64: OnlyFans' 75% EBITDA Margin, Video Games, Dungeon & Dragons, Airbnb & Booking, Elastic Q3, Tobias Carlisle, John Street Capital, Semiconductors, and Beth Harmon Bots

"Whoever had that idea at Chess.com needs a raise."

Every profession has a different way to be smart—different skills to learn and rules to follow.

You might therefore think that the study of "rationality", as a general discipline, wouldn't have much to contribute to real-life success.

And yet it seems to me that how to not be stupid has a great deal in common across professions. If you set out to teach someone how to not turn little mistakes into big mistakes, it's nearly the same art whether in hedge funds or romance, and one of the keys is this: Be ready to admit you lost. —Eliezer Yudkowsky

Allulose experiment, pt.1: I wrote about this promising sugar replacement in edition #62 (“Its taste is said to be sugar-like, in contrast to certain other sweeteners… The caloric value of allulose in humans is about 0.2 to 0.4 kcal/g, relative to about 4 kcal/g for typical carbohydrates… The glycemic index of allulose is very low or negligible.”).

Since then, we bought a bag, made some cookies with the kids, and replaced 50% of the sugar from the recipe with it (I’d have gone with 100%, but my wife is a little bit more cautious than I am).

If I hadn’t known, I don’t think I would’ve noticed there was anything unusual going on. The way they baked, browned, the texture, the taste… It’s all indistinguishable to me. We’ll keep experimenting with it (100% replacement next time), but so far it’s pretty great.

The main downside is that it’s still expensive, at about 10x sugar, but sugar is so cheap that 10x still isn’t terrible. Things could get really interesting when supply increases and it becomes cheaper…

It may seem like a small thing (why is he writing about baking cookies?), but I think few things have as much of an impact on humanity's health than our unnatural level of sugar consumption (especially fructose — see Attia's interview with Rick Johnson).

🔥 Remember that dumpster fire project where you could email something to be burned? (clever marketing by Hey email app — marketing so good, in fact, that I’m basically marketing for them right now 🤔)

They sent me the video of my email being burned. I admit, it’s satisfying in this digital age to have some action-at-a-distance in the world of atoms.

Investing & Business

Video Game Sales

Overall sales rose 35% year-over-year to a November-record $6.97B, according to NPD Group. The figure brought year-to-date overall sales to $44.5B, 22% higher than the first 11 months of 2019. [...]

November record of $1.4B spent on new hardware - up 58% from last year. [...]

PlayStation 5 was the dollar leader in sales, with the highest hardware-platform launch month in terms of dollars and units ever (topping the PS4's launch in November 2013).

Meanwhile, the lower-priced Nintendo Switch sold the most units in November, bringing its streak there to 24 straight months, analyst Mat Piscatella notes. (Source)

The Switch just keeps going forever, like an ARM Mac’s battery life.

Top 10 best-selling games for November 2020:

h/t Tae Kim

Roblox Hits Pause, Will Unpause in 2021

Roblox Corp. delayed its planned IPO after company officials decided that the gravity-defying performance this week of Airbnb Inc. and DoorDash Inc. made it too difficult to determine the right price for the videogame company’s shares. [...] the listing would be delayed until early next year. [...]

The surprise move comes at the tail end of a week to remember in the IPO market. Shares of Airbnb and DoorDash soared beyond expectations when they began trading Wednesday and Thursday, respectively. [...]

The first-day pops have raised questions about the system of pricing IPOs. When shares jump like Airbnb’s and DoorDash’s did, the companies miss out on billions of dollars they might have raised and instead hand them to investors, some of whom are only in it to make a quick buck. (Source)

A different WSJ piece the next day gives a bit more details:

Both Roblox and Affirm will consider selling a larger portion of their shares and changing the mix of stock to be sold by the company, its employees and shareholders as they seek to mitigate any initial pop, some of the people said. (Source)

h/t Trevor Scott and Tae Kim

Business Insight from Dungeon & Dragons

I edition #63 I mentioned in passing that Byrne Hobart was a great writer. Here’s an example of why:

Creating a standard seems to be most effective as a way to commoditize the complement. A company can make one part of its product an open standard, because it has a competitive advantage in benefiting from more supply of whatever product it commoditizes. A fun example of this comes from the world of tabletop role-playing games. In 2000, Dungeons & Dragons released a generic role-playing system that could be grafted on to other themes, like superheroes, spies, and Star Wars. One paper shows that the number of new tabletop gaming companies rose from 20 in 1998-99 (before the introduction of D20) to 68 from 2000-1, after, while employees per game company dropped by half.

So, Dungeons & Dragons' publisher had many new competitors. But that also meant that many more people had 20-sided dice and knew the basic mechanics of games. Since playing a game means matching a group of players who are all interested in the same game, an increase in the number of games published, and the number of unique players, can be a net benefit for the biggest incumbent: among any random set of d20 players, the system they’re all most likely to be familiar with is D&D; there isn’t data available, but it’s possible that this open system both reduced D&D’s share of total players and increased its share of total tabletop games played, by adding so many nodes to the network.

It’s particularly good because it mixes two things: The concept conveyed is interesting and it’s explained in the most vivid and understandable way possible. A lot of people talk about interesting things, and many can come up with interesting anecdotes and analogies, but few can mix the two quite as well as this.

Here’s another example of the same thing happening a few paragraphs lower:

A standard doesn’t have to be perfect, or even consciously designed, to keep working. In fact, they’re more effective when they canonize the market share leader as the only way to do things. This means they often echo much older technological decisions: programmers generally use up to 80 characters per line, because early computer displays were exactly 80 characters wide, and that was because IBM’s punched cards were 80 columns.

A standard is suspiciously similar to a software product: it consists entirely of information, and can be produced at nearly zero marginal cost.

Read the rest of the post here.

It Turns Out, OnlyFans is a Gooood Business

Those sweet 75% EBITDA margins:

This year, the subscription-based social media service will earn $300 million in profits before accounting for expenses like income taxes, amortization and depreciation [...]

That profit will be generated from $400 million in revenue the company expects from its nearly 90 million users, most of which are paying subscribers. While Bloomberg previously reported the revenue numbers, the profit figure hasn’t been previously reported. [...]

Where do those huge margins come from?

OnlyFans’ enviable profit margin is the result of two coalescing features of its business model. [...] OnlyFans essentially pays nothing for the content that flows through its platform. That’s because subscribers pay for access to exclusive content and messaging from creators—including a large contingent of adult entertainers. OnlyFans’ only costs are compensating its small employee base of around 350 people and its web-hosting fees. [...]

OnlyFans has grown to its current size largely through word of mouth—free marketing by its 1 million creators.

They take a 20% cut from creators, vs ˜5% for Patreon and 10% for Substack.

Source. h/t Hangfire (locked account)

Booking and Airbnb Have About the Same Market Cap

Red line is Airbnb, blue like is Booking. You can play with the interactive chart on Koyfin here.

Elastic Q3 Highlights from Peter Offringa

Yes, I know, it’s their fiscal Q2 2021… but what the hell? I know they live a bit in the future, but they’re already half done with 2021?

Right after we abolish daylight savings, I want to abolish offset fiscal calendars, please.

Anyway, I was going to maybe write some highlights about Elastic’s latest quarter, but now I don’t have to, because Peter Offringa covered everything:

Interview: Tobias Carlisle (Podcast)

Bill Brewster’s new podcast — self-described as more of a Rogan-style, long flowing conversation — has a very good hit rate so far. I really enjoyed the past episode with Dan McMurtrie, and this one with Tobias Carlisle is also a joy:

Tobias Carlisle - A Modern Walter Schloss (2h35 mins, or 1h17 at 2x, even though Bill won’t like me to say this)

The Rogan comparison may seem a bit on-the-nose during the UFC blow-by-blow section, but that flows into John Boyd and OODA loops, so it’s all good.

I do like that there’s a lot of — for lack of a better word — investing-psychoanalysis, where Tobias (and Bill, to an extent) will do introspection about their investing styles, why they do things a certain way, how they’re wired, trade-offs, what they wish they were better at, etc.

It’s refreshing to hear so much doubt and meta-thinking rather than someone just trying to appear confident and sell their skills to gather AUM.

I also like the discussion on the power of Twitter/FinTwit. It’s trendy to bash Twitter, and all its flaws are obvious, but I think too many take for granted its good aspects, which can be pretty life-improving if embraced.

Interview: John Street Capital (Podcast)

Always fun to listen to a super-smart person like the pseudonymous John Street Capital.

I choose to believe that they had agreed on a list of topics ahead of time and he had the numbers in front of him and doesn’t have a photographic memory, but who knows:

In this conversation, we discuss asset allocation, structural shifts in 60/40 portfolios, interest rates, public vs private companies, metrics on various public equity verticals, Square/Lemonade/Zoom/Tesla, SPACs, and Bitcoin.

The description above doesn’t make it seem that exciting, but the sheer mind-velocity and lung capacity of John Street makes it a pretty out-of-the-ordinary interview, and Anthony Pompliano did a good job of keeping up.

h/t A locked account that probably doesn’t want me to link & Long Way Capital

Science & Technology

McKinsey Report on Semiconductors

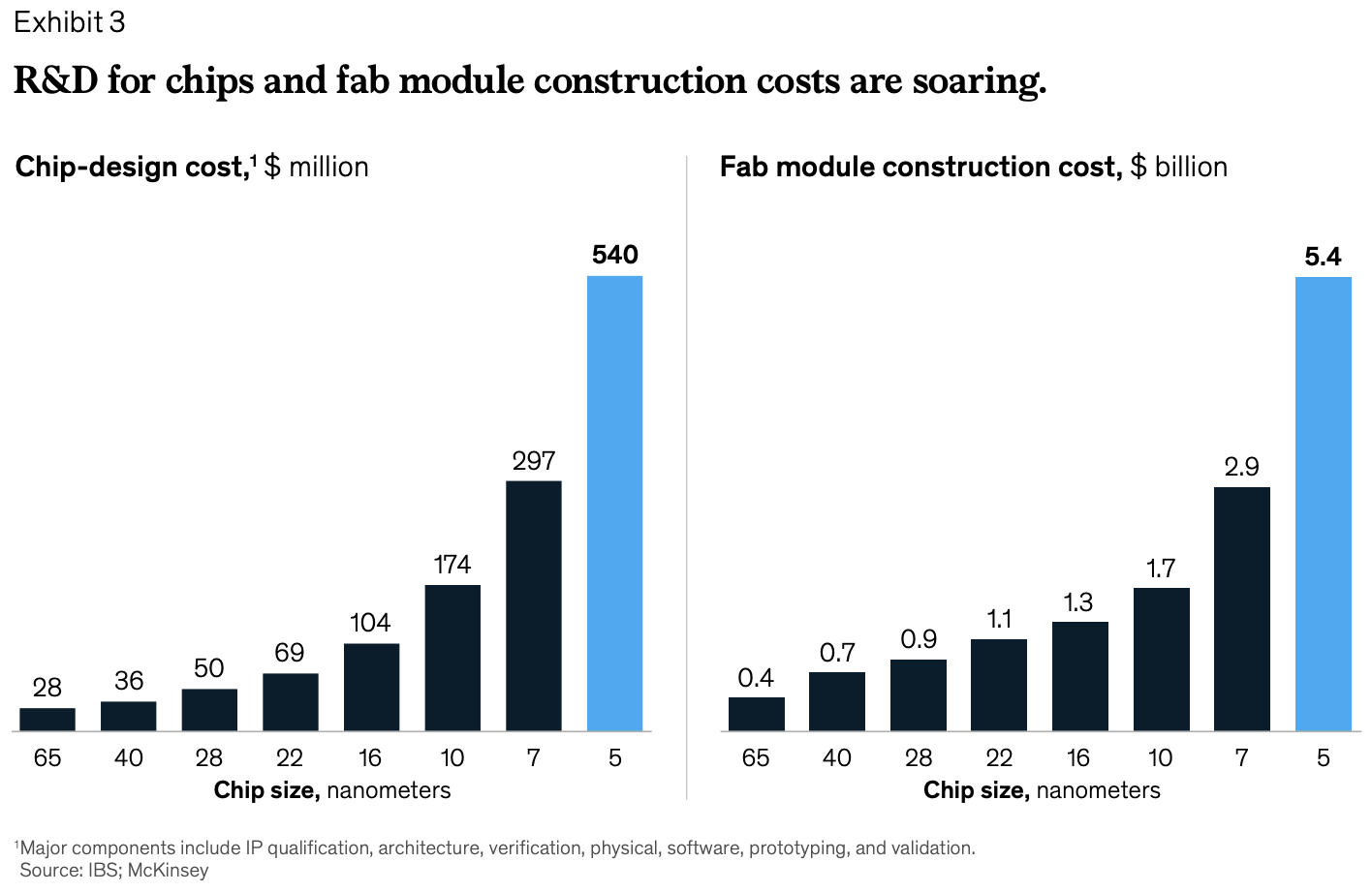

Key takeaways: It’s a tough business where the costs of designing and fabbing chips that are ever better & smaller are going up fast, and there’s a huge power-law, winner-takes-most dynamic at play. Combine these two things, and it means that only a few big winners have the resources to stay winners:

If a company’s product or service is even slightly better than a competitor’s, it typically captures an outsize portion—or even the vast majority—of industry revenue. This phenomenon is apparent along the entire value chain, from equipment production to chip manufacture. Companies that want to challenge the winner may find it difficult to catch up, since the leading players are often several years ahead in technology development. [...]

The cost of building and equipping a facility with 5 nm production lines now runs about $5.4 billion—more than three times the $1.7 billion required for a fab with 10nm production lines. [...]

Now consider R&D. As chips get smaller, R&D becomes more challenging as researchers deal with quantum effects, minor structural variations, and other factors that can complicate development. Designing a 5 nm chip costs about $540 million for everything from validation to IP qualification. That is well above the $175 million required to design a 10nm chip and the $300 million required for a 7 nm chip. We expect that R&D costs will continue to escalate.

Microsoft Setting Stage for More ARM PCs

It’s a small thing, but it’s part of a big thing:

Today, we’re releasing the first preview of x64 emulation for ARM64 devices [...]

When we first launched Windows 10 on ARM in late 2017, the long tail of apps customers needed were dominated by 32-bit-only x86 applications, so we focused our efforts on building an x86 emulator that could run the broad ecosystem of Windows apps seamlessly and transparently. Over time, the ecosystem has moved more toward 64-bit-only x64 apps and we’ve heard the feedback that customers would like to see those x64 apps running on ARM64. (Source)

This is similar to Apple’s x86 Rosetta2 that ships on ARM Macs to make the transition smoother, because at first, a lot of apps won’t be compiled natively for ARM, so it’s extremely useful to have a way to run them through an emulation/translation layer.

This is Microsoft starting to fill gaps so that if more PCs start being built with ARM chips rather than Intel/AMD x86 chips, Windows will be more ready to accommodate that smoothly.

Quick Hit: Lots of Context on Apple ARM Chips

If you want even more on this topic, here’s a good video by René Ritchie:

WRONG About M1 Mac Speed — Apple Silicon Explained! (35 minutes)

His name is Robert Paul… Dr Li Wenliang

The Arts & History

Chess.com Has Beth Harmon Bots

Ok, this is clever. My friend JPV has been playing chess online lately, and like me, has enjoyed watching ‘The Queen’s Gambit’ (2020, Netflix).

Clever: On Chess.com, you can play against bots that mimic the approximate skill level of Beth Harmon at various ages/during various episodes of the show.

Whoever had that idea at Chess.com needs a raise.

‘Season’ (Game Trailer)

Found this from a Twitter ad, of all places. No idea if the game is good, but the trailer is very intriguing. Almost feels like a Miyazaki film at times.

The gameplay is centered around biking, exploring, recording photographs or audio, and encountering local people. The player character is there in the critical moment, just as everything is about to change. You are not there to stop the change but to bear witness to it, to make recordings and attempt to understand what is being lost before it’s gone. [...]

Season’s art direction is inspired by illustrators, painters, and natural light cinematographers. It has been specially developed from the ground up to fit the feeling of the world we are building. It is inspired by the early Japanese woodblock print artists, as well as mid-20th century poster artists such as Norman Wilkinson. It is a minimalist approach to realism. This simplification mindset, getting rid of rather than adding details, set the guidelines we kept in mind while developing the overall look for the game.

Here’s the official blog post from Playstation introducing the game.

Zodiac Killer Cipher Solved 51 Years Later

Maybe it’s because I re-watched the Fincher movie last November and this is fresh in my mind, but I thought this was interesting:

A coded message sent by a brutal serial killer who has never been caught has been cracked more than 51 years after it was sent. [...]

The full text of the cracked cipher reads:

HOPE YOU ARE HAVING LOTS OF FUN IN TRYING TO CATCH ME THAT WASN’T ME ON THE TV SHOW WHICH BRINGS UP A POINT ABOUT ME I AM NOT AFRAID OF THE GAS CHAMBER BECAUSE IT WILL SEND ME TO PARADICE ALL THE SOONER BECAUSE I NOW HAVE ENOUGH SLAVES TO WORK FOR ME WHERE EVERYONE ELSE HAS NOTHING WHEN THEY REACH PARADICE SO THEY ARE AFRAID OF DEATH I AM NOT AFRAID BECAUSE I KNOW THAT MY NEW LIFE WILL BE AN EASY ONE IN PARADICE DEATH

Here’s a video that explains more about the transposition cipher that was used and how it was cracked. Via Ars Technica.