467: Constellation Software, Edwin Land, Boyd Group, Microsoft, Adobe & Figma, Bezos, China’s MASSIVE Hydro, SpaceX of HVAC, and Netflix

"If our grandparents could do it with slide rules"

A conversation is a dialogue, not a monologue.

That’s why there are so few good conversations: due to scarcity, two intelligent talkers seldom meet.

—Truman capote

📸 If, like me, you’re a big fan of Founders Podcast, you know all about Edwin Land, the founder of Polaroid and one of Steve Jobs’ heroes.

Land led his company for 45 years! The average tenure of a CEO these days is 5-7 years.

Above is Lego’s version of the iconic Polaroid OneStep SX-70 instant camera.

The whole thing is a great tribute — check out this page for all the details about the creation of the project. One of the “photos” that comes with it is of a Legoified Edwin Land looking at a roll of film.

The amount of care that went into every detail, including the mechanisms inside, is amazing.

🛀💭 My OSV colleague Dylan (🇮🇪☕️✍️) writes:

I’m worried about the state of children’s literature, movies and television, seems to lack soul

Mostly just big eyes and bright colours

High-fructose corn syrup of the mind

The TV shows seem like the kind of TV show you’d see in a TV showEvery era has its fair share of dreck and terrible stuff and we need to beware of survivorship bias. That said, I still wonder where is the 2020s' Princess Bride? Where is today’s Howl’s Moving Castle?

I’m worried about the Marvelization of art & entertainment targeted at kids, where every formula that works is repeated ad nauseam and pushed too far.

Risk aversion seems too high.

Everybody’s afraid of angering anyone and getting canceled on social media or banned in China or whatever. It pushes everything in a blander direction. 🥱

📘🐯🔭🧒🏼 Speaking of art with soul, I started reading Calvin & Hobbes with my 9yo.

I was worried he may be bored by the verbose style, but he loves it!

💚 🥃 This newsletter is a passion project. I put a lot of myself into it.

My goal is to have fun and explore, and bring you along as we learn interesting stuff while having a good time.

I can only continue with your support. Please consider becoming a paid supporter — you’ll never notice the amount and I’ll really really appreciate it.

Thank you! 🚢⚓️

🏦 💰 Business & Investing 💳 💴

🚂 Boyd Group 🚙👨🏻🔧🧰🛠️⚙️

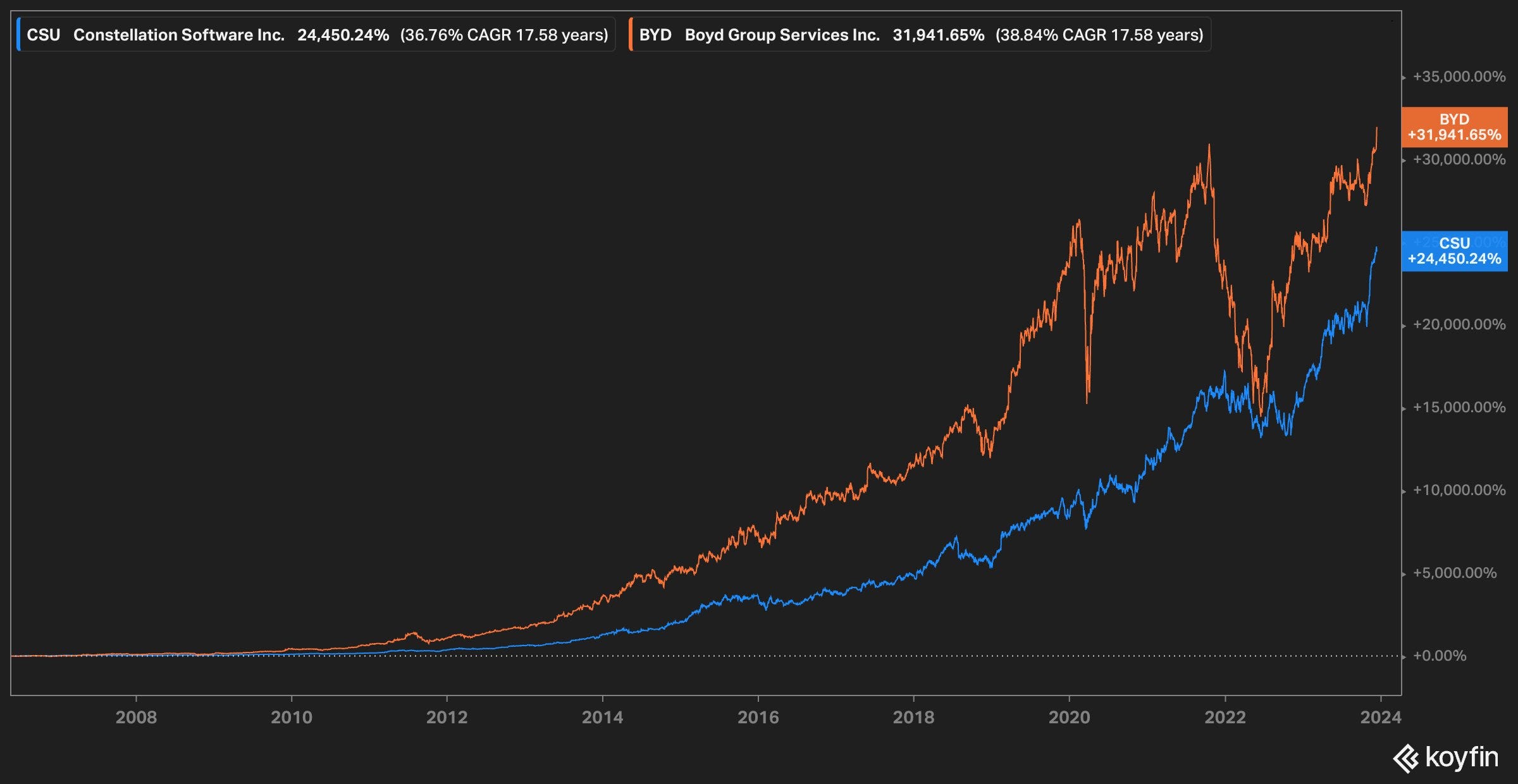

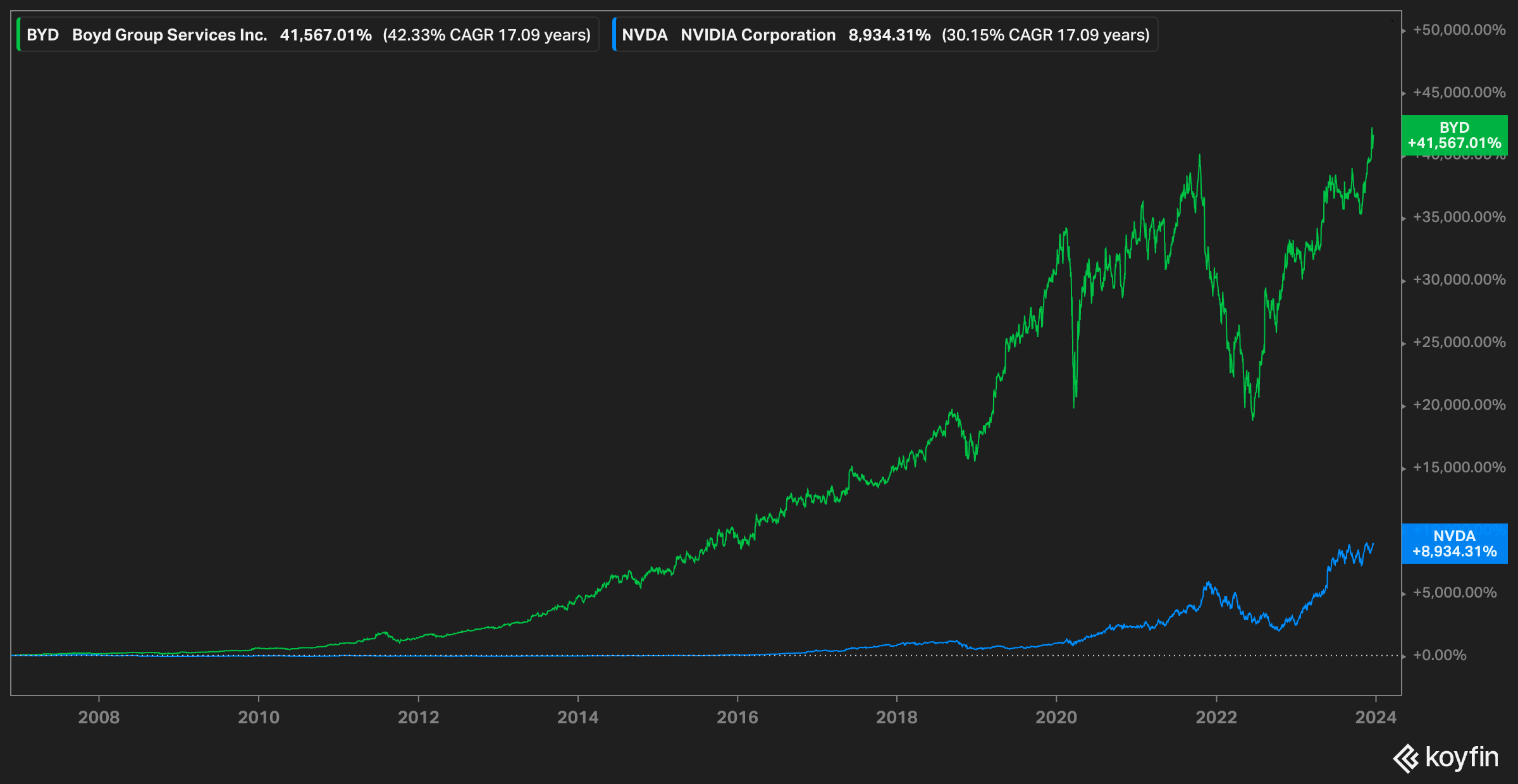

Boyd Group’s stock in Canada had a 42% CAGR over the past 17 years 🐐

(26% CAGR over the past 10, if you want a round number)

So what is it they do? Something sexy like software?

No, collision repair centers 🥱

Here's an impressive stat:

Since Constellation Software's IPO in 2006, Boyd has had better stock returns (the orange vs the blue lines above).

Note that it’s not completely fair since CSI has done two spin-offs, but even taking that into account, it's still hella impressive. 🔥

Here is the same period vs Nvidia:

🔭🤔 Why would a VMS Founder Sell to ✨Constellation Software✨?

Speaking of Constellation, I enjoyed this section from a Tegus interview with a VMS founder who sold to them:

I think [a company] that was acquired, actually, they nurtured it for 14 years and then finally, the CEO, founder and 100% owner, just like, yes, okay, I'm ready to go, called them up, did a deal, and transitioned it over.

Talk about long-term! Who else will build a relationship and check on a company for 14 years just waiting for the right moment? And not just with *one* company, with *tens of thousands* of them…

The whole reason why people do that is when I sold the business to them, I had two other deals on the table. I had one from my Indian competitor. I had one from a private equity firm. Why did I sell to Constellation? Because they didn't want to jump on a private equity firm's roller-coaster.

The thing with private equity is that it’s typically a cycle that repeats every few years.

It’s not a permanent home for the business, and even if the PE that buys the firm does a good job, at the moment of the sale, you can’t know if the next owner will kill it…

We [didn’t] want to sell to my Indian competitor because he was just going to gut it, take all the IP, move all the contracts over to his company, there'll be a migration plan, that software dies.

Then the company that I built is really gone from a name point of view, but then also from an employee point of view.

I want to keep it in Canada, and Constellation said, you're here to live forever, whether you're here or not, but that company, that branding, the software, the people, they're all there for as long as there are customers that are paying for the software.

This is a bit similar to how Berkshire tries to be the buyer of choice for founders who care what happens to their business long-term, even if they won’t always pay top dollar. It’s a non-monetary element, but to some, it’s extremely valuable.

If you are a Tegus subscriber, you can read the whole thing here.

This is shared with permission and using Tegus’ guidelines. I want to be very respectful of the great work they do and I checked with them before sharing.

See also:

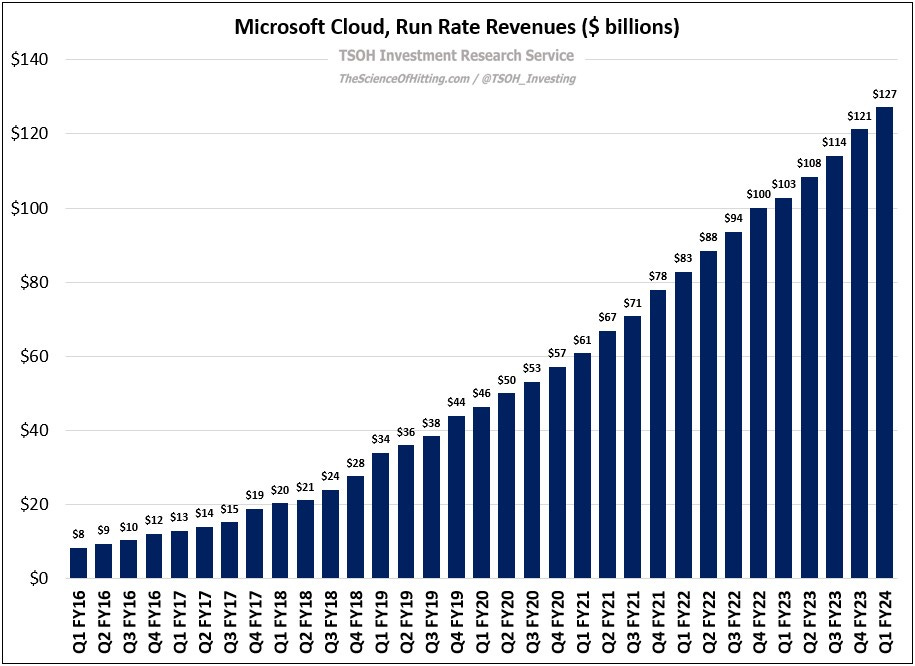

🌱 Transformation, Microsoft Edition 🌳

as of Q1 FY24, run rate revenues for Microsoft Cloud are now at ~$127 billion – nearly 50% higher than the company’s total revenues when Nadella became CEO.

And Azure, the cloud project with immaterial revenues and an uncertain future as Microsoft entered the 2010’s, is on pace to exit FY24 with run rate revenues of ~$75 billion.Via friend-of-the-show Alex Morris (💚 🥃)

🇬🇧🇪🇺 Deal kill:✋ Adobe + Figma 🚫

I guess Adobe is officially ‘Big Tech’ now:

Adobe on Monday shelved its $20 billion deal for cloud-based designer platform Figma, pointing to "no clear path" for antitrust approvals in Europe and the UK for what would have been among the biggest buyouts of a software startup. [...]

Britain's Competition and Markets Authority (CMA) last month said the deal would harm innovation for software used by the vast majority of UK digital designers, echoing similar concerns from the EU on the potential reduction of competition.

[…] the UK regulators have in recent weeks indicated that it would require remedies for Adobe to divest Figma design, a core asset of the acquisition.

This appears to leave Figma in a better position relative to Adobe compared to before the attempted acquisition.

Figma kept building and shipping during this time while Adobe has mostly abandoned its Figma competitor XD. Figma is also getting $1bn to invest in itself without any dilution via the breakup fee. 💰

Not bad for a company that had only raised $330m in the past!

Adobe may have been paying a lot for Figma, partly because the deal took place at a time when valuations were much higher, but it was largely a strategic and defensive acquisition, so a lot of the value wasn’t visible on a spreadsheet.

Figma has expanded its team from 800 to 1300 people in the past year, and is expected to grow its annual recurring revenue by 40% to over $600 million this year, a source familiar with the matter said. The company has also been cash-flow positive, an important metric for public market investors to evaluate potential IPO candidates.

From the customers’ perspective, I’m not sure if this is a win.

Sure, Figma will compete with Adobe, but chances are that each will retain its dominance in certain verticals, and there may now be less interoperability between the pieces.

But who knows, maybe Figma will keep expanding and someday attack Photoshop and Illustrator directly. We can hope that Adobe will improve its collaboration features… We’ll see ¯\_(ツ)_/¯

Meme via Bucco Capital

⚛️ Microsoft wants Nuclear Power for its data centers — Using AI to deal with the paperwork… 🤖📄📄📄📄📄📄📄📄📄

Constellation Energy, the nation’s largest owner of nuclear plants, in June agreed to sell nuclear power to Microsoft for a data center in Virginia when wind and solar aren’t available. It gives Microsoft price certainty and power generation available “second to second,” said Joseph Dominguez, chief executive of Constellation. He calls the matchup between data centers and nuclear power “peanut butter and jelly.” [...]

Constellation projects that because of the emergence of AI, new demand for power for data centers could be five or six times what will be needed for charging electric vehicles.

These are made-up numbers because nobody really knows…

But it shows they're seeing demand on the horizon which hopefully spurs some interest in growing supply and thinking big about energy abundance.

For the past six months, a team of Microsoft employees have been training a large language model with U.S. nuclear regulatory and licensing documents, hoping to expedite the paperwork required for such approvals, which can take years and cost hundreds of millions of dollars.

It’s kind of bonkers that it has come to this.

Using AI to assist with the mountains of paperwork that we’ve created for ourselves, rather than dealing with the source of the problem and making regulations more rational.

I understand that even if regulations were streamlined it would still be extremely complex to do these large projects from an engineering point of view, and it would take some time to build up a trained workforce with experience, but the only way to get there is to get started and power through the difficult reboot phase.

If our grandparents could do it decades ago with slide rules, much lower GDP-per-capita, and comparatively primitive technology, we can do it for sure if we only get out of our own way.

🗺️ Wartime Leaders in a Chaotic and Uncertain World 🧭

I dunno, I just like this piece of writing by friend-of-the-show Byrne Hobart (💚💚💚💚💚 🥃 ):

A fun paradox of history is that leaders who preside over generally good times get few, short books written about them; the big topics are the people who are in charge during, or are the direct cause of, absolute chaos.

Similarly, there's not much to say about the business acumen of someone who rides a trend when it's a good trend to ride: they were either very lucky or very smart when they chose their life's work, and after that choice made one fairly obvious decision after another.

Things get interesting when the future gets murky, and when the best option is to choose among differently disappointing alternatives—one high-risk plan to reduce one constraint, another operationally-intensive effort to mitigate some other problem.

But that's ultimately what growth is; the straightforward, single-variable part is brief, but in the long run, the real world is multivariate and uncertain, and every well-run great business is diversifying into a merely good or actively mediocre one just to stay alive a bit longer.

🧪🔬 Science & Technology 🧬 🔭

🇨🇳 China’s MASSIVE Hydropower 💧🔌⚡️💡

We often hear about China’s coal plants or how much solar they’re building, but the hydro-power fleet is worth more attention than it gets. It’s so large that how it’s doing at any time impacts every other part of the system and has ripple effects on the rest of the world.

If you look at the table above ☝️, yes, that’s 316.9 GW of installed capacity, with hundreds of additional GWs in the pipeline.

“Annual hydropower output in China has been around 1000 TWh per year for the last few years which translates to 4% of global electricity output.”

China’s hydropower installed base the largest in the world and is not just a substantial share of power generation in China, but globally.

It is like most renewables somewhat variable and subject to the vagaries of weather and has been particularly so the last two years with very weak rainfall and low output. Hydro capacity utilization (utilization hours) can swing much more violently over longer periods than wind and solar - it was down 25% at one point in July or in overall generation share terms it went from ~17% to 13% of total generation.

Hydropower is a major driver of Chinese imports of coal and gas due to China’s grid topology. The provinces in China that are part of the Southern Grid do not have substantial coal resources of their own and their imports swing wildly based upon hydro power performance.

Rainfall has picked up materially recently and China’s hydropower output based upon current and forecast weather is likely to improve a great deal.

🚀🔥🥵🥶❄️ Where’s the SpaceX of HVAC?

An industry where I’d love to see some SpaceX-like R&D and engineering is HVAC.

A large fraction of the world’s energy is used to heat and cool buildings. If we can get more efficient systems, better and cheaper heat pumps, improved sensors and control software and such, it would make a huge difference over time and at scale.

Combine that with better and cheaper ways to insulate buildings, retrofitting old ones and making new ones to be way more efficient, and you really move the needle.

It seems a no-brainer — whatever we invest gets paid back many times over the multi-decade life of a building.

A big challenge is getting incentives right. Right now, it’s hard to get anyone to pay more upfront for these future benefits, but I’m sure that it’s possible to figure out a way to align interests.

🚀 Bezos on Lex (Interview) 🛒 🚚📦📦📦📦

Jeff Bezos hasn’t given many long-form interviews in recent times, so I was glad to see that he was a guest on Lex Fridman’s podcast (he’s not always my favorite interviewer, but he did well on this one):

The link above has the transcript as well as the audio and video.

Bezos is good at framing and compressing seemingly obvious ideas that most people rarely think about and making obvious how important they are:

When you invent a better way, you make the whole world richer.

So whenever it was, I don’t know how many thousands of years ago, somebody invented the plow. And when they invented the plow, they made the whole world richer because they made farming less expensive.

And so it is a big deal to invent better ways. That’s how the world gets richer.

🎨 🎭 The Arts & History 👩🎨 🎥

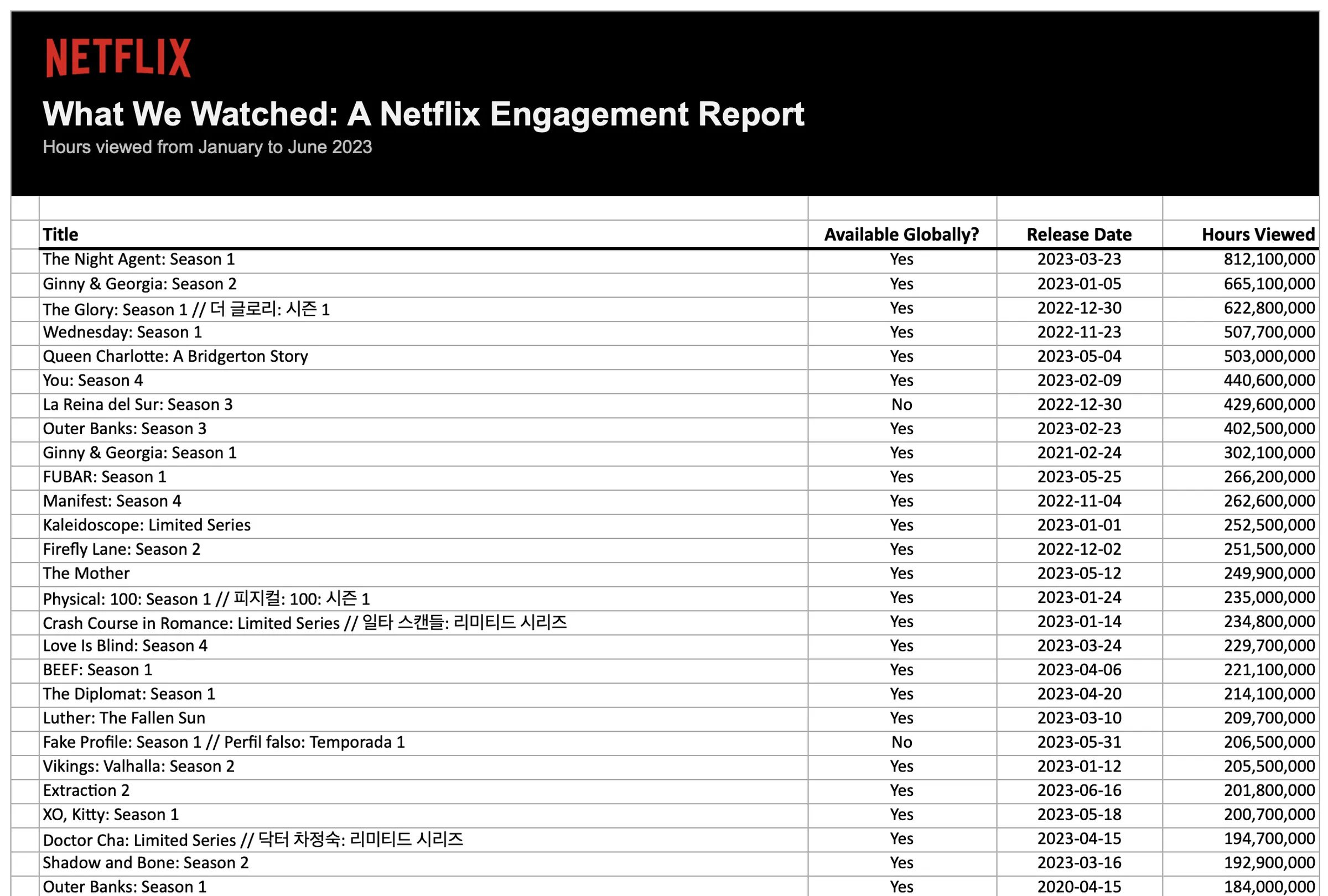

📺 Netflix Finally Shares Viewership Data 🍿

It turns out the most-watched shows are mostly things I've never heard of ¯\_(ツ)_/¯

But this is perfectly cromulent if you consider that most people watch *hours* of TV each day, so they mostly watch filler, not prestige shows.

Re: the SpaceX of HVAC. I have a tiny investment in a startup called Helios Climate (https://www.heliosclimate.io/). They actually started making heat pumps themselves (the website is still there, https://www.electricair.io/) but merged/pivoted to improving the install process when they realized that was the easiest way to make them cheaper and more efficient. I think they might return to actual heat pumps at some point -- I'm not sure all the details on why, but their experience led them to focus on intall for now.

Question is... can we reverse engineer to find the next Boyd Group? 🤔