48: My Thoughts on How to Find Investments, Visa's Antitrust Troubles, WCM, Frank Slootman ❄️, Video Games, Psychedelics Science, and Hexagons

"People think the tap dancing is an effect, but it’s really a cause"

Everything is vague to a degree you do not realize till you have tried to make it precise. —Bertrand Russell

There’s lots of methods for finding new investments.

Mine is to do research on what I find interesting to build up a watchlist of things I like. Then once in a while, something on that list will become cheap (or at least, cheap enough), and I can buy a stake.

Others prefer to look at what looks cheap right now to try to find something that they’d want to own, something that is actually cheap and not just cheap-for-good-reasons (ie. some businesses that trade at 25x may be worth 40x, and some that trade at 10x are worth 5x).

Both approaches can work. I just find the latter to be less fun to implement. I tried it in the past, and it’s not the best fit for my brain’s wiring.

The most important thing (do I sound like Howard Marks yet?) is to find what works for you, and, if you have control over what you research, what leads to more enjoyable work (I wrote about “Investment Style as Lifestyle Design” in edition #44).

It’s not just hedonism: If you enjoy it more, you’ll do more of it, learn more faster, retain information better, and you’ll keep thinking about it even when you’re off the clock and come up with new ideas, connections, want to meet people in the field, etc.

In other words, if Buffett hadn’t been “tap dancing to work” from the start, it’s possible we wouldn’t even know who he is… People think the tap dancing is an effect, but it’s really a cause.

↦ Be kind to yourself & others. And don’t reject others’ kindness (a common indirect way of being hard on yourself, often unconscious). ↤

Investing & Business

Antitrust Lawsuit over Visa’s Plaid Acquisition

The U.S. Justice Department sued to block Visa Inc.’s $5.3 billion acquisition of Plaid Inc., accusing Visa of trying to buy the financial-technology firm to eliminate an emerging threat to its online debit business. [...]

“By acquiring Plaid, Visa would eliminate a nascent competitive threat that would likely result in substantial savings and more innovative online debit services for merchants and consumers,” the government said. [...]

While it doesn’t compete with Visa today, Plaid had been planning a new online debit service that Visa feared would threaten its monopoly, the U.S. said. [...]

as Visa was conducting its due diligence on Plaid, Visa learned the company planned to create a “meaningful” money movement business by the end of 2021. Plaid was seeking to offer the service at a 50% discount to Visa’s fees, saving merchants millions of dollars -- a plan it was upfront with Visa’s executives about. Visa Chief Executive Officer Al Kelly told Chief Financial Officer Vasant Prabhu that the acquisition would be an “insurance policy” to protect the business, according to the complaint. [...]

“As we explained to the DOJ, Plaid is not a payments company,” Visa said in a statement. “Visa’s business faces intense competition from a variety of players -- but Plaid is not one of them. Plaid is a data network that enables individuals to connect their financial accounts to the apps and services they use to manage their financial lives, and its capabilities complement Visa’s.” (Source)

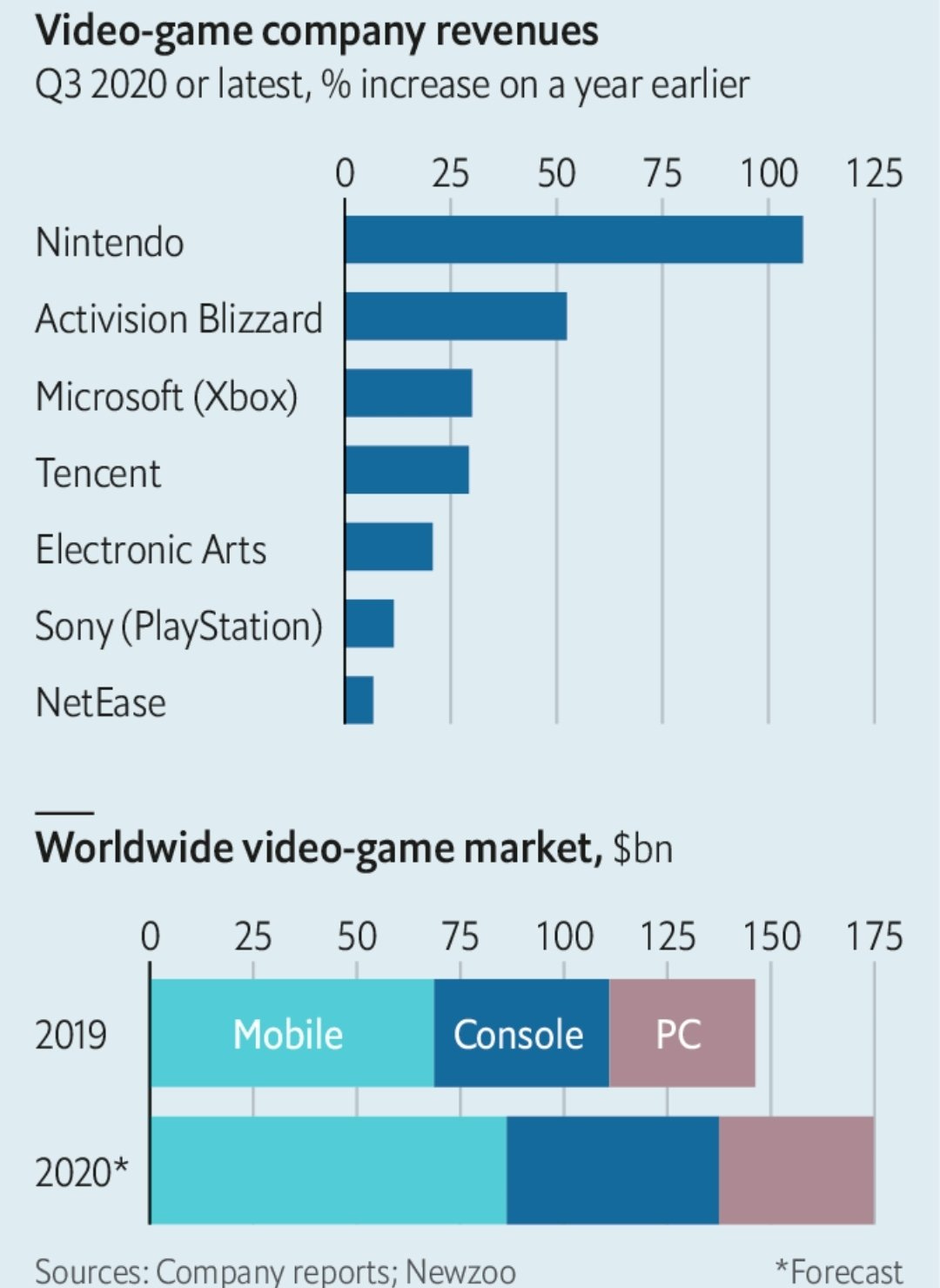

$$$Video Games$$$

As Lana says:

I say, "You da bestest," lean in for a big kiss

Put his favorite perfume on

"Go play your video game"

It's you, it's you, it's all for you

Everything I do

I tell you all the time

Heaven is a place on Earth with you

h/t @StrategeryCap

Interview: Mike Trigg of WCM Capital (Podcast)

A couple years ago, Ted Seides released a really good interview with Paul Black of WCM. I think I listened to it twice, and loved how clearly he articulated some concepts that were floating around my head in fuzzier forms.

Ted recently released another interview with a WCM guy, Mike Trigg (Twitter: @mbtrigg).

I thought it was quite good, and highlighted some important stuff about independent thinking and the importance of culture (it sounds cliché when summarized like this, but #1 all the most important ideas in investing are fairly obvious and #2 the hard part is really internalizing and using them, not knowing about them).

His point about the value of learning from mistakes, and how it can be hard to keep a culture when a certain cohort of employees at a company have gone through hard times together and grown because of it, and then having newer employees who may have only known good times, rang very true to me, having seen it first hand.

I’ve also had a similar evolution to what he described, going from trying to buy quality “wide moat” businesses when they are selling at depressed prices to trying to buy quality “expanding moat” businesses that are earlier in their lifecycle, and that are trying to be tomorrow’s wide moat business (which is inherently much harder to value, but also is much more rewarding when you get it right).

❄️ Frank Slootman Giving an Overview of Snowflake

In this recent company presentation, company CEO Frank Slootman gives a pretty quick overview of Snowflake, how the company came to be, what it does, and what it wants to do. Just keep in mind it’s a company presentation, so it’s one-sided.

It’s a great business. I just wish the stock wasn’t selling for 185x TTM sales…

If you want a bit more details on the company, I went through some highlights from the Snowflake S-1 before IPO in edition #17. h/t Paul Barnes

Blockchain Allows Digital Assets to be "Seized"

The U.S. is suing for the forfeiture of thousands of Bitcoins, totaling more than $1 billion, that it seized on Tuesday.

The cryptocurrency seizure, tied to the Silk Road marketplace, is the largest the U.S. has ever made, the Justice Department said in a statement on Thursday.

The seizure takes a swath of the digital cryptocurrency out of circulation at least temporarily, likely contributing to an increase of about 7% in its price, to about $15,200, on Thursday. In the past, federal authorities have auctioned off seized Bitcoins, but usually months after acquiring them. (Source)

Apparently, a hacker got access to that money from the old Silk Road accounts and the feds then got the private key from that person (source).

What I’m highlighting here is just that other digital assets can’t be seized because you never know who else has copies and is in “control” of the assets (try to seize an audio clip or a video from the internet), while these crypto assets can provably be just in one entity’s control, so that entity can become the government.

As commenter ‘aazaa’ said on HN: "I find it extremely amusing that the US government has over the last several years become one of the world's largest traders in bitcoin.”

h/t to @PaulBieber for recommending the book ‘American Kingpin’ by Nick Bilton on the Silk Road story. Seems interesting, I’ve added it to my ‘to read’ list…

CEOs Can Have Fun Too, Tobi Lutke Edition

Science & Technology

‘Psychedelic Treatment with Psilocybin Relieves Major Depression’

A compound found in so-called magic mushrooms, psilocybin produces visual and auditory hallucinations and profound changes in consciousness over a few hours after ingestion. In 2016, Johns Hopkins Medicine researchers first reported that treatment with psilocybin under psychologically supported conditions significantly relieved existential anxiety and depression in people with a life-threatening cancer diagnosis. [...]

“The magnitude of the effect we saw was about four times larger than what clinical trials have shown for traditional antidepressants on the market,” says Alan Davis, Ph.D., adjunct assistant professor of psychiatry and behavioral sciences at the Johns Hopkins University School of Medicine. “Because most other depression treatments take weeks or months to work and may have undesirable effects, this could be a game changer if these findings hold up in future ‘gold-standard’ placebo-controlled clinical trials.” The published findings cover only a four-week follow-up in 24 participants, all of whom underwent two five-hour psilocybin sessions under the direction of the researchers. [...]

For the entire group of 24 participants, 67% showed a more than 50% reduction in depression symptoms at the one-week follow-up and 71% at the four-week follow-up. Overall, four weeks post-treatment, 54% of participants were considered in remission – meaning they no longer qualified as being depressed.

It’s early days for this research that should’ve been done 50 years ago, but I suppose that the next best time to start is now. More info about this early research at MAPS.org (Multidisciplinary Association for Psychedelic Studies).

Also, gotta link to Homer licking a frog.

Hexagons?!

You wouldn’t expect that there’s too much to learn about a shape as simple as a hexagon, but as it turns out… (is there a more cliché way to end this sentence than “as it turns out?” — well, I guess now with this aside I’ve turned the cliché into an unexpected ending. Kurt Gödel would be proud)

‘It's official: Intel lost the single-threaded desktop performance crown to AMD.’

Our single-threaded tests solidly confirm AMD's claims from the Zen 3 launch—Intel's days of dominating single-threaded benchmarks are over, at least for now. All three of our single-threaded benchmarks show a healthy lead for the two new Zen 3 CPUs over Intel's top-performing single-threaded i9-10900K CPU. (Source)

There’s a good video here showing benchmarks and testing rigs (h/t to Will Hassell for the vid). What interests me most about it is the point that Kyle Hansen makes at the end, about how he’s afraid that if AMD pulls too far ahead of Intel, it could be bad for competition and progress could slow.

As a customer, what you want is generally for the big players to be neck and neck and be trading the 1st place prize back and forth. That’s what leads to the biggest generation-over-generation jumps in performance, to the most innovation, to better prices, etc.

Over the years I’ve seen it over and over again in various places (web browsers were never as bad and as slow to evolved as when Internet Explorer finally crushed the competition). We’re not there yet with Intel vs. AMD, but we should probably all hope that Intel can get back on track (and not only for this reason — it’s strategically important to have cutting edge semiconductor manufacturing be dispersed around the world and not be all concentrated in Taiwan and South-Korea).

If you want even more, here’s another deep-dive review of the new AMD CPUs.

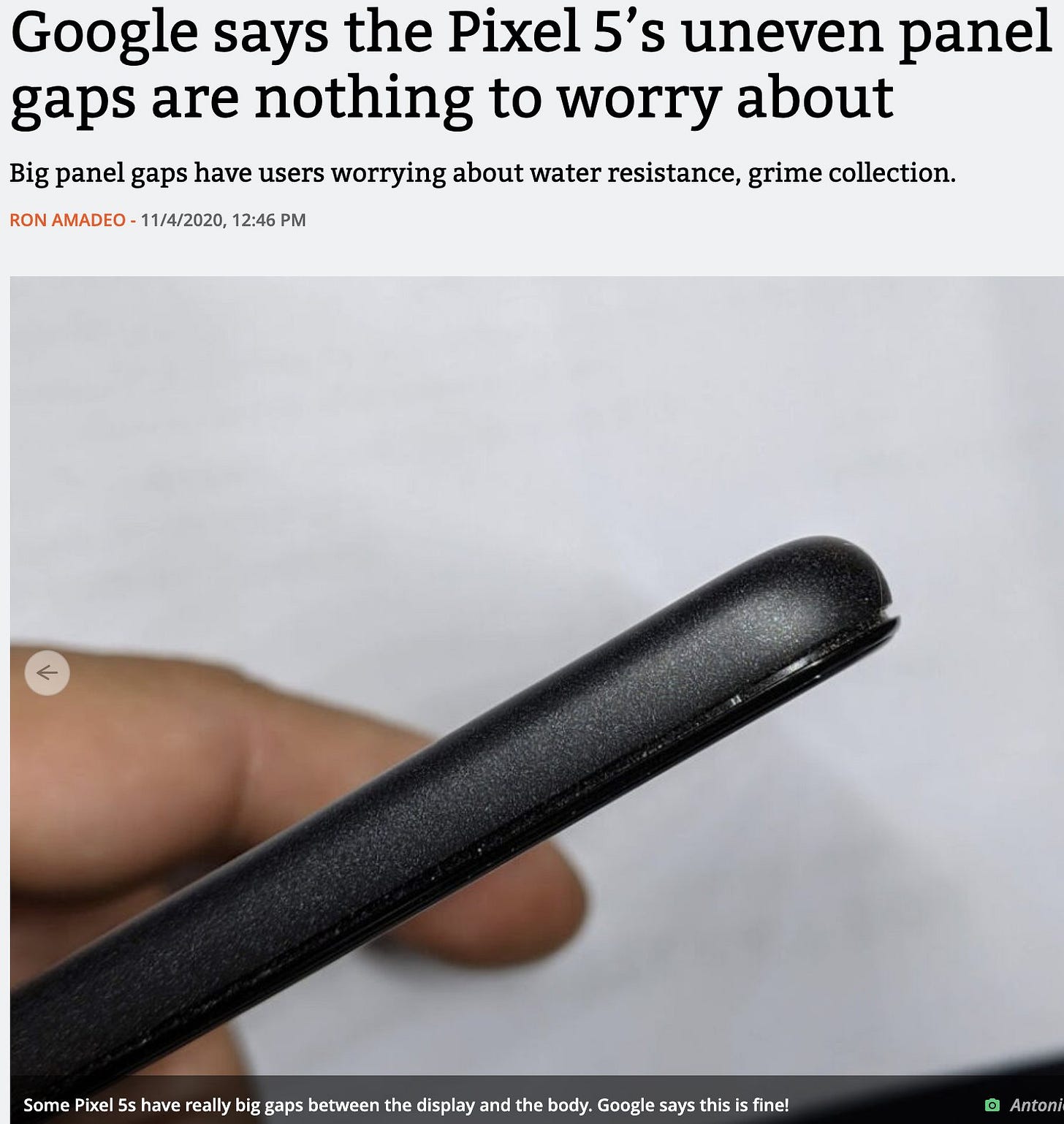

Manufacturing is Hard, Google Edition

"On our review unit, the gap is big enough to stick a fingernail into, but several pictures online show what looks like a much larger gap"

Google: "we can confirm that the variation in the clearance between the body and the display is a normal part of the design of your Pixel 5"

Complaint Corner, Dropbox Edition

Hey Dropbox, why do you need 342 megs of RAM to make sure some files are synched?

I really wish more software companies went back to the old-fashioned virtues of resource frugality and code optimization...

Yes, I understand Dropbox now does more than synch files, but I don’t use any of these other features, and they shouldn’t all be loaded in memory as a monolith.

I’ve been considering for a while moving everything I have in Dropbox over to iCloud Drive. I’ve been testing it for a few years and it seems solid, and I’d get my RAM back (not that I’m starved for it, I have 32gigs, but I hate waste on principle… it’s inelegant).

You also have to think about the bigger picture, because none of these apps operate in a vacuum.

Multiply Dropbox’s unnecessary RAM usage by the company’s number of users, and that’s untold petabytes of RAM being wasted. Then think about every other piece of software that isn’t optimized much because “oh well, computers are fast and RAM is plentiful now”, and it all adds up.

It’s a tragedy of the commons: One app figures its not a big deal, and they all think they’re not a big deal, but when you put it all together, you have gigabytes of RAM being used in ways that produces very low value and reduces headroom for when you really need performance… </end rant>

The Arts & History

A gift from Past Me to Present Me. Thanks, Me!

When you have more books than time to read them... I just remembered I had bought this in hardcover in 2015 when I was watching Mad Men for the first time. Found it on my shelf, had totally forgotten about it.

Ok, That’s Funny… (the less you know going in, the better)

(I know it looks like all those annoying ads, but that’s not what it is… give it a few minutes)

Absolutely love your newsletter, I have discovered so many gems like scuttle blurb, mbi and net interest (I think) from your posts.

I discovered you while looking for info on constellation software.

I have noticed you post about Visa and I am wondering if you have a view or resource to learn more about payments, and what the fin techs in payments might do to the networks a decade or two out. Is it possible that stripe, square, PayPal and the like could disintermediate visa and mastercards duopoly? My knowledge of payments tech is very limited so looking for credible resources to learn more.