582: Constellation Software Q2, Tesla Kills Dojo, American Dirigisme, China vs Nvidia, Lithium Deficiency & Alzheimer's, Gemini, Nuclear on the Moon, and Hamilton

"true economic value creation"

We are not the average of the five people we spend most time with.

We are the average of the five thoughts we spend most time with.

And those thoughts needn't come from people in our life.

—Ankur Warikoo

🧍♂️→🧍♂️🧠🪞‼️ I don’t know why, but I found myself thinking about continuity of consciousness.

There’s a famous thought experiment with teleporters, sometimes called the Star Trek Teleporter Problem or Teletransportation Paradox. I first heard about it in Derek Parfit’s Reasons and Persons (1984), which put it as this Philip K. Dick-style sci-fi scenario:

You enter a teleporter on Earth 🌎

It scans your entire body at the atomic level with perfect fidelity, then destroys it and sends the information to Mars. 💾 📡

On Mars, a machine rebuilds an *exact* copy of you. 🧍♂️→🧍♂️

That copy feels it is you, has your personality, and continues your life.

Parfit asks:

Did you travel to Mars, or did you die and get replaced? 🪦

If the teleporter malfunctions and your original body doesn’t get destroyed, and you end up with two “you”, one on Earth and one on Mars. Which is truly “you”? Or are both equally you? (what if we made 100 identical copies? 1 billion copies?)

It’s nightmare fuel that sends shivers down my spine to imagine a sci-fi society where they haven’t thought of this and millions of people use teleporters daily. Subjectively, it’s the end-of-the-line for them, they walk into a suicide machine, their consciousness extinguishes on the spot and — subjectively — they never walk out on the other side even if their duplicates never notice anything wrong.

This may seem sci-fi, but what about sleeping? 😴 There’s a discontinuity of consciousness there too 🤔

Every night, you lose consciousness. From a subjective, first-person point of view, it’s as if “you” vanish for a while.

In the morning, a mind wakes up with:

All your memories

Your personality

Your habits and goals

Is it the same conscious subject that went to bed, or a new one booted up with the same memory files?

From the outside, there’s no detectable difference, but from the inside, *if* continuity of consciousness matters, then every night might be a tiny death.

I’m not saying it’s a problem or that we can do anything about it, but it’s some mind-bending stuff.

We’re used to it, so we mostly don’t even think about the nightly reboot, but life is strange and consciousness is still one of the thorniest open questions.

👁️🧠💥🚘 Last Tuesday, I had my second ocular migraine as I was driving back from dropping the kids off at camp (I wrote about my first, and included a mockup of what it looked like).

Why is it always when I’m driving? 😩

Knowing what it was this time made all the difference. No panic, I just found a place to park and waited it out, about 15 minutes.

So far, the main commonalities I could identify between both times were possible dehydration and bright light exposure.

It made me wonder if it had happened to me before, maybe years ago, and I never knew what it was, dismissed it as glare, and forgot about it.

Hopefully, it remains a rare occurrence.

📫💚 🥃 Do it! 👇

🏦 💰 Liberty Capital 💳 💴

🚂 ✨Constellation Software✨ Q2 Results + Organic Growth Musings

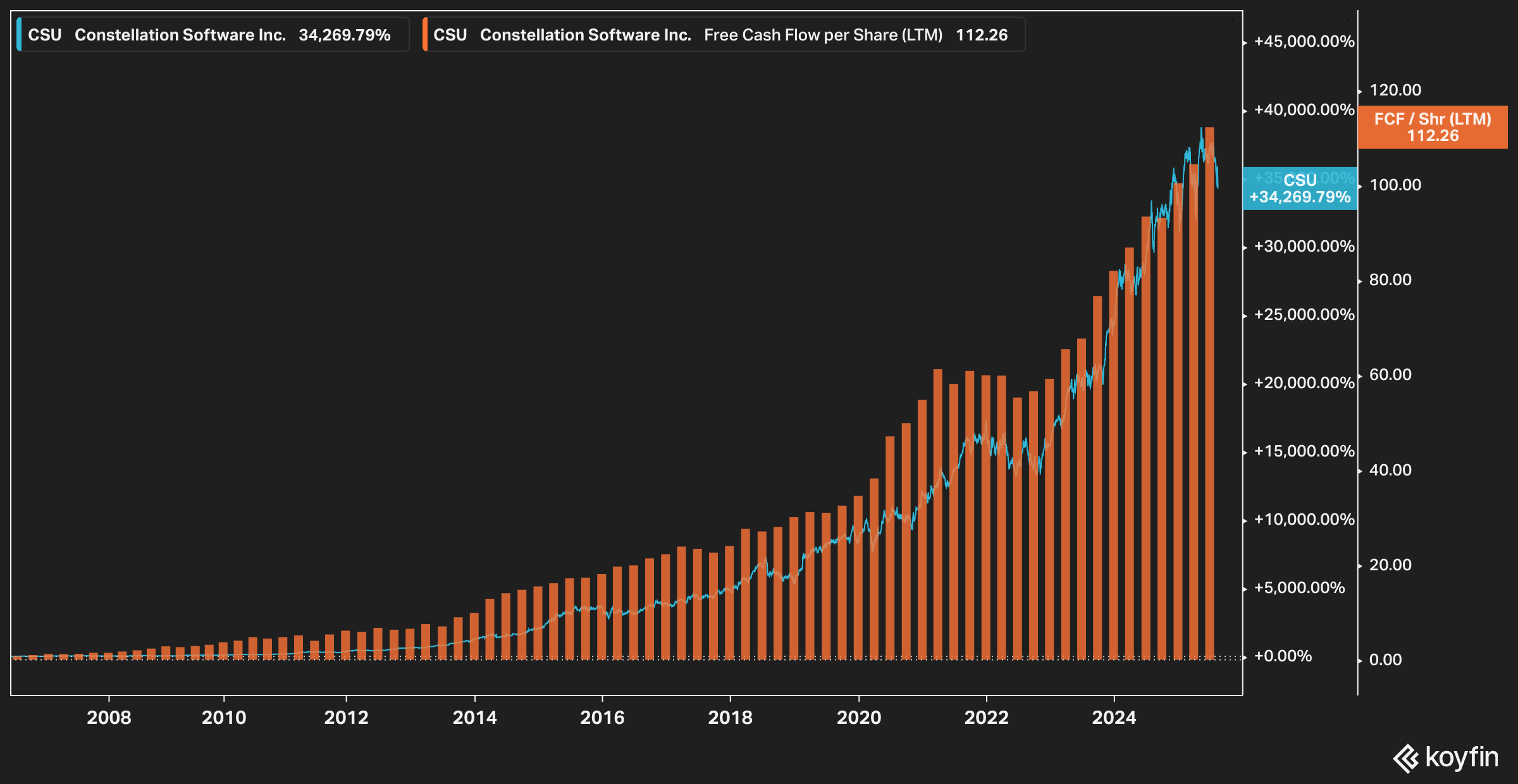

It’s funny how what’s most interesting to write about isn’t always what you should invest in, and vice versa. Constellation just keeps chugging along, executing its playbook, defying the annual predictions that they’ll revert to the mean any day now.

(but maybe they will now?)

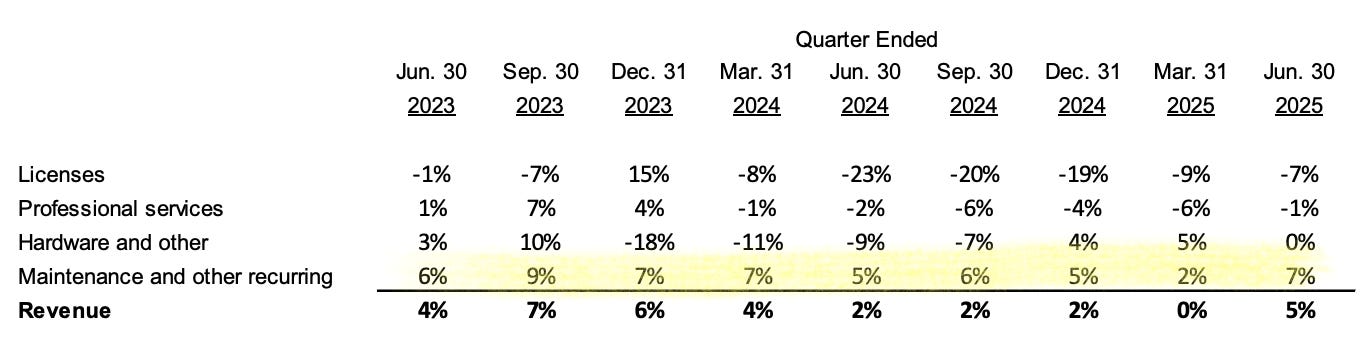

The biggest surprise for Q2 was organic growth of 5% (4% ex-FX). This is notable compared to their typical 2-3% range in the past decade.

If we look at the disaggregated numbers (above 👆), we can see that the ‘maintenance & recurring’ segment is pretty steady and closer to 5-7% (in Q2 it was 6% ex-FX). That’s where most of the value is created because it’s the highest margin and most sticky revenue.

It doesn’t matter too much for shareholder economics if hardware and professional services bounce around, because margins are much lower and that revenue is less recurring. Licenses are high-margin, but that’s always volatile, and as more software has been transitioning to SaaS, there’s a natural downward trend.

The thing to remember when you’re looking at the headline organic growth number, or even at the segment numbers, is that you aren’t really looking at *one* company.

Constellation is literally a constellation of over a thousand companies, closing in on 2,000, and their operating profiles vary widely.

They’re also constantly adding more through M&A, and what they buy also varies a lot.

If they happen to buy more distressed assets than usual, the overall organic growth may take a hit and look worse for a while.

BUT

If they paid the right price and execute well to stabilize those distressed asset, they could still create a ton of value even as the healine numbers look worse. CSI has shown time and time again over the years that they’ll always take true economic value creation over short-term good-looking financial metrics.

In fact, some of their best opportunities to buy distressed assets come fromthe fact that for a lot of other companies, the thinking is the exact opposite: When an asset makes the overall company numbers look bad, they’d rather dump it on someone else (sometimes for pennies on the dollar) just to get rid of it and keep their own metrics clean.

Keep in mind, heavy M&A spending means heavy restructuring. CSI will cut any acquired division that doesn't meet its ROIC targets (eg. commodity hardware or products and services with no path to profit). This may mean that revenues fall post-acquisition, making newly acquired VMSes look temporarily look worse than they are, but it's just trimming the fat.

For Q2, the acquisition numbers are:

A number of acquisitions were completed for aggregate cash consideration of $380 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of $89 million resulting in total consideration of $469 million.

RBC puts it in context:

excluding spin-outs (Topicus.com, Lumine), Constellation has already deployed more in Q3-to-date than all of 1H/FY25 ($266MM Q3-to-date vs. $229MM 1H). Including Topicus's two equity investments in Asseco, Constellation has deployed $1.32B YTD, which equates to ~80% of the capital deployed in all of FY24.We have no idea how many of the companies acquired are growing well and don’t need much surgery, and which are more distressed assets that may be shrinking and require heavy restructuring. And everything in between.

A good example of this, because they broke it out, is the Altera acquisition.

Back in Q4 of 2022, not too long after they acquired it, Altera’s revenue fell -13% and even its ‘maintenance and recurring’ segment was -7%. In Q2 of 2025, that has improved to -3% and +1%, respectively. On a larger asset (around $200m in quarterly revenue), this turnaround moves the needle…

But distressed assets are not a one-time thing for CSI. By the time a cohort turns around, it has been replaced by a new one.

I did an extended podcast about Constellation a few years ago with MBI (🇧🇩🇺🇸). The benefit of a boring company that doesn’t change too fast is that what we discussed is still largely applicable:

🪦 Tesla Cancels Dojo, Key Talent Defects to DensityAI 🐜🤖

On July 23rd, during the Q2 conference call, Musk said:

Q: Next question is, can you give an update on Dojo? And could xAI be a customer for Dojo?

Elon Musk: We expect to have Dojo 2 operating at scale sometime next year, with scale being somewhere around 100,000 H100 equivalents. And then AI5, which is really spectacular, too — and I don't use those words lightly, spectacular, too. The AI5 chip will hopefully be in volume production around the end of next year. That has a lot of potential.

Thinking about Dojo 3 and the AI6 inference chip, intuitively, we want to try to find convergence there where it's basically the same chip, but it's used where, say, 2 of them in a car or an Optimus and maybe a larger number on a board, kind of 5, 12 on a board or something like that, if you want high-bandwidth communication between the chips, for serving -- doing inference serving. That sort of seems like intuitively the sensible way to go.

AI5 and AI6 are Tesla’s inference chips that are intended to power self-driving features. They will also be central to Robotaxis (there’s a small test fleet in Texas) and the Optimus humanoid robots, whenever they come out.

Then on August 7th:

Tesla Disbands Dojo Supercomputer Team, Unwinding Key AI Effort

Peter Bannon, who was heading up Dojo, is leaving and Chief Executive Officer Elon Musk has ordered the effort to be shut down [...] The team has lost about 20 workers recently to newly formed DensityAI, and remaining Dojo workers are being reassigned to other data center and compute projects within Tesla

It’s not clear if the brain drain caused Dojo’s death, or if Dojo’s known impending cancellation made the people working on it look for something else to do 🤔

Probably a mix of both: Problems with Dojo probably made the silicon team look foran exit, which led to a faster demise. If things had been going great, it may have been easier to retain people and justify investing more in the effort..?

Tesla plans to increase its reliance on external technology partners, including Nvidia Corp. and Advanced Micro Devices Inc. for compute and Samsung Electronics Co. for chip manufacturing, the people said.

Jensen is smiling once more 😎

Well, Samsung is pretty happy too, since they got a $16.5bn deal to develop and manufacture the AI6, which will be used for both inference and training (though we’ll see how it does against Nvidia GPUs by the time it comes out — if there are delays or it misses some important development required by the models at the time, it could turn out to be uncompetitive, like Microsoft’s Athena and other ASICs).

Don’t get me wrong: I’m glad Tesla tried to create their own training chip. And they went into it fairly clear-eyed. Musk said almost two years ago:

“I would think of Dojo as a long shot. It’s a long shot worth taking because the payoff is potentially very high. But it’s not something that is a high probability. It’s not like a sure thing at all.”So it was a good try. If anyone had the star power to attract talent and the low cost of capital to justify the risk, it was Musk and Tesla.

But it’s *very* hard to compete with Nvidia if it’s your hobby, your side project, and you don’t throw your A-Team and tons of resources at the problem.

Google’s TPU probably succeeded in large part because compute is central to the core business and has a large impact on everything else the company did (eg. as YouTube grew, the compute costs to transcode the videos, auto-generate transcripts, scan them for copyrighted materials or spam or ToS violation, etc, was climbing rapidly).

And even then, it took many years and a lot of help from partners like Broadcom to get it to where it is today (Google started working on the first TPU back in 2013, and v1 went into internal use in 2015).

Dojo was a “nice to have” for Tesla, but not a top priority when they can just buy Nvidia GPUs instead.

What about DensityAI?

DensityAI, which is poised to come out of stealth soon, is working on chips, hardware and software that will power data centers for AI that are used in robotics, by AI agents and for automotive applications

We’ll see how they do, but they’re certainly well-timed trying to raise money for AI compute. When the ducks are quacking, you feed them! 🦆🦆🦆

🇨🇳🛑 🇺🇸🫴 💰Pay-to-Play: Nvidia’s 15% “License Fee” to Sell H20s in China

Yea, I know, AMD is also targeted by this, but in practice, it’s a Nvidia story.

Remember when “being like France” was one of the worst insults in U.S. politics when discussing the economy and government? It’s a sign of how much has changed that we’re now discussing American Dirigisme.

On the economic freedom spectrum, Dirigisme sits between market economies on one side and the controlled economies of communism and socialism on the other:

Dirigisme (French: [diʁiʒism]) or dirigism (from French diriger 'to direct') is an economic doctrine in which the state plays a strong directive (policies) role, contrary to a merely regulatory or non-interventionist role, over a market economy. As an economic doctrine, dirigisme is the opposite of laissez-faire [...]

Dirigiste policies often include indicative planning, state-directed investment, and the use of market instruments (taxes and subsidies) to incentivize market entities to fulfill state economic objectives.For China, we’d probably call it “state capitalism”.

It’s the idea that the government effecively controls everything and companies operate only at the pleasure of politicians, hoping they don’t fall out of favor and get punished (ask Jack Ma about state capitalism…).

The tool here is a new tax that may be unconstitutional, but who will enforce that? The Rule of Law hasn’t really been doing so well lately (just wait until next month when the federal law banning TikTok is pushed back yet again).

Remember: “Tariff” is just better branding for “tax”.

They’re usually import taxes.

But now we have export taxes targeted at two companies (Nvidia and AMD):

[The U.S. Federal government] will receive 15% of the sales as part of a deal to approve exports of Nvidia’s H20 AI chip to China, according to people familiar with the matter. That could amount to billions of dollars given demand for the H20 chips and is the latest example of the White House employing novel tactics to raise revenue.

The administration has reached the same agreement with AMD for its MI308 chip

What reportedly happened: Even after the reversal on the H20 ban, the export licenses weren’t being issued, so Jensen went to the White House to get things moving. He got asked to pay a 20% quid pro quo for the licenses:

President Donald Trump on Monday said that he initially asked Nvidia for a 20% cut of the chipmaker’s sales to China, but the number came down to 15% after CEO Jensen Huang negotiated with him.

“I said, ‘listen, I want 20% if I’m going to approve this for you, for the country,’” Trump said

That’s 15% of revenues. So, depending on margins, it’s more like 25-40% of profits on top of whatever corporate taxes and other China tariffs that also apply.

If this is a national security issue, you either allow the sale of those hobbled, older GPUS to China or you don’t.

IF the kickback is the reason the sale is allowed — and it wouldn’t be allowed without it — doesn’t that mean that national security has been sold out for what is a relatively inconsequential amount of money to the U.S. treasury?

And if that’s not the case, and the sale would’ve been allowed even without the 15% single-company tax (yeah, yeah, AMD too), then what is the justification other than the U.S. executive branch getting into extorting the country’s crown-jewel companies?

It creates perverse incentives.

First, it sets up a conflict with national security considerations. If the government is collecting billions in taxes, it may hesitate to ban the sale of the chips again, even if national security officials decides that this is what should be done.

It creates a precedent for more targeted taxes (or blocking mergers, changing regulations, etc.) without legislative input, either to raise revenue or to punish companies they dislike and reward those they favor.

Remember when the president was really mad at Amazon and Meta?

This is a move away from the ideal of setting rules that apply to everyone and letting market forces operate on a level playing field. Once governments start making deal with single companies, it opens the door wider to arbitrary, capricious meddling in the economy, especially when there is no process for any of it and it all depends on the daily whims of one person.

I’m sure Huawei and SMIC are pleased to see this, as it makes it easier to compete with Nvidia.

🇨🇳🔐 China Orders Halt to Nvidia GPU Purchases, Citing "Security Concerns" 🤔

Speaking of Nvidia and China, it looks like the Chinese government has decided to make a strategic sacrifice, prioritizing long-term incentives to develop a self-sufficient local silicon ecosystem over short-term access to more compute:

China’s internet regulator in the past two weeks ordered local tech companies including ByteDance, Alibaba Group, and Tencent Holdings to suspend their purchases of Nvidia chips, citing data security concerns with the chips, according to three people briefed on the matter.

The directive came from the Cyberspace Administration of China and was communicated at a meeting the regulator convened with over a dozen Chinese tech firms

Nvidia has denied having backdoors in its chips, but of course, it’s impossible to prove a negative, so that excuse will always be there for the Chinese authorities if they need it.

As explained in this piece, the biggest challenge for China is the lack of access to cutting-edge lithography, high-bandwidth memory, and the mature software ecosystem on which AI labs rely (CUDA):

Before these export controls, NVIDIA already dominated China’s AI compute with a 90% market share. Now China has to deal with restrictions on key inputs to chip production as well.

Without access to foreign semiconductor manufacturing equipment, domestic Chinese manufacturers like SMIC are left playing catch-up. Consider that these chip manufacturing devices aren’t perfect, and only a fraction of produced chips actually work. This fraction, known as the “yield”, decreases when using worse equipment. So it’s no surprise that SMIC’s reported yields are below 50%, compared to TSMC’s 90%. Such low yields make these Chinese chips substantially less economically viable, requiring state support to alleviate this financial burden [...]

In addition to hardware challenges, Chinese AI chips exist within a much less mature software ecosystem than their Western counterparts.

On the one hand, we have NVIDIA’s CUDA, a software ecosystem for training across GPUs. This has benefited from over fifteen years of documentation and refinement, a large user base, and robust integration with popular machine learning frameworks like PyTorch and TensorFlow.

On the other hand, we have Huawei’s CANN framework. This was only introduced in 2019, twelve years after CUDA. And it’s often said by developers to be bug-prone, unstable, and poorly documented, with frequent runtime crashes and limited third-party integration.

Maybe this latest roadblock to the sale of Nvidia GPUs in China will be temporary, just one more bargaining chip for Chinese negotiators to extract more concessions from the U.S., like they did recently with rare earths & magnets.

🧪🔬 Liberty Labs 🧬 🔭

⚛️ State of Nuclear Power in 2025 🇺🇸🇨🇳🇨🇦🇪🇺🇷🇺

Great overview episode with friend-of-the-show Mark Nelson (we’ve done four podcasts together).

🧠👩🔬 Lithium Deficiency Potentially Linked to Alzheimer’s Disease

Interesting paper in Nature indicating that lithium deficiency could be a driver of AD:

we show that endogenous lithium (Li) is dynamically regulated in the brain and contributes to cognitive preservation during ageing. Of the metals we analysed, Li was the only one that was significantly reduced in the brain in individuals with mild cognitive impairment (MCI), a precursor to AD. Li bioavailability was further reduced in AD by amyloid sequestration. We explored the role of endogenous Li in the brain by depleting it from the diet of wild-type and AD mouse models. Reducing endogenous cortical Li by approximately 50% markedly increased the deposition of amyloid-β and the accumulation of phospho-tau, and led to pro-inflammatory microglial activation, the loss of synapses, axons and myelin, and accelerated cognitive decline.My highlights:

A unique deficiency: Among 27 metals assayed in post-mortem metallomics on humans, only lithium was significantly reduced in cortex in both MCI and AD, pointing to “disrupted endogenous Li homeostasis”.

In mouse models: dietary Li deficiency drove AD-like pathology, potentially showing that endogenous Li is protective (of course, humans are not mice, but it tells us we should probably look there in humans). 🐁

Potential therapeutic angle: Unlike lithium carbonate, lithium orotate reduced amyloid binding, letting it act at physiological dose to prevent/reverse plaques, p-tau, and memory loss in AD mice. In old wild-type mice, long-term low-dose LiO dampened neuroinflammation and restored microglial Aβ clearance capacity. 🐭

This makes me glad that I’ve been taking 5mg of Lithium Orotate daily for a long time (10+ years? I’m not sure).

I started doing that after reading a piece about research on natural variability of lithium in drinking water, and how areas with lower lithium tended to have more reported mental issues (depression, etc), and how Li was good at boosting brain-derived neurotrophic factor (BDNF) and neurogenesis.

I figured that while I didn't know my exact intake from food and water, it was a nicely asymmetric bet to ensure I wasn't in the bottom decile by putting a floor on my intake.

5mg orotate Li is a very sub-clinical dose and within normal variability, not at all in the range of psychiatric prescriptions. The word “lithium” may make some people nervous, but they’re already getting lithium, they just don’t know how much, and if it’s enough, or if they might benefit from a little more.

🏅 “Yes, but..” on Gemini and OpenAI’s Math Gold Medal 🏅

I was very impressed when I saw that both labs won a gold medal at the 2025 IMO math competition.

Then I saw this. While I was still impressed, I felt it was important context that was missing from most coverage:

The IMO usually has two easy, two medium, and two hard problems, according both to general perception and Chen’s more granular data.1 2025 was unusual in that it only had one hard problem. [...]

Worse, the one hard problem this year was very hard: according to Chen, there have only been two other such “brutal” (MOHS 50) problems on the IMO since 2000 [...]

Taken at face value, this means AI math capabilities are somewhere between “medium” and “brutal”. I’ll argue that solving these easy-to-medium problems represents only incremental progress: a step forward primarily in terms of reliability, but not a sign of the emergence of any new capability. By the same token, failing to solve the “brutal” problem only rules out extremely rapid progress. That’s not to say these new models don’t have any new capabilities, just that we can’t tell it from this year’s IMO.

🚀🌖⚛️ NASA Wants a Nuclear Reactor on the Moon by 2030

Now *that’s* properly sci-fi:

US space agency Nasa will fast-track plans to build a nuclear reactor on the Moon by 2030 [...]

Mr Duffy called for proposals from commercial companies to build a reactor that could generate at least 100 kilowatts of power. [...]

So it would be a microreactor, a few orders of magnitude smaller than even a nuclear-powered U.S. Navy ship or submarine: Precise thermal output is classified, but attack subs seem to be around 20-50 MW, and large Nimitz class carriers are in the gigawatt range.

Of course, there’s a good chance that this is about headlines. It may not happen:

Mr Duffy's directive came as a surprise following recent turmoil in Nasa after Mr Trump's administration announced cuts of 24% to Nasa's budgets in 2026.

That includes cuts to a significant number of science programmes such as the Mars Sample Return that aims to return samples from the planet's surface to Earth. [...]

Nations including the US, China, Russia, India and Japan are rushing to explore the Moon's surface, with some planning permanent human settlements. [...]

And in May this year, China and Russia announced they plan to build an automated nuclear power station on the Moon by 2035.

Still cool to see the moon getting back on the menu.

🎨 🎭 Liberty Studio 👩🎨 🎥

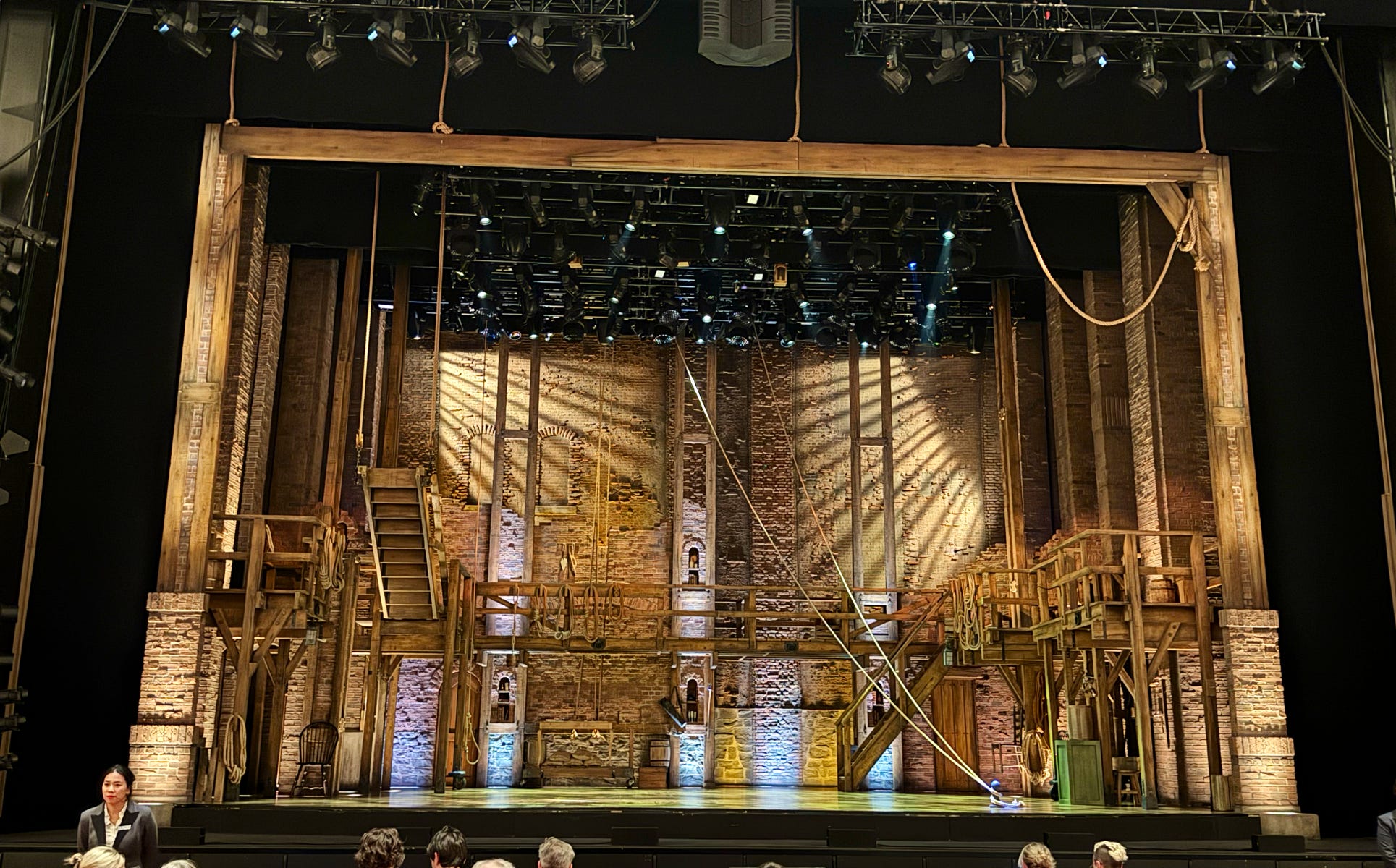

⭐ I saw ‘Hamilton’ Last Night (Touring Cast) 🎶 🎩

I saw the touring production of Hamilton last night. It reaffirmed my belief that the show is a masterpiece, and I'm not usually a fan of musicals (this and the Joss Whedon project ‘Dr. Horrible’ are pretty much it for me).

While I'll always wish I could have seen the original cast on Broadway, the touring cast was quite good. Because I’ve listened to the original cast recording so many times, it took a moment to adjust to the new voices, it was a bit jarring at first. But once I got over that, I enjoyed the performances.

The staging is basically the same as the original, like in the video on Disney+, with a few small tweaks here and there (mostly small jokes that surprised the audience and got extra laughs).

The ending always destroys me, but it was particularly emotional live 🥲

If you like the music but haven’t had a chance to see the show live, and going to Broadway isn’t an option, you may want to check whether the touring show will hit your area in the future.

The first part I'm reminded of a story from Stephen King's novel, with a very similar premise. The father can teleport From one location to the other - but the son is horrible terrified and scarred by the experience. Having to endure multiple consequential lifetimes is a physician LARP equivalent of a scientific research hypothesis, HOWWÉVÉR | the end result is interesting.

Give it a read!

The Aeropress is making you some 🔥🔥🔥 if you're randomly thinking about the continuity of consciousness!