242: New PayPal Book Giveaway, Databricks, Google's ATT, Shopify Logistics pt.4, Bill Nygren, IAC, RISC-V, Factorio, Cast Iron, and King Richard

"others are lateral thinkers, Gabriel is a… swirling thinker? "

Convictions are more dangerous enemies of truth than lies.

—Friedrich Nietzsche

🚨🤞 🎟 📚 🚨 Ok, this is cool, and a bit new for me, but it’s all pure goodness for everyone involved, with no downsides at all, which is rare in life, so let’s seize it!

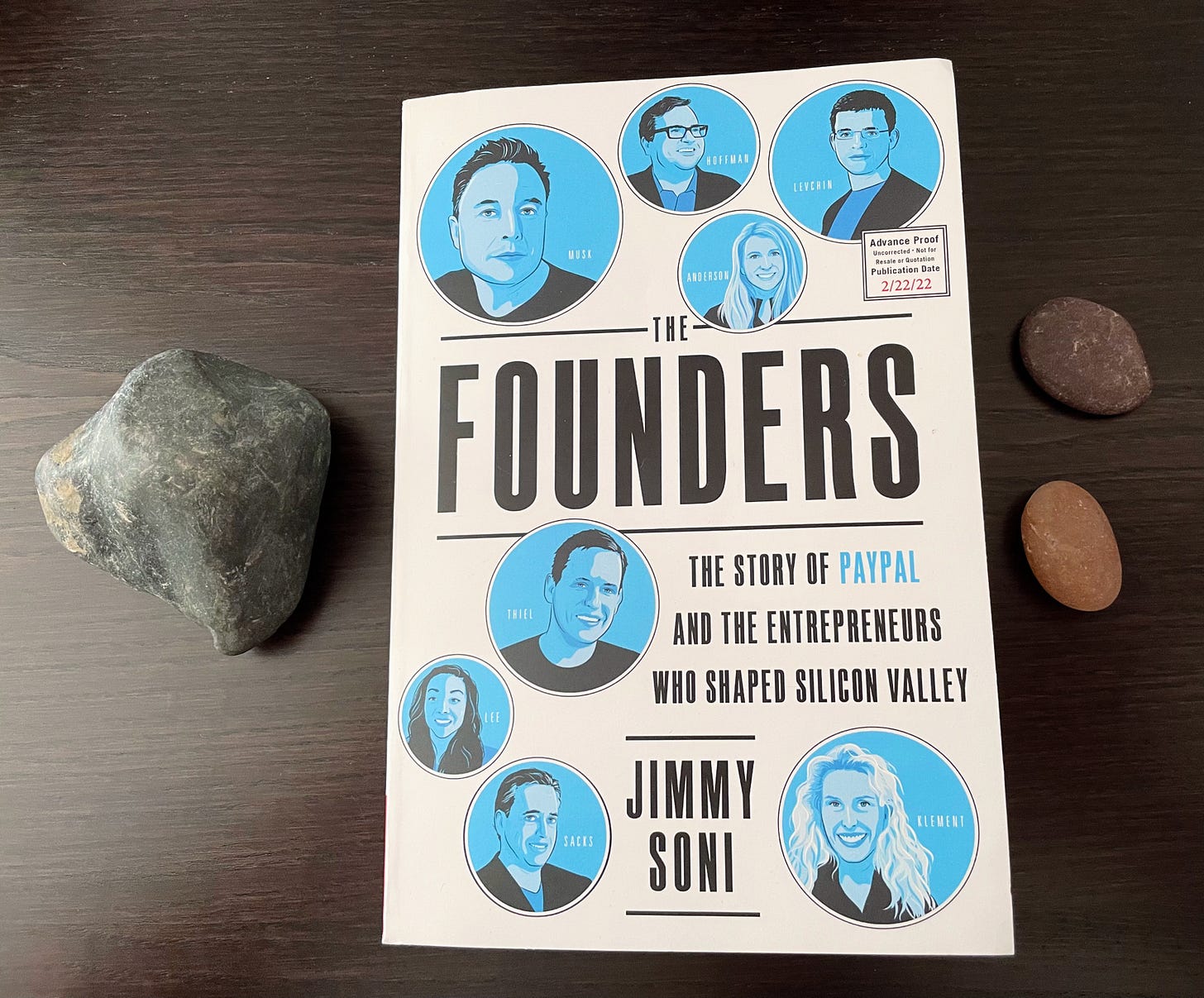

📕 I’m doing a book giveaway! 📗

Friend-of-the-show and supporter (💚 🥃) Jimmy Soni has written a book about PayPal and its incredible agglomeration of talent in the early days of the company.

There’s plenty in it on Elon Musk, Peter Thiel, and Max Levchin, but that’s just the tip of the iceberg, and Jimmy is great at extracting the special moments that make you feel like you were there as it happened, or that give deeper insight into what makes these people stand out.

I haven’t finished reading it yet — I blame my kids for being a slow reader these days — but I’m really digging it so far! But don’t spoil the end for me, I can’t wait to find out if PayPal makes it big or goes bankrupt (*daaad*).

The book will be out on 2/22/22 (what a great launch date! Too bad there’s not 22 months in the year…)

I’m giving away *10 signed copies* to supporters (💚 🥃 📖)

Here are the instructions:

If you’re a paid supporter of the newsletter and are interested, send me a email to let me know you’d like one (you can just reply to any of the newsletter emails). Send this before February 21st at 11:59 PM EST. That’s it.

I’ll compile a list of participants, and on Feb 22nd I’ll draw a name out of a hat, or buy one of those bingo machines with the balls bouncing around, or use randomizing software, whatever, and pick 10 winners. I’ll email you to ask for shipping details.

If you’re NOT a paid supporter now, but would like to become one before the 21st, no problem, you can participate. Hit the subscribe button, and then drop me an email to say you’re interested in the book.

I don’t have that many paid supporters and they surely won’t all participate, so if you do put your name in the hat, your odds of getting a signed book are very good.

If you’re curious about the book, here’s a glowing review in the WSJ.

(you should also read Jimmy’s other book on Claude Shannon, btw)

🛀 I wonder how many hard drives per year google buys these days?

It’s kind of magic that humanity has even succeeded in keeping up with digital storage needs… Can you imagine how many additional bits of storage Youtube requires on a daily basis, on top of how much for the whole archive (which needs to be replicated many times on CDN nodes..).

💚 🥃 If I ever make t-shirts and hoodies:

A Word From Our Sponsor: ⭐️ Tegus ⭐️

What makes a great investor isn’t pedigree or diplomas 🎓, it’s quality thinking and information 🧠

Tegus can’t provide the thinking for you, but on the information front, they’ve got you covered! 📚

With 25,000+ primary source expert calls covering almost any industry or company you may want to learn about, and the ability to conduct your own calls with experts, if you so choose, at a much lower cost than you’ll find elsewhere (70% lower than the average cost of ˜$400), this is the service to turbo-charge the depth and breadth of your knowledge 📈

⭐️ Get your FREE trial at Tegus.co/Liberty ⭐️

Investing & Business

⚙️ Factorio: Systems-Thinking Training Wheels? 🏭

Friend-of-the-show and Extra-Deluxe (💚💚💚💚💚 🥃) supporter Byrne Hobart has a great free post on the game Factorio:

I used to be of the opinion that the computer game Factorio was a colossal waste of talent, burning many billions of dollars of GDP every year. It seemed downright pathological that Shopify lets employees expense it. If anything, my view was that Amazon should be reimbursing Shopify employees for playing.

But since trying it out a bit more I’m starting to suspect that Factorio is the rare computer game to actually increase GDP

What an intro! Intriguing, how does the game do that? Tell me more, Mr Hobart:

you play Factorio in order to habituate yourself to never leaving a manual process un-automated.

Over time, playing the game reveals the metagame: early factories end up poorly laid-out, with redundancies, complex hacky ways of moving products around, and dead ends from which it's impossible to scale. So the basic loop in the game is:

Make a series of design decisions that have some internal logic at the time, but with accruing mistakes.

As you scale, see the consequences compound and necessitate increasingly hacky solutions.

Rip up large fractions of the setup and lay them out again with more straight lines and sensibility

Go to 1, but making the next round of errors subtler, meaning that the complications are correspondingly hard to fix.

Sounds like a great way to train for doing the real thing with actual business processes/computer code/etc.

The player is basically building a giant mesh of in-game APIs (“plug in here to get steel bars, plug in there to get green circuits”), getting those APIs to 100% reliability, and then building something on top of them and getting that to perfect reliability, all while managing scarce resources and dealing with random failures [...]

This metagame ends up giving players the habit of looking at every situation by asking: what's the best way to automate this, and what dependencies of other automations are threatened if I do?

I wish I had time to play it… Maybe someday!

💥📉💥📈💥 Volatility: Riding it out? Trying to avoid it?

What scares me into not even trying to dodge volatility spikes is that they cut both ways.

If I’m not very good at being the first person out when things start to go south, I’ll probably also not be the first back in when things start to rocket up again…

I’m just too slow, it’s in my nature 🐢

If you avoid a few big down days, that may help your yearly performance a lot, but conversely, if you miss a few big up days, you may have missed a large part of your year’s total potential return.

The only thing worse than one misstep is being on the wrong side of both moves (getting out too late, after the drop has mostly happened, and then getting back in too late, when the recovery is mostly over).

Knowing myself, I’m almost certain I do better riding it out. Not saying it’s The Way™️ or optimal for everyone, but for me, I think it is. The lesson here is the usual ‘know thyself and don’t just do stuff because others do it.’

Google follows Apple (again) with its own ATT

Google plans to adopt new privacy restrictions to curtail tracking across apps on Android smartphones, following Apple in putting restraints on an advertising industry that has covertly collected data across billions of mobile devices.

Google’s plans for Android could hasten an end to more than a decade of advertising practices across smartphones in which companies including Meta Platforms Inc.’s Facebook layered their code into hundreds of thousands of apps to track consumer behavior. [...]

it plans to keep supporting current smartphone identifiers for at least the next two years and to give the industry substantial notice before any changes. It said it plans to work with the industry to develop the replacements. [...]

Google said that the app-tracking replacements it plans to develop for mobile phones will work similarly to those it is proposing for web browsers (Source)

Platforms are going all-in on making their first-party data as valuable as possible, it looks like. Oh, and everybody is wrecking Facebook’s party these days…

📦 Shopify Update on Logistics Effort 🚚

From their Q4 release this morning:

Simplifying fulfillment. We are leveraging our learnings to date to continue building simple and fast fulfillment. We are consolidating our network into larger facilities; we are shifting to operate more of them ourselves to better control quality and cost; and we are unifying the network by operationalizing our warehouse management system to highly integrate with Shopify's back office and checkout so merchants can seamlessly offer and achieve delivery promises. In conjunction with our updated, more direct approach, our expectations for Shopify Fulfillment Network revenue, operating expenses and capital expenditures will be incorporated in our overall Shopify outlook, as they are for 2022.

Interview: Bill Nygren

In the first part, Nygren explains why — and this is kind of the reverse of what a lot of others did later — his fund bought Amazon because they really liked retail, but sold because AWS made them less comfortable and they didn’t quite understand it, didn’t know how to value it.

It’s easy *now* to think that AWS was always obvious, but in the early days, there were competing narratives about it, and a lot of them were not flattering (“a bunch of commodity hardware running at a loss, no pricing power, constantly having to lower prices, no stickiness, etc”).

One thing that surprised me — and it’s unfair to read too much into it, not everybody is a geek, and it’s hard to recall everything while speaking on a podcast — but Bill talked about Google, which is their largest position, and he wasn’t sure what their cloud-computing division was called (“It’s GWS I guess..”). I don’t know if it’s a sign that GCP is still kind of overlooked…

I also liked his riff about how basically every company is a “black box” to a certain extent, and that it’s a bit delusional to think that just by reading the filings you’ll somehow be able to really know for sure what is going on inside a business.

On the OG Malone spin:

“Liberty Media spin-off… it was the messiest prospectus I had ever looked at, a complete hodge-podge of assets, and it was very easy for people to come up with excuses for why they didn’t want to bother looking at it. We made Liberty Media our largest holding, and in the ensuing 5 years made about 20x our capital on it.”

*thumps chest twice* RESPECT

h/t — Oops, I’m sorry, I lost track of who posted this one on Twitter ¯\_(ツ)_/¯

🧱 Databricks: IPO, $800m ARR in 2021, growing 80%+ 🧱

Databricks Inc., one of the most valuable startups in the U.S., is still planning an initial public offering even as Wall Street has become more skeptical about growth in the software industry, according to Chief Executive Officer Ali Ghodsi.

“We’re not in a super hurry to IPO. We’re not pushing it out or anything like that. We’re on a long journey.”

Databricks, which provides tools to help companies glean insights from large amounts of information, has raised $3.5 billion and commands a $38 billion valuation. [...]

The San Francisco-based company said it ended 2021 with more than $800 million in annual recurring revenue, more than an 80% jump year-over-year. Snowflake had an estimated $530 million in ARR when it went public in 2020. Databricks said it has more than 7,000 customers and a net retention rate -- the percentage of recurring revenue from existing customers -- of higher than 150% (Source)

Very interesting company, and I’ve been impressed by the founder’s podcast appearances.

I’m looking forward to them being public, if only to learn more about them because of the additional transparency and communications.

Interview: Gabriel Leydon

If some people are straightforward thinkers, and others are lateral thinkers, Gabriel is a… swirling thinker?

He’s certainly an independent mind who sees things that others don’t, and I like that. I’m not saying he’s right about everything, but *he makes me think* about the things he’s talking about, and that’s a valuable trait in itself.

His point about people making things they don’t really like — doing it just for the money or because others have had success at it — and users of a product liking the product more than the people making it… I think that’s profound, and I’ll be using that lens to look at things now.

Interview: Joey Levine, IAC CEO

I know, it’s a Patrick (🍀) double-header today.

I don’t have a lot to say about this one, other than IAC is an interesting business for many reasons, and it’s interesting to hear about it straight from Joey:

when people come into IAC for the first time, they're always surprised by the candor in our conversations, and relatedly the rigor in our conversations. Capital allocation is the most important thing that we do. And it is every week we are sitting down and talking about that. And that process always has everything on the table [...] "Well, we could do this or we could buy back stock. We could do this, or we could buy this other thing. We could do this, and which one makes the most sense over a long period of time? Which one is the most strategic value? Which one has the greatest use of a finite item on capital?"

‘Countries connected to their primary trading partner (2020).’

Source: Anders Sundell (follow the link to see similar graphs with data going back decades)

Science & Technology

RISC-V Licensing, Completely Proprietary Designs Allowed

Follow-up to a question I had in edition #239 about RISC-V IP licensing.

I found this video which compares ARM to RISC-V, and provides a quick history of both.

There’s this slide, which confirms what I suspected:

There’s a good Jim Keller video here that talks about bit about the ARM and RISC-V ISAs.

🍳 Cast Iron Pros & Cons 🥘

Don't forget that real people use your products

Wasting the time of medical doctors has to rank pretty high on the list of “bad things for society”.

The Arts & History

‘King Richard’ (2021)

My wife has this tradition. Each year, she and her mother try to see most films that are nominated for the big Academy Awards categories, and then they watch the Oscars together, eating candy and popcorn.

I usually end up seeing a few of those films with my wife. This is one of those.

‘King Richard’ is primarily the story of Richard Williams, the father of tennis megastars Venus and Serena Williams (trivia: Serena is now married to Reddit’s co-founder). It shows them in their early teen years, how their father created a plan for their success before they were even born (echos of Tiger Woods’ youth), and how much hardship they all had to go through to execute it.

Some of the family aspects reminded me a little of the excellent ‘Captain Fantastic’ (2016), though I think that’s a better film (check it out if you haven’t seen it! don’t even watch a trailer, just trust me on this one)…

In many ways, ‘King Richard’ hits a lot of notes that usually resonate with me:

I like stories of driven people who have big dreams and then go to great lengths to build themselves up, reach their potential, and make them happen by following their own path rather than doing what everybody else is doing.

I think that’s what I liked so much about the Michael Jordan documentary mini-series (Last Dance), even though I don’t watch sports and knew little about Jordan going in.

It’s about the craftsman mindset, deliberate practice, and squeezing out that last 1% of performance that requires 80% of the effort… All that stuff is like catnip to me.

The film had flaws, and it probably painted a more positive picture of Richard than reality partly because his family was involved in producing the film (I think). There’s a scene where they seem to go into a darker direction, but they quickly pull away.

I don’t mind that too much. Not every film needs to follow the same arc of up-down-up, and some clichés were probably avoided because of this. But it does feel like not the whole story.

I don’t know what I’d give it. Maybe a B or B+? Not the best thing ever, but I don’t regret watching it. The acting and writing were pretty good.

Interesting on Databricks, will have to give them a look.

Your going to have to put me down in the list for the book giveaway. . . also -- when is merch coming?

I have Factorio in my steam list. . . but no time to get lost in it. . . one day soon!