249: Constellation's Biggest Acquisition Ever, Snowflake Q4, Visa & Mastercard, Facebook Capex, Steve Jobs, Twitter, and MSCI & FTSE & Moody's

"Over 15 years, it has a negative 9.75% CAGR."

I prayed for twenty years but received no answer until I prayed with my legs.

—Runaway slave Frederick Douglass, on taking action

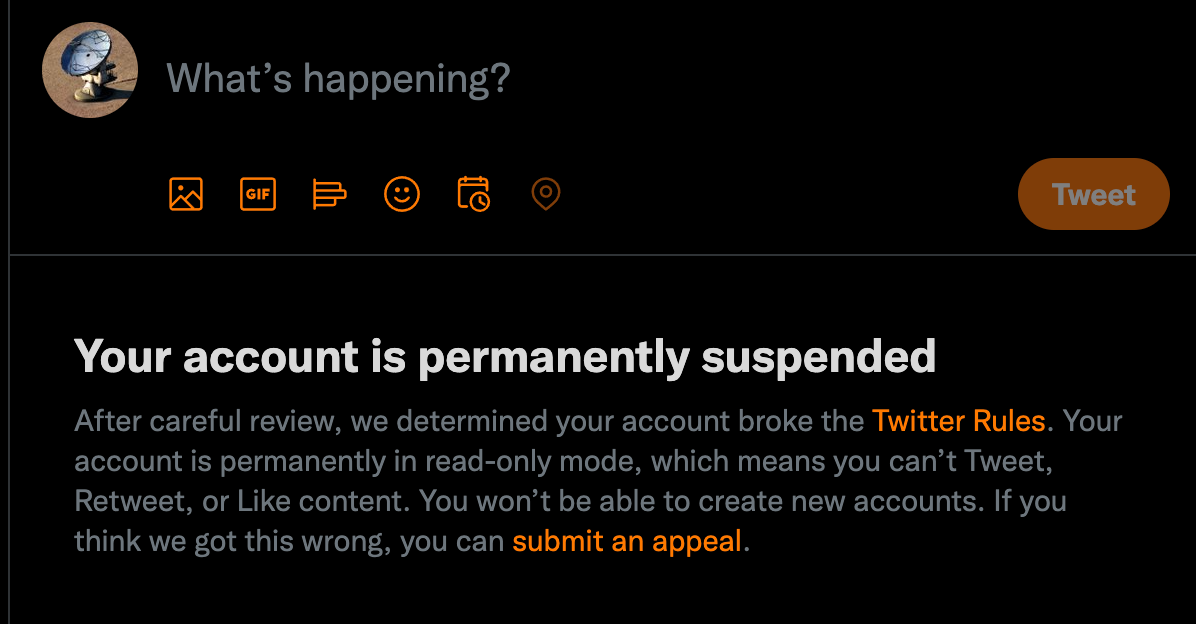

🤬😓 So on Wednesday, I was “permanently” suspended from Twitter for “violating rules against posting violent threats.”

(Boy am I glad that Twitter doesn’t use the dictionary definition of “permanently”)

I guess the automated moderation filters don’t understand sarcasm, especially in the first person, because I was paraphrasing Putin’s negotiation tactic of offering very little while brutally attacking.

With hindsight, the wording does look like a threat and clearly the kind of thing that can be flagged, but at the time, having zero malicious intent, it didn’t even cross my mind that I could be sentenced to eternal damnation by a python script.

I was talking to someone I’ve known for years about a horrific invasion, I was mad at the unfairness of it all and wanted to evoke the horrors of that war by metaphor (why would I threaten Modest Proposal? he’s the best of us).

I appealed the decision using Twitter’s process for that, but within minutes I received a message saying the appeal had been rejected. Probably some overworked mod who glanced at it for 0.5 seconds without context and hit the big red button instead of the green one…

Thankfully, common sense prevailed in the end, but I gotta say that this was a stressful situation. I’m certain that my friends are to thank for this outcome — I’m so grateful to be able to count on such great people 💚 🥃

Lessons learned:

Don’t take irony and sarcasm for granted in a world of machine-learning language models performing automated mass moderation

Don’t count on a human moderator bailing you out from a false positive

You don't know how much you value a thing until you think you've lost it

I’m glad not all my eggs are in the Twitter basket

Here's my Oura ring tracking my heartbeat at the time. The arrow shows when I received the first email from Twitter announcing the suspension:

🐦 Here’s a suggestion for Twitter to make their AI moderation have fewer false positives and be less of a black box.

If someone posts a Tweet that the AI determines is against the rules, that person should get a pop-up — ideally almost instantly, but whenever the filter is triggered —that says something like:

We’ve determined that this tweet violates rule X. We have temporarily hidden the tweet to allow you to make a choice:

1. Post the tweet anyway, which will result in a suspension that you can appeal for human review.

2. Reformulate the tweet to clarify your meaning if it is being incorrectly flagged by our moderation filters.

3. Delete the tweet.

Thank you, have a great day on this wonderful and friendly platform that is working hard to improve its product.I heard from someone that they got a warning when using certain “bad” words, but maybe that’s just on the mobile app. I didn’t have anything like this on the web version ¯\_(ツ)_/¯

🎬 🍿 We are about to have a decade of Hollywood movies where the supervillain is a pouty little bald man with a Russian accent.

🏙 Our minds understand scale better by analogy than numbers (ie. the Sun has a mass of 1.9885×10^30 kg vs the mass of 332,950 Earths). Josh Meyers:

To give a sense of scale, Kyiv is about the size of Chicago, Kharkiv the size of Philadelphia, and Mariupol the size of Oakland. That’s what’s under attack right now

💚 🥃 Merci

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view, and resurfaces it within your existing workflows. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

Investing & Business

RSX is lower than at the bottom of 2008

Over 15 years, it has a negative 9.75% CAGR.

Here’s an interview conducted live on Russian financial TV where a guest “says his current career trajectory is to work as ‘Santa Claus’ and then drinks to the death of the stock market.” (there are English subtitles)

JPMorgan said on Thursday it expected Russia’s economy to contract 35% in the second quarter and 7% in 2022 with the economy suffering an economic output decline comparable to the 1998 crisis.

Personally, I’ll take the over on “7% in 2022”…

Constellation Software makes the biggest acquisition in its history ($700m USD) 💾

They just bought the “Hospitals and Large Physician Practices” business segment from Allscripts for $670m USD in cash + $30m in earnouts over two years. To put it in perspective, this is more than they’ve deployed over any full year except 2021 (h/t friend-of-the-show Barry Schwartz).

If they maintain 2021’s pace on top of this, they’ll deploy over $2bn in 2022.

Jeff Bender mentions having watched this business “for years” — this is the CSI M.O., keep track of everyone for a very long time and be ready when they decide to sell.

“Allscripts’ Hospitals and Large Physician Practices gross revenue for 2021 was US $928M.”

So price is about 0.75x revenue. They tend to pay around 1x revenue for small deals, but larger deals in the past have been a bit higher, with Acceo at 2.1x revenue and TSS at 1.4x, and that’s years ago when software multiples were generally lower than today.

Looking at the financials shows why this had a low multiple:

The low gross margins are because within the segment, there’s a mix of 70%+ gross margin software and ˜20% service stuff.

Historically, Constellation has been good at stabilizing, and possibly even turning around these types of “hairy” assets.

I wouldn’t be surprised if they were able to improve margins quite a bit over time, with their focus on ROIC, which could imply de-emphasizing or cutting some of the low-margin, low-ROIC activities (not always possible, depends how essential and integrated with the software they are).

These may not be directly comparable, but Cerner and Roper’s medical software units certainly have very good margins (their EBITDA margins are around the gross margins of this…).

❄️ Snowflake Q4 Highlights ☃️

Some bonkers numbers:

Q4 revenue: +102%

FY21 revenue: +106%

Net revenue retention: +178% (🤯)

Product gross-margin: 75% (+500bps, notable since they’re on top of hyperscaler infra. Up over 1000bps since 2020)

Total customer number: +44% YoY

Large customer number (>$1m): +139% YoY

Q4 free cash flow margin: 26.5%

RPOs accelerated to 99% YoY at $2.6 billion (🤯)

Interesting to see Snowpark progress (Python version is still in beta, and Java version is GA). This is a big initiative for them that moves them closer in the direction of Databricks.

Their data marketplace is also growing fast and makes them stickier: “In fiscal 2022, the number of stable edges grew 130% year-on-year. 18% of our growing customer base has at least one stable edge that is up from 13% a year ago. Snowflake Data Marketplace listings grew 195% this year, now with more than 1,100 data listings from over 230 providers.”

Here’s their NRR, going up quarter after quarter:

Snowflake has a consumption-based model, not the typical saas with mostly fixed-price, per seat monthly or annual contracts. The dynamic is different, which has some upsides and downsides.

One of the downsides is that it can take a long time for customers to ramp up. The company has talked about 9 months or more before a new customer contributes significant revenue. The upside of that is this massive NRR where existing customers keep spending more and more year after year, both as they ramp up, but also as they find new ways to use the platform to do things that they couldn’t do on whatever they were on before.

The market seems pretty disappointed by the guidance for next year, but IMO it’s a mix of the company sandbagging, and of a very AWS-like aspect to Snowflake: They keep driving their costs down/efficiency up and pass the savings to customers, which makes the product better but hits their revenue temporarily as it improves their competitive position.

See this for example:

We introduced platform enhancements that improved efficiency higher than expected, which lowered credit consumption. [...]

Last year, we called out improvements in storage compression that reduced storage costs for our customers. Similarly, phased throughout this year, we are rolling out platform improvements within our cloud deployments.

No two customers are the same, but our initial testing has shown performance improvements ranging on average from 10% to 20%.

We have assumed an approximately $97 million revenue impact in our full year forecast, but there is still uncertainty around the full impact these improvements can have. While these efforts negatively impact our revenue in the near term, over time, they lead customers to deploy more workloads to Snowflake due to the improved economics.

If I’m a customer and learn that all of a sudden my storage bill for the exact same amount of data went down by double digits, either I pocket the money and spend it somewhere else or spend it on more compute on Snowflake, but either way I’m a happier customer.

Visa & Mastercard exposure to Russia/Ukraine

Mastercard:

Russia and Ukraine are important contributors to our overall company revenues... in 2021, about 4% of our net revenues were derived from business conducted within, into and out of Russia, and similarly approximately 2% of our net revenues were related to Ukraine.

Visa:

In fiscal full-year 2021, total net revenues from Russia, including revenues driven by domestic as well as cross-border activities, were approximately 4% of Visa Inc. net revenues and total net revenues from Ukraine were approximately 1% of Visa Inc. net revenues.

Do you know what would stimulate the Russian economy? Running paper plants to print lots and lots of paper rubles. Maybe Visa and Mastercard rails should be part of the sanctions…

Facebook’s Ramping Scale 📈

My friend MBI (💎 🐕) put together some numbers on the evolution of Facebook’s #:

What a tectonic shift just over the course of a decade for $FB/ $META

Total capex from 2009-2012: ~$2 Bn

Total capex from 2013-2017: ~$17 Bn

Total capex from 2018-2022: ~$93 BnTotal opex from 2009-2012: ~$5.5 Bn

Total opex from 2013-2017: ~$43.8 Bn

Total opex from 2018-2022: ~$225 BnOf course, this is linked with revenue, so here goes

Total revenue from 2009-2012: $11.5 B

Total revenue from 2013-2017: $107 B

Total revenue from 2018-2022: $462 B

While you’d expect a large increase in capex as the company scaled up massively, it’s still bonkers to see these absolute numbers, and know they’ll keep getting bigger going forward.

It’s kind of incredible in the first place that humanity can even produce all this equipment, because Amazon, Microsoft, Google, Alibaba, etc, are all spending tens of billions on it too.

MSCI & FTSE Russell & Moody’s 👋 Russia

MSCI:

MSCI announced today that the MSCI Russia Indexes will be reclassified from Emerging Markets to Standalone Markets status. The reclassification decision will be implemented in one step across all MSCI Indexes, including standard, custom and derived indexes, at a price that is effectively zero and as of the close of March 9, 2022.

FTSE Russell:

Index provider FTSE Russell said on Wednesday it would cut Russian equities from its widely tracked indices while MSCI said it would remove the “uninvestable” country from its emerging market benchmark.

“Russia will be deleted from all FTSE Russell Equity Indices effective from the open on Monday 07 March 2022,” the index provider said in a statement.

Moody’s:

downgraded the Government of Russia's long-term issuer (local- and foreign-currency) and senior unsecured (local- and foreign-currency) debt ratings to B3 from Baa3. [that’s 6 notches!]

Ratings remain on review for further downgrade

I think S&P also downgraded Russia by 8 notches, but I haven’t heard anything about the indexes yet.

Lukoil calls for end to Ukraine invasion “as soon as possible”

Russia’s second-largest oil producer Lukoil called on Thursday for the ending of the conflict in Ukraine as soon as possible.

In a statement on its website, the company said it was concerned by the “tragic events in Ukraine” and supported the negotiations to end the conflict.

Why would they be against “special military operations to liberate and de-nazify Ukraine”? 🙄

Maybe they just don’t like “attempted state-sponsored coups”…

‘For investors with direct exposure to Russia, losses will be deep and not recoverable for the foreseeable future’

There remain creditor groups in France, Russia’s largest creditor at the time of its 1918 default, that today still argue they are owed money as a result. [...]

The United States and European Union’s decision to sanction Russia’s central bank on February 28 has essentially severed the spinal cord of the country’s economy. Russia is set to default on its debts, see its oil export relationships rejuggled to its detriment, its currency collapse even further, and it is now possible that most of its residents’ quality of life may fall to Iranian or potentially even Venezuelan standards in the near future.

Science & Technology

Password Lenght & Complexity Strength

You may have seen one of these years ago, but computing power marches on, so it’s good to update — well, ideally you need 2-factor authentication, or even better, a physical cryptographic key (like a Yubikey), and not to rely on passwords. Source.

Great Steve Jobs Anecdote

Friend-of-the-show David Senra (🎙) shares a great Steve Jobs anecdote from friend-of-the-show and supporter (💚 🥃) Jimmy Soni’s new book, The Founders:

Steve Jobs had been hunting for a CFO of Pixar and reached out to Jordan, who agreed to meet Jobs for breakfast.

“I show up in my suit jacket”, Jordan recalled, “and Jobs walks in in torn clothes, twenty minutes late.”

obs only had two interview questions for Jordan:

Question one: “You went to Stanford Business School in the late '80s, and then you're in the center of the company creation universe in the most exciting time in the world and you became a fucking management consultant?"

Question two: “How could you work at Disney for eight years? Those guys are fucking bozos?”

Jordan saw the questions for what they were: a Steve Jobs stress test.

“I’ll cop to the first one," Jordan said. "It took me ten years to find my way back here, but I’m back and I'm here to stay."

On the question of Disney, he pushed back hard.

“You're wrong on Disney," he said.

Then he explained that Disney stores had higher consumer ratings than the Disney theme parks.

(Jordan had been CFO of Disney Stores)

Jobs seemed satisfied and pitched Jordan on Pixar.Jordan demurred; he had just been a CFO, and he was looking for something different.

Jobs proposed he join Apple instead.

"I have this vision for Apple stores," Jobs said, and proceeded to outline a reimagined shopping experience from the roots up.

Jordan thought Jobs “delusional" and politely declined the offer.

"Of course," Jordan said of Jobs's retail concept, "he nailed it.”

The Arts & History

‘Fixed’

h/t Ani Avetisyan

Afghan context

A bit of history: During the decade of the USSR’s war with Afghanistan, the Soviets lost 14,453 soldiers. This is considered to be a very bloody war and a humiliating military defeat for the then super-power.

Current estimates for Russian losses in Ukraine are in the 5,000 range right now (but of course with the fog-of-war, it’s very hard to know anything for sure).

Even if that’s off, the current invasion of Ukraine is still a very bloody conflict, considering it has only been going on for a week, versus 10 years in Afghanistan.

Somewhat related, but this thread on the history and very special mythos surrounding paratroopers in Russia is interesting. It’s not what I was expecting.

1. I'm super curious what your tweet said. I suppose it's gone forever now, no?

2. Re: password brute forcing: Do you have any idea for how long hackers actually try? If I have a pw that's hackable in 2 weeks, does the hacker give up by then? Their computing power is limited, right? So would it pay to keep going for 2 weeks with uncertain payoff, or go onto others with potentially shorter pw's? Also, the hacker has no idea that my it'll take 2 weeks. What if it's 2m years?! All things being equal, better computing power is bad for our pw safety b/c it lowers the cost of hacking. More computing power = more need for better pw's? Feeling safe with my sentence-long master pw and 40-character mixed pw's right now!

I think you commited the "beginner mistake" of warfare/confrontational twitter accounts.

First, it is a good that you are a beginner in "confrontation twitter" since this is not a place to stay, it gets dirty quickly.

What I mean is that people who share horrible ideas and make propaganda know very well that they can hurt you by forcing you to violate the TOS of twitter. They know exactly what to say and keep "walking" a few inches from the red line of the twitter TOS, but someone who gets triggered may make a mistake that pushes him/her to tweet something that they know can cause an account suspension.

It was very effective in getting you banned.