73: 500 Million MAUs with 4 Employees, Uber Defrauded, Mike Bloomberg's Startup Phase, Bond Rating, 2020 E-Commerce, Pixar's Rendering Farm, Vaccines on Shelves

"a kind of weird reverse-Goldilocks middle-ground"

Hard choices, easy life. Easy choices, hard life.

—Jerzy Gregorek

This one is going to be a bit shorter than usual (I can hear that sigh of relief from here!).

Not because I’ve run out of things to write about✴︎, but because I’ve just had less time to work on this project in recent days.

The kids have been home (no daycare, no school) since December 17th, which has pros and cons. Sometimes I’m afraid of creating too much an an Instagram reality on this newsletter or on Twitter, because there’s a natural tendency to post about the fun things you do or share the nice photos you took, but of course that’s a biased sample.

There are days when things don’t go great or when we don’t do fun activities. You don’t want me to post about those, but I think it’s not a bad idea to acknowledge they exist too.

I recharge my batteries with solitude (classic introvert), and while solitude has been a big problem for many during the pandemic (especially for extroverts, who recharge their batteries when they are with others, and people without partners, kids, etc), in my case it’s been the opposite; I feel like I’ve barely been alone for any stretch in 9 months.

I also miss seeing friends and family in person, of course. One doesn’t preclude the other… It’s a kind of weird reverse-Goldilocks middle-ground that doesn’t give me the solitude I need or the social interactions I’d like to have ¯\_(ツ)_/¯

Anyway, not sure where I’m going with this. Except maybe as a reminder that what we see online isn’t a representative sample, but our brains haven’t evolved for this kind of firehose of both the best and worst news every day, so it can make us feel pretty weird.

So if you feel like you can’t complain because you aren’t doing as bad as those who lost their jobs and parents, but aren’t as good as the people having the time of their lives on Instagram, know that there’s plenty of us stuck in the middle, having good days and bad days, good moments and bad moments.

The best approach I’ve found is to train myself to try to let go of the bad moments really quickly, because you never know if the next moment or the next day will be a good one, unless you hold on to the bad feelings (anger, frustration, disappointment, etc), in which case you can be pretty sure it won’t be good (or at least, not as good as it could be).

✴︎My Notion file full of notes and ideas grows faster than it shrinks, so it’s becoming a bit of a problem. I had to split it into two parts because it was loading slowly…

I wish Notion would have better local caching and would synch more in the background rather than seemingly only when you open a file. When I click on a note, everything should be ready to display and appear immediately the vast majority of the time. It should only rarely feel like loading a webpage (I get there are plenty of edge use cases).

► At a time when a lot of people are making new year’s resolutions that mostly won’t work (the base rate isn’t good), I’d like to recommend considering the concept of yearly themes instead.

Investing & Business

Bond Rating Pricing Power

SPGI latest ratings fees published. Max rating fee on a corporate bond now 7.2bps.

Here’s the history I’ve collected for years.

Graph from FIGfluencer. S&P’s fee disclosure. h/t Jerry Capital & HideNotSlide

E-Commerce in 2020 (sorry, no clever title for this one)

Interesting thread on e-commerce by Cristina Berta Jones:

The US ecommerce market is estimated to have reached $800B in 2020 (33% growth yoy) with Amazon at 40% share.

Of the $200B growth in US e-commerce in 2020

- $90B came from Amazon (39% growth yoy)

- $30B came from online grocery though presumably this excludes Instacart’s $35BAmazon has reached mass-market penetratiom with Prime memberships at 120-130m.

Notably the growth in 2020 came primarily from low income households which accounted for 45% of the growth.

The European ecommerce market is estimated at €717B in 2020 (only 12.5% growth yoy) Amazon is reaching 30-35% market share in UK, DE but it is far weaker in the other EU markets, adding up to a total EU share of 14%, so nowhere near the mass-market penetration it has in the US

h/t Jerry Capital (damn you, Jerry, sharing too many interesting things and making it seem like I get everything from you)

How Mike Bloomberg Built His Business

Good thread by Bob Casey on how Mike Bloomberg ran things during his startup phase. A few highlights:

Bloomberg initially focused on a narrow use case: real time yield curve data for bond traders. Today, Bloomberg covers equity & debt markets around the world, offers financials, news, messaging, alternative data & more. But it started with a simple product & seemingly tiny TAM

They “nailed” product/market fit for this use case because they deeply understood their customers. Not only did Mike Bloomberg and the first four employees all come from the industry, but they also built a tight feedback loop w/ their first "lighthouse" customer, Merrill Lynch

When Bloomberg installed the first 22 terminals at Merrill, they embedded themselves with initial users. They visited daily. They had two users who provided constant feedback, helping to rapidly squash bugs and improve the product. [...]

As the product matured, one happy customer led to the next. The business grew largely via referral. Bloomberg shares how a sale to the Bank of England led to a sale to the Vatican led to a sale to the World Bank

Similar customers with identical use cases make for powerful references if a product relieves a pain point. The power of a narrow TAM helps not just with product market fit, but also with GTM.

Bloomberg notoriously doesn’t discount. Mike says: “To publish one price and then negotiate secretly with those you want to favor... that just encourages dissent, uncertainty, and unpleasantness.” Many software companies struggle to maintain list price. Not Bloomberg.

h/t N (locked account who probably doesn’t want me to link)

Among Us: 500 Million MAUs with 4 Employees

With roughly half a billion people reportedly playing it in November, Among Us has had the most monthly players for a mobile game ever, beating giants like Pokémon GO and Candy Crush Saga. According to Nielsen’s SuperData, the game is “by far the most popular game ever in terms of monthly players.”

The success is even more remarkable because InnerSloth — the company that makes Among Us — only has four employees.

Reminds me of when Whatsapp sold to Facebook with 420 million monthly users and 55 employees.

Source. h/t Brad Slingerlend

‘When Uber Discovered they’d Been Defrauded out of $100M - or 2/3 of their ad spend’

Pretty crazy thread by Nandini Jammi, haven’t seen it independently verified, but wouldn’t surprise me at all, especially with the more lax security on Android and some of those apps being able to do all kinds of insane things. Some highlights:

The biggest story in tech no one’s talking about is Uber discovering they’d been defrauded out of $100M - or 2/3 of their ad spend.

And all bc Sleeping Giants kept bugging them to block their ads on Breitbart. [...]

So Kevin - who is embarrassed bc he had instructed all vendors to block Breitbart (!!) - figures out which ones are letting the ads slip thru & pauses them. It’s ~10% of their total budget, $150M. [...]

He braced for a big hit to new user acquisition. But what happened was...nothing. No change in performance. [...]

So where was this $15M going? For the first time, Kevin starts pulling log files & auditing vendors.

He begins seeing weird things like users clicking on ads and then being logged into Uber 2 seconds later...physically impossible.

Turns out their vendors were making shit up. [...]

For ex, one ad network launched “battery saver” style apps in Google Play, giving them root access to your phone.

When you type the word “Uber” into your Google Play, it auto-fires a click to make it look like you clicked on an Uber ad and attribute the install to themselves. [...]

This shit is BRAZEN, right? So at this point, Kevin turns off 2/3 of their ad spend...and once again, no change in performance!!!

Over $100M worth of ads was doing jack shit. Uber’s customers were coming in organically, on the strength of their brand, WOM, referrals, etc.

Good comment by ‘onlyrealcuzzo’ that adds context:

Specifically to Uber's case - they did NOT turn off 66% of ALL ads randomly to no adverse effect (implying that all ads are worthless).

They DISCOVERED that a certain type of ad (paying for installs on dubious ad networks) was mostly fraud. After turning off 100% of this type of ad - they found no adverse effect.

Via HN

🤔

Science & Technology

‘Pixar’s Rendering Farm’

Interesting thread by a Pixar tech employee on how they allocate compute resources to render their films:

1/ Our world works quite a bit differently than VFX in two major ways: we spend a lot of man hours on optimization, and our scheduler is all about sharing.

Due to optimization, by and large we make the film fit the box, aka each film at its peak gets the same number of cores.2/ in terms of scheduling, some brilliant folks like Josh Grant, Eric Peden have devised a way to lend extra clock cycles to neighbor processes that are underutilizing their checked out cores.

So say process A and process B each check out 8 cores and land on the same host...3/ process A during scene gen gets stuck using 2/8 cores.

Meanwhile process B is brute force patbtracing, using 8/8 cores.

During that time, process B uses 14/8 cores!4/ this means when you look at the average utilization of checked out cores across the farm, most shows hit 80-90%. So we get a little more bang for our buck!

5/ We buy more cores when the needs of all of the upcoming projects show we need more on a consistent basis (eg for many months).

We also lease for short term bursts of need, usually for 4-8 weeks at a time.6/ while each gen of new hardware is clearly faster than their predecessor, the fixed number of cores allocated to a film hasn’t changed in some time.

A film can also choose to spend their production budget on a lease if the story and/or schedule warrants the expense.7/ last but not least, we are truly spoiled by our systems department. We have some killer storage hardware admins that make having many high IO projects IP at the same time possible!

8/ not to mention the insanity of how all of systems had Soul up and running, working from home, almost overnight! And software engineers who put a lot of rapid feature dev into remote reviews.

"That's 35 million vaccines sitting on a shelf somewhere [in the US]"

Since the vaccines have started rolling out, I’ve been keeping an eye on some of the trackers, like OurWorldInData’s and Bloomberg’s.

The thing I always wanted to see for proper context — and maybe it’s there and I’ve just missed it — is how many vaccines have been given and how many have been delivered and are available for use.

It’s bad enough if we’re vaccinating slowly because we’re waiting on delivery of doses from the manufacturers, but it’s much worse if we have doses sitting in a fridge and just can’t get our act together enough to line up some arms.

Well, it looks like it’s the latter, at least in the US:

I also keep reading about doses being wasted and going bad because they can’t inject them all before they expire… That’s just crazy.

You should want the bottleneck to be manufacturing of doses, not injecting people, so you (over)design whatever system you need for that. Because the pandemic is so incredibly expensive, anything that shortens it even a little more than pays for itself.

There’s an endless supply of people to vaccinate at this point. Any problems are not on the demand side, but on the supply side, especially after months of knowing this was coming. I hope January will show rapid acceleration in vaccination rates — it’s not an abstract problem, some people will die because of the slow roll out. Nobody wants to be the last person to die just before a war ends, and nobody wants to be the latest to lose their grandma or uncle after we have a vaccine because we didn’t do all we could to get it to people fast.

Meanwhile, as of Jan 2, Israel has vaccinated 12.59% of its population, the U.S. is at 1.28%, and Canada at 0.3%… *sigh*

‘France Hits Record 19.2% EV Share In December’

France’s plugin electric vehicle market share hit a new record of 19.2% in December 2020, up 5.6× from December 2019. The full year result was 11.2% plugin share, with local favourite Renault ZOE the year’s top selling plugin once again.

The December combined plugin share of 19.2% was dominated by battery electric vehicles (BEVs) at 11.1% of the total auto market, with plugin hybrid vehicles (PHEVs) taking 8.1%. Respective full year contributions were 6.7% BEV and 4.5% PHEV, for an overall 2020 cumulative plugin share of 11.2%. This is growth in share of 4× over full year 2019’s cumulative result of 2.8%. (Source)

Here are Sweden’s numbers for November (“Sweden’s EV Sales Hit New Record In November — 38.7% Market Share”).

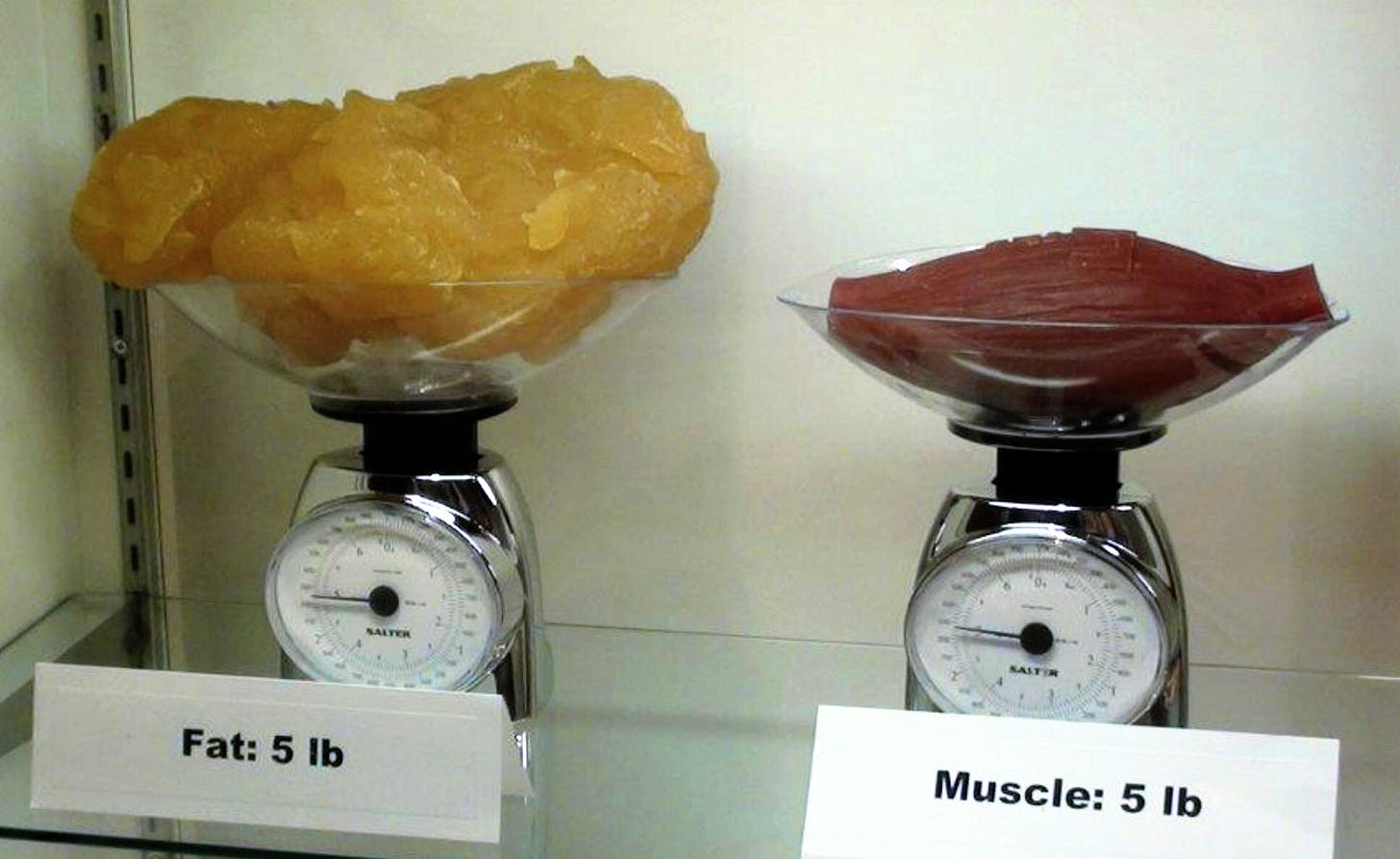

5 Pounds of Fat vs 5 Pounds of Muscle

This helps. Source.

The Arts & History

‘Highly successful Honey Bee’

𝕭 dat 𝓑.

Palm Springs

I really enjoyed 'Palm Springs' (2020).

Possibly my fave movie of the year — I'd have to think about what else I saw this year...

Part of the enjoyment was having no idea what it's about going in, no trailer, nothing, so I recommend going in totally blind (though know it's not for kids).

Maybe later I’ll write more withs spoilers about what I liked and why, but this is your chance to do your homework if you haven’t seen it so that you can read the spoily edition later.

If, and only if, you’ve already seen it and want more, there’s a good podcast episode about it here:

Incomparable #527 (don’t click if you haven’t seen it, because just the title and description on their page will spoil some fun)

Alan Parsons Project

Somehow never really became familiar with this band before — was just kind of vaguely aware of them — but man, is it hitting the spot this afternoon, listening to this as I write.

A lot of the instrumentation makes my brain all tingly. You can hear them having fun with it too, which is always nice.

Thanks to Piyush Pant for pointing out this bit of trivia:

[Alan] Parsons acted as Assistant Engineer on the Beatles' albums Abbey Road (1969) and Let It Be (1970), [and] engineered Pink Floyd's The Dark Side of the Moon (1973)

Listen on Apple Music / Spotify

I love music with an implied smile and wink (Oscar Peterson often has that — listen to ‘Hymn to Freedom’ for example)…

I gotta make sure the original bitcoin sudoku heroin guy gets credit :) from 2018: https://twitter.com/Theophite/status/1030225104234373121?s=20