31: Minimize or Embrace Chaos? Surfing S-Curves, Reed Hastings, Renewable Energy R&D, and Extragalactic Exoplanets

"All you needed was a cup of tea, a light, and your stereo"

You are not the king of your brain. You are the creepy guy standing next to the king going “a most judicious choice, sire.” —Steven Kaas

We’ve all read about the power of incentive and short feedback cycles, but it’s still nice to see it play out up close.

When my wife and I renewed our car insurance, the company that we went with offered us the option to install an app on our phones that would track some metrics about how we drive (using the accelerometer and GPS to track rapid acceleration, deceleration, top speeds, etc) for the possibility of some discounts.

Some will object that it’s creepy to be tracked around. I get that… But then, I’m also using Google Maps, and I bet you are too. ¯\_(ツ)_/¯

In this case, I was mostly curious to see how well the tech worked (I never mind saving a few bucks too), and knew I could turn it off any time (I think they only ask for 1,000 km/year).

So we gave it a try. At first my score was pretty good and I could see that I’d be getting about a 15% discount. But just knowing about the app made me pay a little more attention, try a little harder, and now I’m at a 21% discount with an 89% score.

But that’s not the interesting part. My wife started with a much lower score, mostly because she doesn’t brake and accelerate as smoothly as I do. But being a perfectionist, and with a little playful competition, she changed the way she drives and over a few months went from a score in the red (mid 60s, projected discount in the single digits) to the high 80s, with a project discount rapidly catching up to mine (19%, last I checked — so now I try to do even better to stay ahead).

So it looks like a trivial app created the conditions for a potentially long-term change that will make her and others a little safer, and save energy? It’s a small investment for big gains over decades.

The power of incentives and real-time feedback!

It reminds me of when the first hybrid cars came out. They were the first vehicles with a big LCD screen on the dash showing a graph of fuel economy over time and in real-time. What people found was that part of the fuel savings came from the technology (the hybrid drivetrain), but a significant part came from people changing how they drove to get a “higher score”. Most people don’t want to do badly, but they never really had good feedback on how to do better.

All this makes it clear that every car should have a display that turns both safety and efficiency into more of a game and encourages improvements. After having seen how a simple app changed our driving behavior, I kind of wish that everybody else on the road also had it. Even if some will never care, I think enough would make positive changes that we’d all be safer.

Investing & Business

‘Surfing the Right S-Curve’

I really enjoyed this newsletter by Byrne Hobart. Here’s a few highlights (bolded parts are added by me), but I recommend the whole thing since it’s more an essay where each section builds on the previous argument:

One important element of growth cycles is that they can lower or raise the barrier to copies. A single success in an industry makes competitors more fundable, and offers a playbook for new entrants. Sometimes, all a novel company achieves is a proof-of-concept: that there’s a buyer for a particular kind of product, even if the product itself is not that great. So follow-on entrants can improve the original version, pay closer attention to how high the S-curve goes, and achieve much better returns. [...]

This is so true, and so important to notice, because things can happen a lot quicker after one of these inflection points than before. It’s a bit like exponential growth: It looks like nothing is happening for a long time, then someone opens the floodgates…

Big platforms build potential S-curves for other companies to ride. Google was an affordable sales channel, for paid and organic search. This has created numerous businesses, and enhanced others, but some companies either structured themselves around eternally cheap ads or built themselves around parts of the Google algorithm and layout that weren’t permanent. If Google’s traffic is cheap, and a business can resell it for more, that’s a profit opportunity—for them, but also for Google, which can cut out the middleman. [...]

So many companies have found that out in the past few years… If your business is dependent on some giant deciding not to crush you (even unintentionally), you may wake up one morning and realize you didn’t have the business you thought you had.

The bigger the company, though, the more it reshapes the entire environment; Google made some businesses possible, and since those businesses could grow their audience at Google scale, it made them grow far faster. Platforms are naturally allergic to high-margin hypergrowth by their customers—if it’s scalable and profitable, it’s probably an arbitrage, and owning a platform means having an eventual monopoly on all arbitrages that platform enables. In IBM’s case, they helped make Microsoft ubiquitous, and Microsoft’s ubiquity helped materially erode IBM’s importance. [...]

It’s the signature of every great company that, if it occurs to you to compete with them, you realize you’re a few years behind. [...] A company’s initial S-curve makes them look like a trivial product aiming for a small market—the kind of company that can easily be dismissed as unambitious. And the shift to a new curve diverts resources from other projects, so superficially it looks like an unambitious company that’s also slowing down.

There’s a lot more goodness. Read the whole thing and subscribe to The Diff.

I mean, who else casually throws in a reference to agar in a newsletter about finance and tech?

Minimize or Embrace Chaos?

I think there’s wisdom in these Tweets by Patrick McKenzie (aka Patio11, who works at Stripe):

There are a lot of companies which manage towards being variance minimization machines, with eyes open and very intentionally.

A very small number of companies manage towards being variance understanding machines, also with eyes open and very intentionally.

There's often a mutual misunderstanding between these two types of organizations, and also the broader culture, which might consider one or the other normative.

e.g. A feature of a variance minimization company is consistent profits calculated very precisely.

Whereas a variance understanding company will often be structured as a portfolio of independent bets, and the steady state for them should probably look like it is losing a lot of money in a lot of places.

Which will predictably be characterized as imprudence and mismanagement.

So true.

Interestingly people often accuse companies in one or the other of being excessively financialized, but that's sort of like being excessively software-ized. It's a technology, and both use technology pretty heavily.

A variance minimization machine should certainly have their prudent, risk-averse managers discuss optimal capital structures and levels of leverage. A variance understanding machine probably gets most of the leverage internally but certainly cares about capital structure.

Interview: Reed Hastings, Netflix CEO

Speaking of embracing chaos, I really enjoyed this interview with Reed Hastings. It includes some excerpts from his new book ‘No Rules Rule’.

I listened to it this morning while walking in the woods, so I don’t have detailed notes or excerpts, but Hastings is a pleasure to listen to. A very thoughtful and socratic entrepreneur, he’s a rare systems thinker.

I thought his metaphor of seeing his company’s structure as more like a jazz band than an orchestra was interesting, and the sports team vs family metaphor is also a useful one.

You can listened to the interview here.

h/t Trevor Scott

Spotify Employees Threatening Strike if they Can’t Censor Joe Rogan

I wrote my thoughts on the dangers posed to the podcast ecosystem by Spotify in edition #18.

I thought they would play ‘super nice guy with bags of cash’ for a long time to aggregate as much market share as possible before starting to turn the screws and reshape the ecosystem in ways that are detrimental to listeners and show producers (not because they’re evil, but because that’s how incentives align)... But they may not even have time to execute that strategy because their employees are already revolting:

A contingent of activist Spotify staffers are now considering a walkout or full-blown strike if their demands for direct editorial oversight of The Joe Rogan Experience podcast aren’t met.

Late last week, we first reported that Spotify employees were demanding direct editorial oversight over the recently-acquired Joe Rogan Experience podcast. That would include the ability to directly edit or remove sections of upcoming interviews, or block the uploading of episodes deemed problematic. The employees also demanded the ability to add trigger warnings, corrections, and references to fact-checked articles on topics discussed by Rogan in the course of his multi-hour discussions. (Source)

I guess other big podcasters will think twice before taking a big bag of cash to become a Spotify exclusive… I’m sure Rogan has a pretty bulletproof contract, but that won’t stop the drama.

Will these employees further channel Nancy Reagan and then demand the ability to censor and edit and label every one of the 50+ million songs on the service?

h/t @JerryCap

Science & Technology

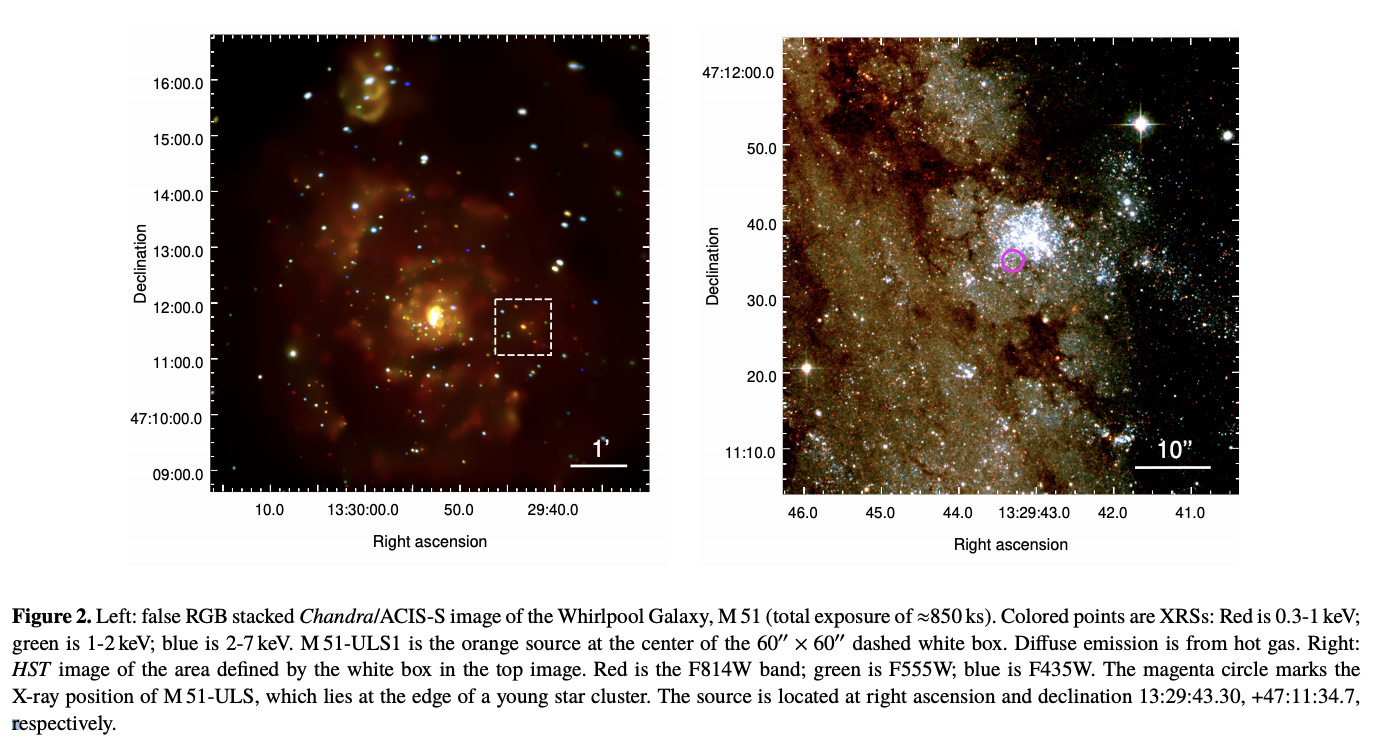

Evidence of First Exoplanet in Another Galaxy

For a while, finding exoplanets was all the rage in astronomy. Journalists reported breathlessly on almost every new one a few years ago (first one was in 1992, but smaller, more Earth-like ones were only detectable more recently).

Then we just kept finding more and more and more. Today there are 4,330 confirmed exoplanets in 3,200 star systems, and there are estimates that the Milky Way alone contains 40 billion worlds.

What’s the saying? Familiarity breeds contempt.

But now the new hotness may just be getting started: Exoplanets in other galaxies.

Do you realize how crazy it is to be able to detect a planet in another galaxy?

Other galaxies are so far away and the stars crammed into such a small region of space, as seen from Earth, that it is hard to identify individual ones let alone the effects of any planets around them. So extragalactic planets have sadly eluded astronomers.

Now Rosanne Di Stefano at the Harvard-Smithsonian Center for Astrophysics along with several colleagues, say they have found a candidate planet in the M51 Whirlpool Galaxy some 23 million light years from Earth near the constellation of Ursa Major. This alien world, christened M51-ULS-1b, is probably slightly smaller than Saturn and orbits a binary system at a distance of perhaps ten times Earth’s distance from the Sun.

If “23 million light years” doesn’t sound impressive, take a moment. The intro quote from edition #28 is very relevant.

So how was it possible to detect to extragalactic exoplanet? Because of very special and awe-inspiring circumstances:

The observation was possible because of a special set of conditions. The planet’s host binary system consists of a neutron star or black hole which is devouring a massive nearby star at a huge rate. The infall of stardust releases huge amounts of energy, making this system one of brightest sources of X-rays in the entire Whirlpool Galaxy. Indeed, its X-ray luminosity is roughly a million times brighter than the entire output of the Sun at all wavelengths.

But the source of these X-rays — the black hole or neutron star — is tiny. That means a Saturn-sized planet orbiting a billion kilometers away can completely eclipse the X-ray source, should it pass directly in front in the line of sight with Earth.

On Sep. 20, 2012, that’s exactly what appears to have happened. Fortuitously, the orbiting Chandra X-ray Observatory was watching at the time. (Source)

If you want to geek out, here’s the paper published the discovery.

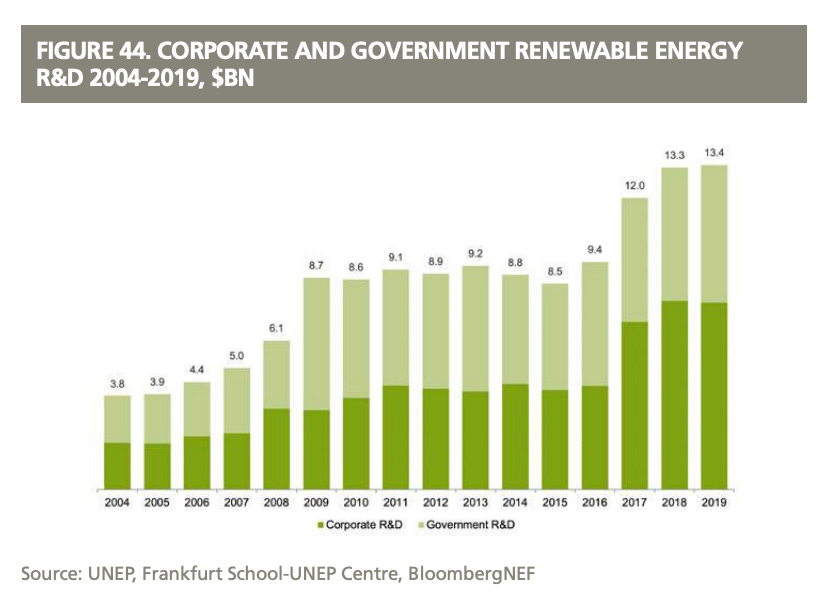

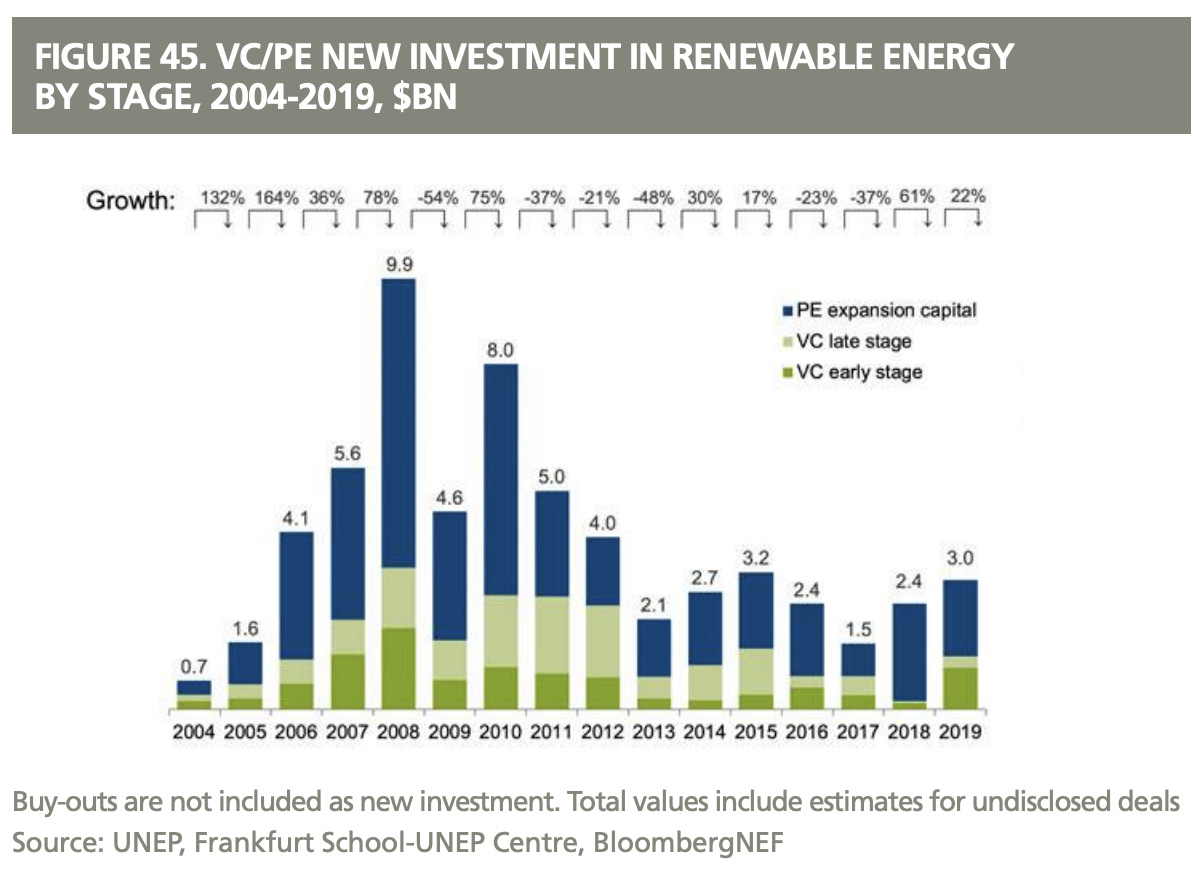

Corporate and Government R&D Spend on Renewable Energy

If we want cheap and reliable renewable energy we need to invest into the research and development of these energy sources. Currently the world spends $13.4 billion. For context, that's 0.8% of the world's military spending. (Source)

Venture capital and private equity money isn’t that much either, considering the size of the industry and how vital it is to human civilization.

Nvidia RTX 3090 Launch Day

Ok, this video showing what it was like outside of an electronics store on the day when the Nvidia RTX 3090 GPU (and more affordable 3080) went on sale is kind of crazy. People lining up outside for over a day, creating their own system of laws to decide how long people can step away from the line, shenanigans, etc.

Like trying to get tickets for Hamilton during the original run + Lord of the Flies, but mostly in a good way.

It’s a bit long (27 minutes, but can watch at 2x and it’s fine), but it’s worth watching to get an idea of how seriously some gamers take this hardware.

h/t Will Hassell

Speaking of Nvidia, here’s some preliminary TensorFlow and NAMD performance numbers. And keep in mind that these numbers will get better as the software and drivers mature to better support the Ampere architecture.

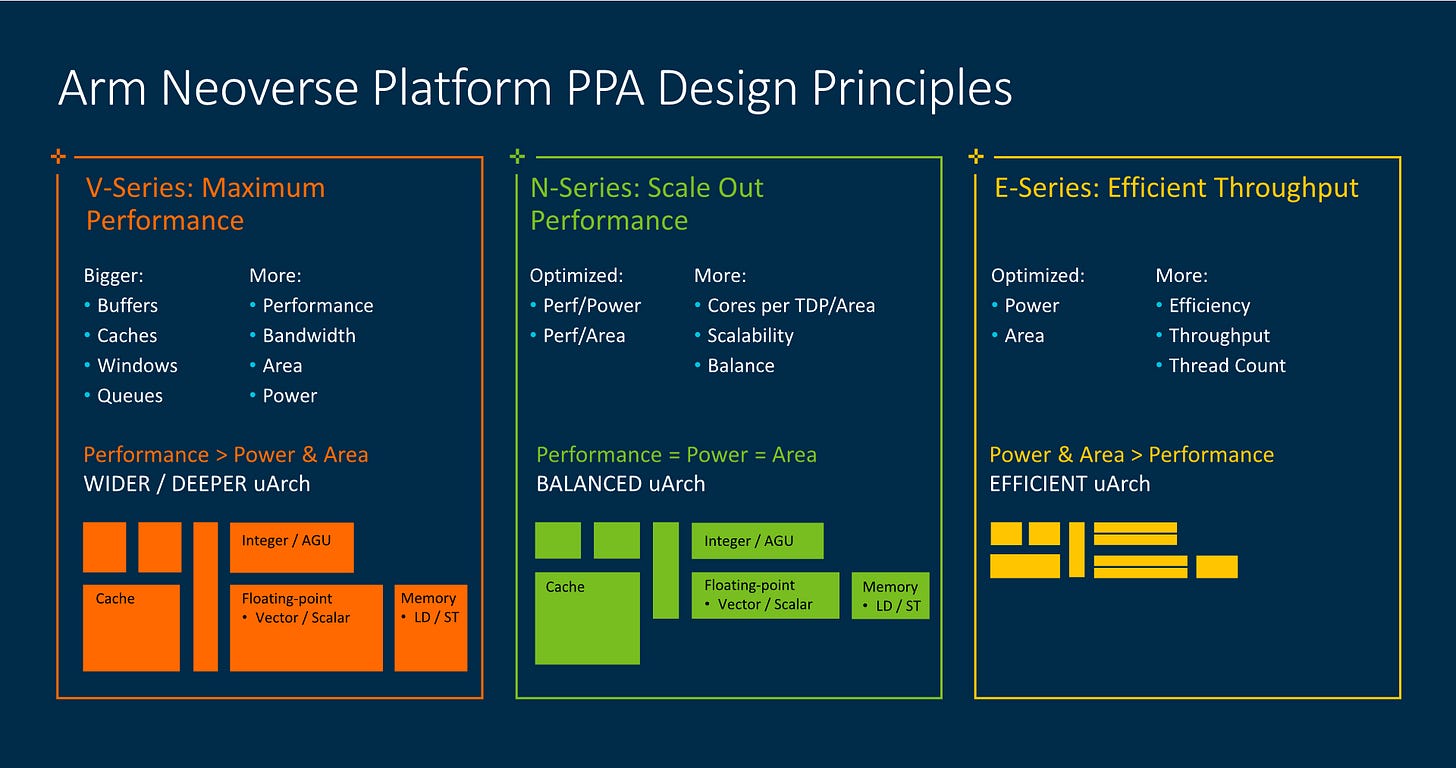

ARM Neoverse V1 & N2 Server CPUs (up to 192 cores!)

The data center has been a target for ARM for a while, and there’s no doubt that part of what Nvidia wants to do with the company is to accelerate these efforts (as well as plug their own IP into the vast ecosystem).

The company recently unveiled some new Neoverse designs, the N2 (a new version of the existing N1 design) and the V1 (a new performance line). Some pretty impressive stuff:

the Neoverse N2, and will be the effective product-positioning successor to the N1. This new CPU IP represents a 40% IPC uplift compared to the N1, however still maintains the same design philosophy of maximising performance within the lowest power and smallest area. (Source)

Techradar reports that the N2, built on a 5nm process, could deliver up to 192 cores at 350-watt TDP (thermal design power).

As for the new V1:

The Zeus microarchitecture in the form of the Neoverse V1 is essentially the infrastructure counterpart to what Arm has achieved in the mobile IP offering with the Hera Cortex-X1 CPU IP: A focus on maximum performance, with a lesser regard to power and area.

This means that the V1 has significantly larger caches, cores structures, using up more area and power to achieve unprecedented performance levels. [...]

achieving a ground-breaking +50 IPC boost compared to Neoverse N1 that we’re seeing in silicon today. The performance uplift potential here is tremendous, as this is merely a same-process ISO-frequency upgrade, and actual products based on the V1 will also in all likelihood also see additional performance gains thanks to increased frequencies through process node advancements.

If we take the conservatively clocked Graviton2 with its 2.5GHz N1 cores as a baseline, a theoretical 3GHz V1 chip would represent an 80% uplift in per-core single-threaded performance. Not only would such a performance uptick vastly exceed any current x86 competition in the server space in terms of per-core performance, it would be enough to match the current best high-performance desktop chips from AMD and Intel today (Though we have to remember it’ll compete against next-gen Zen3 Milan and Sapphire Rapids products). (Source)

That’s pretty badass. Of course, the competition isn’t standing still, but I’m glad to see that things are moving forward rapidly and the space isn’t stagnating.

The Arts & History

Classic Steve Jobs Photo

The photo was taken in Jobs’ Los Gatos, California living room by White House photographer Diana Walker in 1982.

Jobs explained: This was a very typical time. I was single. All you needed was a cup of tea, a light, and your stereo, you know, and that’s what I had.

I think it's a little sad that Jobs was very public in the early part of his life and very private in the latter part, because everybody has anchored on the part where he was worse as a person, and don’t know much about how he improved over time (not saying he was ever super mellow, but he grew a lot).

He seemed to come out so strong and fully formed on so many levels that we forget that he was a multi-millionaire, front-page celebrity, hyper-growth CEO in his 20s, and that most of us wouldn't have handled that great all the time either. Of course, he had an extreme personality to begin with, not excusing some of the things he did, etc. Just some useful context that is sometimes missing in the “yeah but Steve Jobs was an asshole” discussions.

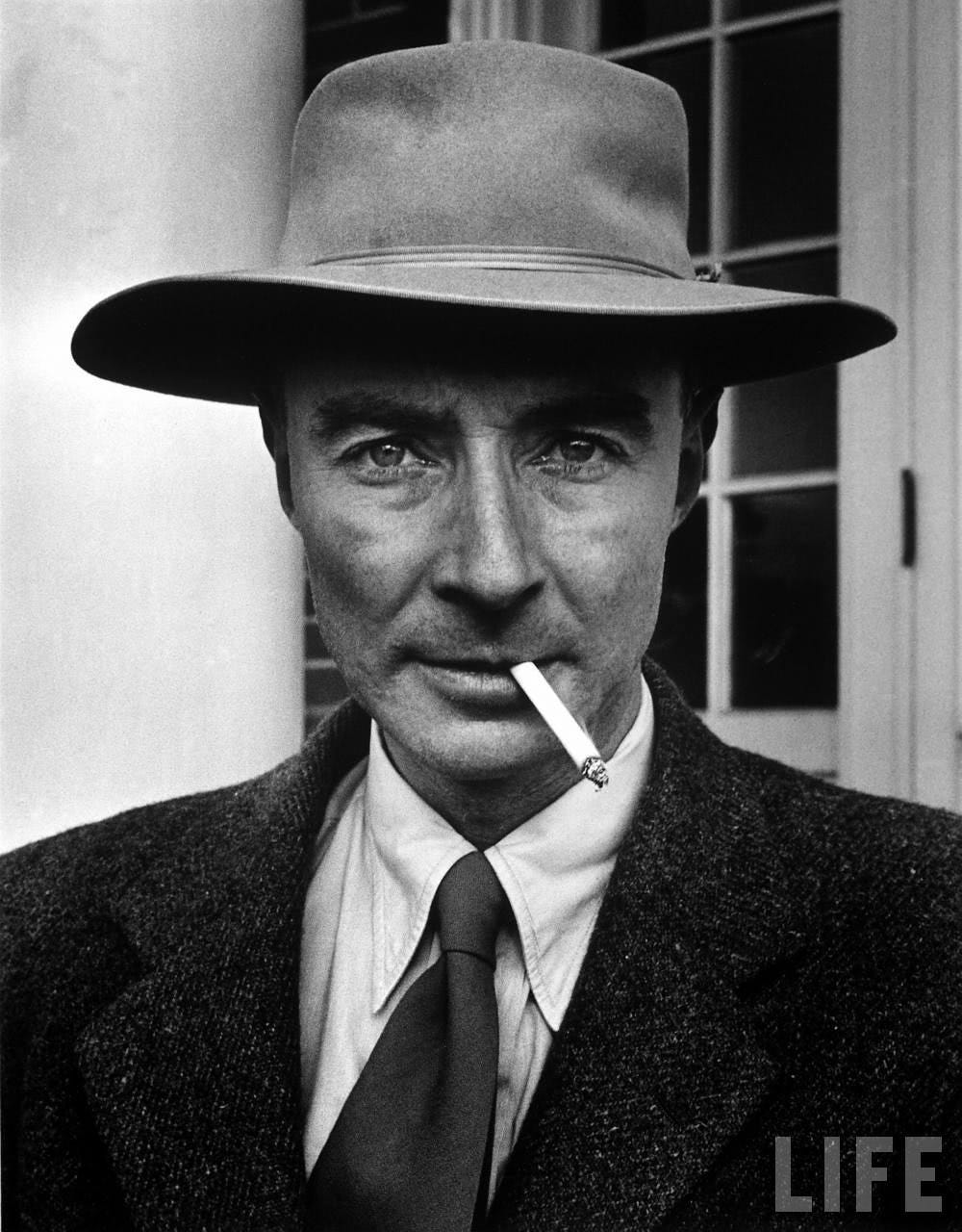

Good Portrait of J. Robert Oppenheimer

Julius Robert Oppenheimer was an American theoretical physicist and professor of physics at the University of California, Berkeley. Oppenheimer was the wartime head of the Los Alamos Laboratory and is among those who are credited with being the "father of the atomic bomb" for their role in the Manhattan Project, the World War II undertaking that developed the first nuclear weapons.

There’s a good biography of him called ‘American Prometheus’ by Kai Bird.

If you’ve never seen this short video of Oppenheimer describing his thoughts after they got the atomic bomb to work at a detonation test, it’s worth watching:

We knew the world would not be the same. A few people laughed, a few people cried. Most people were silent. I remembered the line from the Hindu scripture, the Bhagavad-Gita; Vishnu is trying to persuade the Prince that he should do his duty, and to impress him, takes on his multi-armed form and says, 'Now I am become Death, the destroyer of worlds.' I suppose we all thought that, one way or another.

There’s also, on the Manhattan project more generally, ‘The Making of the Atomic Bomb’ by Richard Rhodes. I haven’t read it yet, but I hear it’s quite good and have it sitting on my shelf, waiting for the right time…

‘Whisper of the Heart’ (1995, originally ‘Mimi wo sumaseba’)

After a hiatus, my family continued the Miyazaki project. We saw ‘Whisper of the Heart’ (1995). It was a lot more realistic, with less magical realism/fantasy elements than the other Miyazaki films we’ve seen so far, but it was so... PURE.

They wove an old John Denver song into it in a very clever way. Loved the musical elements. Felt a bit like a 14-year-old Japanese girl for a couple hours. Not for everyone, slow pace, but I really enjoyed it.

While reading up on the film, I learned the sad news that the director Yoshifumi Kondō (Miyazaki wrote it, but didn’t direct it) died at 47 of an aortic dissection and/or aneurysm a few years after this film was released. His last work seems to have been on ‘Princess Mononoke’ (1997) as an animation and character director.