229: Crowdstrike Investment Difficulties, Spotify's Incentives, Jodorowsky's Dune Book DAO, AWS Graviton3 ARM CPU, and Elon Musk on WWII Planes

"it’s a lot easier to raise money than to raise wisdom"

You do your best work when you're not conscious of yourself.

—Peter Matthiessen

🥅 🥅 📆 I’ve succumbed to peer-pressure and made some goals for this newsletter for 2022. Here they are:

Keep it fun for me

Keep it interesting for me

Keep it fun for readers

Keep it interesting for readers

I mean, if I had to get more quantitative about it, I’d say I wouldn’t mind getting to a full Hobart this year (that’s 12k total subs, based on how many subs The Diff had when I launched). Also wouldn’t mind paid supporters going above 5% and staying there (currently at 4.69%).

But I know I won’t get anywhere if it isn’t fun & interesting, because if it stops being that, I’ll just stop altogether, so that felt like the thing to prioritize.

🛀 🗣 💬 📄 I was reading a conference call transcript, and noticing some question marks at the end of sentences…

Obviously, the first pass on these transcripts is from speech2text software (which makes me wonder, when you see something that is a “final/edited/corrected” transcript, does it mean that a human went over it? Is there an army of people somewhere listening to conference calls all day and fixing speech2text mistakes? I’m not sure how else they could do it…).

My question is: I wonder what heuristics the software uses to know what’s a question?

It’s probably way harder to do it by voice intonation than just by the word choices. ie. “These words in that order are typically a question with 80% confidence” or whatever.

I found a Google documentation page for their speech2text API, but it doesn’t say much except that punctuation can be “inferred”, which makes me think it’s based on the text and not the modulation of the audio… But maybe they use a mix?

What made me question it is that I saw a ‘?’ at the end of a sentence that I don’t think was meant as a question, but I could see how some AI may interpret those words as being a question…

Meta-question: I wonder how many other people besides me have ever wondered about automated transcript punctuation (when it wasn’t their job to care about it)…

In fact, I wonder if some HFT algo has ever been fooled into making a bad trade by a punctuation mistake 🤔

🍳 I want to buy a new fry pan to replace one of our old ones that is all beaten up to hell…

Because life is trade-offs, it’s very hard to find the perfect option, but I found it fun to learn about the different shapes and their uses, as well as the materials and construction types. This overview video was useful:

🛒 😲 My friend Joel made me discover something that I feel I should’ve already known about: The Costco Business Center (🇨🇦 version here).

There’s one in Ottawa, and while I haven’t been yet, I browsed the website and it’s pretty great. A SMB-centric cut-down version of Costco, with different products and some pretty great deals (especially if you have a very large freezer).

Any Costco member can shop in-person at the store, though — as I found out the hard way, after spending a long time browsing everything and filling my cart — they only deliver to addresses that are zoned commercial.

I’ll be driving over at some point, they have a really good deal on carbon steel frying pans and on gigantic quantities of certain frozen-food staples (even bigger than regular Costco).

🛀 Look at any business that did well over long periods of time.

They achieved that through all kinds of macro conditions.

Recessions and booms, high inflation, low inflation, wars, scandals, various types of politicians in power, hemlines going up and down, etc.

But some people make it sound like there’s only a very specific goldilocks macro situation when things can go well, and the rest of the time, nothing will work.

💚 🥃 Thank you for your support, it means a lot.

And if you aren’t part of the club yet, it takes 12 seconds:

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo (brand new website!).

Investing & Business

Crowdstrike CFO’s Investment Priorities & Difficulties

I thought this exchange from a recent Crowdstrike presentation was interesting:

Q: Free cash flow is very strong given your growth profile. What are the key priorities for cash usage?

A: I'm trying to invest. Believe me, I'm trying to invest. I'm trying to invest aggressively. But when you're growing at this pace, the growth is outpacing my ability to invest in the business.

I guess that’s what you call a ‘high-quality problem’ ¯\_(ツ)_/¯

Where is the spend going? Well, I'm really trying to — we, as a company, we're trying to spend more in different geos in R&D. We think we've got an advantage with our balance sheet to continue to invest in R&D aggressively even more so than S&M, which might surprise some of you folks as a percentage of revenue and where we're going. I think we're going to see us -- we're going to see the balance of scale move towards R&D as opposed to anything else as we go forward because the opportunity is so big in front of us.

And the other things that we think about in terms of where we would deploy our capital in international, right? We've got this opportunity to continue to invest and go after opportunity, whether it's emerging markets or in existing markets. We think that we have a long way to go. We've got a tremendous amount of headroom, whether you think about a geo, whether it's EMEA, whether it's APJ. We've done well in those environments, but we've just done really well in America and the Americas. [...]

from a CapEx standpoint, we do look at continuing to invest in our data centers [...]

It's a talent war. And the great news is, as I look at our attrition numbers and I look at the comparatives out there, we're in a really good spot, right? We're well ahead of some of the folks and the companies that are in our space and be able to retain and attract the best that's out there. And we're going to take advantage of it.

Spotify’s Incentives, Slippery Slope Edition

Ben Thompson (💚 🥃 🎩) covered the recent calls for Spotify to censor Joe Rogan over some dumb things said by his guests:

while there is a debate to be had about whether Facebook or YouTube should put their thumbs on the scale in terms of what information or misinformation their algorithm promotes, demanding the removal of a podcast, which takes deliberate effort and time to listen to, is a demand for censorship. Leave aside the content of the podcast in question, and let’s just all agree to be very clear about what this is (we will leave the debate about the accuracy and consistency of officially sanctioned COVID information for another day).

Spotify has so far stood behind Rogan, who has publicly praised Spotify for just that. What is worth noting is that because Spotify is still fighting to be — but is not yet — the dominant player in the space it is heavily incentivized to be seen as publisher friendly. If Spotify were such a dominant Aggregator that it were the only place to find podcast listeners — like YouTube is the only place for video, for example — it might have a different approach.

This last part is especially important. People will go: “Oh but see, Spotify is protecting its creators, it’s protecting free speech, etc.” (I know the 1st amendment applies only to gov’t, but the concept of free speech is broader than that)

As if that tells you that much about what will happen in 3 years or 5 years or 10 years. Things change and are dynamic, Google used to be very different, the plucky “don’t be evil” upstart, and now it’s increasingly looking like a standard big corporation.

Who knows what Spotify will look like in the future?

Do we want all our content eggs in the same basket? (similar reason why I’m glad there’s Apple Music, Amazon Music, YouTube Music, etc…. without competition, *everybody* loses, products get worse, more expensive, creators have no leverage, etc)

Back in the Paleogene era of edition #18, I wrote about ‘My Worries about Spotify & Podcasting’. Here’s a highlight:

I’m afraid that Spotify will look super nice to podcasters for a while, but over time, if they get a major share of the ecosystem, we’ll see the screws begin to tighten and they’ll do what’s best for Spotify, which isn’t necessarily what’s best for podcast listeners and creators.

Once you have one player that controls most discovery and distribution, you are at their mercy […]

Walled gardens inevitably change content rules over time so that certain types of content are excluded or significantly disadvantaged in discovery because it’s not what pleases advertisers... When it’s all decentralized and open, it doesn’t matter if certain things don’t please all advertisers, but when it becomes centralized and any ad can go to any show, there’s levelling by the lowest common denominator. […]

the chilling effect means that everybody starts self-censoring and content starts to be tailor-made to the black-box algorithm, […] So after a while, the ecosystem is a lot less vibrant, a lot less genuine and authentic, and it’s all crap made to please the Spotify SEO god that can make or break your podcast. […]

If Spotify succeeds in dominating podcasting and becoming the controlling player, this may become a new IE6 moment for the internet. I’m not saying it’ll happen tomorrow, but it’s a possibility down the road.

🪡

Whaaaaa..? 🤨

I like Dune as much as anyone, but unless I’m really missing something, this is just bonkers:

Here’s the auction page at Christie’s.

They really paid €2.66 million for a book that was estimated to go for €25-35k, and what they own is just the physical book, none of the IP.

Here’s a fun fact: They owe 5.5% VAT tax on the price paid. On 2.66m that’s €146k *for tax alone*, or 4x more than they probably could’ve bought the book for. 🤦♀️

Meanwhile, the DAO is tweeting stuff like:

(maybe someone should tell them that Neal doesn’t write screenplays…)

This is an object lesson showing that with modern crowd-funding tools (because that’s what this is), it’s a lot easier to raise money than to raise domain knowledge or wisdom.

If you want to see what’s inside the book they bought, there’s been this copy online since 2011.

Science & Technology

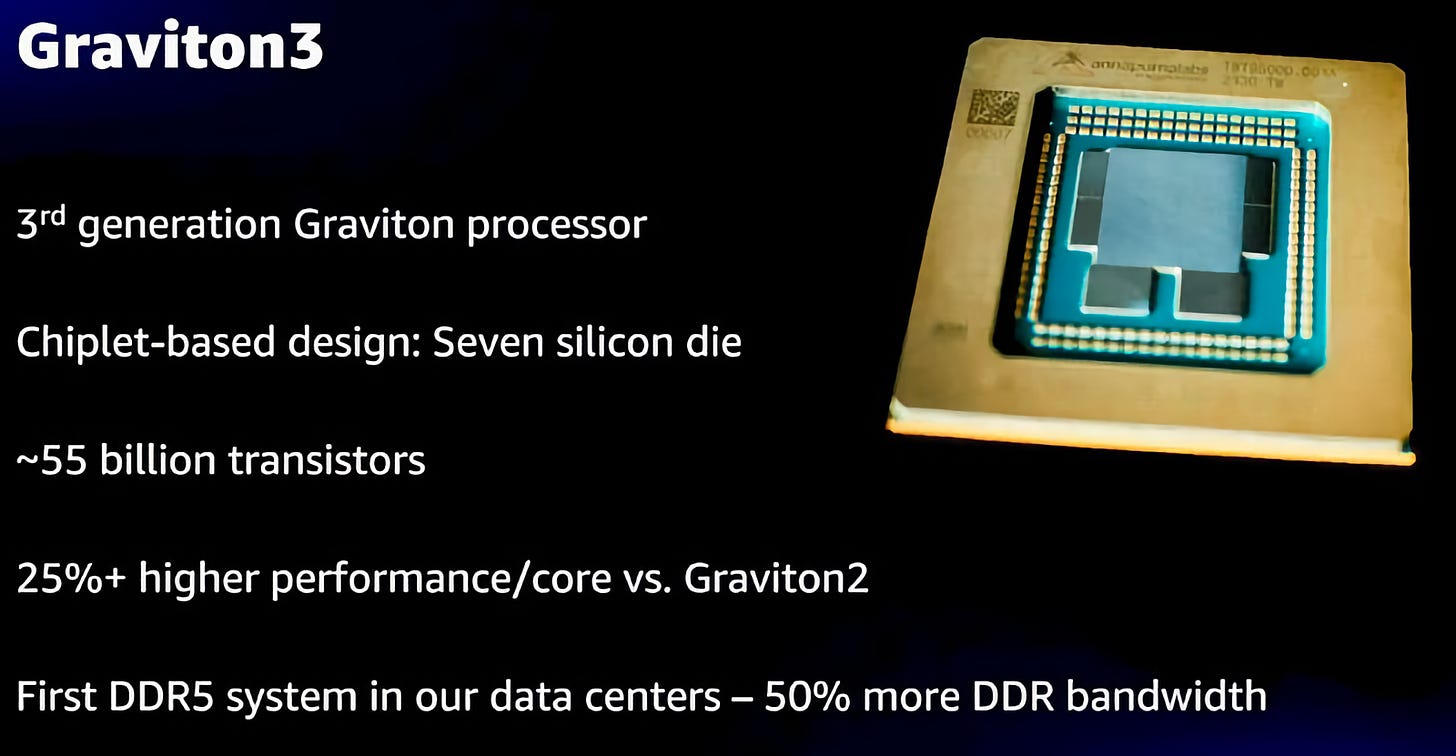

AWS Graviton3 ARM CPU

NextPlatform has a nice deep-dive into AWS’ new in-house ARM CPU.

Some highlights:

Rather than have a central I/O and memory die and then chiplet cores wrapping around it, as AMD has done with the “Rome” Epyc 7002 and “Milan” Epyc 7003 X86 server chips, the Annapurna Labs teams kept all of the 64 cores on the Graviton3 in the center and then broke off the DDR5 memory controllers (which have memory encryption) and PCI-Express 5.0 peripheral controllers separate from these cores. There are two PCI-Express 5.0 controllers at the bottom of the package and four DDR5 memory controllers, two on each side of the package. (This is the first server chip to support DDR5 memory, which has 50 percent more bandwidth than the DDR4 memory commonly used in servers today. Others will follow this year, of course.)

All this adds up to 25 billion more transistors per chip than the Graviton2, for the same number of cores (some of that is no doubt going to beefier cores, some to the 4 extra on-die memory controllers, etc).

Here’s how it compares to previous generations:

Pretty impressive stuff, but we’ll have to wait for details on real-world performance, and most importantly, on cost/performance.

Elon Musk & Dan Carlin on Engineering in War, WWII Airplane Design, High Octane Fuel, etc (Podcast)

I really enjoyed this conversation between Dan Carlin, of the Hardcore History podcast, and Elon Musk and Bill Riley from SpaceX on the role of engineering in warfare (and a bunch of other stuff):

They end up spending most of the convo on WWII fighter planes, some interesting what-ifs, the quality of engineering in the Roman empire, etc.

Great stuff, and it shows just how much of a geek Musk is on this stuff, because he’s not giving a carefully prepared talk with notes, he’s having a free-flowing conversation with a historian and he’s pulling tons of specifics about 70-year-old planes out of his hat. Impressive, considering this is a hobby for him, and as he says at one point, he read some of the books on the topic 30 years ago.

“The hospitalization rate among 3x-vaccinated 80+ year olds is lower than the hospitalization rate among unvaccinated 12-29-year-olds.”

Great granular data from Alberta. h/t Zeynep Tufekci

The Arts & History

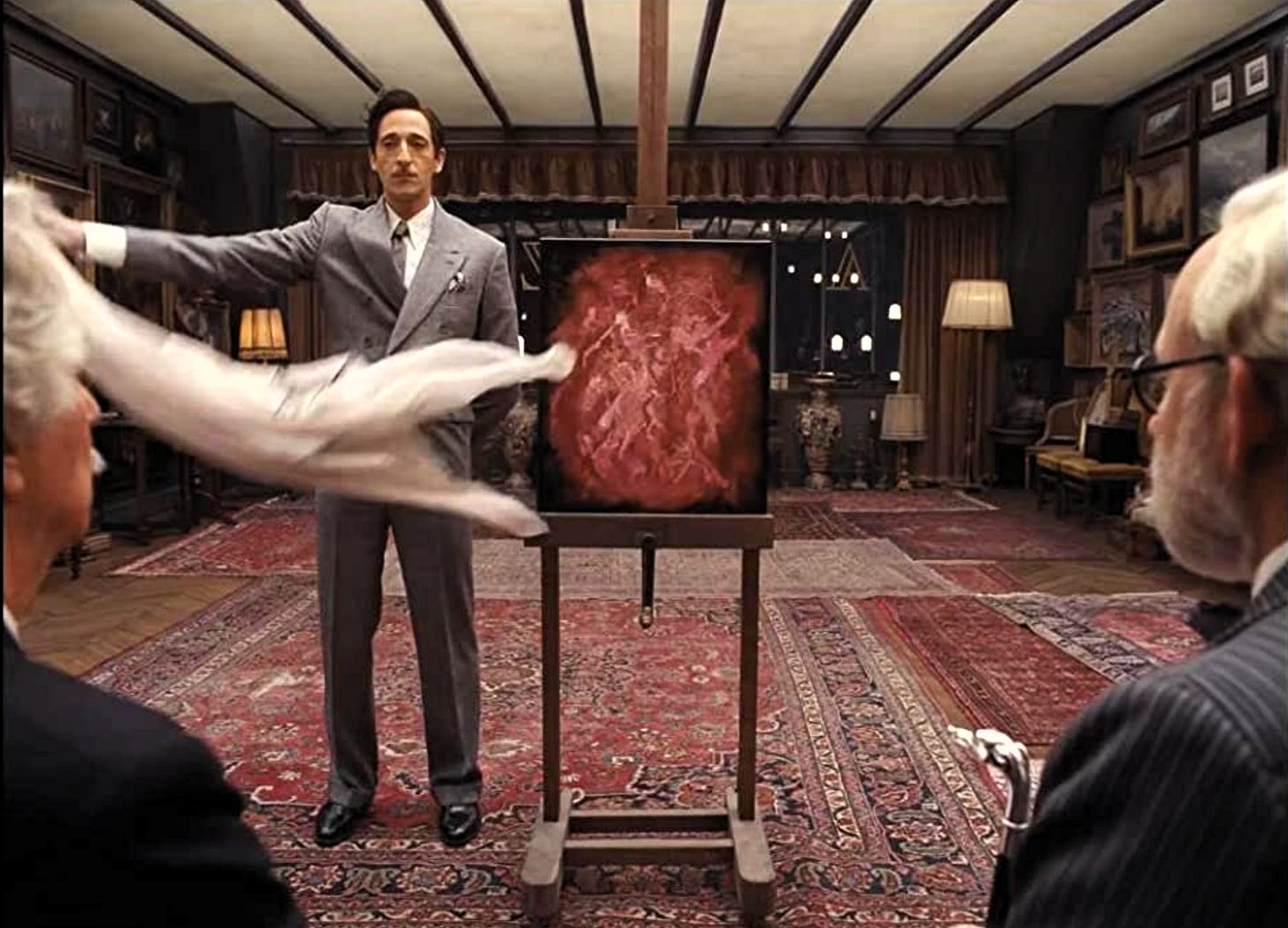

The French Dispatch (Wes Anderson, 2021)

First, a disclaimer: This one is *very* Wes Anderson.

Even if you like some Wes, this one may be too much Wes for you.

But I really enjoyed it.

His previous one, ‘Isle of Dogs’ (2018), didn’t really do it for me — I’m not sure why, it’s not because it’s stop-motion, because I really enjoyed ‘Fantastic Mr. Fox’ (2009) — so I was really happy to see a return to form, at least when it comes to my personal taste.

The anthology format allows him to play with all his favorite toys: Narrators and stories within stories, and experimentation with the aspect ratio of the film (1.37:1 indoors, widescreen outdoors), like in ‘Grand Budapest Hotel’ (2014, possibly my favorite Wes). There’s even animated sections, shifts between black & white and color, characters with flat affect and short emotional outbursts, smart and cultured children, etc. It all feels kind of like theater, but also very cinematographic at the same time, somehow..

It’s largely an homage to crusty old-school writers and editors, which strikes a chord with me, as I’m also a big fan of the writing process and that world in general.

There’s the usual embarrassment of riches when it comes to the cast of one-great-actor-after-the-other. I particularly liked the interplay of Benicio del Toro, Léa Seydoux, and Adrien Brody, but Frances McDormand with Lyna Khoudri and Timothée Chalamet were also great. It was all great.

BUT

It’s probably not for you. If you’re reading this and you’re not already a big Wes Anderson fan, this isn’t the place to start. It’ll likely just make you go “WTF?” and think I’m nuts. Maybe try ‘Rushmore’ (1998) first..?

No crying, and try to make it sound like you wrote it that way on purpose…

Love Wes, found the FD to be a 4/10. Not to my taste.

Otherwise, I love this newsletter and it never fails to make me laugh, good day.

We just watched French Dispatch this weekend! I thought it was great.