147: Koyfin, Apple's App Store, Google Chrome vs Cookies, SpaceX Starlink IPO, Intel & Microsoft + Android Apps, Liquid Rock, Clubhouse, and The Grand Budapest Hotel

"can you really ask anything more out of life?"

Things that have never happened before happen all the time.

—Scott Douglas Sagan, The Limits of Safety

🎧📝 Yesterday, I published a 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟 mini-podcast about my note-taking adventures.

For those who want to give Obsidian a try, I probably should’ve included a link to this 6-part series of Obsidian video tutorial by Nick Milo in the post.

It’s the best way I’ve found to take a running start at that learning curve, and it’s what helped me get started.

h/t to reader and supporter (💚🥃) Billy M. for reminding me of it!

🧙♂️🧴☀️ Sunscreen is one of our technologies that is closest to magic.

If you showed it to a medieval peasant, he would think it's some arcane potion.

“You mean you rub it on your skin, and it disappears, and after that you still feel the heat of the sun just as much, but you don’t get burned by it?” 🤯

(this random thought also reminded me of the suncreen song from 1999...)

🎼🎶 In the previous edition, I wrote about the value of finding a way to inject some weirdness/randomness/strangeness/novelty/etc in your life.

One of the areas where I make sure I do this is with music.

I don’t want to be one of those people who’s musical tastes harden into reinforced concrete (more on cement further down this edition…) after their teens, or early 20s if they’re lucky, and then they spend all their lives discovering new music at a snail’s pace, if at all.

So I actively balance how much of my listening is enjoying the existing collection, and how music is new things.

Both Apple Music and Spotify create weekly playlists of “new music” tailored to your tastes (based on a bunch of signals like your library and what you listen to most often and songs you’ve “hearted” and all that), and I’ve used that a lot to some success.

I’ll also periodically go to various underground music review websites and go through lists of the “best of the year” and “best of the month” and go through them, listen to at least a few seconds of each… See if anything strikes me as worth exploring more.

As an aside, it’s kinda strange just how fast things will get the 👍 or 👎. Sometimes I just hear 2 seconds and my brain is like, “nope”.

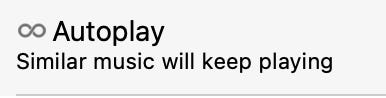

A recent addition to my discovery process is Apple Music’s “autoplay/infinite” feature, which can automatically add similar music after whatever you’re listening to (an album, a playlist). It tries to find similar things, and mixes in new things that aren’t in your library with some things that are.

They’ve had a similar feature for years, that you had to manually trigger, but I never used it because it wasn’t great. But this new one is much better — probably through the magic of machine-learning and very large datasets with lots of parameters.

I know it’s better because I often find myself thinking:

What is that? That’s good!And can you really ask anything more out of life?

💚 🥃 My throat’s a bit dry after all this talking I’ve been doing here…

You get 12 emails for the equivalent of 1 drink a month. If any of these contains even one good idea, what’s that worth?

Investing & Business

Koyfin Goes Plaid… er, Paid

Earlier this year, I became a (small) investor in Koyfin *because* I loved the product & the team, and had been basically living in the app and DM'ing with the founders for a few years. That was my way of putting my money where my mouth is — I'm not just *saying* I think it's great.

For more background, you can read an interview I did with Koyfin’s co-founders, Rob Koyfman and Rich Meatto.

Version 3.4 of Koyfin is out, and it contains some interesting new features… and marks an important milestone for the company that has taken to the next level my use of financial info.

On the feature side, they launched a bunch of cool new stuff:

My dashboards groups

My dashboard UI improvements

Custom financial analysis

ETF exposure

FCF metrics

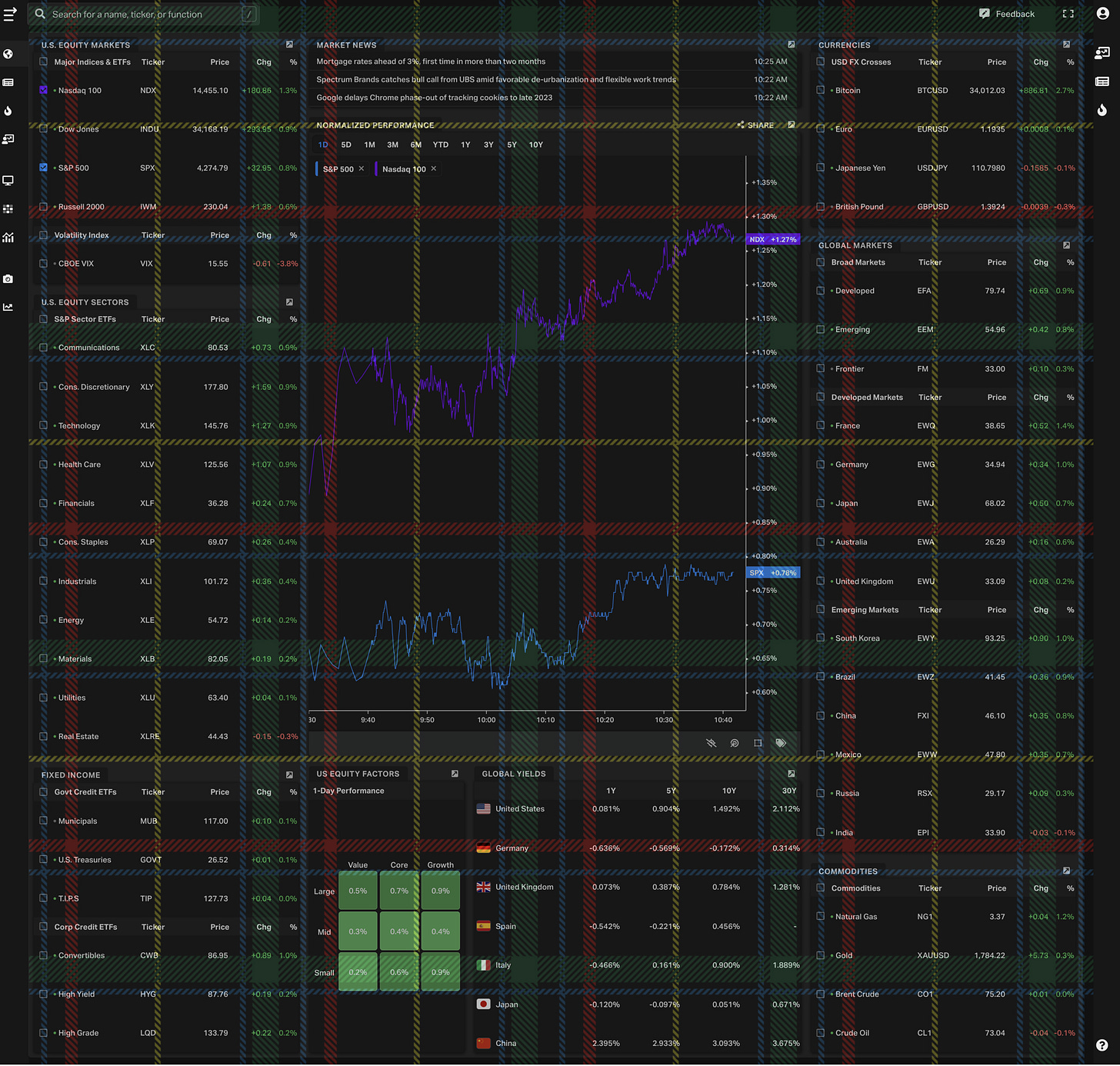

But the big change is paid plans.

Up to this point, Koyfin was entirely free-to-use, financed by investors.

This team gave us a ton of great stuff, to a level of execution that I haven’t seen anywhere else in the space. But engineers, servers, and data-feeds cost muy bux, and those costs go up as the number of users explodes up, so it was always a given that at some point the company needed to get some revenue through the door.

With this announcement, a lot remains free, and there’s a grace period for existing users (July 5), but to get the most out of it, there are Plus, Pro and Enterprise accounts (for a fraction of what the big legacy financial software providers will charge you, so pretty disruptive positioning, IMO).

If you’re investing more than a couple thousand bucks, it’s a no-brainer.

But what’s most exciting about this is that it’ll allow them to hire even more great engineers and work on even more ambitious features, and I’m very much looking forward to seeing what they do next.

Apple’s App Store — Stuck in a Local Maxima

I’ve long believed that something had to give with Apple’s App Store.

The company is clearly trying to drag its feet and slow-play the inevitable, because every day that they can stretch things out means a torrent of additional cash added to their cash Everest…

But the warped incentives of the situation mean that there’s a cost to this cash, and it’s damage to the company’s invaluable relationship with developers and third-party platform participants, and making it an easier target for regulators (if it’s easy to paint a narrative that voters care about, regulators will care — if it’s boring enterprise stuff, like with Microsoft, they’ll give you a forever-yawn).

Friend-of-the-show Trevor Scott wrote a piece about what he thinks will happen with the App Store:

He thinks they’ll bring the fee to 10%, and that while this would have an impact on earnings, that it would also improve duration and lower the risk to that stream of revenue (and the business overall), so it would be a good trade.

I’d also like to see that happen, but I think the incentives are such that Apple will probably try to do some half-way measure, and do something like 10% for apps <$1m in revenue and 15% above, or something like that.

But what I’d really like to see them do is not just play with the % cut, but also with the rules that prevent all kinds of innovations on the platform. For example, sending money between users inside of apps shouldn’t have a fee, or it should be very low (2%? 5%?).

Apple benefits from a vibrant ecosystem, making its devices more useful, and from not angering millions of high-value users and creators with large megaphones.

Google Delays Chrome’s 3rd-Party-Cookie Execution, Now Planned for 2023 🍪🍪🍪

Today, we’re sharing the latest on the Privacy Sandbox initiative including a timeline for Chrome’s plan to phase out support for third-party cookies. While there’s considerable progress with this initiative, it's become clear that more time is needed across the ecosystem to get this right. [...]

we believe the web community needs to come together to develop a set of open standards to fundamentally enhance privacy on the web, giving people more transparency and greater control over how their data is used.

In order to do this, we need to move at a responsible pace.

Sounds like this should be good for The Trade Desk’s OpenID initiative, and Mr. Market seems to agree with this, since the stock is up 15%+ on this news.

our plan for Chrome is to phase out support for third party cookies in two stages:

Stage 1 (Starting late-2022): During stage 1, publishers and the advertising industry will have time to migrate their services. We expect this stage to last for nine months, and we will monitor adoption and feedback carefully before moving to stage 2.

Stage 2 (Starting mid-2023): Chrome will phase out support for third-party cookies over a three month period finishing in late 2023.

SpaceX’s Starlink Satellite Constellation Closer to IPO

Gwynne Shotwell, SpaceX’s prez:

“We’ve successfully deployed 1,800 or so satellites and once all those satellites reach their operational orbit, we will have continuous global coverage, so that should be like September timeframe” [...] before that happens, SpaceX will have to get its service approved in every country it intends to operate, Shotwell said. [...]

In the U.S., the Federal Communications Commission has authorized SpaceX to launch up to 12,000 Starlink satellites in low Earth orbit. The current Starlink constellation is only about 1/10 that intended size, but it has launched beta service in 11 countries in North America, Europe and Oceania. (Source)

12,000! That’s just 🤯

And I knew the number. It just re-blows my mind every time I re-see it.

Meanwhile, Musk on Twitter, on a coming IPO for Starlink:

At least a few years before Starlink revenue is reasonably predictable. Going public sooner than that would be very painful. Will do my best to give long-term Tesla shareholders preference.

Tren Griffin had good stuff on this:

The most challenging aspect of space is that it involves every discipline- engineering (eg, software, electrical, aerospace), physics, mathematics, chemistry, biology, astrology, medicine, law and regulation and politics. What could be more fun for a seeker of worldly wisdom?

The challenge i have thought about the most is creating space-based businesses that generate their own cash flow rather than relying on more money from governments or investors.

Space to Earth or Space to Space businesses that can generate their own cash can scale faster.

While we’re on the topic, here’s a cool graph from ULA that shows how fast debris decay at different orbital altitudes:

Putting Starlink in a lower orbit (550km) means that, among other things, there’s less debris accumulating.

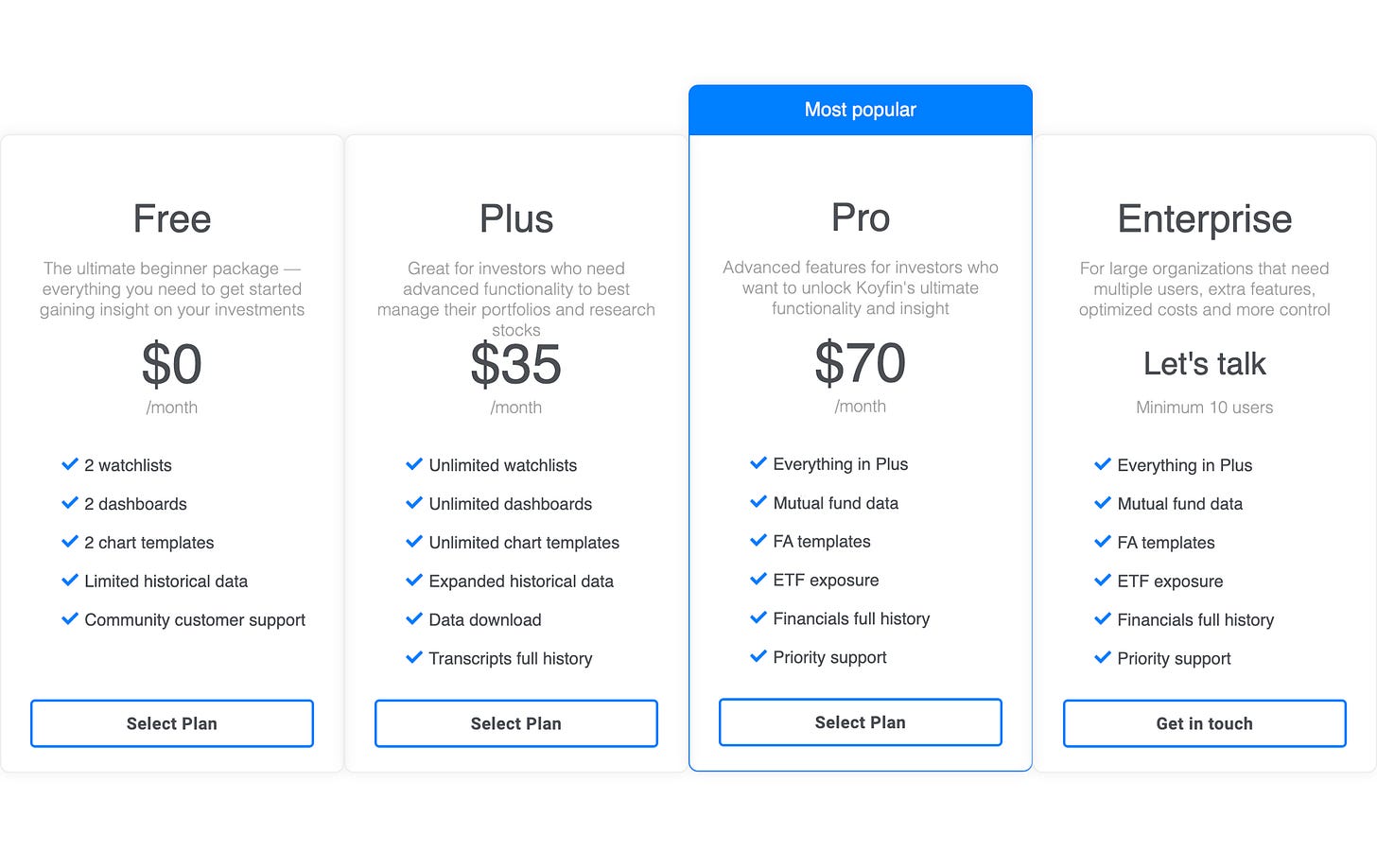

Clubhouse Anyone?

Clubhouse DAUs by country, from AppAnnie, via Cory Wang. Not sure how reliable those numbers are.

The Android launch is certainly making waves in India (though will it follow a similar pattern as other countries?). I was surprised to see Japan that high.

But the way this catches fire and then dies down certainly makes me believe that this is a more niche medium than it may have seemed a few months ago during the mania phase, and that 🐦 Twitter Spaces is probably having an effect because of its superior distribution and integration.

Science & Technology

Cement = Liquid Rock! 🤘

Good thread by Jason Crawford:

Someone asked me recently what's a boring topic that I'm excited/fascinated by.

That's easy: cement.

If it's wasn't thousands of years old, cement would seem futuristic. Think about it: it's *liquid rock*!

Here's how it works:

Cement comes from limestone, a soft, light-colored rock with a grainy texture. The key ingredient in limestone is calcium; it's a sedimentary rock typically formed from crushed seashells. Chalk is a form of limestone (“calcium” is basically “chalk-element”).

To make cement, we crush limestone and burn it, to turn the calcium carbonate (CaCO3) into calcium oxide (CaO). Calcium oxide is a caustic powder, traditionally known as “quicklime” (“quick” meaning “active, alive”).

When quicklime is combined with water, the water does cool it—instead, it reacts with the water, giving off heat! The result is Ca(OH)2, calcium hydroxide, aka “slaked” or “hydrated” lime.

If you then pour slaked lime into a mold, it will re-absorb CO2 from the air… turning back into calcium carbonate, CaCO3 (and giving off water vapor). In other words, when cement sets, it's basically turning *back into limestone.*

Got that? We crush and burn rock, and then re-constitute it at a time and place and in a *form* of our choosing. Like coffee or pancake mix, it's “instant stone—just add water!” Isn't that basically *magic*? [...]

One problem any form of cement has: it's strong under compression, but not under tension. You can build columns and arches with that, but not, say, cantilevered balconies. But during the Industrial Revolution, we figured out how to reinforce concrete with iron bars. [...]

Even more info and details on cement here, because cement is that cool.

Intel & Microsoft to Bring Android Apps to Windows 11

This is a move similar to what Apple did with the M1’s Rosetta translation system — a mix of both software and some hardware acceleration — to provide the ability to run x86 apps on an ARM system.

But Intel and Microsoft are doing it in reverse, to give the ability to their x86 system to be faster at emulating ARM so that Android apps can run:

Intel Bridge Technology is a runtime post-compiler that enables applications to run natively on x86-based devices, including running those applications on Windows.

There’s not much detail yet beyond the marketing-speak above. I’ll be curious to see what it is that they’re doing exactly.

It still leaves them in a worse position than Apple, because the ARM M1 allows them to eventually run both MacOS and iOS apps natively on Macs, after a period of transition, while with this, you have to emulate something as long as you stick to x86 (even if you do it really well).

‘Pandemic drives largest decrease in US life expectancy since 1943’

I know we’re all tired of hearing about the pandemic by this point, but it doesn’t make it any less of a big deal:

U.S. life expectancy decreased by 1.87 years between 2018 and 2020, a drop not seen since World War II [...]

The numbers are even worse for people of color. On average, whereas life expectancy among white Americans decreased by 1.36 years in 2020, it decreased by 3.25 years in Black Americans and 3.88 years in Hispanic Americans. [...]

Other countries also saw declines in life expectancy between 2018 and 2020, but the loss of life expectancy in the U.S. was 8.5 times that of the average for 16 peer countries. The declines for minority populations were 15 to 18 times larger than other countries. (Source)

That’s just bonkers. Over 600,000 official deaths in the US, for sure the actual number is higher. So much death and suffering…

The Arts & History

The Making of ‘The Grand Budapest Hotel’

One of my fave film directors is Wes Anderson, and one of my fave films of his is ‘The Grand Budapest Hotel’ (2014).

I’ve lost track of how many times I’ve seen it, probably at least 5.

I could say about his style what I say about my fave TV series, Deadwood: it’s not for everybody — but if it’s for you, it’s probably really for you.

Anyway, I found this ‘making of’ video and really enjoyed it. Made me wish I could be part of a project like making a film — not even to do anything specific, but just to see it evolve from words on a page to the finished gemstone.

Also because the longer it takes to do something and the harder it is, the more work goes into it and the more problems you have to solve to get to the finish line, the sweeter the wine of victory tastes.

Had to exercise the new comment button! Lol, thanks for adding it. Loved the orbital decay graph. Do you play KSP by chance? I never understood why people watched people play games until coming across Matt Lowne's videos.

Cement as a liquid rock. Very cool way to think about it!