498: Constellation Software Annual Meeting & Q1, OpenAI GPT-4o + Apple, Databricks, Intel + Apollo, Google AlphaFold 3, and Solar Storm

"Having fun is a habit."

No man really becomes a fool until he stops asking questions.

—Charles Proteus Steinmetz

🫙👨🎨 It's super scarce.*

Just look at how many films have *almost* all the critical elements —

a big budget, a talented crew, skilled actors, exceptional artists working on the costumes and sets, state-of-the-art special FX, an effective marketing team…

— yet they lack the crucial component to use that arsenal effectively: taste!

And so they're dogshit 🐕

If you took Denis Villeneuve’s whole team but put a director with *terrible* taste in charge, the result probably wouldn’t be very good. But if you gave Denis a small budget and a team of average talent right out of film school, he could probably figure out a way to do something good with them.

This doesn’t just apply to films!

* Not in absolute numbers. But there’s more demand than supply, and there’s the critical issue that those who don’t have it often don’t know they don’t and can’t reliably identify those who do.

🛀💭 It may sound odd, but sometimes I simply forget to have fun.

I’ll be doing something, but not in the most fun way that I could do it. Why not?

Having fun is a habit.

There’s often a more enjoyable way of doing something, and sometimes it doesn’t even require more time or energy — we just need to remember to do it.

I’m not saying that everything can be super-fun (filing taxes will never be my favorite pastime). However, most things can be *more* fun than we make them.

With the right mindset, going up the stairs can be a pleasurable moment.

📲🔑🚘 I booked a car on Turo for the first time. It’s for our family vacation this summer. I hope it will be a good experience.

It was a bit cheaper compared to renting a car with a traditional company like Hertz, but mostly, I wanted to try it to see what the experience was like, similar to how I was curious about Airbnb a few years ago.

I’ll report back after the trip, but I’m curious if you have tried Turo and what your experience was like.

💚 🥃 🚢⚓️ If you’re getting value from this newsletter, it would mean the world to me if you become a supporter to help me to keep writing it.

If you think that you’re not making a difference, that’s incorrect. Only 2% of readers are supporters, so you make a big difference (elite af!).

You’ll get access to paid editions and the private Discord.

If you only get one good idea per year, it’ll more than pay for itself!

🏦 💰 Liberty Capital 💳 💴

✨ Constellation Software ✨ 2024 Annual Meeting & Q1 Highlights & Thoughts 🔭

Constellation recently reported Q1 numbers and held its annual meeting.

The meeting was still remote although Mark mentioned that he was open to having it in person again if shareholders demanded it. But he added that he feels online is more democratic and reduces the chances of a bunch of private equity guys cornering his operators and trying to extract competitive information from them — yes, he said that!

The Q1 results looked good to me. I’ll highlight the following:

Revenue: +23%

EBITDA: +31%

Overall organic growth: +3% (currency neutral)

Maintenance/Recurring organic: +6% (currency neutral)

Capital deployed for acquisitions during Q1: $288m (including deferred)

Capital deployed for acquisitions post Q1: $395m (including holdbacks & contingent consideration)

So basically 🚂 on that front.

Here’s a funny/ridiculous line from an analyst (or at least, it is out of context):

“Constellation missed our estimates on capital deployment for Q1 because of lower purchase prices on the acquisition of assets from Conduent and Nokia”.(via friend-of-the-show Barry Schwartz — hey Barry 👋)

Before we go to the annual meeting, here’s one for your next trivia game with CSU shareholders:

Who’s the CEO of Constellation Software?

I’d swear it’s Mark Leonard, but looking at the filings and the website, they only refer to him as “president” and every other reference to a CEO or Chief Executive Officer is for the operating groups. Mark also has the shortest bio of anyone with no reference to his tenure as CEO:

Is Constellation technically a company without a CEO? 🤔

I mean, in practice it’s Mark and titles don’t matter, but I thought it was a surprising bit of trivia. (unless I’m missing something)

Back to our regular programming: I found it to be the most interesting AGM in a few years (possibly because Mark was sick with COVID on that day last year…). I also noted that at least four members of management were wearing t-shirts, including Mark L. — these are my people!

Here are some highlights (thanks to SleepwellCap for help on the transcript 👋):

Mark Leonard:

“We did drop the hurdle rates for a while to encourage larger acquisitions. We've since moved the hurdle rates to real hurdle rates. So we're no longer leaving inflation within the hurdle rates. And that has moved up the overall hurdle slightly since we embarked on seeking and building relationships with the people who can bring us large transactions.

It’s something that seems so obvious once you mentioned it, but I had never thought about how hurdle rates should float with inflation — and I bet that at many companies they do not.

This may be because we’ve had low and stable inflation for so long until recently that most capital allocators haven’t had to think this way.

Mark Leonard on large VMS auctions via broker:

“We now see much more in the market than we ever did before. So it doesn't mean that we're ever going to be a huge player in that market, but in very special circumstances, I think we can win some highly contested transactions.

One thing to keep in mind is that it's a brutally hard market in which to operate. And we measured this recently between 70-80% [don’t result in a sale] — and I'm sharing that because I want everyone to know who competes against us that this is a horrible game. You don't want to compete here. You should stop trying to buy these big broker deals. You should leave them to us.”

The delivery on that last part made me laugh out loud.

Mark Leonard: "We would use Constellation stock tomorrow to buy a wonderful vertical market software business for an attractive price. So there's nothing stopping us.

So I'm not averse to using stock. What I am averse to is some of the games people play with stock based compensation. And I think the manipulation of stock price that goes on with stock buybacks and the timing of stock buys and sells is bizarre. I have a hard time understanding it. But for the right company, we will definitely use Constellation shares.”

He was also asked if he would consider doing buybacks if Constellation shares were undervalued.

He just said “absolutely”, but I suspect that he would do it in a unique way that takes into account some of his misgivings about the information asymmetry between insiders and public shareholders and how there can be a conflict — or at least the *appearance* of a conflict of interest.

By the way, at almost any other company this wouldn’t be noteworthy, but at Constellation it is because of what Mark has said about buybacks in the past. For example in the 2013 shareholder letter:

Ideally, we’d like CSI’s stock price to appreciate in tandem with our fundamental economics. At any point in time, we’d prefer the price to be high enough to discourage a takeover bid and low enough so that

our sophisticated long term oriented investors are not tempted to sell. It takes lots of time and effort to attract and educate competent shareholder/partners. The last thing we want them to do, is sell.

If a stock is over-priced and sophisticated investors sell, they are generally replaced by unsophisticated investors who are ultimately disappointed. This may lead to a stock price that over-corrects and in turn precipitate either a takeover bid, or more insidiously, a significant and predatory share buyback. Buybacks are tempting to management and boards: they tend to improve the lot of managers and insiders, while being applauded by the business press. I think they are frequently a tolerated but inappropriate instance of buying based upon insider information. Instead of shareholders being partners, they become

prey.He was also asked about his assertion years ago that Constellation stock was overpriced, in light of the strong returns it has delivered since then.

Mark Leonard: “The growth since then has been significantly more than I expected.”

That’s why valuation is so difficult.

Even the person who knows more about the company than anyone else has to make assumptions that may turn out to be too optimistic or pessimistic, and over the long-term this can make a huge difference in outcomes

Nobody has a crystal ball, not even the wizard 🔮🧙♂️

Mark Leonard on more spins like Topicus and Lumine:

“The multiple spins by corporations through history, those that have been serial spinouts have often spun out things too early that didn't have great teams and that were burning cash. It was a way of financing growth. And so we're not going to do that. We're looking to spend things that are good businesses with good people that you can feel happy holding.

And that would be our preference is that our shareholders end up being shareholders of the spinouts for long periods of time.”

In the context of more spins, they stated that one of the criteria for a new spin is that the company needs to want to be public.

On this, Mark Leonard added:

"Yes. *I* hate being public."

Which could be interpreted in the business and the broader sense…

Q: What if Mark gets hit by a bus?

A: John Billowits: The long running jokes is that it has to be a really large bus to take Mark out.

If you've never seen him in person, Mark is 6'4" and built like a lumberjack. 💥🚌

On risk management:

Mark Leonard: "I'm happy with wide dispersions in outcomes as long as expected IRR is attractive. To me it's just probabilities, statistics, outcomes, and bet sizing. That's your inputs in assessing risk." (paraphrased a bit)

Asked about leverage, Mark mentioned that on a per-acquisition basis, for the “right one” he’d be willing to use “gobs” of leverage.

He mentioned 10x and more, but only for the right one. But at the corporate level, he feels that he has a responsibility to all the groups to have the capital ready to deploy when they have opportunities, so he’s more conservative there.

Robin van Poelje, the CEO of Topicus, mentioned how he used to run with more leverage in the past and has very low leverage now. He said he was comfortable going higher.

Mark was asked what he learned from Charlie Munger:

Mark Leonard: “I think the one of the relatively throwaway lines [from Munger] that I heard during that period was that he felt Berkshire had missed an opportunity and that they didn't use enough financial leverage.

And if you look at the last 20 years of Berkshire's performance, it's easy to imagine them significantly outperforming the S&P500 over that period compared to how they did do if they had used more financial leverage.

And so I think his point was, it's a collection, a diversified collection of great businesses And it could bear a lot more financial leverage. But Warren didn't want to take on financial leverage because he liked the idea of being the backstop for the American economy, the having the ability to write the big check when times got tough. Now that backstop hasn't paid off for a long time. And even when it did pay off the last time around in 'eight, 'nine, it was a relatively small payoff.

He didn't get 20s rates of return on most of the capital that he deployed at that point in time. And so I think the intelligent use of leverage, particularly when it's tax deductible, makes tremendous sense.”

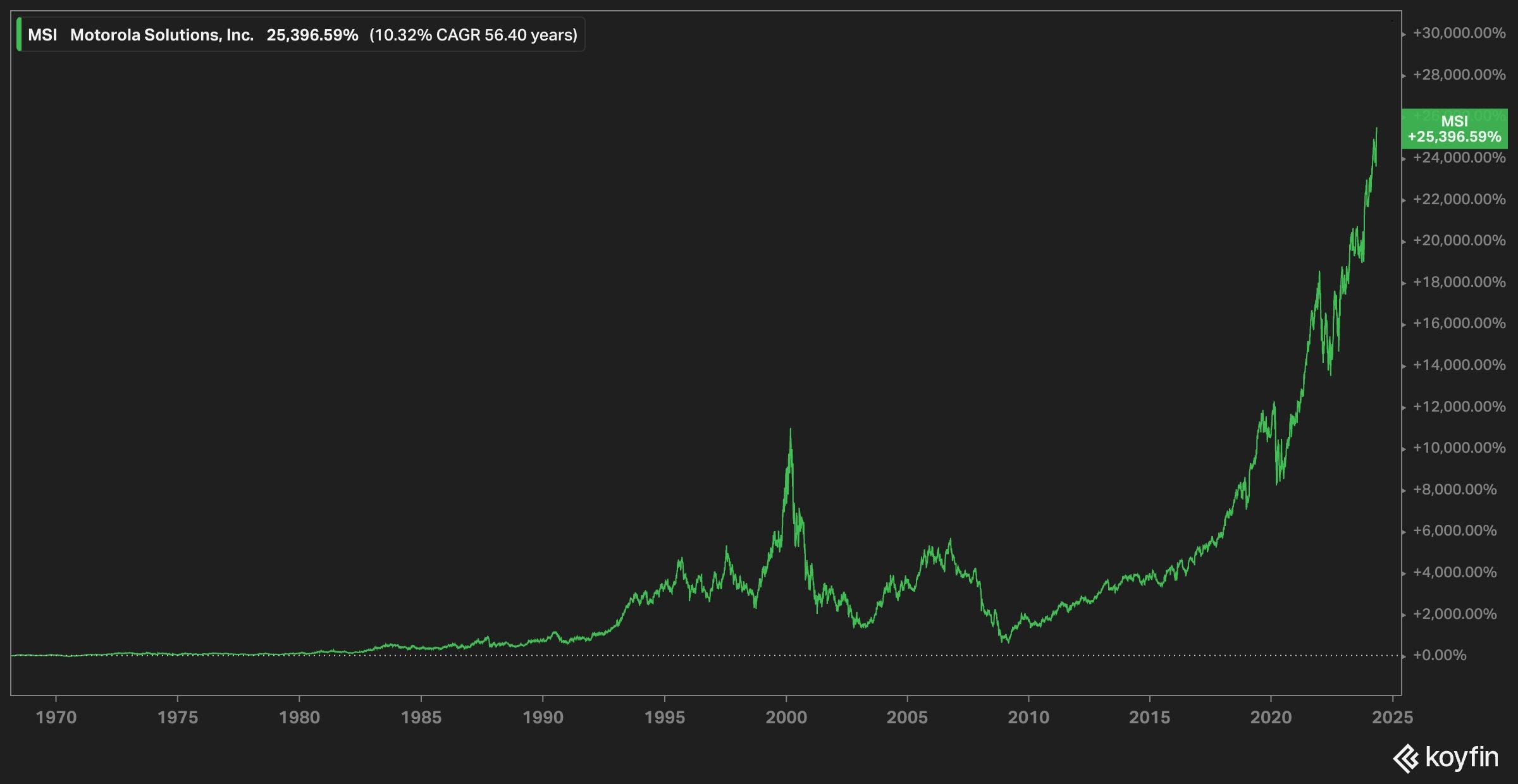

Mark mentioned wanting to study Motorola.

At first, I thought he meant the history of the company, but then I looked at the stock chart (20% CAGR for the past decade):

I had a quick look at what they do. Seems like an interesting space:

Motorola Solutions Inc. is a leading provider of mission-critical communication products, solutions, and services for public safety and commercial customers.

1. Products and Systems Integration: This segment offers a portfolio of infrastructure, devices, accessories, and video security solutions. These include:

- Land mobile radio (LMR) communications systems and devices like two-way radios

- Video security and access control solutions, including fixed video cameras and video analytics software

- Implementation and integration of systems, devices, and applications for government, public safety, and commercial customers

2. Software and Services: This segment provides:

- Command center software applications for public safety and enterprise customers

- Unified communications applications and mobile video solutions

- Managed and support services, including repair, maintenance, monitoring, software updates, and cybersecurity servicesSoftware to help run 911 emergency call centers, video and comm equipment for governments, police, and schools, etc. Risk-averse customers that need something mission-critical.

Margins have been going up over time. ROIC and ROE have been strong for the past 10-15 years (in fact, because of consistent buybacks they went into negative book value for a while).

I made a note to have a closer look at some point… 🩻🔍

Update: Here’s the video of the annual meeting. ⬅️

🇮🇪 Intel in talks with Apollo for $11bn (!!) investment in Ireland Fab 💰💰💰💰💰💰💰💰💰💰💰

Intel is in advanced talks for a transaction in which Apollo Global would supply more than $11 billion to help the chip giant build a plant in Ireland.

How much can one fab cost, Michael?

Well, if you want to be on the smallest, latest node, it can be around $20bn 😬

This isn’t too different from a deal Intel made with Brookfield Asset Management about two years ago for around $30bn to help finance the fabs in Arizona.

🗣️ Interview: Alo Ghodsi, Databricks CEO 🧱

Good interview by Ben Thompson (💚 🥃 🎩):

🎧📄 An Interview with Databricks CEO Ali Ghodsi About Building Enterprise AI (sub required 🔐)

I’ve been enjoying Ben’s interviews and podcasts. Kudos to the OG for evolving and improving even after a decade+ (which in Internet Time is like 63 years).

🧪🔬 Liberty Labs 🧬 🔭

🤖🗣️ OpenAI Releases GPT-4o (Is this the next Siri?)

First, it’s kind of a terrible name. It looks like GPT-40, which would be quite the leap. Why not call it GPT-4 Omni, which is what the “o’ stands for?

Anyway..

The big headlines about GPT-4o are:

It’s faster (especially in non-English languages)

50% cheaper on the API

It’s (a little) smarter

It’ll be available to free users (currently that’s GPT-3.5, which is much dumber)

It’s natively multimodal. That means means it can deal with vision and audio directly, without needing to “translate” to text.

Much lower latency during voice interactions

The model can now infer emotion from tone of voice, and can modulate its own voice to “show emotion” or even sing (look at this!)

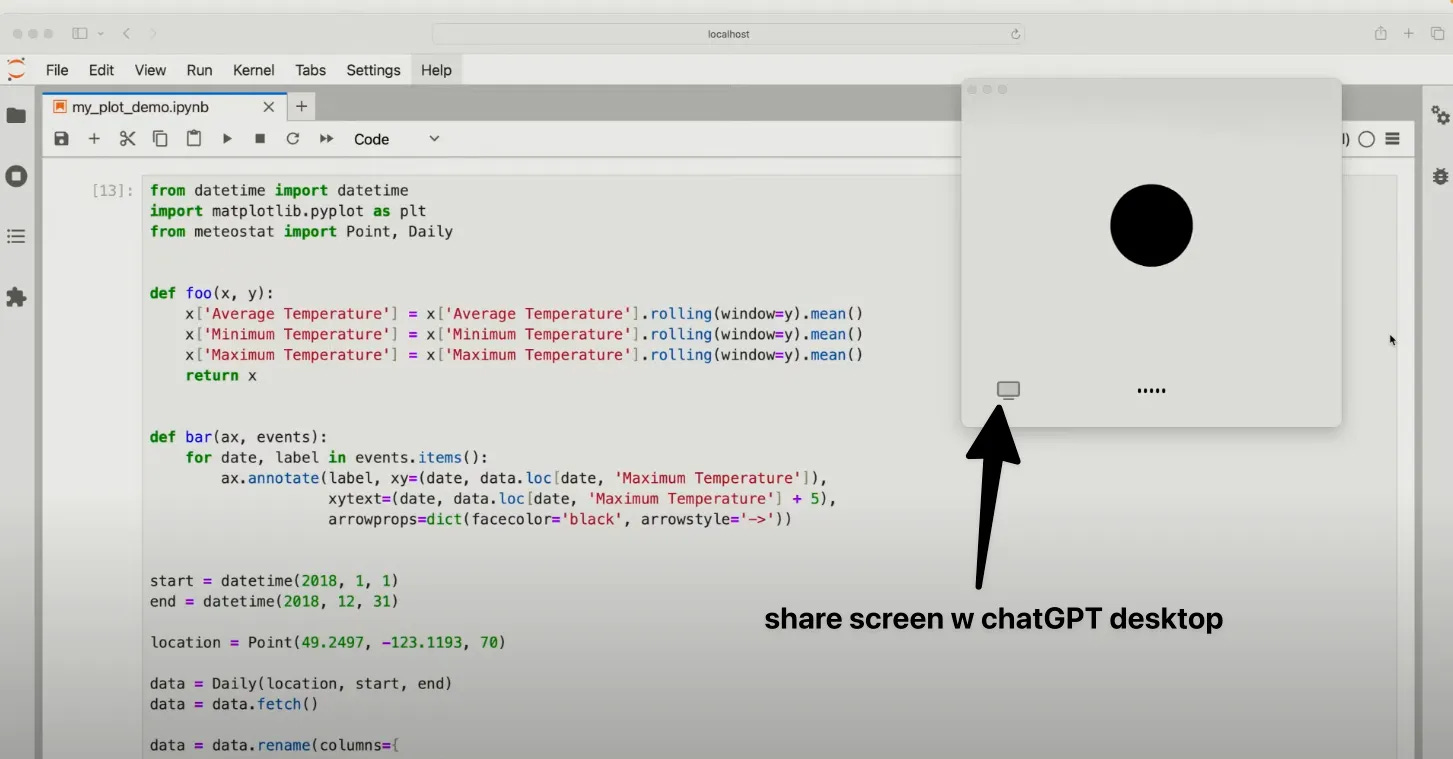

There will be a desktop app (Mac only at first — take that Microsoft!) that allows the model to “see” anything on screen that you decide to show it.

If the rumored deal with Apple works out, it’s easy to imagine this being the foundation for the new AI Siri.

In fact, I have to wonder if the long-running negotiations with Apple isn’t what pushed them to prioritize conversational capabilities to better fit what Apple was looking for 🤔

More details on how they did this:

Prior to GPT-4o, you could use Voice Mode to talk to ChatGPT with latencies of 2.8 seconds (GPT-3.5) and 5.4 seconds (GPT-4) on average.

To achieve this, Voice Mode is a pipeline of three separate models: one simple model transcribes audio to text, GPT-3.5 or GPT-4 takes in text and outputs text, and a third simple model converts that text back to audio. This process means that the main source of intelligence, GPT-4, loses a lot of information—it can’t directly observe tone, multiple speakers, or background noises, and it can’t output laughter, singing, or express emotion.

With GPT-4o, we trained a single new model end-to-end across text, vision, and audio, meaning that all inputs and outputs are processed by the same neural network. Because GPT-4o is our first model combining all of these modalities, we are still just scratching the surface of exploring what the model can do and its limitations. [...]

[GPT-4o] can respond to audio inputs in as little as 232 milliseconds, with an average of 320 milliseconds, which is similar to human response time(opens in a new window) in a conversation. It matches GPT-4 Turbo performance on text in English and code, with significant improvement on text in non-English languages, while also being much faster and 50% cheaper in the API. GPT-4o is especially better at vision and audio understanding compared to existing models.

There’s speculation that one trick they use to make it seem faster is to quickly say a few filler words — possibly using a much smaller and faster model — while the bigger model “thinks” about what to say next.

This is pretty much what humans do when they say “oh yeah, that’s a good question..” before answering ¯\_(ツ)_/¯

I played around with it a bit and at first I thought, “oh, it’s slower than in the demo, maybe they’re having scaling issues”, but then I remembered that I watched the video of the demo at 2x so that made it seem way more responsive than it actually is 😅

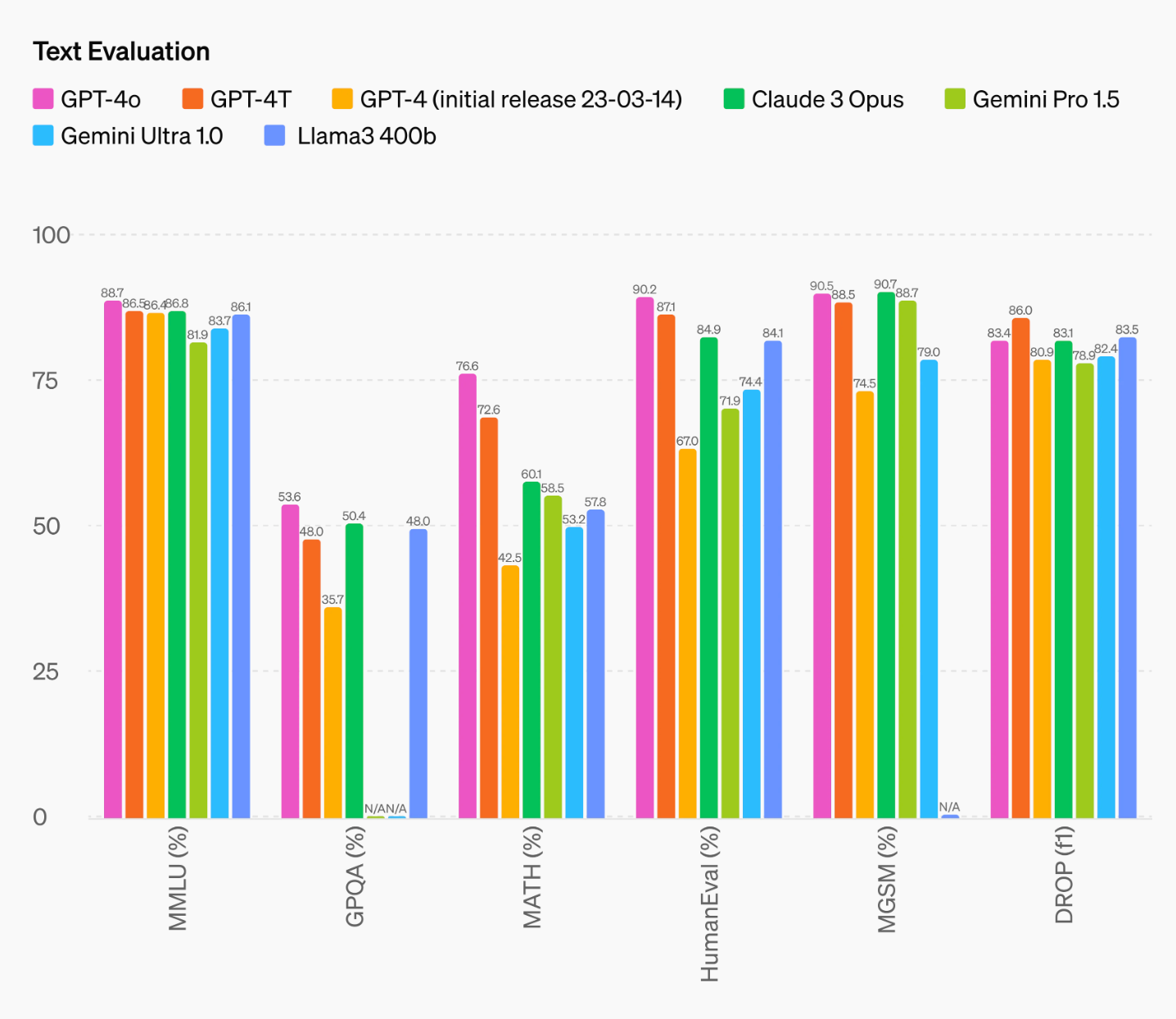

Benchmarks are imperfect and don’t tell the whole story, but they’re a data point:

Interestingly, they include Llama 3 400b. Unless I missed something, it’s not out yet. I guess Meta must’ve published some numbers and they’re going from that…

One big question is how much cheaper they have made inference for GPT-4o because opening it to all free users will mean a 𝖌𝖎𝖌𝖆𝖙𝖔𝖓 of compute.

I suspect they’re using a MoE architecture rather than a dense model to help with efficiency, but I don’t think they’ve ever publicly confirmed it.

One possibility is that part of their deal with Apple includes not only covering the inference costs for their own ecosystem’s usage but also helping OpenAI afford the expense of making GPT-4o free. This would restrict the oxygen supply for smaller competitors like Anthropic, enhance OpenAI’s competitive position, and increase data usage inflows to strengthen their ability to compete with Google.

☀️ Solar Storm Messed with Farmers’ Tractor GPS 🚜 🌾 🧑🌾

One chain of John Deere dealerships warned farmers that the accuracy of some of the systems used by tractors are “extremely compromised,” and that farmers who planted crops during periods of inaccuracy are going to face problems when they go to harvest [...]

“All the tractors are sitting at the ends of the field right now shut down because of the solar storm,” Kevin Kenney, a farmer in Nebraska, told me. “No GPS. We’re right in the middle of corn planting.”

Even industries that may seem “low tech” are very dependent on modern tech (genetics for seeds, software, computerized mechanization, etc).

🧬🔍🤖 Google DeepMind Announces AlphaFold 3

Very cool:

we introduce AlphaFold 3 […] For the interactions of proteins with other molecule types we see at least a 50% improvement compared with existing prediction methods, and for some important categories of interaction we have doubled prediction accuracy.

Going beyond proteins!

AlphaFold 3 takes us beyond proteins to a broad spectrum of biomolecules. This leap could unlock more transformative science, from developing biorenewable materials and more resilient crops, to accelerating drug design and genomics research.

This doesn’t get all the headlines that chatbots get, but this is genuinely making the world better and a foundation block on top of which all kinds of cool science will be done.

For all the details, check out this paper published in Nature.

🎨 🎭 Liberty Studio 👩🎨 🎥

🍏💻🎶 The rebel who gave the Mac its startup sound (without permission) 🎹

A fun bit of trivia. I love the Sosumi sound backstory (“So sue me”).

Okay, so I know they don't use the margin of safety concept, opting for a hurdle rate. But what Leonard says here is similar to how James Mai defines the margin of safety.

Great post. Love the quotes from Mark L!