531: Perplexity, S&P Global, Nvidia & Blackwell, ARM vs Qualcomm, Larry Summers, Floppy Disks, Intel & Altera, Runway's Act-One, Creatine, Rick Rubin, and Tori Amos

"but I expect to be surprised, as usual."

Civilization is a movement and not a condition, a voyage and not a harbor.

—Arnold Toynbee

💻🖥️🔍🤖 Perplexity now has a desktop Mac app.

There are two main modes: the small search bar (at the top of the screenshot above) that can be triggered from anywhere with a keyboard shortcut, and the larger window where search/question results appear.

It seems pretty good so far. They certainly know how to ship fast — if you follow Aravind Srinivas, the CEO and co-founder, on Twitter, you’ll see that he goes from “hmm, maybe we should do this 🤔” to shipping something in a few weeks.

I wish there was a dark mode and a toggle to keep the app on top of other windows, But that's probably coming.

Having separate shortcuts for voice mode, voice dictation, and keyboard search is also nice. They're thinking of power users.

Perplexity is one of my favorite new product companies of the past decade. I use it constantly. It reminds me of when I first fell in love with Google around 1999-2000.

🤘🎸🫶🎹👩🏻🦰 I kind of love that back in the 1990s, there were LOTS of metal dudes — long hair, black t-shirts with angular band logos, headphones on ears or around their necks everywhere — who would basically say the same thing:

“My favorites are Slayer, Metallica, Megadeth, Anthrax, Sepultura, Annihilator, Testament, Dark Angel… and I also really like Tori Amos.”

I think that’s great, she was badass and her first three albums from the 90s were particularly good. I especially dig Little Earthquakes. I almost can’t believe it’s her first solo album — she came out so fully-formed musically!

If you’re younger than I am, this may not sound worth mentioning. But back then, when CD albums cost $15-20 (💿💸 — that’s $32-$43 in 2024 dollars! Per album!), music fans did a lot less genre-hopping than today when everyone has access to everything one click away.

People tended to stick to one or two genres they knew they liked and took fewer chances on completely different things.

This is why, as one of the eclectic ones, I always thought it was cool when an artist had crossover appeal to a very different crowd (ie. a lot of fans of heavy music discovered hip hop when Anthrax did that rap-metal track with Public Enemy, when Faith No More had a hit with “Epic”, and when Rage Against the Machine burst on the scene…).

Back to Tori, here she is in 1992 doing a completely bonkers cover of Led Zeppelin’s Whole Lotta Love:

As the top comment on YouTube says:

she has incredible control over songs. speed, tempo, all dynamics are at her whim and she uses them to full effect. She is in a class by herself.Her eye contact with the audience and her playfulness. Unique.

This whole 1992 concert at Montreux, and the other one from 1991, are worth watching in full.

🏦 💰 Business & Investing 💳 💴

🧠🔮 The Psychology of Market Predictions 📈 📉

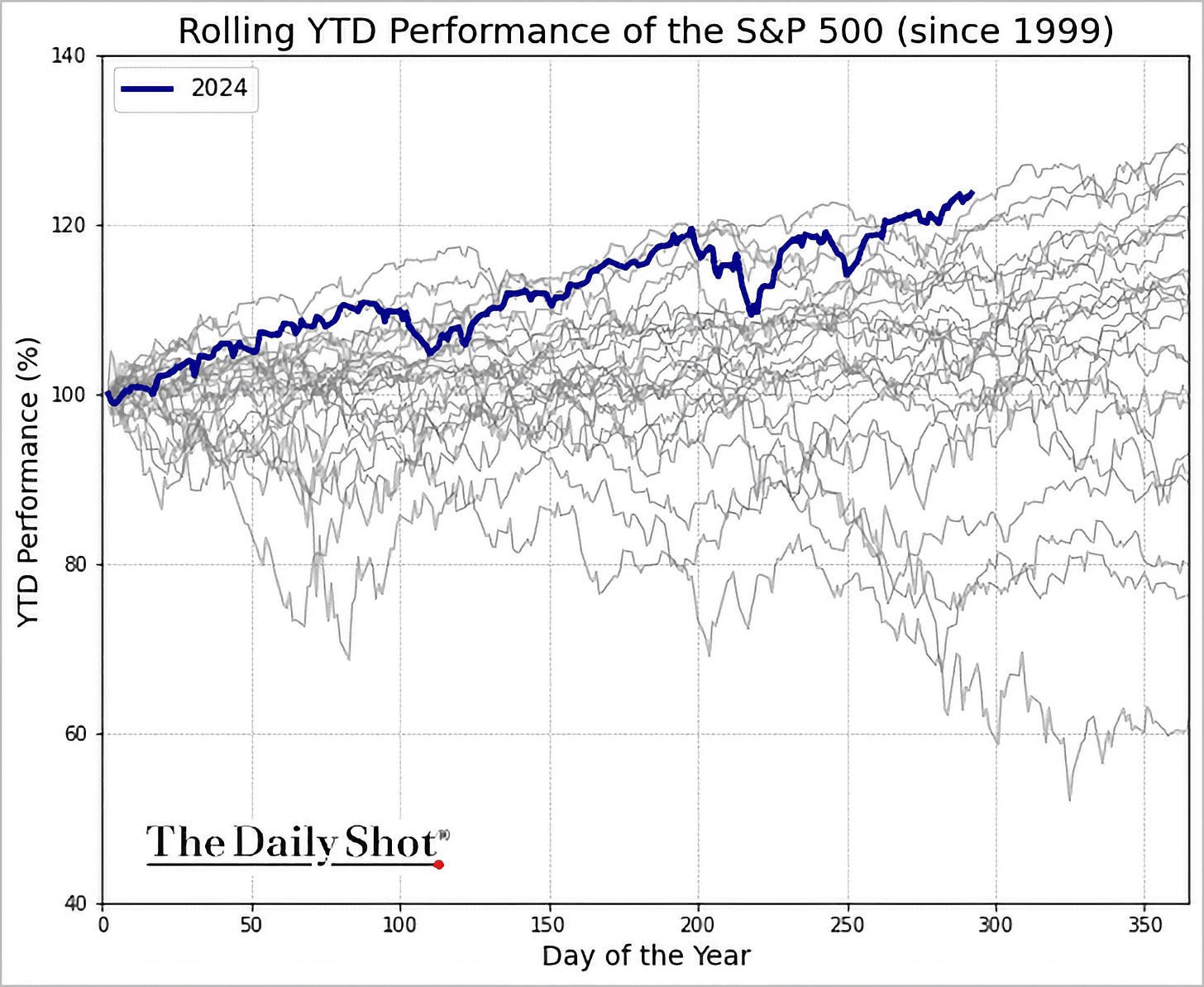

It’s very easy to fall into the gambler’s fallacy when looking at market movements. After a bad year, we secretly hope we’re “due” for a good one. After a good one, we fear we’re “due” for a bad one.

These thoughts are usually balanced against the fact that most investors simply extrapolate current trends, despite all their fancy models and research.

Consider 2021: many people — even many of those who now claim to have seen it coming — were expecting more of the same, believing that “the pandemic had pulled the future forward and we made 5-10 years of progress in a short period and everything has changed”. Similarly, after a painful 2022, many expected markets to keep grinding lower and for elevated valuations to settle much lower because of inflation, war, and a general malaise.

These two opposing forces (➡️ ⬅️) push and pull inside most market observers, even if largely at the sub-conscious level. If asked, they’ll say all the right things, but deep down, many of us can’t help but look at things in these rather simplistic ways. The trick is not to somehow NOT HAVE these thoughts but rather to NOT ACT on them.

As illustrated in the graph above, 2024 is, so far, the best year for the S&P 500 since 1999.

The eternal question: Will 2025 mirror 2022? Or perhaps it’s the next 2021? Will we grind sideways, surprising both optimists and pessimists?

I have no idea at all, but I expect to be surprised, as usual.

Source. h/t Andrew Sarna