305: Amazon's Cancer Vaccine, BWX Technologies, Roper 101, Disney + Trade Desk, Digital Infrastructure, James Webb Space Telescope, and Lithium Batteries

"Not pieces on a chess board. Real life, real people."

My goal in life is to unite my avocation with my vocation,

As my two eyes make one in sight.

—Robert Frost

🔋🪫🔮 Here’s a follow-up on the battery stuff from edition #304 from reader and supporter (💚 🥃) Pat Srinivas:

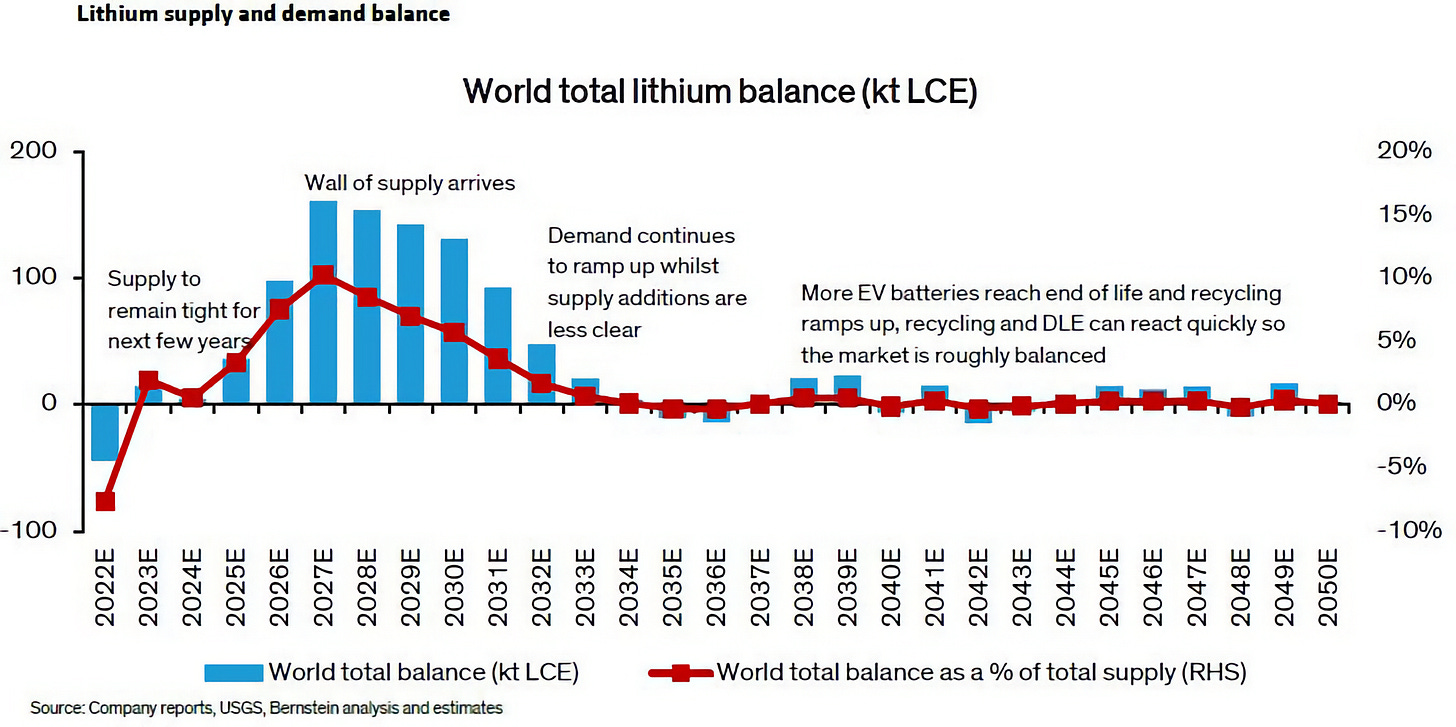

I don’t know how accurate these forecasts will turn out to be — predictions are hard, especially about the future — but I suppose that building mines has a long-enough lead time that you can get a pretty good idea of what is in the pipeline in the near term. The demand side should be harder to predict as it’s not exactly linear, but still…

According to this, it’s during the early years of the transition to EVs that things swing around the most, and after a while, you eventually get to a point where lithium supply from recycling end-of-life packs from the fleet makes up a large fraction of total supply and some equilibrium is reached.

Nobody can really know, but it’s a possible scenario ¯\_(ツ)_/¯

🇺🇦💥🇷🇺 If you don’t even try to do something, your chances of successfully doing it will be much lower than if you give it a real go.

That’s why this piece makes a lot of sense:

If the goal of Ukraine’s allies is only to keep Russia from conquering Ukraine, providing just enough help for them to *not lose*, that will likely leads to a long stalemate.

It increases the destruction and suffering while favoring Russia, with its larger economy buoyed by energy prices (while Ukraine’s GDP will shrink by almost 50%), larger military, and lack of need for popular support (as opposed to allies where support is likely to wane over time).

The countries that support Ukraine should take action to favor a decisive and swift victory.

It’s a very asymmetric situation where Ukraine is entirely justified in defending itself and keeping 100% of its territory. How would Americans feel about having 1/5 of their country occupied?

This isn’t a business negotiation where both sides decided to make a deal in good faith and should meet in the middle; this is mass-murder, mass-rape, targeting residential areas far from the fighting, deporting civilians against their will, kidnapping elected officials, etc. How many other Buchas don’t we know about yet? Is “never again” just some empty slogan?

Not pieces on a chess board. Real life, real people.

Every day that the war is shortened by, lives are safeguarded, more kids will grow up with their parents, billions of dollars are saved, and the refugee and food crises can begin to be addressed.

💚 🥃 If you are not a paid supporter yet, I hope this is the edition that makes you go:

“Hey, I think I want to support what he’s doing here.”

Thank you for that!

Business & Investing

Amazon is working on cancer vaccines?! 💉🧫🔬👩🔬

Well, ok, the headline is a bit more dramatic than the reality, but it’s still cool to see the giant share some of its vast resources with the Fred Hutchinson Cancer Center to help it move its research forward.

A new phase 1 clinic trial (so still *very* early) shows that Amazon AMZN 0.00%↑ is a “collaborator” on a new personalized “Neo-Antigen Peptide Vaccine for the Treatment of Stage IIIC-IV Melanoma or Hormone Receptor Positive Her2 Negative Metastatic Refractory Breast Cancer”.

Amazon’s contribution is “scientific and machine learning expertise”, so likely a lot of AWS compute to help design and pre-screen the molecules and expertise to improve the models. Since this is a “personalized” vaccine, it likely requires a bunch of compute to design each treatment.

This research group has been operating for a while inside Amazon. Here’s a 4-year-old piece about them.

BWX Technologies ⚓️

As a follow-up to what I wrote about the U.S. Navy’s nuclear fleet in edition #304, I thought it was worth mentioning that it’s a publicly-traded company called BWX Technologies BWXT 0.00%↑ that does a lot of that work for the Navy, helping design, build, and maintain these hundreds of nuclear reactors:

BWX Technologies, Inc. (BWXT) offers a complete range of nuclear components and services, including the manufacturing of nuclear reactor components for U.S. Naval submarines and aircraft carriers and other nuclear and non-nuclear research and development and component production.

We have proudly manufactured naval nuclear components and reactors since the 1950s - we designed and fabricated components for the USS Nautilus, the world’s first nuclear-powered submarine. To date, the U.S. government has safely steamed millions of miles using components manufactured at BWXT’s facilities. Our long and successful track record is underscored by our commitments to safety, quality and integrity.

Today, BWXT reactors power the Navy’s Ohio, Virginia, Seawolf and Los Angeles-class submarines as well as its Nimitz and Ford-class aircraft carriers.

BWXT is a full-spectrum supplier of high-consequence, close-tolerance, large-scale components and highly complex, electro-mechanical products. Our facilities are staffed by a highly-skilled, tenured workforce that possesses a unique array of state-of-the-art nuclear and non-nuclear capabilities, ranging from design to manufacturing to inspection to assembly and testing.

They also manufacture commercial nuclear components, such as forging reactor vessels, heat exchangers, steam generators, and do work in the field of nuclear medicine (imaging and radiotherapy).

Interestingly, they also make fuel pellets for CANDU reactors, the very clever home-grown Canadian (🇨🇦) heavy-water design that runs on non-enriched uranium, can also burn thorium and reprocessed fissile materials from nuclear weapons — it can even be refueled without a shutdown — I’ll have to write more about it at some point.

The first time I heard about this company was a few years ago on a podcast with Geoff Gannon. I don’t remember exactly which one it was, but I remember him going in a fair amount of depth into it — it was probably a podcast around when they were spun out of Babcock & Wilcox.

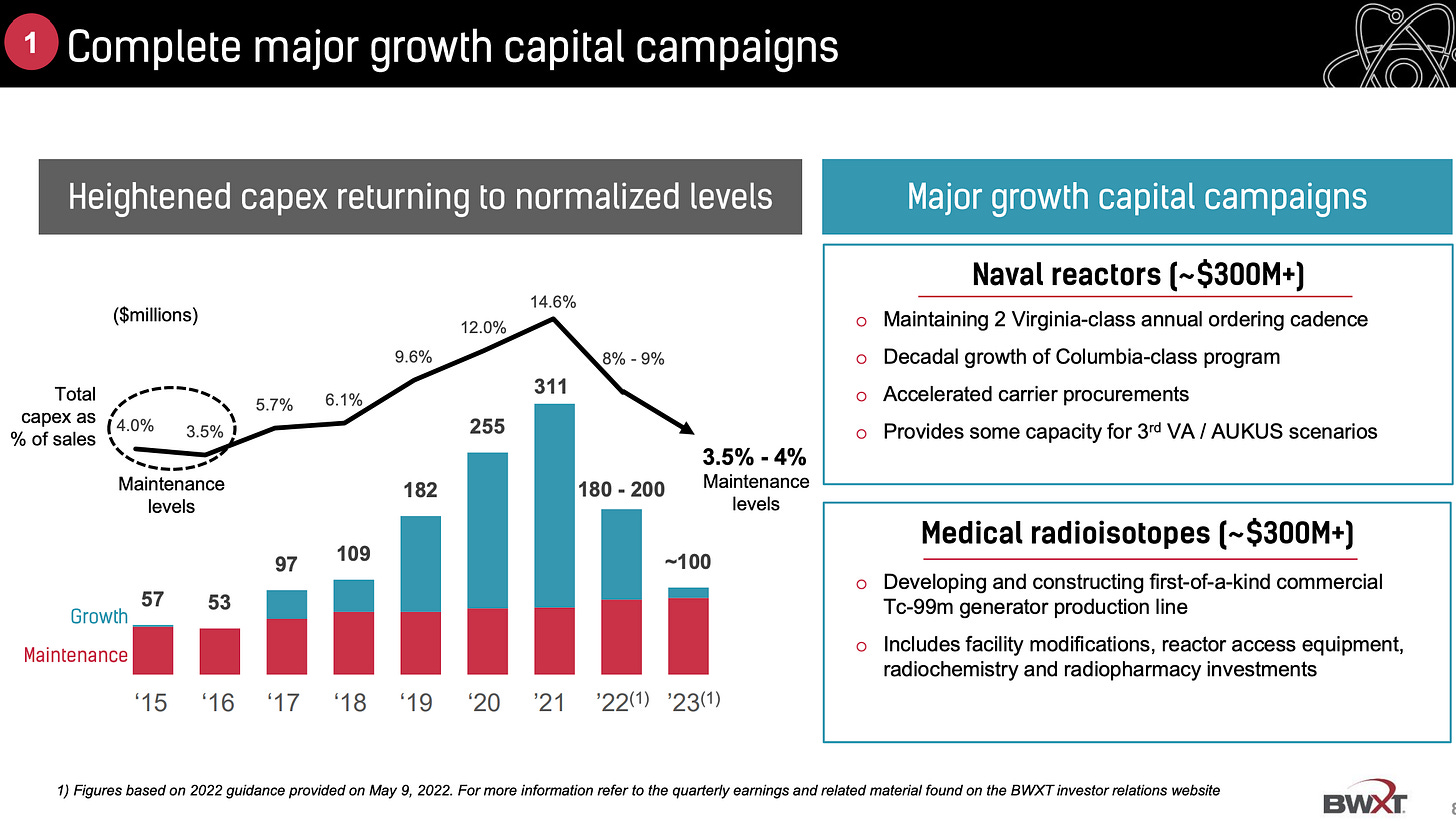

Having a quick look at the company’s financials, I’d be interested in why some of their metrics have been headed the wrong way for a few years and why capex is elevated. Could be the lumpy nature of some projects they’re working on, I don’t know enough about them to comment.

This seems to say that capex will come back down after a large investment cycle:

I know little about this company, but it’s an interesting one as a business. I’m not yet anywhere close to being able to tell if it may be an interesting stock as an investment.

Roper 101 🖇

Young Hamilton has a good overview of Roper. ROP 0.00%↑

It’s a company I’ve been following for close to a decade now, and while they don’t have the value-discipline-that-leads-to-very-high-ROICs of a company like Constellation, it’s been nice seeing them ladder up the quality of their businesses over time and chug along by buying good niche businesses and putting a bit of IG leverage on them, then using their cash flow to buy more businesses that are hopefully better than what they already own (higher margins, lower cyclicality, lower capital intensity, negative net working capital, etc), rinse and repeat.

With the decentralized way they operate, it’s almost like a portfolio of quality independent micro-caps with profiles that are typically not what you see with most public companies (ie. MSD-growers in relatively small TAM niches with boring end-markets but fantastic margins and cash-conversion metrics).

For a lot more of my thoughts on Roper see edition #14 (wow, that’s old 👵🏻)

Disney partners with The Trade Desk for digital ads

Disney has reached an agreement with The Trade Desk, a global ad tech company, that makes it possible for brands to target automated ads across Disney properties using data matched on the back end from Disney and The Trade Desk. [...]

The deal integrates data from Disney’s Clean Room, a privacy-conscious repository of first party data, or data Disney gathers directly from its users with their consent, and matches it with personalized data that‘s been created through an industry framework called the Unified ID 2.0, which The Trade Desk has championed. (Source)

This should help Disney DIS 0.00%↑ reach its goal of having more than 50% of its ad be programmatic, and it certainly helps TTD TTD 0.00%↑ scale-up UID2.0 — the Disney stamp of approval will certainly help this new open-standard, privacy-conscious replacement for cookies gain further traction.

🎧 Interview: Martin Casado on digital infrastructure 💾

Good overview of the digital infrastructure industry today and speculation on where it may be going based on the dynamic between the hyperscale clouds and SAAS providers and API companies that are unbundling various aspects of building software, etc.

I particularly enjoyed the discussion about the pros and cons of building on top of the major clouds vs racking & stacking your own hardware.

Interesting to see the pendulum swing back and forth — or rather, Schrödinger’s pendulum that swings back and forth at the same time, with big winners with both approaches.

🇫🇷 France is re-nationalizing EDF (well, fully)

So much is happening in energy market these days, it’s hard to keep track. We’re getting dangerously close to the point where people start using that Stalin quote…

EDF, in which the state already has an 84% stake, is one of Europe's biggest utilities [...]

Less than two decades after EDF was floated on the stock market to much fanfare, the government announced on Wednesday it would bring it fully back under state ownership. [...]

“The roadmap for the future leader of EDF is to produce more ... as quickly as possible; it is the construction of six new EPR nuclear reactors and it is the continuation of the commitment in renewable energies" [...]

Buying the shares the government does not already own at the current prices would cost about 5 billion euros ($5.1 billion), but analysts expected the government to pay a premium

Source. h/t friend-of-the-show and supporter (💚 🥃) David Golberg

Science & Technology

First deep-deep-deep-space images from the James Webb Space Telescope ✨🔭🛰

There’s a good chance you’ve seen it by now if there are any geeks in your circles…

If you’re curious how much better this is than Hubble, this site allows you to compare the same parts of the sky as seen through both space telescopes.

This is the first image coming out of the recently launched (and painstakingly calibrated) James Webb Space Telescope.

The thing is truly a marvel of human ingenuity. Hopefully it brings us many beautiful images of our universe and scientific discoveries for many many years to come (the way it can infer the atmosphere of distant exoplanets will be a BIG DEAL™️ to possibly find alien life 👽).

Thousands of galaxies – including the faintest objects ever observed in the infrared – have appeared in Webb’s view for the first time. This slice of the vast universe is approximately the size of a grain of sand held at arm’s length by someone on the ground.

This deep field, taken by Webb’s Near-Infrared Camera (NIRCam), is a composite made from images at different wavelengths, totaling 12.5 hours – achieving depths at infrared wavelengths beyond the Hubble Space Telescope’s deepest fields, which took weeks.

The image shows the galaxy cluster SMACS 0723 as it appeared 4.6 billion years ago. The combined mass of this galaxy cluster acts as a gravitational lens, magnifying much more distant galaxies behind it. Webb’s NIRCam has brought those distant galaxies into sharp focus – they have tiny, faint structures that have never been seen before, including star clusters and diffuse features. Researchers will soon begin to learn more about the galaxies’ masses, ages, histories, and compositions, as Webb seeks the earliest galaxies in the universe. (Source)

For the nerds, here’s a good piece about the JWST’s data challenges — it gathers about 57 gigabytes of data a day, and it’s parked at the second Lagrange Point located 1.5 million kilometers from Earth, so there are multiple challenges related to handling all this data internally, and getting it back to Earth reliably.

China’s offshore wind power just went plaid! 🌬🇨🇳

China installed 80% of worldwide new offshore wind capacity in 2021!

In 2021, China’s offshore wind boom drove a threefold surge in new installations worldwide, and though the frenzy is expected to slow this year, the country is still on track to lead the world in offshore wind development for at least the next decade.

China connected nearly 17 gigawatts of new offshore wind capacity to its grid last year, equal to 80 percent of the 21.1 gigawatts connected worldwide, the Global Wind Energy Council said in its latest report. That brings China’s cumulative offshore wind capacity to more than 26 gigawatts — just under half the world’s cumulative capacity.

Here’s the Global Wind Energy Council report.

The Arts & History

DALL-E 2 result for "Early drawings of the iPhone by Leonardo da Vinci"

Ok, that’s cool.

Source. h/t Umang Jaipuria

Enjoyed the Martin Casado pod but couldn't take him seriously after he talked about being co-author on this. https://a16z.com/2021/05/27/cost-of-cloud-paradox-market-cap-cloud-lifecycle-scale-growth-repatriation-optimization/

I remember when it came out last year, thinking how bad it missed the mark.