579: Market Sentiment & Crazy Axis, YouTube Won TV, Jamie Dimon, Nintendo Switch 2, Nick Maggiulli, Google + Brookfield, Gene Therapy, Warrior Kid, and Indiana Jones

"the ability to have a shared culture again"

When your mind is agitated, you see agitation in everything.

When your mind is still, you see the stillness in everything.

—James Pierce

📕 🏋️♂️🥋 I think I first mentioned Jocko’s Warrior Kid books in Edition #243, way back in the Paleoproterozoic era of 2022.

I was reading them to my oldest boy, who was 8 at the time. He loved them, and they inspired him to start jiu-jitsu and work out. But beyond the physical stuff, they also delivered a bunch of important life lessons that I wish I had been exposed to at his age: facing fears, how to cultivate a healthy body & sharp mind, the power of incremental improvement, discipline = freedom, planning and goal setting, resilience, humility, integrity, leadership with peers, etc.

Fast-forward to today, and I’ve started reading them to my youngest son, who’s now 7. He’s loving them too AND my oldest son joins us when we’re reading, so he’s getting a second dose and getting motivated to better himself all over again.

Seriously, if you have children, these books are almost magical in their ability to help kids internalize important life lessons while being entertained.

When it’s time to stop for the night, my boys always beg for one more chapter. That’s a sure sign of a good book!

📺 📅🐻🚰 I’ll say it again: TV shows should go back to releasing one episode per week instead of dropping whole seasons at once. There’s already been some movement in that direction in recent years, but let’s go all the way.

And I don’t want to hear any complaining from binge-watchers. Honestly, I’m jealous of the amount of free time these people have… so they can watch something else until the whole show is out! We shouldn’t ruin TV culture for everyone else just because they lack patience.

For the rest of us, a weekly cadence creates the ability to have a shared culture again.

It’s the only way to ensure you have a large group of people watching the same thing at roughly the same time, so they can talk about it without worrying about spoilers. And you get the fun of speculating about mysteries and plot twists while nobody knows the answer 🕵️♂️ But if it’s already out there, what’s the point of fan theories?

It’ll never be like when there were three channels and 40 million people watched the same shows, but ‘The Bear’ would’ve had even more cultural impact if they hadn’t released the 10 episodes of season 4 on the same day.

🏦 💰 Business & Investing 💳 💴

📈📉📈 Thoughts on Market Sentiment & the Crazy Axis 🤪

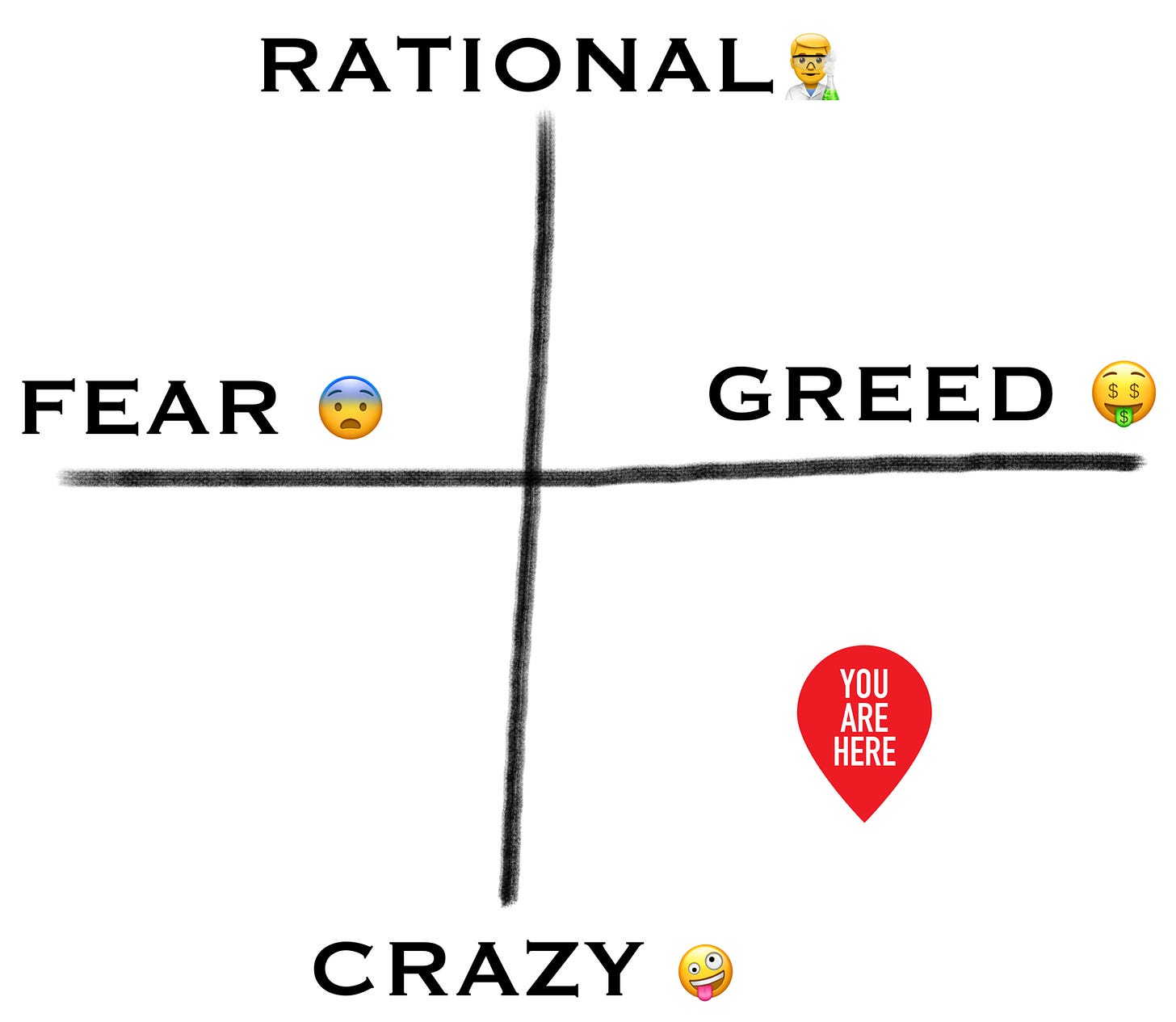

As someone who’s been observing public markets for a medium amount of time (˜25 years), one thing I’ve come to believe is that sentiment is composed of more dimensions than many naive observers might assume.

Yes, it can be flattened to the fear & greed spectrum, but I think there are many more dimensions, and among them, there’s at least one more axis worth tracking. I’ll call it the ‘rational-craziness’ spectrum. It’s a fuzzy, non-precise thing, but I think it’s also very telling about the state of things.

For example, at the bottom of the GFC in 2008-2009, you saw extreme fear, but I think craziness was relatively low. People were afraid, but for pretty rational and concrete reasons.

We *really* did come close to the edge of the precipice…

Back in the Dot-Com bubble era, we had pretty high levels of both greed and craziness. While in, say, I dunno, 2015, greed was probably high too, but craziness was relatively low (from what I can remember, it’s hard to put yourself back in the mindset of the less crazy periods because they are less memorable).

It’s easy to imagine the market going in greed mode for very good reasons, say, a period of history when GDP growth accelerates, companies are finding new markets, inflation is low, barriers to economic activity are falling, there’s synchronized global growth, etc.

Craziness went way up during the pandemic, at both extremes of fear and greed.

The initial spasm of fear in March 2020 was probably pretty rational. Uncertainty was high (look at that VIX spike!), every company's forecast was suddenly thrown in the trash, things were happening fast, and a lot of unprecedented negative events hit us one after the other.

This short-lived rational fear turned into somewhat rational optimism (“We’ve pulled the future forward for e-commerce, SaaS, the Cloud, etc.”)… and that, in turn, overshot into ZIRP-fueled greedy craziness in 2021 (meme stocks, crypto ICOs, rock NFTs 🪨, SPACs, etc), and then fearful craziness in 2022 (META bottomed at $87/share in November 2022, many of the high-flyers of the year before went down 80-90%, etc).

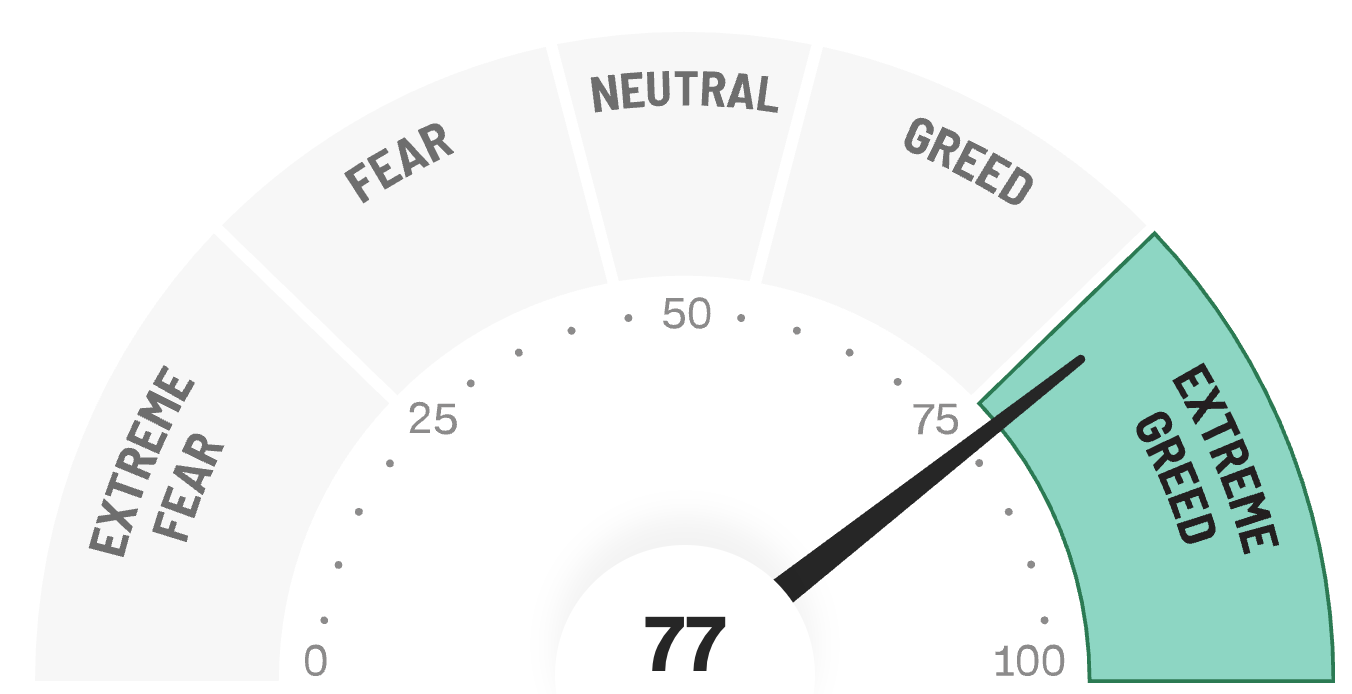

Which brings us to today 🗓️