288: Roper did it, Elastic's Two Cities, Cloudflare Time Machine, Ryan Petersen of Flexport, MBI on Adyen, Apollo Photos, and the Swimmer Body's Illusion

"should I move to the beach house full time?"

Be a window

in a world full of mirrors

—Night Jasmine

🎧🗣🗣🎙 While it’s unfortunate that you couldn’t sit at the table with us and join the discussion, the next best thing is listening to this podcast with friend-of-the-show David Senra (🎙📚) of Founders podcast.

What I learned most from David is the power of focus and knowing what it takes to do great work. We talk about it in the context of what we do, but I’m sure it translates to whatever you’re trying to achieve.

I’ll also say that I bet no other single podcast in the history of the world will have covered Ed Thorpe, Michael Jordan, Mark Leonard, Rick Rubin, Edwin Land, Charlie Munger, Steve Jobs, John D. Rockefeller, Claude Shannon, Warren Buffett, and Jim Simmons… in the same episode!

🛀 Sheryl Sandberg leaving Facebook (I still won’t call it Meta, sorry) made me wonder if we may not see more high-level departures over the next bit of time.

Not that I have any idea about the reasons for Sandberg's departure, but many executives may think to themselves:

Well, this job was hard enough during the *good* times, do I really want to be doing this right now or should I move to the beach house full time?Or as someone speculated on Twitter, maybe she’s going to be Elon Musk’s next CEO of Twitter (can you imagine if that was true? 🤯). Or maybe Bytedance will finally spin-off Tiktok ex-China and she’ll run that!

😯🫤 File this one under “I can’t believe this sells for the price it does”:

These plastic spikes cost $17.24CAD ($13.62 USD) with tax.

There can’t be more than a few cents of plastic in there. Is there a plastic spike mogul out there somewhere?

Who’s making most of the margin on this? Riches in niches..?

💚 🥃 If you are not a paid supporter yet, I hope this is the edition that makes you go:

“Hey, I think I want to support what he’s doing here.”

Thank you for that!

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view, and resurfaces it alongside relevant Google search results. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

🏦 💰 Liberty Capital 💳 💴

Roper sells a 51% stake in its industrial businesses to private equity for $2.6bn

Some people like to remodel their kitchen once in a while.

Neil Hunn has decided to remodel his conglomerate.

After speculating about it in edition #280, it actually happened:

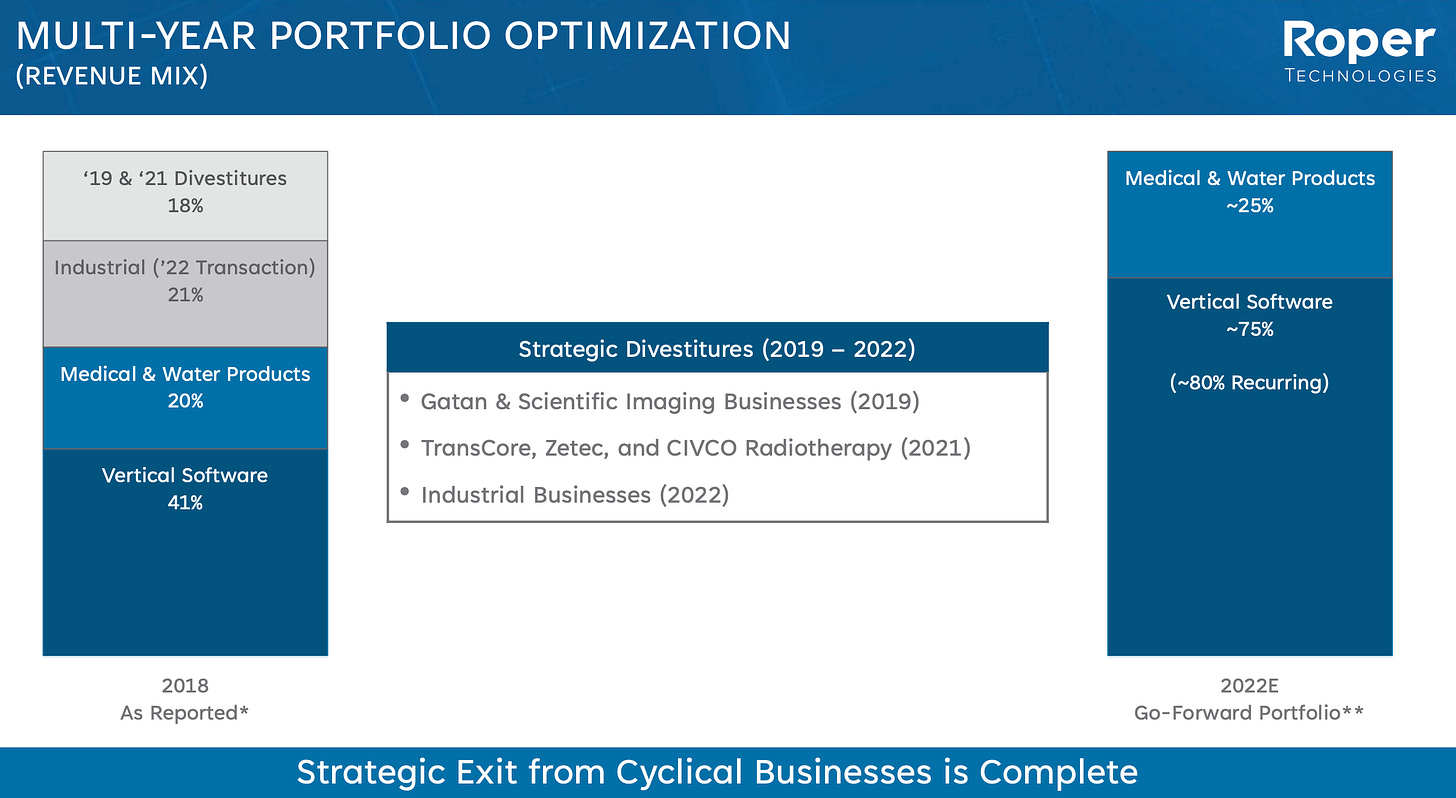

Roper announced that it has agreed to sell a majority stake in its industrial businesses, including its entire Process Technologies segment and the industrial businesses within its Measurement & Analytical Solutions segment, to affiliates of Clayton, Dubilier & Rice.

Roper will receive total upfront, pre-tax cash proceeds of approximately $2.6 billion while retaining a 49% minority interest in a new standalone entity.

The transaction includes the following businesses: Alpha, AMOT, CCC, Cornell, Dynisco, FTI, Hansen, Hardy, Logitech, Metrix, PAC, Roper Pump, Struers, Technolog, Uson, and Viatran.

Collectively, these businesses generated approximately $940 million of revenue and $260 million of EBITDA in 2021.

Because they’re selling only about half, this is approximatively a 20x EBITDA multiple, which is pretty close to Roper’s current market valuation.

They’ll get hit with some tax on it, so the net cash proceeds won’t quite be $2.6bn. But they estimate that after this they’ll have about $7bn+ of “Near-Term M&A Firepower”.

While this follows a bunch of other divestitures, the CEO says it’s the last one: “This is the final step in Roper’s divestiture strategy to reduce the cyclicality and asset intensity of our enterprise.”

How does this change the business?

Net working capital will go from -9% in 2021 (which was already very low compared to +6% in 2014) to an estimated -18% going forward.

The resulting group of businesses will be about 75% vertical market software (~80% of that being recurring revenue) and about 25% medical products & smart water meter stuff (Neptune).

It’ll be interesting what happens to the 49% minority stake over time. Is the plan to sell it at some point, maybe when this private equity firm moves on..? We’ll see.

🐇🐢 Elastic’s Tale of Two Cities

Full Fiscal 2022 Financial Highlights

Total revenue was $862.4 million, an increase of 42% year-over-year, or 41% on a constant currency basis

Elastic Cloud revenue was $298.6 million, an increase of 80% year-over-year, or 79% on a constant currency basis

What started out as a tiny part of the business ESTC 0.00%↑ is growing so much faster than the rest that it’s progressively becoming quite material, and may help lift up the overall growth rate — or at least slow down the rate of decline.

Interesting dynamic when you can find it.

It reminds me a bit of the Connected TV segment at The Trade Desk TTD 0.00%↑ . Just a couple of years ago it was a footnote, but it grew so fast that it’s becoming the engine of the whole thing.

Or the data-center segment at Nvidia NVDA 0.00%↑ , from some science experiment to the biggest segment in less than a decade.

Cloudflare is a time machine ⛅️ 🕰 & being mission-critical and the low-cost provider ⛑

I hope you have the endurance to get through this ongoing series of vignettes on Cloudflare… I promise, I’ll stop at some point!

I liked this metaphor by Matthew Prince:

Cloudflare has always been a time machine where what we think of every day at the company is if we could go back to the late '60s, early '70s when the first protocols of how the Internet was being designed, were being laid down. And we could take every single step of that and say, how can we make — everything that has to happen when you send an e-mail, everything that has to happen when you click on a link, everything that has to happen when you log into your corporate VPN faster, more reliable, more secure, more private and more efficient and cheaper. What would we have done differently? Because the Internet was never designed to be what it is today.

So fundamentally, what Cloudflare is, is that network, we all wish the Internet had been.

Here he channels Bezos, with his “what are the things that won’t change in your business?”:

And I think that no matter what happens in the world. I know that 10 years from now, we're going to want an Internet that's faster, more reliable, more secure, more private, more efficient. And I think that's why clients have continued to slot to us.

Switching gears to the economy, Prince talks about the dark clouds on the horizon:

In our last earnings call, we said Q1 of 2022 was by far the hardest quarter we've seen since Q1 of 2020, which was the COVID quarter. And I think one of the things that is unique about us is because our sales cycles are so fast, measured in less than a quarter typically. [...]

I think companies that may have looked like they were doing very well in Q1 that have longer sales cycles, you're going to start to see them having pipeline problems in Q2, Q3, Q4.

But when the going gets tough and customers have to make choices, who are they going to cut first, and who are they going to cut last?

I think that the world is about to get sorted into must-haves and nice to haves.

And I think we had an early preview of that. If you look at highly impacted industries in the midst of COVID. And if you look at -- if you were in the hotel or hospitality space, if you were in travel and leisure… we do have some hospitality. We do have some travel. And we thought, boy, these guys they're going to have a real hard time and we didn't know for sure whether we were a must-have or nice to have.

And it turned out that all of those customers continue to pay their bills, some -- maybe not all, some of them went out of business. But we were in a position where I think we proved that we are a must-have for companies.

I wouldn't trade places with any other company right now because we are typically, the low-price leader in what we do. The ROI for what we deliver is incredibly high.

While he’s bearish short-term, he keeps an eye on the longer-term opportunity:

The world has gotten harder, and it's going to be good for us, hard in the short term.

But in 24 months, we will come out with our ship being significantly more efficient with us owning a significantly larger share of the market and us being an absolute critical unreplaceable part of how every corporate network is run.

🎧 Interview: Ryan Petersen, CEO & Founder of Flexport (talking global logistics, entrepreneurship, etc)

I mentioned before how I enjoyed every interview with Ryan Petersen (🚚 📦 ⚓️) that I’ve listened to, and a friend-of-the-show and supporter Shomik Ghosh (💚 🥃) was apparently paying attention because he sent me this one:

It’s good stuff.

Petersen has that sparkle ✨ (I almost made a Donnie Darko joke, but it would’ve been pretty niche…) that I like, the smile in his voice and curiosity pushing him to try to figure out the game of life. I dunno, it may sound cheesy, but it’s true ¯\_(ツ)_/¯

There’s a transcript, if that’s your thing.

🎧 Interview: MBI on Adyen, the ‘Navy SEALs’ of Payments 💳 🇳🇱

Brett & Ryan spoke with my friend MBI (💎🐕) about Adyen, the Dutch payment superstar:

The pod goes pretty deep, but if you want the *actual deep dive*, check out MBI’s excellent writeup (I thought it was one of his best! 🏅):

Adyen: The “Navy SEAL” Team of Payments (inexpensive sub. required)

‘If oil were $20 a barrel today, would that help or hurt Putin?’ 🛢🛢🛢🛢📈

Friend-of-the-show Doomberg ( 🟩 🐓) has a great ‘Crazy Pills’ lucid take (sub. required) on what would *really* hurt Putin’s ability to finance his war-machine while also being better for the rest of the world:

Russian oil is selling at a discount compared to the WTI and Brent benchmarks, but it is still moving, and the higher those benchmarks go the more money Putin rakes in. [...]

Instead of attacking the supply of Putin’s energy, we should be doing everything in our power to increase ours. That is the only way to lower price and materially impact the funding of his war machine. For highly inelastic products like oil and natural gas, price action works both ways. It does not take significant undersupply for prices to skyrocket, nor does it take significant oversupply for prices to crash. Famously, oil traded as low as minus $37 a barrel at the peak of the Covid-19 panic, proving how precarious the price of energy can be when supply gluts form and there’s no place to put the stuff. If oil were $20 a barrel today, would that help or hurt Putin? The answer is self-evident and yet lost on our leaders, and we’re running out of crazy pills. To be as straightforward as possible, we present Doomberg’s Law of Combatting Dictators That Have Really, Really, Ridiculously Firm Strongholds on Energy™:

Actions that result in a higher global supply of energy hurt, whereas actions that result in a lower global supply of energy enable!

Combine increased supply with further work on decoupling Europe from Russia’s energy (which will take a while, but it’s crucial to have alternative sources — including sometimes shifting to different types of energy and do demand destruction through a renewed focus on efficiency, ramp up the installation of heat pumps to replace gas furnaces, keep nuclear power plants online and build new ones like in the UK, etc).

You’ll get better results with that than with the moves that spike oil & gas prices we’re seeing from various leaders, and thus flow directly to Putin’s bottom line, achieving the opposite of what they’re trying to do.

Even if the goal is to move away from oil & gas, supply should be increased over the short term to save lives, defend democracy, and alleviate worldwide suffering because of high inflation, high agricultural input prices, etc.

🎧 Interview: Jimmy Soni, author of ‘The Founders: The Story of Paypal”

I always love it when two friends-of-the-show (💚 🥃 💚 🥃) are on the same podcast, it can’t help but be good!

They cover a lot of stuff, from the joys of curiosity to Claude Shannon and information theory, Paypal’s beginnings and Elon Musk’s impact on the world, proto-cryptocurrency, memes, and more.

If you enjoyed this and want more, make sure to check out my own conversation with Jimmy:

🧪🔬 Liberty Labs 🧬 🔭

Earth Restored (Digitally restored images of Earth from space) 🚀 📸 🌏

Only 24 people have journeyed far enough to see the whole Earth against the black of space.

The images they brought back changed our world.

Here is a selection of the most beautiful photographs of Earth

— iconic images and unknown gems — digitally restored to their full glory.Great work by Toby Ord. See for yourself here.

🏊♀️ Are you familiar with the Swimmer’s Body Illusion? 🏊♂️

The swimmer’s body illusion is a cognitive bias where you attribute a trait or characteristic to a certain activity, and not the other way around.

For example, you might look at a professional swimmer’s toned body and think you can gain that same appearance by swimming.

However, these individuals are so good at swimming because they already had that kind of body.You’re super skinny and weak and want to look like a burly rugby player?

Playing rugby may help you get in better shape, but it’ll probably just get your ass kicked because your body type puts you at a disadvantage to those who started out with something more like the prototypical ‘rugby’ body before they even started.

At least, that’s true *at the higher levels* of any of those activities. If you just want to have fun and don’t care too much about performance, go for it, it’ll be good for you!

But once you get to the upper echelons and tiny differences in performance can make or break a career… there’s a reason why all Olympic swimmers kind of look alike, why NBA players are super tall, etc.

This doesn’t mean that there aren’t exceptions and people who defy the odds! But on average, there’s a powerful self-selection effect.

🎨 🎭 Liberty Studio 👩🎨 🎥

👮🏻♂️ We Own This City (HBO, 2022, David Simon, 6-episode mini-series) 🚔

*spoilers below this*

*spoilers below this*

*spoilers below this*

Now that I’ve watched the whole thing, here’s what I think: I mostly liked it, I think it’s very well made, very well-acted, and it’s not dumbed down or too much of a “TV show”, if that makes sense.

They told the story they wanted to tell, in all its messiness, and didn’t go for too many tropes of the genre that would’ve made things neater or easier to follow.

This has downsides. You have to trust the process, especially in the first couple of episodes, because as with any David Simon show, there are lots of characters and there’s no hand-holding.

Is it as good as The Wire?

No, but what is?

It’s a strong show that obviously wants to make a point (about the War on Drugs, on corruption, on attacking symptoms rather than causes, etc).

It ends with a gut punch, especially if you keep in mind that it’s based on true events, and knowing Simon, he probably stuck pretty closely to the facts.

SlothCapital pointed out that there’s an HBO documentary called The Slow Hustle that covers some of the same events — I’ve put it on my list, and am hoping it gives an even better understanding of what happened.

I know there’s controversy on detective Suiter’s actions, and I think Simon and the HBO documentary fall on different sides, but I don’t know much about it (yet). Simon said on Twitter he’d publish an essay explaining why they made the choices they made.

Don’t worry, it’s a pretty interesting company so I’ll no doubt come back plenty often to them. But I like the enthusiasm!

"Cloudflare has always been a time machine where what we think of every day at the company is if we could go back to the late '60s, early '70s when the first protocols of how the Internet was being designed" 💖🧝♀️😊🧠📈💰👍