166: Cloudflare Q2, FANG 2013-2021, Constellation Software Earnings, Nuclear Power Historical Overview, Pasta Upgrade, and Good Night Mare

"Render unto Caesar, Jim Cramer"

Education is a progressive discovery of our own ignorance.

—Will Durant

🛀 Ask someone not in finance to guess what the phrase "new logo generation was strong" means.

Certain bits of jargon become common, like "our customer penetration was excellent this quarter". We don't think about it anymore, but to outsiders this would be pretty weird…

Even stuff like "negative growth" is kinda strange if you think about it. Don’t you just mean revenue decreased? Oh yeah..

A lot of it is purely mimetic (cf. René Girard). People copying how each other talk to show they're now part of the in-group and understand the club’s lingo…

I’m sure other fields have their own funny-to-outsiders jargon too. Someone should make a repository of funny/weird jargon, categorized by profession 💡

🍝 In edition #163, I mentioned a light-hearted, entertaining podcast about pasta shapes.

Well, that one led me down the 🐇 hole into another podcast series by Dan Pashman at The Sporkful, and his 3-year journey creating a new pasta shape called Cascatelli.

I tend to really enjoy these types of entrepreneur/scientist/artist stories, with the ups & downs, challenges & triumphs that come with executing a vision against all odds.

While I can’t try Cascatelli yet (it’s back-ordered for months), it motivated me to do a little bit of 💫 Upgrade My Life 💫 on my pasta choice, and be a bit more intentional about the types of pasta we eat — we try not to eat it too often, but when we do, we may as well make it as good as possible.

First of all, thinking about it, I realized I pretty much dislike Penne pasta the most.

I looked at all the options to find shapes that fit my preferences (sauceability, forkability, and tooth-sinkability, in Dan’s words), and here are the two that I’ve got so far:

On the left and center are the Radiatori, which after just one try shot up to the top of my pasta rankings. I’ll have to eat them a few times before deciding if they’re number 1, but they were great. Held on to so much sauce and flavor and good texture.

This specific one I got is ‘fermentata’, which is basically to pasta what sourdough bread is to regular bread. I didn’t notice any taste difference, but apparently it’s healthier and easier to digest. It makes intuitive sense, since fermented foods tend to be particularly good for you (looking at you, kimchi 🍲).

The other on the right is a short Mafalda. Had it once, and it was excellent, though not as special as the Radiatori.

Hey, it’s the small pleasures in life! In the past, any improvements that we’ve made to our cooking skills have been worth it (like the digital meat thermometer I mentioned in edition #163).

💚 🥃 Imagine we’re in a pub, and I’m talking about various things that I find interesting. You buy me a drink — maybe a nice Lagavulin? — to show appreciation and to keep me talking. This is what this button does:

Investing & Business

FANG: 2013-2021

Based on my 30 seconds of research, Jim Cramer coined the FANG acronym in 2013. Let’s pretend it was on January 1st because I’m not going to dig up the exact date.

So how did these stocks do since?

The CAGRs are of course just bonkers:

Facebook: 34.65%

Amazon: 34.92%

Netflix: 53.51% (!!!)

Google: 20.34%

If we look at where market caps were in 2013:

What used to be considered huge at the time was:

Facebook: $62bn

Amazon: $113bn

Netflix: $5bn

Google: $230bn

Render unto Caesar, Jim Cramer certainly had a good eye there.

🔥 Cloudflare Q2 Highlights

That thing is firing on all cylinders. Or what did I say this expression should be now?

The electric motor is spinning at high RPM or whatever..?

Let’s get to it:

we had our strongest quarter as a public company. In Q2, we achieved revenue of $152 million, up 53% year-over-year. Our revenue growth continued to accelerate as we saw strength across all customer segments. […]

Our expansion rates also improved over Q1 with dollar-based net retention reaching 124% in Q2. Even with this strong revenue and customer growth, our gross margins improved to 78%, up 120 basis points year-over-year. If there were a theme for the quarter, it was Cloudflare winning the business as the largest and most sophisticated companies and organizations in the world.

Big win for their zero trust security offerings:

the world's largest IT buyer, the United States Federal Government chose Cloudflare's Zero Trust solutions in order to help secure federal agencies against the rising threat of cyber attacks. We partnered with Accenture Federal Services and won a contract with the Department of Homeland Security to offer our protection to all civilian executive branch agencies. This is a very competitive process where we are up against nearly every other vendor in the space. Our win highlights how our Zero Trust solutions are now recognized as world-class.

And this deal doesn’t show up in guidance or RPO yet because it won’t ramp up this year, though they’ve already been making investments in their network in Q1 and Q2 of this year to beef it up to support this large customer. So they have the costs but not the benefits yet, but it’s still very real value that has been created.

And this is just the beginning of their selling to the feds:

we are in the process of getting our FedRAMP certification, and we anticipate that in the first half of next year will be fully FedRAMP certified [...]

We have always had a broad set federal customers. The FBI has been a customer for a long time, the U.S. State Department, Library of Congress and a number of others.

Curious what long-term thinking sounds like? This is how:

While we're on the topic of profitability, I wanted to preview a conversation I anticipate having with some of you this time next year. As part of our long-term model, we have an operating margin target of 20%. When we say long term, we really mean it. We remain confident in our ability to reach that long-term target, but we are not in a rush to get there. From the point at which we reach breakeven, we intend to aggressively reinvest excess gross profit back into growth.

We are nowhere close to being out of ideas for new products to build for customers to buy. Cloudflare is optimized for innovation, and we plan to continue to launch new products, add more customers, relentlessly execute and reinvest in growth for the foreseeable future.

Looks like they’re even selling picks & shovels to the crypto people (sounds like Coinbase..?):

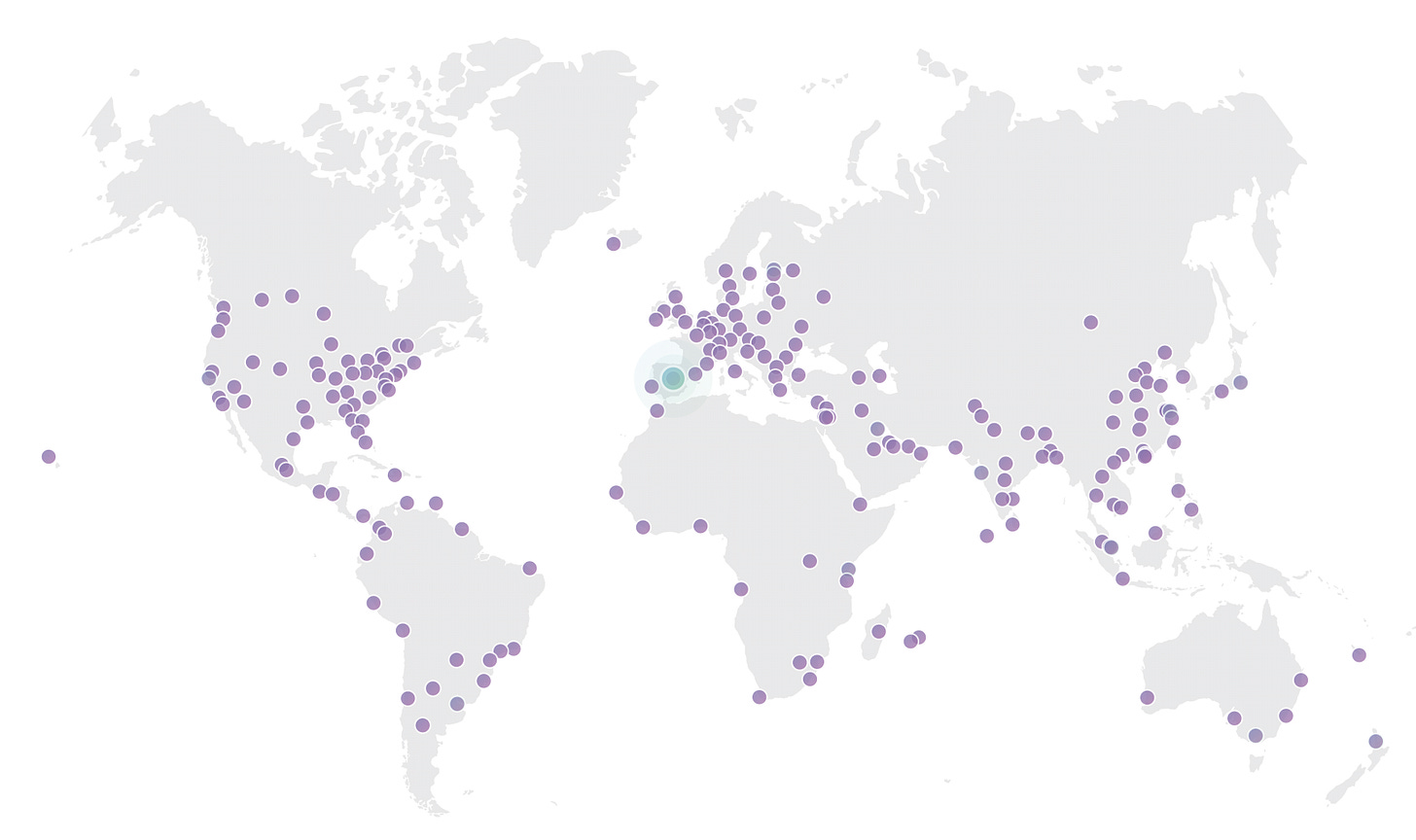

A very large cryptocurrency exchange expanded the use of our network. As an exchange, they are assessed with the fastest possible performance. They leaned heavily on our Argo Smart Routing technology as well as our global presence in more than 200 cities worldwide. They expanded their contract with us in the quarter and now spend over $4 million annually. It's also of note that 3 of the 4 largest cryptocurrency exchanges use Cloudflare's network to be fast and secure.

On the edge compute platform, which is still in its infancy but has big potential:

We see more and more customers building applications around Cloudflare Workers, our [edge] compute platform. […] a financial services software provider signed a 3-year, $3.3 million deal for a number of our products.

They're using Workers as a hyper programmable middleware to stitch together multiple vendor solutions. They love how easy it is for developers on their team to get up and running on the platform because of the broad programming language support and rich developer tools that have been honed and battle-tested in production since workers launched nearly 4 years ago. [...]

we continue to see strength in workers. We see people building and not random start-ups, but really sophisticated large companies, building sophisticated, complicated application using Workers.

And so it is already taking workloads off of the traditional public clouds, and the people and the organization just find it magical.

This dev-friendliness is going to pay dividends for a long time, I think. In its early days, AWS got a lot of startups and growth companies use it, and many of these grew into giants.

I think by encouraging lots of experimentation and being a Swiss army knife that can be used to build all kinds of new things, Cloudflare may get that effect too, of having a generation of companies/products grow up natively on the platform and become meaningful sources of revenue as they scale.

The U.S. represented 52% of revenue and increased 65% year-over-year. EMEA represented 26% of revenue and increased 53% year-over-year. APAC represented 15% of revenue and increased 23% year-over-year.

Interesting geographic and growth distribution. I wonder if they can get APAC to catch up in growth rate, or if there’s a structural reason why it’s slower… 🤔

I know they opened an office in Singapore recently (which is where James Allworth is now — you may know him the co-host of Exponent, with Ben Thompson).

We exited the quarter with 126,735 paying customers, representing an increase of 32% year-over-year. We saw a record number of large customer additions in the second quarter, adding 143 large customers sequentially and 451 year-over-year. We ended the quarter with 1,088 large customers, representing an increase of 71% year-over-year.

Clearly the large customers are where a lot of the revenue growth is coming from, but as I wrote about in past editions (see #133, 135, 138, etc ), the free and small customers are an integral part of what makes this whole machine work as well as it does.

Network CapEx represented 6% of revenue in the second quarter. We continue to expect network CapEx to be 10% to 12% of revenue for fiscal 2021. […]

We had another strong hiring quarter with an increase of 34% year-over-year, bringing our total number of employees to approximately 2,050 at the end of the quarter. […]

We continue to see strong operating leverage in the second quarter, with operating margin improving 690 basis points year-over-year [...] Second quarter gross margin was 78%.

It remains impressive to me that this company is basically handling a very significant fraction of all internet traffic, and doing gigantic amounts of computation over this traffic to detect attacks and bots and malicious actors. It has a great private network through which it routes customer data and bounces things between its own nodes, etc…

And it does all that with only 2,000 people (and that’s after adding like 600 in the past year), low capex (and that’s with the big investments for the US DHS contract), and margins that are almost like pure software companies.

Digital technology gives such leverage to individuals… An undertaking of this magnitude in the industrial era would’ve required armies of people.

They’re really efficient. They have an architecture and model that has been incredibly well thought-out, and their CDN roots are clearly only a small part now, because more legacy CDN companies like Akamai have gross margins more in the mid-50s range.

On bundling and cross-selling, which is increasingly at the heart of their land & expand strategy:

as the product portfolio becomes broader and deeper, the bundling of products and the pricing of those bundles becomes a huge opportunity for us. It's one of the more strategic important projects that we are currently running within Cloudflare…

If you look at companies we admire, like Salesforce and Microsoft, it has been a big part of their journey going up and getting to larger accounts and larger revenue commitments per customers getting more sophisticated in the bundling effort. And we increased 124% of dollar net retention happened primarily because we were really successfully expanding large customers and especially with bundled deals.

In answer to a question, CEO Matthew Prince tells a few personal stories about Apple. The whole thing is too long to reprint here, but here’s a highlight:

in 1996, I was actually in law school. And I heard that Steve Jobs is actually coming back to Apple. And my dad at the time was a stock broker and I worked as a ski instructor the year before and saved up a little bit of money. And so I called him and I said, "I think I want to buy 1,000 shares of Apple stock." And that turned out to be a pretty good decision, which will largely pay for my ability to, among other things, go to business school, a few years later, where I met [co-founder] Michelle and we were able to start Cloudflare from that.

Real-time follow up:

Some people may think that Cloudflare is all about self-serve and gets customer through its free funnel (kind of the Atlassian story about not having sales and all that), but they dispel that notion and make it clear that the free tier isn’t designed for that:

from time to time, we get great customers that come in through that free funnel. But by and large, that's really that's not the purpose of that. The purpose of that is really to be able to just innovate as quickly as we can with such a broad set of customers, and that's paid off incredibly well. I think that if you fast forward 10 years from now, Cloudflare's go-to-market motion looks just like any other big enterprise company.

And I think we're building that out.

You heard a number of deals where we have now named accounts, specific sales reps, increasingly an enterprise sales team increasingly working with channel partners and systems integrators. I think what's different about us is that we have used data to build out our go-to-market function in the same way that we use data across our entire company. And that's allowed us to both go into new geographies and new markets to customer segments and industries and to move up in terms of servicing larger customers in a way that, again, we're not here to tell you that we don't need salespeople.

Ok, this is getting long, so let’s wrap it up with a thought that encapsulates it well:

Whoever has the most developers win. We want to make a platform which yes, satisfies the CIO and CTO and General Counsel for its regulatory compliance.

👋

🥱 Constellation Software Stock on Earnings Day

Constellation Software on earnings day, ladies and gentlemen. The most lethargic shareholders in the world (in a good way):

Note that volume was about 14k shares, or about half of the average daily volume for the past 3 months. Ha! I love it.

Science & Technology

Nuclear Power: Historical Overview + Challenges & Opportunities

I really enjoyed this interview with Jason Crawford, who writes the excellent Roots of Progress.

The first half is mostly about his work and full of interesting stuff, but I want to bring your attention to the second half (around 38 minutes in the interview, which you can watch as the video above or listen to as a podcast here).

In a very short amount of time, Jason goes over many of the technical, economic, and political dynamics that nuclear power has faced and is facing, and looks at challenges and opportunities for the future.

I thought it was probably the best short primer I have ever heard on the topic, and I encourage you to check it out. If you listen to this and don’t learn anything, you are more erudite than I am!

The Arts & History

“Have a good night Mare”

I finished watching the mini-series ‘Mare of Easttown’ (HBO, 2021).

They got me with the ending. (yes Jim, you were right…)

Overall, very strong. Probably ‘A-’ or ‘A’ for me. I recommend it.

Kate Winslet makes it work. She’s just badass and so committed to the role.

After watching the whole thing, I looked around for more info and found out she’s from the UK (doing a delco PA dialect), and that the actress playing her daughter is from Australia. Man, sometimes I wish I could do accents, but all I can do is French Canadian…

From the IMDB trivia page:

According to director Craig Zobel, Kate Winslet was the only actor confident enough to go back to her native accent in between takes; every other actor was terrified to let it go. For the cast and crew, witnessing Winslet immediately switch from a Delco accent to her normal English accent nonchalantly was an astonishing sight.

I also liked this on Winslet’s work ethic:

Evan Peters stated that the dynamic between him and Kate Winslet mimicked the dynamic between their characters- with Peters being intimidated and learning from Winslet. He was constantly amazed by how incredibly detail-oriented she was in preparing for the scene: "She would walk up to me and be like, 'Okay, so it's 2:38pm. We just came from the Deacon's place and we probably stopped for a coffee and lunch. Now we're here and we're doing this thing.' I would look at her and be like, 'Damn. Was I supposed to do that? I didn't prepare like that.'" […]

To understand how to be a detective, Kate Winslet spent several months with police officers across Pennsylvania.

Putting real people on screen:

HBO initially hesitated when they found out that the character of Mare would be without make-up, have unwashed hair and possess unlikable qualities. Kate Winslet was adamant though. "We could have still done the film or TV version of that character, we could have made her hair barrel curl-perfect each day, and she could have been the kind of character who would have put on some simple makeup before going to work. But I didn't believe for one second that she would, first of all, have time, and secondly, care about looking in the mirror."

And

When [Winslet] discovered that she was to have a bigger trailer, she refused, stating that everyone has to be equal on set [...]

Even though Kate Winslet was wrapped for the day, when she heard that Angourie Rice was to shoot an intimate scene that night in a car, she offered to stay. In fact, she volunteered to climb in the boot, and help coordinate the scene, to ensure that the young actors felt safe and protected. Stated Rice: "Kate was like 'I'll just stay after I wrap and just talk to you guys about it. I'll just hang out. I'll be your go-between. You can chat to me about whatever. I just want you to feel comfortable.'"

Wow:

Kate Winslet created so much trauma for Mare that on set, she couldn't be in the same room as Cody Kostro, who portrayed her late son Kevin. In interviews, Winslet would sometimes start crying when discussing the dynamic between Mare and Kevin and his mental health issues. Winslet spent a lot of time with grief therapists, and parents that have lost their children. Her own children had to reassure her throughout filming that it wasn't real.

Can’t say too much about the finale without spoilers, so I’ll leave it there. 👋

I wonder where Matthew Price is rolling this profits now. Recent form 4 show he sells all shares he vests instantly, keeping $NET shares bag at 0. Cognitive dissonance.

Re Cloudflare. While the capital light nature of building out equipment in an ISPs datacenter is a benefit to shareholders, do you think there comes a point in the future where customers view this as a negative? It feels a little like paying a guy to keep your belongings safe and you find out he is storing them at his friends house, but "don't worry he's a good guy".

I might be overthinking this, perhaps physical security is not as important as I think.