Interview with Koyfin co-Founders Rob Koyfman and Rich Meatto

Special Edition #2

Full-disclosure update: All right, I guess I have to start with saying that I recently became an investor in Koyfin.

I started planning this interview before I knew they were doing a round of funding, and while I’ve been on record for a long time about my love for this company, I know that as soon as someone has a financial interest in something, whatever they say about it should be taken with a grain of salt, so feel free to get your shaker out (I recommend this one).

For the record, my intro below was written before the investment was mentioned (yes, I’m that slow).

Invert, always invert: Another way to look at it is that you can be sure I really like this company and I’m not just saying stuff, because I actually put my hard-earned $ where my mouth is.

𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #𝟚

For a long time, retail investors were paupers when it came to access to good financial data and tools. The pros had their fancy Bloombergs, FacSets, and CapIQs, but pyjama-investors like me only had things like Yahoo Finance, Google Finance, Investing.com and a few others.

I mostly used Google Finance, because it was much much faster than the others, you could have looooong watchlists that had real-time price updates, and the information density was high (each line didn't take much vertical space, so you could keep an eye on lots of things at once).

That ended when Google Finance was killed, and it appeared like we were entering a dark time (Google technically redesigned it, but in practice, that killed it)...

Thankfully, that was just the beginning of a new era of innovation in the space. Many new financial information sites popped up, and I love how many different approaches are being tried. It's a new golden-age for innovation in the field.

In the same way that there's been a consumerization with other kinds of tools (software & hardware), I think we're seeing it in finance too, and expectations are being raised about the quality of interfaces and the power of the tools. And my very favorite of that new wave is Koyfin.com.

I think they're on a path to potentially disrupt the industry by simply being better (what a concept) than the expensive pro-tools on some important dimensions. These legacy players may have the best data and deep functionality, but the interface looks stuck in the Geocities era. Meanwhile, as everybody's stuck metaphorically pecking away on their Blackberry and Nokia physical keyboards, Koyfin is building them an iPhone.

I really enjoy their attention to detail when it comes to the user experience.

Sweating the small stuff makes such a difference with this type of software. If it was income tax software that you used once a year, you could quickly forget if something was a bit clunky or unclear. But when you live in a software all day, every day, and click on various parts of the interface thousands of times every month, it matters A LOT to get things right.

Anyway, Koyfin was great before, but they've recently had a major version release that made them even better. I was lucky to have access to the beta, so I've had a while to get used to the changes. I was impressed enough that I wanted to speak to the co-founders, Rob & Rich about it, and about the company.

Enough of this intro, let's get to it (I'm in bold):

Q: Hi Rob, Hi Rich! Can you introduce yourselves a bit. What's your background, what did you do before Koyfin, and how did you pick up the skills that you're using today to build what is a pretty complex product that tries to make useful pretty complex data from a pretty complex industry (I notice a pattern).

Rob: Hiya. My background is on sell-side and buy-side working in a bunch of different groups and investment styles. I started in Goldman Sachs single stock research, then moved to portfolio strategy (more macro-ish), then a proprietary trading desk. After that I worked at Caxton (macro hedge fund), Citi Equity Trading Strategy, Lyxor Asset Management and Tekne Capital.

If there’s one theme to my career it’s that I can’t hold a steady job. Another theme is that I’ve always been interested in graphing and data visualization, which is why charting is such a big part of our product.

On the skills side, I don’t have a lot of technical skills unlike Rich who has learned how to code and design since joining Koyfin.

Rich: Thanks, Rob. I have been involved with the financial markets and technology nearly my whole life. If I was unsuccessful in convincing my mother to open a custodial trading account back in high school, I would have most likely focused on tech from the start. However, after trading stocks during the tech’s boom/bubble, I was hooked on the markets.

After graduating business school, I got involved with trading convertible bonds and ended up trading various products within the credit markets. Prior to Koyfin, I was a distressed high-yield credit trader for a sell-side brokerage firm focusing on unappreciated credits.

Q: I also don't want to assume that everybody reading this has tried the product. Can you describe what Koyfin is and what it does?

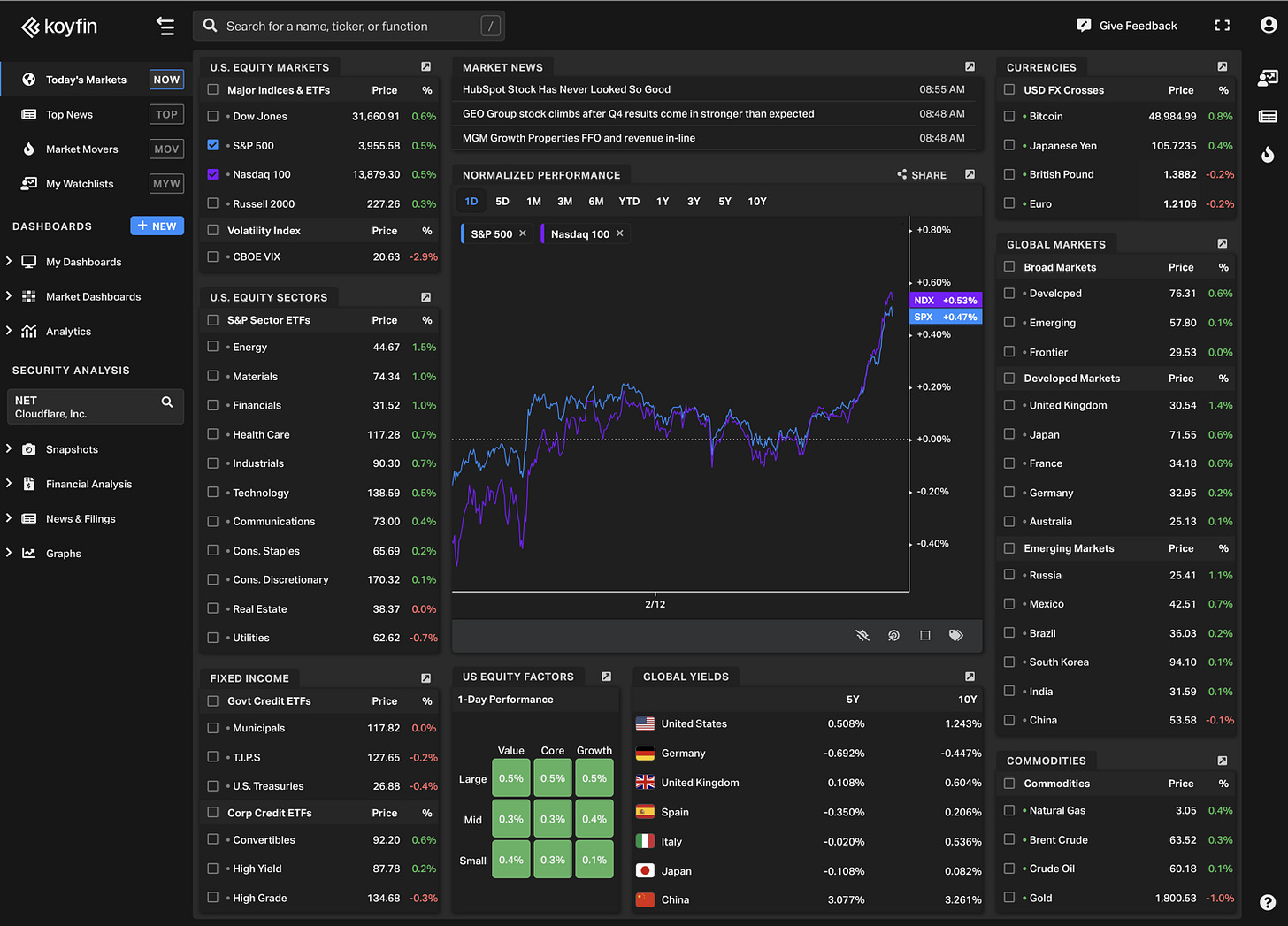

Rob: Koyfin is a financial data and analytics platform to research stocks and understand market trends. Koyfin covers global equities, company fundamentals, consensus estimates, ETFs, mutual funds, FX, bonds, economics, news and twitter. The platform is used by analysts, traders, portfolio managers, financial advisors and individual investors.

There are three key areas of value which we provide:

1) We offer professional grade data not only for stocks but for other asset classes because everyone is a closet macro investor today, or so they think. We curate the data from high quality data providers.

2) We provide analytical tools like charts and dashboards so you can interpret the data and turn it into information. We hope you never need to download our data into Excel because we have the functionality on our platform to accomplish what you want to do in Excel. Having said that, Excel is great for certain things because it’s so versatile and powerful.

3) We focus on making our product delightful with an awesome UI and intuitive user experience.

Q: Do you remember **the moment** when the idea for Koyfin came into being? What was the thing that made you go, "hey, I think I could do something here that would meet some unmet needs", or maybe it was more "gah! I'm so $%#$% mad at this crappy tool, I'll make a better one myself".

Rob: After I left my last Wall St job, I started investing on my own and it was the first time in my career I didn’t have access to a Bloomberg, Factset or any of the other expensive Wall St tools. I started trying different services out there that didn’t cost an arm and a leg. And basically the level of functionality and data quality dropped off exponentially once you excluded the products that cost $25k per year. This was 2016 and there so many cool new tech products like Slack, Dropbox, etc. I also discovered TradingView which I thought was a great product.

I started to think about my own problem and why no one had solved it by creating an investment research platform that was powerful, modern and accessible. And I couldn’t find a good reason. There were several platforms popping up that claimed to do it, but I used them and didn’t think their product was any good.

I think the timing was ideal. Financial data was more readily available than it had been previously. Ten years ago, there weren’t any data providers that would sell professional-grade financial data and that’s changed because there’s more competition now.

The consumerization of the enterprise was just becoming a thing where people started expecting their enterprise software to look and feel like AirBnB, not MS DOS. And lastly on the individual investor side, there was a desire to use professional grade tools that offered fundamental analysis, valuation, macro data, etc. Individuals today want to make investment decisions themselves, not outsource it to a “professional.”

I remember the moment I decided to do Koyfin full time. I bootstrapped the company myself to see if I can develop an MVP. Rich joined me as a co-founder about a year after I started Koyfin.

Q: Koyfin recently launched a major new version, with revised visuals and new features. What were your big goals with it, and what are some of your favorite changes that you were able to ship and that you'd like to highlight to the reader? (I love the recent addition of transcripts!)

Rob: MyDashboards was really a quantum leap in functionality vs. what we offered previously. It’s a place where a user can set up their own widgets and customize the space with whatever they want: Watchlists, Charts, News, etc.

The design improved a lot as well which is something Rich focused on. The platform became more complex but easier to digest because the design was less jagged.

Rich: The original goal was to add global equity coverage but as Rob mentioned it ended with a total redesign of the platform along with adding our new MyDashboard functionality.

Our MyDashboard first version was very popular but if we wanted to improve it further, we would have to reengineer it from the ground up. Even after releasing it, I do not think we are not even close to the full potential of it.

So I might be a bit biased but my favorite change had to do with the overall design change in Koyfin 3.0. I think it gives a professional look and feel while being very flexible in terms of screen responsiveness.

Q: Can you share how big Koyfin’s user base is, how it has been growing over time, has the pandemic had an effect on it and why? Have you found that usage is very tied to what is going on in the market at the moment (f.ex. When there’s lots of volatility, your traffic spikes up and vice versa) or it’s fairly consistent?

Rob: We have about 180,000 users which is 5x growth over the past year. The pandemic has been a tailwind for Koyfin similar to other internet businesses.

Additionally, we benefited as professional investors had to work full-time from home, and weren’t able to share a resource like Bloomberg with other colleagues in the office. The influx of individual investors into the market has also benefited us.

One caveat to that is most new retail investors aren’t looking for an advanced tool like Koyfin. The analytics on Robinhood are enough for them.

Q: When you log in on the site on your own time, what’s the part of the site that you use the most? What’s your favorite section to check purely as a user of Koyfin?

Rob: I check market movers several times throughout the day to see which stocks are moving on abnormal volume. I frequently use the charts where I have several graph templates set up. I’m a big fan of the Lots-of-charts function to see which stocks are leading or lagging in a particular ETF or watchlist. And lastly I have a bunch of watchlists of stocks that I’m watching.

Rich: My favorite part of Koyfin is either My Watchlists or Market Movers. While you can have a watchlist table within a dashboard, the MyWatchlist function is just so simple yet powerful.

Q: What's the longer-term vision for Koyfin (3-5 years)? Feel free to keep some cards close to the vest and not reveal all your secrets, but what are the broad strokes of what Koyfin users should expect to see as the site keeps maturing?

Rob: The long term vision is that Koyfin is the “homebase” for any financial data in the world. Investors can choose which data to subscribe to, and use Koyfin to analyze the data.

If you think about the workflow of a particular investor, they are doing something for 8-10 hours of the day, assuming it’s a full time job. We want to provide all the necessary data and functionality to be the only tool an investor needs to accomplish that work flow. We don’t want you continually switching to other platforms or websites because that’s annoying and disruptive.

Longer term we’ll integrate more closely with other services like brokers and custodians, and continue to add new data sources.

Rich: Switching sucks, so that is why we work hard to include as much broad market data as possible within Koyfin. For investors to digest that information, we want them to utilize Koyfin’s dashboards and financial analysis tools. When we introduce our premium plans, it will allow us to offer even more in-depth market data and functionality within other asset categories like futures, options, and even credit markets.

Q: I sometimes think of finance/investing as an archipelago of islands, and while it's all part of one thing, each island can be quite different (very different species have evolved in each habitat, so to speak).

How are you thinking about building something that has to serve the needs of fundamental investors, technical analysts, macro traders, ETF indexers, dividend hunters, the crypto people, WallStreetBets, etc. And skill levels from beginner retail investors to RIAs with dozens or hundreds of clients to hedge fund analysts and PMs? Is it ever hard to figure out the right balance and trade-offs?

Rob: That’s a great question. Our thesis is that investors want access to all types of financial data, not just the one segment they are focused on. This creates a problem eventually because an options trader might not want to see the same information as a financial advisor.

We’ve thought about it by creating premade macro dashboards for investors to browse assets across the market. That way you can see what data is available on Koyfin, and maybe learn about a new trend happening in another asset class. An equity investor might look at the Global Yields dashboard and see that developed market yields are starting to rise in unison. That has implications for risk and growth overall.

In the near term, there’s enough commonality for different types of investors to use Koyfin and customize it to their own use case using MyDashboards and Graph Templates. In the future, we’ll probably have more specialized functionality that only a subset of users will care about, like model portfolios for Financial Advisors, or bond pricing for credit investors. And we’ll offer that functionality on an à la carte basis for that segment.

Rich: As an investor, I think it is beneficial to have access to as much broad market data as possible. We handle a lot of different data within Koyfin so building core functionality around things like dashboards and graphs allow us to use all different types of data for different use cases.

Q: Any islands that you don't currently serve but that you'd like to colonize in the future?

Rob: All the islands would look more lovely if there were a Koyfin flag flapping in the wind.

Rich: Yes those islands would definitely look amazing. But in looking out in the future, we both believe that options could be a potentially huge island for Koyfin. Personally, I think corporate credit is a special hidden island that many do not realize exists.

Q: What do you find most difficult about building Koyfin? What are the bottlenecks and problems that you haven't been able to fully crack quite yet? If you could have one wish magically granted about Koyfin, what would it be?

Rob: We’re dealing with a lot of different data and data providers. Some offer APIs, others send us XML files. This creates a big ETL [Extract, transform, load -Lib] challenge that’s caused more problems than we anticipated. We’re rebuilding our ETL pipeline to fix some of these issues.

Rich: With a small team, it has been hard sometimes to handle performance issues while continuing developing new functionality. As we continue to grow, our platform is now being used all around the world and in many different ways.

All of this has caused those temporary challenges but we are very close to moving past this, which will make our users very happy.

Q: I'm curious to learn more about the team that is helping you build Koyfin, and what you've learned about hiring and managing people as the business grew from a startup that could fit into a Corolla to now a company that would require a tour bus.

Rob: Right now we’re at a stage where most people are wearing many hats. As we grow, we need to define and optimize our process to be able to hire the right people into the system who specialize at something narrow.

Rich: We got a hard-working team. Nearly everyone on the team had not worked with financial data before Koyfin, but they have done a great job picking it up.

Q: If someone reading this is already a Koyfin user and they have feedback or ideas or suggestions or bug reports, what's the best way for them to help out?

Rob: Click on “Feedback” on the top right of Koyfin, and share your thoughts. Sometimes users email me directly. However, using the Feedback route is ideal because the Koyfin community can vote on your suggestions, and our product team can prioritize it. Rich and I see every post in that feedback forum, and every help email that comes to the help desk.

Rich: Using our feedback board within the platform is the best. It helps us group bugs and feedback easier, allowing us to move quicker.

Q: Thank you for your time! Anything else you'd like to add? Anything cool I didn't ask about?

Rob: Twitter has been such an amazing place to meet users like you. We’ve had so much love and support from Fintwit members who have provided feedback on functionality, and even some that become our investors!

Rich: Yes, thank you for your support!

Bonus: From the Archives

Original Wireframe

Rob: Here are the wireframes that were in the original pitch deck. We’ve evolved since then, huh? The key elements were that Koyfin would be a full screen web application. Early on I thought a command bar with shortcuts would be central to what we do. And lastly a focus on graphing and data visualization. The wireframe below shows margins and forward returns for Micron (MU).

Version 1

Rob: I remember the first time the developers came back with a prototype and I was horrified. WTF is this? It’s really ugly. I quickly learned we need a UI/UX designer. Now I needed to figure out where to find this designer. I went to the place where you can find anything: Craigslist. We hired May who designed version 1 of Koyfin, before Rich joined.

In version 1, we were generous with the bright blue, and bright colors in general. Look at that awesome graph, and it has annotations too! Users quickly started requesting dark mode, for obvious reasons.

This is when the side menu started appearing, along with keyboard shortcuts. This version had Home, Top News and Monitors (Watchlists).

If you’re not already a Koyfin user and want to check it out, you can give it a try for free. And if you want to use the more powerful features (watchlist, dashboards, custom graph templates), you can create an account for free so that all your settings are saved.

You can also join the growing Koyfin Discord using this invite link.

If you enjoyed this and don’t want to miss all the goodies that are coming next, please subscribe:

And check out 𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #𝟙 — an interview with David Kim aka Scuttleblurb.