419: Big Tech IPOs, Cloudflare, Global Luxury, Heico + Wencor, Anthropic + Zoom, Undersea Volcanoes, and Zelda World Design

"Curiosity is like a muscle"

Reality is not always probable, or likely.

—Jorge Luis Borges

🎶🎵🎶📚📺🎬🕰️⏰⌚️Everyone is different, but I don’t think it’s too controversial to say that most people don’t do much exploration once they reach middle age.

People’s tastes largely get set between the ages of 12 and 25, and then it’s common for them to spend the rest of their lives mostly listening, watching, and reading the kind of things that they discovered when they were younger.

I don’t mean that they literally do zero exploration, but I suspect the balance is far from the amount that would lead to the most enjoyment of life and growth.

One way to think about it is that there’s passive and active exploration. 🗺️🧭

It’s the active kind that takes a big dive as people age. They still see new films when everyone is talking about them or there’s a big publicity campaign, and hear new music when it pops up on the radio or in a Spotify playlist, but things that aren’t being conveniently served on the conveyor belt of culture probably won’t be discovered.

The intensity of active discovery is also lower. It’s the difference between listening to a new album over and over again while lying on your bed with your eyes closed vs as background noise while doing something else.

If I had to guesstimate some numbers to illustrate, I’d say that for most people, an optimal exploration ratio may be around 30% — in other words, you spend about 70% of your time with things you know and love, and 30% trying new things — while for most people, actual exploration may be 5-10%.

“Your favorite thing is out there, you just haven’t found it yet.”(it’s my own line, but whenever something is in quotation marks, it has more weight, so why not ¯\_(ツ)_/¯ )

How can we become better at exploration?

The possibilities are endless, but here’s a trick that I find helpful: Arbitrary constraints.

It may seem counterintuitive, but it really works. In a world where everything is available at our fingertips, sometimes we need to limit ourselves — choice paralysis is real!

Turn it into a game with rules.

For example, spend 2 weeks only listening to music from the past 5 years. Or if your blind spot is that you only listen to recent music, reverse it and only listen to music made between 1970-1975. Or only Baroque or Romantic era classical, or only Bebop jazz. Only music from German or Brazilian artists. Only acoustic music, or only electronic. Try a genre you’ve never tried before and don’t give up until you find at least 3 artists that you enjoy (every genre contains many sub-genres and lots of diversity — don’t give up too quickly).

I’m using music as an example, but this can apply to films, books, painters, whatever.

I’ll leave you with an important thing to remember:

Curiosity is like a muscle: the more you exercise it, the stronger it becomes! It’s also contagious, so if you hang around very curious people, you may become more curious yourself!

🚨🗣️🗣️🎙️ In case you missed it last week, I have a new podcast:

My goal with this one is to help you get to know Jim better, from his origin story to his early career in finance and quantitative investing, the writing of his influential book, all the way to the seeds of the idea that became O’Shaughnessy Ventures (OSV) (where I work) and how we see the past and future of the Media space.

I hope you will enjoy our conversation and learn a few things even if you’ve been following Jim for years. If this is your introduction to him, I hope you’ll come out on the other side feeling like you have a good understanding of who he is, what his North Star is, and what he’s building. 🏗️🛠️

🐦 Musk hired a new CEO for Twitter, but she will "focus primarily on business operations" while Musk will "focus on product design & new technology."

So she's freeing up time so he can make even more product/design/platform decisions.

We're getting MORE of him, not less... 🤦♀️

💚 🥃 🐇 This is the free edition of Liberty’s Highlights with 17,900+ subscribers.

You can get 1-2 extra editions/week full of juicy stuff + access to the private Discord 🗣🗣🗣 community by becoming a paid supporter (it’s quick & easy).

🏦 💰 Liberty Capital 💳 💴

📈 Big Tech Returns since IPO 💰

There aren’t that many stock charts that make Google look like a flat line…

If Facebook/Meta was included, it probably wouldn’t be very visible since it went public in 2012 and the stock is ‘only’ up 525% since then.

It goes without saying, but this just shows what happened — it’s not pretending to be a “fair” comparison since each company IPO’ed at different times and at different stages of development. It’s just a snapshot of history, and there’s nothing fair about history (cue The Princess Bride’s grandpa: Who says life is fair, where is that written? 👸🏼).

🤖🦍🇪🇺 Is the rise of Big Tech and AI reversing the decentralizing effects of PCs and the Internet? 🕸️👩💻

Ben Thompson writes (💚 🥃 🎩):

PCs granted incredible freedom and capabilities to individuals, but the Internet’s devolvement into Aggregator-mediated networks gave governments distinct chokepoints on which to push for control of distribution, whether that be explicit as in China or implicit as in much of the West. AI, meanwhile, to the extent it is centralized in the major players, means there are direct loci of control on the actual generation of information.

In theory, this is where a robust open-source AI ecosystem could help counter-balance this dynamic, but this won’t be without hurdles… ⬇️

The EU is pressing hard on the regulatory button these days:

In a bold stroke, the EU’s amended AI Act would ban American companies such as OpenAI, Amazon, Google, and IBM from providing API access to generative AI models. The amended act, voted out of committee on Thursday, would sanction American open-source developers and software distributors, such as GitHub, if unlicensed generative models became available in Europe. While the act includes open source exceptions for traditional machine learning models, it expressly forbids safe-harbor provisions for open source generative systems.

Any model made available in the EU, without first passing extensive, and expensive, licensing, would subject companies to massive fines of the greater of €20,000,000 or 4% of worldwide revenue. Opensource developers, and hosting services such as GitHub – as importers – would be liable for making unlicensed models available. [...]

If enacted, enforcement would be out of the hands of EU member states. Under the AI Act, third parties could sue national governments to compel fines. The act has extraterritorial jurisdiction. A European government could be compelled by third parties to seek conflict with American developers and businesses.

Here are a few examples of what will be looked at by regulators (this is just a sample, there’s way more):

You have to register your “high-risk” AI project or foundational model with the government. Projects will be required to register the anticipated functionality of their systems. Systems that exceed this functionality may be subject to recall.

Expensive Risk Testing Required. Apparently, the various EU states will carry out “third party” assessments in each country, on a sliding scale of fees depending on the size of the applying company.

Risks Very Vaguely Defined: The list of risks includes risks to such things as the environment, democracy, and the rule of law. What’s a risk to democracy? Could this act itself be a risk to democracy? (Source)

In a similar way that the UK’s regulators gave a victory to the biggest player (Sony) in the name of competition, EU regulators may entrench the Big Tech incumbents in the name of privacy and transparency.

Only Big Tech will have the resources to comply with all these regulations — it’ll severely hinder innovation in the EU *and* likely outside of it since it’s hard to imagine competing with Big Tech without access to a global scale, so you end up with a most-restrictive-common-denominator type of situation when it comes to regulation.

🛫 Heico acquires Wencor, its biggest acquisition ever ($2.05 billion) 🛬 ⚙️

What they do:

Founded in 1955, Wencor is a large commercial and military aircraft aftermarket company offering factory-new FAA-approved aircraft replacement parts, value-added distribution of high-use commercial & military aftermarket parts and aircraft & engine accessory component repair and overhaul services.

Wencor is based in Peachtree City, GA and provides its parts and services internationally, employing approximately 1,000 team members in 19 facilities around the United States. HEICO currently employs approximately 9,000 Team Members at over 100 facilities worldwide.

Price paid:

HEICO anticipates that Wencor will generate approximately $724 million and $153 million in adjusted proforma revenues and EBITDA, respectively, in calendar year 2023. Further, HEICO expects to receive estimated tax benefits of approximately $75 million that will be realized through fiscal year 2038. Including the estimated tax benefits and without accounting for any expected synergies, HEICO anticipates that its effective purchase price multiple will be approximately 12.9 times Wencor's projected proforma adjusted EBITDA.

That’s about 21% EBITDA margins. Heico’s FSG’s operating margins have been in that range lately (22.5% last Q).

Regarding leverage: “Following the acquisition's completion, HEICO anticipates its net debt-to-EBITDA leverage ratio will be below 3:1 and will return to its historical levels within roughly a year to eighteen months after the acquisition” (no turning into Transdigm here!)

Given that Heico A shares trade around 32x EBITDA, even at 12.9x it’s a nice arb.

But mostly, it’s a whole different beast from most of their acquisitions, and it has some strategic benefits since Wencor has been competing in the PMA space for 35 years and was basically their biggest scale competitor there.

Now I don’t know if this acquisition will go well — time will tell — but they certainly have a good track record of being disciplined and tend to keep business units pretty decentralized, so there shouldn’t be too much integration risk.

🇨🇦 Canada’s population to hit 40 million soon 🦫🦫🦫

Based on the ‘Canada Real-Time Population Clock’, the country is just a few weeks away from hitting 40 million people.

Canada has increased its immigration levels and is increasing its population by 2.5% each year.

If Canada sustains higher immigration levels then they will pass Spain, South Korea, Argentina over the ten years. Canada will pass 50 million people in that time.

I really need to update. I’ve thought of our population as 30m-something for so long…

It reminds me of when we went from 1999 to 2000 and it took a while to get used to writing years starting with a new number. 🗓️

🏦 Unpredictability: Financing & Technological Impact 💻

Some good highlights from friend-of-the-show and Extra-Deluxe supporter Byrne Hobart (💚💚💚💚💚 🥃):

The more unpredictable a company's outcome, the more predictable its financing: equity is what makes sense when there's a wide range of possibilities that fall anywhere from crazy success to abject failure. It’s a rough guideline that’s easy to back into. The wider the range of possible outcomes, the less probable it is that these outcomes will fall in the exact range where making a loan to the company was a good deal, but owning equity instead wouldn't have been a better deal.

That’s a good way to compress the idea! Here’s a similar framework, but for technological impact:

The more general-purpose a technology is, the harder it is to figure out where value will accrue. In the 1920s, electric utilities were a very hot category of growth stocks, which made sense given that electricity was such an obviously good secular bet. But by the 1960s, the companies earning the most money from ubiquitous electrification weren't utilities, but were big industrials, whose operations and financing were revolutionized by electrification.

🤖🤝📹 Zoom investing in Anthropic, integrating Claude AI in its products

The headline pretty much says it all.

It seems like anyone who isn’t Big Tech needs to figure out how they’re going to position themselves in the AI world, either by partnering with one of the AI labs or going with a more open-source approach.

I’ll particularly be interested to see what Apple does on that front 🍎 Open-source would be a good fit for them as they could differentiate with the silicon and UX… We may learn more soon at WWDC 🤔

🌥️ Cloudflare Overview & Update (Q1 and Investor Day)

Friend-of-the-show Peter Offringa (💿) has a pretty detailed piece on Cloudflare. If you’re interested in the company and are curious about both its model generally, but also what has been going on recently, it’s a great place to start.

Here’s a highlight:

Cloudflare’s design tenets can be summarized as follows:

Owned and Operated. Cloudflare built and manages data centers in proximity to 285+ cities around the globe. This puts a data center within 50ms of 95% of the world’s population. They have also assembled a global network with over 12,000 network interconnects with cloud providers, ISPs and enterprises. While this required significant CapEx and technology investment, Cloudflare is decoupled from reliance on other parties for their infrastructure. They incur no incremental cost to launch new services on their existing network (like Zero Trust).

Run Everywhere. Every one of Cloudflare’s products runs on every server on every data center in parallel. This ensures that critical functionality is as close to the end user as possible and allows any excess capacity to be leveraged across the full network. […]

Composability. Because Cloudflare chose to build a developer runtime (Workers) directly into their network, all services can be customized and even combined with other products. […]

Free Tier. While Cloudflare has over 168k paid customers, they offer services to millions of free users. […]

I also liked these graphs showing the number of products used by customers and the revenue contribution:

I think it shows how powerful cross-selling and distribution is in the space (Microsoft is the kind of this).

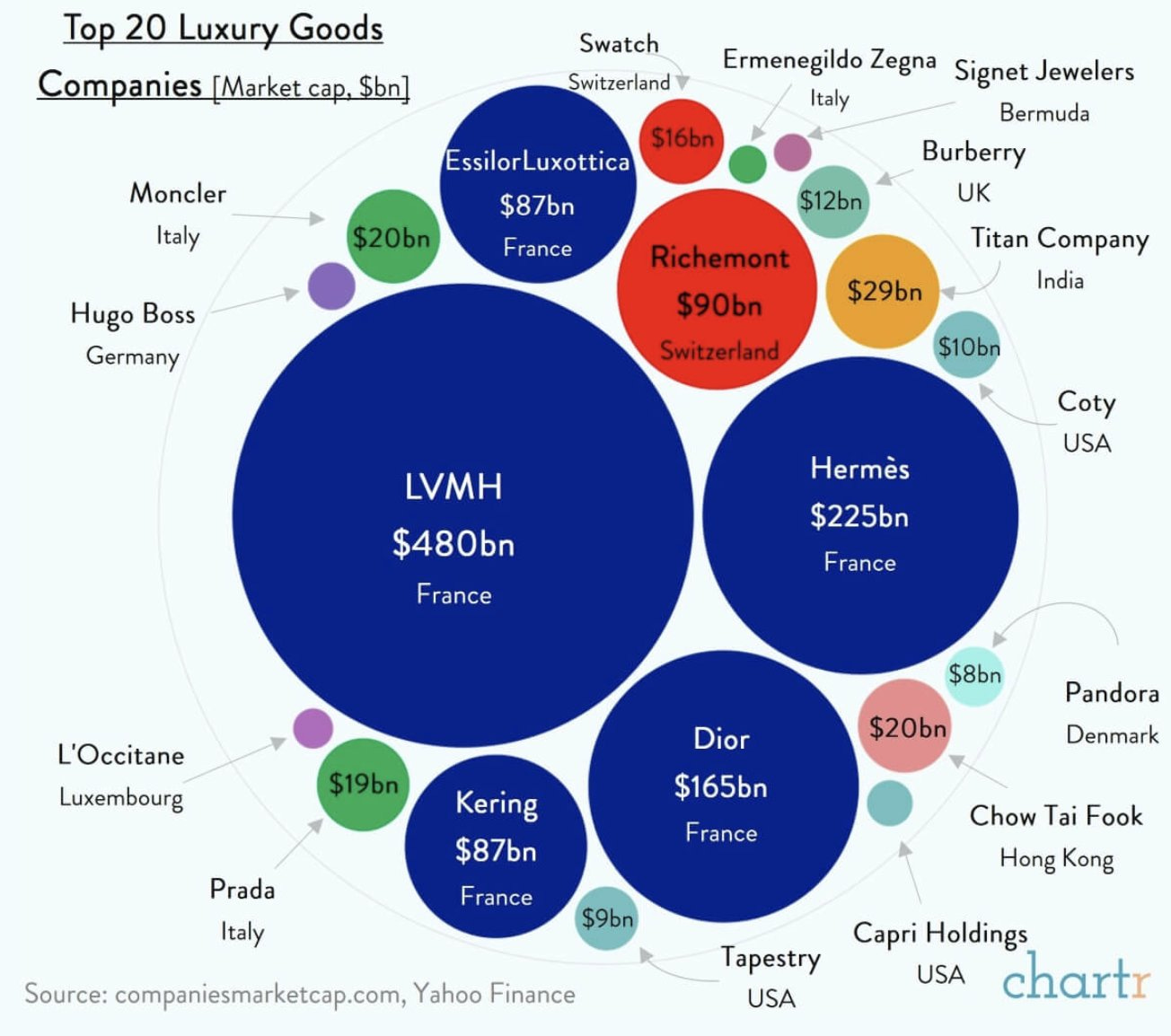

🇫🇷 The global luxury market (in blue are companies from France): 💄👜🍷🍾

Via Chartr

🧪🔬 Liberty Labs 🧬 🔭

🌊🌋🌊 Oceanographers have found almost 20,000 previously-undiscovered underwater volcanoes

SpaceWater, the final frontier:

With only one-quarter of the sea floor mapped with sonar, it is impossible to know how many seamounts exist. But radar satellites that measure ocean height can also find them, by looking for subtle signs of seawater mounding above a hidden seamount, tugged by its gravity.

A 2011 census using the method found more than 24,000. High-resolution radar data have now added more than 19,000 new ones. The vast majority—more than 27,000—remain uncharted by sonar.

“It’s just mind boggling,” says David Sandwell, a marine geophysicist at the Scripps Institution of Oceanography, who helped lead the work.

🏥🥼🚰 From ˜1 million to 15 cases of Guinea Worm Diseases worldwide in 30 years 🌍

In the late 1980s, there were near a million new cases of guinea worm disease recorded worldwide. In 2021, there were only 15.

Guinea worm disease is a painful and debilitating disease that used to be common in Asia, the Middle East, and many countries in Africa.

It’s now close to being eradicated worldwide. This success is thanks to an eradication program that has focused on water treatment and filtration, public education, and providing safe sources of drinking water to reduce its spread. [...]

Almost all of the 15 cases were recorded in Chad. (Source)

Let’s finish the job! 🪱

h/t Alec Stapp

🤖 ‘Context window sizes are the modern day RAM’

The line above is by friend-of-the-show Rohit Krishnan (check out his excellent newsletter Strange Loop Canon).

When I read it, it reminded me of the classic "640K ought to be enough for anybody." (which, btw, Bill Gates denies saying and is probably apocryphal)

When will we have our"640k tokens ought to be enough for anybody" moment?

Currently, Anthropic’s LLM seems to have context up to 100k tokens. I’m sure that number will keep going up until we can trivially upload whole libraries as context for a prompt. The question is: When do we reach diminishing returns?

🏋️♂️ 👩🔬 Andrew Huberman interviews Dr. Layne Norton (nutrition, protein metabolism, muscle gain, fat loss, and the science of energy utilization and balance)

This was a very informative one.

The title says most of what you need to know, but they go in a fair amount of depth and keep it very nuanced and based on known science:

Similar to investing, where concepts can be simple but difficult to consistently execute, refreshing the basics can be helpful in maintaining motivation and staying on track with nutrition and exercise.

🎨 🎭 Liberty Studio 👩🎨 🎥

🎮 🗺️ How Nintendo designed Zelda’s open world so it both favors exploration and guides players to points of interest

If you want a review of the new Zelda that just came out, this is the best one I found.

🎼 Hans Zimmer? 🎹

What I'd like to see is a documentary on how Hans Zimmer works (along with his collaborators, I know he doesn't do everything himself).

Feels like he's a one-man industry, and it's hard to scale as an artist. There must be a good story there.

Has anyone seen anything good?

Alternatively, I would love to see something equivalent about John Williams, the OG household name film composer...?

Regarding IPOs: might be of interest. Cheers!