163: Square + Afterpay, Business Value of Good Taste, Softbank's ARM Ownership, Topicus & Vela (Constellation), Major Software Trends, and Berkshire AGMs as Podcasts

"I think about this graph all the time"

I am not an investor, I am a full-time reader who happens to invest.

—friend-of-the-show and supporter (💚🥃) Bruno Leite (👋)

🍯 A lot of the things that we think we prefer are actually just the things we’re most familiar with.

I frequently test this is by changing back-and-forth between peanut butter brands.

At first, I always like the new one less than the one I'm replacing, and by the end of the jar, I always like the one I had for a while better than the new one (even if that was an old favorite).

🍖 (This one will seem really basic and obvious to some, and will change the life of others. I think it’s worth the first group rolling their eyes at me to try to convince the other, so here we go:)

In the 💫Upgrade Your Life💫 category, here’s a simple and inexpensive one: you should buy a digital cooking thermometer, especially if you eat meat.

Otherwise, it's like flying a plane without instruments. Seems obvious, but it took my wife and I way too long to get one, and for years, almost everything we cooked was worse than it had to be.

This is the model I have, it’s inexpensive and does the job. I’m sure there are better and more sophisticated ones out there, but the biggest improvement is going from zero to one. You can worry later about going from “one” to “best”.

🚢 Titanic follow-up on the intro from edition #162 by reader Adam Keesling:

Re the Titanic, not about the size, but did you realize it’s impact on the early electronics industry? I’m reading The Big Score (latest Stripe Press book) and it mentions how instrumental the sinking of the Titanic was on the Radio Law of 1913 (which required passenger ships to have a radio and an operator).

This, of course, helped the booming radio industry centered in Santa Clara Valley (Stanford, etc) at the time because of all the ships that now needed radios.

The modern equivalent is probably 9/11 and how it changed airport and stadium security, but your post reminded me of that story. You’d probably enjoy the book if you haven’t picked it up yet.

Thanks Adam! I know I shouldn’t judge books by their covers, but I really love the aesthetics of the Stripe Press books.

🐦 Are you a Twitter power user?

You may think so, but do you use these keyboard shortcuts (on the web version)?

🍝 Had too much serious stuff lately? Tired of SEC filings and Excel spreadsheets?

Here’s something a bit lighter: A podcast about pasta shapes.

Made me want to try the Radiatori, as I’ve never had it before and it looks like it ranks high on sauceability and forkability.

The Cascatelli looks fun too, but it’s a recent pasta innovation that has taken the pasta world by storm (yes, there’s a sub-culture for everything), so it’s back-ordered for months…

💚 🥃 Right now, 95.9% of subs to this NL aren’t supporting the project, and 4.1% are paid supporters.

A couple months ago, I set the goal of getting to at least a 5% / 95% ratio, which seems like a good win-win-win start.

I would like as many people as possible to be able to read without paywalls; to have those who enjoy it the most send a few bucks and feel good knowing they’re the reason why it’s happening; and I can pay my bills and justify spending so much time & mindspace on this project rather than other things. Win-win-win.

So if you want to be one of those making it happen (💚 🥃), it’s just 77₵ per edition (not counting the special editions and podcasts, just regular ones) — if you can’t afford that, you probably shouldn’t subscribe, but if you can…:

Investing & Business

The Business Value of Having Good Taste (Trillions in Market Cap)

I think investors tend to underestimate the value of good taste when they're analyzing management and businesses.

Where would Apple be if Steve Steve Jobs didn't have amazing taste and hadn’t infused the company DNA with it from day 1?

Could Disney even exist without its founder’s taste?

That's two of the biggest and most influential companies in the world.

Not saying it's necessary, but it's potent when it's there (one could say that one of Nadella's biggest advantages over Ballmer is much better taste — not great, but when you're coming from a big deficit, it helps).

I’m sure there’s lots of other examples of companies where good tastes has created billions and billions in value (just look at all the European luxury goods cos, many car companies, Sony and Nintendo, etc).

I bet having/developing good taste is very useful on the investing side too…

Softbank’s ARM Ownership, Theory vs Practice Edition

From friend-of-the-show and Extra-Deluxe (💚💚💚💚💚 🥃) supporter David Kim’s 🔥Nvidia deep-dive:

In 2016, ARM projected that by 2020 it would claim 25% of server CPU shipments. Of course, here we now are, and ARM is nowhere near that level, with x86 still comprising ~99% share. [...]

Softbank acquired ARM for $32bn in 2016 as part of a paradigm-shifting vision of shipping 1 trillion AI-infused ARM chips over 20 years (Project Trillium). Under Softbank’s ownership, ARM’s license and royalty revenue growth slowed to a standstill and EBITDA margins collapsed from mid-40s to low-teens as massive R&D investments in IoT/AR/computer vision have thus far yielded no accompanying revenue (minus the IoT services group, ARM’s EBITDA margins are ~35%). Meanwhile, Softbank’s vision of winning 20% of the server market failed to come to fruition. Having made little progress against its original goals, Softbank agreed to sell ARM for not much more than what it paid 4 years earlier ($40bn, implying a 6% annualized return).

Just the facts, m’aam ¯\_(ツ)_/¯

You can read the whole thing on Scuttleblurb here (inexpensive subscription required):

Nvidia supplies the foundational technology to just about every major technology trend – autonomous driving, edge computing, gaming, computing, VR, AR, machine learning, big data, analytics. [...]

For the first half of its life, Nvidia was more or less a widget vendor whose fortunes turned on inventory planning. It was a trading stock for semiconductor experts who had deep insight into specs and inventory cycles. But I think that has become less true, with 2/3 of Nvidia’s engineers now working on software, building full stacks geared to the indefatigable AI mega-trend. This isn’t at all like pumping out commodity chips to meet a fixed quantum of cyclical demand. The thirst for compute is unquenchable.

I did an interview with David a few months ago. 🧯👩🚒 🚒

Topicus & Vela Software Acquire Together (60/40)

CGG has entered into an agreement with Topicus and Vela Software [part of Constellation Software], for the sale of CGG’s GeoSoftware business [...]

The Geosoftware business will be owned jointly by Topicus and Vela, with Topicus owning 60% and Vela 40%.

Not really so strange when you think about it, especially considering that different groups and business units are sometimes competing for deals, but I don’t remember seeing this kind of joint-acquisition between operating groups of Constellation Software happening before.

Maybe I just missed it, or am not remembering it, which is certainly possible after 600 acquisitions…

Maybe they collaborated on it pre-spin, and it just happened after the spin because some of these things take time, so they split it.. could be just a transitional thing.

But now that Topicus is officially spun-out and more independent (than the already very decentralized CSI model) it will be interesting to see if we see more of it in the future…

Where Online/Software-Tech is Going, Major Trends Super-Charged by the Pandemic

Friend-of-the-show Peter Offringa (if Muji is 💾, maybe Peter can have this icon 💿..? 🤔) is giving you a convenient roadmap of things that you should keep an eye on for years to come:

Work from Anywhere. We can no longer assume that most employees will be clustered into a fixed set of office environments. Even if companies discourage remote work, CIOs still have to plan for the network capacity to accommodate a fully remote configuration should another lockdown emerge.

Connected Smart Devices. Putting aside consumer device proliferation, a big opportunity revolves around industrial applications for IoT. As devices gain network connectivity (over 5G), sensors and processing capability, they will be coordinated to improve the efficiency of many physical processes. These could include smart cities, manufacturing, hospital operations, construction, education, etc. This movement is being dubbed Industry 4.0 and machine-to-machine communication.

Data Tsumani. All these devices and new digital experiences are creating an ever-increasing amount of data. Transfer costs are lower if the data is processed closer to the location of its creation.

Digital Transformation. Consumers have realized that performing many daily tasks, such as shopping, ordering food or accessing health care are more convenient through online channels. Enterprises are scrambling to offer digital equivalents of many physical customer interactions. Large producers of consumer goods, like Nike, are rolling out direct-to-consumer channels to replace physical distribution relationships.

Application Decoupling. As the applications that deliver digital experiences become more complex and software engineering teams grow, it is no longer technically feasible to manage everything in one large, monolithic codebase. This has given rise to micro-services, which break the application into independent, self-contained software components oriented around specific functions with their own data stores. These don't all need to be hosted in a central data center.

Serverless. Most aspects of an Internet application are event-driven, meaning they wait for a human or machine-initiated action. These are ideal for a serverless environment, where an active process isn't continually running. In the past, moving this type of processing to a serverless hosted environment was constrained by cold start times. With newer serverless solutions from CDN providers, start up times are imperceptible, allowing much broader applicability.

Data Localization. Concerns for user data privacy and security are causing many governments to establish regulations over where data about their citizens can be stored. In many cases, they require data to reside within the country's physical borders.

Laid over all of this is a heightened need for security. These trends create new attack vectors for hackers, as there is much more surface area to protect.

For much much more, check out ‘Decentralization Effects’ by Peter. It’s his most recent magnum opus.

♾ 🔁 Interview: Johnny Nelson aka ‘(wannabe) Ƀreaker of (the Bad) Loops’

I enjoyed this conversation between friend-of-the-show and supporter (💚 🥃) Jim O’Shaugnessy and @generativist.

I’ll file this one under: Thinking about thinking, about how humans think and how groups of humans think, how social media is changing the meta-game of society, and how we could make it better by mitigating the downsides while turbocharging the upsides.

Good stuff, I recommend it:

Square + Afterpay | ??? + Affirm?

🔲 is paying $29bn in stock to acquire Australian BNPL leader Afterpay.

Makes me wonder if Affirm’s independence is going to last… Max Levchin sure sounds like a long-horizon, company-builder type, but the pressures may become too great.

Logical buyers may be Shopify — who already owns a big chunk of Affirm equity that they got after doing a deal with them a year ago. Or maybe Stripe..? And as Rishi Gosalia (💎🐕) pointed out, “All of square was cheaper than what they paid for afterpay in Apr 2020”.

Issuing pricey stock to acquire pricey stock?

Audio of Berkshire Hathaway Annual Meetings Since 1994 in Podcast Format

I’m not quite sure if this is with permission from Berkshire or not, so the audio may not stay up forever, but hopefully it is, because it sure is a convenient way to listen to some of those old meetings, all available in one feed in your podcast player of choice (mine is Overcast):

h/t friend-of-the-show and 💎🐕 supporter Rishi Gosalia

Science & Technology

I think about this graph all the time…

…as certain sectors keep deflating, mostly because of the impact of technology, and others keep inflating, their respective weights in the GDP pie will shrink on one side and grow on the other. Can’t go on forever…

This also means that any improvements we can make to these expensive sectors has a bigger impact over time (ie. if you can make healthcare 10% less expensive, that makes a bigger difference when it’s 30% of GDP than when it was 10%…).

Q: What is something people don't realize is a privilege?

My favorite answer to that question:

Sewers.

A literal city of tunnels you never see, draining and moving water in and out of your town/city, completely hidden from view.

It's a fckin luxury and you'd be surprised how much of the world doesn't have that while the rest of the world never even thinks about it. (Source)

MIT Press even has a book all about the world’s sewer systems. I haven’t read it, but it seems interesting.

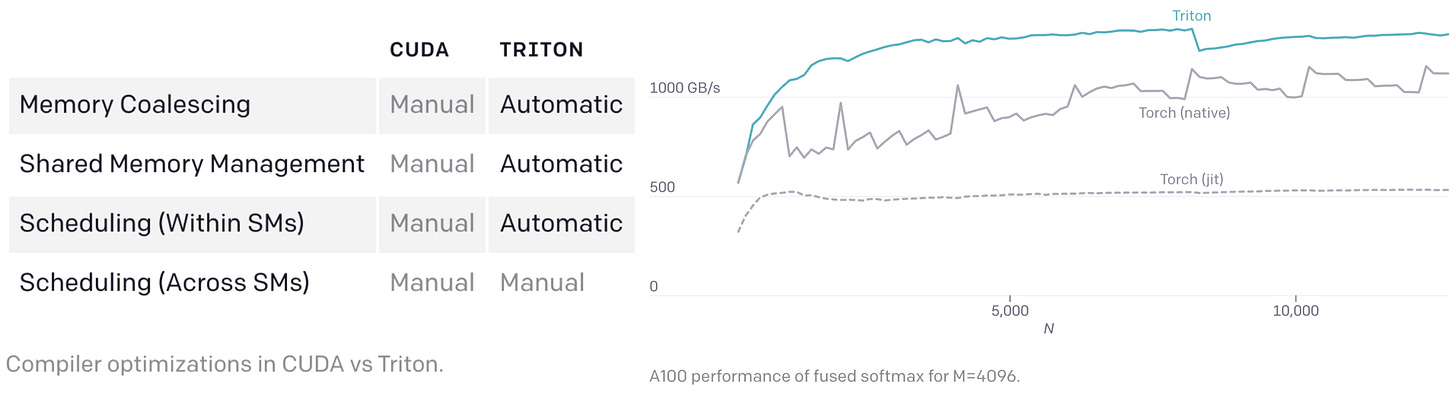

OpenAI releases Triton Programming Language for GPUs

I’m excited about the potential leverage that lots of fields could get from better tools, or even meta-tools (what I’ll call the tools used to make tools).

For example, there’s a lot of cool science that some biologists could do if only they had access to great engineers that could write the proper software for them, but in many cases, that’s not going to happen.

So by making it simpler for those who aren’t the greatest coders in the world to harness the power of machine learning, we should see all kinds of innovation that wouldn’t otherwise take place.

OpenAI seems to have released just such a tool. It’s called Triton, and it’s a new programming language for GPUs:

Triton makes it possible to reach peak hardware performance with relatively little effort; for example, it can be used to write FP16 matrix multiplication kernels that match the performance of cuBLAS—something that many GPU programmers can’t do—in under 25 lines of code. Our researchers have already used it to produce kernels that are up to 2x more efficient than equivalent Torch implementations, and we’re excited to work with the community to make GPU programming more accessible to everyone.

The general idea is that even using something like CUDA to do a lot of heavy lifting, there’s still a lot of decisions that have to be made about how to structure and optimize code to best utilize hardware resources, and that’s what Triton is designed to help with.

From the point of view of the providers of compute, like the big clouds and Nvidia, this is great. Any efficiency gains that mean that fewer resources are used on a specific project are likely to be more than compensated by the growth in number of projects by increasing the returns on them, and by making it easier to create the projects in the first place to a broader population of devs (lowering skill floor to get in).

The Arts & History

The World as Idea/Collaboration Incubator

This video is related to one of the things that I think about a lot these days, and I’ve discussed it recently with friend-of-the-show and supporter (💚 🥃) Rob Koyfman (if the name sounds familiar, it may be because Koyfin is named after him) and friend-of-the-show Tom Morgan; it’s about the huge impact that the online interest graph is having and will have on all aspects of society.

I’m a guy in pyjamas who has never studied or worked in either finance or tech, yet through the innovations of the past few years, I can spend my days learning from and having conversations with all kinds of great people in those fields (and becoming friends with them, in many instances).

There’s so many people that I would never ever have gotten to connect with in any universe that doesn’t include a tool like Twitter.

It used to be that the world had these incubators — Steven Johnson writes about this very convincingly in his book ‘Where Good Ideas Come From’ (thanks Rishi 💎🐕 for the 📗 gift!) — where the connective magic happened.

Maybe some coffee shops in Vienna in the 1800s, or Bell Labs or NYC or whatever for varying fields (the artists in a certain neighborhood of NYC or the rocket scientists in some aerospace cluster/NASA, etc). The “Internet-as-scenius” thing I wrote about in edition #68.

Today, the whole planet is basically an incubator, and the investing people, the entrepreneurs, the artists, the research scientists, etc, can find each other. They exchange ideas and techniques and show their work and collaborate like never before.

A kid randomly born in the “wrong” part of the world can now have a chance to connect and be noticed on their merits in a lot of the scenes.

Soooo…

A long intro just to give context to a Tiktok video 😬

I think it’s great these two people did a duet/collab without ever meeting, talking, or coordinating in any way.

This is kind of the next step, right? The coding equivalent of building some open source piece of code, putting it out there and others build on top of it and create cool things with it.

In this case, a woman create some music, and a man added lyrics and vocals, and the sum of the parts is really good (IMO). The coolest thing is, there could be 50 people singing over that beat without having to ask for permission, and the best version(s) can rise to the top.

Prediction: Someday, there’ll be a number 1 song all over the world from musicians that have never met, and collaborated together without any explicit coordination.

Here’s the video:

Artists are: @istormiweather and @a.t.a.raps

(The rapper only has 4,255 followers on Tiktok!)

Marc Andreessen recently went on Patrick O'Shaunessy's podcast and there's a long discussion specifically addressing "the graph you think about all the time".

Starting at 15:41, ending at 44:16. Transcript below.

https://www.joincolossus.com/episodes/58516750/andreessen-making-the-future?tab=transcript

The World as Idea/Collaboration Incubator- humans can be AMAZING!! 🤙😍💥