277: Constellation Software Capital Deployment, Cloudflare Q1, Data vs Opinion-Driven Decisions, Tech & Media Stocks in 2022, and Russia's Oil & Gas

"Bland, boring, terrible, 🥱, disaster."

There's no sense in being precise when you don't even know what you're talking about.

—John von Neumann

🏋️♀️ 🤕 I was recently discussing doing things despite not being good at them (yet) with fiend-of-the-show David Senra (🎙📚).

One divergence I see is between people who do things while knowing they are not good (yet), and using that knowledge to improve; It’s a sign of a growth mindset rather than a fixed one, knowing you can become better if you work at it.

But there are others who simply don’t realize they’re not good, and so are basically fueled by over-confidence, which is more dangerous and probably increases the odds of bad outcomes and abandoning the pursuit, rather than long-term iteration and improvement.

Good self-calibration and introspection can make all the difference in the end result, even if beginning from the same starting point.

🎧🎙🇸🇬 I have a podcast with friend-of-the-show Cedric Chin ready to release.

We talk about all kinds of stuff, including what investors can learn from operators, the study of expertise, how traditional Chinese businessmen without formal education structure deals, how to level up towards mastery, how medical students are taught about heart attacks, the utopian aspects of the science fiction of Iain M. Banks, etc.

I’ll most likely release it tomorrow to paid supporters as a ‘thank you 💚 🥃’, and later this week or early next week to everyone else.

☢️ ☮️ ♻️🛢⛽️ The more I think about it, the more I realize that the old-school environmental movement has probably done more to damage the global environment than almost anything else by opposing and destroying the brand of nuclear power via emotionally vivid scary stories rather than facts.

It effectively went against so many of its stated goals, pushing the world to depend much more heavily on coal & gas, and making it less beneficial to electrify transportation and heating than if we had a truly low-pollution grid. Ironic, and not in the Alanis Morisette way…

💚 🥃 For the price of one alcoholic drink, you get 12 emails per month (plus 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤 and podcasts!) full of eclectic ideas and investing/tech analysis.

That’s pennies per edition for the Serendipity Engine!

If you make just one good decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

You can even sign up in single digits seconds on your phone with Apple/Google Pay by clicking the button below (if you don’t see paid options, it’s because you’re not logged into your Substack account):

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

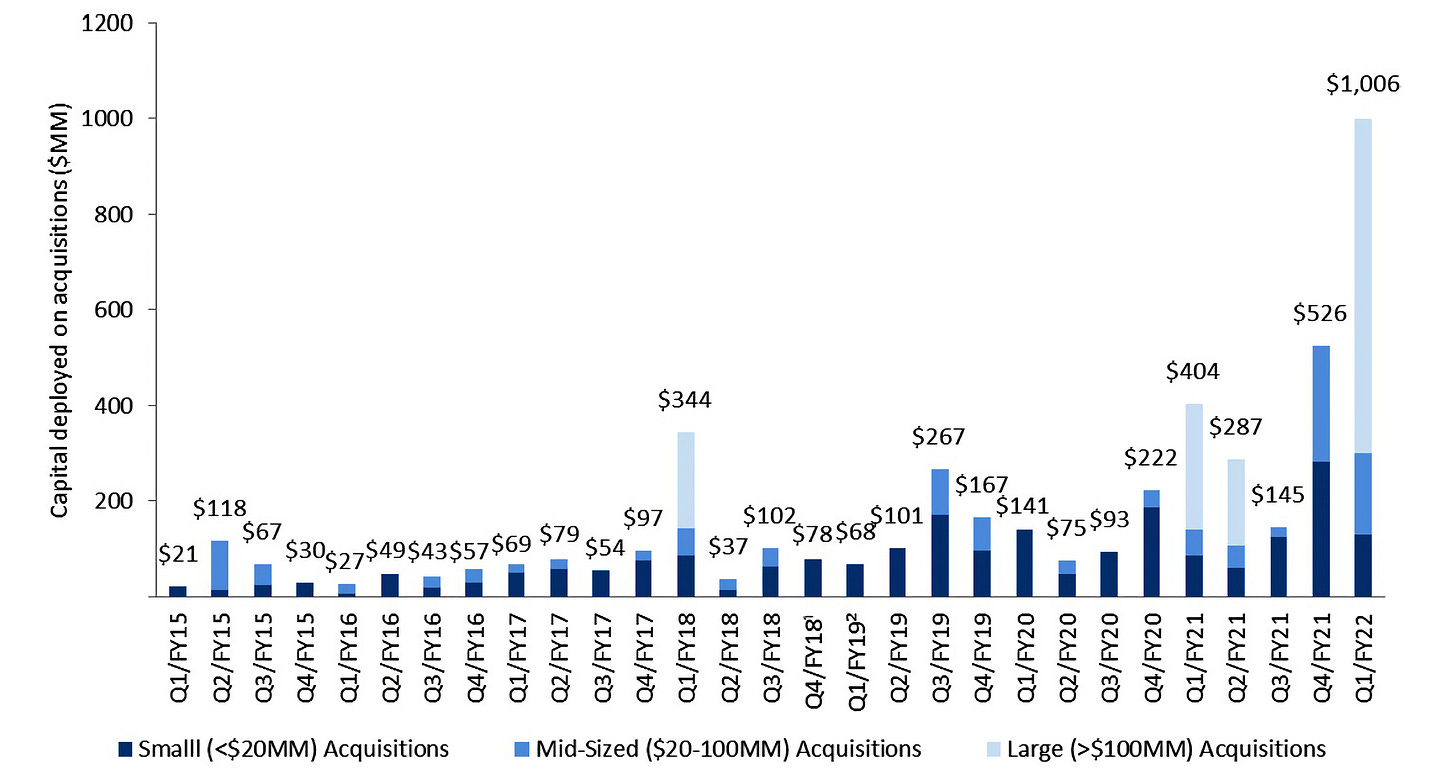

Constellation Software capital deployment over time 📈

h/t Friend-of-the-show C. J. Oppel

⛅️ Cloudflare Q1 Highlights

Interesting how volatile Cloudflare’s stock has been while the business has been operating pretty much like clockwork since IPO. This is probably a good time to remind you that I don’t write much about stocks here — they’re not the most interesting thing to write about for me — I prefer to focus on businesses.

So how are things at Cloudflare? Let’s have a looksee:

Today, 58% of our revenue comes from large customers.

Our largest customers continue to get larger and larger. Those spending over $500,000 a year, growing 68% year-over-year, and those spending over $1 million a year, growing 72% year-over-year. We now have 12 customers and partners spending over $5 million per year with us. And yet, we remain highly diversified, with no customer representing more than 5% of revenue.

This is something to keep an eye on. These large customers have been growing faster than the overall growth rate for a while, and as they become an ever-larger percentage of total, this could help support the growth rate even as the absolute dollar amounts become bigger and bigger. We’ll see..

dollar-based net retention hitting a new record of 127% in the quarter, up 400 basis points year-over-year. New products and an increased interest in consolidating behind a single trusted vendor for network services has been the key to our continued customer expansion.

Unlike some of their consumption-based competitors and adjacent companies, Cloudflare mostly charges flat rates, so the NNR doesn’t quite show the same flex (in either direction!), but they’ve found ways to expand it through product innovation (ie. sell more and more products to existing customers).

We closed our largest acquisition ever in the quarter, buying Area 1 Security for $162 million. We have a very high hurdle rate for acquisitions being strongly biased towards internal development but Area 1 technology and team are special. We started out as a customer. I remember shortly after we implemented their solution, writing to our Chief Security Officer to ask if something was wrong, I hadn't seen any phishing reports in a few weeks, where usually our team would report double digits per day. It turned out Area 1 and their incredible e-mail security tech was the answer.

Anti-phishing solutions are such a low-hanging fruit in security.

Most breaches and malware don’t come from some sophisticated attacker breaking your AES-256 encryption or using a 0-day exploit, but rather from social-engineering their way into getting you to click on something via email…

They share an interesting story, which both reflects well and badly on AWS at the same time:

A Fortune 1000 gaming company signed a $3.3 million, 3-year contract. I love this story. They were using AWS, but found their security couldn't prevent the attacks they were seeing. After struggling to keep their application online, AWS's team eventually told them, "You should just use Cloudflare." And so they did.

On one hand, AWS probably wishes it had better security on that specific thing (I’m sure they’re good at lots of things, and we don’t have all the details here), but if there’s a problem that you can’t quite solve, the second best thing is to help your customer find someone who does — that builds trust and goodwill!

I wanted to close by talking about what we're seeing in Russia and Ukraine. I mentioned the region at the end of the last earnings call [before the war started, on February 10].

A number of you reached out to say it seemed out of place at the time. Unfortunately, it proved prescient. At Cloudflare, our global network serves as an early warning sensor for what's happening across the Internet.

In the month leading up to Russia invasion, we saw characteristics cyber probing and other warning signs that were similar to what we've seen in Georgia and Crimea years earlier. Concerned, we've briefed Western government and offered our services to critical infrastructure providers and government institutions in Ukraine well before the physical invasion began. Many organizations there took us up on our offer of protection.

One of the stories of the war has been the relative lack of cyberattacks. That's not exactly accurate. There have been attacks. However, the number that have been successful are thankfully few. I'm proud of the role that Cloudflare has played to that end.

The idea that non-governmental cyber-security get early warnings of potential conflicts is very interesting. Microsoft has played a public role too, and I’m sure that many others have done a lot, both in and out of the spotlight…

They also mention that inside of Russia, their 1.1.1.1 app (which has a VPN feature that prevents ISPs from sniffing your data) went to #1 on the country’s app store and is helping Russian citizens get access to outside information.

we received 133,000 job applications and saw attrition actually ticked down, while many others are struggling to hire.

At the end of the day, talent is the lifeblood of this industry, so monitoring retention and access to it is crucial.

The U.S. represented 53% of revenue and increased 56% year-over-year. EMEA represented 26% of revenue and increased 57% year-over-year. APAC represented 14% of revenue and increased 31% year-over-year.

One thing I’ve long wondered is why they get so much less traction in APAC. I’d be curious to see their free user distribution — is it just that they’re not as well known there, or that they don’t convert as many free users to paid?

The CFO reminded investors of the strategy for now:

we intend to grow our operating expenses in line with the revenue staying here or at breakeven and reinvest excess profitability back into the business to address the enormous opportunity in front of us.

A big benefit of having a multi-product, integrated system:

once the customer is on our network, we can see traffic across their systems typically and make intelligent recommendations over what additional products. So I'll give you a specific example. We're -- we have an incredible bot management product that is good at stopping malicious automated traffic on a customer's site.

One of the things we do is even before someone is using the bot management product, we can look at their traffic patterns, see how many bots they have and then generate a report for them that says, "You have a bot problem. Here's what we see. Would you like us to help you with it?"

And so I think that those sorts of intelligent recommendations have been very good at getting customers to adopt additional products on our platform. I think going forward, what you'll see us do more and more is bundle together our services into much broader licenses.

Traffic going through the Cloudflare network:

year-over-year traffic growth across our network of 75.8%, quarter-over-quarter growth of 15.9%, and that's in line with sort of the quarter-over-quarter growth that we've seen for the last period. […] CPU usage has actually grown 89.1% [YoY].

It's worth remembering that we don't bill primarily based on usage. We bill in a much more predictable way. And so I think that, that is a good indication that we are taking share from the rest of the industry.

The fact that they can keep such high gross margins as traffic explodes shows just how efficient their network is (huge benefit of being collocated inside of ISPs worldwide, thanks to the CDN/anti-DDoS roots of the company).

if you study developer platforms, for them to really reach escape velocity, takes between 8 and 12 years. And so Workers was launched in late 2017, so we're continuing to develop it. We're on that curve.

It’s rare to hear CEOs discuss their products in terms of 8-12 years adoption curves, mostly because the tenure of most CEOs isn’t that long (that’s one benefit of founders). That’s what long-term thinking sounds like.

🍎 Tony Fadell (aka ‘Father of the iPod at Apple’) on data-driven vs opinion-driven decisions, the power of constraints

Ben Thompson (💚 🥃 🎩) recently had a very interesting interview with Tony Fadell — usually described as ‘father of the iPod’, but even that description can understate his contribution since without success in mobile devices, Apple may never have gotten to the iPhone.

Here are a few highlight:

Tony: Leadership is really the key difference in all of this and understanding the difference between data-driven and opinion-based decisions. Steve was really great at understanding what were opinion-based decisions, and it was his opinion at the end of the day that was going to rule, and he was going to make sure everyone understood that “We’re going to do this. And yes, we don’t know if it’s going to be a success, but this is what I want done. Get it done, please.” [...]

Ben: You talked about this in your book, actually, the opinion-driven versus data-driven decision making, and how to build the iPod in the first place was an opinion-driven decision, but to bring the iPod to Windows ended up being a data-driven decision.

This is such an important skill. It reminds me of Jeff Bezos’ one-way and two-way doors in that if you understand how these choices differ, you can *make better decisions*.

And with data-driven decisions, you can try to convince someone using better data. But if it’s an opinion decision, it’s best to know who will have the final say — who has opinion-primacy, so to speak.

It’s fine to try to convince them, but at the end of the day, they may not be able to tell you exactly why their gut prefers X over Y, but the team has to be ready to go with it anyway.

Trying to make data-driven decisions by committee can probably work, but making opinion-driven decisions by committee is probably a recipe for disaster… Bland, boring, terrible, 🥱, disaster.

Another great point he makes is about the power of having some constraints, and how companies that become really successful and rich tend to become slow, wasteful, and unfocused:

Tony: when there’s too much money, there’s too many people saying that they can do it better, and there’s no time limit or other constraints, money limit, market constraints, what have you, these teams go at it. If you remember, there were two different operating systems going on at the time at Apple, before Steve got back [...]

When there’s a lack of constraints, that’s where all of these things bloom. At Google, when I was there, there were at least four different competing audio projects for audio in the home for playing music. There was four of them! I’m like, four? Why is there four? Everybody had a slightly different take and nobody was willing to go and kill them and prune them and say, “No, this is the right one,” and take all the pieces together, because they were too afraid, for whatever reason, I don’t know. It’s hard enough to have one great product that’s orthogonal to what the company does and saying, “Oh, this is an all new thing,” to have four of them, and say, “We’re going to launch all of them at some point?” That just doesn’t make any sense. Constraints are really key there.

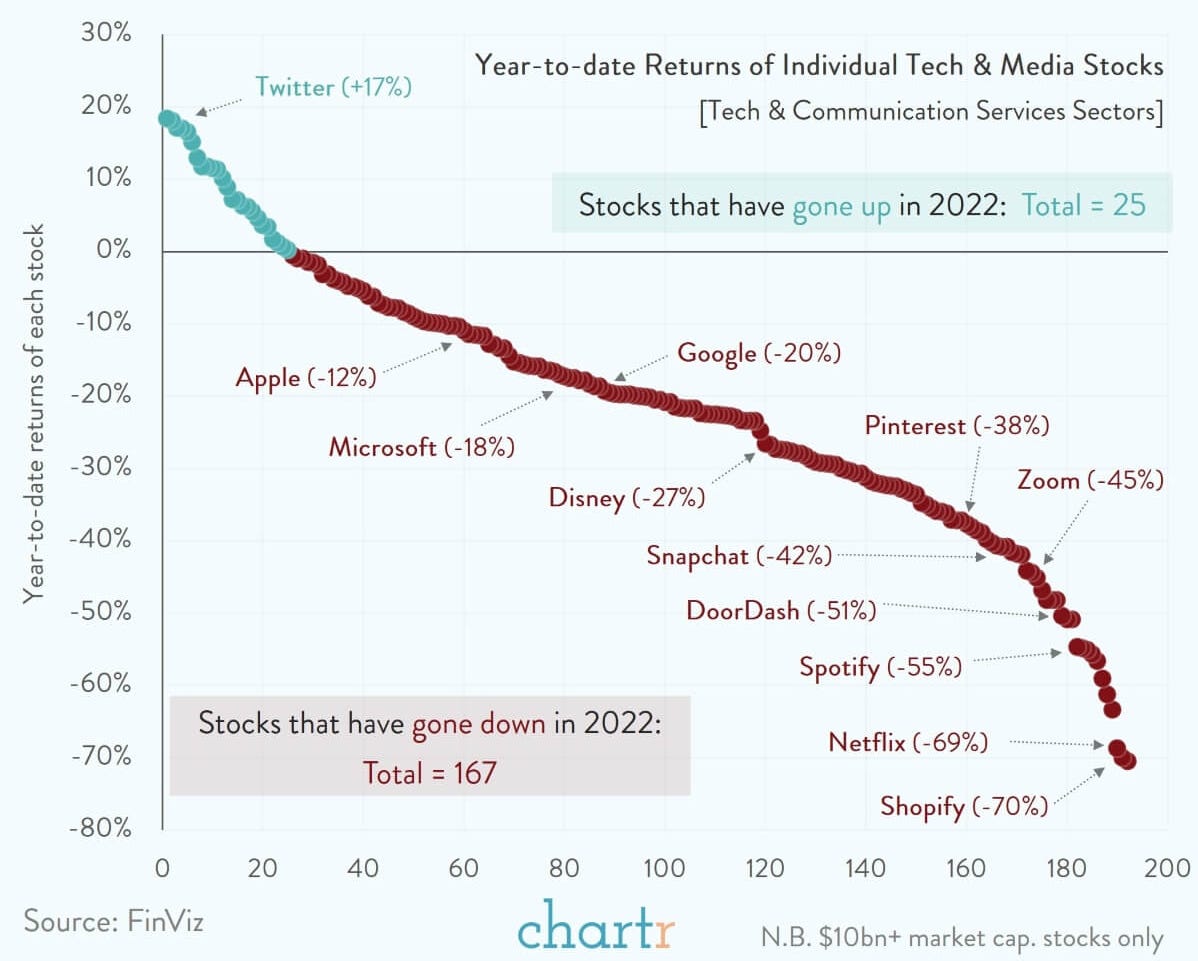

Tech & Media stocks so far in 2022

These are probably lower by the time you read this… We’re in what they call a “fluid environment” ¯\_(ツ)_/¯

Source: Chartr

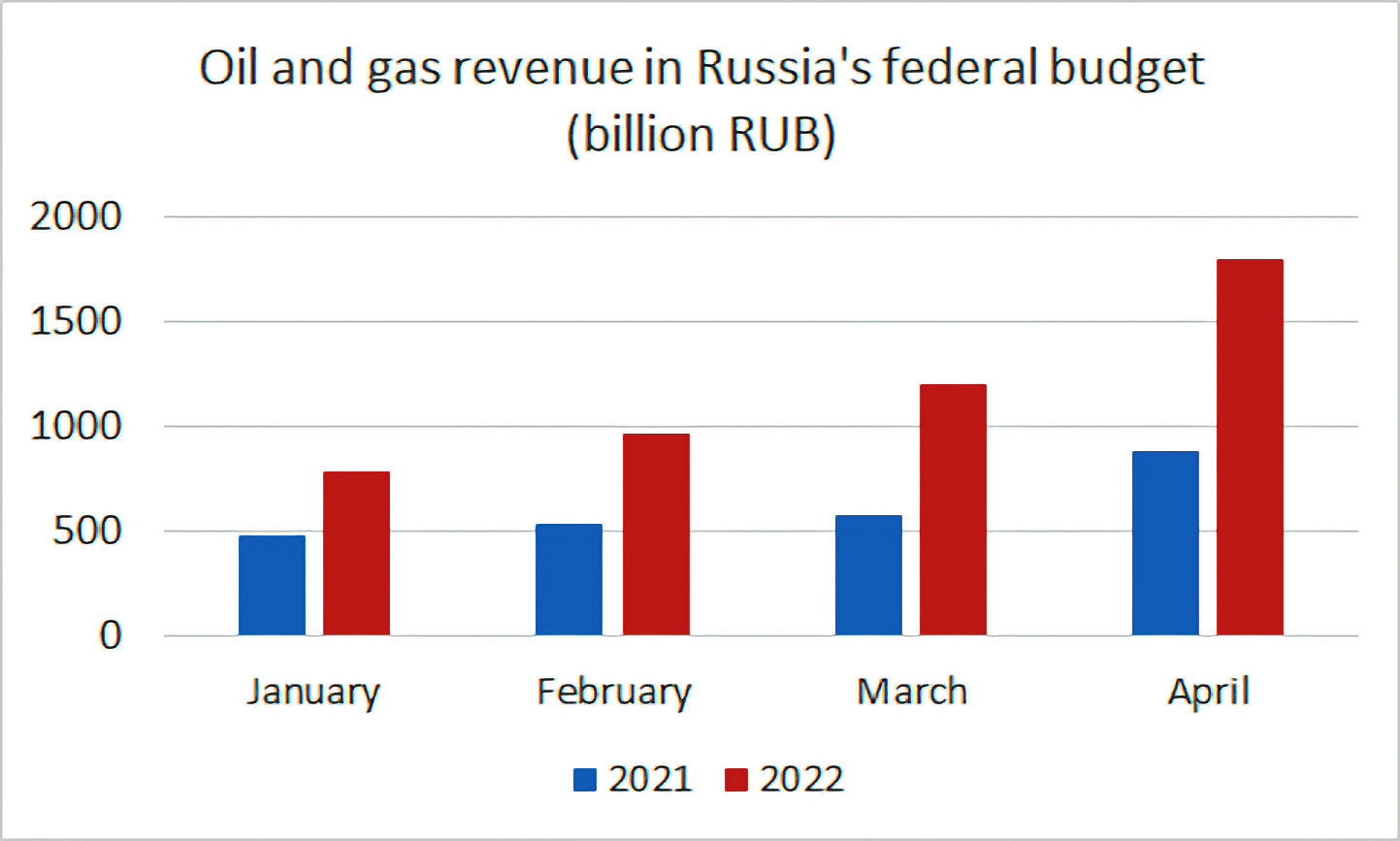

🇷🇺 Russia’s Oil & Gas Revenues 🛢🛢🛢🛢💰💰💰💰

Janis Kluge: “Russia's oil and gas revenues hit another record high in April. 1.8 trillion rubles in a single month, after 1.2 trillion in March. After only 4 months, Russia's federal budget has now already received 50% of the planned oil and gas revenue for 2022 (9.5 trillion).”

Benefiting from the instability they created… Feeding on death and destruction 💀

Science & Technology

🇨🇳 ‘China Orders Government, State Firms to Dump Foreign PCs’ 💻 ➡️ 🗑

The bits are separated via the ‘great firewall of China’, and now the atoms are increasingly separated:

China has ordered central government agencies and state-backed corporations to replace foreign-branded personal computers with domestic alternatives within two years […]

Staff were asked after the week-long May break to turn in foreign PCs for local alternatives that run on operating software developed domestically [...] The exercise, which was mandated by central government authorities, is likely to eventually replace at least 50 million PCs on a central-government level alone.

I wonder what they’ll use on the software front. My first guess was Linux as OS, and that seems likely, but I’m not sure what the apps on top will be.

local developers such as Kingsoft and Standard Software have made rapid strides in office software against the likes of Microsoft Corp. and Adobe Inc. [...]

China will mostly encourage Linux-based operating systems to replace Microsoft’s Windows. Shanghai-based Standard Software is one of the top providers of such tools, one person said. (Source)

‘Global grid storage deployments are nowhere near on track to meet clean-energy goals’

Sarah Constantin does some back-of-the-envelope/smell test math on how much stationary energy storage we have, how much we’re building, and how much we’d need if we were to meet some people’s goals of replacing fossil fuel electricity generation by renewables + storage:

I guess the title is a bit of a spoiler ¯\_(ツ)_/¯

I hate to be the broken record here, but it seems to me like nuclear power is a much better answer if the question is “how can we clean up & decarbonize the power grid”, and the massive supply of batteries that would be going to stationary storage could find better use in the transportation sector, where electrification displaces oil directly.

If a large part of our supply of batteries is going to the grid, this will only increase the cost of EVs and slow down progress on that side.

Remember: Opportunity cost matters!

Not that it has to be all one or the other, it’s fine to have grid-scale battery installations where they make sense and make a huge positive difference to the grid at a low cost relative to alternatives.

But trying to make the whole grid run on solar/wind + batteries when we have better/cheaper alternatives that wouldn’t disrupt the already daunting EV transition is foolish.

The insane engineering of the FGM-148 Javelin

Best video I’ve seen so far explaining the engineering details of the Javelin, how it can pierce armor so well (that hypersonic liquid-metal spear that is formed a fraction of a second before impact to cut through metal like butter is 🤯), as well as how it counters modern reactive armor (this is the square things that explode before the projectile hits, trying to detonate it farther away from the tank).

The Arts & History

♠️♥️♣️♦️ Jason Ladanye and a deck of cards 🤯

This guy is amazing. I just love his stuff. Blows my mind pretty much every time.

True art. Mastery of a skill after decades of practice.

Check these out and see if you like him too:

Not 🤯 yet? Hard to impress? Ok.

There’s a category of card tricks called “self-working” card tricks that are based on math that I totally don’t understand, you just have to follow the instructions and it (apparently) always works. See for yourself:

The insane engineering of the FGM-148 Javelin- this video is just AMAZING!! 😲🎖⛑🚀🤘

Re: Javelin

There is much speculation that the age of the tank (much like the age of the battleship) is over as a weapon of war.

Here is a good article that recently discussed this theory that you might enjoy reading if you are interested in military strategy. In light of new weapon systems like the Javelin (as well the hover-in-place armed drone swarms) coming onto the modern battlefield, there is a growing consensus that the tank is becoming a big slow target that can no longer defend itself from these attacks.

https://warontherocks.com/2022/04/the-tank-is-dead-long-live-the-javelin-the-switchblade-the/

Bill