589: Oracle's Half-Trillion Gambit, OpenAI, Microsoft + Anthropic, YouTube Unlocks New TAM for Every Video, the Nuclear Option, Twitter's Algo, and The Wire

"Engineered reflexivity!"

Everything feels unprecedented when you haven't engaged with history.

—Kelly Hayes

🍄🍄🟫🌎 TIL the largest living organism on Earth might be a massive fungal network.

This hidden giant, nicknamed "Humongous Fungus", is located in Oregon's Blue Mountains. It belongs to the species Armillaria ostoyae, covers roughly 2,385 acres, and weighs an estimated 35,000 tons. Scientists discovered its true size by analyzing DNA samples from mushrooms across the forest and realizing they were all genetically identical 🧬

How old is it?

Best estimates land between 2,400 and 8,650 years. That doesn’t make it the oldest living organism on the planet, though, as several clonal organisms are way older. The “King Clone” creosote is ~11,700 years old, and the seagrass clones Posidonia oceanica are up to ~100,000+ years old, which means they were there when Neanderthals were still around.

Most of this giant fungus is underground as a network of mycelium and rhizomorphs, black or dark brown structures that are kind of like roots or shoelaces.

The mushrooms you might see on a hike in the forest are just temporary fruiting bodies, like apples on a tree 🍎 The real organism is this vast, interconnected web beneath the forest floor that slowly spreads by feeding on tree roots.

This is giving me The Last of Us vibes..

🏦 💰 Business & Investing 💳 💴

🔮 Oracle's Half-Trillion Gambit & $300bn Deal with OpenAI ☁️💰💰💰💰💰💰💰💰💸

Here’s the conference call that shocked an entire industry:

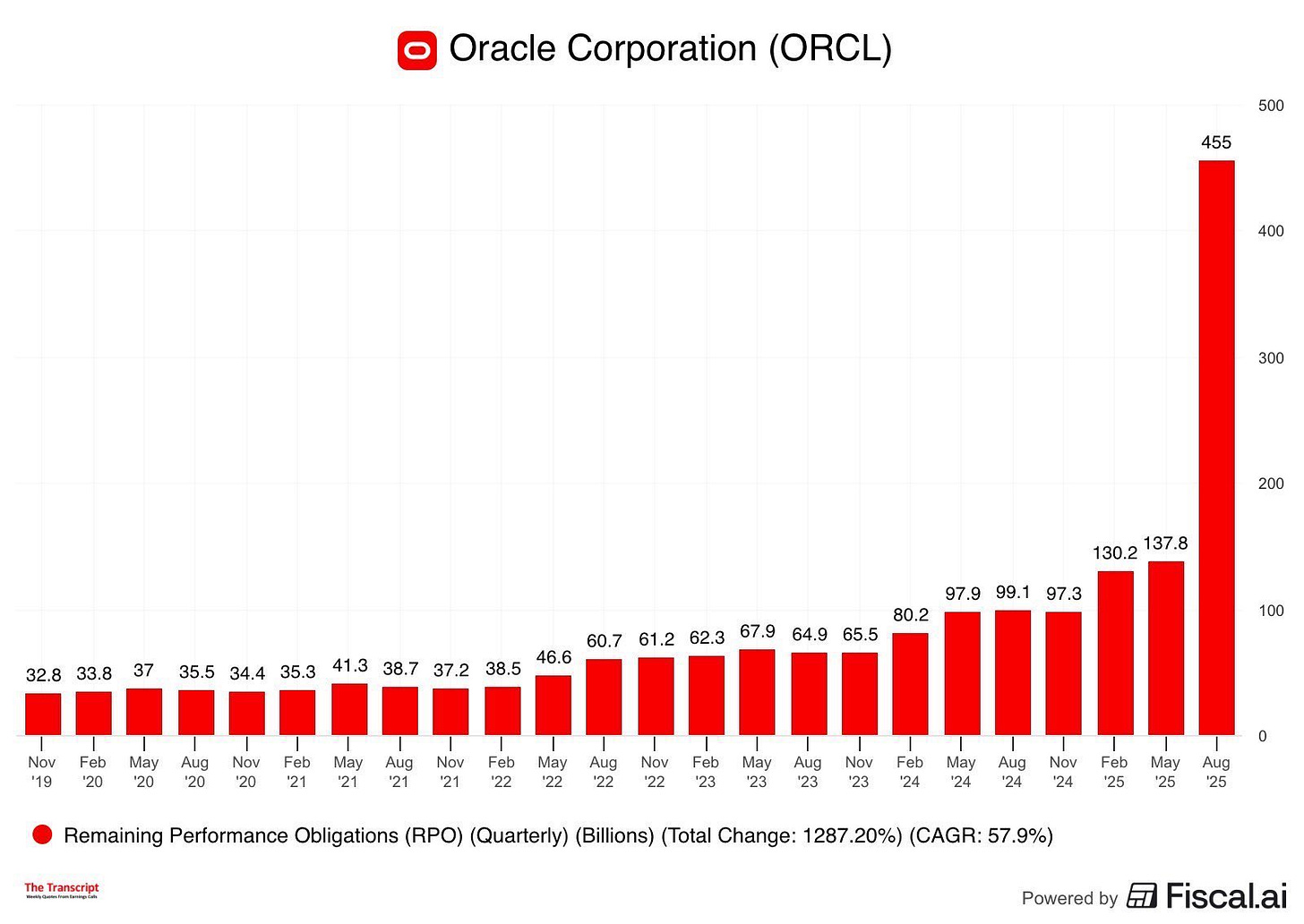

Safra Catz: We have signed significant cloud contracts with the who's who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD and many others. At the end of Q1, remaining performance obligations, or RPO, now to $455 billion. This is up 359% from last year and up $317 billion from the end of Q4.

Our cloud RPO grew nearly 500% on top of 83% growth last year. [...]

I expect we will sign additional multibillion-dollar customers and that RPO will likely grow to exceed $0.5 trillion.

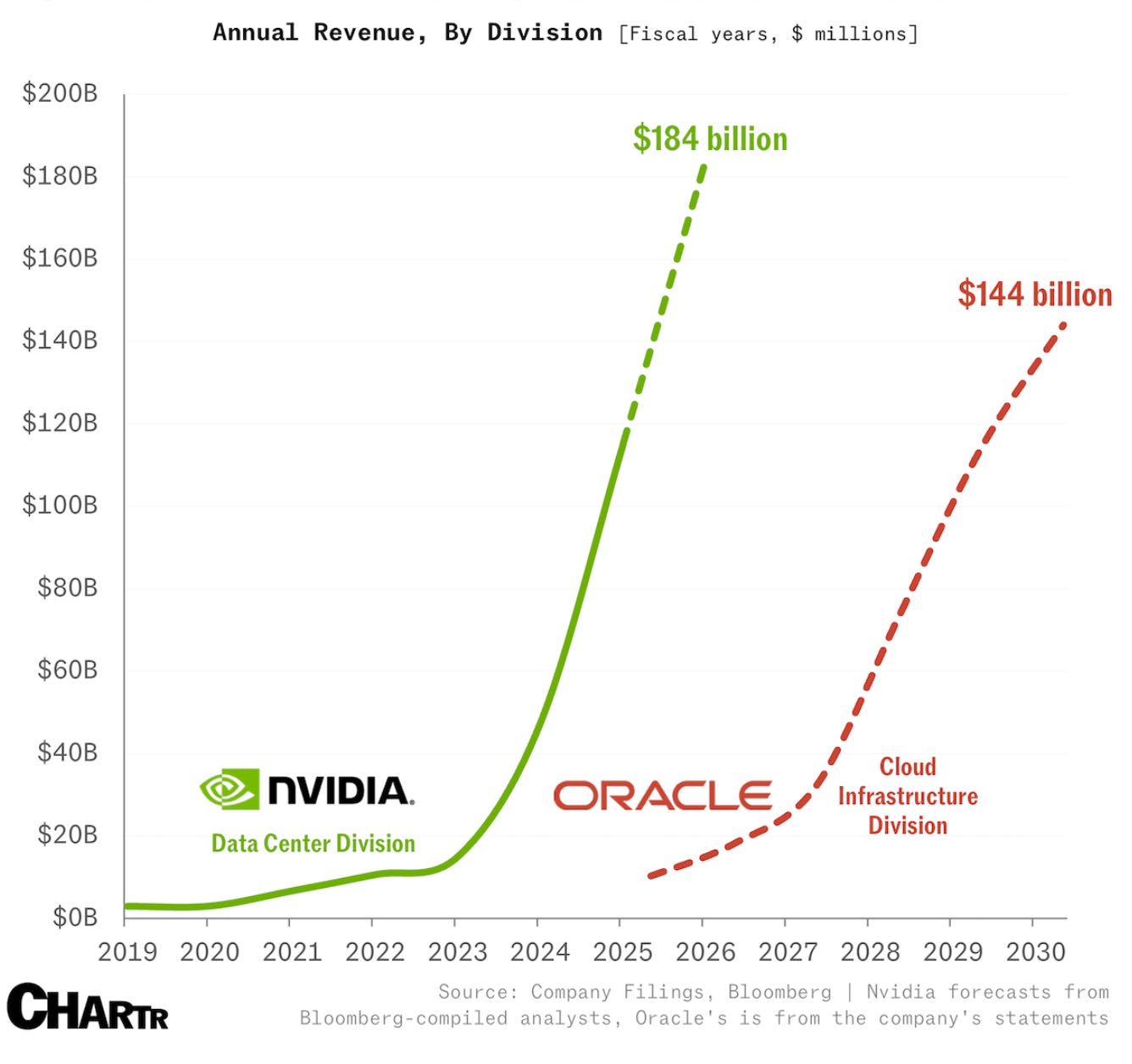

The enormity of this RPO growth enables us to make a large upward revision to the cloud infrastructure portion of our financial plan. We now expect Oracle Cloud Infrastructure will grow 77% to $18 billion this fiscal year and then increase to $32 billion, $73 billion, $114 billion and $144 billion over the following 4 years. Much of this revenue is already booked in our $455 billion RPO number, and we are off to a fantastic start this year.

To be clear, AWS’ current run rate is around $120bn, so these projections would make Oracle Cloud bigger than AWS today in just 3-4 years.

How did the 4th-place cloud suddenly report half a trillion in backlog?

OpenAI signed a contract with Oracle to purchase $300 billion in computing power over roughly five year [...]

The Oracle contract will require 4.5 gigawatts of power capacity, roughly comparable to the electricity produced by more than two Hoover Dams or the amount consumed by about four million homes. [...]

OpenAI is a money-losing startup that disclosed in June it was generating roughly $10 billion in annual revenue—less than one-fifth of the $60 billion it will have to pay on average every year.

If this revenue materializes, Oracle Cloud’s growth will almost parallel Nvidia’s own historic ascension:

This really surprised the market, and Oracle stock shot up by 40%:

The share price surge increased Oracle Chairman Larry Ellison’s wealth by more than $100 billion, pushing him into the range of Elon Musk as the world’s richest person, with a net worth of almost $400 billion.

But once you get past the headline numbers, things become a bit more head-scratching 🤔

But by 2027, OpenAI’s spending to rent Oracle servers, around $30 billion, is set to exceed OpenAI’s spending on Microsoft servers that year by several billion dollars

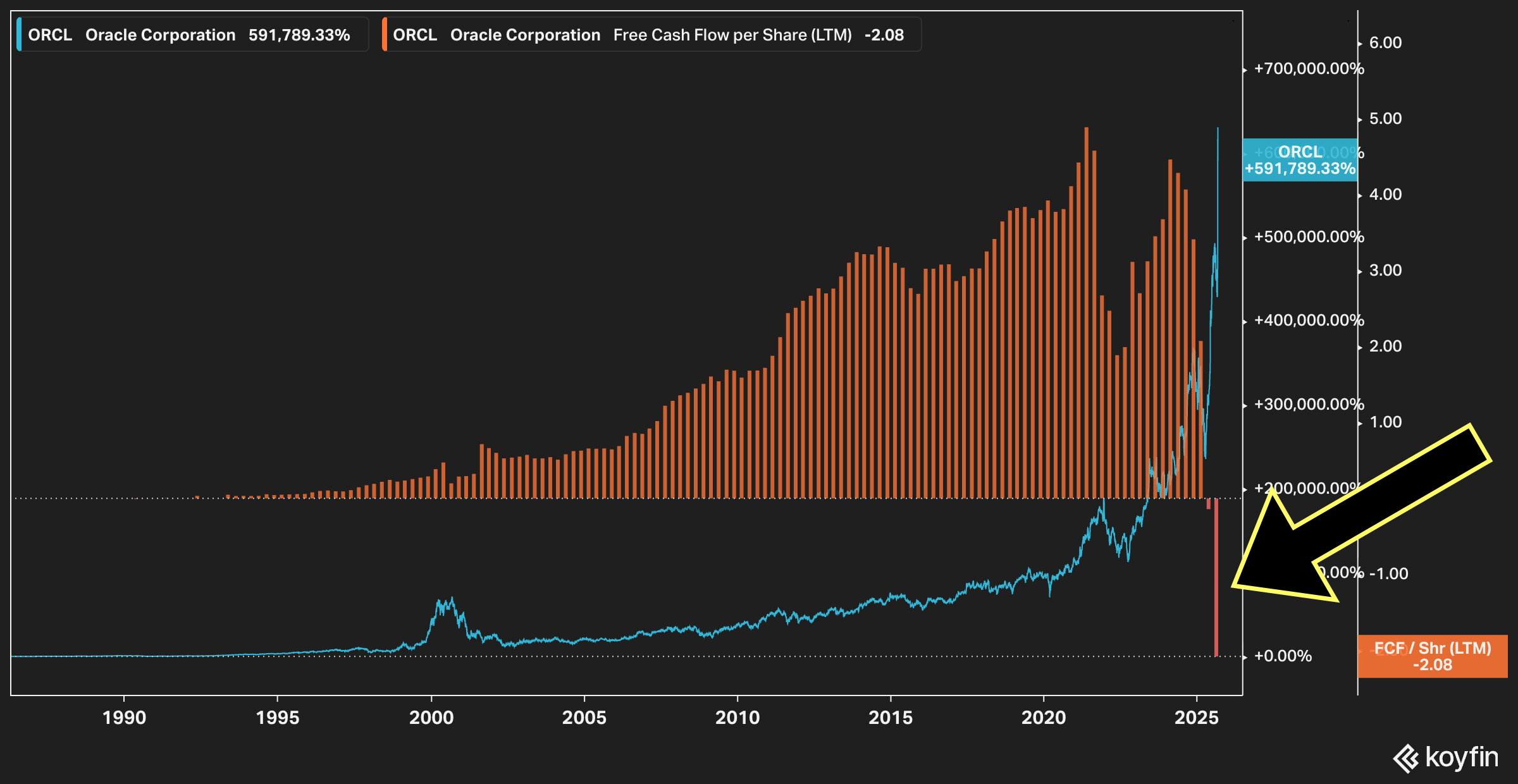

Oracle has around $59bn in revenues (TTM) and $21.5bn in operating cashflow.

Their capex has already exploded, from $2bn in fiscal 2021 to $27.5bn in the past year. A 13.5x increase in less than 5 years. Capex as a percentage of revenue bottomed at 0.82% in 2010, and today it stands at 46.45% 🤯

Strangely, despite their thirst for capital, they still paid out $5bn in dividends over the past year. If they’re serious about this, they should reconsider.

They *already* can’t finance all this from cashflows, so leverage has been going up and they now have $105bn in debt (a billion here and a billion there, and pretty soon we’re talking real money). Their free cash flow has gone deeply negative for the first time in the company’s loooong history:

With OpenAI representing so much of their backlog, they have *significant* customer concentration AND counterparty risk, because OpenAI’s current run-rate is in the $10bn-range.

OAI is growing fast, and I’m sure they have spreadsheets showing a path where the math makes sense, but this is all very contingent on multiple things playing out a certain way. They need to grow customers, grow monetization, and periodically keep raising tens of billions from private markets (maybe eventually from public markets).

What if they stumble? Release a terrible model? Lose too much key talent? What if there’s a big recession or financial crisis that prevents them from accessing capital? The competition has a breakthrough and races ahead, and they can’t catch up? Deep-pocketed competitors accelerate capex even further and they have to follow?

The other thing I wonder about is: Why Oracle? 🤔

What makes them so competitive in a bake-off against the dominant trio of hyperscalers, who have more scale and experience? Why didn’t OpenAI spread its bets more? I know they’re already using all the big clouds, but why not split that $300bn deal more evenly rather than give it all to Oracle?

Is it just how aggressive Oracle is? Are they buying scale by doing deals that make them bear an amount of risk that wouldn’t fly with the others? Are they doing uneconomic deals? What will Oracle’s margins look like on all this?

And even if all goes well on OpenAI’s side and the demand and cash are there, how will Oracle deliver on all this? How can they grow an entire AWS-sized business in less time than it takes California to build 1 mile of high-speed rail?

They don't have a magic source of GPUs or electricity or magical construction crews that can build faster than everybody else... 👷🏗️

In Fact, xAI originally worked with Oracle, but they found them too slow and unable to give them the scale they needed, so they did it themselves (this is the Colossus DC).

Will Oracle just resell a lot of capacity at other clouds on top of whatever they can build themselves? How can that possibly be better for OpenAI than going to those clouds directly?

I tend to agree with my friend MBI (🇧🇩🇺🇸) that surprising the market with a huge number is probably Oracle’s way to finance their way into scale.

They don’t have the operating cashflows or debt capacity to keep up with AWS, Azure, and Google, but if they can shock & awe the market by cobbling together a mind-boggling number (which probably requires doing all kinds of deals with questionable economics, reselling other people’s capacity, bundling with core products, etc), they can use the resulting stock surge to issue equity and finance the capex required to play with the big boys.

Engineered reflexivity! 🔁