559: Nvidia, OpenAI Social Network, E-Commerce Peak, TSMC's $40bn Bet, Jamie Dimon on Cash & Fraud, Bezos Bulldogs, Manufacturing & Trade, and Dehydration

"incredibly precious currency called trust"

Where there is no law, there is no freedom.

—John Locke

🛀💭🗽 I was thinking about what makes us free or not.

Liberty thinking about liberty, if you will.

Laws and norms are symbols on pieces of paper. Their worth depends entirely on the willingness of those with power to respect and uphold them. 📜

The laws themselves are inert. Lifeless.

They need agents who recognize their value and are willing to act on their behalf, even when it’s difficult or inconvenient. Especially when it goes against their own interests.

Liberty doesn’t come from the absence of rules. Take away the rules and you don’t get freedom, you get a playground for the most ruthless despots and warlords. Freedoms emerge from foundational principles that act as a solid bedrock to build on AND guardrails to prevent tyranny. 🏴☠️⚔️🛡️⚖️🏛️🏗️🏡🏘️🏡

There’s a tried-and-true set of these that have proven to be *incredibly* powerful at making societies better off: the rule of law, due process, freedom of speech, the presumption of innocence, property rights, an independent judiciary, equality before the law, separation of powers, etc.

Beware those who talk of “freedom” while dismantling the very structures that make it possible. 🏚️🔨

History has shown us time and again what happens when societies drift from a system of agreed-upon rules to one based on arbitrary and capricious power, subject to the whims of rulers.

When those in power act without restraint or accountability, freedom erodes. Rights become privileges granted or withdrawn at will, and fear replaces the hard-won, slowly accumulated, incredibly precious currency called trust. 🤝

High-trust societies are where quality of life is highest, where innovation thrives, and where wealth is created, making everyone better off, including those in poorer societies who climb the ladder by adopting these innovations and trading with wealthier countries.

This isn’t just a theory. Look at global migration patterns: people aren’t moving from high-trust societies to low-trust societies.

💌 Have I told you lately how much I appreciate you?

As many online communities have been getting worse, more fragmented, overrun with spambots and ragebait, chasing away good people, I find my interactions with you here such a joy.

In my experience, based on the comments, emails, the private supporter Discord, and the group Zoom calls, this steamboat is filled with kind, passionate, deeply curious, authentic, generous, open-minded, creative, no-BS (but always friendly!), and high-agency crew members. ⚓️🚢

You’re genuinely making my life better, so thank you for that *tip of the hat* 🎩

🤔👨💻⌨️ I've been using em-dashes in almost everything I write for years.

That’s just how my mind works: it naturally branches into little side paths and digressions ¯\_(ツ)_/¯

But now, there’s a backlash against “—” because LLMs love em-dashes… Ugh.

I’m trying not to change how I write because of this, but now whenever I use one, I can’t help but feel self-conscious about it.

Screw it, I’ll try to ignore it… but it feels a bit like the machines are taking away my toy. 😅

💚 🥃 🙏☺️ If you’re a free sub, I hope you’ll decide to become a paid supporter in 2025:

🏦 💰 Business & Investing 💳 💴

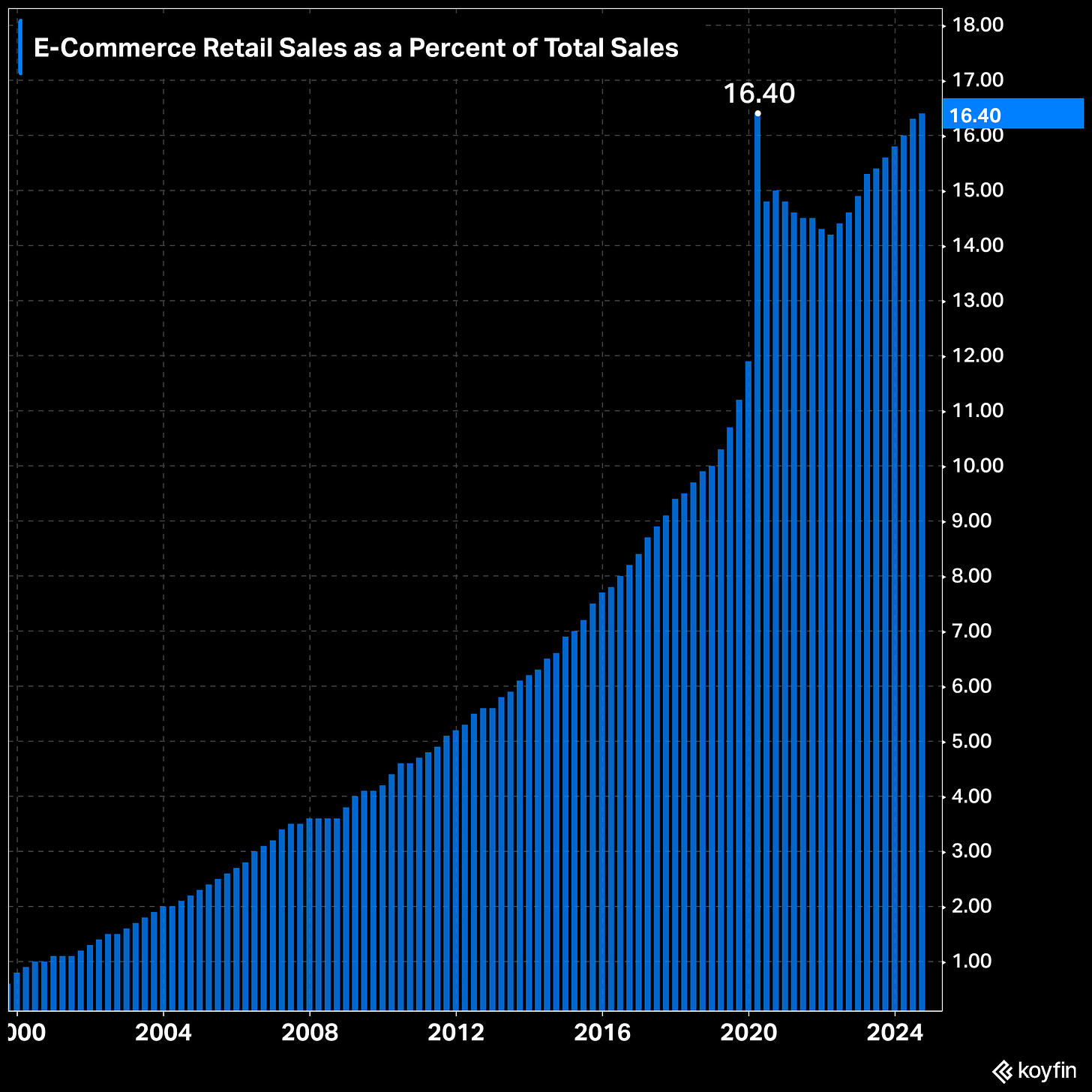

🛒 E-Commerce Retail Sales Return to Pandemic Peak 🚚📦

Remember when “the future was pulled forward” because of the pandemic?

The main narrative at the time was that this was a permanent change, and it seemed like it for a while… then things snapped back to the pre-pandemic trendline, and the 2021 bubble in e-commerce, SaaS, speculative SPACs, and stay-at-home stocks burst 🫧

The next challenge for e-commerce (and all commerce, tbh) will be a certain someone throwing sand and pebbles (and boulders 🪨) into the gears of global trade. ⚙️⚙️💥⚙️

Hat tip to friend-of-the-show Conor Mac (🏴💚 🥃)

🦅🇺🇸 Nvidia Bring Some Blackwell GPU Manufacturing to the U.S. 🏭🤖

In what is likely to be both a genuine commitment AND a strategic PR move targeted at telling the White House what it wants to hear (these days, headlines with big numbers are a must), likely in exchange for avoiding further restrictions on GPU sales to China and semiconductor tariffs, Nvidia has made some announcements about the Blackwell supply chain in the US:

(Update: Well, looks like it didn’t work! Last night, Nvidia announced a $5.5bn write-off (😬) because H20 sales to China will be restricted 🇨🇳💸)

NVIDIA is working with its manufacturing partners to design and build factories that, for the first time, will produce NVIDIA AI supercomputers entirely in the U.S.

Together with leading manufacturing partners, the company has commissioned more than a million square feet of manufacturing space to build and test NVIDIA Blackwell chips in Arizona and AI supercomputers in Texas.

NVIDIA Blackwell chips have started production at TSMC’s chip plants in Phoenix, Arizona. NVIDIA is building supercomputer manufacturing plants in Texas, with Foxconn in Houston and with Wistron in Dallas. Mass production at both plants is expected to ramp up in the next 12-15 months.

I’d be very curious to learn what % of total production capacity the US slice of the pie is expected to represent 🤔

The AI chip and supercomputer supply chain is complex and demands the most advanced manufacturing, packaging, assembly and test technologies. NVIDIA is partnering with Amkor and SPIL for packaging and testing operations in Arizona.

No specific numbers on jobs created by any of these. Construction is likely to require thousands, but once up and running, I’m curious how many people these increasingly automated plants require 🤔

Within the next four years, NVIDIA plans to produce up to half a trillion dollars of AI infrastructure in the U.S. through partnerships with TSMC, Foxconn, Wistron, Amkor and SPIL.

As Dan Nysted points out, this is something we’re seeing more and more:

It’s a bit similar to Canada’s “concessions” during the early days of the trade war which were just a list of things they were already doing (remember that? It feels like a long time ago).

The lead time on all this capex is very long and global supply chains are incredibly complex. It must be impossible for business leaders to investment planning when things are changing every other day and there’s clearly no masterplan when it comes to international trade (the sycophants who come up with post hoc justifications find themselves having to argue something and its exact opposite, sometimes within hours. It’s hilarious and pathetic at the same time).

🇹🇼 TSMC Nears Construction on 1.4-Nanometer Fabs ($40bn+ Investment) 🏗️🏗️🏗️🐜🔬💰💰💰💰

Big money, tiny transistors!

Soon, we’ll have to become familiar with picometers… 🤏

Fab 25 construction should begin in Q3 of this year, and trial production is expected by the end of 2027, with full production coming (if all goes well) in 2028.

This is a massive investment for TSMC, with four planned lines in the project estimated at NT$300 billion each ($9.3 billion), or NT$1.2 to NT$1.5 trillion ($37-$46 billion) for the whole enchilada.

A 1.4nm line will also be built at an existing fab that was originally supposed to be 2nm (this is a machine translation from Chinese):

TSMC has made a major breakthrough in the advancement of the 1.4nm process, and has recently notified suppliers to prepare the equipment required for 1.4nm, and plans to install a mini-line at the second plant in Baoshan, Hsinchu, advanced this year.

It is understood that TSMC originally planned to use the 2nm process of Baoshan Wafer [Fab] 20, of which the third and fourth factories will be changed to 1.4nm process. In the future, it will become the world's most advanced production base for TSMC with the two 1.4nm factories in Baoshan, while Kaohsiung is the manufacturing base for the 2nm process.

💵 Jamie Dimon: The Real Cost of Cash (aka the Bull case on Visa & Mastercard 💳 💳) + Fraud & Scam Arms Race 🔓💸

In his 2024 annual letter, Jamie Dimon writes:

Retailers now pay banks like ours that are subject to this government-mandated pricing 47 basis points (0.47%), on average, for debit card transactions. This is far cheaper for retailers than debit card alternatives, such as cash and checks, while debit cards also provide retailers immediate guaranteed money and are preferred by consumers.

All retailers bear a high cost of processing cash (including defalcation, cash sorting, delivery of cash to a bank, counterfeit funds and higher insurance because of robberies).

The cost of processing cash, even for the largest retailers, is probably more than 4% of the payment.

If you’re also wondering what the heck “defalcation” means, it’s “the act or an instance of embezzling.”

So, 4%!

Forget about debit’s 47 basis points, that makes even credit cards seem cheap!

Here’s Jamie on frauds & scams:

Our Consumer Bank lost $500 million from fraud last year – $300 million from losses as a result of customer fraud committed on us (for example, counterfeit deposited checks) and $200 million from reimbursements to customers who were victims of fraud (it is our policy to reimburse 100% of valid fraud claims).

Unfortunately, we must also process thousands of scam claims where customers authorized transactions but should not have done so (for example, buying nonexistent products or sending money to fake websites), often because they were misled by bad actors.

The loss rate to scams for our cus tomers is amongst the lowest in the industry, and lower than nonbank payment providers. That is because we have made significant investments in fraud and scam detection, as well as prevention capabilities, and believe that our efforts have prevented Chase customers from losing $12 billion.

$12bn for one bank. Imagine how big that number is when you put it all together for every bank, and then for every retailer and other black hat target!

Hat tip to friend-of-the-show Lawrence Hamtil

🐶 Bezos’ Bulldogs 🦴

Over the years, I’ve read Steve Yegge’s classic Platform Rant many times, but I somehow had forgotten about the Bezos Bulldogs part until Bucco Capital reminded me:

Something I think about a lot is the importance of "bulldogs" in getting things done

In Steve Yegge's rant he says Bezos assigned bulldogs to ensure people followed his "Big Mandate" that led to AWS

People will fight for their life to maintain status quo. You need a bulldog

Even a great idea will die a million deaths before seeing the light of day

There are whole careers to be made by just pushing relentlessly through the bureaucracy against every person, system, culture and norm that desperately wants to see the idea failHere’s what Yegge wrote:

Bezos assigned a couple of Chief Bulldogs to oversee the effort and ensure forward progress, headed up by Uber-Chief Bear Bulldog Rick Dalzell.

Rick is an ex-Armgy Ranger, West Point Academy graduate, ex-boxer, ex-Chief Torturer slash CIO at Wal*Mart, and is a big genial scary man who used the word "hardened interface" a lot.

Rick was a walking, talking hardened interface himself, so needless to say, everyone made LOTS of forward progress and made sure Rick knew about it.

I don’t hear about this concept enough when it comes to operations/execution. It’s probably undervalued.

🥇🤝🥇 The Real Story on Manufacturing and Trade 🌐📦

Alex Tabarrok has a good post, which includes this list that addresses a lot of misunderstandings I’m seeing these days:

Let’s begin with some simple but often overlooked points.

The US is a manufacturing powerhouse. We produce $2.5 trillion of value-added in manufacturing output, more than ever before in history.

As a share of total employment, employment in manufacturing is on a long-term, slow, secular trend down. This is true not just in the United States but in most of the world and is primarily a reflection of automation allowing us to produce more with less. Even China has topped out on manufacturing employment.

A substantial majority of US imports are for intermediate goods like capital goods, industrial supplies and raw materials that are used to produce other goods including manufacturing exports! Tariffs, therefore, often make it more costly to manufacture domestically.

When I looked it up, I found that about 45% of imports are used as inputs to make American goods and services.

If you put tariffs on steel, chemicals, electronic components, as well as machine tools from Germany and Japan (CNC, lathes, 5-axis robots, etc), you make it *harder* to manufacture in the US.

The US is a big country and we consume a lot of our own manufacturing output. We do export and import substantial amounts, but trade is not first order when it comes to manufacturing. Regardless of your tariff theories, to increase manufacturing output we need to increase US manufacturing productivity by improving infrastructure, reducing the cost of energy, improving education, reducing regulation and speeding permitting. You can’t build in America if you can’t build power plants, roads and seaports.

The US is the highest income large country in the world. It’s hard to see how we have been ripped off by trade. China is much poorer than the United States.

China produces more manufacturing output than the United States, most of which it consumes domestically. China has more than 4 times the population of the United States. Of course, they produce more! India will produce more than the United States in the future as well. Get used to it. You know what they say about people with big shoes? They have big feet. Countries with big populations. They produce a lot. More Americans would solve this “problem.”

Most economists agree that there are some special cases for subsidizing and protecting a domestic industry, e.g. military production, vaccines.

The wrong-headed idea that trade deficits are *automatically* and *intrinsically* bad needs to be killed with a wooden stake through the heart.🫀(especially since countries create wealth with IP and services too, not just physical manufacturing and assembling, and that most people show a strong revealed preference for non-manufacturing jobs if given the choice)

How is, say, Switzerland (population: 9 million) supposed to buy as much from the U.S. (population: 347 million) as it sells to it? If Americans want Swiss goods, should they be forcefully prevented from buying them to keep trade between the countries “balanced”? Seems like both sides would lose from that 🤨

How is Vietnam (GDP per capita: $4.3k USD, with 1/3 of the population of the U.S.) supposed to buy as much from the U.S. (GDP per capita: $83k USD) as it sells to it? They can’t afford much of what the U.S. sells at this point in their economic development! I’m sure they’ll buy more in the future, though, but who’s seriously suggesting that there are millions of Americans lining up to do the jobs of Vietnam’s export industry? Especially since unemployment is low in the US.

Then if you zoom out further, the fact is that even when you import something from someone, it doesn’t mean that the value is captured by the final assembler of that product.

For example, for an 📱 iPhone or Macbook 💻 : most of the value goes to the US, Japan, Taiwan, Germany (a lot of the machine tools used to make parts), and South Korea. China captures very little of it, even if it gets to stamp “Assembled in China” on it.

🧪🔬 Science & Technology 🧬 🔭

🚰 💧 Is dehydration quietly sabotaging your mind? Even just a little? Are you sure? 🤔💭

I recently spent a few days with my friend Tinkered Thinking (check out his upcoming book ‘White Mirror’ 🪞📖), and he was telling me how he had recently been ‘water-pilled’ by a common friend of ours.

I thought I was also on the water train, but it made me go a bit deeper in that rabbit hole and I found myself changing my priors on ‘stealth’ dehydration, and what I should do to avoid it.

First thing to know: it’s pretty easy to be dehydrated. A significant portion of the population frequently experiences mild dehydration without realizing it.

Research shows that cognitive effects and mood changes can occur with as little as 1-2% body water loss, well before you feel thirsty.

So we’re not talking about dry mouth and powerful thirst.It’s the kind of stuff that you may think it your normal baseline (but isn’t!):

🧠 Cognitive Warning Signs for Dehydration (even mild)

Difficulty concentrating: Even mild dehydration can impair attention span and cognitive functions. This can mean trouble focusing on tasks, reading, or following conversations.

Unexplained irritability or mood changes: You might feel unusually cranky or impatient. Become more easily frustrated, anxious, or moody.

Mild confusion: Tasks that normally seem simple may require more mental effort.

Short-term memory lapses: Temporary difficulty recalling information.

Fatigue without obvious cause: Feeling sleepy or low-energy, even if you’ve slept well.

Mild headache or “fogginess”: Feeling like your thoughts are slower or less sharp.

Processing speed/slower Reaction Times: Taking longer to respond to questions or stimuli. Not great if you’re driving or playing a sport!

Difficulty with decision-making: Struggling to make simple choices, feeling indecisive or mentally “stuck.”

Not a desirable list, eh?

How many bad decisions have been made that could’ve been avoided with a few more glasses of water per day? 🤔

I found a few studies on prevalence:

Although mainstream media frequently claims that 75% of Americans are chronically dehydrated, no scientific evidence in the medical literature supports this assertion. In contrast, dehydration is highly prevalent among older adults, with reported prevalence rates in the United States ranging from 17% to 28%.

Older individuals are 20% to 30% more prone to developing dehydration due to factors such as immobility, impaired thirst mechanism, diabetes, renal disease, and polypharmacy [...]

Infants and children have a higher percentage of total body water (TBW) than adults, approximately 65% to 80%. Young children are especially susceptible to dehydration because they cannot independently communicate their thirst to caregivers or access fluids. [...]

A study published in the American Journal of Public Health found that approximately 54% of U.S. children and adolescents (ages 6-19) show signs of inadequate hydration, based on urine osmolality measurements [...]

Boys were more likely to be inadequately hydrated (63.3%) compared to girls (43.9%)⚠️ Rehydrating isn’t as simple as drinking a glass of water and voilà

For mild cases, it may be all you have to do.

In fact, it’s recommended to drink small amounts steadily throughout the day rather than chugging a big glass once in a while.

But for more severe dehydration, you may need hours, or even days to get back to a good place, and you may need to add electrolytes.

The tricky thing is that you may drink and then immediately have to pee, which may fool you into thinking “oh, I had plenty of water”. That’s because your body adapts in multiple ways to low water intake, even at the cellular level.

Yes, you will likely urinate more frequently during the early days of rehydration.

This phenomenon is called "diuresis", increased urine production as your body adjusts. This happens because your kidneys haven't yet adapted to the higher fluid intake and may initially interpret the sudden increase in fluids as excess and work to eliminate it.

For most people, the kidneys will adapt to the higher water intake within a few days (hormonal systems need to rebalance, particularly antidiuretic hormone/vasopressin levels).

Don’t give up!

At some point, I’ll write more about my experiments with electrolyte supplements.

The short version: If money is no object, stuff like LMNT is probably pretty good. It feels a tad over-priced to me, so I’ve been buying a no-sugar electrolyte mix made by a company called Leanfit. It tastes ok.

I don’t know if it’s placebo, but about 30–45 minutes after I drink a big glass of electrolyte water, I often notice a real boost in mental clarity and energy, almost like I’ve had a cup of coffee.

If you also drink this stuff, let me know in the comments if you notice an effect, please.

🕸️ OpenAI is apparently building a Twitter-like social network 🤔

Well, I guess Musk and Altman aren’t about to reconcile:

OpenAI is working on its own X-like social network […]

While the project is still in early stages, we’re told there’s an internal prototype focused on ChatGPT’s image generation that has a social feed. CEO Sam Altman has been privately asking outsiders for feedback about the project.

It’s unclear if OpenAI’s plan is to release the social network as a separate app or integrate it into ChatGPT

Recent reports that ChatGPT now has 1 billion users certainly give it the distribution muscle to bootstrap something like this.

As Twitter/X keeps getting worse (as mentioned in the intro), there may be space for a new entrant. I wouldn’t be surprised if they used the open AT Protocol or ActivityPub (better known for Bluesky and Threads). Plugging into these existing protocols would save them from having to reinvent the wheel. 🛞

As AI models become more commoditized, OpenAI is clearly trying to make its products differentiated and sticky in other ways (the recent memory feature is a good example of that).

There could be other benefits to having a real-time source of data and making the ChatGPT experience more multi-player, but it could also be a big distraction for the company. Focus matters.

🎨 🎭 The Arts & History 👩🎨 🎥

🎬 Thoughts on 'Sing Sing' (2023, A24): Art, Redemption, and Real People 🍿⛓️💥

➡️ NO spoilers, you can read even if you haven’t seen the film. ⬅️

My wife and I recently watched this prison film.

It’s no Shawshank, but it's nonetheless a good character-drama based on the true story of the Rehabilitation Through the Arts (RTA) program at the Sing Sing maximum security prison in New York State.

I didn’t realize until the credits rolled, but most of the actors are playing themselves and are former members of the RTA program. It really helps the film to see a lot of new faces that are not typical actors.

The duo at the center of the story, played by Colman Doming and Clarence Maclin (as himself!), both give great performances. They put a lot of depth and humanity on screen.

For about the first half, I thought it was well-acted and well-written, and I liked that they threw you into this world without too much preamble, but I was uncertain how much I liked it.

I was worried that the plot would go through the usual "prison film" twists and turns (you know what those are).

But it avoids most of those pitfalls and the second half kept the focus on the inner core of the characters and resonated for me.

It's a $2m production shot in 3 weeks, but the acting and writing crushes most $200m films 🔥 To make the math work, every cast and crew member, including Colman Domingo and director Greg Kwedar, was paid the same rate for their work on the film.

I hear they did a special screen for inmates at the real Sing Sing. That must’ve been a special moment! (I won’t say “I wish I was there”, though 😬).

I recommend it if you like character-based films. Good job by A24. 👍

Definitely interested in hearing about your experiments with electrolyte supplements!

On LMNT: I have it and definitely notice a difference. I got a personal record in my 5K the first time I used it and felt great during and after.

Will admit that it is a little pricey for what is effectively just salt, and it may be a bit of a placebo, so I try to use it only for when I am sweating like crazy (long cardio days) or feeling exceptionally sore/fatigued after a workout. I sometimes will use a pinch of salt with lemon and a banana as a snack to get going in the morning for a smaller boost.

Do you notice any drop off between LMNT & Leanfit? Have you tried making your own mix at home?