281: Mark Leonard's Letters, SAAS Multiples, Commodity Producers' CapEx vs Capital Returns, Microsoft, Google's TPUv4, and Jurassic Park's CGI

"A promise is analogous to a debt"

The endeavor to understand is the first and only basis of virtue.

―Baruch Spinoza

🤔 Really fascinating and thought-provoking thread by Sarah Constantin about promises as debt, and the ensuing implications. 🔒⛓

It’s kind of a long excerpt, but I think it’s worth it:

A promise is analogous to a debt. Making a promise = borrowing. Fulfilling a promise = paying back.

If you have any integrity, it feels awful to be "trapped in debt", knowing you've made promises you probably can't keep.

A positive identity (like 'I am disciplined') is a type of promise. It's a promise to yourself to "live up to" that identity. (implicitly forever?)

Announcing your ambitions in public is also a type of promise, to your listeners.

Taking on certain types of demeanor (like "dignified" or "confident") can also be tagged in your mind as a promise to never do the things you view as inconsistent with that demeanor.

You know how people can make more progress working on something if it's "unofficial" than if they announce it and stake their credibility/reputation on it?

You know how a project gets intimidating and "heavy" if it's a whole Thing?

The "heaviness" of official projects is about the fact that you've PROMISED to finish them.

Sometimes the anxiety that you'll fail to keep your promise is so unpleasant that it actually reduces your motivation.

Part of why being in a leadership position is so stressful is that *taking that role* is a kind of "promise" to be worthy of it.

It actually takes mental energy even when you're not doing anything! You are running a sort of VM instance of "leader" in your head.

It's not surprising that some people want to avoid taking on too much "debt". [...]

when there's a pervasive convention of overpromising, the people who are late to notice that promises are fake, get betrayed.

Inflation hurts creditors relative to debtors; promise-inflation hurts "trust-ers" relative to "promise-ers".Full thread here, there’s a lot more.

🚗 🤖 Is it my imagination, or do we not hear much about Waymo anymore?

Seems like a few years ago you couldn’t go a week without hearing about how it’s worth hundreds of billions and going to take over the auto sector, and now 🦗🦗🦗

🍎🎧 While my Airpods were being fixed by Apple, I had to use wired headphones for a few days. It was a good reminder that convenience is a ratchet, and how hard it is to go backwards.

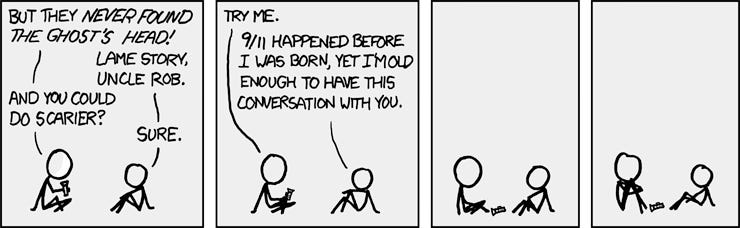

🤯👴🏻🧓🏻⏳ Reader Mikel shared this tweet with me:

iOS is as old now as Windows 3.1 was when iOS first came out.That ‘genre’ of re-contextualization is probably the most effective way to make me feel the passage of time, and to make me feel old.

I don’t remember them exactly, and I don’t care to do the exact math, but there’s a ton of similar ones that go something like:

“There’s less time between when the original Back to the Future came out and 1955 than between now and when the film came out”. When I saw the movie as a kid, the jump back 30 years made everything seem to old-timey and quaint, but from today that’s 1992… Which reminds me, Nirvana’s Nevermind is about as old now as the early Beatles stuff was when Nirvana was around.

There are other good ones that I can’t recall clearly at the moment, like the timeline between the Wright Brothers and the Apollo project or WWII and other historical milestones.

(the scary thing about the comic above is that it came out in 2009, so there’s now been more time since this comic than the time between 9/11 and when that comic originally came out…)

Anyway, time, it flies. It’s one thing to hear the words as a kid, it’s another thing to feel it in your bones. 🦴

💚 🥃 I can’t do it without you! Thank you for your current or future support!

A Word From Our Sponsor: Stratosphere Analytics 📊

We all spend countless hours finding financial data, manipulating it, and struggling to locate everything in one place. 😩

Stratosphere makes it easy to get the financial data you want and beautiful out-of-the-box graphs for your research process. 😃👍

No more complex user interfaces, no more limited historical data.

Get started for free today to utilize:

10 years of historical financial data & customizable views

Stock idea generation & snapshots

Company-specific metrics

Beautiful data visualizations

👉 Start researching stocks with our ✨FREE✨ powerful and highly customizable terminal 👈

Investing & Business

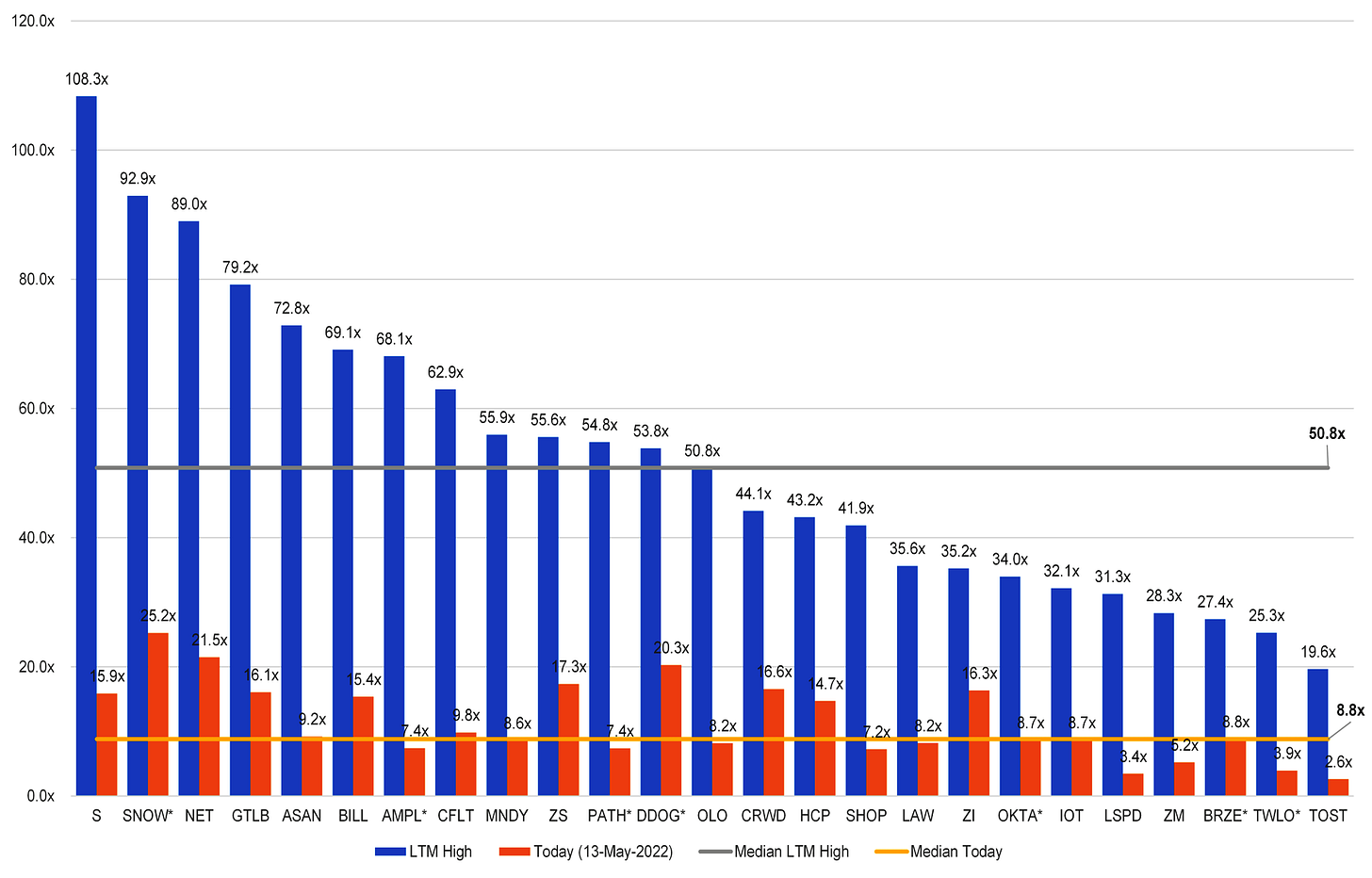

SAAS Multiples: Peak vs Now

Alex Clayton has a good piece looking at the crash in the SAAS sector.

On the chart above:

The peak NTM revenue multiple median was 50.8x and that median has dropped 80% to 8.8x today. The companies are sorted by peak NTM revenue multiple. [...]

the median [multiple] decline is 80%. This is a good representation of what the ripple effect could look like in the private markets. [...]

During the past two years, median multiples reached almost 25x for all public SaaS companies (~90 in total). The median today is 7.1x, lower than the 2017-2019 pre-COVID median of 8.5x. This is a profound change as the public markets are now valuing this group of companies below their pre-COVID trading levels.

This chart shows market caps then and now:

Shopify may not have had the highest multiple at peak, but in absolute dollar terms, its compression was gigantic.

🔥 Podcast: The Letters of Mark Leonard (Constellation Software) 🔥

My friend David Senra (🎙📚) recently read through Leonard’s shareholder letters and recorded an almost-hour-long podcast to share his highlights and thoughts. This is self-recommending, I don’t need to say anything else:

#246 Mark Leonard's Shareholder Letters (free feed has 30-min preview)

For more on Constellation, you can also check out this podcast I did with MBI (💎🐕):

🛢 Commodity Producers: CapEx vs Capital Returns (Dividends + Buybacks) 🪨

h/t Doomberg (🐓 🟩)

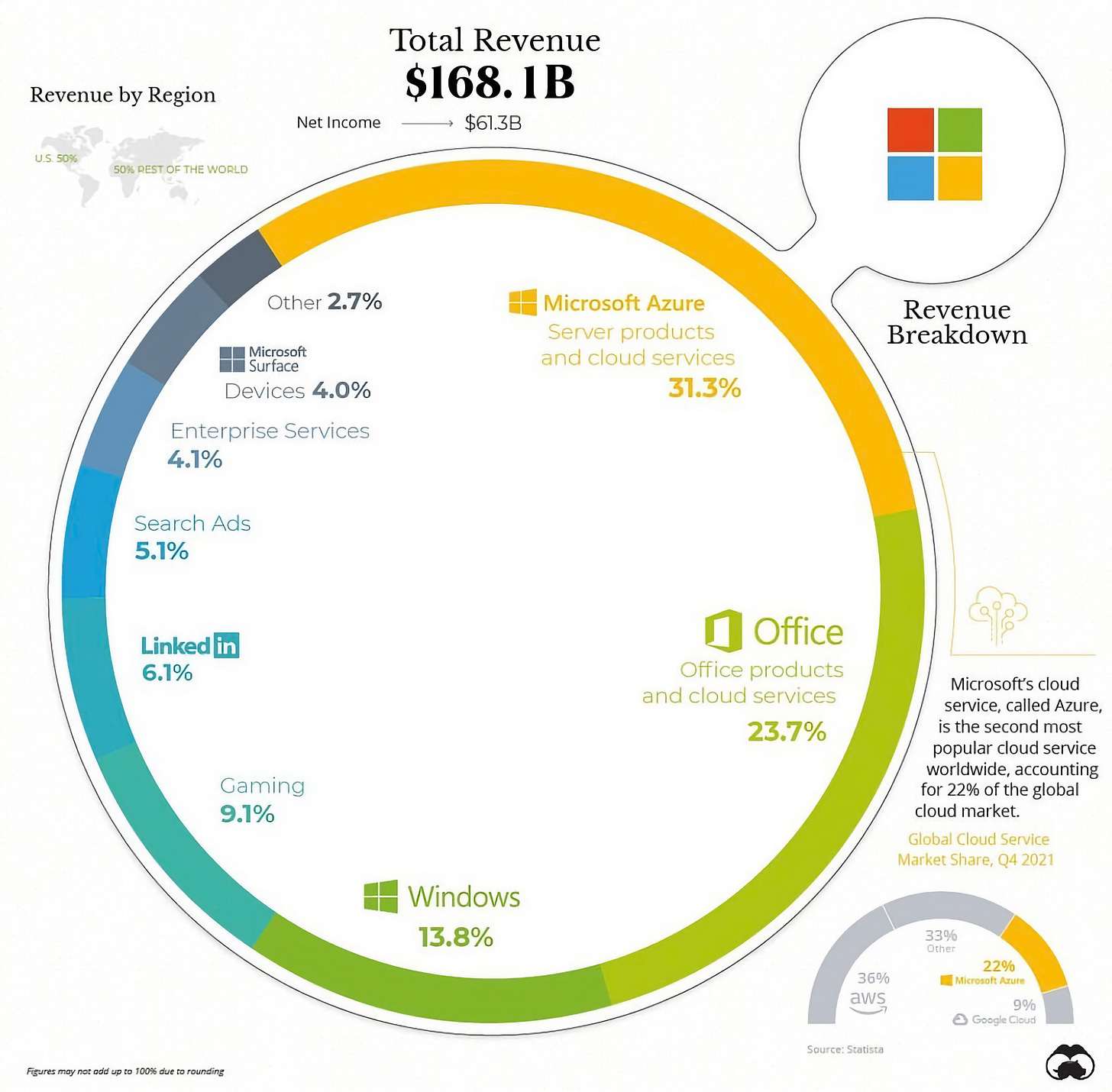

💸 ‘Microsoft Doubles Salary Budget to Retain Staff’ + Pie Chart 🥧

Can you say inflation?

Microsoft said it will “nearly double” its budget for employee salaries and boost the range of stock compensation it gives workers by at least 25%, mainly affecting “early to mid-career employees,” to retain staff and help people cope with rising inflation. (Source)

Everybody else in the industry will have to make similar moves (or at least try to keep up, for smaller, less cash-rich players) or lose talent… Another version of standing on tiptoes at a parade.

Update: Friend-of-the-show and Extra-Deluxe supporter (💚💚💚💚💚 🥃) Daniel Abood pointed out that the Bloomberg piece I cite above was edited and changed to say something else. I hate when they do that without making it clear how and when a piece was edited. The new version is a bit tamer. It says:

Microsoft Will Boost Pay and Stock Compensation to Retain Employees

Microsoft Corp. plans to “nearly double” its budget for employee salary increases and boost the range of stock compensation it gives some workers by at least 25%, an effort to retain staff and help people cope with inflation.

I guess someone from Microsoft reached out to them with a correction…

Speaking of Microsoft, here’s a good pie from friend-of-the-show C.J. Oppel:

Azure/Cloud Services is growing so fast that my model of how big it is compared to the rest of the company tends to get outdated quickly. When I saw it compared to the Windows segment, it really hit home how massive it is.

Even the Office juggernaut is now in second place…

🇷🇺💰💰💰 Russia is on track for a record trade surplus

Russia has stopped publishing detailed monthly trade statistics. But figures from its trading partners can be used to work out what is going on. They suggest that, as imports slide and exports hold up, Russia is running a record trade surplus. [...]

Adding up such flows across eight of Russia’s biggest trading partners, we estimate that Russian imports have fallen by about 44% since the invasion of Ukraine, while its exports have risen by roughly 8%. [...]

As a result, analysts expect Russia’s trade surplus to hit record highs in the coming months. The IIF reckons that in 2022 the current-account surplus, which includes trade and some financial flows, could come in at $250bn (15% of last year’s GDP), more than double the $120bn recorded in 2021. (Source)

Science & Technology

A quick look at Google’s TPUv4 machine-learning accelerator chips 🏎💨

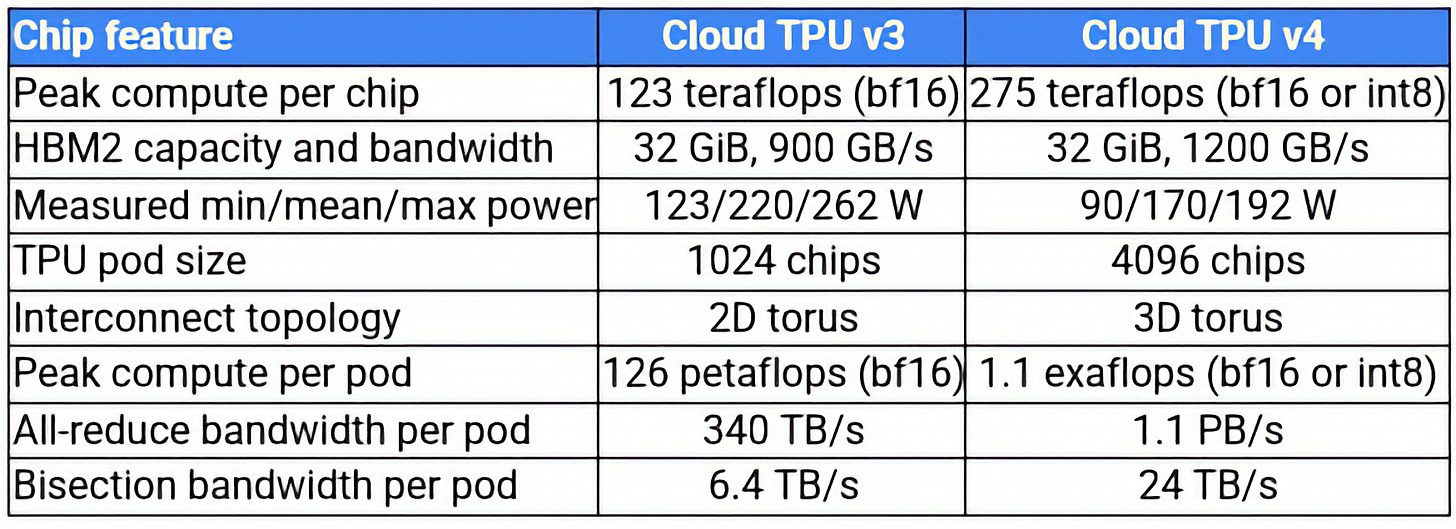

Google has this convenient v3 vs v4 table:

The power envelope is particularly impressive. I’m guessing this is fabbed on 5nm rather than 7nm, which is very cool. The 3rd version was announced in 2018 and fabbed on a 16nm process, so this is quite a leap forward.

Aside from the 2X cores and slight clock speed increase engendered by the chip making process for the TPUv4, it is interesting that Google kept the memory capacity at 32 GB and didn’t move to the HBM3 memory that Nvidia is using with the “Hopper” GH100 GPU accelerators. Nvidia is obsessed about memory bandwidth on the devices and, by extension with its NVLink and NVSwitch, memory bandwidth within nodes and now across nodes with a maximum of 256 devices in a single image.

Google is not as worried about memory atomics (as far as we know) on the proprietary TPU interconnect, device memory bandwidth or device memory capacity. The TPUv4 has the same 32 GB of capacity as the TPUv3, it uses the same HBM2 memory, and it has only a 33 percent increase in speed to just under 1.2 TB/sec. What Google is interested in is bandwidth on the TPU pod interconnect, which is shifting to a 3D torus design that tightly couples 64 TPUv4 chips with “wraparound connections” – something that was not possible with the 2D torus interconnect used with the TPUv3 pods. The increasing dimension of the torus interconnect allows for more TPUs to be pulled into a tighter subnet for collective operations.

🏃🏻♀️ ‘Association Between Physical Activity and Risk of Depression’ (Meta-analysis) ⛹️

Not surprising, but important to remember and act on:

This systematic review and meta-analysis of 15 prospective studies including more than 2 million person-years showed an inverse curvilinear association between physical activity and incident depression, with greater differences in risk at lower exposure levels. Adults meeting physical activity recommendations (equivalent to 2.5 h/wk of brisk walking) had lower risk of depression, compared with adults reporting no physical activity.

The effect size is not small:

Relative to adults not reporting any activity, those accumulating half the recommended volume of physical activity (4.4 marginal metabolic equivalent task hours per week [mMET-h/wk]) had 18% (95% CI, 13%-23%) lower risk of depression.

Adults accumulating the recommended volume of 8.8 mMET hours per week had 25% (95% CI, 18%-32%) lower risk with diminishing potential benefits and higher uncertainty observed beyond that exposure level. There were diminishing additional potential benefits and greater uncertainty at higher volumes of physical activity. Based on an estimate of exposure prevalences among included cohorts, if less active adults had achieved the current physical activity recommendations, 11.5% (95% CI, 7.7%-15.4%) of depression cases could have been prevented.

That’s it, after I publish this, I’m going out for a walk. It’s a nice day.

Update: I suspect the causality goes in both directions. People who are depressed will exercise less, and people who exercise less are more likely to become depressed. This can create virtuous and vicious cycles in both directions, a bit like with lack of sleep and mental health (many mental health conditions affect sleep quality, and so create a negative spiral… But if you take someone with good mental health and sleep deprive them, things will get much worse for them).

The Arts & History

Why are Jurassic Park’s CGI effects so good? What would they look like if done today?

The first part of this is an *excellent* discussion of how and why they made certain choices with CGI special effects in the original Jurassic Park, and why the effects hold up so well almost 30 years later.

Then they have some fun trying to recreate some shots with modern software tools (clearly they don’t get there, but it’s impressive what can be done now in a couple of days and with almost zero budget).

As someone not in the industry, it was particularly interesting to see the digital marketplaces for 3D assets. I wonder if there are many indie artists who make a living just building assets full time… 🤔

Why are Jurassic Park’s CGI effects so good?- Man, I am just a finance nerd easily impressed, but the process of making a graphics intensive video is amazing! What they could do in the past, how they can quickly emulate it in the present. So creative!