513: GE & Danaher, Samsung SNAFU, Wiz & Google, OpenAI + Broadcom, Ozempic Economics, Meta's Llama 3.1, Immunotherapy, and The Bear

"It’s like the Jedi version of meditation."

Teaching is successful only as it causes people to think for themselves.

What the teacher thinks matters little; what he makes the child think matters much.

–Alice Moore Hubbard

🪑⏳ My friend Jim (💚 🥃 📚) has told me a few times about how he likes to sit and do nothing for 20 minutes each day. No music or podcast, nothing to read, no writing. Simply sitting and doing nothing.

It’s like the Jedi version of meditation.

While midwits obsess over TM vs Metta vs Vipassana vs Mindfulness and over which app to subscribe to so some guru can guide them, Jim just sits there.

Every time he told me about it, it sounded like something I should do, but somehow I never could incorporate the habit into my life (new habits are hard, even if you’ve read James Clear).

But I think I finally found a way that works for me!

As I wrote about recently, we got a backyard sauna, and it has been the perfect sit-and-do-nothing solution.

My wife usually joins me, but 15 minutes is enough for her. After she leaves, I stay an extra 15-20 minutes — just sitting there in a box. No phone, no book, no AirPods. Just lil ol’ me and my thoughts. 🤔💭

It’s very productive “processing” time for all kinds of things. For problems I’m working on, but also emotions that I may not have had a chance to fully deal with in the rush of everyday life.

I fell off the meditation train years ago 🧘🏻♂️ — even though I liked how it made me feel and I believe in the benefits. This may be my way of getting back into it effortlessly and without any fuss.

Never underestimate the power of simplicity.

🛀💭 George Mack posted a list of ways to identify high-agency people.

It’s good.

It made me think about what I would add to it, and I came up with this:

By the time you figure out what high-agency people are doing, they're doing it differently (better) or doing something else (more interesting).🔌🚘🔋 Ever since I got an electric car, my desire for any non-electric car has dropped to zero.

💚 🥃 🚢⚓️ If you’re getting value from this newsletter, it would mean the world to me if you become a supporter to help me to keep writing it.

You’ll get access to paid editions, the private Discord, and get invited to the next supporter-only Zoom Q&As with me.

If you only get one good idea per year, it’ll more than pay for itself. If it makes you curious about new things, that’s priceless.

🏦 💰 Business & Investing 💳 💴

👀 Hindsight Bias, GE & Danaher Edition 🫣

Larry Culp, the CEO of Danaher between 2000 and 2014, became CEO of GE on October 1st, 2018.

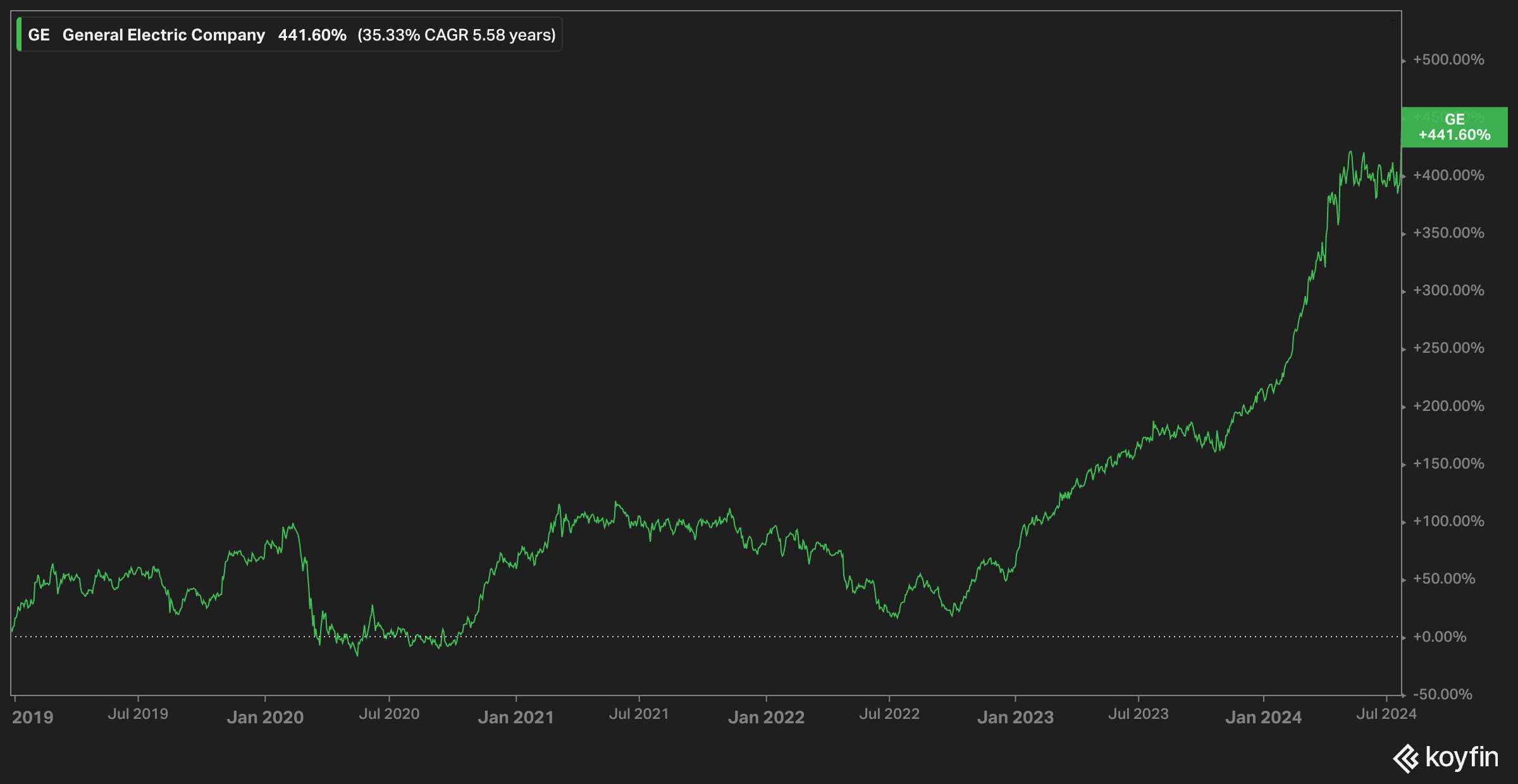

I was recently thinking that when I saw this, the obvious smart move would’ve been to buy the stock. Looking back (see above), that would’ve been a very profitable move (the stock compounded at 35.33%/year).

But that’s hindsight bias. When you know what happens, the moves seem like they were obvious.

If I put myself back in the mindset of the time: GE had been pretty terribly run for a while, going from problem to problem with the stock spending 20 years range-bound under its Welch peak. It increasingly looked like a bureaucratic dinosaur from another era (think IBM) that couldn’t compete with low-cost Chinese firms and whose culture of financial engineering wasn’t all gone (this is what got them in *big* trouble during the GFC).

On top of that, Culp's first big move after he joined GE was to sell some of GE’s best businesses — the biopharma units — to his old company, Danaher, in February 2019 for $21.4 billion.

I remember thinking at the time that this seemed like a conflict of interest — Culp no doubt still owned a lot of Danaher stock (he owned 2.4 million shares in 2015, but I don’t know what happened after that), and he must’ve known that they were pivoting to life sciences.

Selling some of GE’s crown jewels seemed like the work of a double-agent…

Of course, Culp had a justification for it. He wanted to reduce GE’s debt and improve the balance sheet. Maybe he was right and it was the best way to do it, or maybe there was another way that would’ve been better for GE (if worse for DHR). I don’t know ¯\_(ツ)_/¯

But at the time, it furthered my impression that GE was stuck with the leftovers and the turnaround may never happen.

There was a likely scenario where Culp tried for a few years, was paid handsomely for the effort, retired wealthier, and GE remained a troubled business facing all kinds of headwinds. Let’s call that the “Ed Breen at Dow Dupont” scenario 😬

But while I’m not super familiar with GE, Culp appears to have done a good job and it is being rewarded by the market. Free cash flow, which had been negative since 2016, turned positive under him. He divested assets, cut the dividend, and focused on operations in a way that hadn’t been done successfully at the company in recent memory.

I’ll keep an eye on it because I’m curious how the story ends. Turnarounds rarely turn, so when they do, it’s worth seeing if there’s anything to learn.

But the first lesson is that what may seem obvious looking back wasn’t looking forward. That’s evergreen — not a new concept — but it’s good to remind ourselves of it with concrete examples once in a while.

In investing, most of the important concepts are simple. They’re just hard to consistently keep in mind and apply.

Post-scriptum: You know who did well? Danaher, who got a bunch of biopharma assets right on time for the 2020 pandemic…

Samsung’s 2018 “Fat Finger” Event (Employees Got $105 BILLIONS in Stock Comp) ⌨️☝️😬💰💰💰💰💰💰💰💰

Check this out:

on April 8, 2018, in which an employee of Samsung Securities mistakenly distributed shares worth US$100 billion to employees.

The fiasco unspooled last Friday, when a Samsung Securities employee caused the firm to pay out a massive dividend in the form of its own shares to 2,018 employees who were members of a company stock-ownership scheme.

The dividend was supposed to be 1,000 won ($0.94) per share. But the employee mistook the form of measurement, confusing won and shares. The error caused Samsung Securities to issue a dividend that was 1,000 times the value of each share held by the group of employees.

In all, the company deposited 2.8 billion shares worth 111.8 trillion won ($104.8 billion) into employee accounts—more than 30 times the company’s existing issued shares.Someone in the payroll department had a really bad day! 🫢🫣

The company noticed the error 37 minutes later.

However, while the shares were issued and before the company noticed, 16 employees sold the shares which the company gave them. Some of these employees, according to the country's Financial Supervisory Service, proceeded with the sale despite receiving warnings from the company.

The employees who sold their shares could have received US$9 million each. A South Korean financial watchdog later found that 21 employees traded or attempted to sell their shares to profit from the error and were promptly reported to prosecutors.Samsung stock dropped 11% after the error and was volatile for a while after that.

🔒☁️ Wiz says ‘no thanks’ to Google’s $23bn offer, will IPO

As far as I can tell, Wiz had $350m in revenue last year.

Google’s $23bn offer values them at 65.7x ‘23 revenue. Even if they grew 100% YoY in 2024, that’s still a pretty juicy multiple these days (it wouldn’t be anything special in 2021, though).

To explain the decision to reject the offer, Wiz CEO Assaf Rappaport wrote a memo to employees (we have fragments):

"I know the last week has been intense, with the buzz about a potential acquisition. While we are flattered by offers we have received, we have chosen to continue on our path to building Wiz."

"Let me cut to the chase: our next milestones are $1 billion in ARR and an IPO."

"The market validation we have experienced following this news only reinforces our goal – creating a platform that both security and development teams love."

"As we always say: LFG."It’s unclear what motivated the choice to stay indie.

Probably a mix of things, including anti-trust concerns — you don’t want to spend months preparing an acquisition that never happens, that’s very distracting for management and employees and has an especially big opportunity cost for a company in hypergrowth in a landgrab race — and possibly the belief that with Crowdstrike’s recent troubles, there may be an opening to do even better than they expected in the cloud security area (which is one of Crowdstrike’s areas of operation — not the biggest one, but a very fast-growing one).

Google has been expanding its security portfolio. It bought two cybersecurity firms in 2022, Siemplify and Mandiant for $500 million and $5.4 billion respectively. It’ll be interesting to see if it keeps going.

Could SentinelOne be their next target? 🤔

🤖🤝🐜 OpenAI Explores AI Chip Partnership with Broadcom

I already wrote about OpenAI’s internal efforts to build a chip team. They’re also talking to Broadcom:

The ChatGPT maker has been hiring former members of a Google unit that produces Google’s AI chip, the tensor processing unit, and has sought to develop an AI server chip, according to three people who have been involved in the conversations. OpenAI has been talking to chip designers including Broadcom about working on the chip, according to the people.

There’s more than one way for them to benefit from this effort:

A new server chip that would rival the kind made by Nvidia is a long shot that would take years to come to fruition. And in trying to develop a chip, OpenAI risks upsetting Nvidia, OpenAI’s most important chip supplier.

But it could also provide OpenAI with potential leverage in future pricing negotiations with the company.

Whatever happens, it probably won’t come to fruition for a while. Hardware takes time.

🍽️ The Economics of GLP-1 (Ozempic, Wegovy, etc) 🥩

Lean protein “emerged as the biggest winner” on supermarket shelves among shoppers who have taken popular new weight-loss drugs, according to a report using consumer surveys. [...]

Their grocery bills were down by an average of 11%, yet they spent 27% more on lean proteins from lean meat, eggs and seafood. Other gainers were meal replacements (19%), healthy snacks (17%), whole fruits and vegetables (13%) and sports and energy drinks (7%).

Snacks and soda took the brunt of reduced spending by consumers after GLP-1 treatment: snacks and confectionary (-52%), prepared baked goods (-47%), soda/sugary beverages (-28%), alcoholic beverages (-17%) and processed food (-13%).

🧪🔬 Science & Technology 🧬 🔭

🦙🥇🤖 Meta’s Big Llama 3.1 Appears Best-in-Class

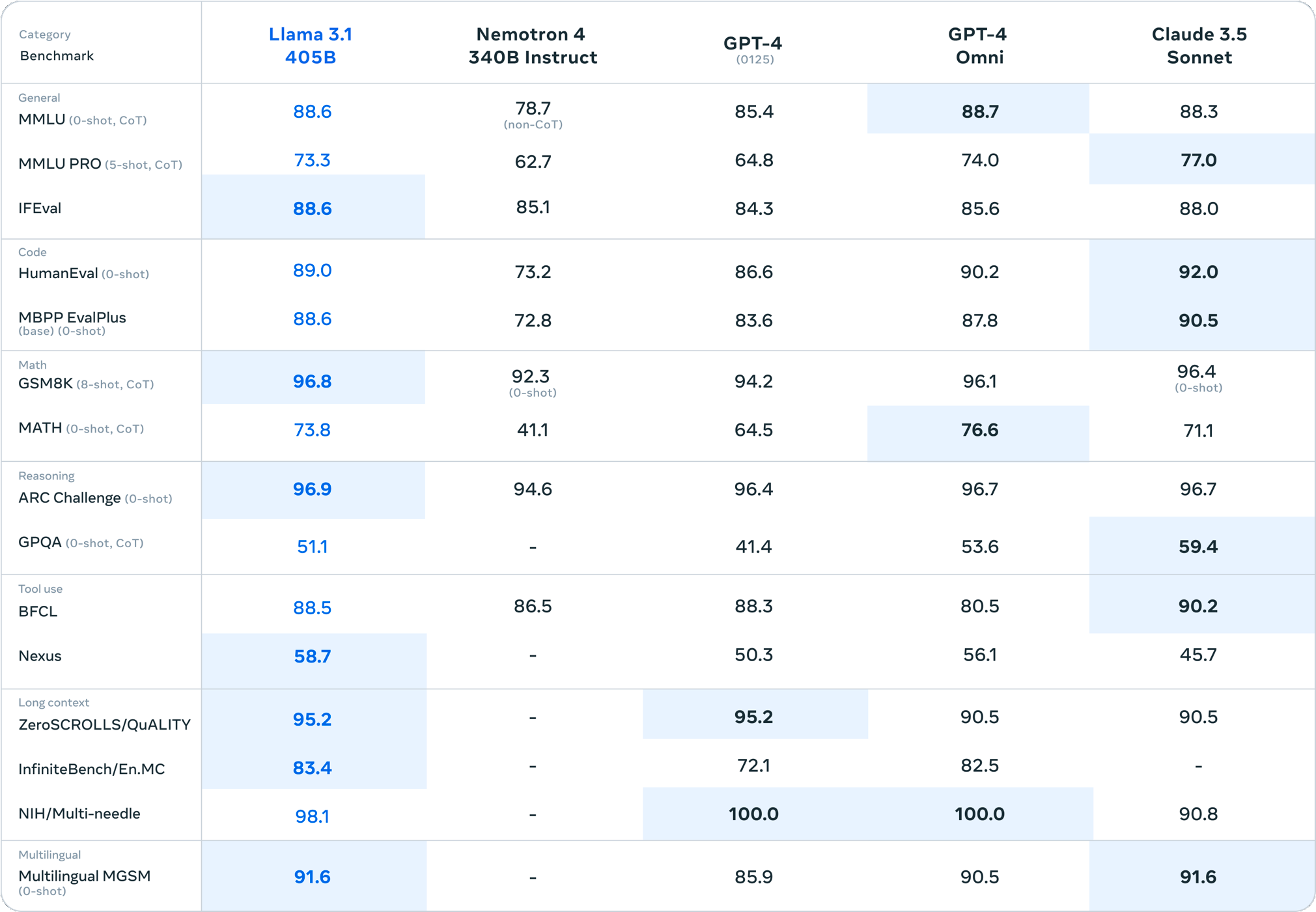

Meta recently unveiled a new 405 billion parameters dense model that beats OpenAI’s GPT-4o and Anthropic’s Claude 3.5 Sonnet on most benchmarks, and pretty much ties with them on the rest.

As our largest model yet, training Llama 3.1 405B on over 15 trillion tokens was a major challenge.

To enable training runs at this scale and achieve the results we have in a reasonable amount of time, we significantly optimized our full training stack and pushed our model training to over 16 thousand H100 GPUs, making the 405B the first Llama model trained at this scale.

16k H100s, 15 trillion tokens!

It’s a very impressive achievement. And all the more notable since Llama 3.1 is an open-source model (or the weights are, if not the whole dataset).

Zuckerberg wrote an open letter about why releasing models for free makes sense for Meta, and how he thinks he may take the lead on the next round:

Today, several tech companies are developing leading closed models. But open source is quickly closing the gap. Last year, Llama 2 was only comparable to an older generation of models behind the frontier. This year, Llama 3 is competitive with the most advanced models and leading in some areas. Starting next year, we expect future Llama models to become the most advanced in the industry.

You can tell he’s got PTSD from this:

One of my formative experiences has been building our services constrained by what Apple will let us build on their platforms. Between the way they tax developers, the arbitrary rules they apply, and all the product innovations they block from shipping, it’s clear that Meta and many other companies would be freed up to build much better services for people if we could build the best versions of our products and competitors were not able to constrain what we could build. On a philosophical level, this is a major reason why I believe so strongly in building open ecosystems in AI and AR/VR for the next generation of computing.

Zuck also claims that Llama 3.1 costs about half of GPT-4o:

Developers can run inference on Llama 3.1 405B on their own infra at roughly 50% the cost of using closed models like GPT-4o, for both user-facing and offline inference tasks.

However, not everyone will want to spin up their own infrastructure or has the high utilization rates to justify it.

The main area where the new Llama lags behind the competition is that it isn’t multi-modal (ie. it cannot handle images, videos, and sound natively), but Meta has announced its intention to get there in future releases.

If you are in the US, you can try Llama 3.1 405bn on Meta.AI. Hopefully, it will be released in Canada soon so I can play with it without a VPN.

P.S. Looking at the benchmarks above highlights just how good Claude 3.5 Sonnet is because it’s much smaller than Llama 3.1 and GPT-4o yet it competes head-to-head. I can’t wait for Claude 3.5 Opus (the big one!).

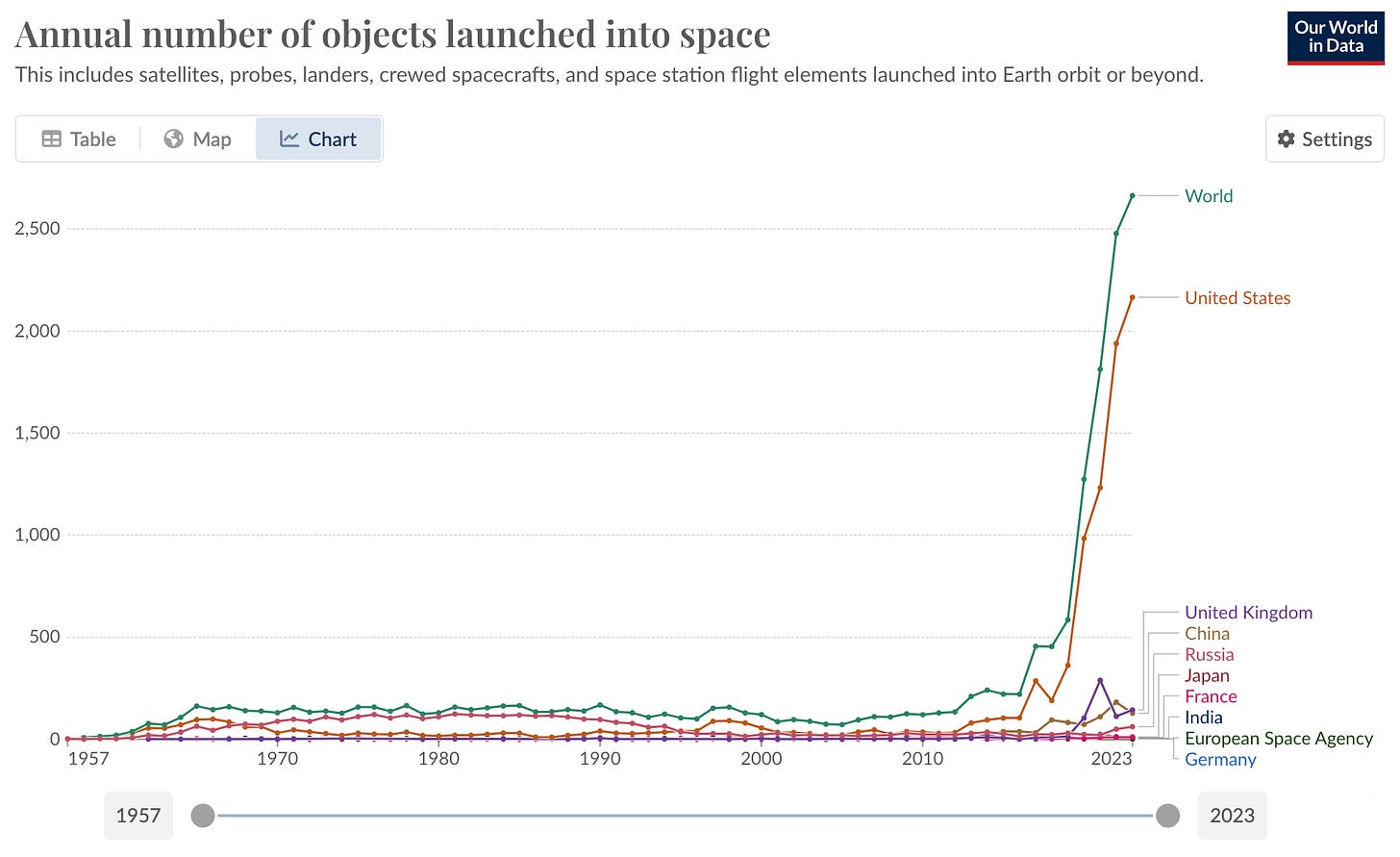

‘Humanity launched more satellites in the past two years than we did in all of 1957 to 2000’ 🚀🚀🚀🛰️🚀🛰️🚀🚀🛰️🛰️🛰️🚀🛰️🚀🛰️🛰️🛰️🛰️🚀🛰️🛰️🚀🛰️🛰️🚀🚀🚀🛰️🛰️🛰️🛰️🚀🛰️🛰️🛰️🚀🚀🚀🛰️🛰️🛰️🚀🛰️🛰️🛰️🛰️🛰️🚀🛰️🛰️

🧬 Immunotherapy vs Brain Cancer 🧫 🧠

Interesting piece on the progress in the battle against cancer using our own immune system:

Choi and Maus had treated their first patient in a clinical trial for an aggressive brain cancer called glioblastoma, infusing genetically modified white blood cells directly into the fluid surrounding the brain. They had been up all night worrying, especially after the patient, a 74-year-old man, developed a fever. Choi had ordered an MRI. “We were not looking for the results,” he said. “We were trying to make sure that our patient was okay.”

When Maus got to Choi’s office, images from the MRI were loading on his screen. They stared in wonder: The patient’s tumor, which a few days before had shown up on the scan as a bright blob the size of a strawberry, had almost entirely disappeared. No one had heard of that kind of regression in glioblastoma, especially not overnight. “My first instinct was that there was something wrong with the MRI scanner,” Choi said. But then the follow-up scans looked even better.

Several weeks later, they treated a second patient, a civil engineer from upstate New York named Tom Fraser, and the process repeated itself: the infusion, the fever, and the rapid regression of the tumor.

This brings tears to my eyes.

My favorite uncle, who was like a second father to me, died from a glioblastoma tumor. This man who was otherwise extremely fit and healthy was dead within months of diagnosis.

Glioblastoma is the most common type of malignant brain cancer. It can strike at any age, and it’s uniformly fatal. Patients are often diagnosed in the emergency room after the tumor causes some somatic catastrophe, such as seizure, sudden loss of speech, or an inability to control the limbs on one side of the body. The median time from diagnosis to death is just over a year.

I can’t wait until we beat this thing (fully and completely and utterly, total defeat of the big C).

Read the rest of the piece here.

🍪 Google Changes its Mind on Third-Party Cookies in Chrome 🥠

After what seems like forever of talking about browser cookies going away, multiple delays, etc, it turns out it won’t happen, or at least not fully.

In a not-very-clear blog post, Google’s VP of Privacy Sandbox (!) said:

we are proposing an updated approach that elevates user choice. Instead of deprecating third-party cookies, we would introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time. We're discussing this new path with regulators, and will engage with the industry as we roll this out.

Jeff Green is probably smiling somewhere.

He’s also spent years creating alternatives to cookies so there’s probably some frustration there, but on the net, I think this is good news for most online players.

🎨 🎭 The Arts & History 👩🎨 🎥

🐻 🍽️ Thoughts on ‘The Bear’ Season 3 (8/10) 🧑🏻🍳🔪

🚨 There are spoilers for the first 8 episodes. As I write this, I haven't seen the last 2. 🚨

.

.

.

Cards on the table: I like it! 👍

But not as much as season 2 (so far).

I’m going to make a music analogy to explain how I like it and what I think they’re doing.

Season two was the show’s Nevermind. They had a strong first season, but they *really* exploded and got on most people’s radar with season 2.

That’s the one that perfected the formula from season 1 and had some really good hit singles (Copenhagen, Fishes, Forks..). It gave us some twists on what we expected (Richie’s arc) and introduced new characters (Claire).

After a hit album, expectations are almost impossible to meet and fans usually want a band to just give them more of what they liked so much. But that can be a creative trap. Nothing feels as good and surprising the second time but anything too different risks being disappointing (even if it’s really good).

I feel like season 3 is a growth season for the show.

They are being just as virtuosic (is that a word?) as in season 2 but in a less accessible manner.

It’s not as catchy and immediate, but I think there’s a lot of depth there. They’re expanding the palette of the show and giving a lot of layers and backstory to characters that in season 1 seemed like barely more than background extras.

They also did something very difficult in episode 8:

They took the most hated character from season two, the mother (Dee, played by Jamie Lee Curtis) and made me feel empathy for her. I still wouldn’t want to be stuck in a room with her for hours, but they turned her from a hyper-manic caricature into more of a real person. And they did that via close-up shots of two people’s faces talking for 20 minutes. That’s not easy!

Don’t get me wrong, it wasn’t as good or as exciting to watch as Forks — I’d much rather rewatch that one than this one — but I’m glad I lived through that moment with them. It was meaningful and made me understand their family dynamic much more.

The very first episode of the season did something similar: It added depth to the backstory but in a much more dream-like way than most flashbacks. It also showed how patient the showrunners are. They didn’t give us the expected resolution to the conflict at the end of S2, instead, they went on a detour, and in many ways, all of S3 is kind of a detour.

It’s also using the analogy of the different menus every night and applying it to the episodes. That’s pretty cool, in a meta way.

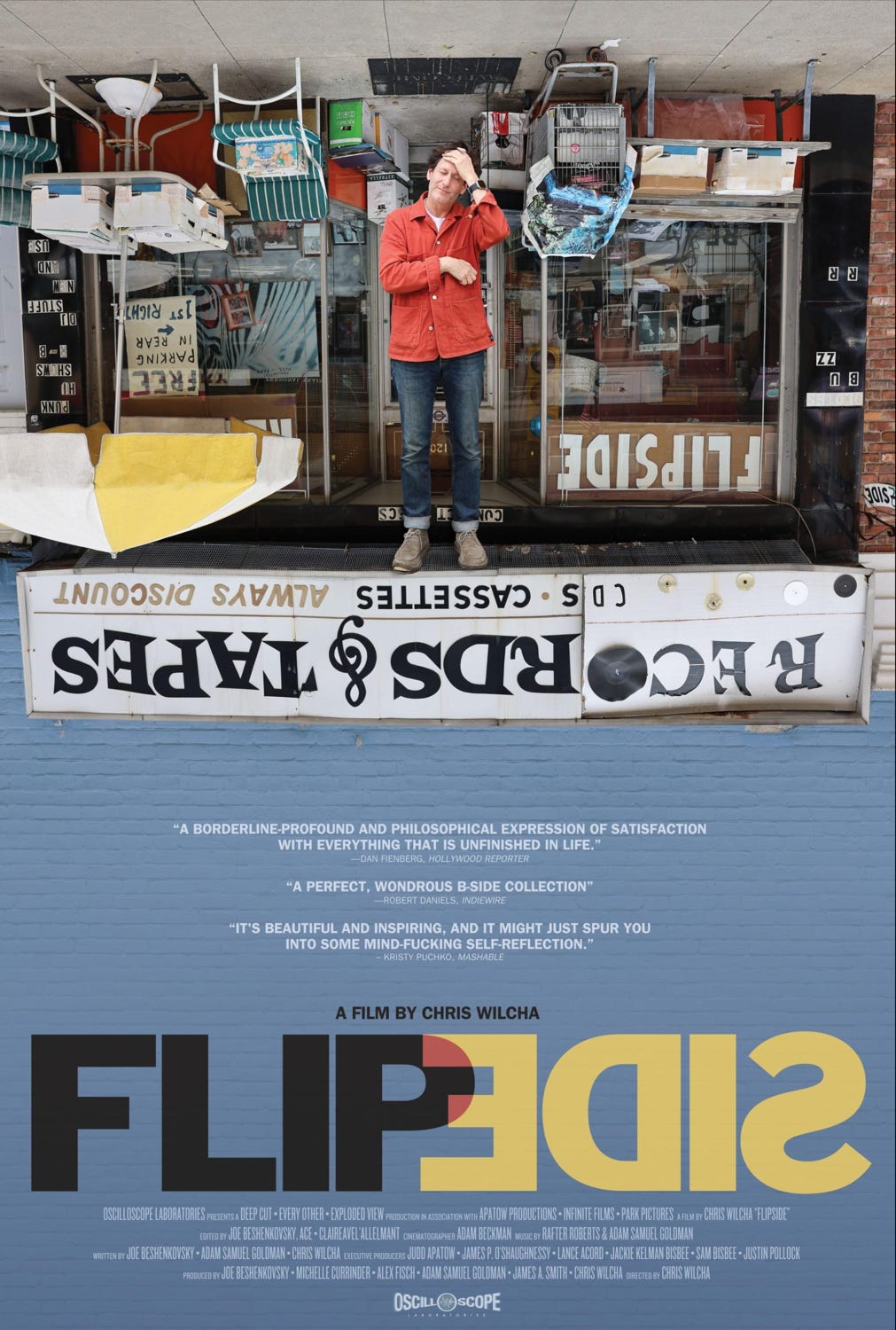

🎬 Flipside is now available to stream

You can rent it on Apple TV, Prime Video, Google Play, etc.

Check it out, it’s a great documentary. You can read my review here.

Full disclosure: Jim O’Shaughnessy is a co-executive producer along with Judd Apatow, and OSV's Infinite Films was involved.

Had been waiting to watch Flipside, so I appreciate the update! Hopefully, I will find time to watch it this week.

As an aside, one of my favorite things about LLMs or engines like Perplexity is linking complex, jargon-heavy articles (such as the Glioblastoma one) and asking it to summarize and explain using language a 14-year-old would understand. Makes learning new things much easier.

Enjoy the rest of your weekend!

Nice edition! It’s fascinating how many satellites we have launched. What changed in recent times that has enabled this? What good is going to come of this?