27: Snowflake's IPO, Transdigm, Amazon Drawdowns & Podcasts, TikTok's Jazz, Round 2 Founders, and NASA’s Crawler Transporter

"It's going to take me 12 years after my death to get done what he's doing within his lifetime."

The strongest of all warriors are these two; time and patience. —Leo Tolstoy

❄️ Snowflake did IPO, and it was a circus. It didn’t start trading until around noon, after the ‘indicated’ price went from $120 to $245 before any public trading (which was already up from the original $75-85 range a few days earlier), and then briefly up to around $320 (which is a market cap around $85bn)…

To put things in context, they raised money at around $12bn earlier this year.

Either they basically gave away a chunk of their company to private investors, or there's a massive amount of turbo-FOMO going on... Not saying $12bn is the correct valuation today, but 7 times that may be a little... extreme?

Investing & Business

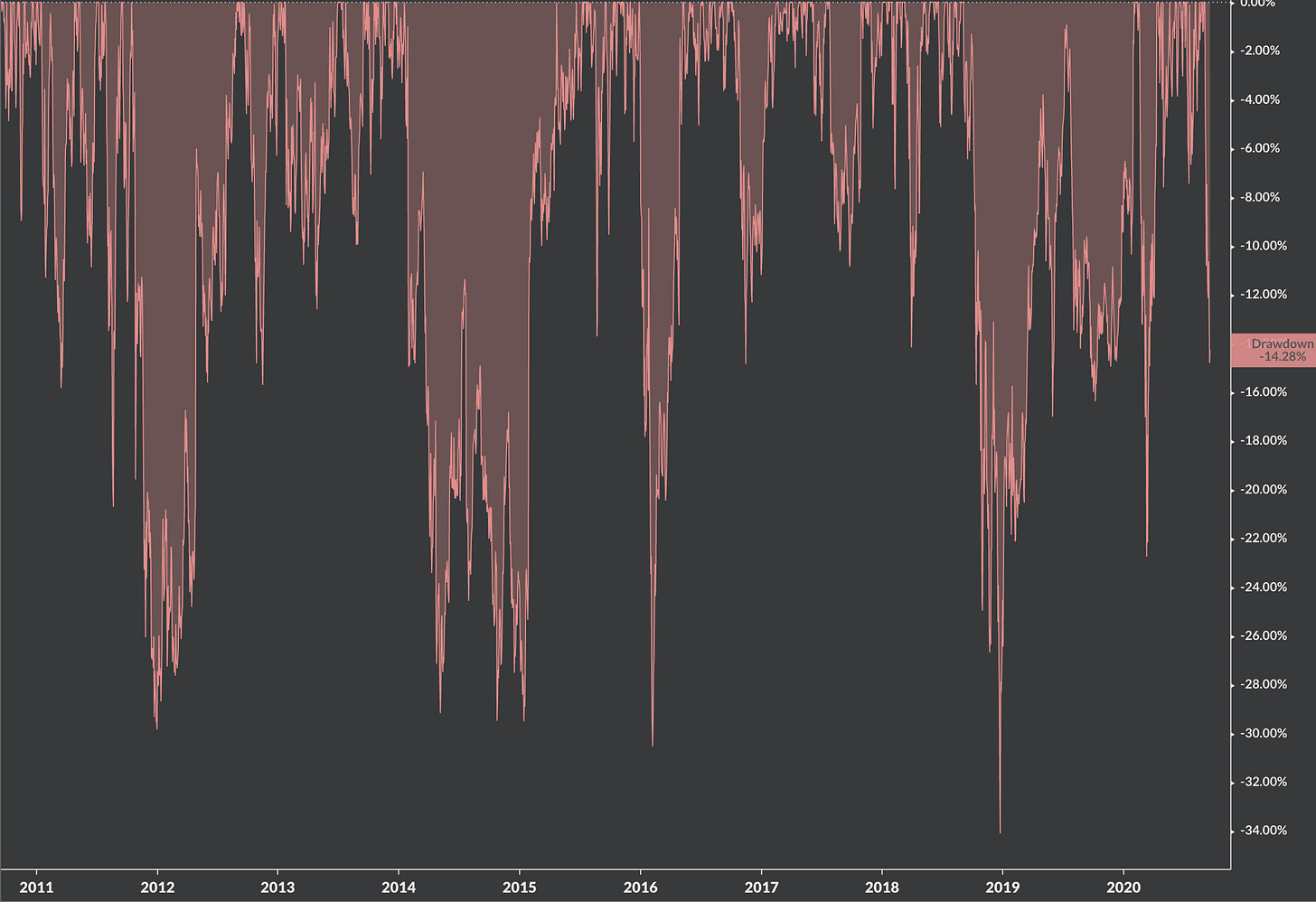

10 Years of Amazon Drawdowns

Cool chart showing 10 years of drawdowns (as percentage decline from peaks):

But if you think that’s rough, have a look at the chart since the company IPO’ed:

TikTok’s Non-Sale to Oracle Wasn’t Enough…

What the TikTok saga reminds me of is jazz, because it’s mostly improvised.

Less than 24 hours after ByteDance announced that it would IPO Tiktok globally with Oracle being a less than 20% minority holder if the deal was approved, with Walmart featuring somewhere in there, the White House is now saying through the Commerce Department that they’re banning both TikTok and Tencent’s WeChat (via a prohibition for US companies to host the apps on their stores and CDNs).

Oil’s Story to Tell

In the chart above, the dotted line is “zero”. I think it's kinda cool that the long-term WTI oil chart will forever have that dent to -$40/barrel in it...

They'll look at it decades from now and know that there's a story to tell there (far enough in the future, and they’ll also think us crazy for being so slow at transitioning to cleaner forms of energy).

Older ‘Round 2’ Founders

I was discussing something with @BlueToothDDS (aka The Dentist — a must-follow if you have any interest in financial infrastructure) when we came to the topic of “round 2 founders”.

These people create new companies, but it isn’t their first rodeo. We came to the conclusion that looking for them may be a good heuristic, especially when it comes to more complex enterprise verticals/niches.

If you’ve been in the industry for a couple decades, maybe built a company and sold it to one of the big players and then worked there for a few years, you have a perspective and expertise that is almost impossible to gain for a first-time founder. So founding a company in your 40s or 50s, you may lack the endless energy of the ramen-fuelled 20-year-old-with-no-family, but you may be able to do things smarter because you know everything wrong with an industry intimately…

Conversely, the advantage may be smaller, or inexistent, in more consumer-facing businesses, where fresh eyes may actually be the advantage. That’s all just a theory, and the effect may be smaller than it seems at first glance because I haven’t spent a lot of time thinking of counter-examples yet.

Some examples of older “round 2” founders that came to mind (I’m sure there are many others — please share them by replying to this email or leaving a comment below):

Jeff Green (The Trade Desk, founder at AdECN, sold to Microsoft)

George Kurtz (Crowdstrike, founder at Foundstone, sold to McAfee where he was CTO)

Pieter van der Does (Adyen, previously at Bibit Global Payment Services)

Benoit Dageville and Thierry Cruanes (Snowflake — previously at Oracle)

Todd McKinnon (Okta, worked assenior vice president of engineering at Salesforce and various roles at PeopleSoft)

Marc Benioff (Salesforce, previously vice president Oracle)

Reid Hoffman (LinkedIn, previously among founders of SocialNet, Paypal)

It’s not as clean an idea as I’d like, because it’s also a filter that just grabs a bunch of serial entrepreneurs, but I think there’s some interest to the idea anyway.

Amazon Getting Into Podcasts

Everybody’s decided that podcasts were the next way to “aggregate attention” and make a buck, so of course Amazon too:

Amazon Music announced today the launch of podcasts in the U.S., U.K., Germany, and Japan, across all tiers of service at no additional cost. For the first time, customers will be able to stream top podcasts they already know and love, as well as new, original shows produced exclusively for Amazon Music and hosted by creators including DJ Khaled, Becky G, Will Smith, Dan Patrick, and more. (Source)

I’m fine with companies throwing their hat into the ring as long as they support the open podcast ecosystem (the equivalent of making a standards-compliant browser for the web) and just want to create content and better players. But not those that try to create the IE6 equivalent for the ecosystem and erect walled-gardens.

For more of my thoughts on this, check out edition #18 and do a search for “Spotify” on the page.

Transdigm Overview

Good writeup on TDG (publish August 17, 2020) by YoungHamilton:

Roll-up business models usually fail in two ways. In the first way, the acquired assets don’t produce a high enough return to justify the cost of acquisition, even when factoring scale advantages. In this case, the cash flows produced from the acquired assets less the payments on the new debt are only slightly positive or even negative. Management teams of these roll-up models think that bigger is better, regardless of the quality of the revenues.

In the second way, the acquired assets aren’t defensible during an economic downturn and the once predictable cash flows are hampered like the rest of the economy. The internal downside model scenario isn’t conservative enough and the company has trouble servicing its debt. As you can see in both cases it’s the debt that ends up crushing the value of the equity.

But TransDigm isn’t your typical roll-up model. The company aims to acquire companies that sell proprietary aerospace products and which are often times the sole source provider of aftermarket products.

The Billionaire Who Wasn’t… Isn’t

This book on Chuck Feeney falls into my favorite category of books; one for which I had pretty high expectations, and they were exceeded by a good margin. His life is fascinating, and inspiring.

Forbes has a feature piece on him, giving an update on his life’s work’s progress and a momentous milestone:

Charles “Chuck” Feeney, 89, who cofounded airport retailer Duty Free Shoppers with Robert Miller in 1960 amassed billions while living a life of monk-like frugality. As a philanthropist, he pioneered the idea of Giving While Living—spending most of your fortune on big, hands-on charity bets instead of funding a foundation upon death. [...]

Over the last four decades, Feeney has donated more than $8 billion to charities, universities, and foundations worldwide through his foundation, the Atlantic Philanthropies. When I first met him in 2012, he estimated he had set aside about $2 million for his and his wife's retirement. In other words, he's given away 375,000% more money than his current net worth. And he gave it away anonymously.

There’s a Buffett angle to this story too, showing that sometimes a few dominos can make a bunch of others fall (Carnegie wasn’t the only influence on Buffett):

His stark generosity and gutsy investments influenced Bill Gates and Warren Buffett when they launched the Giving Pledge in 2010—an aggressive campaign to convince the world's wealthiest to give away at least half their fortunes before their deaths. "Chuck was a cornerstone in terms of inspiration for the Giving Pledge," says Warren Buffett. "He's a model for us all. It's going to take me 12 years after my death to get done what he's doing within his lifetime."

John Arnold also says that Feeney was an inspiration to his philanthropic work (I posted an interview with John Arnold about his gas trading career, hedge fund, and charity works in edition #22)

What a true mensch:

On September 14, 2020, Feeney completed his four-decade mission and signed the documents to shutter the Atlantic Philanthropies. (photo above)

Interview: Rory Sutherland

I don’t mean to link to every interview Patrick O’Shaugnessy does, but lately he’s been hitting it out of the park (hmm, since when do I do sports metaphors? this one just came naturally — strange), so this one is worth highlighting:

I always enjoy his points about the importance of things that may not be easy to measure or put in a spreadsheet, but that have a huge impact on the perception of a product or service by its customers.

And if you like this one, make sure to also listen to the interview that Rory did with Jim O’Shaughnessy (which part of being an interviewer/conversationalist is nature, and which part is nurture, we may ask..?):

Random Business Highlight

Science & Technology

NASA’s Crawler Transporter

NASA Crawler Transporter, 1966. Made by the Marion Power Shovel Company of Marion, Ohio

Name: Missile Crawler Transporter Facilities, aka Crawler Transporter

Length: 40 m (131 ft)

Width: 35 m (114 ft)

Weight: 2,721 tons (6,000,000 lbs)

These are powered by two 2,050 kW (2,750 hp) V16 ALCO 251C diesel engines and

two 750 kW (1,006 hp) generators, driven by two 794 kW (1,065 hp) engines, which are used for jacking, steering, lighting, and ventilating.

More from Wikipedia:

The crawler-transporters, formally known as the Missile Crawler Transporter Facilities, are a pair of tracked vehicles used to transport spacecraft from NASA's Vehicle Assembly Building (VAB) along the Crawlerway to Launch Complex 39. They were originally used to transport the Saturn IB and Saturn V rockets during the Apollo, Skylab and Apollo–Soyuz programs. They were then used to transport Space Shuttles from 1981 to 2011.

The two crawler-transporters were designed and built by Marion Power Shovel Company using components designed and built by Rockwell International at a cost of US$14 million each. Upon its construction, the crawler-transporter became the largest self-powered land vehicle in the world. While other vehicles such as bucket-wheel excavators like Bagger 293, dragline excavators like Big Muskie and power shovels like The Captain are significantly larger, they are powered by external sources. (Source)

Via Mechaddiction

‘Irene Davis, Ph.D.: Evolution of the foot, running injuries, and minimalist shoes’

Good interview by Peter Attia. I’m not a runner (my wife is), but I kinda wish I was… I’ve been picking up information and building up the motivation to try at some point, and this interview was very interesting about the biomechanics of running, the anatomy of our feet and knees, the benefits of running on the balls of our feet vs heels when it comes to how the impact force is distributed through time, etc.

I’m particularly convinced by the idea that having very supportive and bracing shoes weakens our muscles and increases the chances of injury. Our species has been running for 2 million years without all this bracing and cushioning, why do we think we’ll do better with it? Would we wear a permanent neck brace too, and what would happen to our neck muscles if we did?

On my reading list is also the book “Born to Run” by Christopher McDougall. My wife enjoyed it, and it’s mentioned in the Irene Davis interview.

The Arts

Layered Porcelain (Ceramics)

Made by Forest Ceramics. Source.

If you’re curious how this is done, this short video shows how the different layers are revealed.

Photographer: Irenaeus Herok

A.k.a. Iherok, he does portraits, landscapes and aerial drone photography. I like a lot of his work. You can see more on his website (which also links to his various social feeds).

Hey Liberty on Round 2 founders and B2B vs B2C. Justin Kan had a good post about it: https://medium.com/@thanhcs94/why-i-love-b2b-over-b2c-for-startups-and-entrepreneurs-57de8ce421ad

"In B2C, you have to ride a massive wave to become a success. This is more than just being good at building a company: you also have to be very lucky. Google, FB and Twitter all rode massive waves." https://twitter.com/justinkan/status/1017421267031298050?lang=en

I also saw a study saying that there were few successful repeat B2C founders vs many successful repeat B2B founders, but can't find it