515: Nvidia's Jensen & Meta's Zuck Q&A, Software is New Hardware, Taiwan Silicon Shield, Investing Fees, Mercury's Diamonds, Coffee Grinder

"just one good idea per year can be INCREDIBLY valuable"

Baby steps are the royal road to skill.

–Daniel Coyle

☕️☕️☕️ A new chapter in my home espresso adventures: I bought a coffee grinder!

The Fellow Opus went on sale during Prime Day. It was one of the models that made it to the final round during my research and I couldn’t resist the discounted price.

Each finalist had different trade-offs and none were “perfect”. If you’re curious, I also considered the Timemore Sculptor 064S, Niche Zero, and Baratza Sette 270. Note that all of these options are more expensive than the Opus.

I wasn’t sure what to expect. Would I notice the difference? Was this super subtle stuff that doesn’t replicate in blind tests (like a lot of wine stuff)?

But from the very first cup with the Opus, the difference was pretty striking. There was *noticeably* less bitterness than with my old grinder, the Baratza Encore (which is perfectly good, but not designed for Espresso).

I don’t know why. Is it because the grind is finer and more even, so the pressurized water flows through more evenly and slowly through the coffee rather than channeling through only part of it because of the rougher grind, over-extracting that part while under-extracting the rest?

¯\_(ツ)_/¯

It sounds plausible, but I don’t know what’s really going on inside that coffee puck.

All I know is that I’m enjoying my espressos more and my wife also noted the difference 👍

🛫🍁🌊⛱️🐟🦞 I will be traveling with my family next week. We’re going to Halifax, Nova Scotia. It’ll be our first time there, and the first plane trip for the kids.

I’ve always had a soft spot for cities near large bodies of water and how that ends up influencing every aspect of the local culture.

About 10 years ago, I went to Newfoundland for a friend’s wedding, and the maritime vibe was one of my favorite aspects about St-John’s.

💚 🥃 🚢⚓️ If you’re reading this, ideas matter to you. 💡

You likely recognize that ideas are often undervalued, even among those whose job it is to make decisions, solve problems, or have the right idea at the right time. While it's common to hear that "ideas are worthless," this oversimplification does a disservice to the power of great ideas. Yes, execution is crucial, but without a foundation of strong ideas, even perfect execution leads nowhere (or worse).

Consider this: Even just one good idea per year can be INCREDIBLY valuable to anyone with capital to deploy, operating leverage inside of a company, or someone with personal projects that matter to them. 💰

The impact of ideas extends far beyond the professional: Making better decisions with your spouse or about your kids or health can have huge lifelong positive effects. 💪

This newsletter provides exploration as a service and a world of diverse ideas. We can’t know in advance what will be useful, but we can have fun learning and thinking things through together.

Your next favorite thing might be just one newsletter away. Thank you for your support! 💡

🏦 💰 Business & Investing 💳 💴

🗣️🗣️😎 Nvidia’s Jensen Huang and Meta’s Mark Zuckerberg Nerding Out at SIGGRAPH 🔥🤖🐜

The whole thing is worth watching, but here are a few of my highlights:

Jensen: “Your data center of H100s… I think [Meta] is coming up on 600,000 H100s.”

Zuck: “Yeah…we’re good customers. That’s how you get the Jensen Q&A at SIGGRAPH” *laugh*

Funny!

But also, 600k H100s 🤯

Zuck: “The flywheel is spinning really quickly so it's exciting, there is a lot of new stuff to build and I think even if the progress on the foundation models kind of stopped now — which I don't think it will — I think we'd have like five years of product innovation for the industry to figure out how to most effective use all the stuff that's gotten built so far.”

This is something that I wrote about a few times.

These LLMs are largely black boxes. They weren’t designed from the ground up in the way that most software is. They emerge when you train transformer models with gigantic piles of data, compressing patterns into giant matrices of numbers. It’s software that we didn’t write — we wrote the software that wrote the software using the patterns in the data.

This means that we don’t fully know what’s going on inside these models. We’re more like explorers, trying to figure out use cases and capabilities.

This means that — in theory — three years from now we could find something really cool and useful about GPT-4o that was embedded in the model from day one, but that we weren’t aware of.

Zuck: “I actually think the foundational models and progress on the fundamental research is accelerating so it's a it's a pretty wild time.”

One of the biggest questions right now is whether scaling will keep delivering big improvements. All the signals from the people who are looking at the next models seem to indicate that it will, at least for a while.

Kevin Scott, the CTO of Microsoft, who knows what is going on in his company’s labs and likely has good visibility into OpenAI, has been most vocal about this.

If I had to bet, I’d put money on frontier models not hitting a scaling wall at least for a few more years. But who knows after that? Do we need algorithmic breakthroughs to keep on trend beyond a few more turns of the crank?

Jensen: “I thought llama 2 was probably the biggest event in AI last year because when that came out it activated every company, every enterprise, and every industry. All of a sudden every Healthcare company was building AIs, every company was building AIs, every large company small companies startups, was were building AIs. It made it possible for every researcher to be able to re-engage AI again because they have a starting point to do something with.”

It’s a very good point about the leverage of free and open models.

They end up not only in more places but also in places that may not be able to justify spending on spinning up their own AI and wouldn’t entrust their data to a third party. This increases the amount of experimentation in the system, which should be win-win.

I won’t quote the whole thing, but there’s a long riff by Zuck about how frustrated he’s been in the mobile era having to build on someone else’s platform (Apple), and being told what he can and can’t do (the viral moment was that he dropped a F-bomb while talking about it — I don’t think it’s a big deal 🤷♀️).

I’ll reiterate a bit what I wrote about in Edition #514:

It’s aligned with Meta’s strategy to want open platforms and open-source AI and all that. But let’s remember that for a long time, Facebook was considered to be the “closed” system, a “walled garden” that heavily contributed to the decline of the permission-less open web where anything could be built and experimentation was encouraged.

Everything else was accessible freely, could show up on Google, and could be linked to from anywhere, but Facebook wasn’t searchable and you needed to be logged in to access it. In many countries, Facebook basically replaced the open web with something where you can only do what a single company allows you to do.

So while I applaud the open push on the AI front, I also try to remain clear-eyed about the incentives at play and the history.

Facebook tried to launch its own smartphone OS over 10 years ago. It flopped, but if they had succeeded, would it have been an open platform or a (more) closed one than Android and iOS? ¯\_(ツ)_/¯

I’ll stop here, but there’s plenty more in the video (including a jacket exchange at the end). 👋

💾 ‘Software is the new Hardware’ 🛠️⚙️

Friend-of-the-show and Extra Deluxe supporter Byrne Hobart (💚💚💚💚💚 🥃 ) has a great post that I recommend you check out.

Here are a few highlights:

If you spend much time trying to make the case for deep tech investments, you start to get a real appreciation for what a great business software companies have. There are nominally high fixed costs, but most of those costs become fixed well after the company is established. Meanwhile, the marginal cost of delivering the product rounds down to zero, and that means that companies have enormous flexibility in how low they can price

It’s kind of funny how long it too most people to understand this — and by the time it became common knowledge and consensus, it’s starting to change. That’s how things often work out, it seems…

All of that is changing. The marginal cost of writing code is dropping, while the marginal cost of running it—to the extent that much of this new code is frequently using inference, or doing other computationally-intensive tasks—is rising. That's the reverse of the economic tailwind that's done so much for software engineers' incomes and software investors' returns.

Anyone looking at the capex numbers of the hyperscalers and Big Tech like Meta can confirm that point!

something essential about software economics: the complementary good to any given software product is a lot more software! This is part of the mystery of Docusign, i.e. why do they have so many employees? And why doesn't someone else just make a cheaper replacement? [...]

The biggest product typically has the most integrations, and as the cost of launching a new SaaS product declines, the investment required to have the right integrations for 99% of customer use cases actually increases.

But those economics start to look different. They look a lot less like a high-fixed/low-marginal cost business and a lot more like a lower fixed-cost, but higher marginal-cost business.

That's a case where, paradoxically, a labor-saving tool increases the labor cost associated with any given increase in revenue. [...]

Meanwhile, a lower cost to creating new programs also means a shorter half-life for a given piece of code.

It’s such an interesting dynamic to think about. Great systems thinking playground!

💸 The Real Damage of 'Tiny' 1-2% Fees 😬📊

You’re smart, you already know this.

But there are likely a bunch of people in your life who have never thought about personal finance much and could benefit (A LOT) from this simple chart.

Please share it with them.

It shows the results of the S&P 500 index over time vs an index fund with %1 annual fee, 1.5% fee, and so on.

In the same way that compound interest isn’t intuitive, compounding fees aren’t. Most people see a small number (1%) and round it down to zero.

What’s worse is that there’s never just one layer of fees.

It adds up… Fees when you buy, fees when you sell, taxes, banking fees, broker fees, money transfer fees, buy/sell spreads, FX conversion fees, research or data subscription fees, margin interest, whatever.

It’s worse for small investors — if you invest a few hundred bucks at a time, paying a few bucks per transaction can represent a big percentage of your total capital. The impact over decades can be enormous.

h/t Koyfin Charts

🇹🇼🛡️🐜 Taiwan’s Silicon Shield is All that Remains (for now…)

From ChinaTalk:

Jared McKinney of the Air War College and Peter Harris of Colorado State University recently co-authored a fantastic monograph, “Deterrence Gap: Avoiding War in the Taiwan Strait.”

Their major value-add to the Taiwan discussion: interlocking deterrents (as opposed to deterrence). The reason cross-Strait conflict has been held at bay for so long, they argue, is because the PLA was simultaneously facing several deterrents, including US naval dominance, Taiwan air superiority, and even the US threatening to use nuclear weapons.

Constraints (ie. externally imposed limitations) against the PLA have all but disappeared, and restraints (ie. internally motivated reasons to exercise self-control) are quickly dissipating, too. [...]

Conventional army doctrine has it that the attacker-to-defender ratio should be 3:1 for >50% odds at success; for more complex operations — like amphibious assaults — the ratio should probably be up to 5:1.

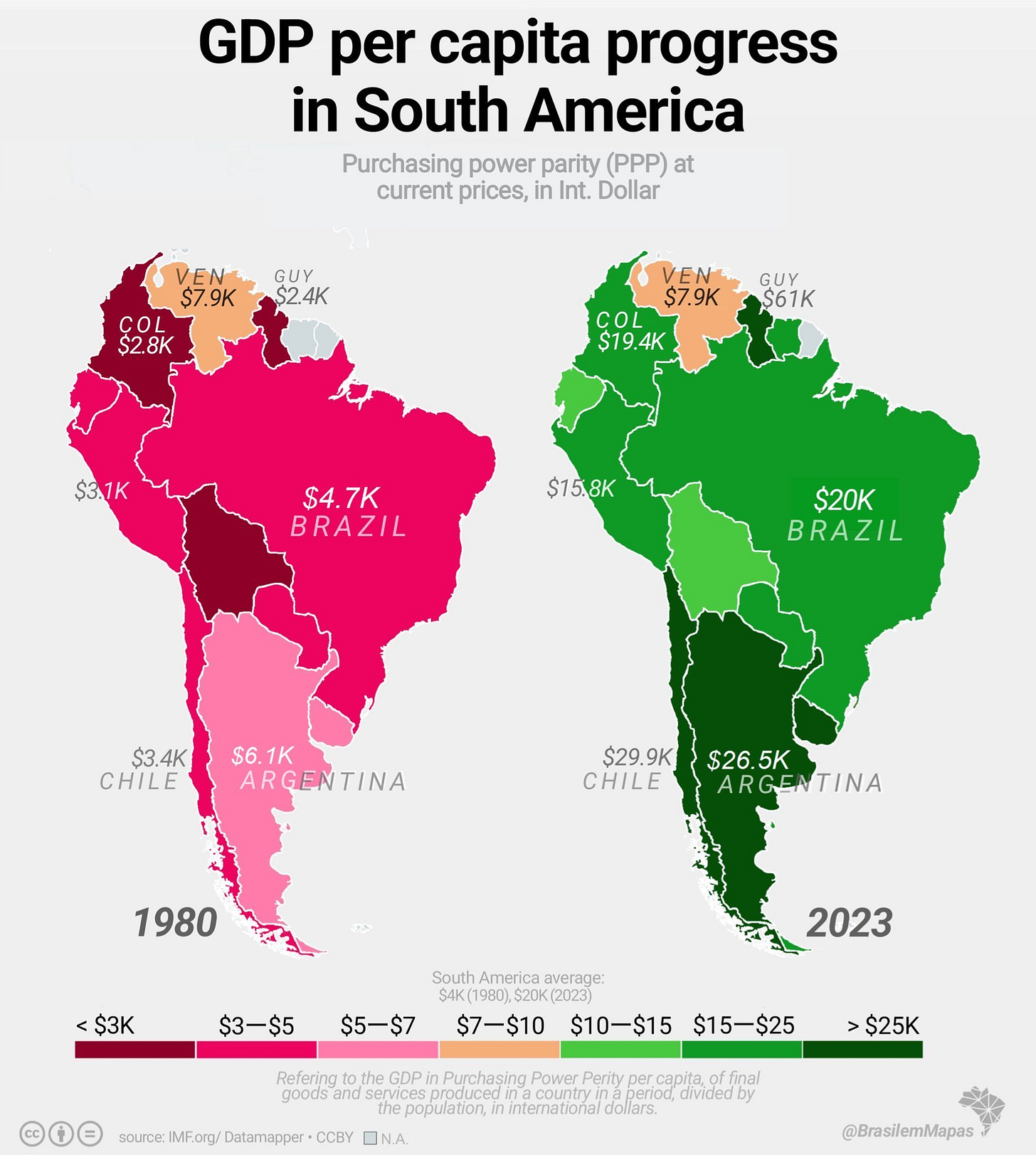

🌎 43 Years in South America 📈⏳🇻🇪📉

One of these is not like the others…

…It’s the one that used to be much wealthier per capita than all the others, that has some of the largest oil reserves in the world and all kinds of other advantages.

This a good reminder that the system — rule of law, strong institutions, incentives for wealth creation, error correction mechanism, democracy, property rights, freedom of speech, checks and balances, due process, etc — is the foundation on top of which almost everything else is built.

🧪🔬 Science & Technology 🧬 🔭

💎💎💎💎💎 Mercury’s 11-Mile Thick Diamond Layer Around its Molten Core 💎💎💎💎💎

The universe throws us all kinds of curve balls:

Scientists from China and Belgium recently published a study in Nature Communications that proposes the existence of a diamond layer at Mercury's core-mantle boundary. It suggests this layer is up to 18 kilometers (11 miles) thick. The finding represents a significant advance in understanding planetary differentiation processes – how planets develop distinct internal layers. [...]

The diamond layer's high thermal conductivity impacts Mercury's thermal dynamics and magnetic field generation. The diamond layer helps transfer heat from the core to the mantle, affecting temperature gradients and convection in the liquid outer core, influencing the magnetic field.

The findings also have implications for understanding other carbon-rich exoplanetary systems and terrestrial planets with similar sizes and compositions to Mercury.

The full paper in Nature can be found here.

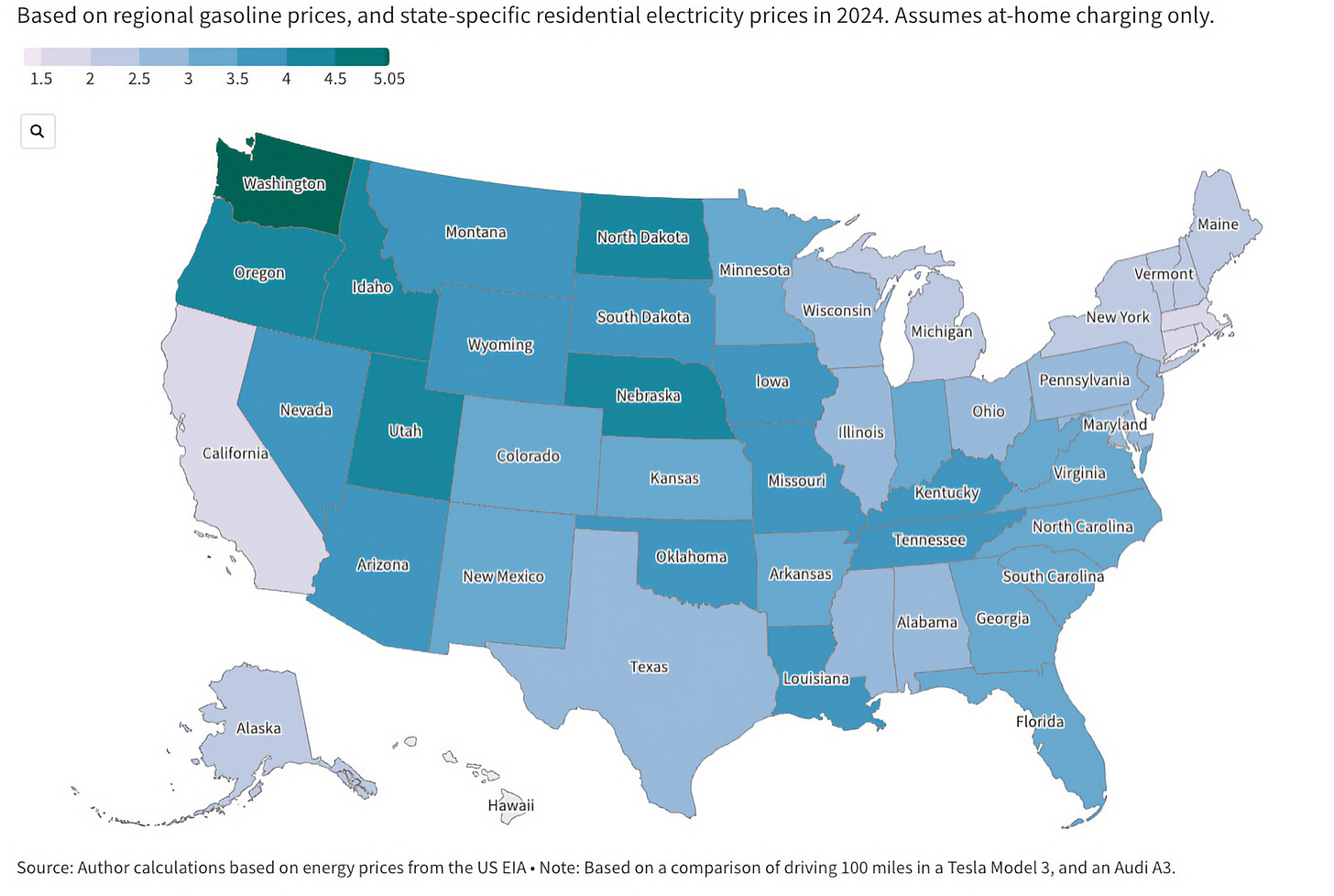

‘How many times more expensive is it to drive 100 miles in a gasoline car versus an electric one?’ 🔌🚘🔋 ⛽️🚙

Interesting napkin math by Hannah Ritchie:

Here, I’m comparing the Audi A3 and the Tesla Model 3. Of course, the result will vary by the choice of cars. I thought these two models were fairly comparable and efficient within their category [...]

For gasoline prices, I’ve taken the latest regional estimates from the US EIA.

For electricity, I’ve taken residential prices by state for April 2024 from the US EIA. This means we’re assuming that cars are charged at home (which is the case around 80% of the time).

It’s cheaper to drive an electric car in every state if you charge it at home. Fast public chargers can be two to three times as expensive, so in some states, the price benefits would disappear entirely if you relied on them instead.

Most US states fall in the 2-4x more expensive for gasoline than electricity range.

California is kind of the worst of both worlds: High electricity prices AND high gasoline prices…

One thing to keep in mind is that EVs can get cleaner and cheaper over time as the grid gets cleaned up and upgraded with lower-cost sources (ie. if solar keeps going down in cost, if we learn to build lots of nuclear again, etc) while gasoline is mostly tied to the cost of oil (+ any carbon taxes) and as engines get older and wear out they tend to pollute more.

🇨🇳 Cannons were invented 12th or 13th century China 📜

I didn’t know this:

The cannon first appeared in China sometime during the 12th and 13th centuries. It was most likely developed in parallel or as an evolution of an earlier gunpowder weapon called the fire lance.

The result was a projectile weapon in the shape of a cylinder that fired projectiles using the explosive pressure of gunpowder. Cannons were used for warfare by the late 13th century in the Yuan dynasty and spread throughout Eurasia in the 14th century.

During the Middle Ages, large and small cannons were developed for siege and field battles. The cannon replaced prior siege weapons such as the trebuchet.

Cannons during the Middle Ages!

The earliest known depiction of a cannon is a sculpture from the Dazu Rock Carvings in Sichuan, dated to 1128, that portrays a figure carrying a vase-shaped bombard, firing flames and a cannonball [...]

The oldest surviving gun bearing a date of production is the Xanadu Gun, dated to 1298. Other specimens have been dated to even earlier periods, such as the Wuwei Bronze Cannon, to 1227, and the Heilongjiang hand cannon, to 1288. However they contain no inscriptions.

It’s interesting to think of how world history may have been different if China had kept developing gunpowder weapons and made more use of them at a time when others didn’t have them.

🎨 🎭 The Arts & History 👩🎨 🎥

🎥 Theatrical vs Naturalistic Acting in Films 🎭

Neat video essay for film nerds. It helps understand why older films feel so different even when the acting is good.

It’s a little long and I admit that I fast-forwarded through some parts, but despite that, there was still enough interesting stuff for me to share with you.

I learned about the big pivotal era in films, and just how important Marlon Brando’s early performances were (and man, the guy lifted weights, look at those arms 💪).

The electric car home vs chargers vs gas were stats were interesting to see. This may already be a thing but I'll make a prediction that when home charging becomes more ubiquitous the utility companies will push for a separate metering for charging which will let them bypass regulation on rates charged, pushing home charging pricing closer to charging station / gas prices.

"Software is the new Hardware" was good read. It's an interesting way to think about it, in a lot of ways it's like going back to the late 90s or the early mid 00s when you had to be as or more concerned with the costs associated with the hardware & networking than the software. That definitely inverted in the late 00s early teens, and now we're circling back around again.

I liked this insight as well -

"What does require that headcount is making sure that the product is integrated with any of X CRMs, automatically archived in Y storage providers, integrated with Z business communications tools. The biggest product typically has the most integrations, and as the cost of launching a new SaaS product declines, the investment required to have the right integrations for 99% of customer use cases actually increases."

I think this does make a lot of sense at least some of the technical reasons for headcount. The venture model also skews everything, that money has to go somewhere and the company with the most engineers must be doing some pretty crazy technical stuff to need that many engineers, right? 😉