167: Jeff Bezos 2004, VR & Gaming, Apple, The Trade Desk + Connected TV, Differentiated Pricing, FTX Leverage, Most Successful Cyber Attack in History, and Instagram Scams

"who says barriers to exit aren’t as important"

My working habits are simple: long periods of thinking, short periods of writing.

—Ernest Hemingway

🔮 Something to think about: your favourite book ever may not have been written yet, your favourite film shot, your favourite album recorded, your favourite video game made.

You may not have met your best friend yet, the love of your life, your soulmate (or if you have, they may keep growing and become even more wonderful over the years).

The future is full of possibilities. 🌈

🎶 🎧 A few years ago, I tried to switch from Apple Music to Spotify (I had previously switched from Spotify to Apple Music — that’s a different story for another time).

I have thousands of albums in my library, so rebuilding things by hands is tedious and impractical.

So I did the logical thing: Looked for software to do it for me.

At the time, all the apps available could only move over playlists, not albums. Must’ve been some limitation with APIs or the way they were scraping the data off the streamers.

Anyway, that was enough for me to give up and stick with Apple Music (who says barriers to exit aren’t as important as barriers to entry, sometimes?).

Buuuut it has come to my attention that apps now exist to migrate whole libraries, not just playlists. I haven’t tried them yet, so this isn’t an endorsement, but I thought I’d do a quick mention here in case you’re in the same situation and have been looking for a tool to help.

Here’s two:

The problem is that in the meantime, I’m not sure anymore that I want to migrate, because recent improvements to Apple Music have increased how much good new music I discover on the service… ¯\_(ツ)_/¯

I’m considering running both services in parallel for a while, a kind of cage-fight of music streaming, to see which emerges victorious.

🤬 I know why they do it, but I still hate the "help me fill out cell D12 in my spreadsheet" types of questions during earnings calls.

🤔 Remember the panic about blood clots a few months ago?

✍️ Muphry's law:

Muphry's law is an adage that states: "If you write anything criticizing editing or proofreading, there will be a fault of some kind in what you have written.”

The name is a deliberate misspelling of "Murphy's law".

This is perfectly illustrated by this Twitter account which tracks the typos made by another account solely dedicated to pointing out typos and errors in the New York Times.

h/t friend-of-the-show Alex!

💚 🥃 Rather than try to convince you to become a paid supporter, I’ll do something a bit different today. As a follow-up to my jargon thing in edition #166, I’ll just post this classic monologue by the late George Carlin (h/t to reader Kamil Ryszkowski for sending it):

A Word from our Sponsor: In Practise

Do you want to invest in high-quality businesses? In Practise is a research service for fundamental investors to learn about high-quality companies.

In Practise conducts hundreds of high-quality interviews with CEOs from the best companies globally. All are available on mobile and desktop.

All for the price of only $40 per month.

🌟 Sign up here (free plan available). 🌟

Two great recent interviews you’ll love:

Investing & Business

Jeff Bezos 2004 Amazon All-Hands Meeting

As told by Jeff Lawson:

In September 2004 I joined Amazon as a product manager, and at the first all-hands meeting I attended, our founder and CEO, Jeff Bezos, said something that has stuck with me ever since. [...]

someone in the crowd of about five thousand people got up and asked a question about retailing—I don’t even remember exactly what it was. But Jeff came back with an answer most of us didn’t expect.

“Amazon,” he said, “is not a retailer. We’re a software company.” [...]

“Jeff’s point was that Amazon was just as much a software company as Microsoft or Oracle or Adobe. It just happened that instead of being the product that we shipped to consumers, our software ran behind the scenes, allowing us to ship brown boxes with books or music or just about anything to someone’s doorstep.

“Our business is not what’s in the brown boxes,” he said. “It’s the software that sends the brown boxes on their way.” We monetized our software not by selling it directly, but by selling everything else—books, DVDs, and CDs. What’s more, the quality of our software would determine whether we succeeded: “Our ability to win,” Jeff said, “is based on our ability to arrange magnetic particles on hard drives better than our competition.”

I had heard that very last sentence somewhere in the past, I don’t know if it was someone else reporting on the same event or if Jeff just used that one a bunch of times (I’d bet on the latter — as I wrote in edition #74, Bezos is very good are compressing ideas into memorable and effective bite-sized capsules).

But anyway, I’ve always loved that way of putting things. Crazy to to think that you have a huge organization, but what matters most at the end of the day is having a better sequence of 01010101000101010111010101010 than the competition.

I also liked this part:

So at Amazon, an internal culture of API documentation arose. One team could find another team’s API documentation and start using their services, often without even needing to talk. [...]

If one team ran their service on ten thousand servers, was that good, or was that horribly inefficient? And what business purpose should that cost be ascribed to? So Amazon started ascribing a cost to using these services, even internally. Some people call this transfer pricing, but in fact it’s a system of doing two things: holding teams accountable for their costs, and deciding where to put more resources in budget cycles.

Small teams are accountable for the efficiency of their service, because they have to effectively publish a “price” for internal customers, and those internal customers have to pay the costs out of their P&Ls. If those “customers” aren’t happy with your costs, then you have work to do. The internal system of accountability aligns everybody’s interests and creates a natural incentive to drive for greater efficiency over time. Internal pricing also enables leaders to make good budget decisions. [...]

without an equalizing scorecard across your initiatives, it wouldn’t necessarily be clear what teams need more investment. So that’s why adding a pricing function, even for internal customers, is tremendously useful.

Amazon is known for the two-pizza teams and for the API culture for interfacing with internal and external orgs that was decreed by Bezos himself, but this second part is less well-known.

Putting a price on internal resources certainly has had to contribute to better capital allocation and efficiency than if the only real “cost of capital” was what you could convince a manager to sign off on…

‘Amazon cloud executive Charlie Bell is leaving [AWS] after 23 years’

Speaking of Amazon, I wonder where Bell will go next.

Any cloud company looking for a CEO right now?

One Does Not Simply Walk Into Gaming + My Old Apple Gaming Theory

Gavin Baker with an interesting take on how hard it may be for big tech to compete with the gaming companies in VR:

1) Roughly 20 years after launching the first Xbox and making it a top strategic priority over the last few years, Microsoft still trails Sony from a units, revenue and profit perspective in console gaming.

2) Yet so many are quick to assume that it's going be trivial for other megacap tech co's to design amazing VR hardware and develop an ecosystem that can compete with the Xbox/PC and Sony gaming ecosystems whenever they decide to get serious about VR. Might be 2022 for Sony.

3) I promise the first party VR AAA exclusives from Sony and Xbox will be more compelling to gamers than any Oculus exclusive so far. And post Bethesda, this is going to include a lot of top 20 titles.

Everybody assumes that they can just walk into gaming, but it's a different culture (not always in a good way, ugh) and requires many specialized skills that the big tech companies may not have, or that may conflict with other priorities.

F.ex., Apple has everything it needs on paper — great hardware and human-interface skills, great software skills, a huge distribution channel — but they just never got it (non-casual gaming). Does Facebook truly *get* (non-casual) gaming?

A few years ago, I thought Apple was going to become one of the main gaming companies simply by coming out with an Apple TV that was basically a gaming console.

Sell it with a great game controller 🎮, have great graphics and a great development platform, plug into App Store existing distribution, and devs would jump on board to have a chance to sell their games into one of the biggest and most profitable ecosystems of customers out there.

Day 1 they could’ve had lots of more casual titles available from iOS ports, and then they could seed the ecosystem by doing very favorable deals with the big studios to port their big titles to Apple too, and maybe acquire a studio to have some good AAA exclusives…

Everything could’ve lined up. But 🕹Serious Gaming 👾 just isn’t in Apple’s DNA.

Can Facebook pull it off? Or will they create a bunch of VR for social stuff, some casual games, and have Oculus as a PC peripheral, but the serious VR gaming will end up on Sony and Xbox (and maybe Nintendo at some point?). ¯\_(ツ)_/¯

The Trade Desk’s Rule of 143 + Connected TV

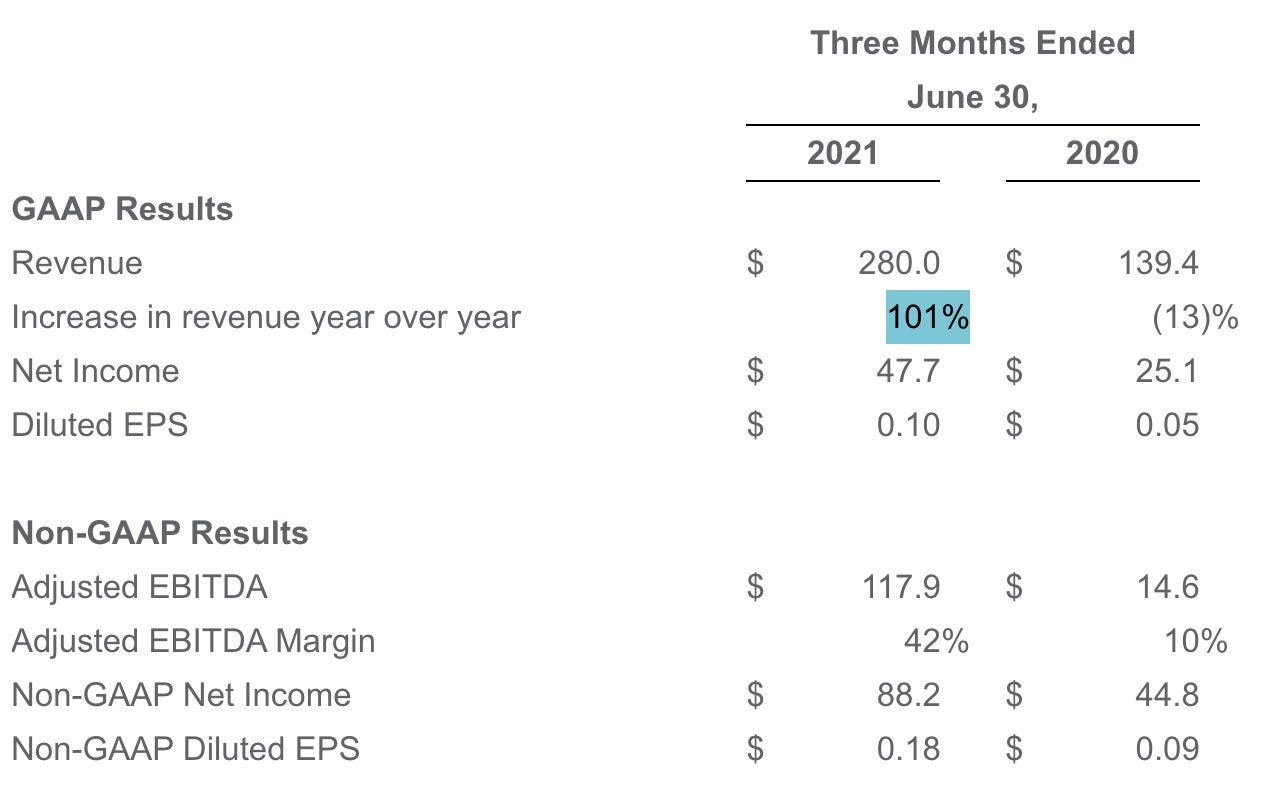

TTD with revenues up 101% and EBITDA margin at 42%. So that's a rule of 143, right?

(of course Q2 2020 was a very weak quarter to compare to, but still…)

Jeff Green on the Reach of Connected TV:

we reached more households via CTV in the U.S. today than are reachable through linear TV. Today, we reach more than 87 million households [...]

MoffettNathanson recently reported that the ad-supported video-on-demand market is growing from $4.4 billion in 2020 to about $18 billion as early as 2025 [...]

CTV growth in EMEA grew 11x year-over-year.

Pretty impressive how fast this switch away from linear TV has been happening (of course, accelerated by the pandemic).

If you’re differentiated, you can charge based on value, not cost…

I enjoyed this part of Patrick O’Shaughnessy’s interview with Segment CEO and co-founder Peter Reinhardt:

we were really scared to ask for money. We sent out this apologetic email to the top 15 customers or something by volume. And we basically said, "Hey, we're thinking we need to raise the price to about $15/month. Would that be okay with you?" And bless his heart. This guy Edwardo from Brazil wrote back and he said, "Guys, this price is so low that I may have to stop using your product because there is no way you're going to be around in a year. So don't charge me more but you better raise your price." [...]

Mitch stops and says, "Peter, in this meeting, you need to ask for $120,000 contract." And I was like, "Mitch, that is 1000 times more expensive than our public price listing. I don't know what you're smoking. I cannot go in and ask for a 1000x price increase." And he's like, "Well, then I quit as your sales advisor." It was literally our first thing. And I was like, "Okay, I'll ask for $120,000." So we go into this. He's like, just trust me. That's the base rate for any enterprise contract which in retrospect is true. As we go into this thing. And then Nat's like, "Okay, well what's the price?" And I was like, well, and I turned beet red. I was like, "Nat the price is $120,000." And I was not believable in any fashion. And he looks at me and is like, "How about $12K a year?" And I was like, "How about $18?" So he agrees to $18K and became our first contract, I think or the second contract once we finally got around to signing. So he was victorious. He saved 85%. I was completely mind-blown because here we were charging 150x, literally 150x. That was a second big awakening moment for me. That the value that we were attaching in our minds was on a cost basis rather than a value basis. And then we had no understanding of the value that we were actually providing to customers but in B2B sales, value is what you should sell on and value is what matters to the customer. They couldn't care less what cost basis is.

This reminds me of a discussion I’ve often had about Apple, and how they can charge a lot more for CPU, storage and RAM upgrades than, say, some random PC or Android maker.

If you’re not differentiated, you have to compete on price. Duh.

If you charge more than what someone else who is selling something pretty functionally equivalent is charging, they’ll just switch.

But if you *are* differentiated, price still matters, but a lot less, and you can charge closer to the value provided.

Doubling the storage on my iPhone from 128gb to 256gb may not cost Apple anywhere close to $100 in parts, but the value it provides me is more than $100 (storing more photos and videos of my kids, more podcasts, apps, TV show episodes, whatever.. not having to worry about running out of space and having to deal with that. That’s worth a lot more than $100 in utility to a lot of people).

They can charge for it because if I’m not ready to pay, all that’s available to me is pretty different and may not be what I want.

Think of it this way: If your partner wants to upgrade their old iPhone and asks you to go buy a new one, and you come back with a Samsung Galaxy and tell them you saved $100 on the storage upgrade, what will they say?

FTX Leverage

Mario Gabriele wrote about crypto-exchange FTX, and this part stood out to me:

Part of FTX’s popularity is due to the leverage it offers traders. Thanks to the risk engine described above, it is able to provide a higher margin with less work, relative to other exchanges.

For most of its brief history, FTX has offered 101x leverage. Hypothetically, that meant that if a trader added $100,000 to their account, they could invest $10.1 million. While winning trades can make a huge sum of money thanks to this leverage, losers can find themselves quickly buried by a bad bet.

After its most recent fundraising round, FTX noted it was reducing the available leverage on the platform to 20x.

Wow.

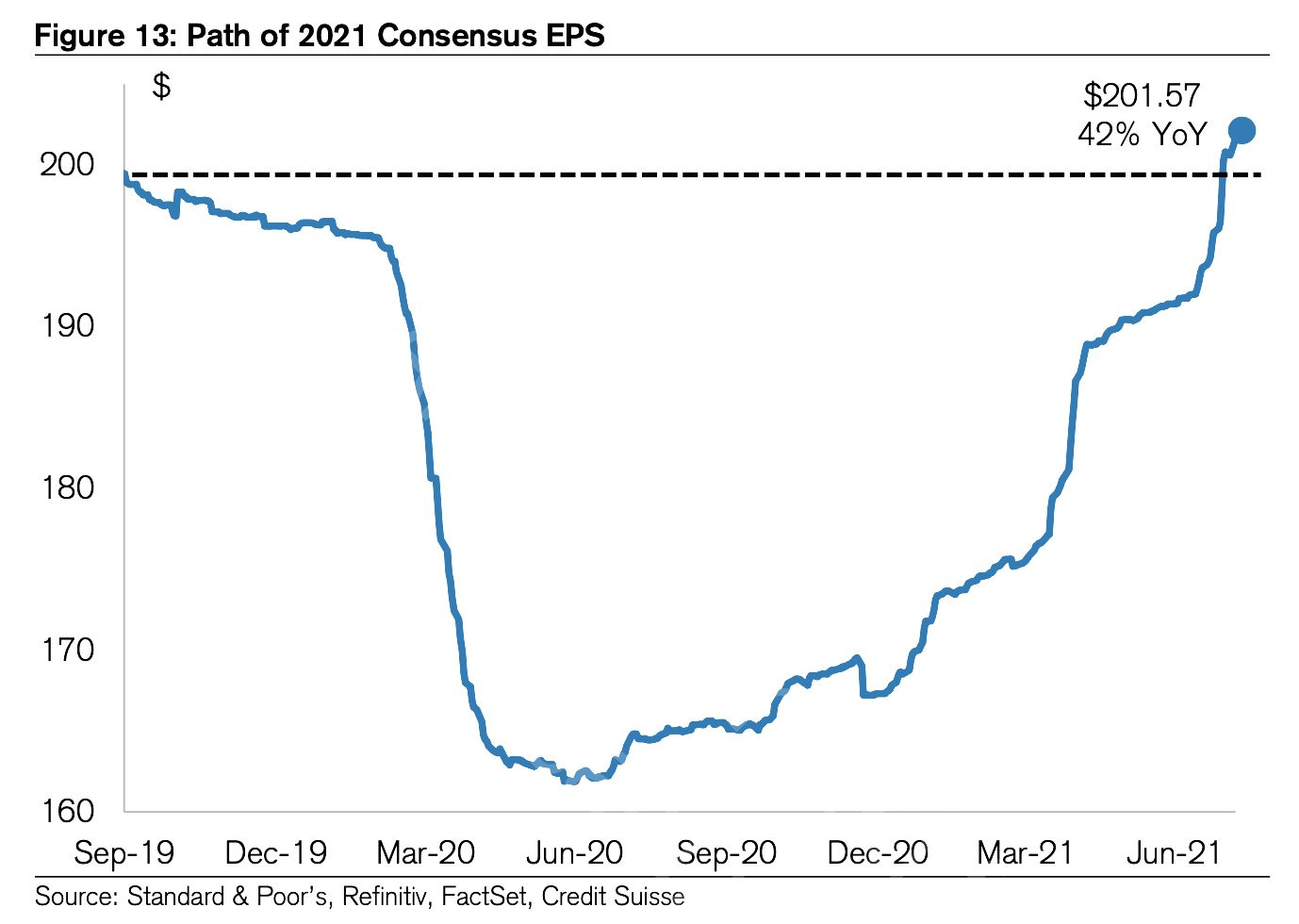

‘what a round trip’

h/t Sam Ro, via Couch Capital

Science & Technology

‘perhaps the most successful cyber attack in the history’, Belarus Edition

Found this via Eliezer Yudkowsky, and his tweet provides good context:

Any time you propose giving a government surveillance powers, you need to keep in mind how awful almost every government is at computer security. Also, holy snarkleroys they made off with what sounds like the entire secret police database.

Here is the thread. The whole thing is worth reading, it’s just bonkers.

My highlights:

First they’ve downloaded the entire “АИС Паспорт” database which contains all personal details of every Belarusian citizen including passport photos, home address, place of work (including those with restricted access who work in KGB and other special services) [...]

Cyber-partisans hacked the entire police database and got access to cameras (at police stations, prisons and even police drones), restricted information about the work history of every police officer (their cases, offences they committed etc). [...]

perhaps most importantly they got access to terabytes of tapped phone calls of regime opponents as well as its supporters (can’t be too careful, right?) Here Luka’s spokesperson asking the head of Minsk SWAT to cover them while she’s out “human hunting” opposition activists

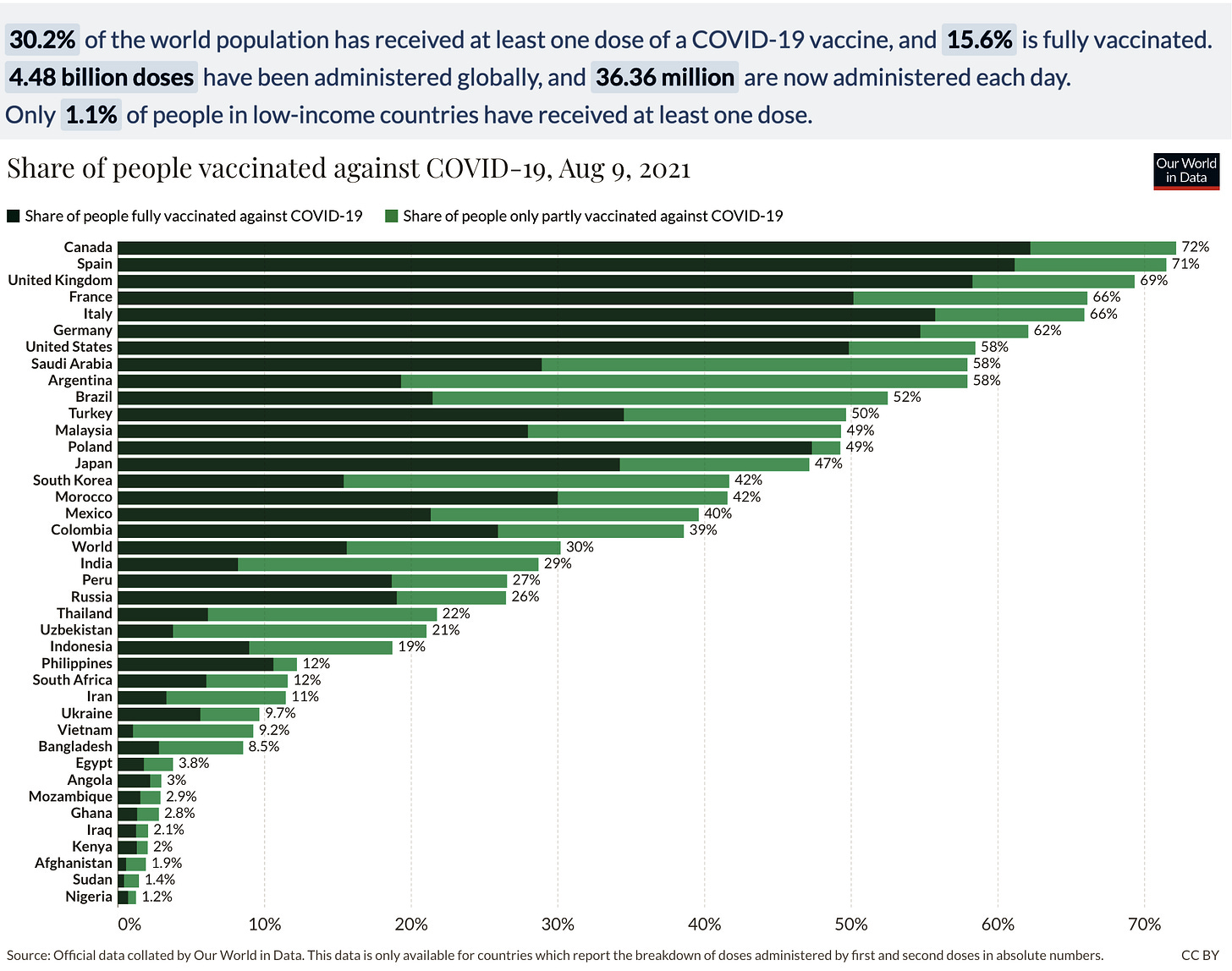

Still a lot of work to do…

Go 🇨🇦.

‘Scammer Service Will Ban Anyone From Instagram for $60’

We’ve seen the rise of ransomware-as-a-service recently, with groups that will provide the support infrastructure for black-hat hackers to do their extortion, and take a cut for their trouble.

But there’s all kind of assholes out in the world who will build businesses around being dicks to individuals and companies.

This “ban-someone-as-a-service” stuff is an example:

Scammers are abusing Instagram's protections against suicide, self-harm, and impersonation to purposefully target and ban Instagram accounts at will, with some people even advertising professionalized ban-as-a-service offerings so anyone can harass or censor others (Source)

The Arts & History

🎵 Kalaido — Lo-fi Instrumental Hip-Hop Beats + Japanese Flavor + Jazzy Late Night Vibes

This one is for those who enjoyed the recommendation for Elijah Nang in edition #165.

Kalaido has many similarities, and I’ve enjoyed the two albums pictured above.

Here’s the official artist page, where you can buy the albums on a “name your price” model. They’re also available on Apple Music and Spotify.

Here’s a short video of the artist performing some of the instrumentation. I always like to see this behind-the-scenes stuff.