507: Jensen Signing Stuff, Anthropic Takes the Lead, Apple AI Polyamory vs OpenAI, Market Concentration, WiFi, SSI, and Dune Scale

"like that Escher drawing, but it actually works!"

If you want him to do it, you've got to change the picture of the world inside his head.

–Robert Penn Warren

✍️😎 Jensen is still signing stuff!

💻 🏎️ 🛜 In Edition #505, I wrote about upgrading my home internet to a 1.5 Gbps fiber connection.

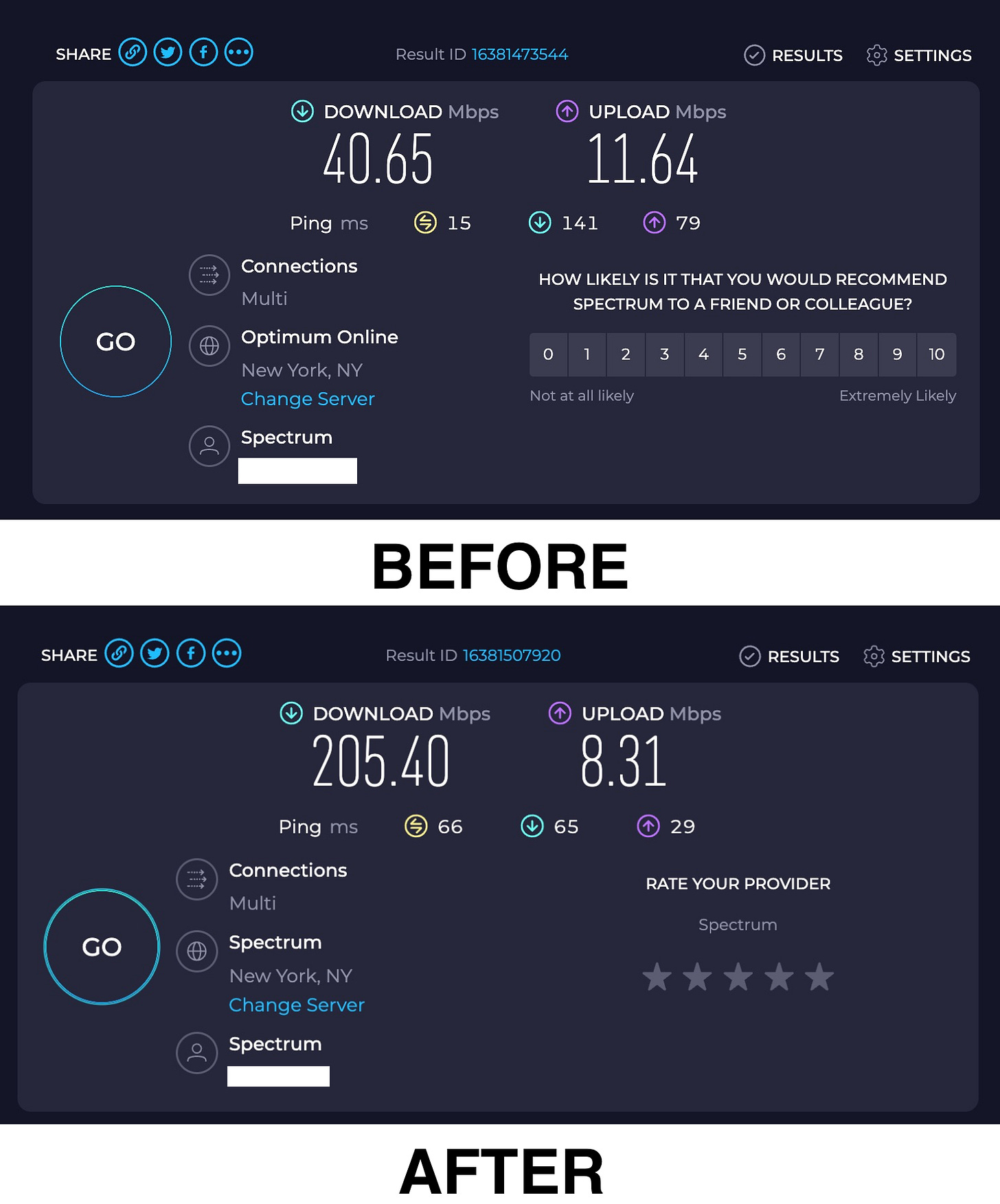

This prompted my friend Jimmy Soni (✍️📚) to text me about internet speeds and routers. He has a nominally 300 Mbps cable connection from Charter Spectrum, but after doing some speed tests, we saw that he was only getting about 40-50 Mbps (the easiest way to test your effective speed is to go to Fast.com, which is operated by Netflix).

He mentioned having an old, inexpensive router, so I suggested the TP-Link Archer AX55. It’s recommended by Wirecutter and is on sale right now for about $88 on Amazon (32% off).

Thanks to 1-day shipping, Jimmy sent me before & after screenshots of his wifi speeds the very next day:

That’s a 5x increase in effective speed from a one-time upgrade costing less than $100. Not bad!

Are you paying for speed that you can’t use because your router is a bottleneck? Are you annoyed by crappy wifi in certain corners of your home?

You should consider investing in a good wifi router, especially if your current one is old and entry-level (anything older than 2020 should be replaced, that’s when the WiFi 6 standard became common).

Good routers are inexpensive, especially compared to their utility in everyday life. It’s worth paying up a little bit to get to the sweet spot of price/performance.

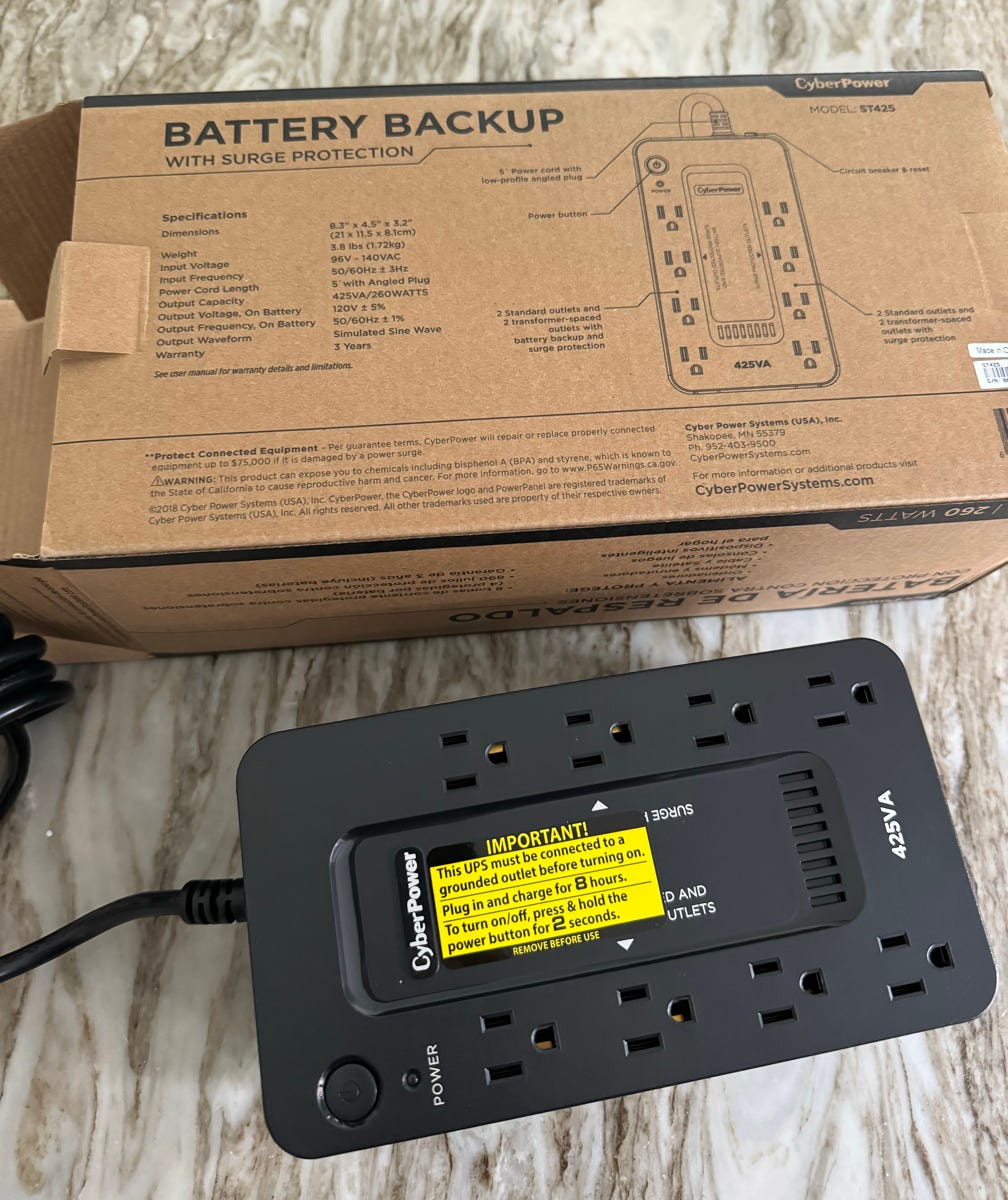

🛜🔌🔋Speaking of WiFi routers: I bought a small UPS for my new fiber router.

A UPS is essentially a power bar that acts as both a surge protector, to protect your electronics if there’s a voltage spike, and it also has an integrated battery so that whatever is plugged into it doesn’t lose power if there’s an electricity outage.

The nicest thing about having this is that if the power goes out for half a second, you don’t have to wait minutes for the router to reboot and reconnect. You stay online as if nothing had happened.

🏦 💰 Liberty Capital 💳 💴

🐌 🐘 Market Concentration Over Time 📈📉📈

In Edition #506, I wrote a riff about the S&P 500 as a kind of giant VC fund.

Reader John (👋) shared a Michael Mauboussin piece that shows how concentrated the market has been over time (not just the S&P 500 — you can see the methodology in the paper):

Concentration at the end of 2023 was 27 percent, approaching the prior peak of 30 percent in 1963. The lowest concentration over this time was 12 percent in 1993, and the level was 14 percent as recently as 2014.

The MSCI All Country World Index, which includes mid and large capitalization stocks in 23 developed and 24 emerging economies and covers about 85 percent of the global investable equity universe, shows a similar pattern. The top 10 stocks in that index were about 19 percent of the total capitalization at the end of 2023, more than double the level ten years earlier. This result is not altogether surprising as U.S. companies were 9 of the 10 constituents on December 30, 2023

The graph stops in 2023, but I wouldn’t be surprised to see that it kept going up in 2024 and that we may be at levels higher than the previous post-1950 peak.

Here’s partial data for 2024:

Concentration continued to increase in early 2024. As of the end of the first quarter, concentration was 28 percent in the U.S. and 20 percent for the MSCI All Country World Index

This other graph shows S&P 500 annualized returns during both periods of increasing and decreasing concentration:

Two findings are noteworthy. First, the top stock has historically been a bad investment. Specifically, the arithmetic average of the series of annual returns of the top stock relative to the S&P 500 from 1950 to 2023 was -1.9 percent. The geometric return of the series was -4.3 percent, reflecting the fact that the series was volatile. That the top stock delivers poor results is consistent with past research.

However, the second and third largest stocks fared considerably better. The index for the second largest stock had an average arithmetic return of 2.6 percent and a geometric return of 0.8 percent. This series was also volatile, but not as volatile as that of the number one stock. Likewise, the third largest stock did well, with an arithmetic return of 1.6 percent and a geometric return of 0.3 percent. The volatility of this series was lower than that of the top two stocks.

I don’t think this is actionable, but it’s interesting trivia.

🍎 There’s a chance that at launch, OpenAI won’t be Apple’s only AI partner 🤔

One thing to remember about Apple’s announcements at WWDC earlier this month is that they’re for the *upcoming* versions of their operating systems (iOS, MacOS, etc). Nothing was launched on that day, it was a preview for things that are coming out in the fall when new iPhones and Macs will be announced.

By that time, there’s a decent chance that OpenAI won’t be the only partner of Apple when it comes to larger AI models. Not only did OpenAI only get to have the spotlight at the very end of Apple’s event and Sam Altman didn’t even get invited to speak on stage, but OpenAI may *never* have distribution to Apple’s user base all to itself.