45: My Thoughts on Apple's Search Engine vs Google, Adyen's Oops, 6 Months at Shopify, Starlink, Microsoft Azure, Stripe, My Thoughts on the Upgrade Treadmill

"This is what happens, Larry!"

“The supreme quality for leadership is unquestionably integrity. Without it, no real success is possible, no matter whether it is on a section gang, a football field, in an army, or in an office.” —Dwight Eisenhower

I recently upgraded my 3-year-old iPhone X to an iPhone 12 Pro and my 12-year-old 32” Samsung LCD TV to a 55” LG OLED (the CX, $300 CAD off on Prime Day!).

Here’s my take on upgrade cycles: If you upgrade too often, you rob yourself of the positive experience of the really big upgrade jump in quality.

Our perception of quality is relative, we’re mostly comparing to something else, so it feels much better to go from a 10 year old car to a new one than get a new lease every 2 years even if to some it seems like in the latter scenario you “have more quality in your life so it should feel better”.

You can notice it a lot with journalists who’s job it is to review something. They always complain that things haven’t improved enough because they have last year’s model, or spend all day test-driving high-end cars, or whatever. They often end up focusing on things that nobody else cares much about because their points of comparison/reference are different from a regular person’s. That’s why we hear about the feel of the plastics on the dashboard and panel gaps, etc.

A tech journalist comparing this year’s iPhone to last year’s will complain about the 15-20% improvement in features X, Y, and Z, while the regular person who upgrades every 3 years will be impressed by the cumulative 50-70% improvement in these things.

So even if I have the money to upgrade a bunch of stuff more frequently, I’d rather wait and really enjoy the experience, rather than spend more money for less enjoyment on the blasé treadmill…

💡 I’ve noticed that on days when the VIX is higher, the open rate for this newsletter is lower. I guess everyone’s busy making/losing money…

→ If you’re a US citizen, please vote. I’m not kidding. ←

Investing & Business

Apple’s Search Engine (👀 Google)

There’s been lots of stories swirling around Apple going into search lately, no doubt caused by speculation around the U.S. government’s anti-trust case against Google, which may end up actually helping the search giant by removing their ability to pay Apple a gigantic stream of cash to be the default search provider on iOS devices (estimates of $8bn-12bn/year, growing over time), and because in iOS 14 Apple is using its own results for some of the Siri searches (including the typed ones, when you pull down from the home screen).

So while the first order effect may be that Apple would lose on that pure-margin revenue and Google would keep that money, the second order effect may be to give a big enough push to Apple to get really serious about bringing more search in-house and be less dependent on Google.

I’ve seen and thought about all kinds of angles on this: Oh, Apple is terrible at web services, they’ll never be able to compete with Google. They should buy DuckDuckGo (and rebrand it?), they should build something on top of Bing’s API (which is kind of what DuckDuckGo does), they should partner with Microsoft more directly, etc.

So here’s a few of my thoughts about all this:

Search quality is in large part based on how much data you have, both what you’ve crawled and how fresh that index is, and how many users you have doing unique searches, clicking on results, etc. This is why Bing has basically paid users to use it, trying to improve through higher usage. With 1.5 billion devices in use, Apple definitely has enough volume. They’ve been crawling the web for a while with AppleBot, and have the resources to deal with this amount of data.

Two and a half years ago, Apple hired Google’s head of search and AI, John Giannandrea. They’ve no doubt been hiring a lot more people with experience in the field too, even if not quite as high-profile.

There may still be issues with Apple’s culture and how it’s not geared for this kind of web service project, but they certainly have people who know how to do it, and if they succeed in creating a kind of separate org within the large company, with its own different culture and incentives, it could be effective.

The idea that to compete, Apple has to make a search engine that is as good or better than Google (to win people over) isn’t quite correct, IMO. I don’t think it’s that binary.

The power of defaults is obviously very important — it’s why Google is sending cargo ships full of cash to Apple in the first place — and for the vast majority of searches, you don’t need to be the best. Google likes to highlight all the complex, unique searches that it gets, but the majority of them are basically just navigation (name of bank, name of website, name of movie, wikipedia fact, name of person, recipe, illness symptoms, travel to city, photo of XYZ, etc).

The quality of the search results matter, especially if you’re doing real complex research and not just basically using the search engine as your bookmark folder, but the user experience (UX) matters too. Google search results used to be spartan clean, and now you often have a page of ads before real results. Just providing results without 3-5 ads does help with the UX, and it will matter to some too if Apple search has a stronger privacy stance.

In short, Apple Search may never be able to go head-to-head with Google on that top X% of most obscure, complex, unique searches. But there’s an enormous mass of searches where it could be competitive, especially if it’s the default, has a cleaner UX, has Apple’s nice UI design touches (I’m sure they’d have interesting ideas on how to do things — and while Google has to balance between doing what’s best for users and what’s best for advertisers, Apple could more exclusively think about what’s best for users, at least at first), is more deeply integrated into the company’s OSes, and is more aligned with the user when it comes to privacy.

So it’s not like everybody’s going to switch from Google to Apple Search. But if they can get a critical mass from their large user base and then bootstrap that into a “good enough” product, it could capture a decent chunk of searches.

And remember, Google doesn’t make most of its money on obscure, esoteric searches. They’ve show a ton of ads on basic stuff like cars and travel and food and basic shopping items. GOOG 0.00%↑ AAPL 0.00%↑

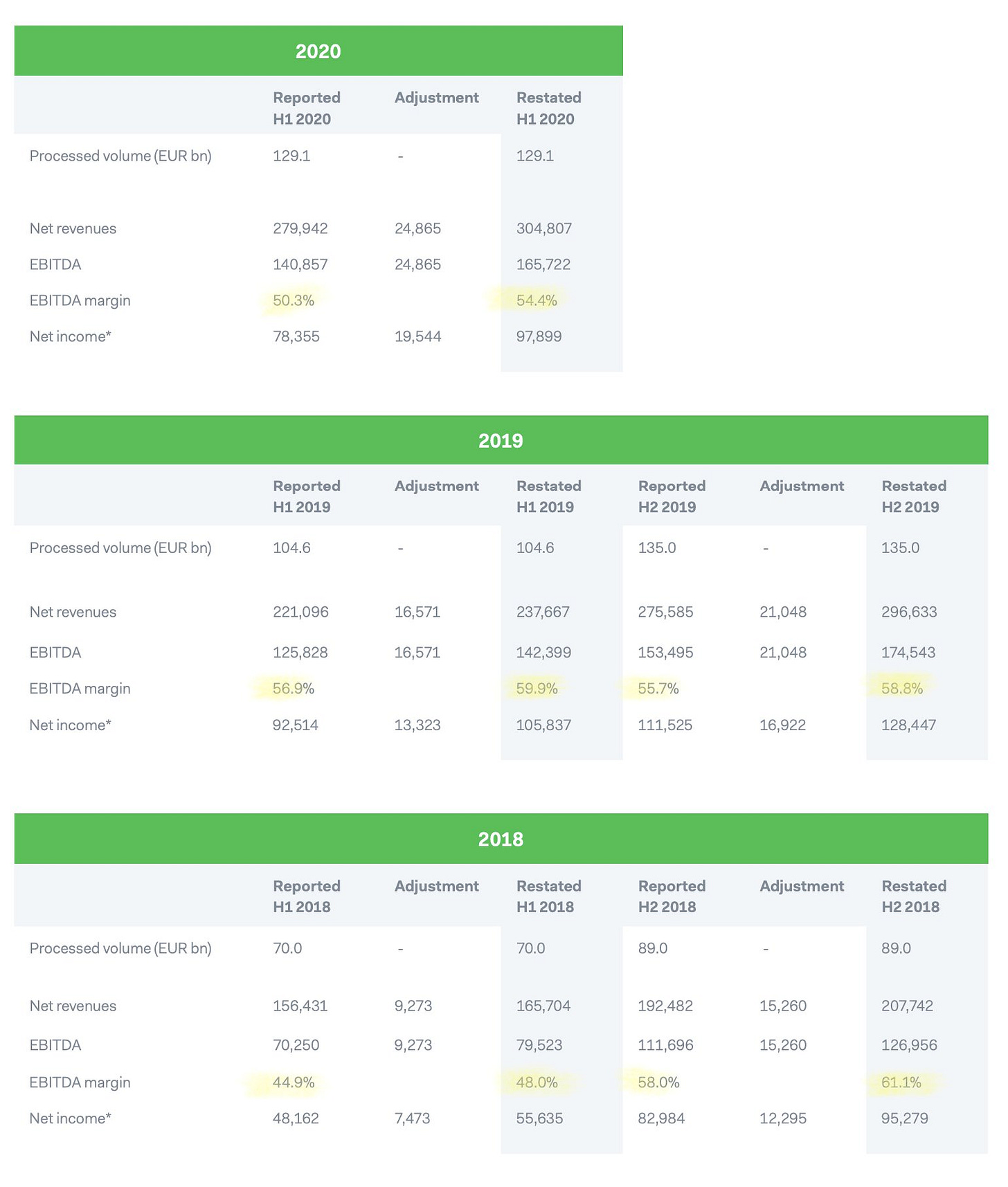

Adyen Discovers It’s Been Understating Revenue & EBITDA

It’s interesting how accounting errors are usually found to have made a company look better than it truly was. But not this time:

We have identified an accounting error that has resulted in an understatement of our net revenue, EBITDA, and EBITDA margin figures and the related impact on tax and net income since 2018. [...]

These duplicate bookings were solely accounting related and did not affect any cash positions, payouts from financial institutions, or payouts and reporting to our merchants. As business processes were not affected, the above-mentioned bookings were not identified right away. All parties were charged and paid the correct amounts. Once identified, we resolved the accounting treatment of these costs.

As the above did not impact the fundamentals of the business, nor the associated trends we have previously explained, we still have the same long-term view of the business.

Oopsie Daisy!

So what are we talking about, here? 0.2% or something, right? They just casually mention it in the middle of a release about trading volumes, it can’t be too big… Oh wait:

So in 2019, their EBITDA margins wasn’t ˜56%, it was actually much closer to 60%… And in the first half of 2020, it goes from 50.3% → 54.4%. That’s not immaterial…

Obviously you’d rather have a company with pristine accounting and no mistakes, but at least in this case, it seems more likely to be an honest mistake than if we found out that their margins were actually 4% lower. Plus the fact that management generally seems to be high-quality.

But who really knows what goes on inside a company if you don’t have access?

Microsoft’s Azure Databases

Satya Nadella: Nearly one million SQL databases have migrated to Azure to date, and we process more than 1.4 trillion customer queries each day. The number of petabyte-scale workloads running on Azure has more than doubled year over year.

Migrated from where, I wonder... Eh, Larry? MSFT 0.00%↑

Talent Buffer at Big Tech

The excellent Byrne Hobart, writing about conglomerates:

Conglomerates are relevant today because some big tech companies look suspiciously similar to conglomerates, and for antitrust purposes would like to look like them. But they’re organic conglomerates: Google didn’t buy its way into self-driving cars, fiber, and immortality research. It built that. Most of its acquisitions have been more related to the core business. These side businesses might be related to another part of the big tech model. After a certain point, every major tech company needs to have a comparative advantage at overhiring talent, just in case it needs to deploy a thousand engineers to some pressing new problem. So they’re generally overstaffed, and need to give their people something to do.

Alex Danco: Lessons from 6 Months at Shopify

Alex Danco joined Shopify 6 months ago and wrote about some of the things he learned and his experience so far:

There have been several profound consequences of Shopify being a Canadian company, tucked out of the way in Ottawa (and then Montreal, Toronto, Waterloo…) and not in the Silicon Valley limelight. The most important consequences have to do with people.

The first impact is on employee retention. Shopify never competed in the never-ending war for Silicon Valley product and engineering talent, where average employee tenure at some companies is under two years (!) and employees work for a portfolio of high-growth companies over their best years, not just commit to one. Instead, the common complaint about Shopify up here in Canada is that all the good tech talent comes to work here, and then never leaves. There’s a virtuous feedback cycle at work: since Shopify can count on you staying for longer than your average tech company can, they can invest more into you when you start. Reciprocally, having everyone get more up-front investment and more context and tenure means that you can make a lot tactical choices in how you work that people really like, and makes them stick around.

Read the whole thing here. SHOP 0.00%↑

Interview: Turner Novak

I enjoyed this interview of Turner Novak by Ryan Reeves (it’s from July, 2020).

how Turner broke into venture capital

what he looks for in early-stage investments

where he thinks his edge is an example of making a VC investment

his analysis on Snapchat

The Snap analysis certainly has paid off since.

You can subscribe to Turner’s newsletter here, and if you haven’t, you gotta check out his hilarious VC Tiktok persona (trust me on that one).

Stripe Makes it Easy to Fund Carbon Removal

Interesting initiative by Stripe, trying to make it very easy for businesses to voluntarily support carbon removal (not just reduction in emissions, but actual removal/sequestration of carbon out of the atmosphere):

With Stripe Climate, you can direct a fraction of your revenue to help scale emerging carbon removal technologies in just a few clicks. Join a growing group of ambitious businesses changing the course of carbon removal. [...]

We direct 100% of your contribution to carbon removal. Our scientific advisors help maximize the long-term impact. Stripe buys carbon removal from the exact same projects. [...]

From the customer’s point of view, when you pay via Stripe and this is enabled, it shows right below the pay button something like: “XYZ will contribute 1% of your purchase to remove CO₂ from the atmosphere.”

Some of the businesses that have joined so far are Substack, Flexport (I’ve always enjoyed interviews with Ryan Petersen, the CEO), Panic (a software dev), and Flipcause.

Some of the projects that they use for sequestration are things like:

“CarbonCure injects CO₂ into fresh concrete, where it mineralizes and is permanently stored.”

Climeworks uses renewable geothermal energy and waste heat to capture CO₂ directly from the air, concentrate it, and permanently sequester it underground in basaltic rock formations with Carbfix.

Charm Industrial has created a novel process for preparing and injecting bio-oil into geologic storage. Bio-oil is produced from biomass and maintains much of the carbon that was captured naturally by the plants. By injecting it into secure geologic storage, they’re making the carbon storage permanent.

What’s most interesting about this is that it provides funding to younger technology at a point in their development where extra money makes a big difference. This is different from spending the money on solar farms or reforestation. You don’t get much movement on the learning curve by doing that, even if it does help reduce pollution.

Interview: Joe Frankenfield from Saga Partners

Good interview by Tobias Carlisle. They cover Joe’s investment style and go in more depth into The Trade Desk and Carvana.

Joe: I hate the being categorized as a growth investor versus a value investor. I say, I’m a value investor, because I’m trying to earn an attractive return in any asset. You may look at our portfolio and, yes, the companies we own are high compounders today, but that’s because that’s where we find the opportunities today. I tell investors our portfolio, I mean, I would be happy to own a no-growth company if I found it an attractive rate of return.

Check it out:

Science & Technology

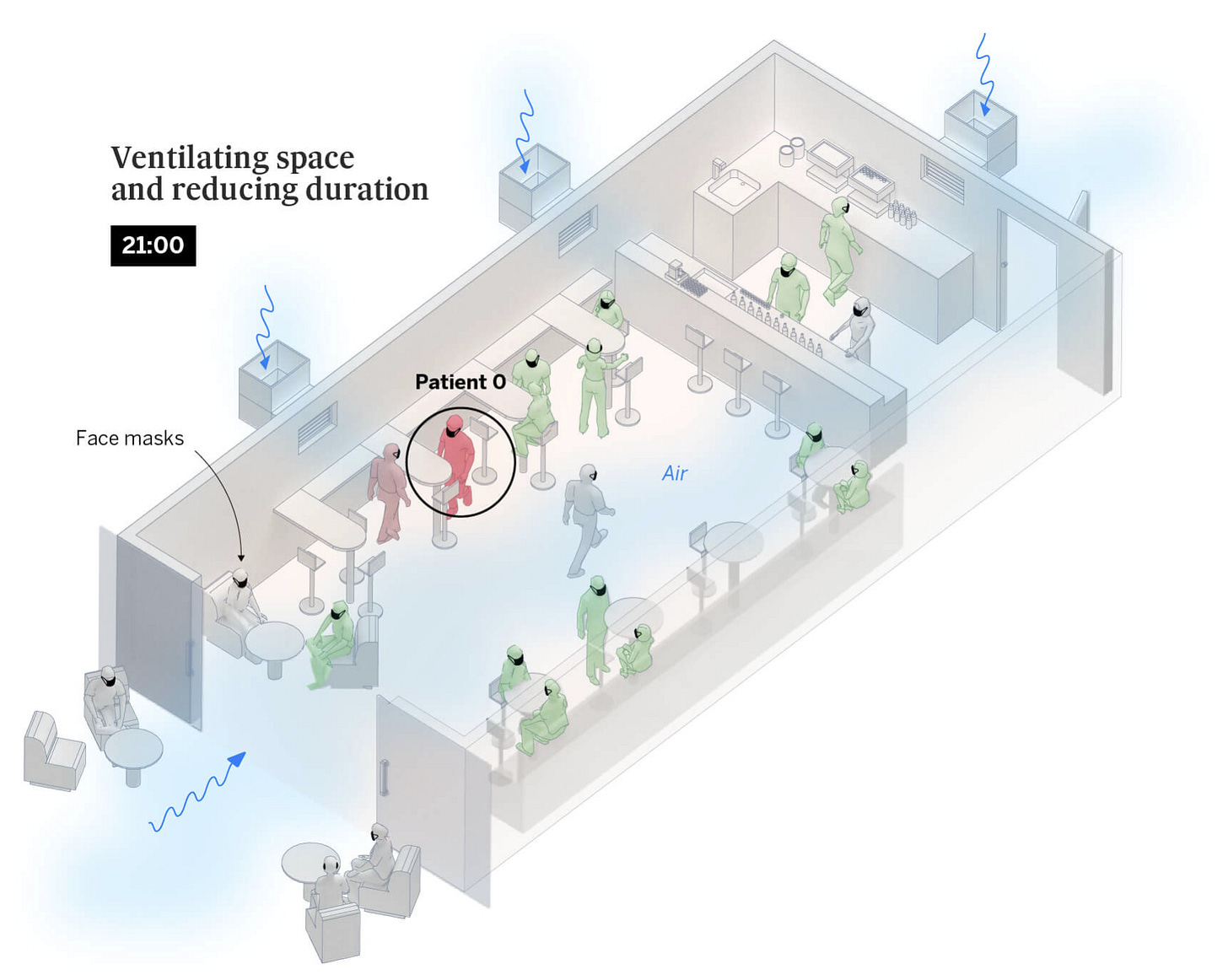

Better Understanding Sars-CoV-2 Aerosols

El Pais (from Spain, but they have an English version of the piece) has a great visualization showing how aerosols behave in various situations, and how much of a difference time of exposure and ventilation makes.

Masks are effective for short exposures and a no-brainer generally, but for longer ones inside buildings, nothing replaces ventilation or reducing duration.

The animated graphics are very good, check it out and pass it around.

Lockheed Have Blue Stealth Demonstrator

One of my favorite books that I’ve read in the past few years is ‘Skunkworks: A Personal Memoir of My Years at Lockheed’ by Ben Rich. It’s lots of fun, and if you’re kind of an aerospace geek like I am, it’s great to learn the stories behind some iconic planes (the U2, SR-71, F117A, etc).

Now that I think of it, it’s a good companion book to “Boyd: The Fighter Pilot Who Changed the Art of War”, which goes into more detail into the OODA loop and the design of the F15 and F16 fighters.

Anyway, one of the great sections in Skunkworks is about the development of the stealth technology for the F117A, and how when they brought one of their models to the radar range, it was detected as having the size of a tennis ball (from memory, maybe a golf ball?).

The development program cost US$35 million in 1978 dollars. Adjusted for inflation, that’s $139.72m. That’s nothing. It’s probably what they spent on R&D for velcro straps on the F35.

There was an intermediate step before the actual F117A, the Have Blue, a flyable prototype. They made two, and both were destroyed because of mechanical troubles. But it’s still very cool to see the photos (this image compares the size to the final F117A design) and learn about it. If this sounds like fun to you, head over to this page.

SpaceX Starlink’s “Better Than Nothing Beta”

Called the “Better Than Nothing Beta” test, according to multiple screenshots of the email seen by CNBC, initial Starlink service is priced at $99 a month — plus a $499 upfront cost to order the Starlink Kit. That kit includes a user terminal to connect to the satellites, a mounting tripod and a Wi-Fi router. There is also now a Starlink app listed by SpaceX on the Google Play and Apple iOS app stores.

“As you can tell from the title, we are trying to lower your initial expectations,” the emails said, signed “Starlink Team.” “Expect to see data speeds vary from 50Mb/s to 150Mb/s and latency from 20ms to 40ms over the next several months as we enhance the Starlink system. There will also be brief periods of no connectivity at all.” (Source)

The Arts & History

Some nature photos I took with my new iPhone 12 Pro (wrote a bunch about both the camera and the silicon in edition #43). I was testing out the wide-angle lens:

The proverbial fork in the road.

So far I like how they come out, how the camera and software deals with the dynamic range. The colors look good to me (I’ve barely done anything to these, just hit one button in GraphicConverter 11 to adjust things a bit):

I love the long shadows in the morning at this time of year. Makes everything look so much more interesting.