47: Constellation Software Q3, Amazon Q3, Ant's Delayed IPO, Greenhaven Road, ARM Macs, Distributed Computing, and The Last of US

"wouldn't it be cool if there’s one episode where Joel and Ellie get on motorcycles and confront a motorcycle gang?"

“If you don’t make mistakes, you’re not working on hard enough problems. And that’s a big mistake.” –Frank Wilczek, American theoretical physicist

The waiting is the hardest part

Every day you see one more card

♛ I’ve covered a lot of semiconductor and software stuff in the newsletter so far. It doesn’t mean that it’s “the topic”, just that it’s what I’m learning about these days. If I had started the newsletter at a different time, it may have been full of stuff about Visa and MasterCard, Transdigm and Heico, or about S&P Global and Moody’s.

I guess I’m saying you can expect more topics to pop up over time, I just don’t know when. I’m following my curiosity, and as they say, if we knew what we were looking for, we wouldn’t call it “research” ¯\_(ツ)_/¯

➡︎ What am I going to put down here now? I guess… Be kind to others, and yourself. That’ll do. ⬅︎

Investing & Business

Constellation Software Q3

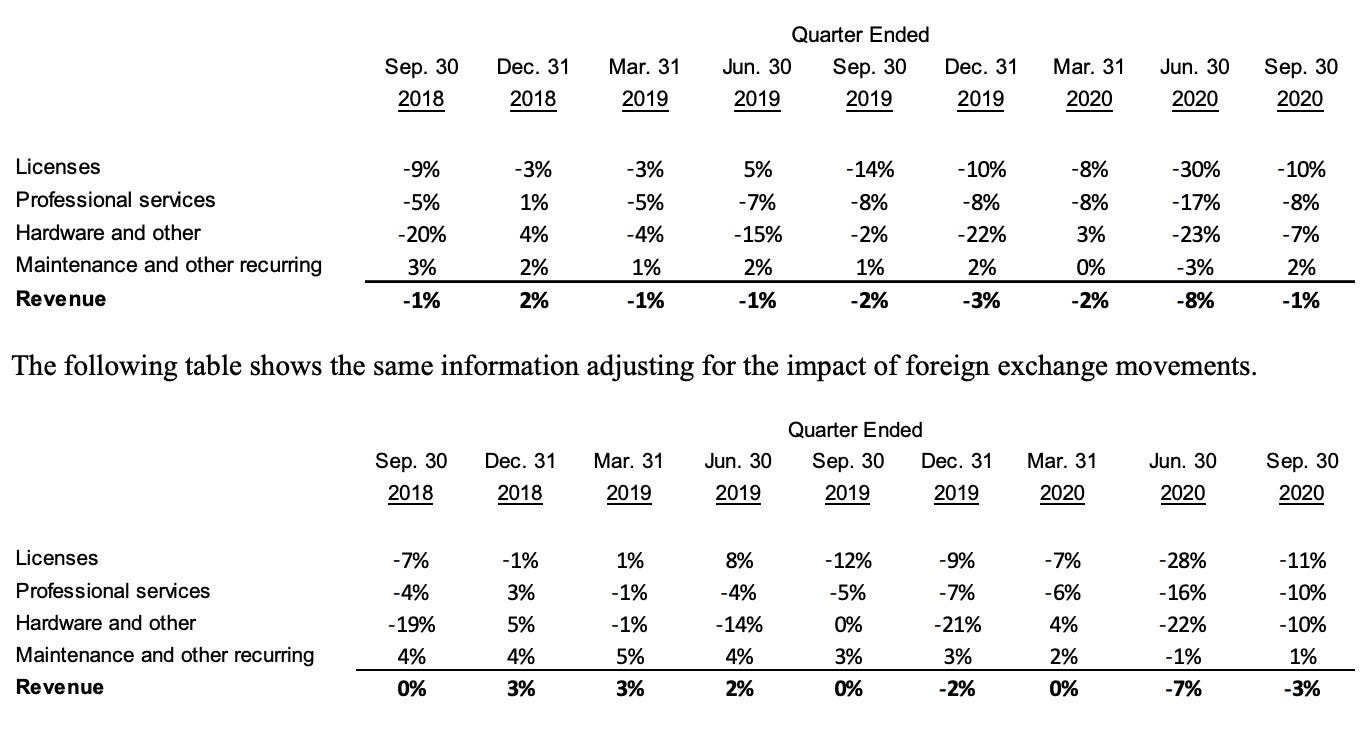

This shows CSI’s organic growth over the past few years. The table at the bottom is adjusted to take out foreign exchange, so it’s more representative of business performance.

It’s clear that the pandemic has had a big impact on various aspects of the business, but remember that most of the value is created by the “maintenance and recurring” line, and that during the worst of the crisis, this was -1% ex-FX, and now is back to +1% ex-FX.

Licenses, which are very high margin, but more lumpy, also had significant sequential improvement (from -28% to -11%), as did pro services and hardware (always lumpy, and much lower margin).

To me it’s hard to think of a bigger test of the business, and from a defensive angle, things held up very well.

On the offensive side, it looks like capital deployment is doing well:

A number of acquisitions were completed for aggregate cash consideration of $123 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of $25 million resulting in total consideration of $148 million. [...]

Subsequent to September 30, 2020, the Company completed or entered into agreements to acquire a number of businesses for aggregate cash consideration of $47 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of $19 million resulting in total consideration of $66 million.

I’ve seen an analyst theorize that maybe they were getting better multiples on the businesses that they were buying, but that’s hard to know for sure (they could be paying lower multiple, but for worse businesses, for example). I would guess that the very small companies that CSI buys aren’t quite as impacted by low interest rates and public market multiple expansion as larger software companies, but they may be more impacted by the damage in the real economy, so it’s possible that some may be selling for lower multiples. That’s just my guess, though.

Overall revenue grew 15% in Q3 (-1% organic ex-FX, which sure beats -7% organic ex-FX in Q2). Cash from ops +32%, free cash flow +35%, and EBITDA margin abnormally high around 33%, but that includes some govt help and grants and reduced operational expenses (travel, etc).

The TSS “membership liability” going up as fast as it has lately — +85% YTD — is probably a good sign about how well that group has been doing (which bodes well for the spin).

They still expect the Topicus acquisition to close “in 2020”, which will then pave the way for the completion of the spin of the new TSS+Topicus entity. I’m sure they’re looking forward to having some of that Topicus know-how and culture spread to TSS and the rest of CSI, as Topicus has been very successful at organic growth and launching new products, which hasn’t been CSI’s strongest point (well, to be fair, if they weren’t world class at M&A, they’d surely invest a lot more in organic growth and would be doing better).

I wrote about Topicus a bit in edition #29.

Trouble in China for Nvidia’s ARM Acquisition

Because foreign most companies need to do joint-ventures with local companies to do business in China, you get weird situations like this:

Nvidia’s $40bn deal for the UK-based chip designer Arm is facing fresh problems in China, after it emerged that the disaffected head of Arm’s local joint venture controls almost 17 per cent of its shares.

Allen Wu, the chief executive of Arm China, assumed control of a key investment firm in November last year, and now controls four out of six of Arm China’s shareholders.

Two of the companies controlled by Mr Wu have filed lawsuits in Shenzhen to protest that he was wrongfully dismissed by Arm and its main partner in the joint venture, the private equity firm Hopu.

In June, Arm China’s board voted 7-1 to remove Mr Wu after he was accused of conflicts of interest relating to his Alphatecture investment fund. [...]

One person close to Arm China’s board said he rated the odds of success for the deal at “only 50-50”.

Arm’s current owner, Japanese group SoftBank, put Eric Chen, the head of its China operations, in charge of negotiating an exit for Mr Wu, according to two people familiar with the process.

They said the discussions revolved around a potential payout of between $100m and $200m. (Source)

Greenhaven Road Q3 Letter

Impressive YTD performance:

Greenhaven’s estimated returns for the third quarter totaled approximately +50% net of fees and expenses. August was the best month in the partnership history. The net result is that both funds are up around 55% for the year, comparing favorably to the Russell 2000, which ended September down -8.7% year to date. We continue to own zero businesses in the S&P 500.

They write about their biggest holdings, which are APPS, KKR, PAR, ESTC and ROKU. Here’s an highlight on ESTC, which is the one among these that I’m most familiar with:

On the surface, exposing the IP and giving the software away to most users is a bit of a head scratcher. The monopolistic robber barons of yesteryear may not approve, but there are distinct advantages to the model. Elastic has made trial incredibly easy and frictionless with zero cost. There have been hundreds of millions of downloads of their software. The result is that there is an unpaid army of users and developers who identify as being part of an Elastic community. It is a differentiated distribution. How many non-consumer-facing software companies can you name that sell “merch” such as T-shirts and stickers on their website? [...]

Elastic has a very strong tailwind. The value of their products increases as the amount of data and data sources a company has increase. In simple terms, the utility of a search tool is limited if you are only looking at 10 pieces of data from a single source. The same search tool is invaluable if you are looking at one billion pieces of data from 200 different data sources. Elastic typically does not price their products based on seat licenses but rather based on usage. This encourages trial of products as the cost is minimal if the usage is minimal, but it also allows Elastic revenue to be more closely tied to the data growth of their customers. The tailwind of increased data volumes and new products can be seen in the net revenue retention remaining above 130% for every quarter they have disclosed it.

You can read the whole letter here.

The Mitochondria in Startups/Companies

Biological analogies can sometimes be useful. Sarah Tavel has this interesting one (from 2016):

I believe all employees in a startup are on a spectrum between two poles:

On one side, there are employees who think of the company like a job. They come in, they work hard, and they do their job. Some excel at doing their job. But ultimately, it’s a job. [...]

Then there is the other side of the spectrum. This group has a different DNA – they act more like founders than employees. They pour their passion into the company because they believe in its mission, and it is how they operate. They add value to the company beyond their job description and responsibilities. They ask and do what is best for the company. They work hard and late, because for them, the company isn’t a job. [...] their value is not linear: they energize and power startup teams through good times and bad. I think of this class of people as the mitochondria in hypergrowth startups.

It’s a founder’s job to attract and retain mitochondria through all stages of a company’s growth. At the early stages, this rare group of individuals is the core of the company. As your startup scales, they are your leaders. They should be cherished, recruited, and the mindset encouraged in other employees.

Ant Group's IPO Suspended

In a notice to Ant posted online late Tuesday, the stock exchange said that the company’s proposed offering may not meet the conditions for listing after Chinese regulators summoned company executives, including Jack Ma, the Alibaba co-founder who is also Ant’s controlling shareholder, for a meeting on Monday. (Source)

🤔

Amazon Q3

A few highlights from Amazon’s third quarter call:

we have incurred more than $7.5 billion in incremental COVID-related costs in the first 3 quarters of 2020, and we expect to incur approximately $4 billion in Q4.

more than 150 million Prime members around the world... 3P seller services revenue continued to grow faster than online stores revenue... 3P units continue to represent over half of overall unit volume, increasing to 54% of the total unit mix in Q3.

We welcomed 250,000 permanent full-time and part-time employees just in Q3 and have already added about 100,000 more in the first month of Q4... these are permanent jobs

big year for capital investments. We've invested nearly $30 billion in CapEx and finance leases through the first 9 months of 2020, including over $12 billion in Q3... we expect to grow our fulfillment and logistics network square footage by approximately 50% this year

the dynamics of Prime Day, because it's a deal-oriented time period, that's usually not the highest margin period, and that is shifted into Q4.

Science & Technology

Distributed Computing Season

In the Northern hemisphere, distributed computing season is starting for me. For 15+ years now, I’ve run scientific distributed computing on my computers during the cold season.

The general idea is that there’s various scientific projects that can use a lot of computing to make progress toward their goals, but they don’t have the budget to just spin up a zillion EC2 instances on AWS or whatever. So they ask for volunteer to donate CPU/GPU cycles by installing a piece of software on their computers and/or game consoles.

That software uses idle processor cycles (ie. when you’re doing something, it pauses) to crunch the data, and then sends back the results to the project.

I run this in the winter because the waste heat produced by my CPUs just displaces BTUs that would come from the house’s furnace, making them very low cost.

There’s many many projects that you can contribute to, but my favorites for the past 10+ years have been Rosetta@home and Folding@home (note that on the homepage, Satya Nadella, Dr. Lisa Su, and Jensen Huang are F@H ‘ambassadors’).

They’re doing computational biology, trying to better understand how protein folds and how to design targeted drug molecules to fight various diseases (including COVID19, in the past year, but also Alzheimer's, cancer, malaria, etc).

There’s pretty good leverage to volunteering your compute because you’re not only helping develop the drugs and do the basic science, but also the tool that can then design more drugs and do more basic science. As these projects improve the modeling software to make it faster, more accurate, and better able to handle larger proteins, these improvements can be levered by all kinds of other research projects (they publish their findings).

Here’s how to contribute:

Join Folding@home (here’s a chart showing how much compute F@H has vs the world’s fastest super-computers)

Once the software is installed, you can set it so that it only runs between certain hours, that it only runs on a certain number of CPU cores, etc. It’s not always the most intuitive software in the world to set up at first, but once it’s done, it’s low maintenance.

AWS Open-Sourcing COVID-19 Machine Learning Simulator

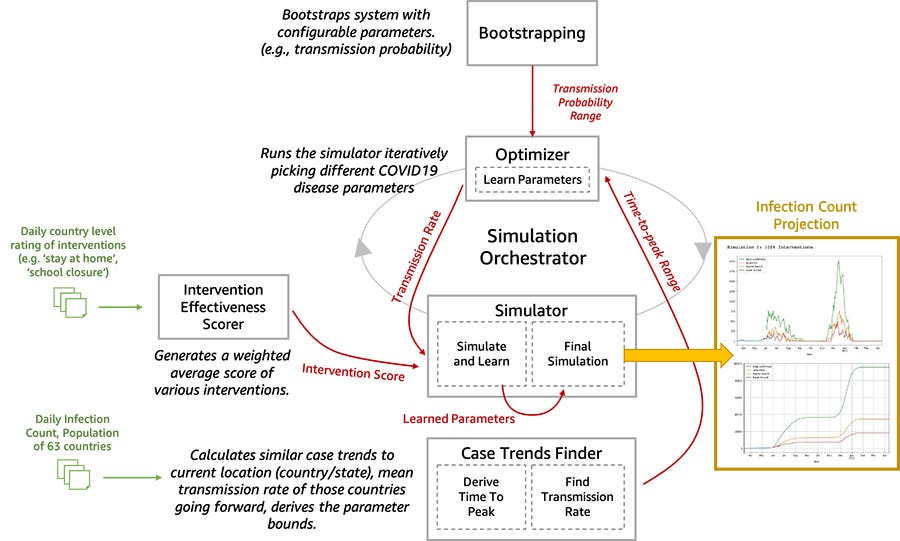

We are now open-sourcing a toolset for researchers and data scientists to better model and understand the progression of COVID-19 in a given community over time. This toolset is comprised of a disease progression simulator and several machine learning (ML) models to test the impact of various interventions. First, the ML models help bootstrap the system by estimating the disease progression and comparing the outcomes to historical data. Next, you can run the simulator with learned parameters to play out what-if scenarios for various interventions. (Source)

Building a Silicon City One Floor at a Time

Good analogy by Mule:

I think of building a semiconductor like laying a city filled with skyscrapers one floor at a time. Each step in the process either adds or subtracts a floor. After hundreds of steps, you then take a step back and you have your fully built “city”, complete with the hundreds of miniature skyscraper-like transistors.

This is from his introduction to a series about various aspects of semiconductors.

ARM Macs are Coming!

Apple has announced they would be holding an event on November 10. It’s widely expected that this is when they’ll be unveiling their first ARM-based Macs (I’ve written about Apple’s silicon design in edition #43).

This is a big deal: it doesn’t happen very often for a computer-maker to transition from one CPU architecture to another, and involves a lot of heavy lifting and all software needs to be recompiled, debugged, and optimized. They don’t do this lightly, it has to be worth it and make a big difference for the long-term.

Apple has done it in the past when moving away from PowerPC (which are chips using instructions co-created by the Apple–IBM–Motorola alliance) to Intel’s x86 chips and instruction set in 2006-2007 (it was announced in 2005).

Now Apple has announced that they’ll be moving all of their Macs to their own custom-designed, ARM-based chips within a couple years.

This is exciting because Apple has a great silicon-design team, and its mobile chips are industry-leading in mobile, and even beat many laptop chips.

I’m looking forward to what they can do with chips that have fewer thermal and power constraints (it’s very very limiting to have to run on batteries in a tightly packed space with no airflow).

They’ll probably start with their best-selling models, like the Macbook Air and Macbook Pro, but what I really want to see is what they can do with models that are plugged-in and have good airflow, like the iMac and Mac Pro. These will show what they truly can do when it comes to maximum performance.

I’m also curious to see how heterogenous the design will be: Will they mix and match all kinds of cores? I’d expect them to have low and high power cores in laptops, but maybe only high-power cores in desktops, where power consumption matters less.

I’d also expect them to port over their machine-learning acceleration cores (what they call the Neural Engine on the A-series chips) and the secure enclave that helps boost security on iOS by physically segregating some information (on biometrics, encryption, etc) in a one-way box that malicious software can’t read (my understanding is that you can ask the secure enclave if a password/encryption key/biometric reading matches, and it’ll tell you “yes” or “no”, but you can’t ask it to give you the key/info, and you can only query it at a certain hardware-limited rate, making brute-force attacks much harder).

It’ll also be interesting to see what trade-offs they make on the laptops (how much they squeeze for maximum battery life vs maximum performance, and whether they can get best-in-breed numbers on both sides). I also wouldn’t be surprised to see the laptops get FaceID like the phones.

From a business perspective, it makes sense for the company. The R&D that goes into iPhone and iPad chips can largely be re-used and not having to pay Intel’s margin may provide nice savings, and they probably will be happy not to have to wait around for Intel to fix its problems and be stuck on their unpredictable schedule anymore (how many Mac updates have had to be spiked in recent years because they didn’t have an Intel chip ready to go?).

‘You can’t believe anything you see these says’

The Arts & History

Chernobyl Creator Working on ‘The Last of Us’ TV Series

I consider ‘The Last of Us’ to be one of the best video games of all time, and I didn’t even play it. I watched one of my favorite streamers play it from start to finish on Youtube a few years ago.

Imagine my delight when I learned (reading this piece about audio by Matt Ball) that ‘Chernobyl’ creator/writer Craig Mazin is working on making a TV series based on the game for HBO.

The show will be written and produced by Craig Mazin (Chernobyl) along with Neil Druckmann, the original creative director and writer of the game. [...]

Mazin, who was being interviewed for BBC Radio 5 Live’s Chernobyl Special, said “I think fans of something worry that, when the property gets licenced to someone else, those people don’t really understand it, or are going to change it, … In this case, I’m doing it with the guy who did it, and so the changes that we’re making are designed to fill things out and expand, not to undo, but rather to enhance.”

Maizn added, “We’re creating anew and we’re also reimagining what is already there to present a different format, … It’s kind of a dream come true for me. I’m a little bit scared because a lot of emotions connected to this game are rather intense. I think I’m probably going to go hide in a bunker for a while because you can’t make everyone happy!”

Emmy-winning director Johan Renck (Chernobyl) is on board to direct the pilot episode, and possibly more. (Source)

From a different article:

“[T]here's quite a few things like that, where it's not like we just decided, ‘Well, wouldn't it be cool if there’s one episode where Joel and Ellie get on motorcycles and confront a motorcycle gang?’” he said. “That's not what we do. There's no episodic nonsense here. This is all very much, like, curated. But the things that are new and enhancing of the storyline that we’re doing are connected in organic, serious ways that I think fans of the game and newcomers alike will appreciate.”

I hope the TV series will be really good, because I’d love to relive that story, but with every year that passes, the 2013 graphics (even the remastered version that came out later) are aging and starting to make it harder to be quite as immersed in the world…

It’s weird, because in my memory, the graphics haven’t aged at all. I remember the characters, the action, the music, the voice acting, and the landscapes in a “pure” and “abstract” way that is ageless. But when I actually go look at some footage of the game, my 2020 expectations for polygon-count and light-shaders and character-animation gets in the way a bit.

I guess an extreme version of this is when you have fond memories of a cartoon you saw as a kid, and then see it again as an adult. It can be brutal.

‘An old plane hidden in the middle of a field in the Polish village of Wólka Nosowska’

Here’s the Google Maps Streetview of the plane. Source.