241: Cloudflare Q4, Streaming Churn, Construction Costs, SpaceX, Deepmind AI + Youtube, Fusion Breakthrough, Bloomberg vs Coal, and Type I & II Fun

"Relying on coercion seems to produce a kind of mental friction"

The single biggest problem in communication is the illusion that it has taken place.

—George Bernard Shaw

🛀 🎤 If I ran a call center (for customer service or marketing or whatever), I'd get really good microphones for all my agents, with really good background-noise isolation and podcast-level clarity.

I bet it'd pay for itself with shorter calls, higher conversion rates, and happier customers & employees.

While at it, I’d also give really good microphones to every public company so earning calls are super-clear rather than sounding like everybody’s talking into the same echo-y speakerphone at the center of the conference room table…

🧗♂️ Type 1 fun vs type 2 fun:

Type I Fun

Type 1 fun is enjoyable while it’s happening.

Also known as, simply, fun. Good food, 5.8 hand cracks. Sport climbing, powder skiing, margaritas.

Type II Fun

Type 2 fun is miserable while it’s happening, but fun in retrospect.

It usually begins with the best intentions, and then things get carried away. Riding your bicycle across the country. Doing an ultramarathon. Working out till you puke, and, usually, ice and alpine climbing

This is making me wonder, what parts of investing are fun for me?

I think what I like are the research and learning (type I). The buying and selling, watching positions go up and down, that stuff leaves me pretty neutral now. I used to react more…

How about you? Do you experience strong type I fun when things are going well? Are bad periods type II fun when you look back on them later on?

🐙 Love these tweets by Kanjun Qiu:

Discipline is most sustainable & enjoyable when it stems from self-respect, rather than self-coercion.

I’ve switched to entirely using “dedication” vs “discipline”, and it’s made a surprising difference to how I feel. Discipline feels hard, coercive, as if an outside force is making you act. Dedication, on the contrary, feels like a yearning, a pull from inside, rooted in desire.

Relying on coercion seems to produce a kind of mental friction that leads to avoidance and burnout. It removes choice and induces a sense of obligation. The yearning pull seems much more sustainable - it relies on you choosing the thing you want, over and over again.

I think I need to try this mental reframing on myself. Sometimes the right angle, the right word, the right lens is all that’s needed to push you over the edge…

💚 🥃 Ding ding ding! 🔔🚨

Thanks to the 5 new paid supporters who pushed us over the 5% threshold since last edition (merci to Josh (💚 🥃), Geoff (💚 🥃), Chen (💚 🥃), Extra-Deluxe (💚💚💚💚 🥃) Ryan, and Extra-Extra-Deluxe (💚💚💚💚💚💚 🥃 Nayut!).

I’m officially pressing the “START” button on the AMA podcast project. *whiiiir*

If you have a question for me, here’s a simple form to send it:

If you’re new here and would like an intro-to-me podcast, this conversation with friend-of-the-show and supporter (💚 🥃) Jim O’Shaughnessy is probably a good place to start.

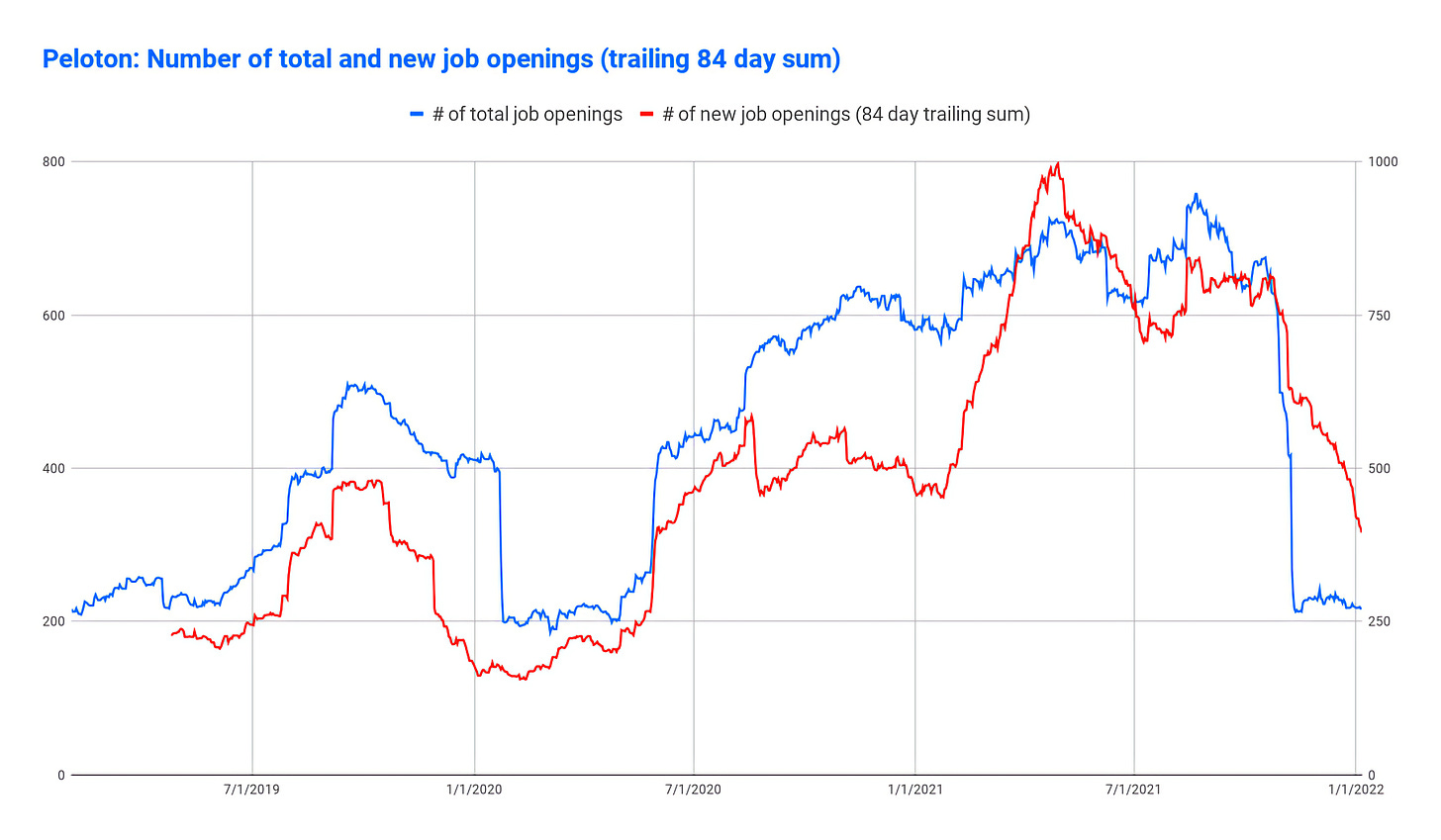

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

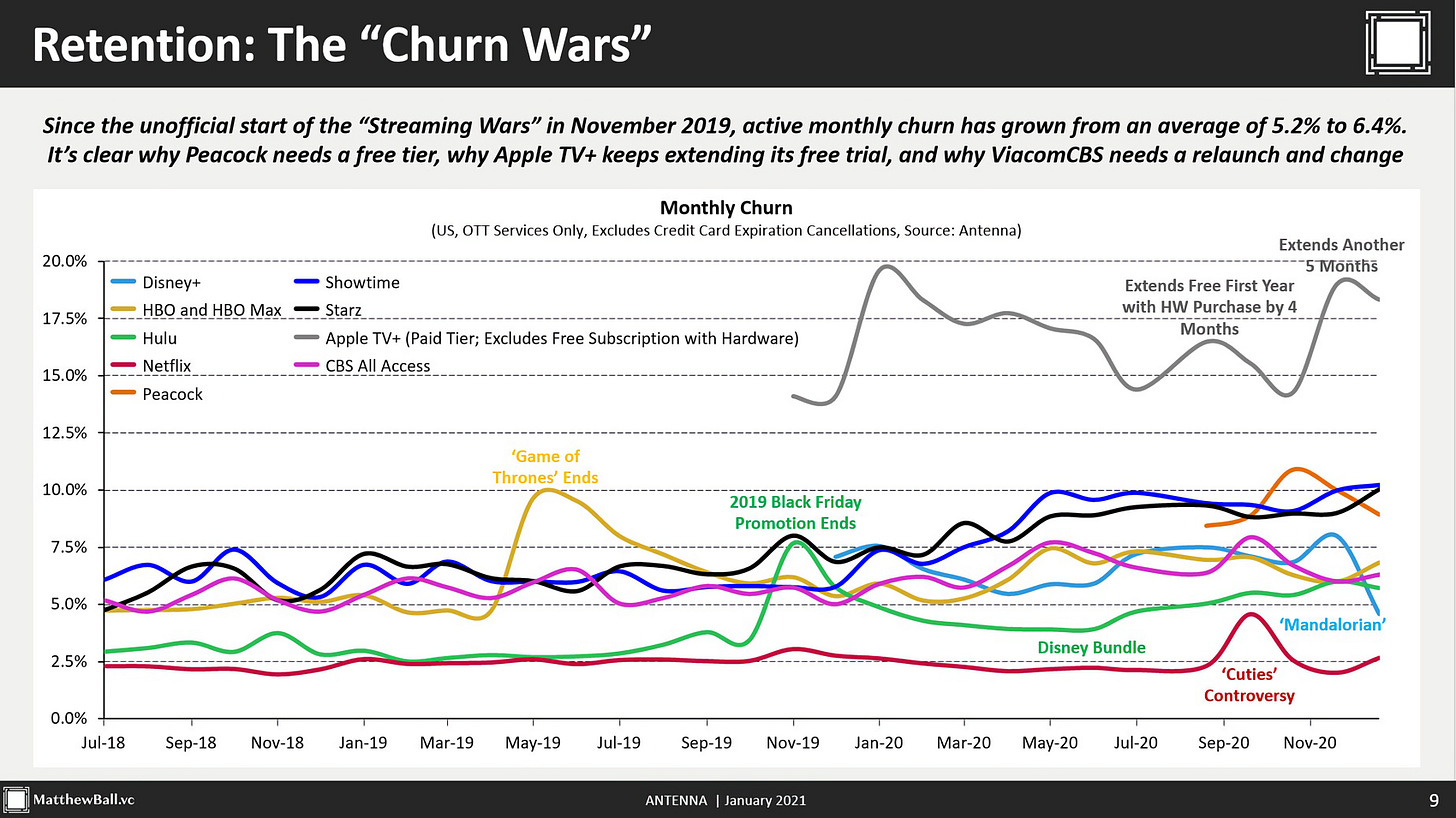

The Churn Wars (at the Streamers)

h/t Friend-of-the-show Matt Ball (👨🚒) (posted in February 2021, so older data, but still very cool)

Cloudflare Q4 Highlights 🌥 (aka the Flappy Bird Quarter)

First some numbers, to get us going a bit:

Q4 revenues +54%

FY21 revenues +52%

Both are the highest in 4 years. Growth is accelerating as the company is becoming bigger, which is relatively rare.

Q4 Non-GAAP gross margins: 79.2% (+110bps)

Q4 FCF: $8.6 million (4% margin, first positive quarter since IPO)

Q4 RPOs: +63%

Dollar-based net retention: 125% (+600 bps)

Some highlights from the call:

Matthew Prince: we are not in a rush to be significantly profitable.

Over the years, our team is asking about profitability. The story I told them was to imagine every year, you saw your neighbor shoveling money into a machine. A year later, a lot more money came out. Year after year, the money kept piling up and getting shoveled back in. If, one year, you look at your window and didn't see your neighbor shoveling all the money back into the machine, you'd worry, what's wrong with the machine?

It’s a good metaphor, but all I can think of is:

To be clear, there is nothing wrong with our machine. We will continue to shovel money back in to drive innovation and reach new customers as long as we can achieve exceptional growth.

We think of managing our operating margin a bit like that game Flappy Bird, not too high, not too low. For as long as we can, we want our operating margin to hold just above breakeven and right where it's been in the last 2 quarters. In other words, we've done something wrong if we beat significantly on EPS.

🦤

We're proud that this is Cloudflare's first quarter since we've been public to be free cash flow positive. It also won't be our last. We know this is a business that can generate significant cash flows when we want. [...] We admire and seek to emulate other companies that came before us and had significant cash flows while holding operating margins at breakeven.

Cloudflare often references the Amazon model, and this is right out of ‘Your Margin is My Opportunity™️’:

While talk across the industry is about increasing cost and pricing pressure, we achieved a gross margin of 79%. That remains above our long-term target gross margin range of 75% to 77% and create some opportunities. We expect to use this exceptional gross margin as a weapon to take business from competitors more vulnerable than we are to pricing and cost pressures. It also allows us to bundle together products into an overall platform no competitor can match.

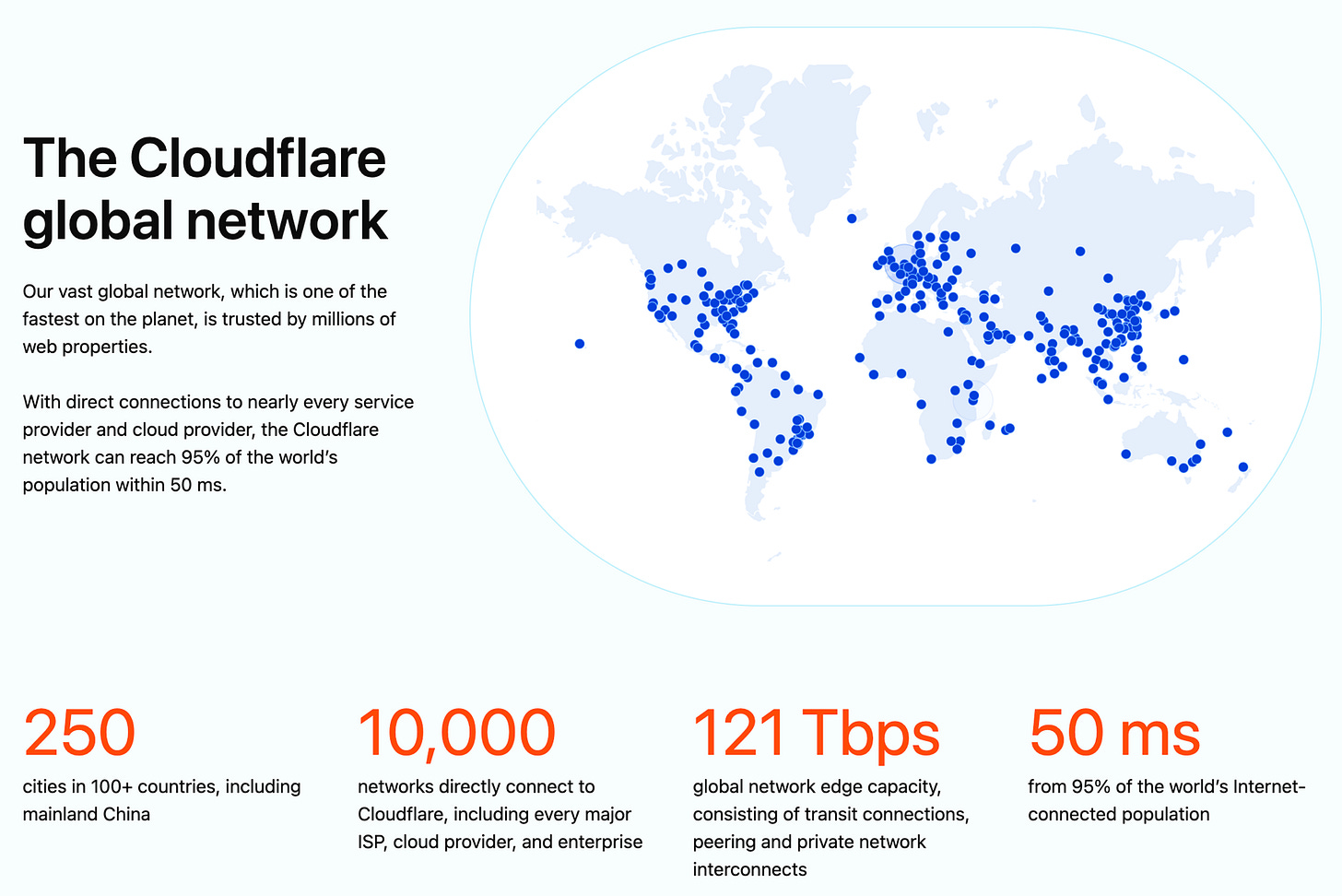

121 terabits of capacity!

“Network effects” and “flywheels” are clichés now, but some truly have them:

Network effects are spawned by networks, and we run one of the largest networks in the world. As customers join our network, our network gets better and more efficient. If you want to understand how we've been able to continue to drive our business at this rate, this virtuous cycle is where to look.

And because it's a flywheel, this efficiency allows us to continue to invest in products. Our team love launching new products, and we're planning at least 7 innovation weeks full of new products in 2022, further extending our network, introducing new capabilities and growing our TAM.

It’ll be interesting if they can keep up the kind of product development velocity that they had in 2021, and whether they can iterate and evolve their existing products (launching new things is more exciting, but a lot of value is created by doing boring things better than anyone else).

Speaking of new products:

The products we announced in 2021 are already thriving. For example, we had over 200,000 domains sign up for our e-mail routing service and seemingly overnight to become a major e-mail security provider. R2, our zero egress object store has had more than 9,000 sign-ups for its closed beta, including some incredible logos. They represent hundreds of petabytes of storage and demonstrates the palpable excitement around our Workers developer platform. We're on track for R2 to progress to open beta in Q2 and then be generally available in the second half of 2022.

On their new acquisition:

we've acquired Vectrix, a start-up that has built the easiest to use, most powerful CASB we've seen.

CASBs, Cloud Access Security Brokers, are a category of services that give visibility and control over data stored in SaaS applications. [...] their product is a natural add-on to every current Cloudflare customer…. further rounds out our zero trust platform, giving visibility not only for data flowing across the network, but now also data at rest in service providers.

Ukraine 🇺🇦:

Modern warfare increasingly includes the cyber battlefield. While they don't generate meaningful revenue, we have onboarded a number of Ukrainian businesses, news outlets and government organizations in anticipation of potential attacks. While we hope the current tensions will resolve peacefully, we have experienced mitigating nation-state cyberattacks, and we are prepared to defend our customers and network whatever may come.

They’re still not growing as fast in Asia-Pacific, but accelerating, and there’s definitely a big opportunity there:

The U.S. represented 52% of revenue and increased 52% year-over-year. EMEA represented 27% of revenue and increased 60% year-over-year. APAC represented 14% of revenue and increased 29% year-over-year.

That’s a lot of customers:

We exited the quarter with 140,096 paying customers, representing an increase of 26% year-over-year. We ended the year with 1,416 large customers, representing an increase of 71% year-over-year.

They also have millions of free accounts that provide all kinds of benefits, which I wrote about previously (rapid beta-testing, data to feed ML models, self-serve top of funnel, etc)

In Q4, traffic volumes grew by 88% compared to the same quarter last year. Despite these significant increases, we were able to maintain network CapEx as a percentage of revenue at 11%, and a high gross margin of 78.6% for fiscal 2021.

That’s pretty efficient infrastructure.

It helps to be *inside* so many ISPs around the world and running on commodity hardware (I wrote about this too — starting as a CDN and reverse-proxy that mitigates DDoS has had huge positioning benefits for the company).

Good anecdote on the huge Log4j vulnerability that shook the whole internet recently:

it's sometimes underappreciated the scale of Cloudflare, what effectively is our sensor network. And so we were able to, after the Log4j vulnerability was reported, look back across our network, which is comprised of millions and millions of sites with a huge diversity in terms of geography, in terms of size and scale. And we were able to see some of the very first exploits of that. What's interesting about that is it turned out, in fact, we had the data that was 2 days before anyone else that was out there.

And it turned out that we actually caught the researchers themselves testing the vulnerability.

Detecting needles in the giant haystack of the internet. 🪡

if you go back over the last 5 years, we have rather consistently spent about 11% to 12% of revenue for network traffic. So the new guidance is 12% to 14%, it's a slight uptick. There is only a modest amount of R2 investment in this number. […]

We don't invest freely in idle capacity and hope that we fill it over time. We follow demand expansion with existing customers.

In other words, the higher capex is partly because of the buildout of some new products, but mostly because of higher existing demand, not speculation on future demand.

What we are trying to do is directly interconnect with as many networks around the world as possible. And so you can turn up a whole bunch of PoPs [points of presence]. But if they're not connected to network, they don't give you any real benefit.

We have traditionally talked about the cities that we are in, and we continue to expand that. What we have not done because, again, it doesn't really matter to our customers, is break down within those cities, how many individual facilities we're in. We are in most major cities now is in multiple different facilities.

In certain cities now, we'll have multiple individual availability zones in order to make sure that we have high degree of availability. But we are continuing to go into more and more networks around the world.

Here’s part of the secret sauce:

What's unique about us is that we continue to have it so that every day, our phone rings with network providers around the world who are inviting us to be directly in their networks. And that's unique, and it's unique because of the broad set of services we provide, the broad set of customers that we have… that is part of what explains how we've been able to achieve and maintain and actually improve on our gross margins even as our traffic rates have continued to increase. And that's really differentiated from anyone else in the space.

👋

A Tale of Two Fintwits 🐦🐧

With some accounts on financial Twitter, you can read their timeline archive and have no idea what the market was doing at the time (up, down, volatile, calm, who knows ¯\_(ツ)_/¯ ).

While with others, you could recreate the chart in fairly high detail just by reading their tweets. 📈📉

Halves instead of Quarters? (½ vs ¼)

I was having a look at Adyen’s H2 results — the only company I know that makes an animated video with cartoon characters for its earnings release — and it got me thinking: maybe it would be a good idea if the US market moved to 1H/2H earnings instead of 4xQs.

Add to that maybe 50 extra days a year when markets are closed during weekdays, and most market participants would likely do better IMO.

While I’m at it, other ideas on my list:

The SEC should mandate that every investors relations website needs to have high-quality transcripts of every call available soon after calls, and keep them archived on the site forever. (Such a low-cost, no-brainer)

Every earnings conference call should skip the scripted presentation and jump straight to Q&A. Release the document online before the call, make sure there’s enough time for everyone to read it, and stop wasting everyone’s valuable time (I’m not just talking of listeners — the execs surely have better things to do to create value than read a long Word Document out loud on the phone every 90 days).

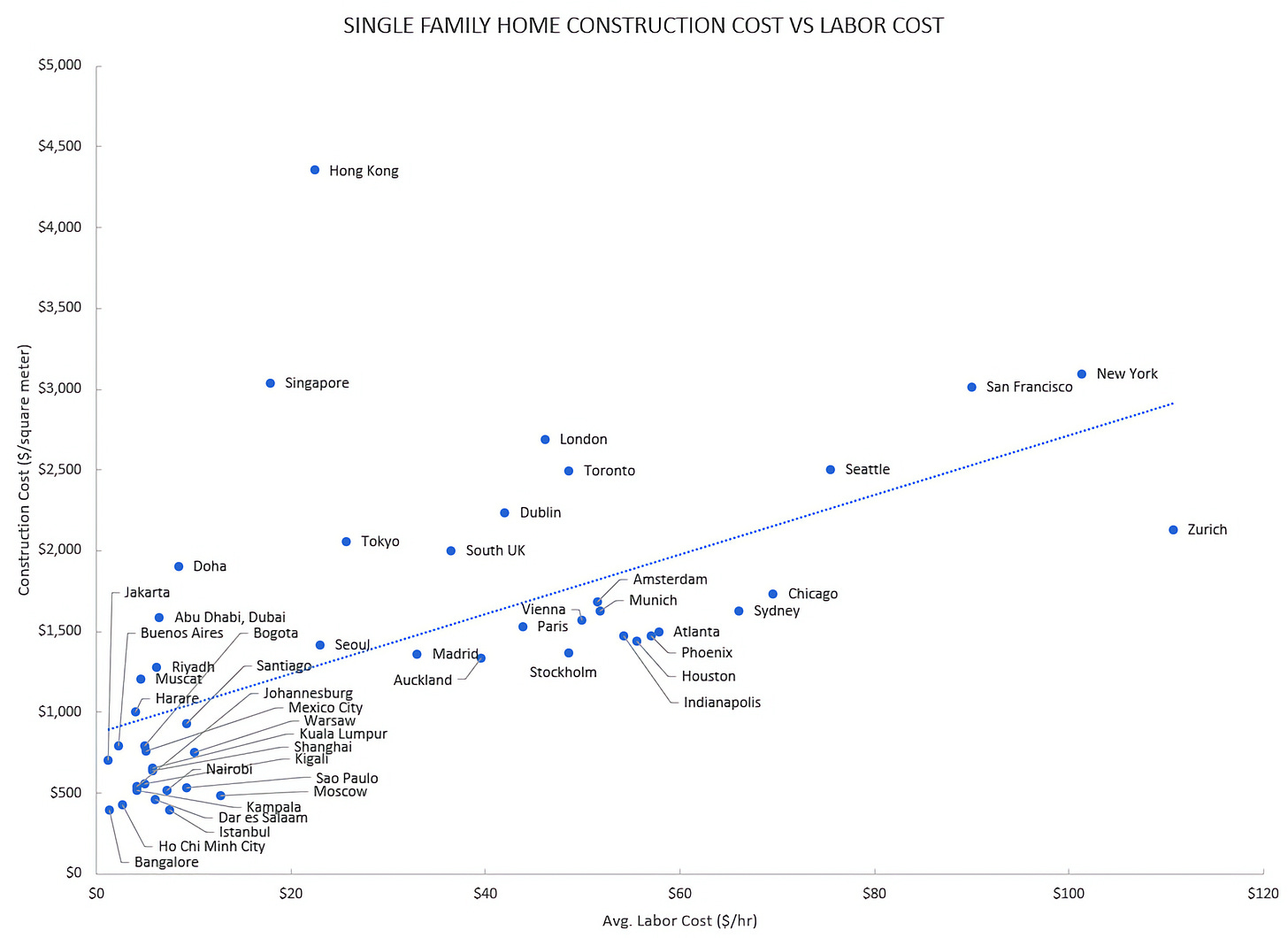

‘Construction Costs Around the World: How Does the US Compare?’ 🏠🏚🧱🏢🔨👷♂️

Very interesting post by Construction Physics:

to summarize:

We see almost no relationship between labor OR material costs, and construction costs for residential construction, outside of whether you’re in a western country or not.

The US does particularly well at building homes, apartments, and other projects that have low administrative overhead or government involvement.

The US does particularly poorly at projects with a high degree of administrative burden, government oversight, or where the government is a major stakeholder. European countries do far better by comparison.

There’s little evidence that US homes are built to worse standards than in comparable countries.

For residential construction, there’s little evidence that other countries have substantially more efficient construction methods that the US should adopt.

In the US, low construction costs translate to low property prices, making the US an outlier in housing affordability on a unit-area metric.

There’s a handy map-of-content here for topics they cover (such as “Where are the robotic bricklayers?” and “Where are my damn learning curves?”)

🪞Through the looking glass 🙃

Jordan Singer: “somewhere in a parallel universe”:

Science & Technology

Less rosy aspects of the Starlink experience 📡 🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰🛰

I’ve posted a lot of positive stuff on SpaceX’s Starlink, and for good reasons.

But I like to know about both the pros and cons of things. This video highlights some of the real-world issues with Starlink and is worth a watch (at 2x maybe) if you’re interested in the space (the space, get it?).

Deepmind AI Optimizing Video CODECs for Youtube

MuZero, for example, mastered Chess, Go, Shogi, and Atari without needing to be told the rules. But so far these agents have focused on solving games. Now, in pursuit of DeepMind’s mission to solve intelligence, MuZero has taken a first step towards mastering a real-world task by optimising video on YouTube. [...]

we’ve demonstrated an average 4% bitrate reduction across a large, diverse set of videos. [...]

4% may not sound like much until you remember that this is just a first step, and that 4% at Youtube scale is a ginormous amount of data.

These codecs make multiple decisions for each frame in a video. Decades of hand engineering have gone into optimising these codecs, which are responsible for many of the video experiences now possible on the internet, including video on demand, video calls, video games, and virtual reality. However, because RL is particularly well-suited to sequential decision-making problems like those in codecs, we’re exploring how an RL-learned algorithm can help.

Our initial focus is on the VP9 codec (specifically the open source version libvpx), since it’s widely used by YouTube and other streaming services. [...]

By learning the dynamics of video encoding and determining how best to allocate bits, our MuZero Rate-Controller (MuZero-RC) is able to reduce bitrate without quality degradation. QP selection is just one of numerous encoding decisions in the encoding process. While decades of research and engineering have resulted in efficient algorithms, we envision a single algorithm that can automatically learn to make these encoding decisions to obtain the optimal rate-distortion tradeoff. (Source)

What the model does is optimize how the CODEC is fine-tuned and used, rather than create a new, better video CODEC (maybe that’ll come someday too).

It’s interesting to think of similar use-cases, where humans can get pretty good at tuning something, but there are just too many parameters that interact and vary over time for anything but an AI to truly master.

I’m sure Google is already using Deepmind models internally to tune certain parts of its infrastructure for exactly this reason.

Fusion Breakthrough (but we’re not there yet…)

On Wednesday the UKAEA announced the Joint European Torus (JET), the largest and most powerful operational reactor called a tokamak, had produced a world record total of 59 megajoules of heat energy from fusion over a five second period – the duration of the experiment.

During this experiment, JET averaged a fusion power of around 11 megawatts (megajoules per second).

The previous energy record from a fusion experiment, achieved by JET in 1997, was 22 megajoules of heat energy.

Tony Donne, EUROfusion programme manager, said: “If we can maintain fusion for five seconds, we can do it for five minutes and then five hours as we scale up our operations in future machines.

“This is a big moment for every one of us and the entire fusion community.” (Source)

I’ll be curious to see if large, long-term projects like ITER make the most progress over the coming years, or if the recent crop of fusion startups like Helion move faster because what they lack in sheer scale, they compensate for by being more nimble and adopting the state of the art more rapidly.

If you want to learn more, Omega Tau has two excellent long-form interviews with fusion physicists that I highly recommend, I learned a lot from them:

Michael Bloomberg’s Fight Against Coal

I think I was vaguely aware of this, but I hadn’t really taken a closer look until reader AT mentioned it in a comment:

Mr. Bloomberg [...] has worked to shutter coal plants in the United States since 2011, and two years ago devoted $500 million to the effort. It has been linked with hastening the retirement of about 280 coal plants in the United States.

The new effort is aimed at closing a quarter of the world’s 2,445 coal plants as well as stopping efforts underway to build 519 new coal plants by 2025 [...] He did not say how much money he intended to devote to the plan, but he spends about $150 million annually on efforts to shut down coal in the United States and Europe, according to Bloomberg Philanthropies.

I don’t know how much credit B’s effort deserves on every single plant that was closed — maybe just a little for some and a lot for others — but in general, this is the right approach.

Coal is the low-hanging fruit, and attacking it directly will yield a higher ROI versus dancing around the issue and spreading money to 15 different kinds of things that don’t make as much difference.

The Arts & History

How to tell something *isn’t* CGI?

I’ve posted a bunch of CGI/VFX stuff on how to make better CGI, but here’s a twist: How to tell when something *isn’t* CGI? What are the subtle cues and details that are very hard to get perfectly right on CGI?

In other words, what makes reality superior to our eyes? 👀

The video above digs deep by looking at that famous video of dancing robots from Boston Robotics.

I've always like the ratio of discipline/desire. I'm stealing this from an author that I can't remember, but he said something like: Discipline without desire breeds drudgery and desire without discipline yields disappointment.

Ton of type 2 fun related to university. Taking public transportation at early hours in the morning, studying for exams with your friends until your eyeballs turn to drywall. Seems pretty miserable at the time, but I look back at those moments fondly