195: I did a Podcast, Facebook vs Apple on VR, Microsoft, Intel on Supply Chain, S&P Global, Market Efficiency Cuts Both Ways, Bill Miller, EV Forecasts, and Oppenheimer biopic

"Here’s a thought: Don’t."

One perennial problem is the overwhelming incentive for analysts to issue “Buy” recommendations. The universe of stocks not owned by a customer is always much larger than the list of those currently owned. Consequently, it’s much easier to generate commissions from new “Buy” recommendations than from recommendations to sell.

—Joel Greenblatt

🗣🎤🎧 My podcast conversation with friend-of-the-show and supporter (💚 🥃) Jim O’Shaughnessy is coming out tomorrow.

I had a great time recording it, but I have no idea what others will think of it. If you do listen, get your quill and let me know what you think.

If you don’t want to miss it, subscribe to Infinite Loops in your podcast player of choice (the correct answers are Overcast or Castro). Jim usually has great guests, I think I was filling a diversity quota for French Canadians ¯\_(ツ)_/¯

[ ✅ | ❌ ] Over our lives, we’ll all be, alternatingly:

Right for the right reasons

Right for the wrong reasons

Wrong for the right reasons

Wrong for the wrong reasons

One way to be right for the right reasons more often is to learn to notice as much as possible which buckets various decisions fall into, so that we can learn what to do more of and what to avoid doing or what to change.

Most people seem to only care about the first word of those lines (did I turn out to be right or wrong? This is Annie Duke’s resulting), and it muddies the waters and can lead some people down terrible paths where they do *worse* than if they had just flipped a coin each time (ie. bad habits are reinforced and incentivized)…

🤷♀️ If you think you know my position on XYZ based on something I wrote where I don’t explicitly state a position, but you think one is implied, here’s a caveat for you:

There’s a good chance that I don’t even know what my position is.

On most things, I’m kind of confused and can see some good and bad points to multiple sides (btw, nothing says there’s only going to be two sides to every issue — why should this complex world be so two-dimensional? Reality doesn’t care about making it convenient for humans to play their us-vs-them tribal games… things can be a lot more complex than that).

Which also doesn’t mean I’m confused on everything. There’s some stuff where I know quite well where I stand. Just don’t assume all my positions come in a predictable cluster, that’s all.

🏁 🏇 I was thinking about the race to “win” virtual reality (VR)…

Everybody’s focused on Facebook because they are the noisiest contender, talking about every move they’re making and about the billions they’re spending.

But Apple seems a likelier winner to me. They have much better product chops and semiconductor/miniaturization capabilities than Facebook, and importantly, better taste when it comes to something you wear on your face and keep in the living room.

They’re also already a massively successful platform company with experience having others build on their OSes/products, and not just a long-time-wannabe-platform. Their numerous issues there don’t negate their strengths.

So they feel like the shadow leader in the space to me, but they never talk about their work in the field and do it all in secret, so people forget about them and focus on what they can see (also Sony, HTC, Valve, etc).

(similar factors apply to augmented reality aka AR)

🏴☠️ Cyber-criminal groups either try to give themselves cool names (REvil), or white hats given them code names, and these tend to be fairly cool (Crazy Bear, Nobelium, etc).

Here’s a thought: Don’t.

White hats don’t control what the black hats call themselves, but if you’re going to give them code names and then refer to them that way in blog posts and to the media, give them really stupid names that sound dumb and low status.

Otherwise you’re basically helping them recruit and feel good about themselves. Way to shoot yourself in the foot…

🛀 One of the big benefits of the model I’ve got going here — and that I hadn’t even thought about when I decided on it, to be frank — is that because I write about all kinds of stuff, whatever interests me, I get people messaging me about an eclectic mix of interesting stuff.

If I wrote 100% about some corner of business, I’d likely only get feedback about that thing.

Not that it would be bad per se, but it feels a lot more fun to have people send me suggestions of albums, scientific facts, business insights, historical trivia, book suggestions, cool Youtube/Tiktok videos, podcasts, film & TV show suggestions, etc.

💚 🥃 I’ve heard this again and again from new supporters (most recently from R. 👋): “I’ve been meaning to do it for months… the money is immaterial, but I was kept away by the hassle of going through the process…”

I get it. Everybody hates filling out forms.

But you can do this with Apple/Google Pay, it literally takes seconds (and if you don’t see the paid choices, just hit that “login” button on the Substack page). It means I can keep writing all this stuff for you:

Investing & Business

Are you a boring business? Are politicians unable to win any votes by going after you? Is the media unable to get clicks by writing about you? Congrats!

One of my recurring ideas in recent years is the above. Why is every big tech getting dragged over the coals except for Microsoft?

Bingo.

There’s even a power law in the level of attention: Going after Amazon because they compete with sellers is getting a lot more attention than going after Costco's Kirkland or Walmart's Great Value...

It’s more about who does the thing and how much attention that entity generates rather than the thing itself.

Apple’s phones have a minor defect (real or imagined)? We’ll talk about it for months and it’ll be on every frontpage forever. Samsung’s phones *literally explode like tiny bombs* and can’t be brought on airplanes? Eh, we can move on from that pretty quickly…

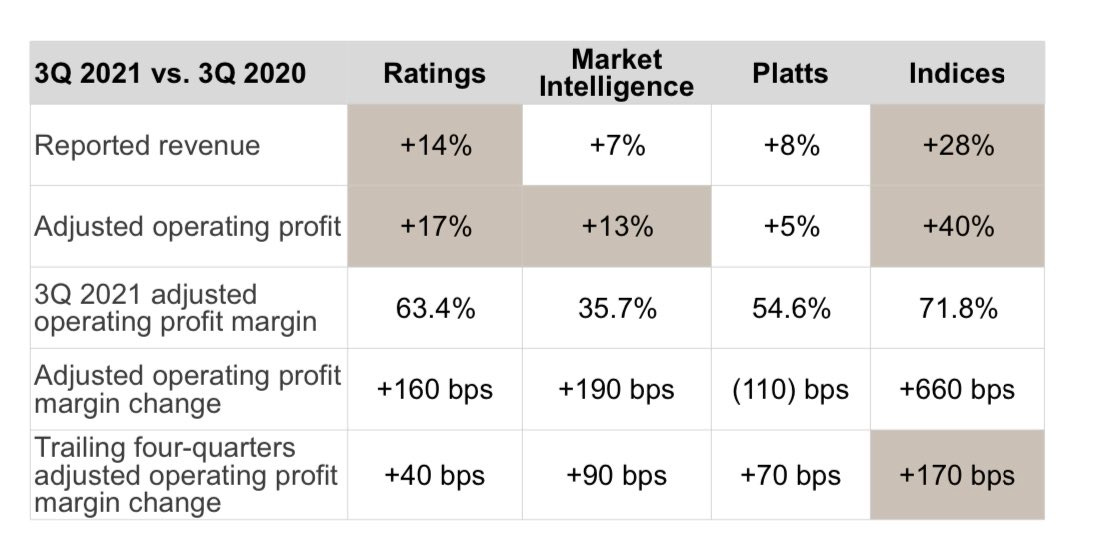

This is why a company like S&P Global can have margins like these while operating as a duopoly with Moody’s (with similar economics):

But you won’t see it on the frontpage or hear about it in a TV soundbyte.

Market Efficiency Cuts Both Ways

If we consider the market to be fairly efficient, then it should be as hard to know when something is overvalued as when it’s undervalued.

But why does it seem like everybody thinks it’s easier to do the former than the latter?

Is it because of the asymmetric nature of long investors vs short sellers? Or is it actually similarly hard and we’re fooling ourselves?

Lots of companies that were “obviously” overvalued went on to do very well over long periods (Amazon, Netflix, and Salesforce used to be the poster-boys for Value Investors who railed against profitless, ridiculously-expensive companies).

Hey Microsoft, It’s Time…

You need to break out dollar-amounts for Azure rather than just give a percentage of growth.

It’s getting a bit ridiculous now… That business would be worth hundreds of billions as a standalone publicly traded company, yet we have to guesstimate how much it brings in.

Also, kind of bonkers that there are startups who don’t grow as fast as this 2-trillion market cap company founded in 1975. In Q3, free cash flow was up 30%, Azure +50%…

‘the more interesting the data, the more likely it is to be wrong’

Here’s friend-of-the-show and Extra-Deluxe (💚💚💚💚💚 🥃) supporter Byrne Hobart on alternative data, but I think what he says applies much more widely:

There's an observation many alternative data purveyors have made over time: the more interesting the data, the more likely it is to be wrong [...] there are many horror stories, and they're quite frustrating: the bigger the call you can make with data, the more likely that call is to be completely wrong because the dataset is either picking up something noisy or missing something important.

Intel’s Supply Chain Issues

The supply chain is holding back the server business, and not just in the way you are thinking. Yes, there is a limited supply of manufacturing and packaging capacity for server-class processors based on the most advanced semiconductor nodes. It’s in the less obvious ways, such as the availability of power supplies and various kinds of controllers and peripherals that the OEMs and the ODMs need when they make a server.

“Trust me, we would be shipping a lot more units if we were not constrained by the supply chain of these other components in the industry,” explained Pat Gelsinger, the chief executive officer who was brought into Intel in January to save it from itself and get it back to what it once was. “Our customers, both cloud customers and OEMs, have very strong backlogs that they are pressing us aggressively to satisfy. But we are really limited by these ‘match sets’ as we call it in the industry.”

Bill Miller’s Last Quarterly Letter

After 40 years of investing and the accompanying letters, Bill Miller has decided to stop the regular writing (he mentioned he may write again if he has something to say — pulling a Mark Leonard, I guess).

Here’s a highlight from his last Q-letter:

[S]ince no one has privileged access to the future, forecasting the market is a waste of time. It is more useful to try and understand what is happening now and give up trying to predict what is going to happen. In the post-war period the US stock market has gone up in around 70% of the years because the US economy grows most of the time. Odds much less favorable than that have made casino owners very rich, yet most investors try to guess the 30% of the time stocks decline, or even worse spend time trying to surf, to no avail, the quarterly up and down waves in the market. Most of the returns in stocks are concentrated in sharp bursts beginning in periods of great pessimism or fear, as we saw most recently in the 2020 pandemic decline. We believe time, not timing, is key to building wealth in the stock market.

When I am asked what I worry about in the market, the answer usually is “nothing”, because everyone else in the market seems to spend an inordinate amount of time worrying, and so all of the relevant worries seem to be covered. My worries won’t have any impact except to detract from something much more useful, which is trying to make good long-term investment decisions.

Science & Technology

Forecasting EV Market Share to 2030

As someone who has been around the block a bit when it comes to these types of forecasts, I can say that they’re not only *always* wrong, but they’re always hilariously wrong.

Probably because they’re more about the ego of the person making the forecast — it has to sound plausible and conservative and be hard to make fun of to avoid career risk — rather than about learning from past forecasting mistakes.

Here’s a chart that shows actual solar photovoltaic additions (black line) vs forecasts made each year (lines of various colors):

This isn’t that different from forecasts of interest rates over time:

Reality isn’t linear, it’s not smooth.. There are tipping points and feedback loops and such (let’s play “complex adaptive system” bingo). If I had to take the over or under on the EV prediction above, I’d take the over without thinking about it for very long…

Russian Hacker Group Behind SolarWinds Attacks is on the Prowl… 🇷🇺🏴☠️

Microsoft wrote an update on the group, which the U.S. government and others have identified as being part of Russia’s foreign intelligence service known as the SVR.

They call them Nobelium, but in the spirit of what I wrote about in the intro today, I’ll rename them:

[Hairy butthole] has been attempting to replicate the approach it has used in past attacks by targeting organizations integral to the global IT supply chain. This time, it is attacking a different part of the supply chain: resellers and other technology service providers that customize, deploy and manage cloud services and other technologies on behalf of their customers. We believe [Hairy butthole] ultimately hopes to piggyback on any direct access that resellers may have to their customers’ IT systems and more easily impersonate an organization’s trusted technology partner to gain access to their downstream customers. We began observing this latest campaign in May 2021 and have been notifying impacted partners and customers while also developing new technical assistance and guidance for the reseller community. Since May, we have notified more than 140 resellers and technology service providers that have been targeted by [Hairy butthole]. We continue to investigate, but to date we believe as many as 14 of these resellers and service providers have been compromised. Fortunately, we have discovered this campaign during its early stages, and we are sharing these developments to help cloud service resellers, technology providers, and their customers take timely steps to help ensure [Hairy butthole] is not more successful.

These attacks have been a part of a larger wave of [Hairy butthole] activities this summer. In fact, between July 1 and October 19 this year, we informed 609 customers that they had been attacked 22,868 times by [Hairy butthole], with a success rate in the low single digits. By comparison, prior to July 1, 2021, we had notified customers about attacks from all nation-state actors 20,500 times over the past three years.

The beefing-up of cybersecurity and the generational shift to zero trust technologies is a high priority, but it should probably be an even higher priority.

Almost everything important these days, everything valuable, is digital and internet-connected.

If you aren’t secure, you won’t be anything for long…

The Arts & History

🤘 Dune Part 2 Greenlit! 🤘

“I just received news from Legendary that we are officially moving forward with Dune: Part Two,” Villeneuve said in a statement. “It was a dream of mine to adapt Frank Herbert’s Dune and I have the fans, the cast, and crew, Legendary and Warner Bros. to thank for supporting this dream. This is only the beginning.”

Aiming for October 2023.

Who knew Hans Zimmer was a funny guy. On the news, he tweeted: “Part Two is moving forward! Thank goodness I have some music left.”

h/t to OG supporter (💚 🥃 🎩) Jeremy S.

Now Entering: Rick and Morty Season Two…

A few days ago, I watched the first two Rick and Morty episodes from season two.

Wow.

The one with Unity was amazing, didn’t think it could easily be topped, but the next one was Totall Rickall.

Genius.

They have better ideas AND they push them so much farther than others would…

They somehow cram whole science-fiction short stories and novellas into 23-minute episodes, and on top of the top-notch SF ideas, they also have some pretty cool character beats, commentary on the human condition, and some pretty funny jokes.

Pulling off just one of these is already a pretty high level of difficulty, but all of them at the same time, consistently, over and over again, is really impressive.

Oppenheimer biopic by Christopher Nolan?!

This sounds promising. I’ve read the biography by Kai Bird on which the script is based, and it was a very good read. I’m sure the apple incident will make an appearance in the film…

I can’t think of Oppenheimer without thinking of this famous ‘I am become death’ video of him, commenting on the memory of the first time an atomic bomb was successfully detonated at a test site:

I hope they find someone good to play Richard P. Feynman 🔥 (these initials look familiar 🤔)

So far, it looks like they’ve got Cillian Murphy to play J. Robert, and Emily Blunt (who I loved in Sicario and Edge of Tomorrow — she’s badass af).

Two great quotes -- "On most things, I’m kind of confused and can see some good and bad points to multiple sides (btw, nothing says there’s only going to be two sides to every issue — why should this complex world be so two-dimensional? Reality doesn’t care about making it convenient for humans to play their us-vs-them tribal games… things can be a lot more complex than that)." and "As someone who has been around the block a bit when it comes to these types of forecasts, I can say that they’re not only *always* wrong, but they’re always hilariously wrong." That said, I think there is a strategy to predicting often, loudly and against consensus. People forget when you are wrong, but when you get it right (albeit by blind chance) you look like a genius. :)

Looking forward to the podcast drop!

On a similar line to being boring... How much time (and money) does it take to completely rehab your image? After the recent spat of negative Bill Gates news, I've been seeing more Bill Gates ads that portray him as the goofy grandpa that loves to give his money to good causes. Most people today seem surprised when they hear about Bill Gates the monopolist!