353: Cloud CAPEX, Amazon Layoffs, Berkshire + TSMC, John Malone, Cultivated Meat, and Van Halen

"getting paid-for-inverse-performance"

Real choice is deeply recursive. What’s available changes what we want. —Rory Sutherland

🚨🕵️♀️🧠🚨 How to recognize ‘dark triad’ personality traits should be taught in schools (around middle school, maybe?):

Narcissism is characterized by grandiosity, pride, egotism, and a lack of empathy.

Machiavellianism is characterized by the manipulation and exploitation of others, an absence of morality, unemotional callousness, and a higher level of self-interest.

Psychopathy is characterized by continuous antisocial behavior, impulsivity, selfishness, callous and unemotional traits, and remorselessness.

It would save a lot of people a lot of pain… maybe even improve some countries’ politics.

🛀 What fools us about unlikely events is that while any *specific* unlikely thing is very unlikely to happen, there are *so many* different unlikely things that are possible that at any one moment, the odds that *any one of them* is happening are much higher than just looking at the probabilities for one specific event would lead you to believe.

That’s why we’ve been rolling through years and years of “once-in-a-century” events happening frequently.

📺 🐦 What happened with Youtube comments over the past few years?

They used to be the sewer of the internet, a well-understood punchline.

Creators had post-it notes on their monitors that said: “Don’t read the comments”.

Now, every time I look, they tend to be pretty good and informative, closer to Reddit comments. Maybe it’s just on the specific videos that I watch? ¯\_(ツ)_/¯

Elon Musk should be talking to the Youtube people about how they got better signal-to-noise, more civility, and fewer trolls…

📺 🤦♀️ Speaking of Youtube, that was the good…

Here’s the bad. They made a *really stupid* move recently: They removed the ability to sort videos by "newest to oldest" or "oldest to newest".

Now, only "popular" and "recent" exist. If you go to a channel with a thousand videos and want to see early ones, you have to scroll and scroll and scroll forever.

And if you were watching them in chronological order and you reload your browser, you have to scroll again and manually try to re-find where you were in the stream of hundreds of videos.

Incredibly user-hostile & unnecessary. How does this make the product better for anyone? Is this about saving on CDN infrastructure?

🎧 🔥 I really enjoyed this podcast conversation between my friend David Senra (📚🎙) and Chris Powers (🏢). The enthusiasm fires me up! It’s contagious:

💚 🥃 🦕 A change is coming. It’s BIG! Soon…

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view, and resurfaces it within your existing workflows. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

🏦 💰 Liberty Capital 💳 💴

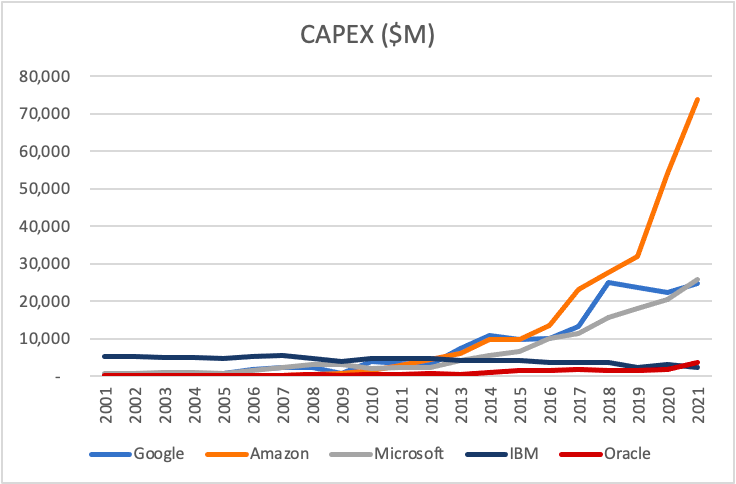

☁️☁️☁️ Cloud CAPEX ☁️☁️

"Oracle’s CAPEX uptick edges them past IBM, but the two of them are still battling to differentiate themselves from the x-axis"

Savage line 😬

Of course, not all of this capex is cloud-related, especially at Amazon…

If you look at it as a % of revenue, you can more clearly see Oracle’s spiking investment. It’s also interesting to see just how steadily Amazon and Microsoft — the two largest hyperscalers — have been increasing their share.

Source. h/t friend-of-the-show Tren Griffin (🦀)

🗜💸 Amazon’s Belt-Tightening, Part 2 🛒 🚚 📦📦📦📦

A follow-up to edition #351 where I wrote about Andy Jassy’s major cost-cutting review: some layoffs have been announced at the Seattle giant.

Amazon plans to lay off approximately 10,000 people in corporate and technology jobs starting as soon as this week, people with knowledge of the matter said, in what would be the largest job cuts in the company’s history.

The cuts will focus on Amazon’s devices organization, including the voice-assistant Alexa, as well as at its retail division and in human resources [...]

While it’s a large absolute number of people, and I deeply empathize with anyone going through a tough time because of this, on the biz analysis side, this isn’t a very large % compared to Amazon’s giant size.

The total number of layoffs remains fluid. But if it stays around 10,000, that would represent roughly 3 percent of Amazon’s corporate employees and less than 1 percent of its global work force of more than 1.5 million, which is primarily composed of hourly workers.

Amazon froze hiring in several smaller teams in September. In October, it stopped filling more than 10,000 open roles in its core retail business. Two weeks ago, it froze corporate hiring across the company, including its cloud computing division, for the next few months.

The layoffs in combination with the freezes do show that the company is serious about cutting costs and better matching its size to its actual growth (vs what was projected during the pandemic). They may be less visible than layoffs (sins of omission vs commission), by hiring freezes can affect just as many jobs that would otherwise have existed.

You know they’re really serious too when even AWS is getting hit…

As predicted, the Alexa division is getting a lot of scrutiny:

Alexa and related devices rocketed to a top company priority as Amazon raced to create the leading voice assistant, which leaders thought could succeed mobile phones as the next essential consumer interface. From 2017 to 2018, Amazon doubled staff on Alexa and Echo devices to 10,000 engineers. At one point, any engineer getting a job offer for other Amazon roles was supposed to also get an offer from Alexa.

The company has sold hundreds of millions of Alexa-enabled devices. But Amazon has said the products are often low margin and other potential revenue sources such as voice shopping have not caught on.

In 2018, Echo and Alexa lost about $5 billion, said a person with knowledge of the finances. (Source)

That’s a big hole, even for Amazon.

I won’t repeat what I wrote in #351 about Alexa, but it sounds like the once-expected massive opportunity isn’t there, but it could remain a very nice business with less grandiose ambitions and a smaller footprint.

Berkshire buys $4.1bn of TSMC 🇹🇼 🤔

It’s 13F season, and one of the interesting revelations was a new 60-million share position in TSMC at Berkshire, worth about $4.1bn.

My first thought was that this had to be a Todd and/or Ted position, but at that size, it’s borderline for them and makes me wonder if maybe they haven’t been talking with Buffett about it.

If the size keeps growing and it gets much bigger, that would improve my confidence that this is what’s going on, but at 4.1bn it remains within the realm of the possible as a T&T position (the size of their assets under management has been growing over time, and maybe at a time when the market is very volatile and there are more opportunities, they’ve been handed a few extra billions to deploy).

Of course, if Buffett was involved, I seriously doubt that the technical aspects of TSMC are within his circle of competence. But if you squint hard enough, there are some parallels with his purchase of Apple. Hear me out!

Of course, Apple is pretty different from TSMC (reminder: total speculation, I think it’s more likely T&T), but even at Apple there are also lots of technical aspects that are outside his circle and it didn’t stop him (I don’t think he knows much about design, hardware, software..). He can understand the main drivers of success for the company and that’s what matters.

I think maybe the same could apply for TSMC.

Once you understand the high-level industry dynamics: secular demand for more chips, how capital-intensive the cutting edge is, how few companies have the expertise, skilled labor, and institutional knowledge; the bottlenecks in the supply chain to anyone wanting to compete (China doesn’t even have access to the leading edge supply chain anymore), etc.

Maybe at that level, Buffett could like that TSMC is a near-monopoly with dynamics that make it stronger over time and leave the details to others.

ie. The more scale it gets, the more it can re-invest in extremely expensive fabs. The more competitors fall behind, the less scale they have to build their own fabs...

Just a wild guess, I really don’t know ¯\_(ツ)_/¯

What’s going on with John Malone’s empire? 💸 📉

Friend-of-the-show and OG supporter (💚 🥃 🎩) Andrew Walker has a good post looking at the Liberty empire (as an aside, many may assume I picked the name “Liberty” because I was a Malone fan, but I chose it before I knew who the good Doctor even was, so it’s purely coincidental).

Here are some highlights:

Every single Liberty stock is less valuable than it was at this time last year. Obviously the market is down over that time period, but the majority of Liberty’s stocks have underperformed the index over the past year, with three of the stocks (Broadband, QRTEA, and LTRPA) dramatically underperforming.

And this isn’t just cherry picking a bad year; it’s now hard to find a single stock in Liberty’s portfolio that outperforms the index on a five year basis, and most dramatically underperform.

That’s a lot of underperformance over a pretty long time period, and I haven’t even included the “Liberty adjacent” stocks that don’t include Maffei like LBTYA, LILAK, and WBD (all of which have been just abject disasters).

😬

Andrew’s theory on what’s causing this?

John Malone was one of the greatest capital allocators / businessmen of all time, but he has done a terrible job in choosing successors. All of his successors sound smart and they know how to talk about creating long term wealth…. but they don’t know how to make money (well, they don’t know how to make money for shareholders; they’ve done just fine making money for themselves with their enormous pay packages!), and Malone’s too rich and too old to admit his mistake and fire his friends / successors, plus he’s maybe a little stuck in the legacy media world and doesn’t see the ball as clearly on how media is evolving.

Andrew then gives a bunch of examples to support his theory.

I generally agree with his take. You can only make excuses and say that you have to wait some more for it to be “long-term” before you run out of time and have to show results. These managers haven’t delivered, yet are some of the best-paid CEOs in the business, kind of getting paid-for-inverse-performance. 🙄

🧪🔬 Liberty Labs 🧬 🔭

🇨🇳 ‘U.S. blocks more than 1 gigawatt of solar shipments over Chinese slave labor concerns’ ☀️⛓

Can we all agree that slave labor and concentration camps are bad?

More than 1,000 shipments of solar energy components worth hundreds of millions of dollars have piled up at U.S. ports since June under a new law banning imports from China's Xinjiang region over concerns about slave labor, according to federal customs officials and industry sources.

One more danger of relying so much on solar power to try to clean up the grid is that most panels come from China, and a lot of them are cheap because of government support and slave labor.

You don’t want your energy system to be reliant on Putin’s gas *and* you don’t want your energy system to be reliant on Xi’s solar panels either. Both are bad ideas.

It would take years to build up large-scale solar production capacity in the West, which would likely make significantly more expensive panels than China (I wrote in edition #335 about why ‘levelized cost of energy’ (LCOE) is misleading and wind and solar are a lot more expensive than they seem).

Three industry sources with knowledge of the matter told Reuters the detained products include panels and polysilicon cells likely amounting to up to 1 gigawatt of capacity and primarily made by three Chinese manufacturers - Longi Green Energy Technology, Trina Solar and JinkoSolar Holding.

The whole supply chain seems to be kind of borked right now:

Solar installations in the United States slowed by 23% in the third quarter, and nearly 23 gigawatts of solar projects are delayed, largely due to an inability to obtain panels, according to the American Clean Power Association trade group. (Source)

😬

🥩🧫👩🔬 Cultivated Meat 101

Interesting piece by the co-founder of a meat-without-animals startup.

Some highlights:

Cultivated meat is the holy grail of meat alternatives, enabling the same taste, texture, and nutrition of conventional meat, because fundamentally it is real meat, just produced in a better way, without the negative impact on climate or animal welfare. [...]

Over time, biopharma learned how to grow the cells in high density suspension cultures to maximize the productivity of the process.

Cultivated meat can use essentially the same approach and technology to grow animal cells for food. However, the output of this process is just a bunch of individual cells, essentially meat paste. While those cells can have the fats and proteins that create the flavor of meat, they don’t have any structure. Making a steak requires those cells to arrange together to form muscle fibers and other tissues that have 3D structure [...]

That’s what makes it so hard!

You don’t just want the cells, you want what’s around them too. But every time you add one more element, you need even more elements to support that element, and complexity explodes away from you! 💥

many cultivated meat companies are trying to borrow the techniques of regenerative medicine to make 100% cultivated meat that could be sold at commodity prices. This often involves using 3D printing to deposit living cells precisely exactly onto some kind of scaffold where these cells can then differentiate into tissue. Unfortunately, there are some major challenges with this approach. First and foremost, 3D printing is slow and expensive. Secondly, animal cells will only attach to very specific substrates, or substrates coated in animal proteins like collagen. But making a scaffold out of recombinant collagen is very expensive. So is coating a plant-based scaffold with the recombinant animal proteins needed to get cells to attach.

Once those cells have managed to attach to a scaffold, they need to be kept alive while they are differentiating into tissues. This isn’t straightforward—cells need to be fed with a constant mix of appropriate cell culture media that includes sugar, amino acids, growth factors etc, and to be bathed in oxygen, or they will die. Unfortunately cell culture media can’t perfuse more than a couple of cells deep through a 3D block of tissue, which means that the scaffold needs to include vasculature (blood vessels) to enable the media to perfuse throughout the tissue. Needless to say, the technology to scale such a complicated process does not exist, not even in the context of regenerative medicine.

It’s very frustrating to me that the more I learn about this space, the harder it seems to actually pull off.

But it’s worth the work, because it’s such a desirable outcome — meat, without the ethical and environmental downsides of factory farming (clear-cutting the Amazon forest to graze cattle, etc).

What keeps my hope alive is that there are plenty of technologies that work and are affordable today that would’ve sounded just as crazy difficult if you had described them before we had found solutions.

I’m glad that so many companies are working on this. I hope they succeed quickly, because meat consumption is only going up (“the percentage of vegans and vegetarians in the US population hasn’t really changed since the 1970's (it’s around 5%”):

🎨 🎭 Liberty Studio 👩🎨 🎥

🎸 Innovation in Music: Eddie Van Halen explains how he discovered tapping 🎶

The video above should automatically start around 25 minutes in when Eddie gets up, grabs his guitar, and starts giving a history class on the invention of tapping (what existed before him and why he played around with the techniques).

When he says at the end that he was too poor to afford effects pedals, so he figured out every way to make all kinds of sounds with his guitar, it truly is a perfect example of “necessity is the mother of invention” *chef’s kiss* 🧑🏻🍳

Absolutely loving your content Liberty, would you be open to allowing us to share it with our 60k+ audience as well?

Did the Amazon layoff include AWS?