161: China Govt vs China Big Tech, Texas Instruments, WallStreetBets, AI for Food, Amazon Kindle, Stewart Butterfield & Systems Thinking, and a Battleship Turret

“'Wyoming Instruments' just wouldn’t have the same ring to it."

The person you want to learn from is not at the summit of Mount Everest, it's the person a few steps ahead of you.

—Tiago forte (on a podcast with David Perell)

🍔🌭🌮🍕🍱🍜🍪🍝 🥟I was thinking about food, and how the design-space for food, while limited by our senses, is still really large, and there’s no reason to think that we’ve already come up with all the big blockbuster categories of food that we’ll ever have.

This means that there could be something coming soon that’ll be as big culturally as pizza or burgers or sushi or whatever.

I mean, Thaïs didn’t even have chilis until relatively recently, and Italians only got tomatoes after the Europeans went to the Americas, and it then took about 200 years for them to be widely used, so it’s not like popular dishes are extremely Lindy to begin with (when you take the longer view of humanity).

To connect two fields: I’m curious when AI/machine-learning will be used to come up with some of these hyper-palatable and popular new types of dishes that will be as popular as some of the big ones around the world today.

I see no reason why this can’t happen at some point, if only by training a model based on what people like most based on the various aspects that we can detect (a certain number of flavors, aromas, spiciness levels, textures, aesthetics, etc).

It also makes me wonder how interesting things would be if humans could somehow detect 10x or 100x the number of variables in food (more types of flavors, aromas, textures, etc). Since food is about combinations, increasing our sensory capabilities even just a little would makes the food design-space explode in size.

🐦 The cutest little bit of whimsy that Twitter has kept in its UX is probably the color-picker in display settings for the web version:

I love how each color is illustrated with an emoji.

🐙 Octopus purple! 🔥 Fire orange (that’s my choice)! 🥑 Avocado green!

I don’t know why they don’t offer the same color customization on the mobile app. Easy way to make it more fun for users, and keep it consistent across platforms.

🥅 🏆 Last night, the 5,000th subscriber joined this steamboat.

It can be useful and fun to have goals and milestones to look forward to, if only as a way to mark progress and to have little things to celebrate along the journey (because there’s no destination — it’s all journey, so you may as well make it fun).

I've decided that my next big ambitious goal (I won’t say hairy, that’s kinda gross) is 12,000 total subs.

Why? Because around the time when I started this, I noticed that friend-of-the-show, Extra-Deluxe (💚💚💚💚💚 🥃) supporter, and über-writer Byrne Hobart had 12,000 total subs.

Past-me 👨🌾 thought that was amazing, and I'd like to try what that kind of amazing feels like. So present-me 🤪 is telling future-me 👨🚀 to remember to take a moment to stop and realize what’s going on if/when I get there. Enjoy it, smell the roses, etc.

It's not really a destination, just a marker along the road. Remember, journeys, not destinations…

🐭 🪤 Caught a little field mouse in my basement with one of those humane mousetraps.

Released it in a field a couple klicks from my house.

I probably should figure out how he got in 🤔

💚 🥃 I figure that the price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month full of eclectic ideas and investing/tech analysis.

The entertainment has to be worth something, but for those that care most about the bottom line, there’s also optionality:

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 on mobile with Apple/Google Pay — just make sure you’re logged in your Substack account):

A Word from our Sponsor: In Practise

Do you want to invest in high-quality businesses? In Practise is a research service for fundamental investors to learn about high-quality companies.

In Practise conducts hundreds of high-quality interviews every year with CEO’s from the best companies globally. All interviews are available on mobile and desktop. All for the price of only $40 per month.

💫 Sign up here. 💫

Two great recent interviews that you’ll love:

💰 & 🏭

Did r/WallStreetBets Win?

AMC up 1,7450% YTD, GME up 871% YTD.

So... I guess WSB won?

I get that it's likely a very temporary victory, but I wouldn't have guessed things would be this stable at elevated levels *months* after the initial mania... ¯\_(ツ)_/¯

And I mean, by the standards of traders, this thing has been going on for a very long time.

🇨🇳 China Govt vs China Big Tech 🛡🗡

This is a complex topic. I decided years ago that I wasn’t comfortable investing in China, even if they had some really great entrepreneurs and engineers building some really innovative companies.

As Noah Smith writes about, in recent times the Chinese authorities have been striking at most of the biggest and most powerful Chinese tech companies, or at least, the ones that are in the social/ecomm/internet space (so more Alibaba and Tencent, less Huawei).

Liviam Capital posted some of his thoughts, and this led to an interesting discussion with people who fall along the spectrum of optimism/pessimism.

I’m a complete tourist here, I don’t know anything about China, so don’t listen to me (go read friend-of-the-show and supporter (💚 🥃) Lillian Li instead). But nonetheless, I have some thoughts (don’t we all?).

Some people think this kind of pessimistic moment is exactly the point when one should consider buying. That may be correct, but I think the risk profile has still changed.

It's never binary. Even if the govt doesn't wreck these companies, knowing that they could wreck them at any time means they're worth a lot less.

It’s a bayesian thing. The risk was always there, for sure, but now we have *new information* that should make us update, and probably increase some probabilities of unpleasant things happening.

Some people also say that this is pretty much just like the government backlash facing big tech companies in the US.

I don’t think it’s quite the case. China isn’t the US, and I think that a lot of people are extrapolating the last 5-10 years in China when in fact, China appears to be both an extremely old society, and basically a brand new one, at the same time.

Things are changing very fast, so if you take the recent past as guide, it should make you wonder where we’ll be in 10-15 years. And if you take the longer term, you can see that there’s not exactly well-established culture & norms of respect for private properties and the government sharing power with private entities.

In fact, as Lillian Li points out, these moves reining in big tech may be broadly popular with Chinese citizens, so the incentives may not be to reduce the crack downs, but rather to increase them.

Also, a lot of investors probably bought these on a "quality low-drama compounder" thesis, not a "in turmoil, but cheap" thesis ( I don't think people had "Jack Ma exiled to re-education camps" on their thesis a few years ago..).

In my experience, it tends to be dangerous to change your thesis and shouldn’t be done lightly, especially if it’s from a way that you know how to invest successfully, to another way that you may be a lot less familiar with (though I’m sure there are some ambidextrous investors too).

If you have spent years building pattern-matching in knowing how to make money investing in quality companies that are free to innovate and where most of the surprises are positive, you may not be able to transfer those learnings directly to some knife fight with regulatory overhang and governments having life-or-death control over you.

I'm not making a call one way or the other, btw.

I’m just saying it's not an easy call to make, and whatever happens in the end, it doesn't mean that that outcome was obvious (this is what Annie Duke calls 'resulting').

And sometimes, it's not even about price. It's about not wanting certain types of risks/drama in your portfolio.

Personally, I don't want to spend all day thinking about what Xi ate for breakfast1. It's just a lifestyle design choice (I wrote about stock selection as lifestyle design in edition #44).

Owning a business where you never know what headlines you're going to wake up to and what it may mean for the future creates a certain mental burden that some people handle better than others.

Another angle: How many of the things your business needs to succeed are out of its control, and how many in its control.

Personally, I’d rather take my risks in areas others than “will the government decide to allow me to retain my ownership in this”.

But remember, I don’t know what I’m talking about here, so this is probably wrong in the specifics. But I do think that the meta way I’m thinking about it is correct.

So with better specific data, I could tune and calibrate, but I’d probably still use the same way of thinking about things, if that makes sense.

How do you even compete with Texas Instruments?

TXN: "Over the last 12 months, we have invested $1.6 billion in R&D."

They're making literally tens and tens of thousands of SKUs, most of which cost pennies or dollars, and they’re selling those to tens and tens of thousands of customers. How do you even go about competing with that as a new entrant? (I’m aware of Analog Devices — a lot of what I say also applies to them here, in a kind of Visa & Mastercard way)

Good luck even finding a critical mass of good analog semiconductors engineers (these are rare beasts, initiated in the arcane dark arts of silicon — this isn’t your run-of-the-mill transistor wizard we’re talking about)... And if you do, how long to replicate even 1% of the back catalog?

I mean, sure, you could start-up with some VC money and peel of some of their SKUs, but how do you make money selling low quantities of cheap SKUs, and how do you compete with TI and Analog Devices when you have no reputation and no known expertise at hand-holding customers (TI provides reference designs and such, and they have a huge e-commerce platform where engineers can order all the SKUs they need in a one-stop-shop — you can check it out at TI.com).

And because they own their own fabs and equipment — that they often buy second-hand at a huge discount during semi down cycles — they have a big cost advantage over any fabless or sub-scale player that either has to invest a ton in fabs, or pay someone else’s profit margin. And even vs the other analog players they tend to have a cost advantage because of their 300mm fabs (vs 200mm).

I talked some more about Texas Instruments in this interview I did last year with Rob Koyfman (who you may know as the CEO and co-founder of Koyfin). I wasn’t great in it, and did it without any notes, but it contains more of what I think of TXN, if you’re curious.

P.S. “Wyoming Instruments” just wouldn’t have the same ring to it. I’m trying to think if there’s a better state for this company to have been founded in… I think my runner up is “Nevada Instruments”.

It’s all 1s and 0s

I liked this excerpt from something Ben Thompson wrote in 2015 (which he recently resurfaced in this piece about Netflix):

Too much of the debate about monetization and the future of publishing in particular has artificially restricted itself to monetizing text. That constraint made sense in a physical world: a business that invested heavily in printing presses and delivery trucks didn’t really have a choice but to stick the product and the business model together, but now that everything — text, video, audio files, you name it — is 1’s and 0’s, what is the point in limiting one’s thinking to a particular configuration of those 1’s and 0’s?

It’s an interesting situation, because it’s both true that it’s extremely hard for a company to go out of their area of expertise and be really competitive, but it’s also now possible for companies to more easily move out of their areas because such a move mostly doesn’t involve the huge capital expenditures of building new factories and infrastructure and buying a ton of equipment.

Sometimes it’s as simple as writing checks to those who know how to do things X, and you get back a bunch of digital files that you plug that into your existing distribution system.

That’s what a lot of horizontal software companies have been doing, and I wonder if we’ll see it more with content companies like Netflix (getting into games, maybe someday into VR worlds or whatever).

It’s a tall order, though…

Interview: Stewart Butterfield (Founder & CEO Slack)

I really enjoyed this one by Patrick O’Shaughnessy:

One thing I’ve been noticing more and more over the years when I listen to people speak is whether they appear to be systems thinkers or not. It’s not a binary thing, some have a stronger skew in that direction than others, some incorporate it in almost every thing they say while others just in very specific things… But once you start noticing it, you can’t stop seeing the signs.

Butterfield is a fairly strong systems thinker, IMO. Try to look for the signs as you listen to this, and see if you agree with me.

If you’re looking for a good primer on this, I recommend this book by Donella Meadows (recommended to me by 💎🐕 Rishi Gosalia).

🔬 & 💻

Kindle Test Drive

I mentioned a few editions ago that I was buying a Kindle Paperwhite. My first Kindle ever.

Since then, I got it and started reading ‘Tape Sucks’ by Frank Slootman, a book about his time at Data Domain. Friend-of-the-show and OG day-1 supporter (💚 🥃) Nick E. mentioned that it was better than ‘Rise of the Data Cloud’, so I’m giving it a go.

With the Kindle, I’m mostly looking for 1) a dedicated reading device, to avoid it being too easy to do other things on it when I’m supposed to be reading, which can be the problem with an iPad and 2) a screen that is better on the eyes, has forever-battery, and can be read on just as well in bright daylight as in the dark.

So far I’m liking it, though the UX is pretty clunky. But it’s still a bit early for a useful review.

P.S. Ok, one bit of early review in case any Kindle engineers are reading this: If I put it in dark mode, you should know that I don’t want it to open to light-mode interface menus before going to dark mode (I get that e-ink sometimes has to refresh with a flash, but this is a different issue).

If I’m trying to read in bed without waking my wife, I don’t want to open the Kindle and be blinded — temporarily losing my night vision — before I finally get that dark mode page. and maybe you could turn off the backlight briefly during refreshes? It’d help. kthx

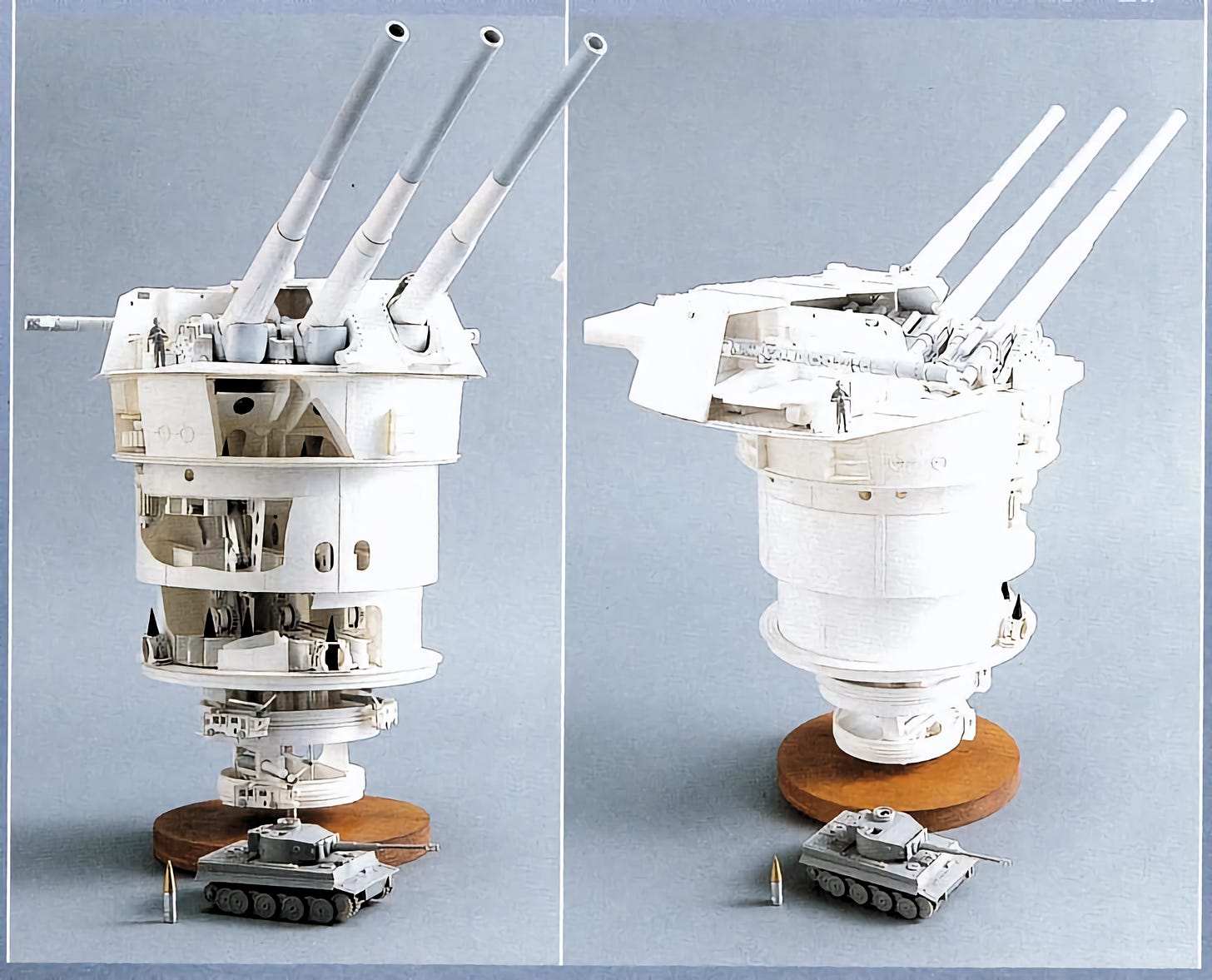

German Tiger Tank for Scale (🍌 not available)

My father forwarded this one to me, from some Facebook group he’s a member of to discuss historical warships (I know):

A model of the 460-mm turret of the battleship Yamato, an APC Type 91 projectile and a German Tiger tank.

On the same scale.

The Tiger II (if that’s what this is… maybe a Tiger I — I’m no expert at telling them apart) is almost 25 feet long and weights about 70 tonnes. So it’s not exactly small, even though it looks like a toy compared to this turret.

It does remind me of the war memoir by E. B. Sledge (‘With the Old Breed’), and what he writes about the terror of naval bombardments. You really don’t want to be on the receiving end of these things…

🎨 & 📜

Artist at Work, Tarot Edition

I just love watching good artists/craftspeople at work.

Every field has so much technique and domain-specific-knowledge that outsiders never think about.

Always fun to get a glimpse at some of it, rather than just at the finished product, which often just leaves you mystified over how they can even produce it.

Here’s the video:

This is by artist Bradley Blair.

Not literally, obviously, but I was thinking of kremlinology during the cold war, when outsiders were constantly trying to guess what a statement meant, or how a certain official felt about certain things, does that person in charge like area X or hate Y? It was very opaque.

Like, did Jack Ma personally insult Xi or some high-ranking official with a speech, etc? lots of things to worry about that for me are totally outside of what I can even guess about…

Since you're into Kindle, have you tried Readwise?

It helps you to collect and remember the highlights you have saved!

This is one of the best pieces of software I have used!

Check it out: https://readwise.io/i/rishikesh2

(You get 60days for free and I get 30days! 😀)

Read my review: https://rishikeshs.com/readwise-review/

Artist at Work, Tarot Edition. That was AMAZING! What they do is almost Magic 💫🤯