to companies for millions. The ROIC on typing “META” in that ETF application form must be pretty sweet!

Science & Technology

🧰👨🏻🔧 Home-improvement edition

One of the benefits of having a boomer father who can fix physical things is that when your 11-years-old clothes dryer stops producing heat, he can open it up, take out the heating element that is clearly broken, and you can order a $30 replacement part on Amazon to fix it.

I could probably have done it myself with Youtube videos, but it would’ve taken me a lot longer, and I would’ve 🤬 a lot more…

Update: I got the part (one day earlier than expected, thank you Amazon Prime), but my father couldn’t help me put it all back together because my boy has covid, so I did it myself. AND IT WORKED!

Feeling quite the handyman now 👨🏻🔧🪛🧰

While on the topic, I also got some ‘anti-vibration pads’ to put under the feet of our washing machine.

Front-loaders spin really fast to try to wring out as much water out of clothes as possible (it’s more energy-efficient that way than in a dryer), but that can cause strong vibration that you hear through walls and make the unit move around.

These act as both shock-absorbers to dampen vibration, and are super grippy so the machine stays in place. I wish I had discovered these years ago.

🍎 🖥 ‘The Apple M1 was released in November 2020’

By the time the iMac Pro comes out, assuming it comes out in the summer or fall of 2022, the M1 family of chips will be almost 2 years old.

I wish they would release it with M2-based SoCs (M2 Pro and M2 Max, to follow the existing naming scheme), which being based on the A15 will already be almost a year old by then, and would come out almost at the same time as the A16 in the iPhone 14, so it would be two architecture generations behind (and 1-2 TSMC nodes).

I get that Apple doesn’t have to be on a yearly cadence for computers, but I feel they’re stretching it a bit here.

Why does it matter? Because that’s the computer I want to buy!

The Arts & History

Giving 2021 Dune the Shield Special FX from 1984 Dune

Learning how they did the original effect in the 80s without computers is just 🤯

Get well, get well soon!

On $META - they also paid $60m to Meta Financial Group (ticker: CASH) for the rights to the name and trademark almost two months ago. I'm attaching the 8-K. The acquirer ("Beige Key LLC") is Facebook. I was pretty happy with that as a CASH shareholder!

https://www.sec.gov/Archives/edgar/data/907471/000110465921148898/tm2134686d1_8k.htm

Hope you get well soon!

Bill